- Home

- »

- Homecare & Decor

- »

-

Biodegradable Tableware Market Size & Share Report, 2030GVR Report cover

![Biodegradable Tableware Market Size, Share & Trends Report]()

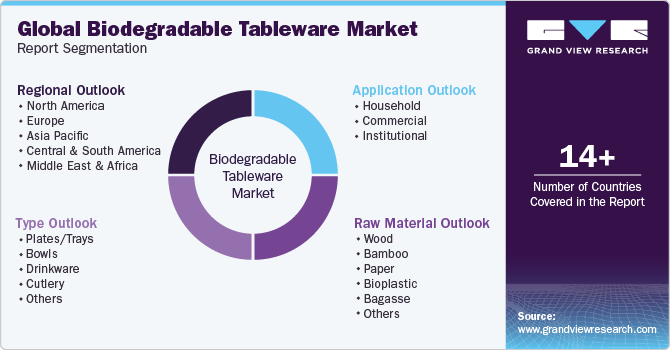

Biodegradable Tableware Market Size, Share & Trends Analysis Report By Product (Plates/Trays, Bowls), By Raw Material (Wood, Bamboo), By Application (Household, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-180-1

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Consumer Goods

Biodegradable Tableware Market Trends

The global biodegradable tableware market size was estimated at USD 15.27 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030. Factors pushing the use of biodegradable tableware include growing consumer awareness about the negative impact of plastic pollution, government regulations, and bans on single-use plastics. With increasing government support for eco-friendly products, consumers are shifting towards sustainable alternatives such as biodegradable tableware. In October 2023, the National Development and Reform Commission (NDRC) of China launched a “Three-year action plan for promoting bamboo as an eco-friendly substitute for plastics”. The government aims to promote the use of bamboo in daily use articles such as bamboo tableware.

Manufacturers are investing heavily in research and development activities to develop innovative, eco-friendly materials that are affordable, functional, and aesthetically pleasing. These eco-friendly products have numerous benefits over conventional products, such as reduced waste, biodegradability, and sustainability. Key players in the industry are using both online and offline sales channels to cater to the growing consumer demand for eco-friendly products. In April 2023, Chuk, an India-based compostable tableware brand, announced a partnership with Zomato's Hyperpure to expand its online presence. In addition, the company had previously partnered with Blinkit in February 2022 to provide an instant delivery service of sustainable tableware products in India.

Increasing popularity of takeaway and delivery food services globally along with rise in environmental conscious customers is driving demand for eco-friendly solutions for reducing greenhouse emissions. To meet this demand, manufacturers are expanding their production lines to include sustainable options. In July 2021, for example, Novolex launched a new production line in the United States that produces compostable cold beverage cups made from plant-based plastic. These clear cups are made using polylactic acid (PLA), a type of plastic polymer created from starch-based plants such as corn, sugarcane, and wheat straw.

The widespread availability of sustainable raw materials, such as wood, rice husk, bamboo, paper, straw, wheat bran, bioplastics, sugarcane bagasse, pineapple waste, apple prunes, and banana waste, led manufacturers to introduce eco-friendly tableware products. In addition, the increase in consumers' disposable income and awareness of the benefits of biodegradable products has raised their focus on spending on premium eco-friendly products. The growth of the travel and tourism industry has also contributed to the rise in demand for such products. According to the World Tourism Organization (UNWTO), the total number of international tourist arrivals increased from 406.88 million in 2020 to around 965.32 million in 2022.

The hospitality industry, including hotels, resorts, cafes, and restaurants, has witnessed a rise in demand for biodegradable cutlery, plates, and drinkware due to increasing concerns about pollution caused by single-use plastics. Major global hotel chains have taken a pledge to reduce their use of single-use plastics through the Global Tourism Plastics Initiative (GTPI), led by the United Nations Environment Programme (UNEP) and the World Tourism Organization in collaboration with the Ellen MacArthur Foundation. In 2020, French travel and tourism operator, Club Med, phased out 23.1 million plastic items and packaging in its food and beverage services, equivalent to 101.1 metric tonnes, including cups, plates, forks, and spoons.

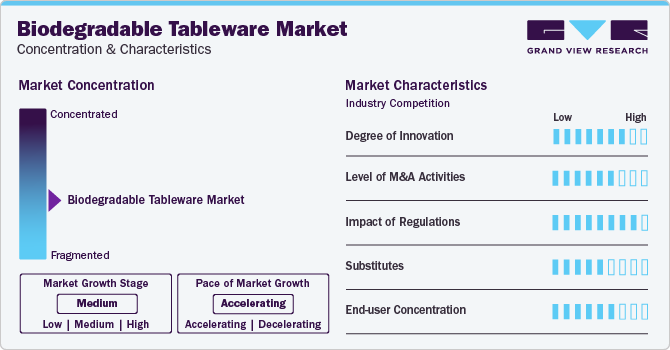

Market Concentration & Characteristics

Market growth stage is high, and the pace of the market growth is accelerating. The biodegradable tableware industry is characterized by a high degree of innovation due to the rapid technological advancements and development of biopolymers derived from agricultural waste, mycelium-based products, and algae-based composites. These innovations aim to address existing challenges such as limited water resistance, oil and grease absorption, and lack of heat tolerance. Emerging technologies like 3D printing are also being explored to create customizable and personalized biodegradable tableware options. In addition, smart coatings are being developed to enhance the functionality and sustainability of biodegradable products.

The biodegradable tableware industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new technologies, enhance their market share, and expand product offerings.

The biodegradable tableware market is also subject to increasing regulatory scrutiny. Governments around the world are implementing stricter regulations on single-use plastics, which is leading to a growing demand for sustainable alternatives. This trend is creating a positive effect on the biodegradable tableware industry. To stay competitive in this market, companies need to keep themselves updated on the latest regulations and ensure their products comply with the latest standards.

There are several direct product substitutes for biodegradable tableware. Biodegradable tableware is an alternative eco-friendly option to traditional plastic. However, it faces tough competition from other sustainable options such as tableware made from recycled materials and reusable tableware. To stand out in the market, companies in the biodegradable tableware industry should focus on highlighting the unique benefits of their products. They need to emphasize the convenience, portability, and compostability of their products to differentiate themselves from their competitors.

End-user concentration is a significant factor in the market. Several end-user industries are driving demand for biodegradable tableware solutions. The concentration of demand in a small number of end-user industries, particularly in restaurants, cafes, and catering businesses, creates opportunities for companies that focus on developing eco-friendly solutions for these industries. Diversifying product offerings and expanding into new end-use applications, such as households and institutions, can help mitigate these risks and ensure long-term market success. However, it also creates challenges for companies that are trying to compete in a crowded market.

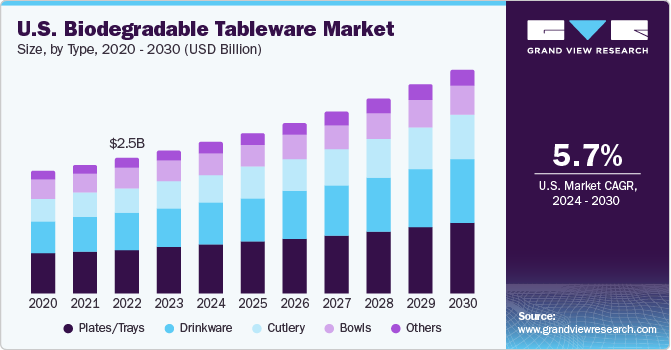

Type Insights

Plates/trays segment accounted for a maximum revenue share of 34.2% in 2023. Plates and trays are a convenient option for handling food, especially in restaurants, cafes, and catering services. The demand for takeaway and delivery food services is increasing, along with the growing popularity of outdoor events and picnics, which is driving the demand for plates and trays made from eco-friendly materials. There is a rising interest in compartmentalized plates with leak-proof and grease-resistant options for serving different food items. In July 2022, Hefty launched compostable printed paper plates and bowls that are made with 98 percent plant-based materials and are compostable.

Cutlery segment is anticipated to register a CAGR of 7.1% over the forecast period. The demand for heat-resistant and sturdy cutlery is increasing, leading to a rise in the demand for raw materials such as bamboo, wood, and other plant-based materials. Manufacturers are developing biodegradable cutleries with a focus on attractive ergonomic designs and user comfort. Furthermore, due to government bodies banning single-use plastic cutlery, manufacturers are developing cutleries from sustainable materials. From 1st October 2023, the UK government announced a ban on some single-use plastic products across England. Under this new rule, shops and hospitality businesses will no longer be able to supply plastic cutlery, balloon sticks, and polystyrene cups.

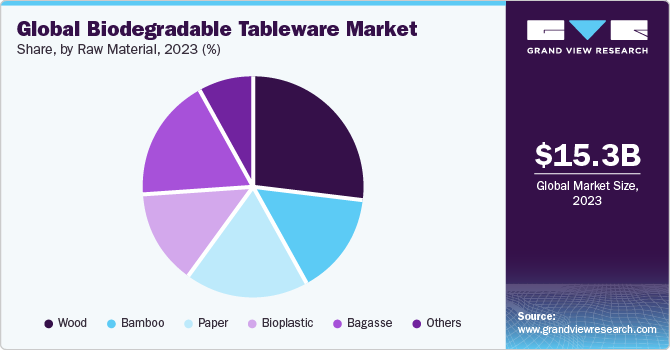

Raw Material Insights

Wood segment dominated the market with a revenue share of 26.5% in 2023. Wood offers a natural and attractive appearance, enhancing the dining experience for consumers. Growing demand for sturdy and durable tableware is driving the demand for wood products, especially cutleries, plates, stir sticks, and others. Due to its abundance of availability, affordability, and high compostability, wood is the preferred choice among tableware manufacturers. The biggest advantage of using wooden cutlery is that it is 100% compostable. Birch, maple, cherry, and oak are common type of hardwood used for making biodegradable tableware products.

Application Insights

Commercial segment dominated the market with a revenue share of 65.8% in 2023. Biodegradable tableware offers a sustainable and convenient option for catering events, weddings, and conferences. Thus, many events and catering service operators are utilizing biodegradable tableware as part of their sustainability initiatives. With the growing popularity of takeaway and delivery services, there is an increasing demand for eco-friendly disposables such as bagasse plates, wooden bowls and cutleries. Full-service restaurants are becoming more eco-conscious and are offering biodegradable tableware in guest rooms, restaurants, and events. Accor S.A., a French multinational hospitality company, has announced its plan to eliminate all guest-related single-use plastic items, including straws, stirrers, cutlery, plates, and cups, from their food and beverage services by 2025.

Institutional segment is set to expand at a CAGR of about 6% over the forecast period. Increasing environmental awareness within institutions such as schools, hospitals, and offices, along with government regulations and procurement policies favoring sustainable practices, are creating opportunities for business expansion. Biodegradable tableware offers a hygienic and eco-friendly option for serving food to patients and staff in hospitals and healthcare facilities. Moreover, stadiums, arenas, and other venues are now using biodegradable tableware to reduce their environmental impact and cater to eco-conscious fans. Educational institutions are also implementing sustainability initiatives, opting for biodegradable tableware for cafeterias, events, and vending machines. In February 2021, George Washington University announced a ban on single-use plastics, including water bottles, cutlery, candy wrappers, and bags.

Demand for paper based biodegradable tableware is set to expand at a CAGR of about 7% over the forecast period. Paper-based tableware is a lightweight and compact option, which makes it easy to transport and store. This makes it ideal for on-the-go consumption and events. Paper-based tableware is available in a wide range of designs, shapes, and sizes that cater to diverse consumer preferences and needs. Moreover, paper products are typically compostable in commercial composting facilities, contributing to a circular economy and reducing landfill waste. In June 2023, Sabert launched EcoEdge paper cutlery, which is both compostable and recyclable. The range comprises a spoon, serrated knife, and fork, and has been made using FSC-certified renewable materials. The pressed paperboard cutlery range has been designed to offer a sustainable and viable alternative to eco-conscious consumers and industries who wish to replace their plastic cutlery.

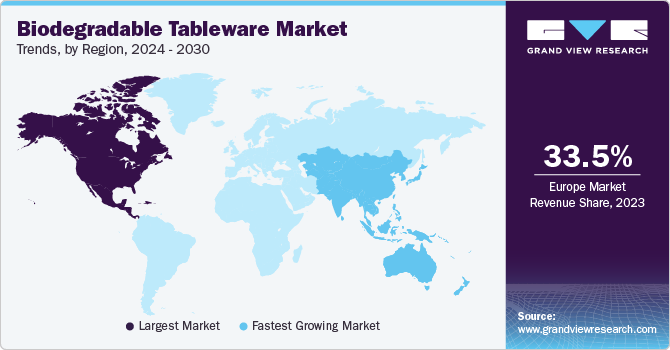

Regional Insights

Europe dominated the global industry with a revenue share of 33.5% in 2023. Europe has some of the strictest regulations when it comes to single-use plastics in the world. This includes bans and restrictions on items such as cutlery and plates. In December 2022, France banned single-use cutlery and tableware in dine-in restaurants, and fast food places in the country. As a result, there is a high demand for biodegradable alternatives in the region. Consumers in the region are highly aware of the environmental impact of synthetic plastics and are actively seeking eco-friendly products. Governments in the area are also promoting the use of biodegradable products through financial incentives and awareness campaigns. The EU has implemented a program to encourage businesses and consumers to switch to biodegradable tableware. They are offering financial incentives, tax breaks, and subsidies to businesses that invest in eco-friendly alternatives and adopt sustainable practices.

Asia Pacific is set to grow at a CAGR of about 7% over the forecast period. The Asia-Pacific region is experiencing rapid industrialization and urbanization, increasing in the middle-class population and consumers are opting to purchase premium and sustainable tableware. Moreover, the cultural preference for natural materials such as bamboo and sugarcane in Asia-Pacific leads to a higher acceptance of biodegradable tableware made from these materials. The food and beverage industry in the region, particularly the takeaway and restaurant sector, is thriving, resulting in a high demand for disposable tableware. For instance, there were around 17.03 million food service establishments in the Asia-Pacific region, accounting for 73.6% of the total number of food service establishments worldwide.

Key Companies & Market Share Insights

Some of the key players operating in the market include Pactiv LLC; Huhtamäki Oyj; Biotrem; PAPSTAR GmbH and Novolex

-

Pactiv LLC is a U.S.-based manufacturer and distributor of food packaging and foodservice products. The company products are distributed to foodservice, food processor, and retail grocery customers. Pactiv LLC operates through two segments including foodservice and consumer products. The food service segment offers a wide range of foodservice disposables, including plates, cups, cutlery, trays, and wraps. The consumer products segment focuses on food storage and preparation solutions, such as bags, wraps, containers, and aluminum foil.

-

Huhtamaki Oyj is a Finnish multinational packaging company with a global presence. The company has presenece in 37 countries and 116 locations around the world. The company’s product line of Bioware CPLA cutlery offers premium strength paired with sustainability. Bioware CPLA cutlery is made from Ingeo biopolymer, 100% compostable plastic made from renewable resources.

Genpak; BioPak; Dart Container Corporation; Reynolds Consumer Products LLC; and Bionatic GmbH & Co. KG are some of the emerging market participants in the biodegradable tableware industry.

-

Genpak is a U.S.-based food packaging manufacturer and innovator offering foam containers, plates, plastic bowls, clear deli containers, condiment cups, eco-friendly packaging, and custom engineered solutions. The company's manufacturing facilities are spread across 2.7 million square feet throughout North America.

-

Biopak is a plant-based compostable packaging company engaged in the production of cups, containers & lids, plates & trays, cutlery & straws, bags, napkins etc. BioPak combines innovative material design with a business model that is responsible and sustainable to create a truly regenerative brand.

Key Biodegradable Tableware Companies:

- Pactiv LLC

- Reynolds Consumer Products LLC

- Huhtamäki Oyj

- Genpak

- Bionatic GmbH & Co. KG

- Biotrem

- BioPak

- Novolex

- Dart Container Corporation

- PAPSTAR GmbH

Recent Developments

-

In June 2023, Seow Khim Polythelene Co (SKP), a Singapore-based supplier of disposable food packaging announced to expand its sustainable food packaging and cutlery range in Singapore to meet and serve the growing B2B and B2C need for food packaging through the manufacturing of its eco-friendly food packaging range.

-

In August 2021, Novolex announced the acquisition of Vegware, the UK-based compostable foodservice packaging company. The products of Vegware will complement the existing product line of Eco-Products, which is made of renewable materials that can be recycled or composted. This partnership will help Novolex to expand its presence in Europe and offer better access to the North American market.

Biodegradable Tableware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.23 billion

Revenue forecast in 2030

USD 24.69 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Pactiv LLC; Reynolds Consumer Products LLC; Huhtamäki Oyj; Genpak, Bionatic GmbH & Co. KG; Biotrem; BioPak; Novolex; Dart Container Corporation; PAPSTAR GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Biodegradable Tableware Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biodegradable tableware market report on based product, type, distribution channel, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Plates/Trays

-

Bowls

-

Drinkware

-

Cutlery

-

Others

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Wood

-

Bamboo

-

Paper

-

Bioplastic

-

Bagasse

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

Full Service Restaurants

-

Quick Service Restaurants

-

Catering

-

Others

-

-

Institutional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global biodegradable tableware market was estimated at USD 15.27 billion in 2023 and is expected to reach USD 16.23 billion in 2024.

b. The global biodegradable tableware market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 24.69 billion by 2030.

b. Europe dominated the biodegradable tableware market with a share of around 33.6% in 2023. Consumers in the region are highly aware of the environmental impact of synthetic plastics and are actively seeking eco-friendly products.

b. Some of the key players operating in the biodegradable tableware market include Pactiv LLC, Reynolds Consumer Products LLC, Huhtamäki Oyj, Genpak, Bionatic GmbH & Co. KG, Biotrem, BioPak, Novolex, Dart Container Corporation, PAPSTAR GmbH

b. Key factors that are driving the biodegradable tableware market growth include growing consumer awareness about the negative impact of plastic pollution, government regulations, and bans on single-use plastics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."