- Home

- »

- Plastics, Polymers & Resins

- »

-

Polystyrene Market Size And Share, Industry Report, 2030GVR Report cover

![Polystyrene Market Size, Share & Trends Report]()

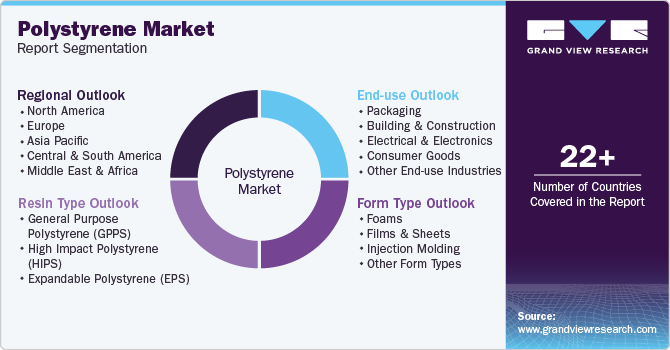

Polystyrene Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin Type (General Purpose Polystyrene (GPPS), High Impact Polystyrene (HIPS), Expandable Polystyrene (EPS)), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-138-3

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polystyrene Market Summary

The global polystyrene market size was estimated at USD 48.91 billion in 2024 and is anticipated to reach USD 61.36 billion by 2030, growing at a CAGR of 3.8% from 2025 to 2030. The increasing demand for polystyrene (PS) in the packaging industry. PS's lightweight and excellent insulation properties have made it a preferred choice for packaging materials, particularly in the food and beverage sector.

Key Market Trends & Insights

- Asia Pacific is the dominating region of the global polystyrene industry and accounted for more than 54.0% share of the overall revenue in 2024.

- The U.S. is a major consumer and producer of polystyrene, supported by robust industrial sectors.

- By resin type, High Impact Polystyrene (HIPS) is the dominating resin type of the global polystyrene market and accounted for more than 53.0% of the overall revenue in 2024.

- By form type, foams is the dominating form type segment of the global polystyrene market and accounted for more than 43.0% share of the overall revenue in 2024.

- By end-use, packaging is the dominating end-use segment of the global polystyrene market and accounted for more than 33.0% share of the overall revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 48.91 Billion

- 2030 Projected Market Size: USD 61.36 Billion

- CAGR (2025-2030): 3.8%

- Asia Pacific: Largest market in 2024

As consumers become more environmentally conscious, there is also a growing interest in sustainable and recyclable packaging solutions. In response to this trend, manufacturers are developing bio-based and recycled PS products to meet the evolving market demands. Moreover, another noteworthy trend in the polystyrene market is the expansion of the construction and automotive industries. PS foam boards and sheets find extensive applications in insulation and construction, while polystyrene is used in various automotive components, contributing to lightweighting efforts. These industries are poised for growth, especially in emerging economies, which is expected to drive the demand further. Additionally, the electronics and consumer goods sectors continue to rely on PS for manufacturing, further bolstering market growth. However, environmental concerns and regulations related to Polystyrene waste and recycling are becoming increasingly stringent, pushing companies to invest in research and development for more sustainable PS alternatives. In conclusion, the global market is evolving to meet the demands of both traditional and emerging industries, driven by sustainability considerations and innovative product development.

The polystyrene market in the U.S. has exhibited a dynamic landscape characterized by evolving trends and influential driving factors. The growing demand for expanded polystyrene (EPS) foam in the building & construction industry is one of the prominant trend for the PS market. EPS foam, known for its excellent insulation properties, is extensively used in residential and commercial construction for insulation panels and roofing materials. With a rising emphasis on energy efficiency and sustainable building practices, the demand for EPS foam insulation is expected to continue its upward trajectory. Additionally, the packaging sector remains a significant contributor to the market in the U.S. As e-commerce and food delivery services continue to expand, the need for protective packaging materials, including PS foam and rigid PS containers, has surged. Manufacturers are also focusing on developing PS products that are not only functional but also environmentally friendly to align with consumer preferences for sustainable packaging solutions.

The driving factor behind the PS market in the U.S. includes the nation's robust manufacturing sector. Polystyrene is a key component in the production of various consumer goods, such as electronics, toys, and disposable utensils, which are essential for everyday life. This consistent demand from manufacturers has been a stabilizing force in the U.S. PS market. Moreover, the automotive industry plays a pivotal role as a driving factor. Polystyrene is used in the production of various automotive components, contributing to lightweighting efforts and improving fuel efficiency in vehicles. However, it's important to note that environmental concerns and regulatory pressures are increasingly shaping the PS market in the U.S. as well. Legislation and consumer awareness around plastic waste and recycling have prompted industry players to explore sustainable alternatives and recycling initiatives, ushering in a transition toward more eco-friendly PS products in response to these evolving market dynamics.

Resin Type Insights

High Impact Polystyrene (HIPS) is the dominating resin type of the global polystyrene market and accounted for more than 53.0% of the overall revenue in 2024 due to its exceptional versatility, offering robust impact resistance and rigidity across various industries. HIPS is known for its robust impact resistance and rigidity, making it a preferred choice in the production of consumer goods, electronics, toys, and packaging materials. This broad utility has led to widespread adoption across various industries, contributing significantly to its market share.

Furthermore, the demand for HIPS has been boosted by its cost-effectiveness. HIPS is relatively affordable compared to some other engineering plastics, making it an attractive choice for manufacturers looking to maintain cost-efficiency without compromising on product quality. This cost advantage has been particularly appealing in industries like consumer electronics and automotive, where high-volume production is common. Additionally, the recyclability of HIPS has gained prominence in the context of sustainability and environmental concerns. As consumers and governments worldwide prioritize eco-friendly materials and recycling initiatives, HIPS's recyclability and compatibility with existing recycling infrastructure have further cemented its position as the leading resin type in the global PS market. In conclusion, the dominance of High Impact Polystyrene in the global market in 2024 can be attributed to its versatility, cost-effectiveness, and environmental considerations, making it a preferred choice for manufacturers across various sectors.

Form Type Insights

Foams is the dominating form type segment of the global polystyrene market and accounted for more than 43.0% share of the overall revenue in 2024 due to their widespread use in insulation and packaging applications, aligning with increased demand for energy efficiency and protective shipping solutions. PS foams are widely favored for their exceptional insulating properties. This makes them a go-to choice in the construction and building industry for applications like insulation panels and roofing materials. As energy efficiency continues to be a significant concern worldwide, the demand for effective insulation materials has surged, propelling the growth of polystyrene foam products.

Furthermore, polystyrene foams have found extensive use in the packaging sector. With the expansion of e-commerce and online retail, there has been a heightened need for protective packaging materials that can safeguard products during transit. PS foam's cushioning and shock-absorbing capabilities make it an ideal choice for shipping delicate and fragile items. Additionally, the lightweight nature of PS foams helps reduce shipping costs, further enhancing their appeal in the packaging industry.

Moreover, PS foam's versatility extends beyond construction and packaging. It is utilized in various consumer goods, including disposable tableware, food containers, and product packaging. Its low cost and ease of production make it an economical choice for manufacturers, contributing to its dominance in the polystyrene market. Lastly, as environmental concerns continue to drive the market, manufacturers are exploring sustainable alternatives within the PS foam category, such as biodegradable foams and recycling initiatives, ensuring that PS foam remains a formidable force in the global polystyrene market.

End-use Insights

Packaging is the dominating end-use segment of the global polystyrene market and accounted for more than 33.0% share of the overall revenue in 2024 due to its versatile qualities, including transparency, structural integrity, and insulation, making PS a favored choice for various packaging applications, from food containers to shipping materials, meeting diverse industry needs. Polystyrene possesses a unique set of properties that make it exceptionally well-suited for various packaging applications. Its transparency allows consumers to easily see and evaluate products, which is crucial for marketing and presentation. Additionally, PS offers rigidity and strength, ensuring that packaging maintains its structural integrity during transportation and handling. These characteristics are particularly important in the food and beverage industry, where polystyrene containers and packaging materials are widely used to keep perishable goods fresh and protected.

Furthermore, the rapid growth of e-commerce and online retail has significantly boosted the demand for packaging materials, further solidifying the packaging segment's dominance. With the increasing volume of goods being shipped globally, there's a heightened need for packaging solutions that can provide both protection and cost-efficiency. Polystyrene excels in this regard due to its ability to cushion and safeguard fragile items during transit, while also being lightweight, which helps reduce shipping costs. The visibility and clarity of PS packaging enhance the aesthetic appeal of products and contribute to consumer satisfaction. While sustainability concerns have led to greater scrutiny of PS packaging, ongoing efforts to develop recyclable and environmentally friendly PS alternatives ensure that it continues to be a preferred choice for packaging applications, maintaining its dominant position in the global industry. In conclusion, the packaging sector's dominance in the global market in 2024 is a result of PS's versatile properties, cost-effectiveness, and suitability for diverse packaging needs, particularly in the context of the expanding e-commerce industry and the focus on sustainable packaging solutions.

Regional Insights

Asia Pacific is the dominating region of the global polystyrene industry and accounted for more than 54.0% share of the overall revenue in 2024. The region dominates the global polystyrene market, primarily due to high consumption from emerging economies such as China, India, South Korea, and Southeast Asia. The region’s expanding packaging, electronics, and consumer goods industries are major growth drivers. Polystyrene is widely used in disposable food containers, insulation materials, and appliance housings, all of which are in strong demand due to the region’s rising middle class and urbanization. Moreover, the availability of raw materials, low production costs, and supportive government manufacturing policies make Asia Pacific a favorable hub for polystyrene production and export.

China leads the global polystyrene market in terms of both production and consumption. As the world’s largest manufacturing economy, China uses massive quantities of polystyrene in packaging, electronics, household appliances, and disposable products. Its large population and increasing consumerism drive domestic demand for food containers, insulation materials, and consumer electronics, all of which use polystyrene extensively. Additionally, local players such as CHIMEI and Sinopec dominate regional supply chains, ensuring cost-effective production.

North America Polystyrene Market Trends

The region’s growth in the polystyrene market is driven by its strong industrial base and high consumption in food packaging and appliances. Polystyrene’s use in disposable packaging, such as cups, trays, and clamshell containers, is prevalent across the U.S. and Canada, supported by the large food service and quick-service restaurant (QSR) industries. Additionally, the region’s well-developed construction sector fuels demand for EPS in thermal insulation applications.

The U.S. is a major consumer and producer of polystyrene, supported by robust industrial sectors such as packaging, automotive, electronics, and construction. Polystyrene’s affordability and functionality make it a staple in foodservice packaging, especially for foam containers and cups. Despite ongoing debates about environmental impact, polystyrene remains prevalent in fast-food chains and grocery packaging. Companies such as Dow and INEOS Styrolution maintain significant market share and production infrastructure within the country.

Europe Polystyrene Market Trends

Europe’s polystyrene market is driven by stringent energy efficiency regulations that boost EPS demand in the construction industry. Countries across the European Union, including Germany, France, and Italy, mandate high insulation standards for buildings, fueling the adoption of polystyrene-based materials. Moreover, Europe’s mature automotive and electronics sectors contribute to consistent demand for general-purpose and high-impact polystyrene (GPPS and HIPS). Moreover, sustainability trends in Europe are pushing the polystyrene market towards eco-friendlier practices. European firms are adopting innovative recycling methods and promoting reusable applications of polystyrene to align with EU Green Deal objectives.

Germany polystyrene market growthcan be attributed to its due to its advanced industrial base and strict energy efficiency regulations. The construction industry’s high demand for insulation materials, particularly EPS, is a major growth driver. Germany’s stringent building codes and support for passive housing fuel the adoption of energy-saving materials, including polystyrene-based products. Additionally, its strong presence in the automotive and appliance manufacturing sectors supports the use of GPPS and HIPS.

Key Polystyrene Company Insights

The market has been characterized by the presence of key players along with a few medium and small regional players. Major players are continuously working on developing polymers for the production of polystyrene owing to the rising demand for polystyrene components from end-use industries.

The global polystyrene market is a highly competitive market due to the presence of major industries across the region as these companies are comparatively concentrated and fiercely competitive along with product launch, acquisitions, mergers, and collaborations.

-

In February 2025, Trinseo launched the first transparent recycled polystyrene (rPS) product in Europe specifically designed for direct food contact applications, compliant with the EU Regulation 2022/1616. Produced at their Schkopau facility in Germany, the rPS contains 30% recycled content sourced from pre- and post-consumer polystyrene provided by Heathland and offers an estimated 18% reduction in carbon footprint compared to virgin polystyrene. This innovation enables applications such as dairy containers, hot and cold drink cups, food trays, and refrigerator parts, supporting sustainability goals and helping customers meet recycled content targets under the European Packaging and Packaging Waste Regulation (PPWR).

-

In January 2025, INEOS Styrolution launched mechanically recycled polystyrene for food contact applications, marking a significant breakthrough in circular packaging solutions. This innovation, developed through a multi-step mechanical recycling process including advanced sorting, washing, and a proprietary "super clean process," achieves food contact quality recyclates with purity levels previously only attained by PET bottle recyclates, complying with EU regulation 2022/1616. This development not only supports sustainability goals but also significantly reduces the environmental footprint compared to conventional polystyrene.

Key Polystyrene Companies:

The following are the leading companies in the polystyrene market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Molded Products

- Alpek S.A.B. de CV

- Americas Styrenics LLC (AmSty)

- BASF SE

- CHIMEI

- Formosa Chemicals & Fibre Corp.

- INEOS Styrolution Group GmbH

- Innova

- KUMHO PETROCHEMICAL

- LG Chem

- SABIC

- Synthos

- Total

- Trinseo

- Versalis SpA

Polystyrene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.99 billion

Revenue forecast in 2030

USD 61.36 billion

Growth rate

CAGR of 3.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands, China, India, Japan, South Korea, Australia, Thailand, Malaysia, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, UAE , South Africa

Key companies profiled

Atlas Molded Products, Alpek S.A.B. de CV, Americas Styrenics LLC (AmSty), BASF SE, CHIMEI, Formosa Chemicals & Fibre Corp., INEOS Styrolution Group GmbH, Innova, KUMHO PETROCHEMICAL, LG Chem, SABIC, Synthos, Total, Trinseo, Versalis SpA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polystyrene Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2025 to 2030. For the purpose of this study, Grand View Research has segmented the global polystyrene market report on the basis of resin type, form type, end-use, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

General Purpose Polystyrene (GPPS)

-

High Impact Polystyrene (HIPS)

-

Expandable Polystyrene (EPS)

-

-

Form Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Foams

-

Films & Sheets

-

Injection Molding

-

Other Form Types

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Building & Construction

-

Electrical & Electronics

-

Consumer Goods

-

Other End-use Industries

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polystyrene market size was estimated at USD 48.91 billion in 2024 and is expected to reach USD 50.99 billion in 2025.

b. The global polystyrene market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 61.36 billion by 2030.

b. Packaging accounted for the largest share of the global polystyrene market, with a revenue share of over 33.0% in 2024 due to its versatile qualities, including transparency, structural integrity, and insulation, making PS a favored choice for various packaging applications, from food containers to shipping materials, meeting diverse industry needs.

b. Major players present across the polystyrene market include Atlas Molded Products, Alpek S.A.B. de CV, Americas Styrenics LLC (AmSty), BASF SE, CHIMEI, Formosa Chemicals & Fibre Corp., INEOS Styrolution Group GmbH, Innova, KUMHO PETROCHEMICAL, LG Chem, SABIC, Synthos, Total, Trinseo, Versalis SpA

b. The polystyrene market is driven by its versatility, cost-effectiveness, and demand in industries such as packaging, construction, and insulation, along with growing environmental concerns pushing for more sustainable alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.