- Home

- »

- Biotechnology

- »

-

Biofilter Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Biofilter Market Size, Share & Trends Report]()

Biofilter Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Biological Aerated Biofilter System, Fixed Films), By Filter Media, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-026-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biofilter Market Size & Trends

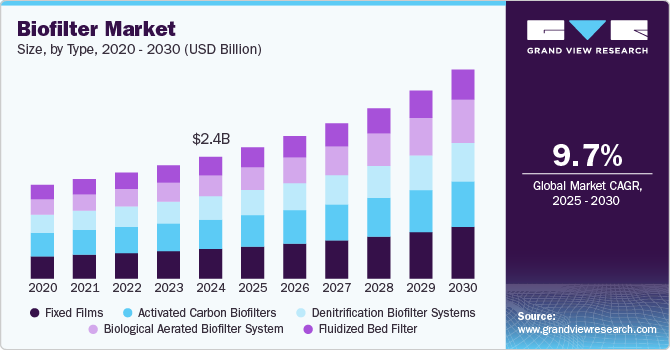

The global biofilter market size was estimated at USD 2.4 billion in 2024 and is projected to grow at a CAGR of 9.7% from 2025 to 2030. The increasing applications for biofiltration are expected to drive the market's growth. Since, biofiltration has a wider application in wastewater treatment, gas and oil plants, petrochemicals, and paint industries, the growth remains promising.

Some examples of biofiltration are seaweeds, which filter pollutants released from the gills of fish and other aquaculture animals. According to research on horticulture from Penn State University, plant roots combined with limestone and soil can be used to create a biofilter to filter wastewater. Bacteria present in plant roots can eliminate pollutants and convert wastewater into a usable resource.

The increasing initiatives and funding programs by universities to accelerate research in biofiltration are expected to support market growth. For instance, in December 2022, Hawai’i Pacific University received USD 188,000 grant from the National Oceanic and Atmospheric Administration. The funding is to assist in the scientific assessment of the biofiltration capacity of the limu, and its growth rate.

Similarly, in December 2022, the U.S. Department of Energy awarded USD 280,861 to North Carolina Agricultural and Technical State University for developing a system for biofiltration-microalgae symbiotic and microalgae-based biochar-hydrogel-iron composite. The system and composite are intended to enhance microalgal production in wastewater.

Furthermore, the regulatory bodies in developed countries are undertaking stringent actions to implement biofiltration systems for improving water quality. For instance, in November 2022, the New York state Department of Environmental Conservation (DEC) penalized the New England Waste Services of NY, Inc., Ontario Count, and Casella Waste Services of Ontario, LLC, for violating various environmental laws. The operators and facility owners are expected to pay USD 500,000 as a penalty. Around USD 250,000 will be invested by the authorities in setting up a biofiltration system in the Marsh Creek wastewater treatment plant.

Moreover, players in the market are constantly developing novel technologies to support biofiltration systems. At the Tekna aquaculture conference that was held in November 2022, NaturalShrimp, Inc. presented hydrogas and electrocoagulation technologies for the aquaculture industry. The technologies enable a system for zero liquid discharge without requiring water exchange to extract unnecessary nitrate buildup while using traditional methods of biofiltration. The development of novel technologies remains an integral part of the growth strategy in the industry.

Type Insights

The activated carbon biofilter segment held largest share of 24.2% of the biofilter market in 2024. The primary application of activated carbon biofilters is the treatment of municipal wastewater. Increasing environmental regulations, the need for efficient air and water purification, and technological advancements in filtration. Industrial expansion, especially in emerging economies, boosts demand for pollutant control solutions, while the focus on sustainability and green building initiatives further accelerates adoption. Additionally, activated carbon biofilters offer benefits such as cost-effectiveness and low-energy requirements, making them a preferred choice for industries aiming to reduce their environmental impact.

Biological aerated filter (BAFs) is the fastest-growing sub-segment in the market. It is expected to grow at a CAGR of 13.6% between 2025 and 2030. The Biological Aerated Filter (BAF) market is growing rapidly due to its high efficiency in treating wastewater and air pollution with a compact design requiring less space than traditional systems. BAF systems enhance microbial activity through aeration, leading to more effective pollutant removal while being energy-efficient. Their modular nature makes them suitable for both industrial and municipal applications, especially in areas with limited space. The focus on sustainable treatment solutions that reduce chemical usage and operational costs further drives their adoption across various industries

Filter Media Insights

The ceramic ring segment held the largest market share of 33.8% in 2024. It is considered to be significant biological filtration media for applications like filtration systems in aquariums. The ceramic ring filters the uneaten food waste, ammonia released from plant matter, and wastewater in fish tanks. Its advantages such as affordability, denitrifying bacteria, ease-of-use, long-lasting, and ease to clean application are expected to assist the segment to maintain its dominance during the forecast period.

Bio balls are anticipated to witness a significant growth rate of 10.5% from 2025 to 2030. The balls are also known as nitrate factories since it is designed with holes and grooves to accelerate the surface area. This results in the development of various stagnant areas where detritus can be easily captured. Its effectiveness in improving water quality is anticipated to be the key growth determinant of the segment.

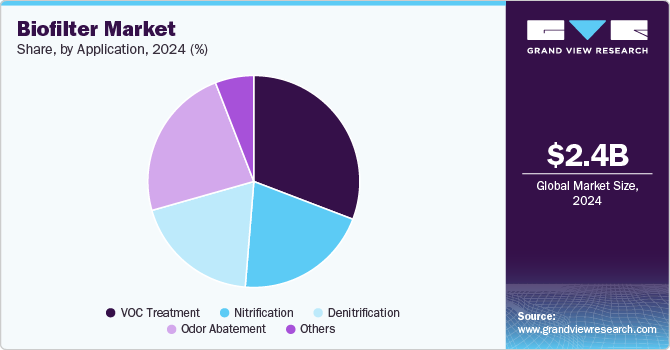

Application Insights

Volatile organic compounds (VOC) treatment held the largest market share of 30.8% in in 2024. Various industries such as automobiles are mandated to build VOC treatment plants by regulatory bodies. For instance, in April 2022, the Michigan Department of Environment ordered a motor parts manufacturer, ZF Active Safety U.S. Inc. to install a treatment system forchlorinated volatile organic compounds. Since the presence of VOC posed a threat of contamination to the water supply of Milford village.

Odor abatement is projected to have the fastest growth rate of 12.9% during the forecasted period. Regulatory bodies such as Federal Clean Air Act (CAA), has not specifically designed regulation framework for odors. However, there are around 187 dangerous air pollutants that are required to be under control by the U.S. EPA. Biofiltration is one of the measures for removing gaseous pollutants.

End-use Insights

Aquaculture segment held the largest market share of 23.7% in 2024. The demand for biofilters for aquarium cleaning and filtration is growing which boosts the biofiltration industry. As per recent research, biofilter manufacturers are developing cost-effective recirculating aquaculture systems (RAS) for small capital investment in fish farming. For instance, Aqua Shark Company collaborated with BioFishency company to develop simple operating RAS beneficial for fish farmers. The global biofilter industry is projected to exhibit significant growth in the upcoming years due to increased demand for fish farming. The market companies manufacturing biofilters mainly focus on improving the filtration rate and efficiency of the product and increasing sustainability. These factors enhance the overall productivity of the filters, which boosts the global biofiltration industry.

The water & wastewater collection segment is the fastest-growing segment for the biofiltration industry with an expected growth rate of 11.8% from 2025 to 2030. The increasing water scarcity in various parts of the globe is expected to accelerate the adoption of water reuse and the practice of wastewater treatment to make it drinkable. Biofiltration is an innovative technology to treat drinking water.

Regional Insights

North America biofilter market accounted for the largest share of 43.4% in the biofilter market in 2024, owing to the presence of major companies, extensive government funding, and an increase in research activities in the region. North America is the leading manufacturer of biofilters as the early implementation of biofiltration technique compared to other regions. The concept of self-cleaning aquariums with the application of biofiltration continues to boost market growth.

U.S. Biofilter Market Trends

U.S. biofilter market growth is primarily driven by stringent environmental regulations and the need for sustainable water and air treatment solutions, with advanced technologies enhancing efficiency in water purification and industrial processes.

Europe Biofilter Market Trends

The European biofilter market is growing due to strict environmental regulations and a focus on sustainable practices. Countries like Germany and the UK are leading in biofilter adoption for air and water treatment, driven by the need to reduce emissions and enhance water quality. Technological innovations and green initiatives further support market expansion across the region

Biofilter market in Germany is fueled by its technological advancements in biofilter materials and systems, particularly for industrial and municipal applications, backed by strict environmental policies

The UK biofilter market benefits from strong governmental policies aimed at reducing industrial emissions and promoting clean technologies, which are driving innovation in biofiltration for water and air quality management.

Asia Pacific Biofilter Market Trends

Asia Pacific is expected to grow at the highest rate during the forecasted period. Since the region is considered to be a major fishery market globally, contributing to the growth of the market. Moreover, rising environmental concerns and strict wastewater treatment regulations have boosted the growth of biofilter market in this region. Major countries such as China, Japan, and India are driving this growth through investments in sustainable technologies and infrastructure, making biofiltration an essential component for environmental compliance.

Japan biofilter market is expanding due to its focus on integrating biofilters with intelligent environmental control systems and the development of compact, high-capacity solutions for both industrial and household use

Biofilter market in China also has a high focus on wastewater treatment, with water treatment plants for wastewater treatment for about 98.1% of municipalities and around 28% of rural areas. China Biofilter market growth is influenced by its severe air and water pollution issues, leading to increased demand for efficient biofilters as part of large-scale environmental clean-up and industrial regulation initiatives

Middle East & Africa Biofilter Market Trends

Saudi Arabia biofilter market is growing due to the need for water treatment solutions in its arid climate, along with investments in sustainable technologies for industrial wastewater management

Biofilter market in UAE is growing due to the country's emphasis on innovative environmental solutions and sustainable development goals, with a focus on air quality improvement and wastewater treatment.

Key Biofilter Company Insights

The continuous demand for biofiltration solutions by multiple end use has created numerous market opportunities for major players to capitalize on.

Key Biofilter Companies:

The following are the leading companies in the biofilter market. These companies collectively hold the largest market share and dictate industry trends.

- Aquael

- Aquaneering, Inc.

- AZOO BIO CORPORATION

- EHEIM GmBh & Co. KG

- Pentair Aquatic Eco-systems, Inc

- Veolia Water Technologies

- Aqua Design Amano Co., Ltd.

- Zoo Med Laboratories, Inc.

- Waterlife Research Ind. Ltd.

Recent Development

-

In October 2024, Veolia Water Technologies opened a new Life Science center of excellence in Dublin, Ireland. This center is aimed at driving water treatment innovation, training, and growth in industries beyond the pharmaceutical, science, and healthcare industry in Europe.

-

In October 2024, Veolia Water Technology partnered with the University Area Joint Authority in State College, Pennsylvania, to implement its first biological hydrolysis system in North America. This collaboration aims to enhance decarbonized energy production in the region, supporting efforts to reduce carbon emissions and promote sustainable energy solutions.

-

In July 2024, Waterloo Biofilter Systems Inc. announced the acquisition of a specialist in advanced moving bed biofilm reactor technology, RH20, Inc. With this development, Waterloo expanded its technology portfolio.

Biofilter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.59 billion

Revenue forecast in 2030

USD 4.12 billion

Growth rate

CAGR of 9.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, filter media, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Aquael, Aquaneering, Inc.; AZOO BIO CORPORATION; EHEIM GmBh & Co. KG; Pentair Aquatic Eco-systems, Inc; Aqua Design Amano Co.,Ltd.; Veolia Water Technologies; Zoo Med Laboratories, Inc.; Waterlife Research Ind. Ltd

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biofilter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global biofilter market report based on type, filter media, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biological Aerated Biofilter System

-

Denitrification Biofilter Systems

-

Activated Carbon Biofilters

-

Fixed Films

-

Fluidized Bed Filter

-

-

Filter Media Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic Rings

-

Bio Balls

-

Moving Bed Filter Media

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

VOC Treatment

-

Nitrification

-

Denitrification

-

Odor Abatement

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Storm Water Management

-

Water & Wastewater collection

-

Chemical processing

-

Food & Beverage

-

Aquaculture

-

Biopharma industry

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biofilter market size was estimated at USD 2.40 billion in 2024 and is expected to reach USD 2.59 billion in 2025

b. The global biofilter market is expected to grow at a compound annual growth rate of 9.74% from 2025 to 2030 to reach USD 4.12 billion by 2030.

b. North America dominated the biofiltration market with a share of 43.37% in 2024. This is attributable to rising biofilter awareness coupled with rising environmental consciousness among industry sectors including such food processing, pharma, and others.

b. Some key players operating in the biofilter market include Aquael, Aquaneering, Inc., EHEIM GmBh & Co. KG, Pentair Aquatic Eco-systems, Inc, Aqua Design Amano Co.,Ltd., Veolia Water Technologies, Aqua Design Amano Co.,Ltd., Zoo Med Laboratories, Inc., and others.

b. The biofiltration market is primarily driven by rising water pollution and the global spread of waterborne diseases. Furthermore, rising fish consumption also benefits biofilter manufacturers in aquaculture & fisheries and further boost the biofiltration market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.