- Home

- »

- Renewable Energy

- »

-

Global Biogas Market Size, Share & Growth Report, 2030GVR Report cover

![Biogas Market Size, Share & Trends Report]()

Biogas Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Municipal, Agricultural, Industrial), By Application (Vehicle Fuel, Electricity, Heat, Upgraded Biogas, Cooking Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-208-2

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biogas Market Summary

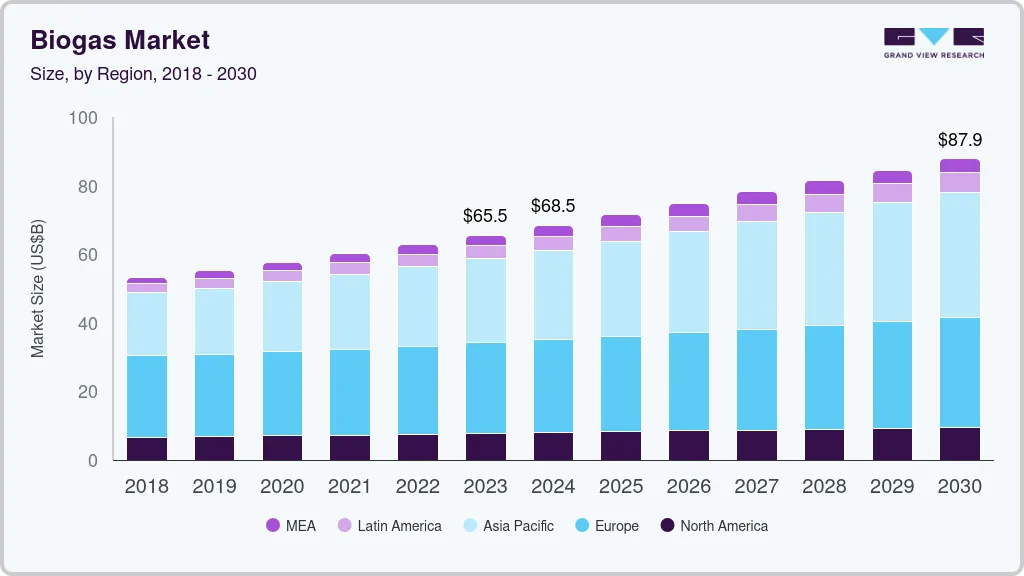

The global biogas market size was estimated at USD 65.53 billion in 2023 and is projected to reach USD 87.86 billion by 2030, growing at a CAGR of 4.2% from 2024 to 2030.The industry is expected to witness growth due to increasing product demand from various application segments, including heat, electricity, upgraded biogas, vehicle fuel, and cooking gas.

Key Market Trends & Insights

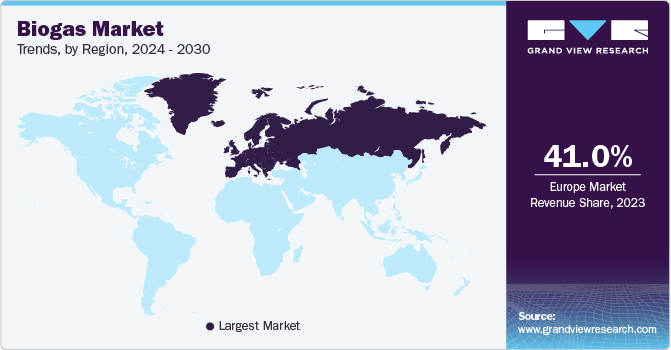

- Europe was the dominant regional segment and accounted for about 41% of revenue share in 2023.

- Italy's biogas market growth is driven by government efforts to move toward decarbonization.

- By application, the electricity application segment led the market and accounted for around 30% of the revenue share in 2023.

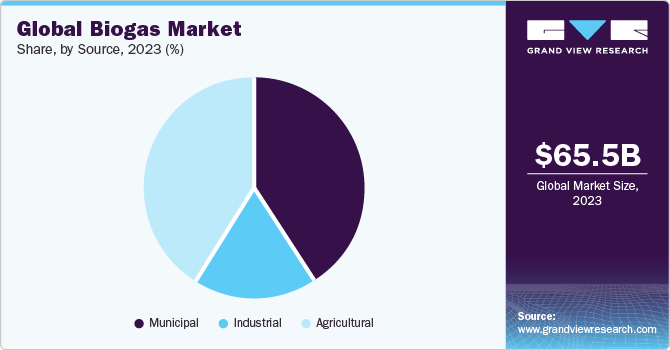

- By source, municipal sources accounted for the largest revenue share of 41.35% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 65.53 Billion

- 2030 Projected Market Size: USD 87.86 Billion

- CAGR (2024-2030): 4.2%

- Europe: Largest market in 2023

Moreover, a shift in focus toward the use of renewable energy, particularly in the electric power sector, has significantly driven biogas demand in electricity applications. Also, the rising need to reduce dependency on fossil fuels is creating lucrative opportunities for biogas in vehicle fuel applications.

The U.S. emerged as one of the largest markets for biogas in North America in 2023 and is anticipated to expand at a substantial CAGR, based on revenue, over the projection period. The country's government has introduced a number of regulations to reduce its dependency on conventional fuels and meet its zero carbon emissions target. Significant factors that influence market growth such as favorable regulatory & political support, environmental support, and customer support, geopolitical support, agricultural and economic support.

Biogas demand in North America is primarily driven by the U.S. Growing demand in applications, such as cooking gas, electricity, vehicle fuel, heat, and others, is expected to have a positive impact on industry growth over the forecast period. Major factors supporting the regional market include high demand for green fuels, stringent environmental regulations, and increased investment for the development of refineries.

The abrupt onset of the COVID-19 pandemic caused an industrial lockdown that brought all manufacturing activity to a grinding halt in most industries around the world. Hence, it has also impacted product demand in heat generation applications. Sluggish industrial activities have reduced demand for heat consumption, thereby negatively affecting demand for biogas.

Market Dynamics

As per the International Renewable Energy Agency (IRENA), transitioning to biogas for use as vehicle fuel can lead to reductions in greenhouse gas emissions by 60-80%, when compared to fossil fuels. Owing to the issue of climate change and rising environmental concerns, a majority of governments have set targets to cut down their emissions. Thus, there have been significant investments in renewable energy and alternative fuels, with the trend expected to continue in the near future. For example, in February 2021, Clean Energy Fuels Corp. signed a deal with the Los Angeles County Metropolitan Transportation Authority (Metro) for around 47.5 million gallons of its renewable natural gas (RNG) to fuel the largest transit bus fleet in the country. The agreement would mark the completion of Metro’s 5-year goal to shift its diesel fleet to cleaner, low-carbon fuel, with 2,400 buses powered by RNG. Thus, an increasing inclination toward environment-friendly products to reduce emissions is expected to fuel demand for biogas over the forecast period.

However, the high initial investment required to establish a biogas plant is expected to restrain market growth. The cost of biogas plant construction comprises land, materials, equipment, and labor. Financial aid is needed for developing and expanding biogas facilities. The process to procure and store raw materials is time-consuming and expensive. Regulation and financial assistance are required for collecting, sorting, processing, supplying, and distributing feedstock; plant construction & operation; and biogas sale & distribution. Output of the plant needs to be sufficient and consistent to cover the installation and operating costs.

Application Insights

The electricity application segment led the market and accounted for around 30% of the revenue share in 2023. Growing attention to renewable energy uses, particularly in the electric power sector, has significantly increased the use of biogas for electricity generation.

In 2022, approximately 220 million kWh of electricity was generated using biogas (from 24 livestock and dairy operations) and from industrial and sewage wastewater treatment facilities approx. 1 billion kWh of electricity was produced in the U.S. Biogas qualifies as a renewable energy fuel in the country, to generate electricity as per the state renewable electricity standards (RES).

The upgrade biogas segment is expected to expand substantially over the forecast period, aided by the rising biofuel demand in various end-use sectors, including automotive. Upgrade biogas is the result of converting biogas into biomethane by removing hydrogen sulfide, water, carbon dioxide, and contaminants from biogas.

Source Insights

Municipal sources accounted for the largest revenue share of 41.35% in 2023. Growing usage of this municipal solid waste (MSW) in biogas production for reducing landfills and greenhouse emissions is expected to support market demand over the forecast period.

The industrial segment is expected to witness significant growth over the estimated period. A growing interest in finding effective means to obtain bio-products and biofuel from industrial food waste coupled with an increasing need for wastewater treatment in the industrial sector is expected to fuel market demand over the forecast period.

Regional Insights

Europe was the dominant regional segment and accounted for about 41% of revenue share in 2023. The European biogas sector is growing owing to technological developments and increasing investments in the refinery industry. Companies across Europe are investing huge capital in research and development of biogas production from existing sources and planning to increase their share of feedstock over the next few years. This will fuel regional market growth.

Italy's biogas market growth is driven by government efforts to move toward decarbonization. For instance, in March 2021, Eni SpA (BIT: ENI) agreed to buy an Italian biogas company from FRI-EL Greenpower, a Gostner family holding, through its circular economy subsidiary, ‘Ecofuel’. This acquisition, however, is yet to be approved by relevant antitrust authorities.

Key Companies & Market Share Insights

Biogas industry is highly competitive due to the global presence of major companies. Key biogas solutions & service providers include Air Liquide, PlanET Biogas, Wartsila, EnviTech Biogas AG, Robert Bosch GmbH, Asia Biogas, and Schmack Biogas GmbH. Air Liquide, PlanET Biogas, Wartsila, and EnviTech Biogas AG are full-scale manufacturers and leaders in terms of investment in R&D.

Spanish companies are taking active steps to drive the adoption of biogas in the country. For instance, Repsol, a Spanish fuel company, in June 2020, announced the development of an industrial-scale biogas project.

Key Biogas Companies:

- Agrinz Technologies GmbH

- Air Liquide

- DMT International

- Gasum Oy

- HomeBiogas Inc.

- PlanET Biogas

- Scandinavian Biogas Fuels International AB

- Schmack Biogas Service

- Total

- Xebec Adsorption Inc.

Biogas Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 68.48 billion

Revenue forecast in 2030

USD 87.86 billion

Growth Rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Russia; Italy; U.K.; Germany; Switzerland; Spain; France; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; UAE

Key companies profiled

Agrinz Technologies GmbH; Air Liquide; DMT International; Gasum Oy; HomeBiogas Inc; PlanET Biogas; Scandinavian Biogas Fuels International AB; Schmack Biogas Service; Total;Xebec Adsorption Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biogas Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global biogas market report based on source, application, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Landfill

-

Wastewater

-

-

Industrial

-

Food Scrap

-

Wastewater

-

-

Agricultural

-

Dairy

-

Poultry

-

Swine Farm

-

Agricultural Residue

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vehicle Fuel

-

Electricity

-

Heat

-

Upgraded Biogas

-

Cooking Gas

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Italy

-

France

-

Russia

-

U.K.

-

Spain

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biogas market size was estimated at USD 65.53 billion in 2023 and is expected to reach USD 68.48 billion in 2024.

b. The global biogas market is expected to witness a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 87.86 billion by 2030.

b. Electricity accounted for the largest application segment in 2023 and is expected to grow at a CAGR of about 3.3% over the forecast period.

b. Scandinavian Biogas Fuels International AB, Schmack Biogas Service, Gasum Oy, TotalEnergies, Agrinz Technologies GmbH, Homebiogas Inc, Xebec Adsorption Inc., DMT International, Air Liquide, PlanET Biogas are some of the key companies operating in the biogas market.

b. The global biogas market is expected to be driven by the increasing demand from various applications such as electricity, heat, vehicle fuel, upgraded biogas, and cooking gas. The growing need to reduce emissions is expected to aid the overall market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.