- Home

- »

- Agrochemicals & Fertilizers

- »

-

Bioherbicides Market Size & Share, Industry Report, 2030GVR Report cover

![Bioherbicides Market Size, Share & Trends Report]()

Bioherbicides Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Grains & Cereals, Oil seeds, Fruits & Vegetables, Turf & Ornamental Grass), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: 978-1-68038-850-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioherbicides Market Summary

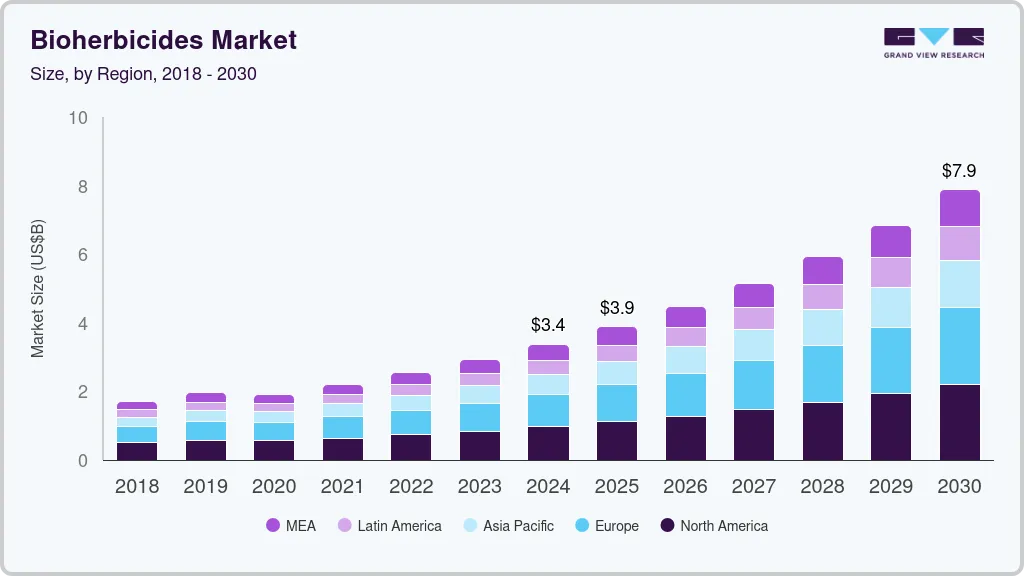

The global bioherbicides market size was estimated at USD 3,369.4 million in 2024 and is projected to reach USD 7,873.2 million by 2030, growing at a CAGR of 15.2% from 2025 to 2030. As awareness of the harmful effects of synthetic herbicides increases, farmers are seeking alternative solutions that are safer for the environment, human health, and beneficial insects.

Key Market Trends & Insights

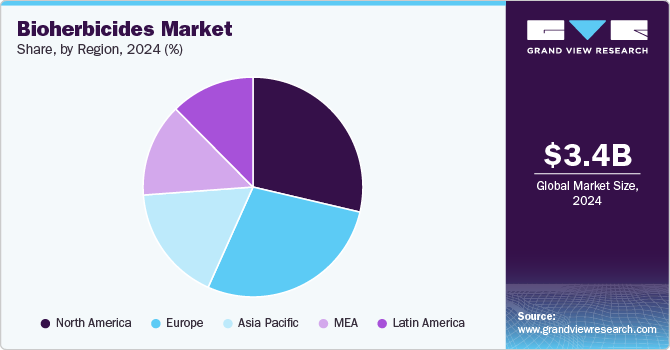

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, turf & ornamental grass accounted for a revenue of USD 1,078.3 million in 2024.

- Turf & Ornamental Grass is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,369.4 Million

- 2030 Projected Market Size: USD 7,873.2 Million

- CAGR (2025-2030): 15.2%

- North America: Largest market in 2024

Bioherbicides, derived from natural organisms or substances, provide a viable weed control solution without the negative environmental impact of traditional chemical herbicides.

The growing adoption of integrated pest management (IPM) systems proliferates the market. IPM strategies aim to combine biological, cultural, mechanical, and chemical control methods to manage pests and weeds while minimizing the use of chemicals. Bioherbicides fit perfectly into IPM as they are a natural and non-toxic alternative to conventional herbicides, offering a targeted approach to weed control. This growing trend towards sustainable agriculture, where bioherbicides are seen as an essential tool for weed management, is driving their adoption among farmers globally.

The increasing regulatory pressure on chemical herbicides is also fueling market growth. Governments worldwide are tightening regulations on the use of synthetic herbicides due to concerns about their long-term effects on soil health, water quality, and biodiversity. Many countries encourage the development and use of bio-based products through financial incentives, subsidies, and research grants. This regulatory shift pushes agricultural companies to invest in research and development to create new and effective bioherbicides, further stimulating market growth.

Technological advancements in biotechnology and microbiology are another major factor contributing to the growth of the bioherbicide industry. Innovations such as developing microbial-based bioherbicides, including bacteria, fungi, and viruses, have expanded the range of bioherbicides available to farmers. These advancements have created more effective, target-specific products that offer improved weed control with minimal impact on non-target species. The growing investment in research and innovation is making bioherbicides more accessible and efficient, which is increasing their popularity among farmers.

Drivers, Opportunities & Restraints

Traditional herbicides often lead to soil degradation, water contamination, and adverse effects on non-target organisms. As consumers and regulatory bodies demand more sustainable agricultural practices, bioherbicides, natural or biological substances that control weeds, are emerging as a safer alternative. These products, which often consist of microorganisms, plant-based compounds, or other natural ingredients, are perceived as environmentally friendly and less toxic, thus fueling their adoption in modern farming.

Opportunities within the bioherbicides industry are abundant due to the expanding global organic farming sector and the growing consumer shift toward natural and sustainably produced food products. As organic farming continues gaining traction, bioherbicides are essential for effective weed management without relying on conventional chemical pesticides. In addition, advancements in biotechnology and microbiology open new possibilities for developing more efficient and tailored bioherbicides. Companies are increasingly focusing on the research and development of novel formulations, offering improved efficacy, longer shelf life, and broader weed control spectrum, which could enhance the adoption of bioherbicides in mainstream agriculture.

Despite the promising growth prospects, the bioherbicides industry faces several restraints that may limit its expansion. One significant challenge is the relatively lower efficacy of bioherbicides than chemical herbicides, which can deter farmers from seeking immediate and high-performance solutions. The need for more precise application techniques and a greater understanding of the environmental conditions for optimal bioherbicide performance can also complicate its widespread adoption.

Moreover, the cost of production and the lack of sufficient infrastructure for large-scale manufacturing and distribution could hinder accessibility, particularly in developing markets where traditional herbicides are more affordable and readily available. These factors may slow the transition toward bioherbicides in some regions.

Application Insights

Based on application, the fruits & vegetables segment led the market with the largest revenue share of 27.57% in 2024. Traditional chemical herbicides often leave harmful residues on fruits and vegetables, posing health risks to consumers and polluting the ecosystem. Bioherbicides, on the other hand, offer a safer option for weed management, reducing chemical residue levels and improving soil health over time. The growing regulatory pressure on chemical pesticides in agriculture further accelerates the demand for bioherbicides in cultivating fruits and vegetables.

The turf & ornamental grass segment is anticipated to register at the fastest CAGR of 15.5% over the forecast period. The shift toward organic lawn care and landscaping fosters the demand for bioherbicides that align with organic certification standards. Bioherbicides are critical for maintaining healthy turf and ornamental grass without relying on harmful synthetic chemicals. As the demand for organic and pesticide-free gardens, lawns, and green spaces rises, bioherbicides are gaining traction as a natural alternative that ensures effective weed control while preserving the health of the plants, soil, and surrounding ecosystem.

Regional Insights

North America dominated the bioherbicides market with the largest revenue share of 28.67% in 2024. Regulatory bodies such as the Environmental Protection Agency (EPA) are increasingly enforcing stricter regulations on the use of chemical herbicides due to concerns over their toxicity and long-term environmental effects. This has increased emphasis on developing and approving biopesticides, including bioherbicides.

U.S. Bioherbicides Market Trends

The bioherbicides market in the U.S. accounted for the largest revenue share in North America in 2024. Organic farming regulations prohibit synthetic chemicals, creating a growing demand for natural herbicide solutions. Bioherbicides are a vital component in the toolkit for organic farmers, enabling them to control weeds effectively without compromising their organic certification. As the organic food market expands, driven by consumer preferences for pesticide-free produce, the demand for bioherbicides will continue rising.

Moreover, the Organic Transition Initiative (OTI), a USD 300 million initiative by the USDA, aims to facilitate farmers' transition to organic practices while enhancing organic market infrastructure. This program is crucial for farmers who face a challenging three-year transition period during which they must manage their land without synthetic pesticides before achieving organic certification. As more farmers transition to organic farming methods under initiatives like the OTI, there is an increasing demand for sustainable pest management solutions, including bioherbicides.

Asia Pacific Bioherbicides Market Trends

The bioherbicides market in Asia Pacific is anticipated to experience at a significant CAGR during the forecast period, as farmers in key countries such as India, China, and Japan are becoming more conscious of the adverse effects of chemical herbicides on health, the environment, and biodiversity. As a result, there is a growing shift toward natural and eco-friendly alternatives, such as bioherbicides, which are non-toxic, biodegradable, and environmentally sustainable.

Europe Bioherbicides Market Trends

The bioherbicides market in Europe is anticipated to experience at a significant CAGR during the forecast period. The European Union has implemented stringent laws to reduce the use of harmful chemical pesticides to safeguard the environment and public health. The European Green Deal and the Farm to Fork Strategy are integral to this shift, encouraging the use of safer, more sustainable alternatives to chemical herbicides. These regulations are pushing farmers to seek bioherbicide solutions as an efficient way to comply with these rules while still maintaining crop yields and productivity.

Latin America Bioherbicides Market Trends

The bioherbicides market in Latin America is anticipated to grow at a substantial CAGR during the forecast period. Latin American countries, such as Argentina and Brazil, have witnessed an increase in demand for organic products, both domestically and for export, due to consumer preference for clean, pesticide-free produce. This growing trend toward organic farming is expected to fuel the demand for bioherbicides, as they provide an effective solution that aligns with organic certification standards.

Middle East & Africa Bioherbicides Market Trends

The bioherbicides market in the Middle East & Africa is anticipated to grow at a significant CAGR during the forecast period. The key countries in the Middle East, such as Saudi Arabia and the United Arab Emirates, face severe water shortages, which significantly impact agricultural practices. Using chemical herbicides, which can harm soil and water resources, has led to a growing concern over their long-term sustainability. Bioherbicides, with their reduced environmental impact, are a potential solution to mitigate these issues. These products require fewer water resources, making them an attractive option for water-scarce regions looking to protect their agricultural productivity while maintaining environmental sustainability.

Key Bioherbicides Company Insights

Some of the key players operating in the market include Hindustan Bio-tech, MycoLogic Inc., Engage Agro US, and others.

-

Hindustan Bio-Tech is a pioneering company in biotechnology, focusing on sustainable agricultural solutions. The company specializes in developing and producing bioherbicides, which are environmentally friendly alternatives to chemical herbicides. These bioherbicides are derived from natural organisms and substances, effectively targeting specific weeds while minimizing harm to crops and beneficial organisms.

-

Engage Agro US specializes in providing innovative agricultural solutions, mainly focusing on sustainable practices through developing and distributing bioherbicides. These bioherbicides leverage biological mechanisms, such as microbial activity or plant extracts, to effectively manage weeds without the adverse effects of traditional chemical herbicides.

Key Bioherbicides Companies:

The following are the leading companies in the bioherbicides market. These companies collectively hold the largest market share and dictate industry trends.

- Marrone Bio Innovations Inc.

- Emery Oleochemicals

- Harpe Bio

- Verdesian Life Sciences

- Certified Organics Australia PTY Ltd

- Syngenta

- Special Biochem Pvt. Ltd

- Seipasa

- FMC Corp

- Bioherbicides Australia PTY Ltd

- Herbanatur

- Certis Biologicals

Bioherbicides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.88 billion

Revenue forecast in 2030

USD 7.87 billion

Growth rate

CAGR of 15.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; China; India; Japan; Australia; Brazil; and Saudi Arabia

Key companies profiled

Marrone Bio Innovations Inc.; Emery Oleochemicals; Harpe Bio; Verdesian Life Sciences; Certified Organics Australia PTY Ltd; Syngenta; Special Biochem Pvt. Ltd; Seipasa; FMC Corp; Bioherbicides Australia PTY Ltd; Herbanatur; Certis Biologicals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioherbicides Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioherbicides market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Grains & Cereals

-

Oil seeds

-

Fruits & Vegetables

-

Turf & Ornamental Grass

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bioherbicides market size was estimated at USD 3.37 billion in 2024 and is expected to reach USD 3.88 billion in 2025.

b. The global bioherbicides market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2030 to reach USD 7.87 billion by 2030.

b. Fruits & Vegetables accounted for the largest revenue share 27.6% in 2024 of bioherbicides market owing to increased consumer preference for organic fruits and vegetables, which align with sustainable farming practices.

b. Some of the key players operating in the bioherbicides market include Marrone Bio Innovations Inc., Emery Oleochemicals, Harpe Bio, Verdesian Life Sciences, among others.

b. The key factors that are driving the bioherbicides market include the rising demand for organic food products coupled with increasing awareness of the harmful effects of chemical herbicides on human health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.