- Home

- »

- Power Generation & Storage

- »

-

Bioliquid Heat And Power Generation Market Report, 2030GVR Report cover

![Bioliquid Heat And Power Generation Market Size, Share & Trends Report]()

Bioliquid Heat And Power Generation Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Bioethanol, Biodiesel), By Application (Heat Production, Electricity Generation), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-384-2

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioliquid Heat And Power Generation Market Summary

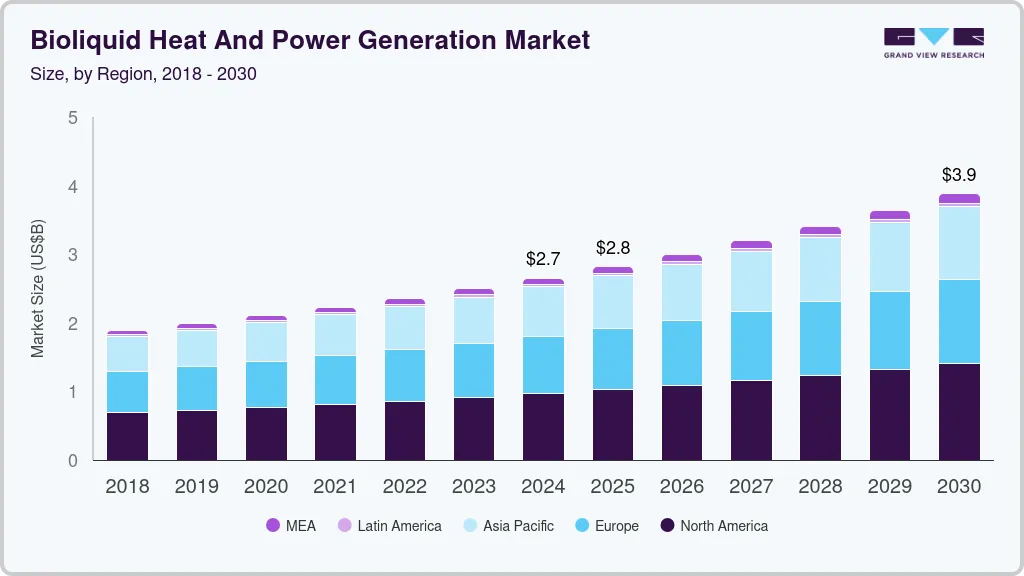

The global bioliquid heat and power generation market size was estimated at USD 2,650.7 thousand in 2024 and is projected to reach USD 3,878.7 thousand by 2030, growing at a CAGR of 6.6% from 2025 to 2030. Increasing demand for renewable and cleaner energy sources worldwide is likely to act as a key growth factor for the market.

Key Market Trends & Insights

-

North America held over 36% revenue share of the overall bioliquid heat and power generation market.

-

By type, bioethanol type segment held the largest revenue share of over 60% in 2023.

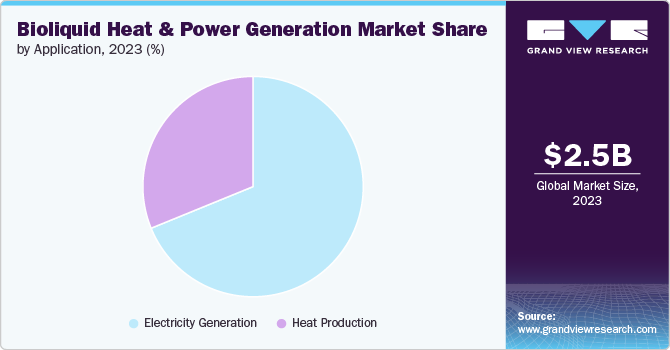

- By application, heat production application held the largest revenue share of over 55% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 2,650.7 Thousand

- 2030 Projected Market Size: USD 3,878.7 Thousand

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2023

The countries around the world are trying to reduce their carbon emissions and reliance on fossil fuels, in such scenario, bioliquids are likely to act as promising alternative. These renewable fuels are derived from biological materials, offering a sustainable and environmentally friendly solution for generating heat and electricity. Rising focus on sustainability, along with stringent governmental regulations on carbon emissions is anticipated to remain a driving factor for the market in the long run.

Drivers, Opportunities & Restraints

Increasing need for energy security and independence is likely to fuel the market growth over the coming years. Bioliquids provides an opportunity to diversify their energy sources reducing their vulnerability to geopolitical conflicts and fluctuations in oil prices. Using local biological resources countries can produce their own energy, minimizing their dependence on imported fossil fuels. Thus, energy self-sufficiency supports local economies and agricultural sectors and thus expected to boost the investments in this space.

High production and technology costs is anticipated to hinder the market growth over the short term. Conversion of biological materials to bioliquids requires technology and high capital investment. Additionally, the cost of setting up and maintaining the infrastructure for bioliquid production and power generation can be expensive. Thus such barriers mainly impact smaller players and countries with constrained budgets.

Development of advanced biofuels is anticipated to present multiple opportunities for market players. Biofuels made from non-food biomass and waste materials offer a solution to the food versus fuel debate that plagues first-generation biofuels. These advanced biofuels can be produced more sustainably and without competing with food production, paving the way for increased acceptance and utilization of bioliquids. Investment in research and development of these technologies are expected to benefit the market, making bioliquids an even more attractive and feasible energy source.

Type Insights

“Bioethanol type segment held the largest revenue share of over 60% in 2023.”

Bioethanol being one of the most widely used bioliquids for energy production is expected to dominate the market growth. It is produced from feedstocks like sugarcane, corn, and wheat, bioethanol is a versatile fuel that can be used in both heat and power generation. Governments' support through mandates and blending requirements has fostered the growth of the bioethanol market. Its relatively simple production process, low carbon emissions, and compatibility with existing energy infrastructure make it a key player in the renewable energy sector.

Technological advancements and innovations in bioethanol production, for products such as cellulosic and algae-based ethanol is anticipated to provide new opportunities for market participants. These next-generation products are garnering attention for their potential to produce energy more efficiently and sustainably compared to traditional products. Rising investment and research in these areas could significantly enhance the viability and attractiveness of bioethanol as a renewable energy source.

Application Insights

“Heat production application held the largest revenue share of over 55% in 2023.”

Bioliquids being cleaner, renewable alternative to conventional heating fuels like coal, oil, and natural gas are anticipated to benefit the market growth. Use of these products in residential and commercial heating systems provides a new avenues for decarbonizing the heating sector, which contributes to global greenhouse gas emissions. Moreover, their local production can support energy independence and security, further driving interest and investment in bioliquids space.

Bioliquids being flexible and renewable energy source helps power generation segment. These products can also be deployed in traditional combustion engines and turbines, making them suitable for both large-scale power plants and smaller, decentralized energy systems. This versatility allows for the deployment of bioliquids into existing energy infrastructures, facilitating the transition towards more sustainable energy practices. The ability of bioliquids to provide stable and controllable power generation can be incorporated with wind and solar and thus benefiting the market growth.

Regional Insights

“North America held over 36% revenue share of the overall bioliquid heat and power generation market.”

North America Bioliquid Heat And Power Generation Market Trends

Supportive governmental policies and incentives for biofuels are expected to act as a growing factor for the market growth. The region's commitment to reducing greenhouse gas emissions and its focus on increasing the share of renewables in the energy mix is anticipated to provide new opportunities for market participants.

U.S. Bioliquid Heat And Power Generation Market Trends

Incentives like Renewable Fuel Standard (RFS) Program and various state-level policies, is likely to increase adoption for bioliquids for heat and power generation. The U.S. has relatively a mature bioethanol industry compared to other countries, which serves as a foundation for expanding into other bioliquid segments.

Europe Bioliquid Heat And Power Generation Market Trends

European market is characterized by stringent environmental regulations and ambitious renewable energy goals, making it a promising region in the adoption of bioliquid heat and power generation technologies. Europe's focus on reducing its carbon footprint and enhancing energy security is likely to remain act as driving factor for the regional market.

Asia Pacific Bioliquid Heat And Power Generation Market Trends

Rapid economic growth in Asia Pacific and escalating energy demands is likely to act as growth factor for the market. Easy availability of agricultural residues and a pressing systems in countries such as China, India, and Southeast Asian are expected to push the production of biofuels.

Key Bioliquid Heat And Power Generation Company Insights

Some of key players operating in market include Argent Energy, Kraton and BTG.

-

Argent Energy deals with production of clean, and green biofuels from waste. The company focused on conversion of waste fats, oils, and greases into high-quality biodiesel, contributing to the global goals of reducing carbon emissions.

-

Kraton Corporation is one of the leading producer of engineered polymers and high-value bio-based products derived from wood pulping co-products. The company caters to different end markets, including adhesives, road and roofing applications, and personal care.

Key Bioliquid Heat And Power Generation Companies:

The following are the leading companies in the bioliquid heat and power generation market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland Company

- Argent Energy

- BTG

- Ensyn Fuels

- Kraton

- MBP Group

- Munzer Bioindustrie

- Neste

- Olleco

- REG

Recent Developments

-

In July 2024, Shell Nederland Raffinaderij announced temporary halt for construction work at its 820 kilotons capacity biofuel plant in Chemicals Park in Rotterdam.

-

In July 2024, Oceania Biofuels halted USD 339 million biofuel plant in Gladstone. The product is likely to be use for sustainable aviation and renewable diesel. The project was launched by the Queensland state government to benefit the local community.

Bioliquid Heat And Power Generation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,8117.8 thousand

Revenue forecast in 2030

USD 3,878.7 thousand

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East, Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Russia, China, India, Japan, South Korea, Brazil, GCC, South Africa

Key companies profiled

Archer Daniels Midland Company; Argent Energy; BTG; Ensyn Fuels; Kraton; MBP Group; Munzer Bioindustrie; Neste; Olleco, REG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioliquid Heat And Power Generation Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioliquid heat and power generation market report based on type, application, and region.

-

Type Outlook (USD Billion; 2018 - 2030)

-

Bioethanol

-

Biodiesel

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Heat Production

-

Electricity Generation

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bioliquid heat and power generation market size was estimated at USD 2.50 billion in 2023 and is expected to reach USD 2.65 billion in 2024.

b. The global bioliquid heat and power generation market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 3.88 billion by 2030.

b. By application, electricity generation dominated the market with a revenue share of over 68.0% in 2023.

b. Some of the key vendors of the global bioliquid heat and power generation market are Archer Daniels Midland Company, Argent Energy, BTG, Ensyn Fuels, Kraton, MBP Group, Munzer Bioindustrie, Neste, Olleco and REG.

b. The key factor driving the growth of the global bioliquid heat and power generation market is growing awareness around environment-friendly products and limited conventional energy sources

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.