- Home

- »

- Medical Devices

- »

-

Biological Implants Market Size, Share, Growth Report, 2030GVR Report cover

![Biological Implants Market Size, Share & Trends Report]()

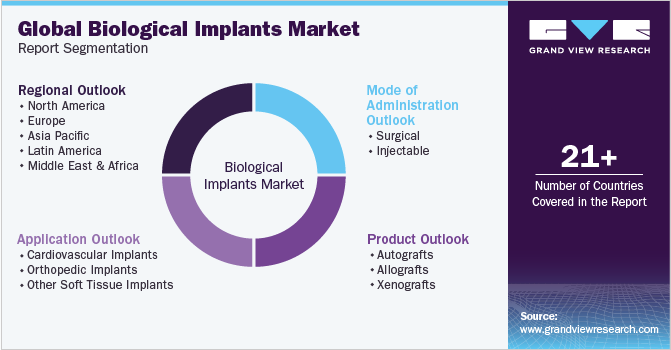

Biological Implants Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Autografts, Allografts), By Mode of Administration (Surgical, Injectable), By Application (Cardiovascular Implants), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-270-9

- Number of Report Pages: 147

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biological Implants Market Summary

The global biological implants market size was estimated at USD 7.91 billion in 2022 and is projected to reach USD 13.61 billion by 2030, growing at a CAGR of 7.2% from 2023 to 2030. Bio Implants are devices or tissues that are implanted into the human body to replace, enhance, or support a damaged or missing biological structure.

Key Market Trends & Insights

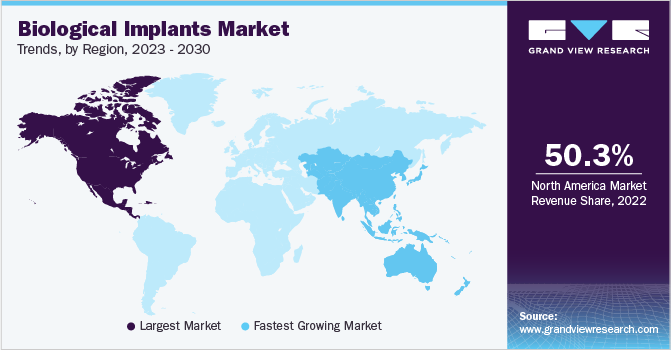

- The North America dominated the market with the largest revenue share of 50.3% in 2022.

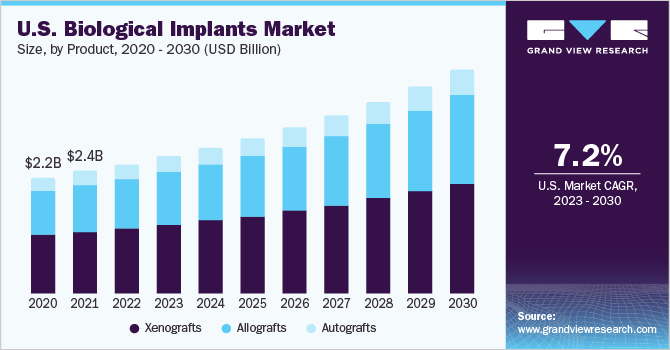

- Based on product, the xenografts segment dominated the market in 2022 with the largest revenue share.

- Based on application, the other soft tissue implants segment dominated the market with the largest revenue share in 2022.

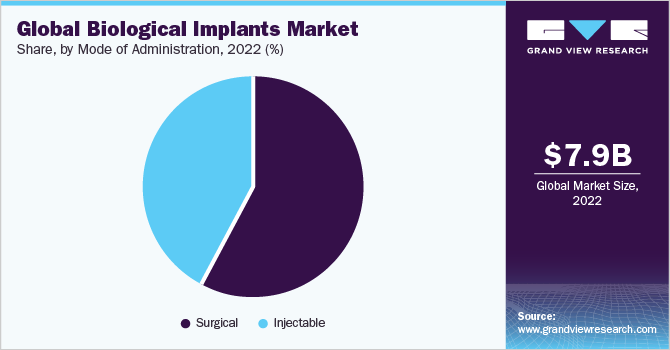

- Based on mode of administration, the surgical segment dominated the market with the largest revenue share of 57.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7.91 Billion

- 2030 Projected Market USD 13.61 Billion

- CAGR (2023-2030): 7.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

They are comprised of several biosynthetic components such as tissue-engineered products in clinical applications such as skin, cartilage, bone, heart valves, and bladder. Different materials including polymers, ceramics, and metals are used for biological implants. Some of the common types of bio-implants are dental implants, orthopedic implants, ocular implants, cosmetic implants, neural implants, and cardiovascular implants.

During the peak of the pandemic, many hospitals and healthcare facilities prioritized resources and capacity for COVID-19 patients. As a result, elective surgeries, including some implant procedures, were delayed or postponed. The global pandemic led to disruptions in supply chains, including the production and distribution of medical devices and implants affecting the scheduling and availability of biological implant surgeries. One of the main concerns regarding COVID-19 and biological implants was the risk of infection and inflammation.

Development in the regenerative medicine sector, which includes a variety of therapeutic approaches such as the utilization of bio-based materials and biologics for targeting the root cause of an ailment has sparked a new trend leading to increasing adoption of these products, which is one of the crucial factors propelling market growth over the forecast period. According to the Global Observatory on Donation and Transplantation, 2081 patients underwent heart transplantation across European countries during the COVID-19 pandemic. In the same year, 6,352 patients were on the active waiting list; 435 passed away while awaiting a suitable donor.

The utilization of soft tissue grafts in various intricate procedures, including abdominal wall reconstruction, thoracic reconstruction, and breast reconstruction, is driven by several significant factors. These factors include the lower contamination rates observed in bio-prosthetic mesh materials, their ability to maintain stable vascularization even in infected wound sites, and their capacity to reduce adhesions at visceral repair sites. These advantages contribute to the preference for soft tissue grafts over prosthetic mesh materials in these medical applications.

Product Insights

In terms of product, the xenografts segment dominated the market in 2022 with the largest revenue share owing to advancements in the field of vascular engineering and tissue engineering for the treatment of diseases. Xenografts are transplants of living cells, tissues, or organs from one species to another, such as from animals to humans. With the many discoveries and enhancements in genetic engineering as well as a better comprehension of cross-species incompatibilities, the field of xenotransplantation is anticipated to grow. Pigs are deemed to be the finest species for donating organs for human heart transplantation considering their similarities to that of humans in organ size and function. To address the growing scarcity of resources & donors reachable for replacement, xenotransplant of hearts, corneas, skin, and kidneys has been experimented with. The present application provides a chemical process that disinfects, eliminates antigens from, and/or reinforces xenograft implants. Due to insufficient availability of human allografts, and recent scientific and biotechnical advancement, the new development of investigational therapeutic approaches drive the use of xenotransplantation in human recipients.

The allografts segment is expected to grow at the fastest CAGR during the forecast period. Allografts are tissues obtained from human donors that are transplanted into another human recipient for the purpose of replacing or repairing damaged or diseased tissues. Allografts can be derived from various sources, such as bone, cartilage, tendon, ligament, skin, cornea, heart valve, and blood vessels. Allografts offer several advantages over other types of grafts, such as avoiding the need for harvesting autologous tissues, reducing surgical time and morbidity, providing immediate structural support and osteon conductive properties, and minimizing the risk of immune rejection and disease transmission.

Application Insights

Based on application, this segment is categorized into cardiovascular, orthopedic, and other soft tissue implants. The other soft tissue implants segment dominated the market with the largest revenue share in 2022. Soft tissue biological implants find application in a wide range of medical procedures, serving to repair or substitute damaged or absent soft tissue within the body. These implants are sourced from biological origins, including human or animal tissues, and present distinct advantages over synthetic substances. Notably, soft tissue biological implants exhibit enhanced biocompatibility with the recipient's body in comparison to synthetic materials. This characteristic reduces the probability of immune responses or rejection, consequently facilitating superior integration and long-term success rates of the implants.

The cardiovascular implants segment is expected to grow at the fastest CAGR over the forecast period owing to the rising incidence of cholesterol abnormalities and cardiovascular disorders, which is anticipated to positively reinforce this segment’s potential over the forecast period. With the use of 3D printing technology, scientists at the Indian Institute of Science (IISc) in Bengaluru have created a smart gel-based sheet that can self-roll into a tube during surgery to create a nerve conduit, which could simplify operations and promote quick recovery from nerve damage.

Availability of various cardiac tissues in the market in the form of allograft valves, heterograft valves that are obtained from the porcine heart & bovine pericardial valves, and a stentless valve, which can be trimmed according to the requirement is attributed to the projected progress in this segment. According to the study by the National Library of Medicine with regard to dental implants, certain biological and technical complications were observed during a 5-year follow-up period.

Mode of Administration Insights

In terms of mode of administration, the surgical segment dominated the market with the largest revenue share of 57.6% in 2022 and is also expected to grow at the fastest CAGR of 7.2% over the forecast period as a result of the constant unveiling of biological products offered by companies. The surgical mode of administration involves inserting the implant into the body through an incision or a small opening, commonly used for implants that are large, rigid, or require precise placement, such as dental implants, joint replacements, or pacemakers. Surgical implants usually have a longer duration of action and a lower risk of migration than injectable implants.

The injectable segment held a significant revenue share of 42.3% in 2022. Injectable products emerged as an attractive platform for the delivery of peptide and protein macromolecules, owing to their ease of application and tissue biocompatibility, consequently boosting revenue generation for injectable implants. Moreover, increasing customer expectations of an injectable implantation mode has spurred the demand for a minimally invasive mode of reconstructive surgeries in this segment. This method is suitable for small, flexible, or biodegradable implants, such as drug delivery systems, contraceptive implants, or tissue fillers.

Regional Insights

Based on region, North America dominated the market with the largest revenue share of 50.3% in 2022. The region is observed to have a significant proportion of the market due to the growing incidence of chronic illnesses, and the availability of enhanced healthcare infrastructure is the primary factor driving the market growth. According to the Centers for Disease Control and Prevention (CDC), 6 million of the population aged 18 and older will be diagnosed with kidney disease in the U.S. region in 2022. In the same year, around 24 million unintentional injuries were reported in physician office visits in the U.S.

Asia Pacific is expected to grow at the fastest CAGR of 7.7% during the forecast period due to the increasing population in the region, giving rise to the alarming rate of traffic accidents and the growing prevalence of orthopedic illnesses are among the factors attributing to the growth of this segment. According to recent data from the Global Observatory on Donation and Transplantation, 75,412 patients underwent organ transplants globally in 2022.

Key Companies & Market Share Insights

The rise in competition is leading to rapid technological advancements and companies are constantly working towards the improvement of their products with a major focus on research and development. Factors such as investment in research & development, compliance with regulatory policies, and technological advancements are constantly driving the introduction of novel techniques. The market is highly competitive, with a large number of service providers. These players are involved in the implementation of portfolio separations and regional expansion strategies as a value-enhancement opportunity for enhancing the market presence and product approvals. For instance, in January 2022, NuVasive, Inc., a company involved in spine technology innovation,announced that it obtained clearance from the U.S. Food and Drug Administration (FDA), specifically the 510(k) clearance, to broaden the scope of applications for Attrax Putty within its extensive thoracolumbar interbody portfolio intended for spine surgery. This clearance resembles a significant milestone as Attrax Putty becomes the inaugural synthetic biologic to receive indications for use in interbody fusions involving the thoracolumbar spine.

Market players are playing a pivotal role in addressing the challenge of foreign body rejection associated with synthetic devices by the development of biologically derived reconstructive solutions. For instance, Integra offers widespread expertise in collagen biomaterials for companies pursuing strategic associations. Their products are made from the purest sources of Type 1 collagen, bovine deep flexor tendon, with biocompatibility and safety demonstrated in over 10 million implants (plastic surgery, reconstructive surgery, neurosurgery, orthopedic surgery). Some of the prominent players operating in the global biological implants market include:

-

Integra LifeSciences

-

NuVasive, Inc.

-

Edwards Lifesciences Corporation

-

Stryker

-

LifeCell International Pvt. Ltd.

-

Medtronic

-

Osteotec Limited

-

RTI Surgical

-

BioPolymer GmbH & Co KG

-

Johnson & Johnson Private Limited

-

Baxter

-

Vericel

-

ATEC Spine, Inc

-

Artivion, Inc

-

Maxigen Biotech Inc.

-

Implandata Ophthalmic Products GmbH

-

CONMED Corporation

-

AbbVie Inc.

-

BioTissue

-

Auto Tissue Berlin GmbH

-

MIMEDX Group, Inc.

-

Organogenesis Inc.

-

Smith+Nephew

Biological Implants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.39 billion

Revenue forecast 2030

USD 13.61 billion

Growth rate

CAGR of 7.2 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, mode of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Integra LifeSciences; NuVasive, Inc.; Edwards Lifesciences Corporation; Stryker; LifeCell International Pvt. Ltd.; Medtronic; Osteotec Limited; RTI Surgical; BioPolymer GmbH & Co KG; Johnson & Johnson Private Limited; Baxter; Vericel; ATEC Spine, Inc; Artivion, Inc; Maxigen Biotech Inc.; Implandata Ophthalmic Products GmbH; CONMED Corporation; AbbVie Inc.; BioTissue; Auto Tissue Berlin GmbH; MIMEDX Group, Inc.; Organogenesis Inc.; Smith+Nephew

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biological Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biological implants market report based on product, application, mode of administration, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Autografts

-

Allografts

-

Xenografts

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Implants

-

Orthopedic Implants

-

Other Soft Tissue Implants

-

-

Mode of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical

-

Injectable

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biological implants market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 13.61 billion by 2030.

b. Xenografts dominated the biological implants market with a share of 50.7% in 2022. This is owing to advancements in the field of vascular engineering and tissue engineering for the treatment of diseases with the use of a scaffold that is a structurally intact xenogeneic vessel.

b. Some key players operating in the biological implants market include Integra LifeSciences Corporation; NuVasive, Inc.; Edwards LifeSciences Corporation; Stryker Corporation; RTI Surgical; BioPolymer GmbH & Co. KG; Baxter; Vericel Corporation; Aplhatec Spine Inc.; Maxigen Biotech Inc.; IOP Ophthalmics.; Conmed Corporation; Allergan Plc; Auto Tissue Berlin GmbH; MiMedx Group, Inc.; and Osiris Therapeutics.

b. Key factors that are driving the market growth include technological advancements in biological implants, rising market competition amongst prominent market entities, development in composite grafting, and rising demand as a consequence of accidental injuries.

b. The global biological implants market size was estimated at USD 7.91 billion in 2022 and is expected to reach USD 8.39 billion in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.