- Home

- »

- Medical Devices

- »

-

Biological Indicators Market Size, Industry Report, 2033GVR Report cover

![Biological Indicators Market Size, Share & Trends Report]()

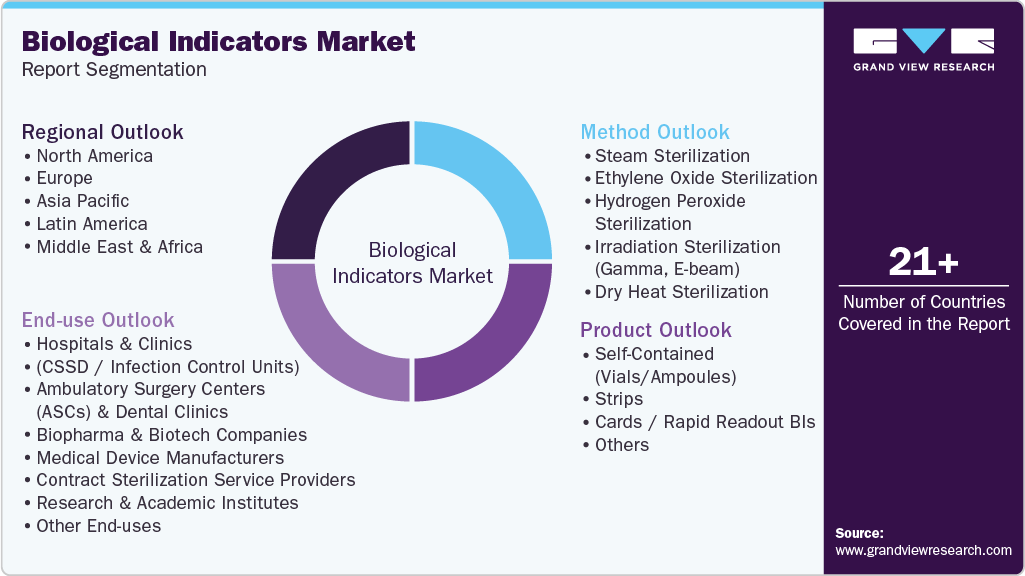

Biological Indicators Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Self-Contained, Strips, Cards/Rapid Readout BIs), By Method (Ethylene Oxide Sterilization, Hydrogen Peroxide Sterilization), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-757-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biological Indicators Market Summary

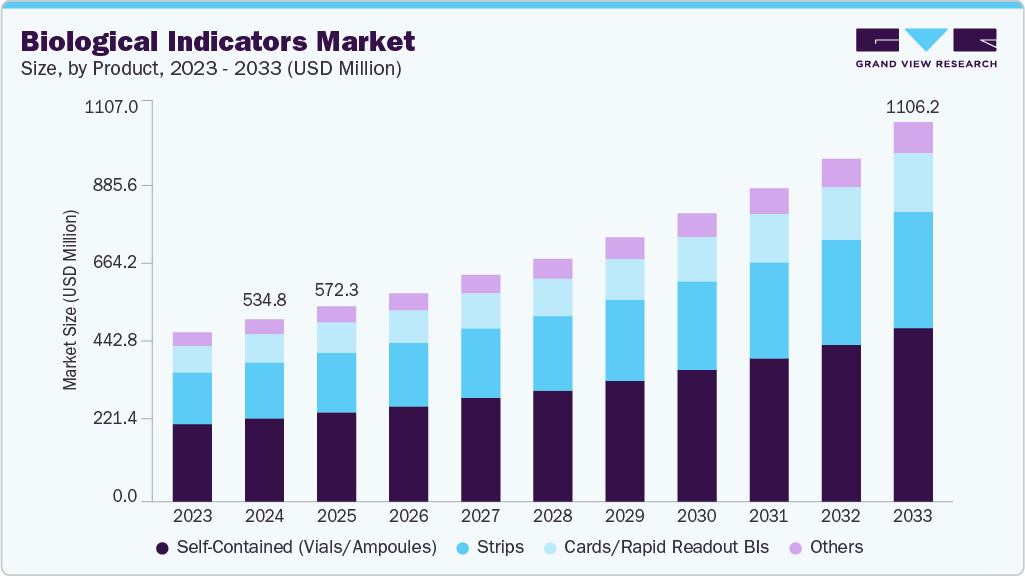

The global biological indicators market size was estimated at USD 572.28 million in 2025 and is projected to reach USD 1,106.24 million by 2033, growing at a CAGR of 8.78% from 2026 to 2033. This growth is attributed to the growing emphasis on sterilization and infection control across healthcare, pharmaceutical, and food industries.

Key Market Trends & Insights

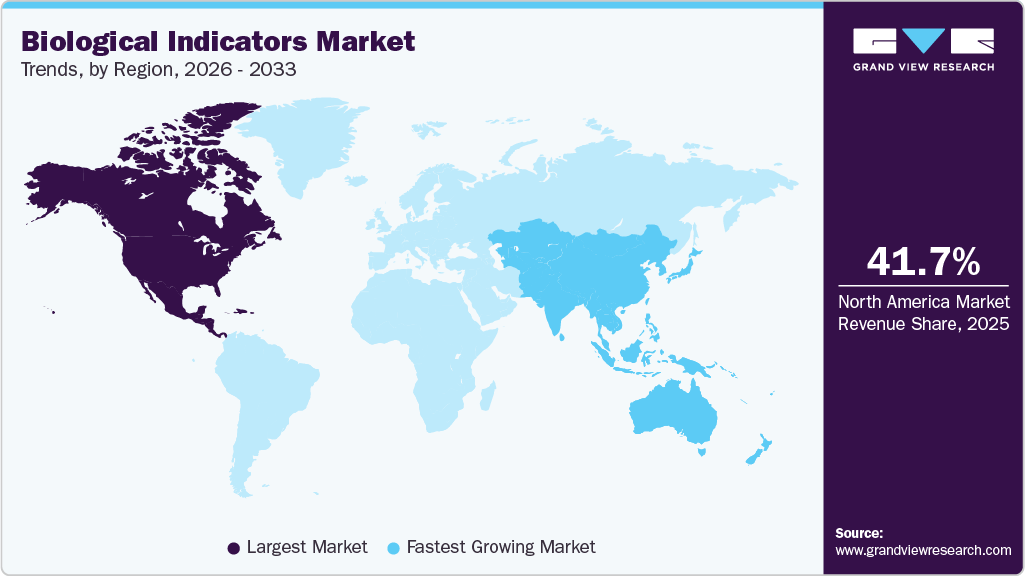

- North America dominated the global biological indicators industry with the largest revenue share of 41.75% in 2025.

- The biological indicators industry in the U.S. accounted for the largest market revenue share in the North America region in 2025.

- Based on product, the self-contained segment led the market with the largest revenue share in 2025.

- Based on method, the steam sterilization segment led the market with the largest revenue share in 2025.

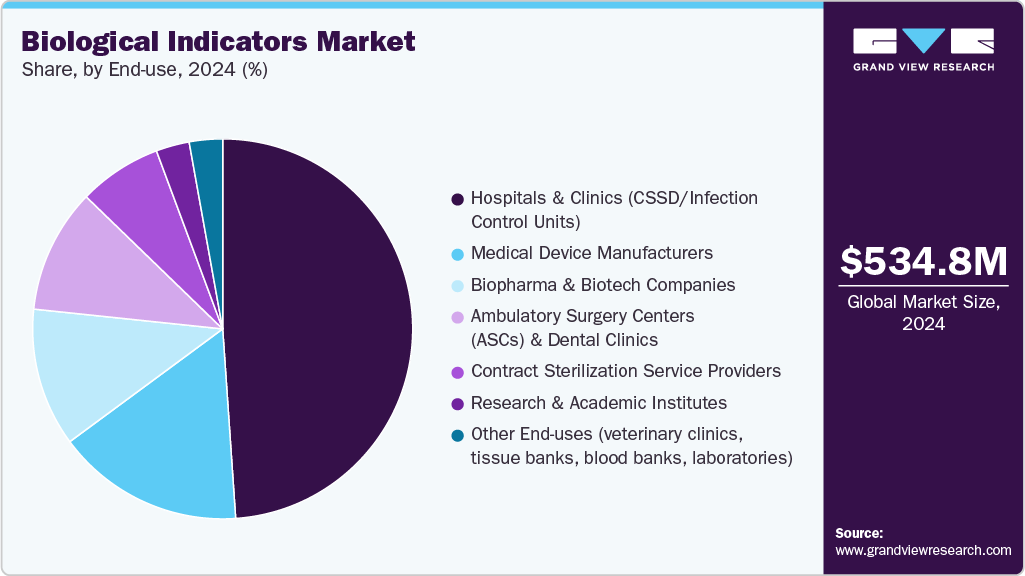

- Based on end use, the hospitals & clinics segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Application: USD 572.28 Million

- 2033 Projected Market Application: USD 1,106.24 Million

- CAGR (2026-2033): 8.78%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Increasing concerns over hospital-acquired infections (HAIs) and stringent regulatory requirements for validating sterilization processes are boosting demand for reliable and rapid BI solutions. In addition, advancements in rapid-readout and automation technologies, coupled with the rising adoption of sterilization methods in emerging markets, are further accelerating the growth of the market. Stringent regulatory requirements play a pivotal role in driving the biological indicators industry, as global health authorities mandate the validation of sterilization processes across industries such as medical devices, pharmaceuticals, and biotechnology. Biological indicators are the gold standard for confirming sterilization efficacy, making them a necessity for compliance. For instance, the U.S. Food and Drug Administration (FDA) requires medical device manufacturers to demonstrate sterilization validation under 21 CFR Part 820 (Quality System Regulation), while the European Medicines Agency (EMA) and the ISO 11138 standard outline specific criteria for biological indicator use in sterilization assurance. Similarly, compliance with Good Manufacturing Practices (GMP) in pharmaceuticals necessitates biological indicator-based validation for sterilized drug products and equipment. These strict regulatory frameworks ensure patient safety and product reliability, fueling consistent demand for biological indicators across critical healthcare and life sciences sectors.

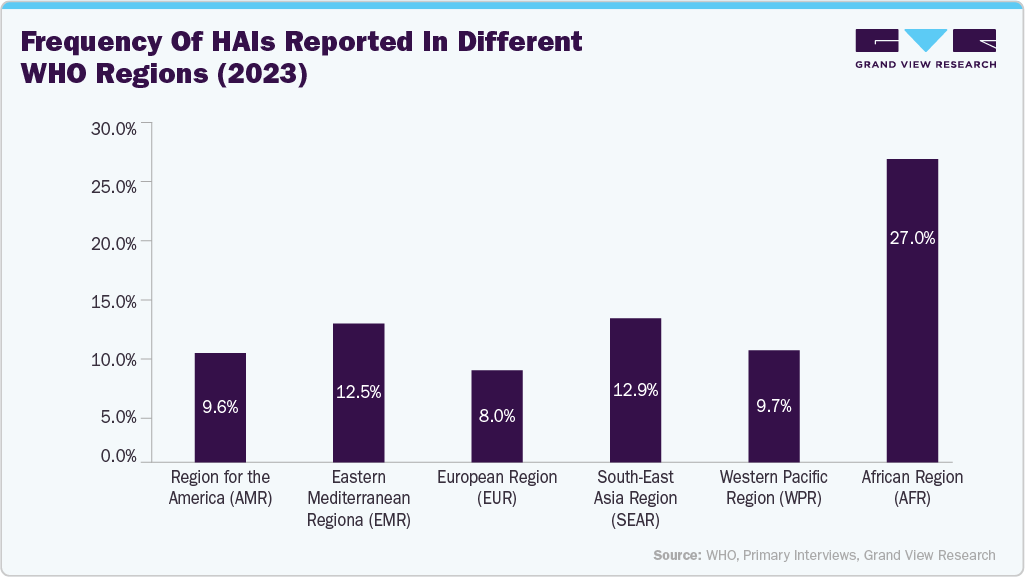

The rising burden of hospital-acquired infections (HAIs) is a key factor driving the growth of the biological indicators industry, as healthcare facilities are increasingly focusing on strengthening infection control and sterilization practices. According to the WHO’s Global Report on Infection Prevention and Control 2024, a large-scale systematic review of nearly 400 studies estimated the global prevalence of HAIs at around 14% in 2023. Furthermore, a European point prevalence survey conducted in 2022/2023 across 28 EU/EEA countries and three Western Balkan nations/territories reported an adjusted prevalence of 8% for patients with at least one HAI. This growing incidence of HAIs underscores the critical need for reliable sterilization validation, fueling the demand for biological indicators to ensure the effectiveness of sterilization processes over the forecast period.

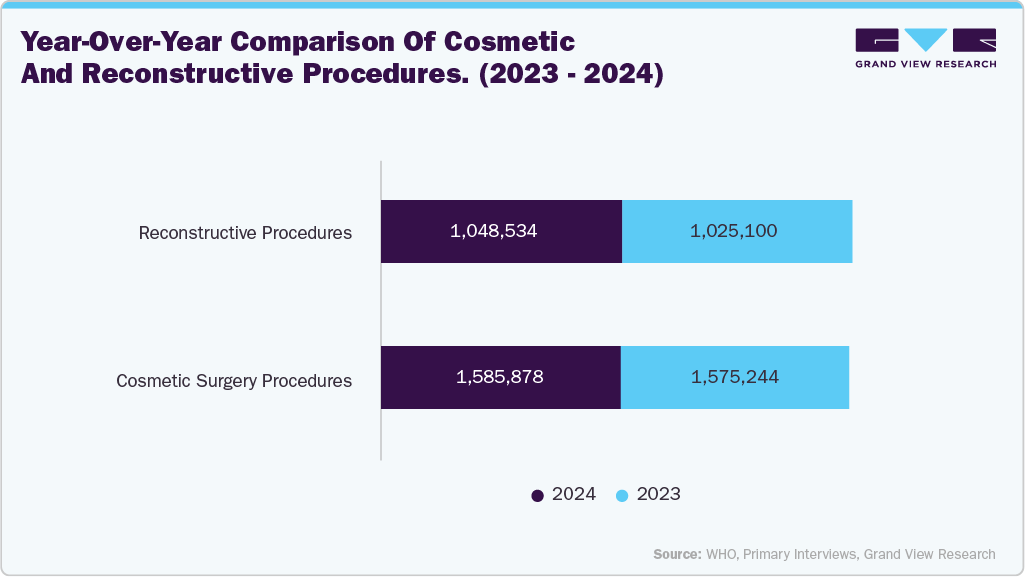

The global rise in surgical procedures, ranging from elective operations to complex organ transplants, is significantly driving demand in the biological indicators industry. The growing procedural load in hospitals and surgical centers has led to a sharp increase in the daily use of reusable instruments that must undergo validated sterilization. This surge creates volume pressures and raises the bar for quality and compliance, pushing healthcare facilities to adopt stringent sterilization validation practices. According to the 2024 Procedural Statistics Release, approximately 1,585,878 cosmetic surgeries were performed in 2024, marking a 1% increase from 2023, while reconstructive procedures rose by 2% over the same period. The steady growth in surgical interventions highlights the critical need for biological indicators to ensure the effectiveness of sterilization processes and safeguard patient safety.

Technological advancements significantly shape the market by improving efficiency, accuracy, and compliance in sterilization validation. Innovations such as rapid-readout indicators have reduced the time required to confirm sterilization efficacy from several days to a few hours, accelerating instrument turnaround in busy healthcare facilities. For instance, in June 2025, Solventum introduced its Attest Super Rapid Vaporized Hydrogen Peroxide (VH₂O₂) Clear Challenge Pack, a ready-to-use solution that combines two previously FDA-cleared indicators into one test system. The pack integrates a biological indicator (BI) to confirm microbial inactivation and a chemical indicator (CI) to verify sterilizer performance, all within a transparent, single-use container for simplified and reliable sterilization validation.

"Innovations that make every load monitoring easier to adopt, more reliable, and faster across sterilization modalities empower healthcare facilities to consistently uphold the highest patient safety standards while supporting the increasing productivity demand of modern sterile processing departments," said Sharon Greene-Golden, past president of the Healthcare Sterile Processing Association (HSPA).

"In the high-stakes environment of sterile processing where patients' lives are at stake, both speed and accuracy are non-negotiable," said Doug Bartlett, senior vice president of the company's Infection Prevention & Surgical Solutions business. "Solventum innovations equip dedicated professionals with intuitive, cutting-edge resources that help them to safeguard patient health, reflecting our drive to continually support elevated standards of care in critical settings."

Major Brands Operating in the Market

Companies

Brand Name

Technology

End-Use

3M

Attest

Biological Indicator Incubators

Biological Indicator

STERIS

CELERITY

Celerity Steam Biological Indicators

Biological Indicators

STERIS

VERIFY

VERIFY BIOLOGICAL INDICATORS

Getinge

Getinge

Assured EO Self-Contained Biological Indicator

Biological Indicators

Source: Company Websites, Grand View Research

Market Concentration & Characteristics

The degree of innovation in the biological indicators industry is high, driven by the need for faster, more accurate, and reliable sterilization validation solutions. Recent advancements include rapid-readout biological indicators that significantly reduce result turnaround time, self-contained biological indicators (SCBI) that simplify handling and minimize contamination risk, and integration with digital monitoring systems for real-time tracking, automated documentation, and remote compliance verification. In addition, innovations in spore formulations, sensor technologies, and IoT-enabled devices are enhancing the precision and efficiency of sterilization validation across healthcare, pharmaceutical, and biotechnology settings, reflecting the market’s strong focus on technological advancement and regulatory compliance.

Regulations significantly impact the market, as global health authorities mandate strict validation of sterilization processes to ensure patient safety and product reliability. Compliance with standards such as FDA guidelines, ISO 11138, and Good Manufacturing Practices (GMP) requires healthcare facilities, pharmaceutical manufacturers, and biotechnology companies to adopt biological indicators for sterilization verification. These regulatory requirements drive consistent demand for high-quality, reliable indicators, encourage technological advancements to meet compliance standards, and ensure widespread adoption across hospitals, clinics, and manufacturing facilities, reinforcing the critical role of biological indicators in infection control and sterilization assurance.

The market has witnessed moderate to high mergers and acquisitions, reflecting the sector’s focus on expanding product portfolios, technological capabilities, and geographic reach. Established players are acquiring smaller specialized companies or forming strategic partnerships to integrate advanced sterilization validation technologies, such as rapid-readout indicators and digital monitoring systems, into their offerings. These M&A activities enable companies to strengthen their competitive position, enhance R&D capabilities, and access new markets, particularly in emerging regions where healthcare infrastructure and demand for sterilization compliance are rapidly growing. For instance, in October 2023, Mesa Laboratories, Inc. announced the completion of its acquisition of GKE-GmbH’s sterilization indicators business and its accredited independent testing laboratory, SAL GmbH. Subsequently, in December 2023, Mesa finalized the acquisition of GKE’s Chinese sales entity, Beijing GKE Science & Technology Co., Ltd. (“GKE China”), completing all related transactions.

The market primarily serves a concentrated group of users, including hospitals, surgical centers, pharmaceutical manufacturers, and biotechnology labs. Hospitals and healthcare facilities make up the largest portion of this demand, as they rely on biological indicators to ensure strict sterilization and protect patients from healthcare-associated infections. Pharmaceutical and biotech companies use these indicators regularly to meet regulatory standards for sterile production. While large institutions and multinational manufacturers account for much of the consumption, growing adoption in smaller clinics, outpatient centers, and developing regions is gradually broadening the market and bringing these essential tools to a broader range of healthcare providers.

Product Insights

Based on product, the self-contained segment held the largest share in 2025 and is expected to witness the fastest growth over the forecast period. This growth can be attributed to its convenience, ease of use, and reduced risk of contamination, as the spore carrier and growth medium are integrated into a single unit. This design simplifies sterilization validation processes for healthcare facilities and pharmaceutical manufacturers, enhancing reliability and efficiency. Moreover, there is an increasing demand for rapid and user-friendly sterilization monitoring solutions.

The self-contained segment is expected to register the fastest growth during the forecast period, driven by its ability to deliver accurate results while streamlining workflows. Supported by increasing regulatory requirements for validated sterilization methods and the rising global focus on infection prevention. Moreover, growing adoption in emerging markets with expanding healthcare infrastructure and advancements in rapid-readout technologies will further accelerate segment growth, reinforcing SCBIs as a key market driver.

Method Insights

Based on method, the steam sterilization segment held the largest share in 2025. This growth can be attributed to its proven effectiveness, safety, and cost-efficiency in eliminating resistant microorganisms. It remains the most widely adopted sterilization method in hospitals for surgical instruments, in laboratories for reusable glassware, and in the pharmaceutical industry for production equipment and culture media. For instance, steam sterilization autoclaves are standard in operating rooms and central sterile supply departments (CSSDs) to ensure patient safety. Similarly, in pharmaceutical manufacturing, steam sterilization is routinely used to validate aseptic processes and meet strict regulatory standards. These broad applications and regulatory acceptance have reinforced the dominance of steam sterilization in the market.

The hydrogen peroxide sterilization segment is expected to witness the fastest CAGR over the forecast period. This growth is driven by the increasing regulatory and institutional pressure to adopt sterilization methods that are effective against resistant pathogens yet gentler on materials. Hydrogen peroxide fits both criteria as a low-temperature, residue-free option. Moreover, growing concern over hospital-acquired infections (HAIs) and the push for higher sterilization validation standards across healthcare and pharmaceutical industries are driving demand. In addition, innovation in equipment and delivery systems (e.g., vaporized or plasma hydrogen peroxide systems) is improving cycle times, efficacy, and integration with healthcare workflows, making it a more attractive option.

End Use Insights

In terms of end use, the hospitals & clinics segment held the largest share in 2025. This dominance is attributed to the high volume of surgical procedures and sterilization needs for critical instruments, endoscopes, and implantable devices. With hospitals being the primary centers for complex treatments, strict adherence to sterilization standards and infection control protocols has driven widespread adoption of biological indicators. Moreover, the rising burden of hospital-acquired infections (HAIs) and increasing regulatory oversight have further reinforced the demand for reliable sterilization validation tools in these healthcare settings, solidifying their market dominance.

The Ambulatory Surgical Centers (ASCs) & dental clinics segment is expected to witness the fastest CAGR over the forecast period. This growth is driven by the growing preference for outpatient care that emphasizes cost efficiency, convenience, and faster recovery compared to traditional hospital settings. Patients are drawn to these centers for the reduced logistical burdens and because clinics and ASCs are rapidly adopting technologies like rapid biological sterilization indicators and advanced monitoring systems to ensure strict infection control while maintaining efficient workflows. The trend is further fueled by favorable reimbursement policies, the rising prevalence of chronic and dental diseases, and investments aimed at improving access in underserved areas, all of which together are accelerating segment growth and positioning ASCs and dental clinics as a central pillar in the future of modern, patient-focused healthcare.

Regional Insights

North America dominated the global biological indicators industry with the largest revenue share of 41.75% in 2025. The North American market is primarily driven by the rising prevalence of healthcare-associated infections (HAIs), which has heightened the need for reliable sterilization validation in hospitals, surgical centers, and clinics. Strict regulatory requirements from agencies such as the FDA and adherence to standards like ISO 11138 further compel healthcare and pharmaceutical facilities to adopt biological indicators. In addition, the region’s well-established healthcare infrastructure, growing number of surgical procedures, and expansion of the biopharmaceutical industry are fueling demand.

U.S. Biological Indicators Market Trends

The biological indicators market in the U.S. is primarily driven by the increasing number of surgical procedures, stringent regulatory requirements, and the rising demand for sterilization in the healthcare and pharmaceutical industries. Technological advancements, such as integrating digital monitoring systems and automation in sterilization processes, are enhancing the efficiency and reliability of biological indicators. In addition, the growing emphasis on infection control and patient safety is prompting healthcare facilities to adopt advanced sterilization validation tools, further driving market growth. A key driver of the U.S. biological indicators industry is the rising prevalence of healthcare-associated infections (HAIs), which has heightened the need for reliable sterilization validation in hospitals, surgical centers, and outpatient facilities. For instance, a CDC report highlighted that in 2023, approximately 19.5% of ICU patients across U.S. hospitals had at least one HAI, emphasizing the critical role of sterilization monitoring.

Europe Biological Indicators Market Trends

The biological indicators market in Europe is witnessing steady growth, driven by multiple factors. The implementation of evolving EN ISO standards and regional procurement policies prioritizing traceable sterilization tools encourages healthcare facilities to adopt reliable sterilization monitoring solutions. Investments in upgrading public hospitals and integrating sterilization tracking software with hospital information systems are becoming standard practices, improving operational efficiency and ensuring compliance with stringent regulations. In addition, the rising prevalence of healthcare-associated infections (HAIs) across Europe highlights the urgent need for effective sterilization processes, further boosting the demand for biological indicators in the region.

The UK biological indicators market is steadily growing and is fueled by several important factors. Updated EN ISO standards and regional procurement policies emphasizing traceable sterilization tools encourage hospitals and clinics to adopt more reliable monitoring solutions. At the same time, investments in upgrading public hospitals and integrating sterilization tracking software with hospital information systems are helping healthcare facilities work more efficiently while staying compliant with strict regulations. On top of this, the rising number of healthcare-associated infections (HAIs) across the UK underscores the critical need for effective sterilization practices, further driving the demand for biological indicators in the region.

Asia Pacific Biological Indicators Market Trends

The biological indicators market in the Asia Pacific is anticipated to experience the fastest CAGR of 13.75% from 2026 to 2033. Rapidly expanding healthcare infrastructure in countries such as China, India, and Japan is increasing access to advanced sterilization technologies. Rising healthcare expenditures and growing awareness of infection control measures are prompting hospitals and surgical centers to adopt reliable sterilization validation tools. In addition, the surge in surgical procedures and the expansion of the biopharmaceutical sector in the region further fuel demand for biological indicators. Supportive government initiatives, investments in modern medical facilities, and a strong focus on patient safety collectively position the Asia Pacific market as the fastest-growing segment globally.

China biological indicators market is experiencing rapid growth, driven by several key factors. The country's expanding healthcare infrastructure, particularly in tier-2 and tier-3 cities, enhances access to advanced sterilization technologies. This growth is further supported by rising healthcare expenditures and increasing awareness about infection control measures.

Latin America Biological Indicators Market Trends

The biological indicators market in Latin America is experiencing steady growth, driven by several key factors. The region’s expanding healthcare infrastructure is improving access to advanced sterilization technologies. Rising awareness about infection control measures and increasing healthcare expenditures are prompting hospitals and clinics to adopt reliable sterilization monitoring solutions. In addition, the growing focus on patient safety and compliance with international sterilization standards is further boosting the demand for biological indicators across Latin America.

Middle East Africa Biological Indicators Market Trends

The biological indicators market in the MEA is witnessing strong growth, driven by several key factors. Expanding healthcare infrastructure in countries like the UAE and Saudi Arabia is improving access to advanced sterilization technologies. Rising awareness about infection control measures and increasing healthcare investments are prompting hospitals and clinics to adopt reliable sterilization monitoring solutions. In addition, a growing focus on patient safety and adherence to international sterilization standards is driving the demand for biological indicators across the MEA region.

Key Biological Indicators Company Insights

The biological indicators industry is extremely fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority share in the market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the biological indicators industry is predicted to grow during the forecast period.

Key Biological Indicators Companies:

The following key companies have been profiled for this study on the biological indicators market.

- STERIS plc.

- Solventum

- Getinge

- Mesa Laboratories, Inc.

- 3M

- Terragene S.A.

- Propper Manufacturing Co., Inc.

- Tuttnauer

- Ecolab Inc.

- H.W.Andersen Products Ltd.

- MATACHANA GROUP

- LISTER BIOMEDICAL CO., LTD

- Liofilchem S.r.l.

- Steelco S.p.A

- Zhejiang Tailin Bioengineering Co., Ltd.

- Cole-Parmer Instrument Company, LLC (Antylia Scientific)

- Anhui Tianrun Medical Packaging Materials Co., Ltd.

- Medline Industries, LP.

- True Indicating

Recent Developments

-

In October 2023, Mesa Laboratories, Inc. announced the completion of its acquisition of GKE-GmbH’s sterilization indicators business and its accredited independent testing laboratory, SAL GmbH. Subsequently, on December 31, 2023, Mesa finalized the acquisition of GKE’s Chinese sales entity, Beijing GKE Science & Technology Co., Ltd. (“GKE China”), completing all related transactions.

-

In April 2024, 3M finalized the spin-off of its healthcare division, officially launching Solventum Corporation as an independent entity. The company is now listed on the New York Stock Exchange under the ticker symbol SOLV.

-

In June 2025, Solventum introduced its Attest Super Rapid Vaporized Hydrogen Peroxide (VH₂O₂) Clear Challenge Pack. This ready-to-use test combines two previously FDA-cleared indicators, a biological indicator (BI) for verifying microbial inactivation and a chemical indicator (CI) for confirming proper sterilizer function, into a single-use pack with a transparent container for easy and reliable sterilization validation.

Biological Indicators Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 613.60 million

Revenue forecast in 2033

USD 1,106.24 million

Growth rate

CAGR of 8.78% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE.

Key companies profiled

STERIS plc.; Solventum; Getinge ; Mesa Laboratories, Inc.; 3M; Terragene S.A.; Propper Manufacturing Co., Inc.; Tuttnauer; Ecolab Inc.; H.W.Andersen Products Ltd.; MATACHANA GROUP; LISTER BIOMEDICAL CO., LTD; Liofilchem S.r.l.; Steelco S.p.A; Zhejiang Tailin Bioengineering Co., Ltd.; Cole-Parmer Instrument Company, LLC (Antylia Scientific); Anhui Tianrun Medical Packaging Materials Co., Ltd.; Medline Industries, LP.; True Indicating

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biological Indicators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biological indicators market report based on product, method, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Self-Contained (Vials/Ampoules)

-

Strips

-

Cards / Rapid Readout BIs

-

Others

-

-

Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Steam Sterilization

-

Ethylene Oxide Sterilization

-

Hydrogen Peroxide Sterilization

-

Irradiation Sterilization (Gamma, E-beam)

-

Dry Heat Sterilization

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics (CSSD / Infection Control Units)

-

Ambulatory Surgery Centers (ASCs) & Dental Clinics

-

Biopharma & Biotech Companies

-

Medical Device Manufacturers

-

Contract Sterilization Service Providers

-

Research & Academic Institutes

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biological indicators market size was estimated at USD 534.80 Million in 2024 and is expected to reach USD 572.28 Million in 2025.

b. The global biological indicators market is expected to grow at a compound annual growth rate of 8.59% from 2025 to 2033 to reach USD 1,106.24 million by 2033.

b. North America dominated the biological indicators market with a share of 42.4% in 2024. This is attributable the rising prevalence of healthcare-associated infections (HAIs), which has heightened the need for reliable sterilization validation in hospitals, surgical centers, and clinics.

b. Some key players operating in the biological indicators market include STERIS plc.; Solventum; Getinge ; Mesa Laboratories, Inc.; 3Ml Terragene S.A.; Propper Manufacturing Co., Inc.; Tuttnauer; Ecolab Inc.; H.W.Andersen Products Ltd.; MATACHANA GROUP; LISTER BIOMEDICAL CO.,LTD; Liofilchem S.r.l.; Steelco S.p.A; Zhejiang Tailin Bioengineering Co., Ltd.; Cole-Parmer Instrument Company, LLC (Antylia Scientific); Anhui Tianrun Medical Packaging Materials Co., Ltd.; Medline Industries, LP.; True Indicating

b. Key factors that are driving the market growth include the growing emphasis on sterilization and infection control across healthcare, pharmaceutical, and food industries. Increasing concerns over hospital-acquired infections (HAIs) and stringent regulatory requirements for validating sterilization processes are boosting demand for reliable and rapid BI solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.