- Home

- »

- Disinfectants & Preservatives

- »

-

Hydrogen Peroxide Market Size, Share, Industry Report 2030GVR Report cover

![Hydrogen Peroxide Market Size, Share & Trends Report]()

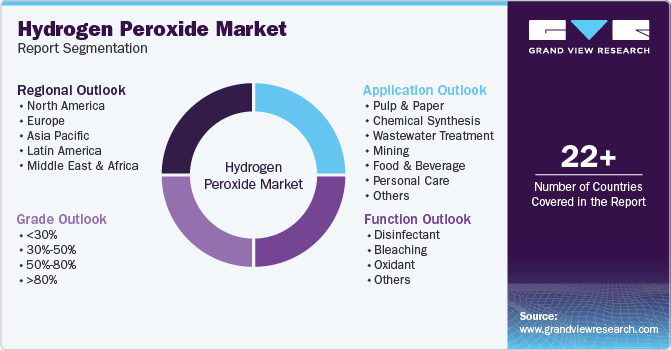

Hydrogen Peroxide Market (2025 - 2030) Size, Share & Trends Analysis Report, By Grade (<30%, 30%-50%), By Function (Oxidant, Disinfectant), By Application (Pulp & Paper, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-783-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Peroxide Market Summary

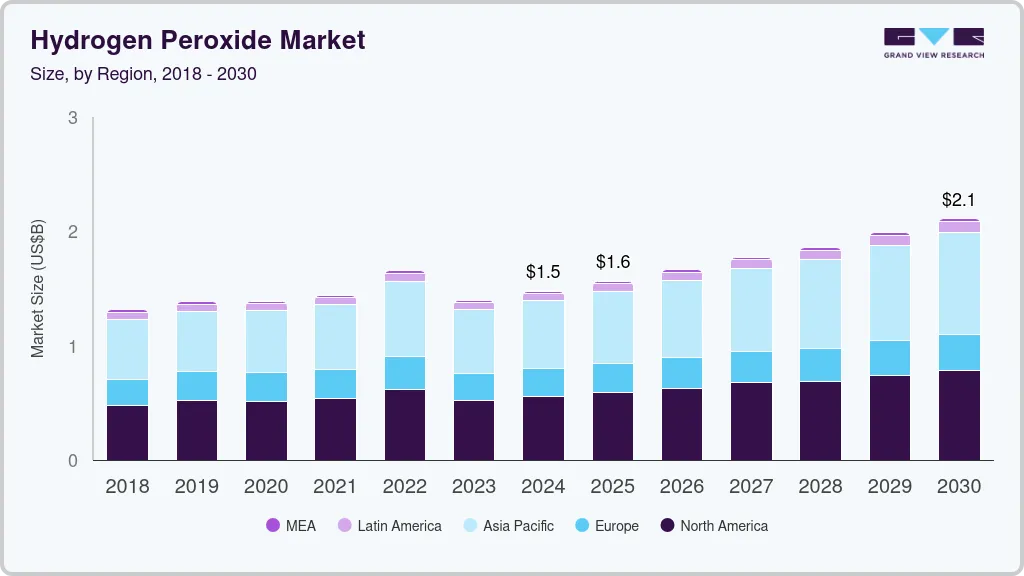

The global hydrogen peroxide market size was estimated at USD 1.48 billion in 2024 and is projected to reach USD 2.11 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. This growth is attributed to the increasing demand from end-use industries such as pulp and paper, chemical synthesis, and water treatment.

Key Market Trends & Insights

- Asia Pacific hydrogen peroxide market dominated the global hydrogen peroxide industry and accounted for the largest revenue share of 40.3% in 2024.

- The U.S. hydrogen peroxide market dominated the North American market and accounted for the largest revenue share in 2024.

- Based on grade, the below 30% segment led the market and accounted for the largest revenue share of 38.1% in 2024.

- Based on function, the bleaching segment dominated the market and accounted for the largest revenue share of 35.4% in 2024.

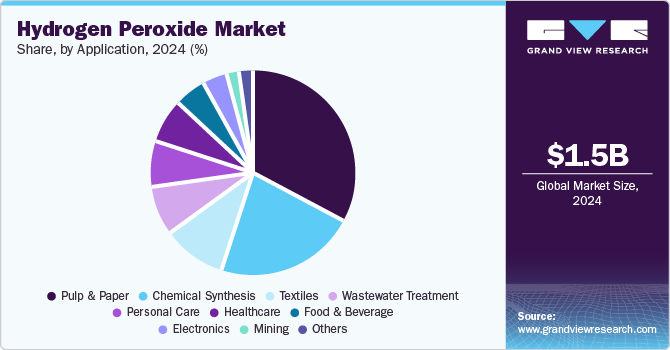

- Based on application, the pulp and paper segment led the market and accounted for the largest revenue share of 33.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.48 Billion

- 2030 Projected Market Size: 2.11 Billion

- CAGR (2024-2030): 6.2%

- Asia Pacific: Largest market in 2024

In addition, the rise in personal care and healthcare applications, coupled with rapid industrialization in emerging economies, further fuels this growth. Furthermore, the shift towards environmentally friendly bleaching agents in the pulp and paper industry also enhances hydrogen peroxide's appeal, supporting its expanding market presence globally.Hydrogen peroxide, a chemical compound with the formula H₂O₂, is a pale blue liquid commonly used as an oxidizer, bleaching agent, and antiseptic. Its demand in the water treatment industry has surged due to its efficacy as a disinfectant and odor neutralizer. Hydrogen peroxide effectively eliminates microorganisms and degrades organic pollutants, and it is increasingly favored over chlorine as it does not produce harmful by-products. As environmental concerns rise, this chlorine-free alternative aligns with stringent regulations and sustainable practices, enhancing its appeal.

In addition to water treatment, hydrogen peroxide's versatility across various sectors is propelling the market growth. It serves multiple functions in industrial, commercial, and household applications. Its strong bleaching properties make it ideal for the paper and textile industries, while in healthcare, it acts as an antiseptic and antimicrobial agent. Moreover, hydrogen peroxide is utilized in electronics as a high-quality cleaning agent and plays a crucial role in producing detergent bleaches such as sodium percarbonate.

Furthermore, the increasing focus on eco-friendly solutions and regulatory compliance further drives the adoption of hydrogen peroxide. Innovations in water treatment technologies, such as advanced oxidation processes, are expanding their usage to ensure clean and safe water for drinking and industrial purposes. As industries seek sustainable alternatives to traditional chemicals, hydrogen peroxide stands out for its ability to decompose into harmless water and oxygen, making it a preferred choice for environmentally conscious applications.

Grade Insights

Below 30% grade led the market and accounted for the largest revenue share of 38.1% in 2024. This growth is attributed to its growing use in household and personal care products. These lower concentrations are favored for their safety and effectiveness as disinfectants and bleaching agents in cleaning solutions. Furthermore, the heightened awareness of hygiene, especially post-pandemic, has increased demand for eco-friendly cleaning agents. Moreover, the versatility of hydrogen peroxide in various applications, including cosmetics and food processing, further supports its widespread adoption in consumer markets.

The 30%- 50% grade segment is expected to grow at a CAGR of 6.3% over the forecast period, driven by its application in industrial processes, particularly in the pulp and paper industry. Due to its effectiveness and efficiency, this concentration range is preferred for bleaching and oxidation processes. In addition, the rising demand for sustainable practices in manufacturing has prompted industries to adopt hydrogen peroxide as a harmless substitute for chlorine-based chemicals. Furthermore, advancements in water treatment technologies that utilize this concentration for disinfection and odor control also contribute to its market expansion as industries increasingly seek environmentally friendly solutions.

Function Insights

The bleaching function dominated the market and accounted for the largest revenue share of 35.4% in 2024. This growth is attributed to its eco-friendly properties and effectiveness in various industries. Hydrogen peroxide is a chlorine-free bleaching agent, making it a preferred choice in the pulp and paper industry for enhancing paper quality and brightness while minimizing environmental impact. Furthermore, its strong bleaching capabilities are utilized in textiles and cosmetics, where it helps achieve the desired whiteness and purity.

The disinfectant functions are expected to grow at a CAGR of 6.7% from 2025 to 2030, owing to heightened hygiene awareness, especially following the COVID-19 pandemic. Its potent antimicrobial properties make it an effective disinfectant for various applications, including healthcare settings, public spaces, and household cleaning products. Furthermore, governments worldwide have emphasized the importance of disinfection to control virus spread, leading to increased utilization of hydrogen peroxide-based sanitizers and cleaning agents.

Application Insights

The pulp and paper application led the hydrogen peroxide market and accounted for the largest revenue share of 33.4% in 2024, primarily driven by its effectiveness as a bleaching agent. In addition, hydrogen peroxide is favored for its environmentally friendly properties, serving as a chlorine-free alternative that enhances the quality and brightness of paper products. Furthermore, increasing regulatory pressures to reduce harmful chemicals in manufacturing processes further boost its adoption. Moreover, the rising demand for sustainable and recycled paper products has led to greater utilization of hydrogen peroxide in various stages of pulp processing, ensuring compliance with environmental standards.

The healthcare segment is expected to grow at a CAGR of 7.4% over the forecast period, owing to its antiseptic and disinfectant properties. It is widely used for wound care, effectively killing bacteria and promoting healing by releasing oxygen upon contact with tissues. In addition, its ability to decompose into harmless water and oxygen without leaving residues makes it an attractive choice for hospitals and clinics. Furthermore, as healthcare facilities prioritize infection control, hydrogen peroxide's role as a reliable antimicrobial agent continues to drive its market growth in this sector.

Regional Insights

Asia Pacific hydrogen peroxide market dominated the global hydrogen peroxide industry and accounted for the largest revenue share of 40.3% in 2024 attributed to rapid industrialization and urbanization. Countries such as China and India are experiencing substantial economic growth, leading to increased demand for hydrogen peroxide across various sectors, including pulp and paper, textiles, and water treatment. In addition, the region's expanding manufacturing capabilities and investments in infrastructure further enhance hydrogen peroxide consumption. Furthermore, the shift towards environmentally friendly practices and stringent regulations promoting sustainable chemicals propel market growth in this dynamic region.

The hydrogen peroxide market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its extensive use in the pulp and paper industry, where it serves as an eco-friendly bleaching agent. In addition, the country's booming manufacturing sector and rising domestic consumption of paper products drive the demand for hydrogen peroxide. Furthermore, China's focus on environmental sustainability and adherence to strict regulations regarding chemical usage further bolster the market. Moreover, the increasing adoption of hydrogen peroxide in wastewater treatment processes also contributes to its growth as industries seek effective solutions for pollution control.

Latin America Hydrogen Peroxide Market Trends

The Latin America hydrogen peroxide market is expected to grow at a CAGR of 6.0% over the forecast period, owing to the increasing applications in various industries such as textiles, food processing, and water treatment. In addition, the region's expanding manufacturing base and rising awareness of environmental sustainability drive demand for hydrogen peroxide as a bleaching agent and disinfectant. Furthermore, investments in infrastructure development and improvements in industrial processes are enhancing the efficiency of hydrogen peroxide usage. Moreover, the push towards eco-friendly alternatives to traditional chemicals further supports market growth in this region.

North America Hydrogen Peroxide Market Trends

The hydrogen peroxide market in North America is expected to experience substantial growth over the forecast period, driven by its well-established end-use industries, particularly in pulp and paper production. Furthermore, the growing emphasis on sustainable practices and regulatory compliance encourages industries to adopt hydrogen peroxide as a safer alternative to chlorine-based chemicals. Moreover, the healthcare sector's increasing reliance on hydrogen peroxide for disinfecting purposes also significantly drives market growth in this region.

The U.S. hydrogen peroxide market dominated the North American market and accounted for the largest revenue share in 2024, owing to its wide use in various applications, including healthcare and chemical synthesis. In addition, the country is home to some of the largest producers of hydrogen peroxide globally, ensuring a steady supply for domestic needs. The heightened focus on hygiene post-pandemic has increased demand for hydrogen peroxide disinfectants. Furthermore, advancements in production technologies and investments in sustainable practices are expected to drive further growth in this sector.

Europe Hydrogen Peroxide Market Trends

Europe hydrogen peroxide market is expected to grow significantly over the forecast period, driven by stringent environmental regulations promoting the use of eco-friendly chemicals across industries. The demand for hydrogen peroxide as a bleaching agent in the pulp and paper sector is significant due to its ability to produce high-quality products without harmful by-products. Furthermore, increasing water treatment and personal care product applications contribute to market expansion. Moreover, the commitment to sustainability within European industries ensures that hydrogen peroxide remains a key player in achieving environmental goals.

The growth of the hydrogen peroxide market in Germany is driven by its advanced manufacturing capabilities and strong industrial base. The country's focus on innovation and sustainability fosters the adoption of hydrogen peroxide across various applications, including textiles and food processing. Furthermore, Germany's stringent regulations regarding chemical usage encourage industries to seek environmentally friendly alternatives such as hydrogen peroxide. As a result, the demand for this chemical continues to grow, reinforcing Germany's position as a leader in the European hydrogen peroxide market.

Key Hydrogen Peroxide Company Insights

Some of the key players in the market include Evonik Industries AG, Taekwang Industrial, CO., LTD., Arkema, and others. These companies are adopting various strategies to enhance their competitive edge. These include investing in research and development to innovate new applications and improve production processes. In addition, companies are also focusing on strategic partnerships and collaborations to expand their market reach and enhance supply chain efficiencies. Furthermore, firms emphasize sustainability by developing eco-friendly products and adhering to stringent environmental regulations, aligning with the growing consumer demand for greener alternatives in industrial processes.

-

Arkema manufactures a range of hydrogen peroxide grades, including Valsterane for aseptic packaging and Peroxal for demanding applications. The company operates in various segments, including food packaging, healthcare, and electronics, providing innovative products that meet stringent safety and regulatory standards. With a focus on sustainability and advanced technology, the company continues to enhance its hydrogen peroxide offerings to cater to diverse industrial needs.

-

Grupa Azoty produces hydrogen peroxide primarily for the pulp and paper industry, textiles, and environmental applications. The company operates within the broader chemical sector, emphasizing innovation and efficiency in its production processes. By leveraging its expertise in chemical manufacturing, the company aims to provide high-quality hydrogen peroxide solutions that meet the evolving demands of various industries.

Key Hydrogen Peroxide Companies:

The following are the leading companies in the hydrogen peroxide market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Taekwang Industrial, CO., LTD.

- Arkema

- Grupa Azoty

- Solvay

- Akzo Nobel N.V.

- Gujarat Alkalies & Chemicals Ltd.

- National Peroxide Limited

- OCI Company Ltd.

- Airedale Chemical

Recent Developments

-

In January 2024, Solvay announced the extension of its hydrogen peroxide production capacity at the Shandong Huatai Interox Chemical site in China. With this strategic investment, the company aims to achieve 48 kilotons production of photovoltaic-grade hydrogen peroxide per year by 2025, supporting China's carbon neutrality goals. The expansion is expected to enhance the renewable energy sector by supplying high-quality hydrogen peroxide, essential for cleaning photovoltaic cells during solar panel manufacturing.

-

In December 2023, Evonik announced the full acquisition of Thai Peroxide Company Limited, enhancing its hydrogen peroxide and peracetic acid production capabilities in Asia. This strategic move, finalized on December 15, strengthens Evonik's specialty chemicals portfolio, which is crucial for microchip and solar cell manufacturing, wastewater treatment, and food safety applications. The acquisition aligns with Evonik’s commitment to sustainable solutions in high-demand markets, reinforcing its position as a leader in hydrogen peroxide production.

Hydrogen Peroxide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.57 billion

Revenue forecast in 2030

USD 2.11 billion

Growth Rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million/Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, function, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, China, India, Japan, Germany, UK, France, and Netherlands.

Key companies profiled

Evonik Industries AG; Taekwang Industrial, CO., LTD.; Arkema; Grupa Azoty; Solvay; Akzo Nobel N.V.; Gujarat Alkalies & Chemicals Ltd.; National Peroxide Limited; OCI Company Ltd.; Airedale Chemical.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Peroxide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the hydrogen peroxide market report based on grade, function, application, and region.

-

Grade Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

<30%

-

30%-50%

-

50%-80%

-

>80%

-

-

Function Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

Disinfectant

-

Bleaching

-

Oxidant

-

Others

-

-

Application Outlook (Volume kilotons; Revenue, USD Million, 2018 - 2030)

-

Pulp & Paper

-

Chemical Synthesis

-

Wastewater Treatment

-

Mining

-

Food & Beverage

-

Personal Care

-

Healthcare

-

Textiles

-

Electronics

-

Propulsion Systems

-

Others

-

-

Regional Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.