- Home

- »

- Medical Devices

- »

-

Biologics Contract Development And Manufacturing Organization Market Report, 2033GVR Report cover

![Biologics Contract Development And Manufacturing Organization Market Size, Share & Trends Report]()

Biologics Contract Development And Manufacturing Organization Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Service, By Source, By Workflow, By Therapeutic Area, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-773-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biologics Contract Development And Manufacturing Organization Market Summary

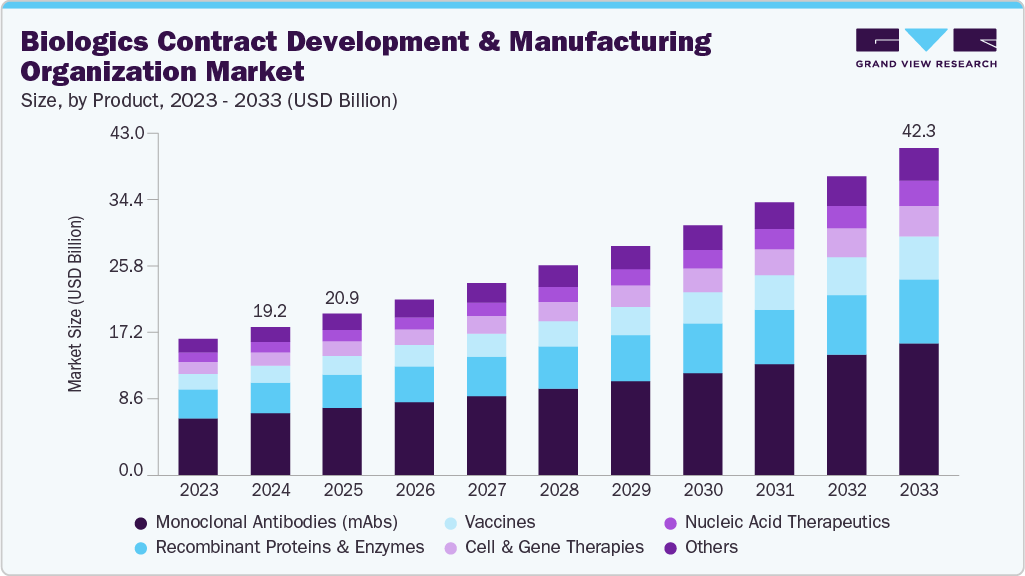

The global biologics contract development and manufacturing organization market size was estimated at USD 19.22 billion in 2024 and is projected to reach USD 42.32 billion by 2033, growing at a CAGR of 9.21% from 2025 to 2033. The market is driven by the rising prevalence of chronic and rare diseases, an aging global population, and the growing demand for highly targeted therapies.

Key Market Trends & Insights

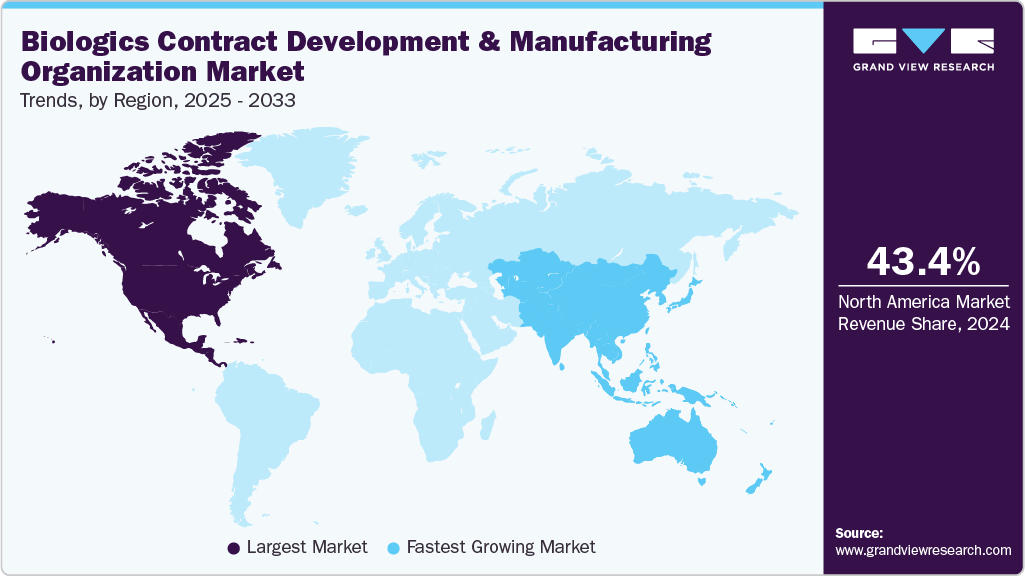

- The North America biologics contract development and manufacturing organization (CDMO) market held the largest share of 43.41% of the global market in 2024.

- The biologics contract development and manufacturing organization (CDMO) in the U.S. is expected to grow significantly over the forecast period.

- Based on product, the monoclonal antibodies (mAbs) segment held the largest market share in 2024.

- Based on service, the contract manufacturing segment held the largest market share in 2024.

- Based on source, the microbial segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.22 Billion

- 2033 Projected Market Size: USD 42.32 Billion

- CAGR (2025-2033): 9.21%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Besides, with the increasing need for biologics, the pharmaceutical and biopharmaceutical industry continues to show a surge in the number of companies opting for CDMO services. Furthermore, growing investments in biologics are expected to drive venture capital, strategic collaborations, mergers, and acquisitions, further contributing to market growth across the value chain. Most pharmaceutical & biopharmaceutical companies are increasingly partnering with CDMO service providers to expand capacity and access specialized technologies, while private equity and institutional investors are expanding their funds into platform companies with innovative models. In addition, most large pharmaceutical companies are focusing on acquisitions to strengthen their biologics pipelines, diversify therapeutic portfolios, and secure advanced manufacturing capabilities. Thus, these capital investments and strategic innovations are accelerating commercialization and reshaping the competitive landscape and are expected to drive the market in the coming years.

Moreover, with the growing focus on regulatory scenarios, the U.S. FDA, EMA, and other global authorities are refining approval pathways for biosimilars, cell therapies, and gene-based treatments, creating guidelines to encourage innovation while safeguarding patient safety. In addition, harmonized standards across regions support streamlining submissions and reducing delays, while post-market surveillance & evidence requirements remain stringent in the market. The evolving regulatory environment significantly enables faster approvals for novel therapies while raising the compliance burden on developers to meet rigorous chemistry, manufacturing, and control expectations. Such factors are expected to drive the market over the estimated time period.

Opportunity Analysis

The biologics CDMO market is experiencing considerable growth due to the rapid expansion of biologics pipelines, such as monoclonal antibodies, bi-specifics, and gene therapies. Besides, increased investment in R&D and a rising demand for outsourced manufacturing further contribute to allowing access to advanced production capabilities without incurring heavy capital costs. In addition, growing technological innovations such as continuous bioprocessing, single-use bioreactors, and automated cell culture systems are contributing to increased efficiency, cost reductions, and new service offerings. Moreover, growing emerging markets and the rising adoption of biologics for treating chronic and rare diseases are expanding the requirement for CDMO service providers and pharmaceutical and biotechnology companies.

Furthermore, leading CDMOs are pursuing strategic collaborations and developing their capacities to secure early-stage development contracts and scale up commercial production. Besides, most service providers offer flexible, high-quality, and technologically advanced solutions, positioned to benefit from the increasing trend toward outsourcing, catering to niche and large-scale manufacturing needs. Thus, the biologics CDMO industry is anticipated to witness new growth opportunities.

Impact of U.S. Tariffs on the Global Biologics Contract Development And Manufacturing Organization (CDMO) Market

U.S. tariffs have presented significant challenges to the biologics CDMO market, affecting cost structures, supply chains, and competitive dynamics. Besides, tariffs on imported raw materials, consumables, and specialized equipment have increased production costs for CDMOs that depend on international supply chains. In addition, the surge in expenses has led to decreased profit margins due to higher product prices. Furthermore, companies operating within the U.S. have encountered increased expenses when procuring biologics components from impacted countries, prompting them to consider strategic shifts toward alternative suppliers. Moreover, growing implications of tariffs extend beyond costs, leading to a slowdown in project timelines and influencing the pace at which biologics development and commercialization of the products are being developed among the companies. CDMOs with a global reach that serve U.S. clients may need to navigate pricing pressures and renegotiate contracts to compensate for these increased expenses. On the other hand, some companies view these challenges as an opportunity to support manufacturing capabilities, diversify their supply chains, and invest in automation to mitigate the impacts of tariffs. Thus, U.S. tariffs have transformed operational strategies and competitive positioning within the global biologics CDMO landscape.

Technological Advancements

Technological advancements such as continuous bioprocessing, single-use bioreactors, advanced analytical techniques, automation and digitalization, and cell & gene therapy platforms are significantly reshaping the landscape of the biologics market. In essence, continuous bioprocessing enhances efficiency, scalability, and cost-effectiveness while ensuring consistent product quality. Besides, adopting single-use bioreactors promotes increased flexibility, minimizes contamination risks, and facilitates rapid changeovers in multiproduct facilities, further contributing to market-rising demand for personalized biologics. Moreover, analytical techniques ensure quality and timelines and mitigate the associated risks. In addition, integrating automation and digitalization, through robotics, digital twins, and electronic batch records, streamlines operations, enhances traceability, and bolsters regulatory compliance.

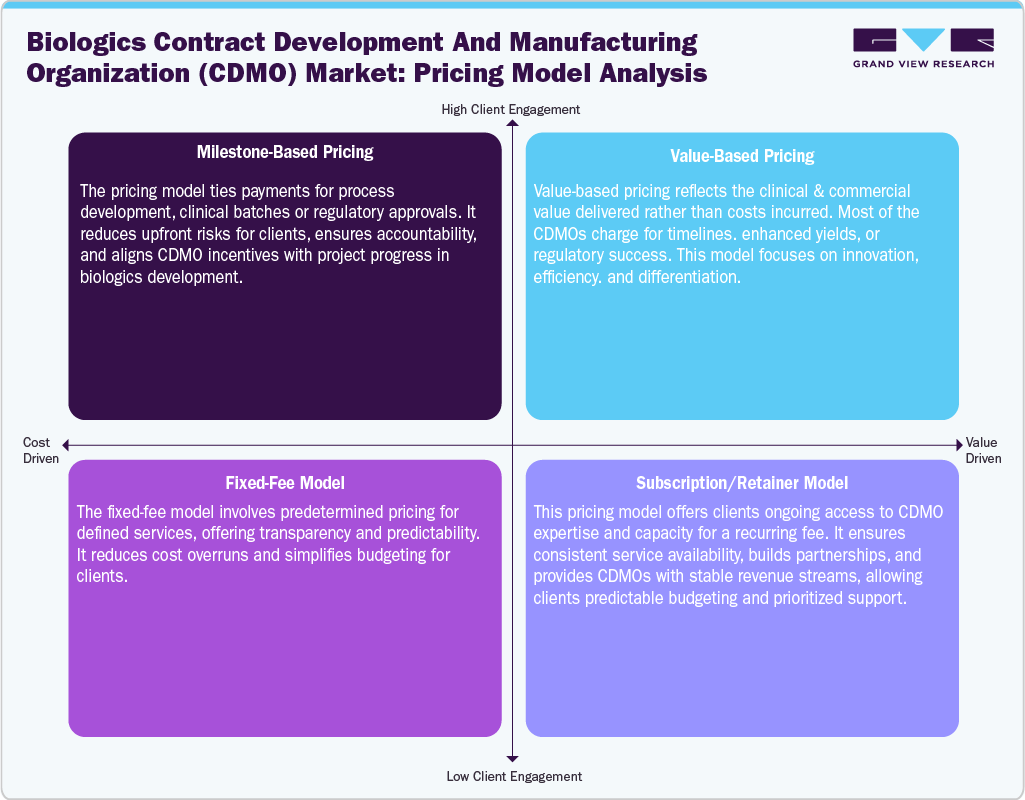

Pricing Model Analysis

The biologics CDMOs market employs various pricing models to balance client requirements, project risks, and value delivery. Milestone-based pricing ties payments to process development, clinical supply, or regulatory approval, ensuring accountability & reducing risks for clients. Besides, value-based pricing focuses on the tangible benefits delivered faster timelines, higher yields, or successful approvals. The linked-fee model offers clarity & predictability with defined costs for services, supporting the clients to manage budgets while CDMOs assume risk if unforeseen complexities arise. Moreover, the subscription or retainer model provides clients with expertise & capacity for a recurring fee, supporting consistency, priority service, and long-term collaboration. Thus, these models demonstrate flexible, transparent, and partnership-oriented arrangements, enabling CDMOs to support the growing complexity of biologics development and manufacturing.

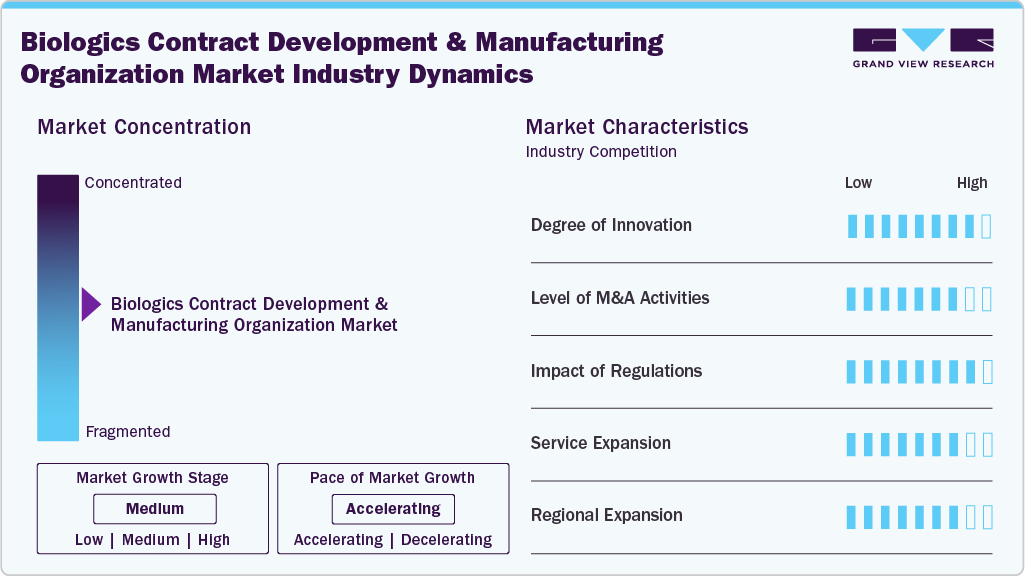

Market Concentration & Characteristics

The biologics contract development and manufacturing organization (CDMO) market growth stage is high, and growth is accelerating. The industry is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Innovation drives competitiveness as CDMOs adopt advanced bioprocessing, single-use technologies & next-generation biologics like bispecific antibodies and ADCs. These advancements improve efficiency, accelerate timelines, and enable adaptability, making CDMOs critical partners for complex biologics development and manufacturing projects.

M&A activities consolidate expertise, expand capabilities, and enhance geographic presence. In addition, strategic acquisitions provide access to advanced technologies and biologics-focused facilities. This integration strengthens competitiveness, enriches service offerings, and accelerates entry into the growing biologics market.

Regulatory compliance shapes biologics CDMO operations through stringent GMP, biosafety, and therapeutic guidelines. Besides, meeting these requirements impacts costs, approvals, and timelines. CDMOs with strong regulatory expertise manage risks effectively, achieve faster approvals, and deliver reliable, compliant solutions for global biologics clients.

Biologics CDMOs expand services from early development to large-scale manufacturing, covering analytics, cell line development, and commercialization. Comprehensive portfolios attract major biopharma clients, reduce dependency on single offerings, and drive long-term partnerships, enabling CDMOs to create more substantial value throughout the biologic’s lifecycle.

Regional expansion supports the market to access, boost the revenue, and create cost-effective manufacturing hubs. Besides, establishing presence in emerging regions enhances supply chain resilience, regulatory compliance, and scalability, empowering CDMOs to serve multinational clients and strengthen competitiveness in the global biologics market.

Product Insights

On the basis of product, the monoclonal antibodies (mAbs) segment held the largest market revenue share of 41.91% in 2024. The segment is driven by rising demand for targeted therapies, and laboratory-engineered proteins designed to mimic natural antibodies and target specific antigens with high precision. Besides, rapid adoption in biopharmaceutical pipelines, with continuous innovation driving formats like bispecific and antibody-drug conjugates, is expected to drive the segment growth.

The nucleic acid therapeutics segment is expected to grow significantly during the forecast period. The segment growth is driven by its ability to provide targeted, personalized treatments for genetic and rare diseases. Besides, advances in delivery technologies, the success of mRNA vaccines, growing biopharma R&D investments & supportive regulatory frameworks are expected to drive the development of these therapeutics. Thus, these factors are expected to enhance adoption, expand pipelines, and position nucleic acid therapies over the estimated period.

Service Insights

In terms of service, the contract manufacturing segment accounted for the largest share in 2024 during the forecast period. The growth is fueled by the rising complexity in biologics development, rising R&D costs, and the demand for faster time-to-market. In addition, contract manufacturing offers a range of services that allow companies to access advanced technologies, specialized expertise, and scalable manufacturing without heavy capital investment, further fueling the innovation in the market.

The contract development segment is expected to grow significantly during the forecast period. The Contract development in the pharmaceutical and biotechnology industry involves outsourcing various drug or biologics production stages to specialized CDMOs encompassing cell line development, formulation, process development, analytical testing, and clinical batch production. By collaborating with CDMOs, companies gain advanced technical expertise, cutting-edge technologies, and extensive regulatory knowledge without the heavy financial burden. This approach helps companies speed up their timelines, lower costs, and minimize operational risks while adhering to high-quality standards.

Source Insights

Based on source, the microbial segment dominated the market with the largest revenue share in 2024. The increasing requirement for cost-effective microbial production, offering higher yields at lower costs than mammalian systems, has bolstered the segment growth. Besides, rising demand for vaccines, enzymes, and therapeutics is expected to drive the market over the estimated period. In addition, growing regulatory support with microbial platforms facilitates faster approvals, making them a preferred choice for developing safe, reliable, and commercially viable biologics. Moreover, advances in genetic engineering, fermentation technologies, and process optimization have enhanced yield, safety, and product consistency. Such factors are expected to drive segment growth.

On the other hand, the mammalian segment is projected to grow at a notable CAGR during the forecast period. The segment is driven by the rising need for complex, high-quality therapeutics requiring proper protein folding and post-translational modifications. Besides, growing advances in cell line engineering, bioreactor technologies, and process optimization that support enhanced yield, scalability, and consistency are expected to drive the segment growth. In addition, some other factors contributing to segment growth are the rising demand for monoclonal antibodies, recombinant proteins, and personalized therapies, which further contribute to market growth. In addition, the increasing prevalence of chronic, rare, and complex diseases drives investment in mammalian platforms, further supporting the segment growth.

Workflow Insights

On the basis of workflow, the commercial segment accounted for the largest share in 2024 during the forecast period. The growing demand for safe and effective therapeutics, including monoclonal antibodies, vaccines, and recombinant proteins, has provided an impetus to industry growth. Besides, the increasing prevalence of chronic, rare, and complex diseases has prompted stakeholders to invest in the segment. In addition, increasing advances in manufacturing technologies, process optimization, and quality control ensure consistent, high-quality output, which fuels the segment growth. In addition, regulatory support and streamlined approval pathways accelerate market entry. Moreover, increasing investments from pharma/biopharma companies and expanding healthcare infrastructure globally are boosting the market. Thus, these factors are expected to drive the market.

The clinical segment is expected to grow significantly during the forecast period. The growth is attributed to an expanding pipeline of innovative therapies, including monoclonal antibodies, cell and gene therapies, and recombinant proteins. Besides, rising R&D investments, advances in preclinical and clinical development technologies, and regulatory incentives accelerate progression from discovery to trials, which are expected to support the market. In addition, the Growing demand for treatments targeting rare, chronic, and complex diseases further fuels the clinical biologics development, driving the market. Thus, such factors are expected to drive new growth opportunities over the estimated period.

Therapeutic Area Insights

With respect to the therapeutic area, the oncology segment accounted for the largest share in 2024 during the forecast period. The segment growth is driven by rising cancer prevalence, increasing patent expirations, growing demand for innovative treatments, and high demand for targeted therapies, including monoclonal antibodies, antibody-drug conjugates, and cell & gene therapies. For instance, the Cancer Atlas mentioned that the number of cancer cases is expected to reach 29 million globally by 2040. This is expected to drive the development of innovative treatments, creating opportunities for outsourced manufacturing and development services. Besides, CDMOs support oncology companies in achieving faster market entry from early-stage process development and clinical batch production to commercial-scale manufacturing, further contributing to segment growth. Moreover, advances in biologics platforms, high-potency manufacturing, and regulatory expertise enable CDMOs to deliver complex oncology therapeutics efficiently, ensuring quality, scalability, and faster time-to-market for addressing the market needs.

The autoimmune diseases segment is expected to grow at a robust CAGR during the forecast period. The rising prevalence of rheumatoid arthritis, psoriasis, and multiple sclerosis drives the segment. This has led pharmaceutical and biotech companies to shift towards CDMOs with increasing patient requirements for targeted and effective therapies. Moreover, most CDMO companies offer a range of advanced technologies in monoclonal antibodies, fusion proteins, and novel biologics that improve efficacy and safety profile, which further drives the market. Thus, innovation, adoption, and expansion of biologics for autoimmune disease are expected to drive the segment growth over the estimated period.

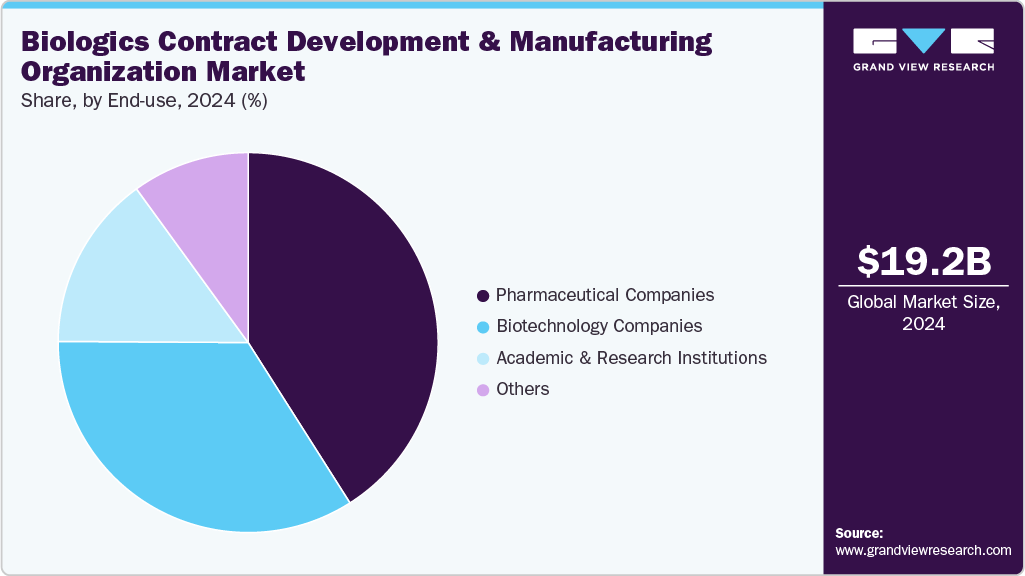

End Use Insights

On the basis of end-use, the pharmaceutical companies segment accounted for the largest share in 2024 during the forecast period. Pharmaceutical companies play a crucial role in driving the biologics CDMO market by outsourcing development and manufacturing to leverage specialized expertise, advanced technologies, and scalable production capabilities. Besides, rising R&D investments, demand for complex biologics, and the need to accelerate time-to-market encourage partnerships with CDMOs, which further contribute to market growth. Moreover, most of the pharma companies benefit from cost efficiencies, risk mitigation, and regulatory compliance support, enabling faster commercialization of therapies. Thus, such factors are expected to drive the market over the estimated time period.

The biotechnology companies segment is expected to grow at the fastest CAGR during the forecast period. Biotechnology companies drive growth in the biologics CDMO market by developing innovative therapies such as monoclonal antibodies, nucleic acid therapeutics, and cell & gene therapies. Besides, most of the biotechnology companies lack the in-house manufacturing capabilities, often leading to partnerships with CDMOs for process development, clinical, and commercial-scale production. These collaborations provide access to specialized expertise, advanced technologies, and regulatory support, enabling faster time-to-market. Moreover, rising investments, focus on personalized medicine, and the need for scalable, cost-effective production further contribute to segment growth.

Regional Insights

The North America biologics contract development and manufacturing organization (CDMO) industry dominated the global market in 2024, holding a revenue share of 43.41%. The growth is attributed to the presence of a strong biopharmaceutical infrastructure, high R&D investment, and the increasing presence of biotech and pharmaceutical companies. Besides, the presence of advanced manufacturing facilities, a skilled workforce, and an increasing adoption of innovative technologies drives the region’s innovations in biologics products. In addition, favorable regulatory frameworks and high healthcare expenditure support the market. Moreover, increasing demand for monoclonal antibodies, cell & gene therapies, and personalized medicines is anticipated to drive the biologics outsourcing, innovation, and commercialization in the region.

U.S. Biologics Contract Development And Manufacturing Organization (CDMO) Market Trends

The biologics contract development and manufacturing organization (CDMO) industry in the U.S. accounted for the highest market share in the region, owing to the strong presence of established biotech and pharmaceutical companies, increased R&D investments, and advanced manufacturing infrastructure. Besides, early adoption of cutting-edge technologies, including single-use bioreactors, continuous bioprocessing, and gene therapy platforms, supports innovative, robust biologics production. Moreover, favorable regulatory frameworks and streamlined approval pathways accelerate the commercialization of monoclonal antibodies and personalized medicines, further creating the U.S. as a critical hub for biologics innovation. Such factors are expected to drive the U.S. market.

The Canada biologics contract development and manufacturing organization (CDMO) industry is expected to grow at a significant CAGR during the forecast period. The market is driven by increasing biotech activities, supportive government policies, and growing advancements in manufacturing facilities. Besides, most companies are opting for CDMO partnerships for both clinical and commercial-scale biologics production, benefiting from regulatory guidance and cost-effective solutions. In addition, growing demand for monoclonal antibodies, vaccines, and therapies for rare diseases is expected to establish the country as an emerging hub for biologics innovation and outsourcing in North America.

Europe Biologics Contract Development And Manufacturing Organization (CDMO) Market Trends

The Europe biologics contract development and manufacturing organization (CDMO) industry benefits from a strong biopharma industry, government incentives, and investment in advanced manufacturing technologies. Countries like Germany, France, and Switzerland are major biotech hubs with skilled workforces and robust regulatory expertise. The presence of established companies in the region is expected to meet the end-use demand for monoclonal antibodies, gene and cell therapies, and vaccines, further fueling the collaborations with CDMOs. Moreover, favorable conditions for clinical trials and GMP compliance further drive the region as Europe's Central market for biologics outsourcing and production.

The biologics contract development and manufacturing organization (CDMO) industry in Germany held the largest share in 2024. Germany is one of the leading biologics CDMO hubs, supported by advanced infrastructure, a skilled workforce, and strong biopharma R&D activities. Besides, increased demand for monoclonal antibodies, vaccines, and innovative therapies drives outsourcing to CDMOs, further supporting the market growth. Moreover, regulatory expertise and GMP-compliant facilities attract global clients, reinforcing Germany's critical position in European clinical and commercial biologics manufacturing.

The UK biologics contract development and manufacturing organization (CDMO) industry is expected to grow significantly over the forecast period. The country's growth is fueled by the presence of established biotech clusters, regulatory support, and advanced manufacturing capabilities. Besides, significant demand for monoclonal antibodies, cell and gene therapies, and vaccines propels outsourcing to CDMOs. Moreover, with strong R&D investments, a skilled workforce, and favorable government initiatives, the UK remains an influential hub for biologics development and production in Europe.

Asia Pacific Biologics Contract Development And Manufacturing Organization (CDMO) Market Trends

The Asia Pacific biologics contract development and manufacturing organization (CDMO) industry is expected to grow at a significant CAGR over the forecast period. The market is driven by increasing biopharma investment, growing healthcare demands, and cost-effective manufacturing solutions. Countries such as China, India, and Japan lead the regional market, offering skilled talent and advanced facilities with regulatory alignment. Rising demand for monoclonal antibodies, vaccines, and biosimilars drives outsourcing, allowing CDMOs to cater efficiently to global clients while boosting local market growth.

The biologics contract development and manufacturing organization (CDMO) industry in China is witnessing new growth opportunities due to leveraging government support and expanding biotech R&D, alongside cost-effective manufacturing. Besides, the increasing demand for monoclonal antibodies, vaccines, and gene therapies further supports the market. In addition, the presence of advanced facilities and a skilled workforce for both domestic and international companies is expected to drive the clinical and commercial biologics production, enhancing China's position in the global biopharmaceutical market.

The biologics contract development and manufacturing organization (CDMO) industry in Japan is driven by characterized by a strong pharmaceutical infrastructure, a skilled workforce, and regulatory support. The country's high demand for monoclonal antibodies, vaccines, and cell therapies, as well as outsourcing, supports market growth. Moreover, Japan's Advanced manufacturing capabilities and GMP-compliant facilities, combined with a focus on innovative biologics, further support the market growth.

The India biologics contract development and manufacturing organization (CDMO) industry is experiencing rapid expansion, attributed to low labor costs, a cost-effective hub for biologics CDMO offering skilled talent, advanced manufacturing capabilities, and regulatory alignment. The growing demand for monoclonal antibodies, biosimilars, and vaccines propels outsourcing activities. In addition, local and global biopharma companies are leveraging India's scalable facilities to accelerate development and reduce costs, strengthening the country's footprint in the Asia Pacific biologics market.

Latin America Biologics Contract Development And Manufacturing Organization (CDMO) Market Trends

The biologics contract development and manufacturing organization (CDMO) industry in Latin America is expected to significantly grow over the estimated time period. The market is driven by increasing healthcare demands, government support, and investments in manufacturing infrastructure. By outsourcing CDMOs, companies can access cost-effective production, regulatory expertise, and scalable facilities, bolstering regional and international biologics supply chains.

The Brazil biologics contract development and manufacturing organization (CDMO) industry is driven by supportive government initiatives and increasing biopharma R&D investments. The rising demand for monoclonal antibodies, vaccines, and biosimilars is fueling the market. Besides, CDMOs in the country provide scalable, cost-effective, and regulatory-compliant manufacturing solutions, further supporting companies to drive the development and expand regional access, cementing Brazil's status as a key biologics production hub.

Middle East & Africa Biologics Contract Development And Manufacturing Organization (CDMO) Market Trends

The biologics contract development and manufacturing organization (CDMO) industry in the Middle East and Africa region is expected to experience steady growth over the forecast period. The market is driven by increasing healthcare investments, government initiatives, and a growing demand for vaccines and biologics. Besides, outsourcing to CDMOs offers access to expertise, scalable manufacturing, and regulatory guidance. Moreover, the growing expansion of the market is enhancing the supply chain resilience, enabling companies to serve local populations while strengthening their biologics manufacturing capabilities effectively.

The UAE biologics contract development and manufacturing organization (CDMO) industry is experiencing growth driven by government support, investments in advanced manufacturing, and its strategic location. There is significant demand for vaccines, monoclonal antibodies, and innovative therapies, which fuels outsourcing. CDMOs in the UAE provide scalable, compliant, and cost-effective production, allowing both global and regional biopharma companies to enhance their biologics development and market presence within the Middle East.

Key Biologics Contract Development And Manufacturing Organization (CDMO) Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in April 2025, AGC Biologics introduced a new division focused on cell and gene therapies. The cell and gene technologies division aims to enhance AGC Biologics’ current capabilities while providing developers with additional capacity, specialized scientific expertise, and access to highly qualified CDMO services for cell and gene therapy manufacturing.

Key Biologics Contract Development And Manufacturing Organization (CDMO) Companies:

The following are the leading companies in the biologics contract development and manufacturing organization (CDMO) market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza Group

- Catalent Pharma Solutions

- Samsung Biologics

- WuXi Biologics / WuXi AppTec

- Thermo Fisher Scientific

- Fujifilm Diosynth Biotechnologies

- Boehringer Ingelheim (Biopharma CDMO)

- Rentschler Biopharma SE

- AGC Biologics

- Charles River Laboratories

- Siegfried Holding

- Sandoz

- GenScript Biologics

- Vetter Pharma

- IDT Biologika

Recent Developments

-

In September 2025, Rezon Bio announced its launch as a European CDMO specializing in biologics. While as a new brand, it leverages an established track record of supporting biologics development from gene-level research to global commercialization through partnerships with experienced industry collaborators.

-

In July 2025, Samsung Biologics partnered with 35Pharma, enabling the development and clinical approvals of two recombinant proteins through coordinated CDMO support, operational excellence, and trusted collaboration, accelerating therapeutic innovation from concept to clinic.

-

In May 2025, Radyus Research and Eurofins CDMO Alphora launched a strategic partnership, integrating development, regulatory, and GMP manufacturing capabilities to streamline global biotech drug programs from preclinical through clinical proof-of-concept with end-to-end solutions.

Biologics Contract Development And Manufacturing Organization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.92 billion

Revenue forecast in 2033

USD 42.32 billion

Growth rate

CAGR of 9.21% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, source, workflow, therapeutic area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Lonza Group; Catalent Pharma Solutions; Samsung Biologics; WuXi Biologics / WuXi AppTec; Thermo Fisher Scientific; Fujifilm Diosynth Biotechnologies; Boehringer Ingelheim (Biopharma CDMO); Rentschler; Biopharma SE; AGC Biologics; Charles River Laboratories; Siegfried Holding; Sandoz; GenScript Biologics; Vetter Pharma; IDT Biologika

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biologics Contract Development And Manufacturing Organization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biologics contract development and manufacturing organization (CDMO) market report based on product, service, source, workflow, therapeutic area, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Monoclonal antibodies (mAbs)

-

Recombinant proteins & enzymes

-

Vaccines

-

Cell & Gene Therapies

-

Nucleic acid Therapeutics

-

Others

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Development

-

Cell Line Development

-

Process Development

-

Upstream

-

Downstream

-

-

Analytical Testing & Method Validation

-

Scale-Up & Tech Transfer

-

-

Contract Manufacturing

-

API Manufacturing

-

Finished Drug Products Manufacturing

-

-

Packaging and Labelling

-

Regulatory Affairs

-

Logistics & Storage

-

Others

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Mammalian

-

Microbial

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical

-

Commercial

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Autoimmune Diseases

-

Infectious Diseases

-

Cardiovascular Diseases

-

Metabolic Diseases

-

Neurological Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Academic and Research Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global biologics contract development and manufacturing organization market is expected to grow at a compound annual growth rate of 9.21% from 2025 to 2033 to reach USD 42.32 billion by 2033.

b. The monoclonal antibodies (mAbs) segment dominated the biologics CDMO market with a share of 41.91% in 2024. The market growth is attributed to rising demand for targeted therapies and laboratory-engineered proteins designed to mimic natural antibodies and target specific antigens with high precision. Besides, rapid adoption in biopharmaceutical pipelines, with continuous innovation driving formats like bispecific and antibody-drug conjugates, further contributing to the market growth.

b. The global biologics contract development and manufacturing organization market size was estimated at USD 19.22 billion in 2024 and is expected to reach USD 20.92 billion in 2025.

b. Some key players operating in the biologics CDMO market include Lonza Group, Catalent Pharma Solutions, Samsung Biologics, WuXi Biologics / WuXi AppTec, Thermo Fisher Scientific, Fujifilm Diosynth Biotechnologies, Boehringer Ingelheim (Biopharma CDMO), Rentschler, Biopharma SE, AGC Biologics, Charles River Laboratories, Siegfried Holding, Sandoz, GenScript Biologics, Vetter Pharma, and IDT Biologika, among others.

b. The market growth is driven by rising prevalence of chronic and rare diseases, an aging global population, and the growing demand for highly targeted therapies. Besides, with the increasing need for biologics, the pharmaceutical and biopharmaceutical industry continues to show a surge in the number of companies opting for CDMO services. Besides, increasing the adoption of biosimilars provides cost-effective alternatives while expanding patient access, further supporting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.