- Home

- »

- Plastics, Polymers & Resins

- »

-

Biopolymer Packaging Market Size, Industry Report, 2030GVR Report cover

![Biopolymer Packaging Market Size, Share & Trends Report]()

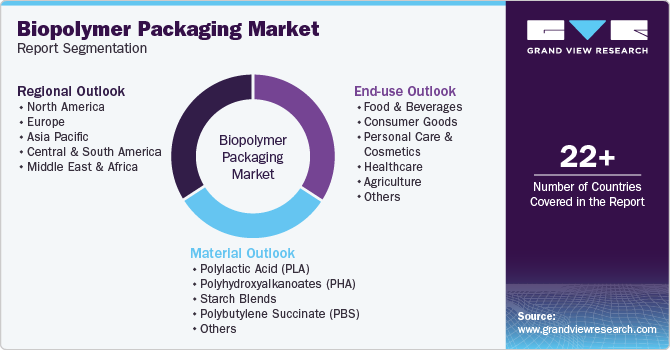

Biopolymer Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch Blends, Polybutylene Succinate (PBS)), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-530-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biopolymer Packaging Market Size & Trends

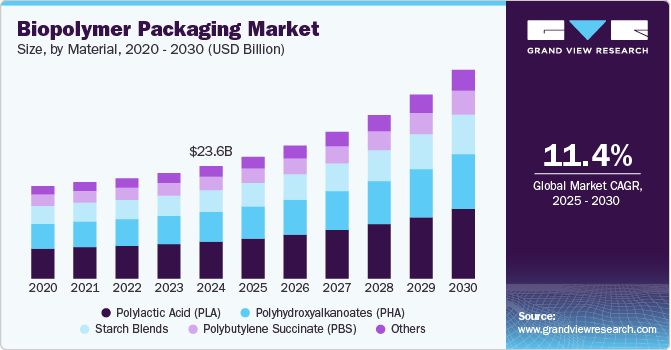

The global biopolymer packaging market size was estimated at USD 23.56 billion in 2024 and is expected to grow at a CAGR of 11.4% from 2025 to 2030. The global biopolymer packaging market is driven by increasing environmental concerns and regulatory support for sustainable packaging solutions. Governments worldwide are implementing strict regulations to reduce plastic waste, such as the EU’s Single-Use Plastics Directive and bans on single-use plastic bags in countries such as India and China. These policies encourage the adoption of biodegradable and compostable packaging materials.

In addition, rising consumer awareness about the environmental impact of conventional plastic packaging is prompting businesses to shift towards eco-friendly alternatives, such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based plastics. For instance, in August 2023, CJ Biomaterials and Riman Korea partnered to create eco-friendly packaging for Riman’s premium IncellDerm skincare product line. This collaboration combines CJ Biomaterials’ patented polyhydroxyalkanoate (PHA) technology with polylactic acid (PLA) to produce sustainable packaging that reduces reliance on fossil fuel-based materials.

The growing demand for sustainable packaging in the food and beverage industry is propelling the growth of the market. With increasing health consciousness, consumers prefer packaging that is free from harmful chemicals such as BPA and offers better recyclability. Fast-food chains and grocery retailers are adopting biopolymer-based packaging to meet customer expectations and regulatory compliance. For instance, in October 2024, UPM Specialty Papers and Eastman collaborated to develop an innovative biopolymer-coated paper packaging solution tailored for food applications requiring grease and oxygen barriers. This solution integrates Eastman’s biobased and compostable Solus performance additives with BioPBS polymer, forming a thin, recyclable coating on UPM's compostable and recyclable barrier base papers

The expansion of advanced biopolymer production technologies is also accelerating market growth. Companies are investing in large-scale production of PHA and PLA, making biopolymers more accessible and cost-effective for packaging applications. For instance, in December 2023, Sulzer introduced a new licensed technology called CAPSUL for the continuous production of polycaprolactone (PCL), a biodegradable polyester widely used in industries such as packaging, textiles, agriculture, and horticulture.

Moreover, corporate sustainability initiatives and brand differentiation strategies are pushing companies to adopt biopolymer packaging. Prominent brands are integrating sustainability into their core business models to enhance their brand image and appeal to eco-conscious consumers. For example, Nestlé and Unilever have committed to achieving 100% recyclable or compostable packaging by 2025, driving the demand for biopolymers. As businesses continue to align with global sustainability goals, the biopolymer packaging market is expected to experience significant growth in the coming years.

Material Insights

The PLA material segment recorded the largest market revenue share of over 32.0% in 2024. PLA is a biodegradable and bio-based polymer derived from renewable resources such as corn starch or sugarcane. It is widely used in biopolymer packaging due to its transparency, high strength, and compostability under industrial conditions. PLA is commonly used in food packaging, disposable cutlery, and films.

Polyhydroxyalkanoates (PHA) are biodegradable polyesters produced through bacterial fermentation of renewable feedstocks such as plant oils and sugars. PHAs are known for their excellent biodegradability in various environments, including marine conditions, making them a strong alternative to conventional plastics.

The others segment is projected to grow at the fastest CAGR of 12.7% during the forecast period of 2025 to 2030. It includes bio-based polybutylene adipate terephthalate (PBAT), polyethylene furanoate (PEF), and cellulose-based polymers. PBAT is widely used for flexible packaging due to its excellent biodegradability and flexibility, while PEF offers superior barrier properties and is seen as a strong alternative to PET. Cellulose-based packaging is derived from natural fibers and is utilized in applications such as films and coatings.

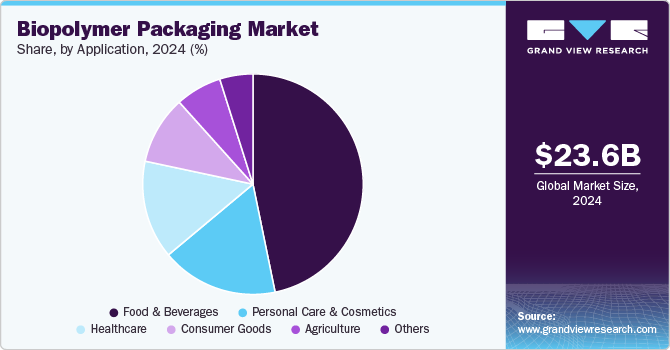

Application Insights

The food & beverages segment recorded the largest market share of over 46.0% in 2024. Biopolymer packaging is widely used in the food & beverages industry due to its eco-friendly and biodegradable properties. Applications include food wraps, containers, pouches, and bottles made from PLA, PHA, and starch-based bioplastics. These materials offer excellent barrier properties against moisture and oxygen, ensuring food preservation while reducing reliance on petroleum-based plastics.

The consumer goods segment is projected to grow at the fastest CAGR of 12.7% during the forecast period. Consumer goods, including household products, electronics, and textiles, are increasingly using biopolymer packaging to reduce plastic waste and improve sustainability. Packaging for items such as detergents, personal electronics, and non-food retail products is shifting toward bio-based films and rigid containers made from PLA, PHA, and bio-based polyethylene (PE).

The personal care & cosmetics sector is adopting biopolymer packaging for items such as skincare products, shampoos, and lotions. Companies are using bio-based PET, biodegradable polymers, and compostable films to reduce environmental impact. Luxurious and sustainable packaging solutions are gaining traction, driven by eco-conscious consumer preferences.

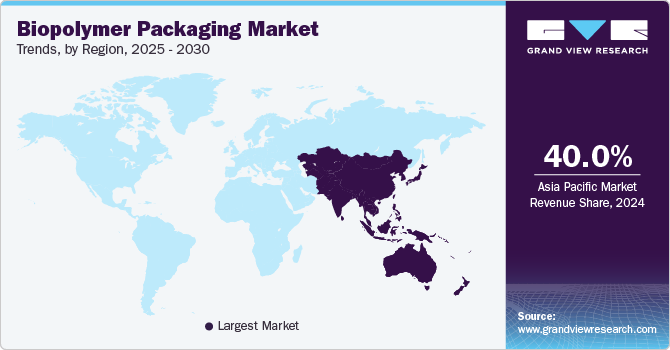

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 40.0% in 2024 and is anticipated to grow at the fastest CAGR of 11.7% over the forecast period. The Asia Pacific region is dominating the region segment of the global biopolymer packaging market due to rising environmental awareness coupled with stringent government regulations against single-use plastics. This outlook has created a substantial demand for sustainable packaging solutions across countries such as China, Japan, India, and South Korea. Moreover, the region's abundant agricultural resources provide cost-effective raw materials for biopolymer production. Countries such as Thailand and Indonesia leverage their cassava and sugarcane industries to produce bioplastics, creating vertically integrated supply chains that enhance cost competitiveness.

China Biopolymer Packaging Market Trends

China's biopolymer packaging market is experiencing robust growth driven by several interrelated factors. The government has enacted aggressive policies that encourage the adoption of sustainable packaging solutions by providing substantial subsidies to manufacturers transitioning to biopolymer production and imposing steep penalties on those who continue using traditional plastics. This favorable regulatory framework, coupled with the country’s strong manufacturing infrastructure, has led rapid market expansion. In addition, Chinese biopolymer packaging producers leverage the country's well-established export networks and competitive pricing strategies, further boosting the industry's growth.

North America Biopolymer Packaging Market Trends

North America’s growth in the Global biopolymer packaging market is primarily due to the heightened environmental awareness and stringent regulatory frameworks across the region. The region has experienced a significant consumer shift toward sustainable products, with major retailers and brands committing to eco-friendly packaging solutions. Companies such as Walmart, Amazon, and Whole Foods have established sustainability goals that prioritize biodegradable and compostable packaging materials, creating substantial market demand, thus triggering the market growth in the region.

The U.S. biopolymer packaging market growth is majorly driven by robust consumer demand for sustainable packaging and supportive regulatory changes. Several states, such as California, New York, and Washington, have enacted or proposed bans on single-use plastics, thus opening opportunities for biopolymer alternatives. In addition, federal initiatives that favor bio-based products through procurement policies and R&D funding have further propelled market expansion, along with effective waste management systems in many areas that can handle compostable biopolymer packaging.

Europe Biopolymer Packaging Market Trends

Europe’s growth in the global biopolymer packaging market is primarily fueled by its stringent regulations and environmental policies. The European Union has implemented comprehensive legislation such as the Single-Use Plastics Directive and Circular Economy Action Plan, which actively discourage traditional plastics and incentivize sustainable alternatives. In addition, the EU's plastic tax on non-recycled plastic packaging waste creates direct financial motivation for companies to adopt biopolymer solutions.

The biopolymer packaging market in Germany is primarily driven by its combination of strong environmental policies, technological innovation, and consumer demand. German chemical companies such as BASF and Evonik AG made substantial investments in biopolymer research and development, creating innovative materials that maintain functionality while reducing environmental impact. For instance, in June 2024, BASF expanded its biopolymers portfolio by introducing a biomass-balanced version of ecoflex, a polybutylene adipate terephthalate (PBAT) biopolymer. This innovation, known as ecoflex F Blend C1200 BMB, replaces traditional fossil raw materials with renewable feedstocks derived from waste and residual biomass.

Key Biopolymer Packaging Company Insights

The global biopolymer packaging market is highly competitive, with both established chemical companies and innovative niche players striving for a substantial market share. Firms are investing heavily in R&D to develop advanced, cost-effective, and eco-friendly biopolymers, while strategic partnerships, mergers, and geographical expansions further intensify the competitive landscape. Regulatory pressures and shifting consumer preferences toward green packaging solutions drive continuous innovation, compelling companies to differentiate through performance, efficiency, and sustainability.

-

In November 2024, Accredo Packaging, in collaboration with Fresh-Lock and Braskem, developed a 100% sugarcane-derived recyclable polyethylene pouch with a bioplastic zipper closure. This innovative packaging solution combines Braskem's "I'm Green" bio-based resin, Fresh-Lock's Renewables line zipper closures, and Accredo's in-house converting expertise. The pouch is designed for store drop-off recycling and is suitable for applications in food, cosmetics, personal care, and household goods industries.

-

In September 2024, Danimer Scientific and Ningbo Homelink Eco-iTech launched home-compostable drink cups coated with Nodax PHA-based biopolymers. These cups are designed to replace traditional polyethylene coatings in paper cups, offering a sustainable alternative that is both repulpable and compostable in home and industrial settings.

-

In April 2023, NatureWorks introduced Ingeo 6500D, a new biopolymer designed to enhance the performance of biobased nonwovens used in hygiene products such as diapers and wipes. This innovation offers a 40% increase in softness, improved tensile strength, and better fluid management when combined with optimized hydrophilic surface finishes. The product also enables lighter, thinner absorbent hygiene products with enhanced durability and skin health benefits, marking a significant advancement in eco-friendly nonwoven applications.

Key Biopolymer Packaging Companies:

The following are the leading companies in the biopolymer packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Danimer Scientific

- Sphere Group

- Vegware Global

- VICTOR Güthoff & Partner GmbH

- NatureWorks, LLC

- BioBag International AS

- PLAST-UP

- Polybags Ltd

- Clondalkin Group Holdings B.V.

- Genpak

- SIMPAC

- TERDEX GmbH

- Packman Packaging

- Greendot Biopak

- Accredo Packaging

Biopolymer Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.50 billion

Revenue forecast in 2030

USD 43.78 billion

Growth rate

CAGR of 11.4% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Danimer Scientific; Sphere Group; Vegware Global; VICTOR Güthoff & Partner GmbH; NatureWorks, LLC; BioBag International AS; PLAST-UP; Polybags Ltd; Clondalkin Group Holdings B.V.; Genpak; SIMPAC; TERDEX GmbH; Packman Packaging; Greendot Biopak; Accredo Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopolymer Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biopolymer packaging market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polylactic Acid (PLA)

-

Polyhydroxyalkanoates (PHA)

-

Starch Blends

-

Polybutylene Succinate (PBS)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Consumer Goods

-

Personal Care & Cosmetics

-

Healthcare

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Polylactic Acid dominated the biopolymer packaging market across the product segmentation in terms of revenue, accounting for a market share of 32.84% in 2024. PLA is a biodegradable and bio-based polymer derived from renewable resources such as corn starch or sugarcane. It is widely used in biopolymer packaging due to its transparency, high strength, and compostability under industrial conditions.

b. Some key players operating in the biopolymer packaging market include Danimer Scientific; Sphere Group; Vegware Global; VICTOR Güthoff & Partner GmbH; NatureWorks, LLC; BioBag International AS; PLAST-UP; Polybags Ltd; and Clondalkin Group Holdings B.V., among others

b. The global biopolymer packaging market is driven by increasing environmental concerns and regulatory support for sustainable packaging solutions. Additionally, rising consumer awareness about the environmental impact of conventional plastic packaging is prompting businesses to shift towards eco-friendly alternatives, such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based plastics.

b. The global biopolymer packaging market size was estimated at USD 23.56 billion in 2024 and is expected to reach USD 25.50 billion in 2025.

b. The global biopolymer packaging market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2030 to reach USD 43.78 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.