- Home

- »

- Plastics, Polymers & Resins

- »

-

Edible Packaging Market Size, Share & Trends Report, 2030GVR Report cover

![Edible Packaging Market Size, Share & Trends Report]()

Edible Packaging Market (2023 - 2030) Size, Share & Trends Analysis Report By Source, By Material (Protein, Polysaccharides, Lipid), By Packaging Type, By End-use (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-776-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Edible Packaging Market Summary

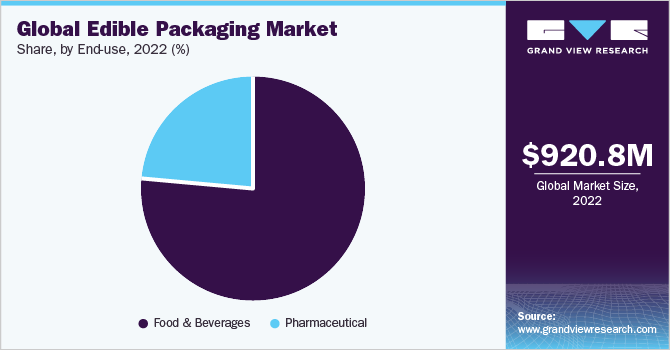

The global edible packaging market size was estimated at USD 920.78 million in 2022 and is expected to grow at a CAGR of 5.7% during the forecast period 2023 to 2030. The market growth is attributed to increased demand for sustainable packaging and demand for processed foods.

Key Market Trends & Insights

- North America accounted for the leading market revenue share of 28.8% in 2022.

- By material, the protein segment dominated the market with over 46.0% in 2022.

- By packaging type, the films segment accounted for the largest market share over 61.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 920.78 Million

- 2030 Projected Market Size: USD 1,416.77 Million

- CAGR (2023-2030): 5.7%

- North America: Largest market in 2022

For instance, evoware manufactures seaweed burger wraps for packaging burgers that are to be consumed with the burger.

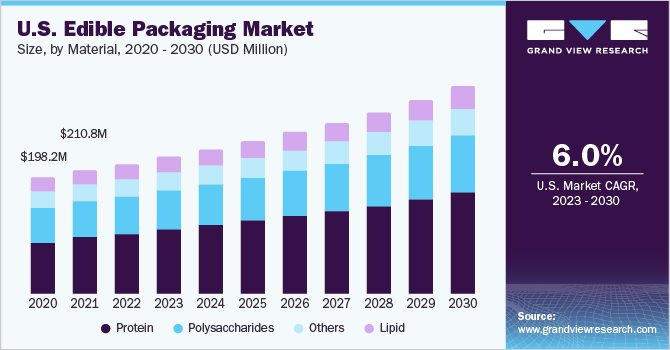

The U.S. market for edible packaging has been growing rapidly owing to several factors such as growing consumer awareness and demand for eco-friendly packaging solutions. In addition, stringent government regulations for promoting manufacturers to adopt sustainable packaging options are driving the market in the country. For instance, the U.S. government has been emphasizing and encouraging manufacturers to adapt to eco-friendly packaging through initiatives such as Food Recover Hierarchy and Sustainable Packaging Coalition.

In addition, owing to the busy schedules of consumers, the need for processed foods is growing in the country. These processed foods require a longer shelf life, which is offered by edible coatings and films. Hence, the large consumption of processed foods in the country has a positive impact on the edible food packaging market. Moreover, the market is driven by several key players in the country manufacturing edible packaging solutions such as JRF Technology, LLC, MonoSol, LLC, evoware, and others.

Source Insights

Based on source, the market has been categorized into plant and animal based sources. Among these, plant-based sources recorded a higher market share and accounted for over 76.0% in the base year 2022. Plant-based sources such as algae and seaweed are gaining popularity owing to their rich nutrient offering and ability to eliminate the need for additional chemicals in packaging solutions. Moreover, the growing trend of vegan diets across the globe gives rise to an increased demand for plant-based materials.

Animal-based sources such as collagen and gelatin offer high protein and functional properties. The animal-based coatings are mainly used on meat products to protect them from moisture and microbial growth. For instance, refrigerated chicken meat is packaged in whey protein coatings to avoid bacterial growth. The growing demand for protein-based diets from diet-conscious consumers is fueling the market growth for this segment.

Material Insights

Based on material, the market has been segmented into protein, polysaccharides, lipid, and others. Among these, the proteins segment dominated the market in 2022 with over 46.0% market share. The edible protein-based films are made of whey, gelatin, plants, soy, collagen, zein, and gluten. In comparison of lipid and polysaccharide-based films the protein films have better mechanical properties, and it acts as an excellent barrier against gas. Protein-based edible packaging materials, such as gelatin and casein, have good barrier properties that can help extend the shelf life of food products which further drives the market growth for this segment.

Polysaccharide materials are a group of complex carbohydrates derived from starch, cellulose, chitin, and others. Polysaccharides are commonly used in the manufacturing of edible packaging solutions owing to their desirable properties, such as biodegradability, non-toxicity, and cost-effectiveness.

Lipid based films such as beeswax, and fatty oils are a group of organic compounds that have a wide application in the food & beverage industry due to their ability to protect food quality by acting as a barrier against the external environment to extend the shelf life of the products. These films are mainly used in the packaging and coating of fruits and vegetables to keep them fresh for longer periods of time.

Packaging Type Insights

Based on packaging type, the market has been segmented into films, coatings, and others. Among these, the films segment accounted for the largest market share over 61.0% in 2022. The film packaging is lightweight and can be sealed easily, ensuring the freshness and extended shelf-life of the products during shipment and warehousing. Moreover, these films can be customized to fit different shapes and sizes of food products such as fruits and vegetables which further drives the market growth for this segment.

The coating packaging type market growth is attributed to its excellent barrier properties against air, moisture, gas, and preventing texture changes and microbial growth. It creates a more uniform surface and adds a matte or glossy finish to the food products, improving their appearance and texture which further drives the market for this segment.

End-use Insights

Based on end-use, the market is further categorized into food & beverage and pharmaceutical end-use. Among these, the food & beverage segment accounted for the highest market share of over 76.0% in the base year 2022. The edible packaging solutions are used in a wide range of food & beverage products such as snacks, confectionery, baked goods, and beverages. For instance, evoware manufactures edible coffee and spices sachets that are dissolved in water to eliminate plastic waste. Growing demand for processed foods across the globe is attributed to the busy life schedules of consumers. This leads to a growing need for convenience and ready-to-consume food products, thus driving the consumption of edible packaging in this segment.

Furthermore, there are several manufacturers in the food & beverage industry that produce edible packaging solutions contributing to the market growth. For instance, a UK-based company Notpla Limited produces edible packaging solutions made from seaweed and other natural materials. Its flagship product is the Ooho, which is an edible bubble designed for liquids that can be consumed after use.

The edible packaging demand in the pharmaceutical sector is expected to grow owing to its application in the packaging of capsules and other tablets. Edible packaging improves patient compliance by making the capsule or tablet convenient to consume. Patients are more likely to take their medication on time and as prescribed if the packaging is easy to swallow and does not have an unpleasant taste or texture which drives the demand for edible packaging.

Regional Insights

The North American region held the largest market share of 28.8% in 2022 owing to the presence of several key players in the edible packaging sector, research and development related to edible packaging, and increased government funding to develop eco-friendly packaging projects. In addition, the region has a well-established food processing industry, which generates a significant amount of food waste that can be used as raw material for edible packaging solutions which has made it easier for manufacturers to source the raw materials needed to produce edible packaging solutions. For instance, Apeel Sciences derives its required ingredients for developing edible coating from leaves, stems, fruits, and flowers that are authorized by World Health Organization (WHO), the United States Food and Drug Administration (FDA), and Health Canada.

The U.S. is the major contributor to the edible packaging market in the region owing to the growing innovation and experimentation with new packaging materials and products in this market. Furthermore, the increased consciousness among consumers for organic and healthy foods drives the market demand as these packaging solutions are made with healthy ingredients such as seaweed.

Asia Pacific is expected to grow at a fast rate over the forecast period owing to several factors such as stringent government regulations on the ban of single-use plastics in the region and encouraging manufacturers to adopt sustainable packaging solutions. For instance, ASAHI GROUP HOLDINGS, LTD is a Japanese beverage manufacturer which offers a consumable beer cup made of potato starch. Moreover, the pharmaceutical industry is growing in the region due to the increasing aging population and rising chronic diseases. Countries such as India, Japan, and China are major contributors to the aging population and diseases leading to increased demand for customized capsule solutions, such as edible capsules which further drives the demand for the market in the region.

China recorded the largest market share in 2022 in the region owing to the rise in disposable income of consumers. As disposable income in the country increases, consumers are willing to pay more for eco-friendly and sustainable packaging solutions, which are seen as more environmentally responsible. In addition, expanding food & beverages end-use owing to the trend of purchasing ready-to-eat is expected to drive the demand for this market in the country. For instance, Monsol LLC, offers single serve oatmeal packaging made from seaweed and oatmeal.

Europe accounted for a significant market share in 2022 attributed to several research & developments and ongoing projects to create an alternative to traditional packaging solutions in the region. For instance, an ongoing SeaFilm project for food packaging aims to create an alternative to single-use plastic films in conserving frozen sea food. This film is edible in nature as it is made from edible algae and seaweed extracts helping in increasing the shelf life of the products. This further drives the demand for the market of edible packaging in the region.

Key Companies & Market Share Insights

Key Companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations to produce an advanced product with superior performance characteristics to increase revenue. For instance, in April 2023, SARIA International, a manufacturer of food and pharmaceutical products announced the acquisition of Devro, a global supplier of edible packaging solutions. This acquisition is expected to help SARIA International to expand its product portfolio and strengthen its position in the sustainable packaging market. Some prominent players in the global edible packaging market include:

-

NAGASE & CO., LTD

-

WIKICELL DESIGNS INC.

-

JRF Technology, LLC

-

evoware

-

Notpla ltd

-

Devro Plc

-

Amtrex Nature Care Pvt Ltd

-

Ingredion

-

Glanbia plc

-

Skipping Rocks Labs

-

Coolhaus

-

Apeel Sciences

-

Mantrose UK Ltd

-

Do eat

-

TSUKIOKA FILM PHARMA CO., LTD.

Edible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 963.42 million

Revenue forecast in 2030

USD 1,416.77 million

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, material, packaging type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Southeast Asia; Brazil; Argentina; Saudi Arabia; United Arab Emirates; South Africa

Key companies profiled

NAGASE & CO., LTD; WIKICELL DESIGNS INC.; JRF Technology, LLC; evoware; Notpla Ltd; Devro Plc; Amtrex Nature Care Pvt Ltd; Ingredion; Glanbia plc; Skipping Rocks Labs; Coolhaus; Apeel Sciences; Mantrose UK Ltd; Do eat; TSUKIOKA FILM PHARMA CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edible Packaging Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edible packaging market report based on source, material, packaging type, end-use, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Plant

-

Animal

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein

-

Polysaccharides

-

Lipid

-

Others

-

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Films

-

Coatings

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceutical

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global edible packaging market size was estimated at USD 920.78 million in 2022 and is expected to reach USD 963.42 million in 2023.

b. The global edible packaging market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 1,416.77 million by 2030.

b. The food & beverage in the end use segment accounted for the largest share of over 76.0% in 2022 for the global edible packaging market.

b. Some key players operating in the edible packaging market include NAGASE & CO., LTD, WIKICELL DESIGNS INC., JRF Technology, LLC, evoware, Notpla ltd, Devro Plc, Amtrex Nature Care Pvt Ltd, Ingredion, and Glanbia plc among others.

b. Key factors that are driving the market growth include increasing demand for biodegradable packaging across the world, growing processed food markets, and globally increasing innovation in food packaging.

b. Proteins are considered the widely used materials in edible packaging products due to their good barrier properties which help extend the shelf life of food products

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.