- Home

- »

- Healthcare IT

- »

-

Biosimilar Contract Manufacturing Market Size Report, 2033GVR Report cover

![Biosimilar Contract Manufacturing Market Size, Share & Trends Report]()

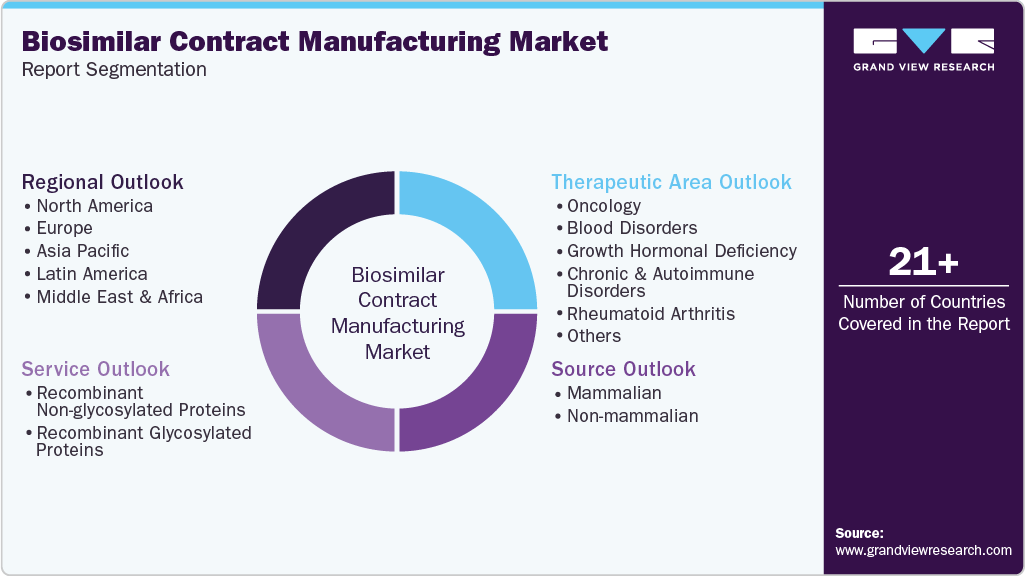

Biosimilar Contract Manufacturing Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Mammalian, Non-mammalian), By Therapeutic Area (Oncology, Blood Disorders), By Service, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-970-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biosimilar Contract Manufacturing Market Summary

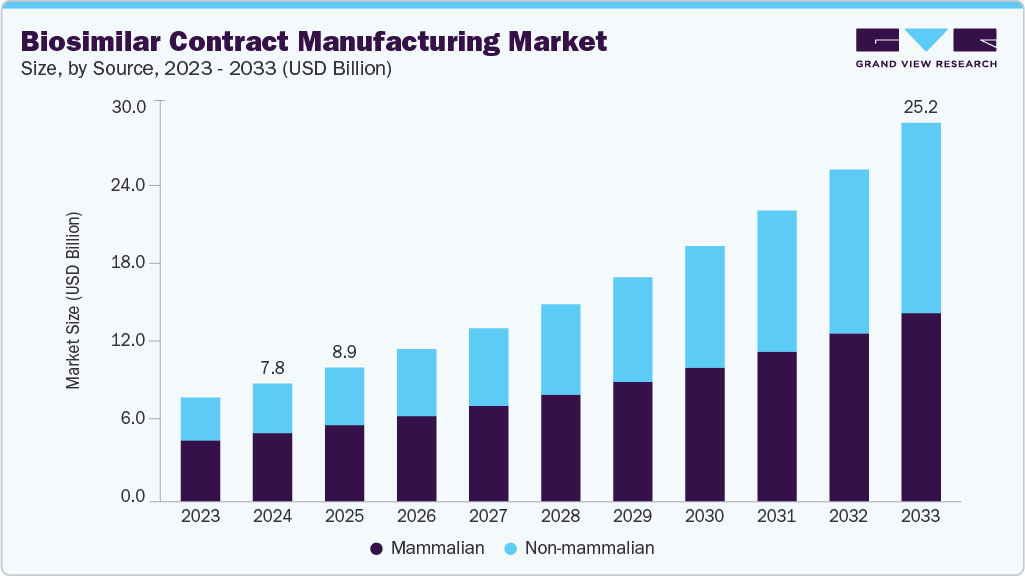

The global biosimilar contract manufacturing market size was estimated at USD 7.84 billion in 2024 and is projected to reach USD 25.19 billion by 2033, growing at a CAGR of 13.87% from 2025 to 2033. The increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is driving demand for affordable biologics.

Key Market Trends & Insights

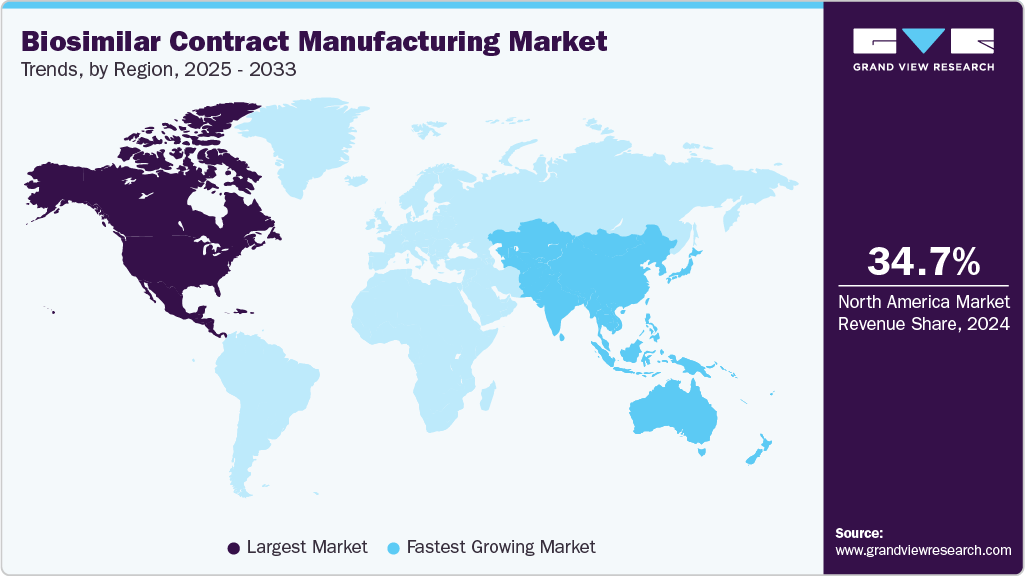

- North America biosimilar contract manufacturing market held the largest share of 34.70% of the global market in 2024.

- The biosimilar contract manufacturing market in the U.S. is expected to grow lucratively over the forecast period.

- By source, mammalian segment held the largest market share of 58% in 2024.

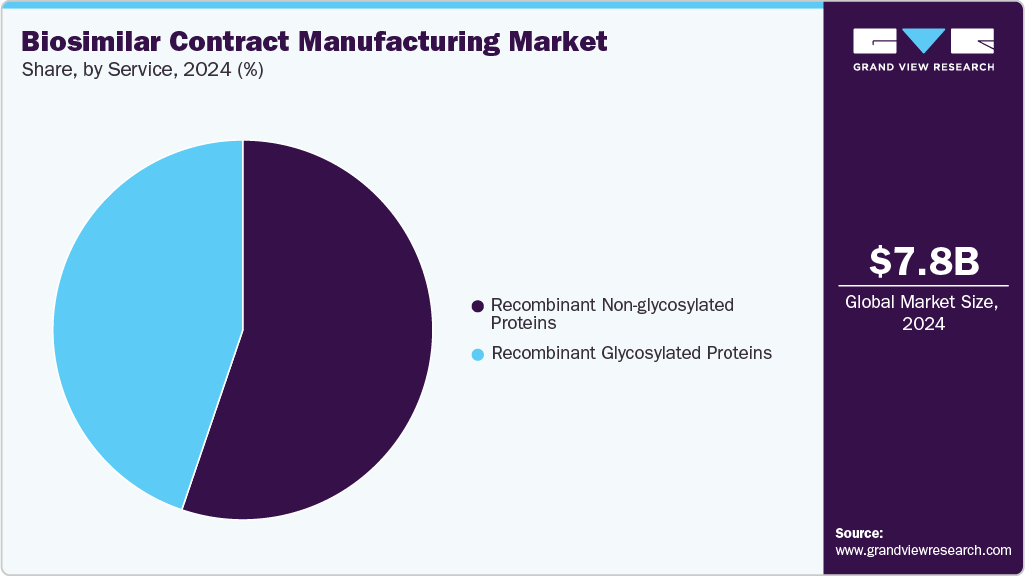

- Based on service, the recombinant non-glycosylated proteins segment held the largest market share of 55.21% in 2024.

- By therapeutic area, the rheumatoid arthritis segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.84 Billion

- 2033 Projected Market Size: USD 25.19 Billion

- CAGR (2025-2033): 13.87%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Biosimilars offer cost-effective alternatives to expensive branded biologics, making them highly suitable for healthcare systems and patients. Pharmaceutical companies are increasingly outsourcing biosimilar production to contract manufacturing organizations (CMOs) to reduce operational costs, ensure regulatory compliance, and accelerate time-to-market. This growing demand and patent expirations of blockbuster biologics fuel strong market expansion for contract manufacturing services, enabling drug developers to focus on innovation while leveraging CMOs’ expertise in large-scale, efficient biosimilar production.In addition, expiration of patents for blockbuster biologics such as monoclonal antibodies, insulin analogs, and growth factors has opened significant opportunities for biosimilar manufacturers. With billions of dollars in biologics revenue at stake, pharmaceutical companies are increasingly racing to develop biosimilars to capture market share. However, due to high production complexity, many companies rely on contract manufacturing organizations (CMOs) with specialized expertise in biologics development, scale-up, and regulatory compliance. This trend accelerates outsourcing partnerships, enabling faster biosimilar launches while reducing risks and operational costs, thereby driving market growth.

Furthermore, contract manufacturing organizations are heavily investing in advanced biomanufacturing technologies, including single-use systems, high-capacity bioreactors, and continuous processing, to meet the rising demand for biosimilars. These technological advancements enhance efficiency, flexibility, and scalability, attracting pharmaceutical companies to partner with CMOs. In addition, CMOs are expanding global facilities to comply with regional regulatory standards, supporting multinational drug launches. Such expansions enable biosimilar developers to overcome infrastructure limitations, reduce upfront investment costs, and accelerate commercialization timelines. The increasing sophistication and global footprint of CMOs make them indispensable partners, propelling market growth.

Besides these, supportive regulatory environments in key markets such as the U.S., Europe, and emerging economies are fostering the adoption of biosimilars. Regulatory agencies such as the U.S. FDA and EMA have established streamlined approval pathways, ensuring safety and efficacy while expediting market entry. These frameworks encourage investment in biosimilar development, driving demand for high-quality manufacturing partners. Contract manufacturing organizations benefit from their expertise in adhering to stringent regulatory standards, providing companies with compliance assurance and global market access. As regulatory clarity improves worldwide, the reliance on CMOs for biosimilar production is expected to intensify, boosting market growth further.

Key Biosimilar Biologics License Application (BLAs) Under Review

Proposed Biosimilar

Reference Product

Therapeutic Category

Company/Developer

FDA Status

TVB-009P

Prolia and Xgeva (denosumab)

Endocrinology

Teva

BLA Accepted: October 2024

HLX14

Prolia and Xgeva (denosumab)

Endocrinology

Henlius / Organon

BLA Accepted: October 2024

FKS518

Prolia and Xgeva (denosumab)

Endocrinology

Fresenius Kabi

BLA Accepted: May 2024

CT-P41

Prolia and Xgeva (denosumab)

Endocrinology

Celltrion

BLA Submitted: November 2023

Xlucane

Lucentis (ranibizumab)

Ophthalmology

Xbrane / STADA / Bausch + Lomb

BLA Accepted: June 2023

DRL_RI

Rituxan (rituximab)

Oncology

Dr. Reddy’s Laboratories / Fresenius Kabi

BLA Accepted: July 2023

BAT2206

Stelara (ustekinumab)

Immunology

Bio-Thera

BLA Accepted: July 2024

CT-P39

Xolair (omalizumab)

Immunology

Celltrion

BLA Submitted: March 2024

CT-P47

Actemra (tocilizumab)

Immunology

Celltrion

BLA Submitted: January 2024

Source: USFDA, exemplary biosimilars.

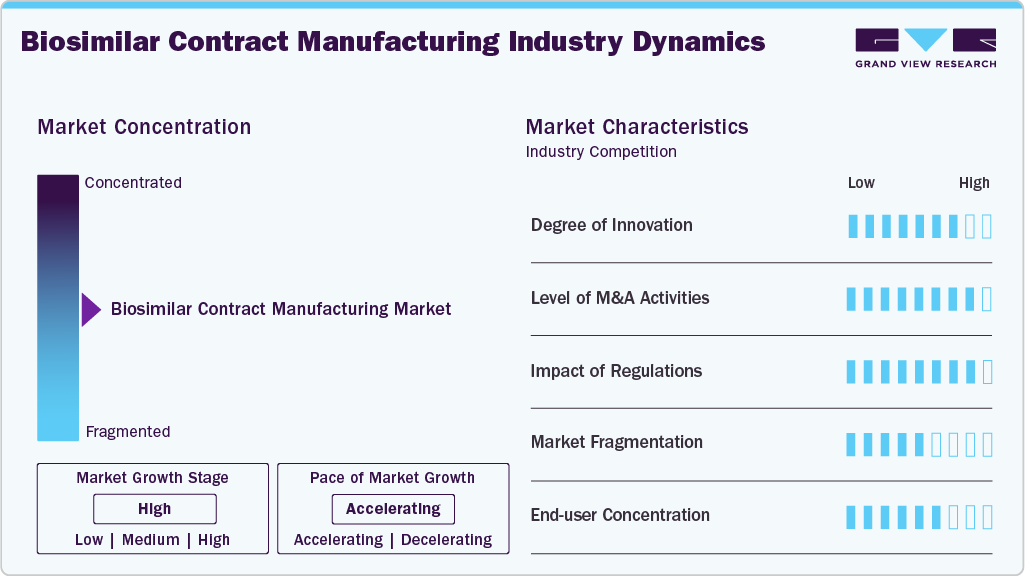

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. Outsourced production models characterize the market, where pharmaceutical companies leverage CMOs’ expertise in complex biologic processes, regulatory compliance, and quality control. Advanced technologies enhance efficiency and scalability, including single-use bioreactors and continuous processing. Global facility networks enable market reach, while collaborative development with CMOs accelerates biosimilar commercialization, reduces costs, and ensures adherence to stringent FDA and EMA standards.

The biosimilar contract manufacturing industry thrives on innovation, driven by the need for advanced bioprocessing technologies, high-yield cell lines, and novel purification methods. CMOs invest heavily in single-use systems, continuous manufacturing, and automation to improve efficiency, scalability, and product quality. Innovative approaches reduce production costs, accelerate development timelines, and support complex biosimilar pipelines, giving companies a competitive edge globally.

Regulatory frameworks by the U.S. FDA, EMA, and other authorities significantly shape the market. Stringent guidelines on Good Manufacturing Practices (GMP), product validation, and quality control demand specialized expertise from CMOs. In April 2022, Biocon Biologics’ Bengaluru B3 facility received EU GMP certification from Ireland’s HPRA, expanding monoclonal antibody manufacturing capacity for biosimilars like Bevacizumab, Trastuzumab, and Pegfilgrastim globally. Adhering to evolving regulations is critical, influencing outsourcing decisions, facility investments, and strategic partnerships, while enabling access to international markets.

Mergers, acquisitions, and strategic alliances are key drivers in the biosimilar CMO market. Companies consolidate to expand production capacities, acquire technological expertise, or enter new geographic regions. M&A activities facilitate portfolio diversification, risk-sharing, and faster biosimilar commercialization. In April 2025, Chime Biologics partnered with Polpharma Biologics to advance global biosimilar development, providing end-to-end support from IND to commercial manufacturing, targeting FDA BLA submission, and expanding market presence in Europe in the near future.

The biosimilar contract manufacturing industry is moderately fragmented, with numerous global and regional CMOs offering specialized services. Fragmentation boosts competitive pricing, technological differentiation, and niche specialization. While leading players dominate large-scale production, smaller CMOs focus on high-value or early-stage development services. This structure promotes innovation, flexibility, and choice for pharmaceutical companies worldwide seeking tailored biosimilar manufacturing solutions.

The market primarily serves pharmaceutical and biotechnology companies developing biosimilars. High end-user concentration allows CMOs to focus on tailored production solutions and build long-term strategic partnerships. Major players rely on a limited number of large clients for consistent revenue, emphasizing customized services, scalability, and regulatory support. This concentration drives innovation while creating stable demand in the competitive market.

Source Insights

The mammalian expression system represented the largest segment, with a share of 58% in 2024, owing to its ability to produce complex proteins with proper folding and post-translational modifications. This system is widely preferred for manufacturing monoclonal antibodies and other therapeutic proteins essential for treating chronic conditions such as cancer and autoimmune diseases. Its scalability, efficiency, and compliance with regulatory requirements make it the backbone of large-scale biosimilar production. Increasing demand for high-quality biologics and the dominance of mammalian cell culture in advanced therapies continue to drive its market leadership.

The non-mammalian expression system is the fastest-growing segment in the market, driven by its cost-effectiveness, rapid production cycles, and simplicity in genetic manipulation. Systems such as yeast, bacterial, and plant-based platforms enable efficient biosimilar production with high yields, making them attractive for emerging biotech companies. Rising demand for affordable biologics and technological advancements in non-mammalian expression support faster development timelines and scalability, positioning this segment as a rapidly expanding and high-potential area within global biosimilar contract manufacturing.

Therapeutic Area Insights

The rheumatoid arthritis segment accounted for the largest revenue market share. The high global prevalence of rheumatoid arthritis, coupled with escalating treatment costs of reference biologics such as adalimumab, infliximab, and etanercept, has intensified the demand for biosimilars. This has created strong opportunities for CDMOs specializing in large-scale biologics manufacturing, analytical testing, and fill-finish capabilities. With major markets such as the U.S., Europe, and Asia-Pacific implementing regulatory pathways that support biosimilar approvals, demand for outsourcing has accelerated as pharmaceutical companies seek to reduce production costs and enhance supply chain flexibility. In addition, competitive pricing strategies and payer-driven adoption of biosimilars for RA treatment further stimulate contract manufacturing requirements. As RA biosimilars continue expanding globally, CDMOs with advanced biologics capacity, cGMP compliance, and established track records in immunology are positioned to capture long-term growth in this segment.

Oncology is the fastest-growing segment over the forecast period, driven by increasing global cancer prevalence and rising demand for monoclonal antibodies and other oncology biologics. Pharmaceutical companies outsource production to CMOs to ensure high-quality, scalable, and cost-effective manufacturing. Advances in cell culture technologies, bioprocess optimization, and regulatory support for oncology biosimilars further accelerate growth. Expanding treatment accessibility and continuous innovation in targeted cancer therapies position this segment as a rapidly expanding and high-value area within the biosimilar manufacturing market.

Service Insights

The recombinant non-glycosylated proteins segment held the largest revenue share in the biosimilar contract manufacturing market in 2024, due to its streamlined production processes, lower manufacturing costs, and broad therapeutic applications, including insulin, growth hormones, and cytokines. Unlike glycosylated proteins, these proteins require less complex expression systems, reducing regulatory and technical challenges. High demand from pharmaceutical companies seeking efficient, scalable, and cost-effective biosimilar solutions further drives this segment’s growth. In addition, the increasing prevalence of chronic diseases and expanding biologics adoption globally reinforce the preference for recombinant non-glycosylated proteins, solidifying their position as the market’s largest segment.

The recombinant glycosylated proteins segment is the fastest-growing, fueled by rising demand for complex therapeutic biologics such as monoclonal antibodies and erythropoietin. Advanced manufacturing technologies and specialized expression systems enable high-quality glycosylation, crucial for protein stability and efficacy. The increasing prevalence of chronic and autoimmune diseases and pharmaceutical companies outsourcing production to experienced CMOs accelerates adoption. Continuous innovation and growing investment in biosimilar pipelines further drive the rapid expansion of this high-value segment globally.

Regional Insights

North America biosimilar contract manufacturing market held the largest revenue share of 34.70% in 2024, driven by rising demand for cost-efficient biosimilar production, growing biopharmaceutical companies, and expanding strategic collaborations enhancing accessibility and affordability. Key players include Pfizer, Lonza, Enzene Biosciences, and Alvotech. Advancements in manufacturing technology, regulatory support, and increased biosimilar approvals propel market growth.

U.S. Biosimilar Contract Manufacturing Market Trends

The biosimilar contract manufacturing market in the U.S. is rapidly growing, driven by rising demand for affordable biologics, patent expirations of blockbuster drugs, and expansions. For instance, in June 2025, UCB announced a USD 5.0 billion U.S. investment to build a state-of-the-art biologics facility, create 300 skilled jobs, and expand CMO partnerships, supporting patient growth, innovation, and sustainable healthcare.

Europe Biosimilar Contract Manufacturing Market Trends

The biosimilar contract manufacturing market in Europe is expanding, driven by expiring biologic patents, supportive EMA regulations, and growing demand for affordable biologics. Leading players Sandoz, Novartis, Celltrion, Amgen, WuXi’s European hubs, and Fareva are scaling capacity. Advancements in single-use bioreactors, AI-driven process optimization, and modular facilities enhance bioprocessing efficiency, fueling accelerated biosimilar commercialization across the region. In May 2025, ProBioGen partnered with Polpharma Biologics to provide high-performance cell line development using CHO.RiGHT and DirectedLuck technology, ensuring robust, high-quality biosimilar production and accelerating Polpharma’s expanding pipeline.

The UK biosimilar contract manufacturing market is projected to grow rapidly, driven by rising demand for cost-effective biosimilars, patent expirations, and government support for affordable healthcare. Key players include Lonza, Catalent, IQVIA, Boehringer Ingelheim, and Rentschler Biopharma. Advancements in recombinant protein technologies and bioprocessing efficiency fuel market expansion, especially in oncology and autoimmune disease treatments.

Asia Pacific Biosimilar Contract Manufacturing Market Trends

The biosimilar contract manufacturing market in the Asia Pacific is the fastest-growing, driven by rising chronic diseases, increasing healthcare investments, and affordable production costs. Key players include Biocon, Samsung BioLogics, WuXi Biologics, and Lotus partnering with Formycon for aflibercept biosimilar AHZANTIVE. Technological advancements in recombinant protein production and regulatory alignment accelerate biosimilar accessibility and market growth.

India biosimilar contract manufacturing market is advancing rapidly, driven by rising demand for biologics, cost advantages, and growing biopharmaceutical investments. Key player Aragen has operationalized a USD 30 million state-of-the-art biologics facility in Bangalore, according to the report of April 2024, supporting GMP manufacturing with intensified fed-batch platforms and single-use bioreactors. Technological advancements and integrated Gene-to-GMP services bolster India’s position as a competitive biosimilar manufacturing hub.

Latin America Biosimilar Contract Manufacturing Market Trends

The biosimilar contract manufacturing market in Latin America is driven by increasing chronic diseases, growing demand for cost-effective biologics, and patent expirations of original products. Key players include Lonza, Catalent, Biocon, and Boehringer Ingelheim. Advances in recombinant protein and glycosylation technologies enhance manufacturing capabilities, supporting market growth and improved access to biosimilars in the region.

Brazil biosimilar contract manufacturing market is expanding, driven by increasing demand for cost-effective biologics, regulatory reforms, and investments in advanced biologics manufacturing infrastructure. Key players include Bionovis, Ache Laboratorios Farmaceuticos, and Biotimize. Advancements in mammalian cell platforms, monoclonal antibody production, and integrated CDMO services are boosting Brazil's position as a key biopharmaceutical manufacturing hub in Latin America.

Middle East & Africa Biosimilar Contract Manufacturing Market Trends

The biosimilar contract manufacturing market in the MEA is driven by rising chronic diseases, increasing healthcare investments, and government initiatives promoting biosimilar adoption. Key players include Biocon, Lonza, and local manufacturers in the UAE and Saudi Arabia. Advancements in regulatory support, manufacturing infrastructure, and collaborations with global biopharma companies are accelerating market growth and biosimilar accessibility in the region.

South Africa biosimilar contract manufacturing market is driven by rising chronic disease prevalence, increasing demand for affordable biologics, and expanding healthcare infrastructure. Key players include Lonza, Catalent, Biocon, and Boehringer Ingelheim. Technological advancements in recombinant protein manufacturing, glycosylation processes, and single-use bioreactor systems are accelerating market growth and improving biosimilar accessibility in the region.

Key Biosimilar Contract Manufacturing Company Insights

Key market companies include Samsung Biologics, Biocon, Amgen, Pfizer, Boehringer Ingelheim, Lonza, Catalent, and WuXi Biologics. These firms leverage advanced bioprocessing technologies and robust manufacturing capacities to meet increasing global demand. Strategic partnerships and capacity expansions, such as Samsung’s collaboration with Pfizer, boost market reach. Biocon's cost-effective operations in India and Boehringer Ingelheim’s comprehensive biologics services are critical competitive advantages. These industry leaders drive innovation, enhance quality control, and navigate regulatory landscapes, capturing significant market share and shaping industry trends worldwide.

-

Boehringer Ingelheim Biopharmaceuticals GmbH offers comprehensive contract manufacturing services for biosimilars through its BioXcellence unit. They provide end-to-end solutions, including developing and manufacturing biologics such as monoclonal antibodies and recombinant proteins. Boehringer Ingelheim supports the production of biosimilars from DNA to fill and finish, leveraging advanced technologies and a global network of manufacturing facilities. Their expertise spans mammalian cell cultures and microbial & yeast fermentations, ensuring high-quality and efficient production processes

-

Biocon Biologics offers comprehensive contract manufacturing services for biosimilars, leveraging advanced technologies and state-of-the-art facilities in Bengaluru, India, and Johor, Malaysia. Their capabilities include large-scale microbial fermentation, mammalian cell culture, and aseptic formulation, ensuring compliance with global regulatory standards. With specialized facilities for monoclonal antibodies and insulins, Biocon’s infrastructure supports a diverse portfolio addressing therapeutic areas like diabetes, oncology, and immunology.

Key Biosimilar Contract Manufacturing Companies:

The following are the leading companies in the biosimilar contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim GmbH

- Lonza

- Catalent, Inc.

- Rentschler Biopharma SE

- AGC Biologics

- ProBioGen

- FUJIFILM Diosynth Biotechnologies

- Toyobo Co. Ltd.

- Samsung Biologics

- Thermo Fisher Scientific, Inc.

- Binex Co., Ltd.

- WuXi Biologics

- AbbVie, Inc.

- ADMA Biologics, Inc.

- Cambrex Corporation

- Pfizer Inc.

- Siegfried Holding AG

Recent Developments

-

In June 2025, UCB announced a USD 5 billion U.S. investment to build a state-of-the-art biologics facility, create 300 skilled jobs, and expand CMO partnerships, supporting patient growth, innovation, and sustainable healthcare.

-

In May 2025, ProBioGen partners with Polpharma Biologics to provide high-performance cell line development using CHO.RiGHT and DirectedLuck technology, ensuring robust, high-quality biosimilar production and accelerating Polpharma’s expanding pipeline.

-

In April 2024, Aragen has operationalized a USD 30 million state-of-the-art biologics facility in Bangalore, supporting GMP manufacturing with intensified fed-batch platforms and single-use bioreactors.

Biosimilar Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.91 billion

Revenue forecast in 2033

USD 25.19 billion

Growth rate

CAGR of 13.87% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, biosimilar contract manufacturing outlook.

Segments covered

Source, service, therapeutic area, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Boehringer Ingelheim GmbH; Lonza; Catalent, Inc.; Rentschler Biopharma SE; AGC Biologics; ProBioGen; FUJIFILM Diosynth Biotechnologies; Toyobo Co. Ltd.; Samsung Biologics; Thermo Fisher Scientific, Inc.; Binex Co., Ltd.; WuXi Biologics; AbbVie, Inc.; ADMA Biologics, Inc.; Cambrex Corporation; Pfizer Inc.; Siegfried Holding AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biosimilar Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biosimilar contract manufacturing market report based on source, service, therapeutic area, and region

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Mammalian

-

Non-mammalian

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Recombinant Non-glycosylated Proteins

-

Recombinant Glycosylated Proteins

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Blood Disorders

-

Growth Hormonal Deficiency

-

Chronic & Autoimmune Disorders

-

Rheumatoid Arthritis

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global biosimilar contract manufacturing market size was estimated at USD 7.84 billion in 2024 and is expected to reach USD 8.91 billion in 2025.

b. The global biosimilar contract manufacturing market is expected to grow at a compound annual growth rate of 13.87% from 2025 to 2033 to reach USD 25.19 billion by 2033.

b. North America dominated the biosimilar contract manufacturing market with a share of 34.70% in 2024. the regions growth is doe to a well-defined regulatory framework for biosimilars and the presence of significant biopharmaceutical contract development and manufacturing organizations like Lonza, Boehringer Ingelheim GmbH, Rentschler Biopharma SE and Element Materials Technology.

b. Some key players operating in the biosimilar contract manufacturing market include Boehringer Ingelheim GmbH; Lonza; Catalent, Inc.; Rentschler Biopharma SE; AGC Biologics; ProBioGen; FUJIFILM Diosynth Biotechnologies; Toyobo Co. Ltd.; Samsung Biologics; Thermo Fisher Scientific, Inc.; Binex Co., Ltd.; WuXi Biologics; AbbVie, Inc.; ADMA Biologics, Inc.; Cambrex Corporation; Pfizer Inc.; Siegfried Holding AG

b. Key factors that are driving the biosimilar contract manufacturing market growth include increasing popularity of biosimilars in treating diseases such as cancer, autoimmune diseases, blood disorders, and others and the low cost of biosimilars as compared to biologics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.