- Home

- »

- Pharmaceuticals

- »

-

Protein Expression Market Size, Share, Industry Report 2030GVR Report cover

![Protein Expression Market Size, Share & Trends Report]()

Protein Expression Market (2025 - 2030) Size, Share & Trends Analysis Report By Expression Systems (Prokaryotic, Mammalian cell), By Product (Reagents, Competent cells, Instruments), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-473-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Expression Market Summary

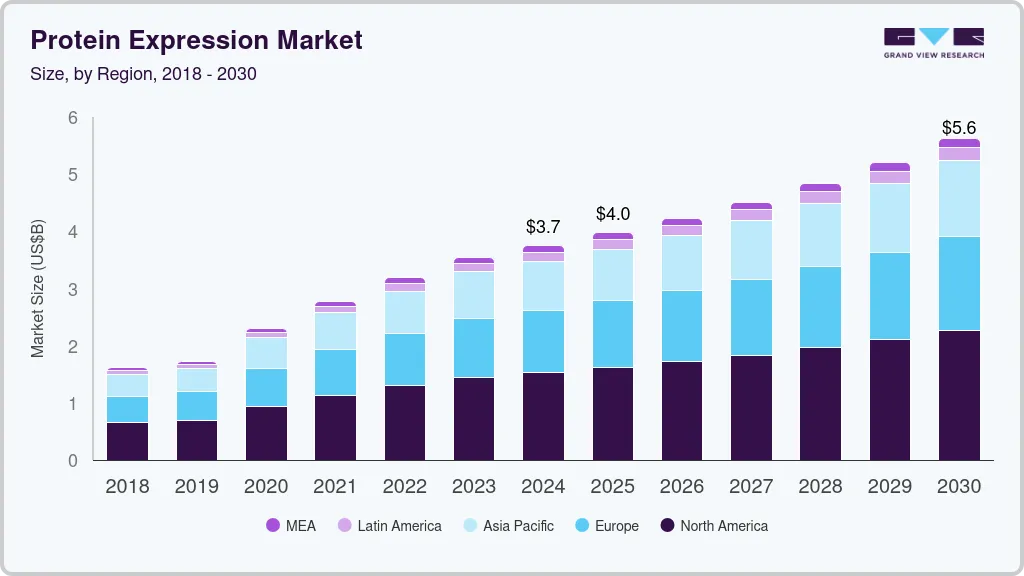

The global protein expression market size was estimated at USD 3,749.3 million in 2024 and is projected to reach USD 5,619.8 million by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The market is driven by increasing demand for recombinant proteins in therapeutic applications.

Key Market Trends & Insights

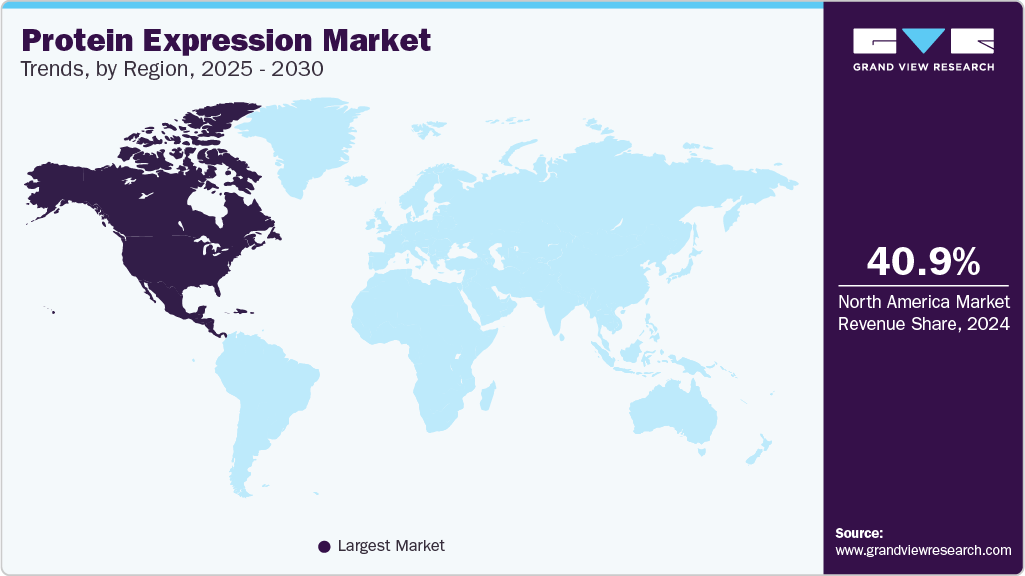

- North America's protein expression industry dominated the market with 40.88% share in 2024.

- The Asia Pacific protein expression market is expected to grow at the fastest CAGR from 2025 to 2030.

- Based on expression systems, the mammalian cell segment held the largest market share of 37.57% in 2024.

- Based on product, the reagents segment dominated the market with a leading market share of 44.20% in 2024.

- Based on application, the therapeutic segment held the highest market share with 43.47% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,749.3 million

- 2030 Projected Market Size: USD 5,619.8 million

- CAGR (2025-2030): 7.2%

- North America: Largest market in 2024

Advancements in biotechnology enhance the efficiency and yield of protein production. Furthermore, the rise of personalized medicine creates a need for tailored protein-based therapies. The global protein expression market is surging as the outcome of rising demand for personalized therapeutics and the rapidly growing R&D activities that support protein expression. The discovery of protein therapeutic is driven via protein engineering, along with the artificial construction of recombinant proteins. The advancement in technology is creating favorable opportunities for enhancing patient care by developing personalized medical therapies. Strategic initiatives between companies and academic institutions to develop innovative technologies are anticipated to support the upward market momentum. For instance, in February 2025, the Department of Biotechnology (DBT) and the Biotechnology Industry Research Assistance Council (BIRAC) in India launched a joint call for proposals focusing on 'Smart Proteins'.

This initiative encourages collaborations between academic institutions and industry to develop sustainable and affordable protein production methods, including fermentation-derived and cell culture-based proteins. Similarly, the researchers from the Novartis Institutes for Bioedical Research and the University of California, Berkeley collaborated to develop and commercialize a platform for protein stabilization to surge the innovation in therapeutics for genetic disorders and cancer. In July 2022, the researchers launched Vicinitas Therapeutics with USD 65 million in series A funding. Similarly, numerous players are employing strategic initiatives to expand their presence in the market.

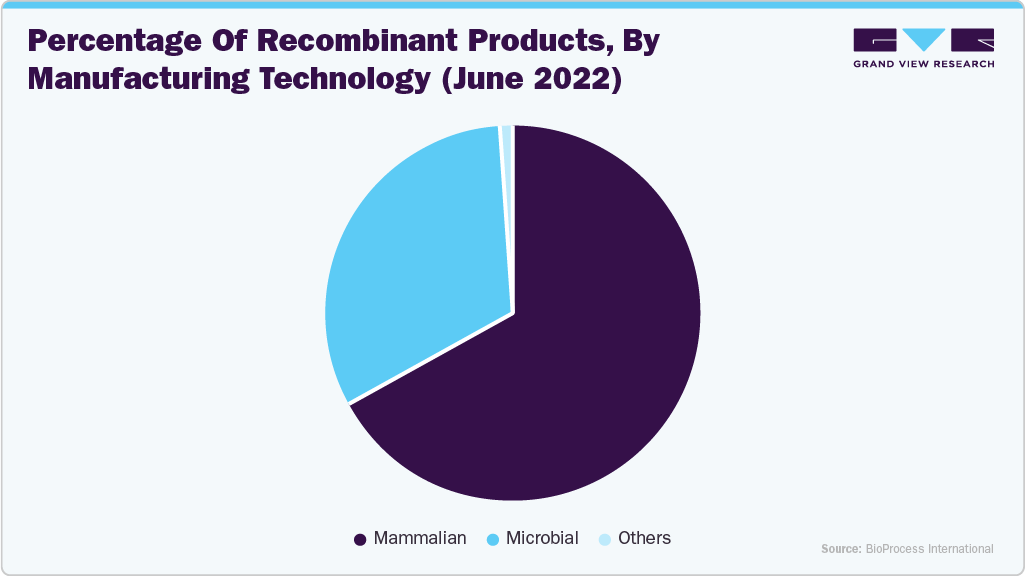

Moreover, since 2002, there has been a significant shift in recombinant product manufacturing, with mammalian cell culture increasingly dominating. Back in 2002, the 82 approved recombinant products were almost evenly divided between mammalian and microbial expression systems. However, by June 2022, the number of commercialized recombinant products had more than tripled to 329, with around 70% now produced using mammalian expression technologies. This trend reflects a faster annual growth rate for mammalian-based products compared to microbially expressed ones.

Protein-based therapies remain a major focus of drug innovation, with monoclonal and bispecific antibodies leading approvals. The FDA approved 50 new therapeutics in 2024, including 16 protein-based therapies (32% of total approvals). These include 10 new monoclonal antibodies and 3 bispecific antibodies. Acceleration in product launches coupled with the development of strong pipelines by operating players is projected to increase the usage of protein expression by the players. For instance, in May 2022, Biocon Biologics Ltd. and Viatris Inc. announced the launch of Abevmy (bevacizumab) in Canada. The product is the fourth biosimilar in Canada that is offered by Viatris for cancer.

The stringent regulations on the production of biologics products and lengthy time frame for license, approval, and clearance of the product are anticipated to restrain the growth of the market to a certain extend. However, significant changes were made by the U.S-FDA in section 506C of the FD&C Act, to address the interruption and discontinuances of biologics products in the market. Such as the manufacturer is required to inform FDA about the discontinuance of a product at least 6 months before the initiative.

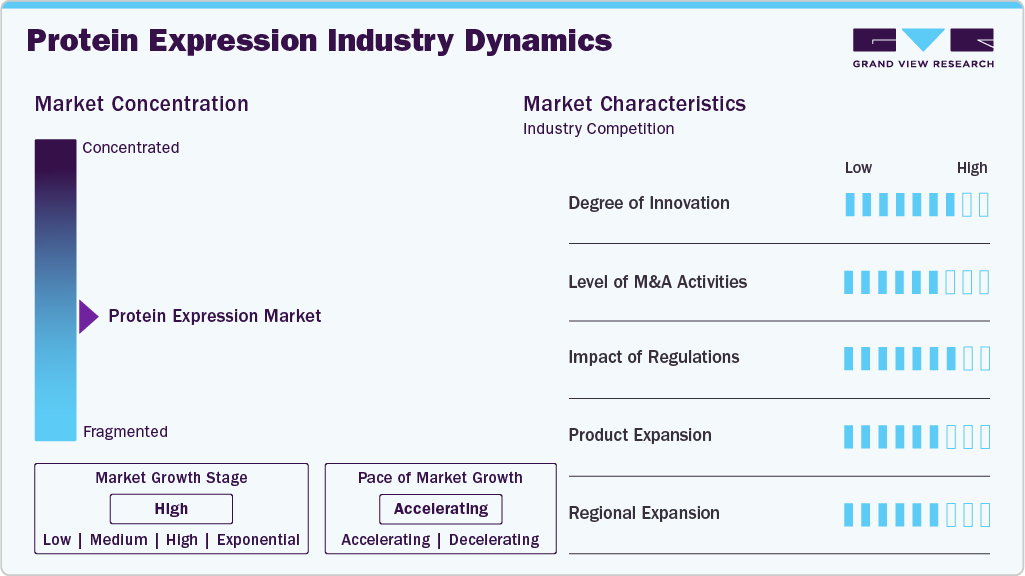

Market Concentration & Characteristics

The degree of innovation in the protein expression industry is high. This sector is characterized by rapid advancements in technologies such as recombinant DNA technology, CRISPR gene editing, and cell-free protein synthesis systems. In June 2024, the Broad Institute announced a novel epigenetic editing technique that uses molecular tools to permanently silence the gene responsible for producing prion proteins in the brain. This method, delivered via a single intravenous injection of an engineered adeno-associated virus (AAV), has shown promise in animal studies by reducing prion protein levels by over 80%, which could potentially treat prion diseases effectively.

The level of merger and acquisition activities in the protein expression market is medium. The landscape has seen a notable increase in M&A activity as companies seek to expand their technological capabilities, diversify their product offerings, or enter new markets. In August 2022, BioIVT announced the acquisition of Cypex, as the acquired company’s product range of proteins complements BioIVT’s solutions for drug research and development. Furthermore, Cypex’s offerings are developed through patented technology that allows the expression of human drug-metabolizing enzymes in bacteria, without the need for a major modification to the proteins.

The impact of regulations on the protein expression industry is high. Regulatory frameworks governing biopharmaceuticals are stringent due to safety concerns associated with biologics. Agencies like the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) impose rigorous guidelines on clinical trials, manufacturing processes, and quality control measures for protein products. Compliance with these regulations can be resource-intensive for companies, but is essential for ensuring product safety and efficacy. As a result, regulatory considerations significantly influence research priorities, investment decisions, and market entry strategies.

A product expansion scenario in the protein expression market typically involves companies broadening their offerings across different expression systems, service capabilities, and end-use applications to capture a larger market share and address evolving research and manufacturing needs. For instance, diversification across expression systems, such as expansion from bacterial systems (e.g., E. coli) to include yeast, insect, and mammalian systems, enables the expression of more complex and post-translationally modified proteins.

The potential for regional expansion in the protein expression market is high. Emerging economies are increasingly investing in biotechnology infrastructure and capabilities, creating opportunities for growth outside traditional markets like North America and Europe. Countries in Asia-Pacific (e.g., China and India) are rapidly developing their biotech sectors due to favorable government policies, increased funding for research initiatives, and a growing talent pool. This regional expansion not only opens new markets but also fosters collaboration between local firms and global players seeking to leverage cost-effective production capabilities.

Expression Systems Insights

The mammalian cell segment held the largest market share of 37.57% in 2024. As various pharmaceutical companies have employed mammalian expression systems to develop and produce protein transiently or complete formed cell lines. This takes place where particular expression constructs combine into the genome host. However, the employment of systems depends on the purpose and approach. In March 2022, ProteoGenix introduced its XtenCHOTM Transient Expression System, a novel mammalian cell-based platform that enhances plasmid stability and optimizes metabolism. This system enables up to tenfold increases in protein yields while reducing hands-on time, streamlining recombinant protein production and expediting early-stage drug screening.

The prokaryotic segment is expected to register significant growth rate during the forecast period owing to favorable characteristics, such as the large scale of recombinant protein production in a short time and at a lower cost. In July 2021, a Nature article highlighted advancements in prokaryotic synthetic biology by integrating eukaryotic transcription factors, specifically the QF factor, into E. coli. This innovation allows for enhanced gene expression control and the creation of genetic circuits that maintain strong output signals even at low input levels.

Product Insights

In 2024, reagents segment dominated the market with a leading market share of 44.20%. The market consists of mature players such as Agilent Technologies, Inc. and Thermo Fisher Scientific. The companies offer a wide range of transfection reagents to fulfill the particular needs of transfection and idealized the conditions of cell culture. For instance, Nuclera’s eProtein Discovery system offers reagents that enhance protein accessibility by analyzing and purifying various DNA constructs and expression conditions. This system can evaluate 192 combinations within a single day, enabling users to identify the best conditions for scaling up protein production.

The services segment is expected to grow rapidly over the forecast period. The growth is attributed to the increasing outsourcing by pharmaceutical and biotech companies to antibody production companies for protein production and expression, in order to support their personalized assay development and discovery of therapeutic antibodies. For instance, ProMab Biotechnologies offers a Stable Cell Line Development service to maximize protein production. Their experienced scientific team uses optimized, proprietary technologies to generate highly expressing stable cell lines for recombinant protein expression projects.

Application Insights

The therapeutic segment held the highest market share with 43.47% in 2024. Since protein therapeutic poses numerous advantages over other medications. They are relatively more customized to the target, resulting in a more effective and low probability of side effects. Additionally, it can act as a replacement treatment during the shortage of a functional protein in the body owing to gene deficiency. The most important driver of this application is the increasing participation of companies in developing protein-based therapeutics. In a review published in November 2023 in Biologics, a potential strategy for reducing manufacturing costs involves utilizing Escherichia coli for the production of larger biomolecules, such as full-length antibodies, which are typically produced using Chinese Hamster Ovary (CHO) cells. This approach is complemented by the adoption of continuous manufacturing processes and the transition to cell-free synthesis methods.

The industrial segment is expected to witness lucrative growth rate over the forecast period. The industrial segment is primarily driven by the increasing demand for high-quality proteins in various applications, including food and feed additives, enzymes for industrial processes, and biofuels. The rise in biomanufacturing techniques has led to enhanced efficiency and cost-effectiveness, making it attractive for industries seeking sustainable production methods. In June 2024, researchers at the Indian Institute of Science’s Department of Biochemistry introduced a groundbreaking technique for producing recombinant proteins. Traditionally, this process relied on methanol in yeast cell factories, which poses safety risks and can lead to harmful byproducts. The new method utilizes monosodium glutamate (MSG), a common food additive, offering a safer alternative for mass production.

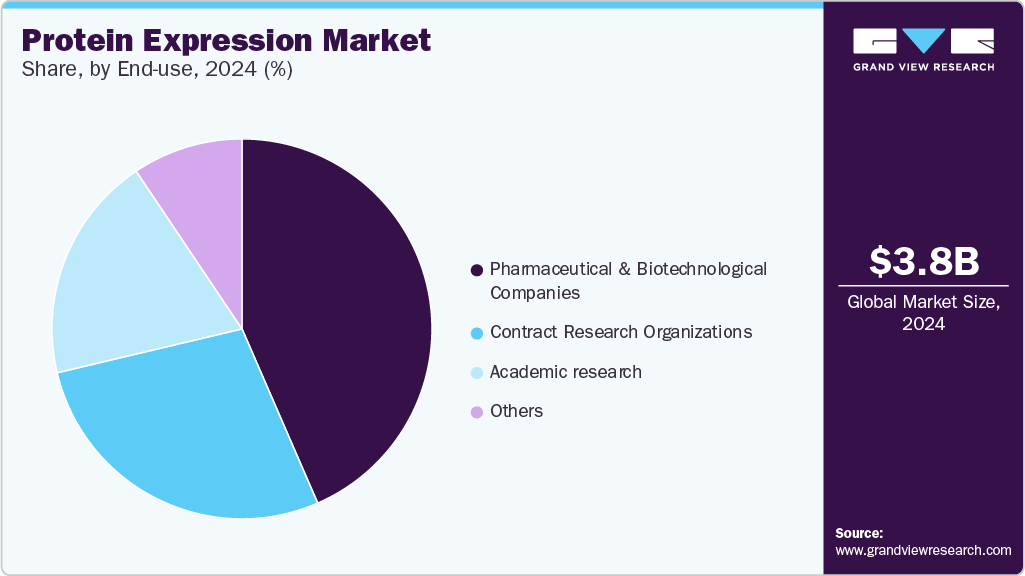

End Use Insights

The pharmaceutical and biotechnological companies segment held the maximum market share in 2024 with 43.46%. The widespread use of cultured cells for the development of therapeutics and personalized medicines is driving the market. The segment is also driven by the increasing innovative use of proteins in the pharmaceutical industry. For creating a superior value in therapeutic and protein stability, the companies use existing proteins with genetic variants coupled with completely new protein designs. In February 2024, BioAscent launched a cutting-edge protein production facility to enhance its drug discovery capabilities. This investment allows the company to conduct in-house protein production, facilitating more effective screening processes for clients. The facility will be operated by a team of experienced protein scientists skilled in various aspects of protein biochemistry and purification

The contract research organizations segment is expected to witness a fastest CAGR over the forecast period. The range of specialized services provided by the organizations to the pharma and biopharma companies at considerable pricing, and offering a competitive advantage over their competitors is anticipated to drive the growth of this segment. For instance, In June 2024, Syngene International Ltd. introduced a novel protein production platform that leverages a cell line and transposon technology licensed from ExcellGene. This innovative system enhances efficiency and precision in protein production, facilitating faster preclinical and clinical development as well as expedited product launches.

Regional Insights

North America's protein expression industry dominated the market with 40.88% share in 2024. his major proportion of share can be attributed to the presence of key players in the region with increasing fund flow in R&D, coupled with strong pipelines of biosimilars. It has been observed that collaboration between companies and academic institutions is one of the key strategies employed in the North American region. In April 2024, Sino Biological, Inc., a biotechnology firm focused on biological research reagents and contract research services, successfully acquired SignalChem Biotech Inc., a Vancouver-based biotechnology company. This strategic partnership enhances the capabilities of both companies, allowing them to offer a wider array of products and services that support advancements in life sciences, including the development of new treatments, vaccines, and diagnostic tools.

U.S. Protein Expression Market Trends

The U.S. protein expression market is projected to expand over the period. The U.S. protein expression market is driven by advancements in biotechnology and increasing demand for therapeutic proteins and monoclonal antibodies. The rise of personalized medicine and the growing prevalence of chronic diseases are propelling investments in research and development, particularly in the pharmaceutical and biopharmaceutical sectors. The In April 2024, researchers at Northwestern Medicine introduced a groundbreaking technique to assess protein expression in individual neurons, as detailed in a study published in Molecular Psychiatry. This advancement allows for a deeper investigation into how neuronal communication disruptions contribute to various disorders, including autism, Parkinson’s, and Alzheimer’s disease. Previously, the inability to measure protein levels in single neuron types hindered the study of dysfunctional neurons.

Europe Protein Expression Market Trends

Europe's protein expression market is recognized as a lucrative region owing to collaborative research initiatives among academic institutions and industry players. Countries such as Germany, France, and the UK are at the forefront of innovation due to their strong regulatory frameworks that support biopharmaceutical development. The increasing focus on biologics for disease treatment led to a heightened investment in protein engineering technologies. Europe’s commitment to sustainability is driving interest in plant-based protein expression systems as alternatives to traditional methods. In May 2024, Nuclera announced the successful installation of its eProtein Discovery system at 11 prominent academic institutions, starting with the University of Southampton. Other notable placements include University College London, University of Cambridge, University of Manchester, VIB in Belgium, and the CRUK Cambridge Institute.

The protein expression industry in the UK is expected to grow over the forecast period. The UK protein expression market is witnessing a dynamic shift influenced by Brexit-related changes that have prompted local biotech companies to adapt their strategies for regulatory compliance and funding access. Despite uncertainties, there remains a strong emphasis on innovation within life sciences, supported by government initiatives aimed at boosting R&D investment. In June 2024, Nuclera, an innovative biotech company specializing in protein expression and purification, received significant funding from Innovate UK to advance its eProtein Discovery system. The funding includes a grant for sustainable technologies in collaboration with DeepMirror and another for engineering biology, enabling further enhancements to their platform.

France protein expression market is anticipated to grow over the forecast period. France’s protein expression market is marked by a growing emphasis on biomanufacturing capabilities as part of its national strategy to bolster biotechnology innovation. French companies are increasingly investing in high-throughput screening technologies and cell-free systems that expedite protein production processes while maintaining quality standards. The government’s support for biopharmaceutical research through funding programs has catalyzed advancements in therapeutic proteins aimed at treating various diseases, including cancer and autoimmune disorders. France’s strategic location within Europe facilitates collaboration with neighboring countries’ biotech sectors, enhancing its competitive edge.

The protein expression market in Germany is expected to grow over the forecast period. Germany stands out as a powerhouse within the European protein expression market due to its well-established infrastructure supporting biopharmaceutical manufacturing and research activities. The country’s focus on precision medicine has led to increased demand for recombinant proteins used in diagnostics and therapeutics. German firms are leveraging cutting-edge technologies such as mammalian cell culture systems which provide higher yields of complex proteins compared to traditional methods. Germany’s commitment to sustainability is reflected in its investment towards developing eco-friendly production processes that minimize waste while maximizing output efficiency.

Asia Pacific Protein Expression Market Trends

The Asia Pacific protein expression market is expected to grow at the fastest CAGR from 2025 to 2030. The fast growth is due to the extensive developments by India and China in the adoption of protein expression in various applications. Additionally, the emerging focus on proteomics and genomics research, coupled with increasing initiatives by academic institutions for innovative development in protein therapeutic have impacted the Asia Pacific market with lucrative growth opportunities throughout the forecast period. In May 2023, WHO and the Republic of Korea signed a Memorandum of Understanding (MOU) with the aim of establishing a worldwide training hub in biomanufacturing. This global training facility will benefit all low and middle-income countries by providing expertise in the production of biologicals, including vaccines, insulin, monoclonal antibodies, and cancer treatments.

The protein expression market in China is expected to grow over the forecast period. The protein expression market in China is driven by the increasing demand for biopharmaceuticals and advancements in biotechnology. The Chinese government has heavily invested in life sciences and biomanufacturing, leading to a surge in research activities. For instance, in July 2022, Beijing Luzhu Biotechnology and Maxvax Biotechnology are fundraising for their respective R&D programs for developing a vaccine. Maxvax raised approximately USD 74 million via Series B funding to support multiple clinical trials of its vaccine pipeline. The company owns various platforms, such as recombinant protein expression and an mRNA that are employed across the globe.

Japan protein expression market is anticipated to grow at a significant CAGR over the forecast period. Japan’s protein expression market is characterized by its strong emphasis on innovation and high-quality standards. The country is home to several leading pharmaceutical companies such as Takeda Pharmaceutical Company and Astellas Pharma, which are increasingly investing in biologics and monoclonal antibodies. The Japanese government supports this trend through initiatives aimed at promoting regenerative medicine and advanced therapies. Furthermore, collaborations between academia and industry are fostering advancements in protein engineering techniques. For example, the University of Tokyo has partnered with various biotech firms to develop novel expression systems that improve yield and functionality of therapeutic proteins.

The protein expression market in India is anticipated to grow at a rapid rate over the forecast period. India’s protein expression market is witnessing significant growth due to the expanding biotechnology sector and increasing investments from both domestic and foreign players. The country’s skilled workforce and cost-effective manufacturing capabilities make it an attractive destination for biopharmaceutical production. Companies such as Biocon Limited are leveraging recombinant DNA technology to produce insulin and other therapeutic proteins at competitive prices.

Middle East and Africa Protein Expression Market Trends

The protein expression market in Middle East and Africa is projected to grow in near future. The Middle East & Africa region’s protein expression market is gradually evolving as countries invest more heavily in healthcare infrastructure and biotechnology research. Nations such as South Africa are emerging as key players due to their established pharmaceutical industries and increasing focus on biomanufacturing capabilities. In the Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and UAE, there is a push towards diversifying economies away from oil dependency by investing in biotechnology sectors. For example, initiatives such as Saudi Vision 2030 aim to enhance local production of biologics through partnerships with global biotech firms, thereby expanding the regional protein expression landscape.

The protein expression market in Saudi Arabia is expected to grow over the forecast period. Saudi Arabia’s protein expression market is poised for growth as part of its broader economic diversification strategy under Vision 2030. The Kingdom aims to establish itself as a hub for biotechnology by attracting foreign investment and fostering local talent through educational programs focused on life sciences. Notable projects include collaborations with international biotech companies to develop advanced therapeutics using recombinant proteins. In August 2023, Unibio and its local partner Edhafat signed a Memorandum of Understanding (MOU) with SAGIA, the General Investment Authority of Saudi Arabia, to initiate plans for a protein production facility utilizing methane gas in Saudi Arabia.

Kuwait protein expression market is anticipated to witness growth over the forecast period. Kuwait’s protein expression market is still emerging but shows potential due to recent investments aimed at enhancing healthcare services and biotechnology research capabilities. The Kuwaiti government has recognized the importance of developing a robust healthcare system that includes biopharmaceutical production as part of its national development plans. Collaborations with international research institutions are being explored to build local expertise in protein engineering technologies.

Key Protein Expression Company Insights

The competitive benchmarking illustrated above highlights that Thermo Fisher Scientific and Merck KGaA, BioRad and Agilent are the dominant players in the protein expression market, owing to their strong product portfolios, robust strategic initiatives, and broad global presence. Bio-Rad Laboratories and Agilent Technologies demonstrate significant competitiveness, particularly in terms of product offerings and targeted strategic moves. However, they exhibit relatively moderate geographic reach and fewer large-scale initiatives compared to the other players. Overall, the analysis underscores a clear leadership hierarchy while also indicating growth opportunities for mid-tier companies through expansion and innovation.

Key Protein Expression Companies:

The following are the leading companies in the protein expression market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories

- Thermo Fisher Scientific, Inc.

- Merck Millipore

- New England BioLabs, Inc.

- Promega Corporation

- QIAGEN

- Takara Bio, Inc.

- Oxford Expression Technologies

- Lucigen Corporation

Recent Developments

-

In June 2024, LenioBio and Labscoop announced a strategic partnership to enhance access to LenioBio’s scalable cell-free protein synthesis technology across North America. This collaboration enables Labscoop to feature LenioBio’s products and services, especially the ALiCE (Almost Living Cell-Free Expression) platform, on the Labscoop Marketplace, making it broadly accessible to academic and commercial laboratories throughout the region.

-

In April 2024, Expression Systems and Thomson collaborated to showcase the effectiveness of Expression Systems’ ESF AdvanCD cell culture medium combined with Thomson’s Optimum Growth flasks for enhancing protein production. This partnership demonstrated consistent cell growth and high expression levels across different flask sizes and culture volumes, indicating a reliable and scalable production platform.

-

In January 2023, Quantum-Si Incorporated, known for its advancements in protein sequencing, announced a collaboration with Aviva Systems Biology, a prominent provider of antibody and protein reagents. This partnership aims to jointly develop protein enrichment kits that will facilitate an in-depth analysis of proteins and their variants, referred to as proteoforms, through enhanced protein sequencing techniques.

-

In March 2022, Sygnature Discovery strengthened its capabilities in protein production and structure determination by acquiring Peak Proteins Ltd., following a successful partnership between the two companies. This deal enables seamless integration of protein production and related projects within Sygnature. The acquisition enhances Sygnature’s offerings in protein production and structure determination.

Protein Expression Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.97 billion

Revenue forecast in 2030

USD 5.62 billion

Growth rate

CAGR of 7.17% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Expression system, product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Agilent Technologies, Inc.; Bio-Rad Laboratories; Thermo Fisher Scientific, Inc.; Merck Millipore; New England BioLabs, Inc.; Promega Corporation; QIAGEN; Takara Bio, Inc.; Oxford Expression Technologies; Lucigen Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Expression Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein expression market report based on expression systems, product, application, end use, and region:

-

Expression Systems Outlook (Revenue, USD Million, 2018 - 2030)

-

Prokaryotic

-

Mammalian cell

-

Insect cell

-

Yeast

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Competent cells

-

Expression vectors

-

Services

-

Instruments

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic

-

Industrial

-

Research

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and biotechnological companies

-

Academic research

-

Contract research organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global protein expression market size was estimated at USD 3.75 billion in 2024 and is expected to reach USD 3.97 billion in 2024.

b. The global protein expression market is expected to grow at a compound annual growth rate of 7.17% from 2025 to 2030 to reach USD 5.62 billion by 2030.

b. The mammalian cell segment held the largest market share of 37.57% in 2024 As various pharmaceutical companies have employed mammalian expression systems to develop and produce protein transiently or complete formed cell lines.

b. Some key players operating in the protein expression market include Agilent Technologies, Inc., Bio-Rad Laboratories, Thermo Fisher Scientific, Inc., Merck Millipore, New England BioLabs, Inc., Promega Corporation, QIAGEN, Takara Bio, Inc., Oxford Expression Technologies, and Lucigen Corporation.

b. The market is driven by increasing demand for recombinant proteins in therapeutic applications. Advancements in biotechnology enhance the efficiency and yield of protein production. Furthermore, the rise of personalized medicine creates a need for tailored protein-based therapies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.