- Home

- »

- Consumer F&B

- »

-

Biotech Flavor Market Size, Share & Trends Report, 2030GVR Report cover

![Biotech Flavor Market Size, Share & Trends Report]()

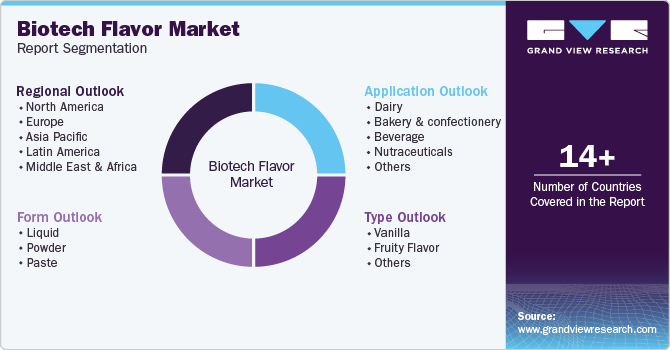

Biotech Flavor Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Vanilla, Fruity Flavor, Others), By Form (Liquid, Powder, Paste), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-922-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biotech Flavor Market Size & Trends

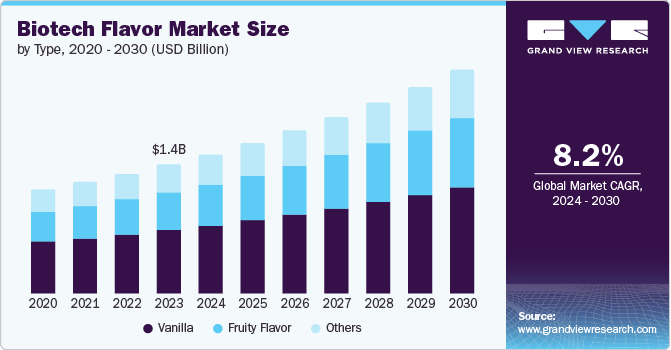

The global biotech flavor market size was valued at USD 1.42 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. Consumer demand for natural and clean-label ingredients has fueled interest in biotech flavor derived from microbial fermentation. These flavors are perceived as more natural and sustainable alternatives to traditional synthetic flavors, aligning with the trend towards healthier and more transparent food choices among consumers globally.

Biotech flavors also offer manufacturers more control over flavor profiles, allowing them to create unique and complex taste sensations that enhance product differentiation in a competitive market. The expanding application of biotech flavor extends beyond traditional food and beverage sectors into pharmaceuticals, nutraceuticals, and personal care products. The ability to tailor flavors to specific dietary preferences, nutritional requirements, or functional benefits enhances their appeal across various industries. As biotech companies continue to innovate and collaborate with food manufacturers and product developers, adopting biotech flavor is expected to accelerate, driving growth and fostering a new era of flavor innovation that prioritizes health, sustainability, and sensory satisfaction.

Consumers' increasing environmental concern has motivated manufacturers to substitute synthetic ingredients in food products with biotech products. The market growth of biotech flavor is expected to be driven by their lack of reliance on harvest procedures for production. Natural flavors have become more popular than artificial flavors in recent years because of their health benefits in adding taste to food items. Biotech flavor offers a practical solution for food manufacturers to meet the rising consumer demand for nutritious products while ensuring enhanced taste experiences. Additionally, due to increased awareness of environmental sustainability, the food and beverage industry is opting for biotech flavor as an eco-friendly substitute.

Furthermore, advancements in biotechnology and fermentation techniques have expanded the repertoire of flavors that can be produced sustainably and cost-effectively. Biotech companies are leveraging genetic engineering and fermentation technologies to cultivate specific strains of microorganisms capable of delivering desired flavor compounds. This approach reduces reliance on scarce natural resources and minimizes environmental impact compared to traditional flavor extraction methods. As regulatory agencies increasingly scrutinize synthetic ingredients and environmental sustainability becomes a priority for consumers and manufacturers alike, biotech flavor are poised to play a crucial role in shaping the future of flavor innovation in the food and beverage industry.

Type Insights

The vanilla flavor segment dominated the market and accounted for a share of 49.0% in 2023. Natural vanilla, derived from vanilla orchids, faces significant supply constraints due to its labor-intensive cultivation process and susceptibility to weather conditions. Biotech flavors offer a sustainable alternative by utilizing fermentation techniques to produce vanillin, the primary compound responsible for vanilla flavor, from renewable sources such as sugar cane or lignin. This approach reduces dependency on natural vanilla, mitigates price volatility, and ensures a stable supply of vanilla flavor for food, beverage, and cosmetic industries.

The fruity flavor segment is expected to register the fastest CAGR of 9.0% during the forecast period. There is a growing demand for natural and authentic fruity flavors in the food, beverage, and personal care industries. Biotech flavors offer a sustainable alternative to traditional fruit extracts by utilizing fermentation processes to produce specific aroma compounds found in fruits. This approach enhances the authenticity of fruity flavors and ensures consistency in taste profiles across different batches of products, which is crucial for maintaining consumer satisfaction and brand loyalty.

Form Insights

The powder segment accounted for the largest market revenue share in 2023. Powdered biotech flavor offer stability and shelf-life, making them ideal for long-term storage and transportation applications, such as dry mixes, bakery products, and dietary supplements. The powdered form also allows for precise dosage control and easy incorporation into dry formulations, ensuring consistent flavor distribution and enhancing product uniformity.

The liquid segment is expected to register the fastest CAGR during the forecast period. Liquid biotech flavor offer convenience and versatility in product formulation and application. Manufacturers incorporate liquid flavors into various products such as beverages, sauces, confectionery, and pharmaceutical formulations, ensuring homogeneous distribution and consistent flavor profiles. This flexibility allows for quick and efficient flavor adjustments during production, facilitating rapid product development and innovation cycles.

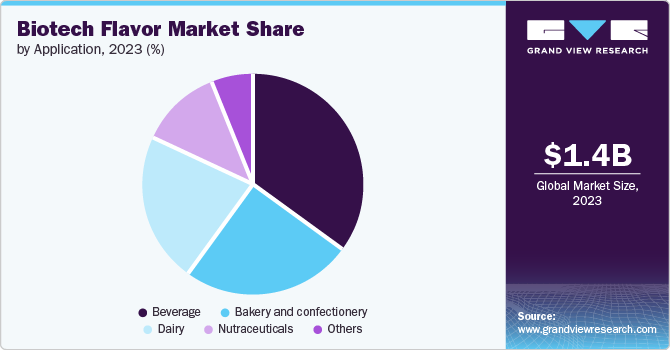

Application Insights

The beverage segment dominated the market in 2023. There is a growing consumer demand for enhanced sensory experiences and innovative flavor profiles in beverages. Biotech flavors allow manufacturers to create complex and authentic taste sensations that appeal to diverse consumer preferences, ranging from traditional favorites to novel and exotic flavors. This flexibility in flavor development allows beverage companies to differentiate their products in a competitive market and effectively cater to changing consumer tastes. Consumers are increasingly seeking artificial preservatives and additives-free beverages, choosing products made with natural ingredients. Biotech flavors, obtained from fermentation processes using natural substrates, align with these preferences by offering clean-label solutions that enhance the flavor without compromising quality or taste.

The nutraceuticals segment is anticipated to witness the fastest CAGR over the forecast period. Nutraceuticals, encompassing functional foods, beverages, and dietary supplements fortified with bioactive compounds, benefit from biotech flavor to enhance palatability and consumer acceptance. Biotech flavors offer natural and clean-label solutions that align with consumer preferences for products perceived as healthier and free from artificial ingredients. This trend is particularly evident in the growing market for supplements and fortified foods that promote specific health benefits such as immune support, digestive health, and cognitive function.

Regional Insights & Trends

North America dominated the biotech flavor market with a revenue share of 39.6% in 2023. The expanding application of biotech flavor beyond traditional food and beverage sectors into pharmaceuticals, nutraceuticals, and personal care products further drives market growth in North America. The versatility of biotech flavor allows for customization to meet specific industry needs, such as improving the taste and compliance of medications or enhancing the sensory experience of personal care products. As North American consumers prioritize health, wellness, and sustainability in their purchasing decisions, biotech flavor are poised to continue their upward trajectory, supported by innovation, regulatory compliance, and consumer-driven demand for high-quality, natural flavor solutions.

U.S. Biotech Flavor Market Trends

The U.S. Biotech flavors market was identified as a lucrative region in this industry. The Food and Drug Administration (FDA) and other regulatory bodies have approved various biotech flavor compounds for use in food and beverage applications, providing manufacturers with a clear pathway to commercialize their products. Additionally, the demand for specialty and customized flavors in the U.S. market has spurred investment in research and development within the biotech flavor sector, leading to a diverse portfolio of flavor options that cater to evolving consumer preferences and industry trends.

Europe Biotech Flavor Market Trends

Europe biotech flavor market is anticipated to register a significant CAGR over the forecast period. Increasing consumer demand for natural and sustainable food products has been a substantial driver for the biotech flavor market in Europe. Biotech flavors, produced using advanced biotechnology processes, are healthier and more environmentally friendly than traditional artificial flavors. The European Union has also implemented various regulations and initiatives to promote using natural and sustainable ingredients in the food and beverage industry. For instance, the EU's "Farm to Fork" strategy aims to make food systems more sustainable, which has increased the demand for biotech flavor that align with these environmental goals. Significant investments in research and development by European flavor companies have also contributed to the growth of the biotech flavor market in the region.

The UK biotech flavor market is expected to grow rapidly in the coming years. As consumers become more conscious of their health and environmental impact, the demand for biotech flavor is expected to surge, driving the market growth in the UK. Biotechnology and flavor science advancements are leading to the development of innovative and diverse biotech flavor profiles that cater to consumers' evolving tastes and preferences. Additionally, government support and initiatives to promote biotechnology and sustainable food production are fostering a favorable environment for the biotech flavor market in the UK.

Biotech flavor market in Germany held a substantial market share in 2023. In Germany, the growth of biotech flavor is driven by a convergence of factors that underscore consumer demand for natural, sustainable, and high-quality food products. German consumers prefer clean-label products free from artificial additives and genetically modified organisms (GMOs). Biotech flavors, produced through fermentation processes using natural substrates, align perfectly with these preferences by offering a reliable and sustainable alternative to traditional flavorings derived from synthetic or natural extracts.

Asia Pacific Biotech Flavor Market Trends

Asia Pacific Biotech Flavors market is anticipated to witness significant growth in the biotech flavor market. Consumers prefer to invest in biotech flavored ingredients over synthetic chemical ingredients because they are safe for the body and do not pose any harm. Rising awareness of health risks from artificial food flavors and the benefits of natural flavors in countries such as India and China have resulted in a higher demand for biotech flavor.

Key Biotech Flavor Company Insights

Some of the key companies in the biotech flavor market include Givaudan SA, Firmenich SA, Symrise AG, International Flavors & Fragrances Inc. (IFF), Takasago International Corporation, Sensient Technologies Corporation, Kerry Group plc, Bell Flavors & Fragrances Inc., and Flavorchem Corporation. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Firmenich SA offers high-quality fragrances, flavor components, and oral care items. The company's offerings in the biotech flavor space include a sequence of innovative ingredients designed to provide customers with essential nutrients, catering to the growing interest in natural, sustainable, and clean-label products.

-

Givaudan SA's biotech flavor offerings are built upon its molecular biology, fermentation technology, and expertise in extracting natural ingredients. The company specializes in developing flavors through microbial fermentation and enzymatic transformation, allowing the production of authentic and sustainable flavor profiles. These biotech flavor are designed to meet stringent regulatory standards and consumer preferences for clean-label products that are natural, transparent, and free from synthetic additives.

Key Biotech Flavor Companies:

The following are the leading companies in the biotech flavor market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan SA

- Firmenich SA

- Symrise AG

- International Flavors & Fragrances Inc. (IFF)

- Takasago International Corporation

- Sensient Technologies Corporation

- Kerry Group plc

- Bell Flavors & Fragrances Inc.

- Flavorchem Corporation

- T. Hasegawa Co., Ltd.

Recent Developments

- In February 2021, International Flavors & Fragrances Inc. merged with DuPont to offer its customers a more holistic suite of solutions. IFF’s proficiency in flavors and fragrances was combined with DuPont’s knowledge of probiotics, enzymes, and food protection.

Biotech Flavor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.52 billion

Revenue forecast in 2030

USD 2.45 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application, region

Regional scope

North America, Europe, Asia Pacific, MEA, Central & South America.

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Italy, Spain, China, Japan, India, South Korea, Australia, New Zealand, Saudi Arabia, Brazil.

Key companies profiled

Givaudan SA, Firmenich SA, Symrise AG, International Flavors & Fragrances Inc. (IFF), Takasago International Corporation, Sensient Technologies Corporation, Kerry Group plc, Bell Flavors & Fragrances Inc., Flavorchem Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biotech Flavor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biotech flavor market report based on type, form, application and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vanilla

-

Fruity Flavor

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Paste

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy

-

Bakery and confectionery

-

Beverage

-

Nutraceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.