- Home

- »

- Alcohol & Tobacco

- »

-

Black Beer Market Size & Share Report, 2021-2028GVR Report cover

![Black Beer Market Size, Share & Trends Report]()

Black Beer Market (2021 - 2028) Size, Share & Trends Analysis Report By Packaging (Cans, Bottles), By Product (Dark Lager, Dark Ale, Brown Porter, Stout), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-588-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Black Beer Market Summary

The global black beer market size was valued at USD 25.96 billion in 2020 and is expected to reach USD 51.20 billion by 2028, expanding at a compound annual growth rate (CAGR) of 8.9% from 2021 to 2028. A rise in demand for black beer for preventing diseases caused due to obesity is expected to have a positive impact on the market growth over the forecast period.

Key Market Trends & Insights

- Asia Pacific captured the largest revenue share of over 35.0% in 2020.

- By packing, the cans segment held the largest revenue share of over 65.0% in 2020.

- By product, dark lager segment held the largest revenue share of over 50.0% in 2020.

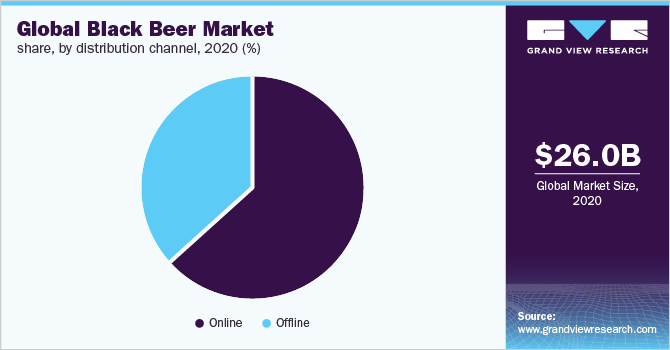

- By distribution channel, the online segment held the largest share of over 75.0% in 2020.

Market Size & Forecast

- 2020 Market Size: USD 25.96 Billion

- 2028 Projected Market Size: USD 51.20 Billion

- CAGR (2021-2028): 8.9%

- Asia Pacific: Largest market in 2020

Moreover, the increasing consumption of alcoholic beverages among millennials is anticipated to boost the market growth. The COVID-19 pandemic has had a devastating impact on the alcoholic beverages industry. On-premise and off-premise closures due to strict lockdown measures resulted in disastrous consequences, with sales decreasing by 20%-30% from March to April 2020 globally. Companies have been responding positively to the crisis by offering black beers through the online medium as consumers preferred online shopping over offline owing to safety concerns.

An increase in demand for craft beer among premium drinkers and millennials is strengthening the market growth. In recent years, a large number of local breweries have emerged that has propelled the demand for black beer majorly processed in microbreweries. The presence of distinctive taste and uncommon flavors, coupled with a shift in consumer preferences from regular beers to flavored beers, is anticipated to fuel product demand.

Furthermore, that has been a huge year-on-year rise in beer consumption across the globe. Based on a study by the Agricultural & Applied Economics Association U.S., beer is the most preferred alcoholic beverage and is 2.5 times larger than the market for wine across the globe. The study also revealed that consumption of the product has increased more than 8% per year from 2010 to 2020.

Rising awareness regarding the various benefits of consuming flavonoids in black beers has resulted in a rise in their demand over the last few years. Based on a study by coronary thrombosis research laboratory at the University of Wisconsin in Madison, black beer is rich in flavonoids that consist of powerful antioxidant effects, which help prevent blood clots. Furthermore, a scientific session by the American Heart Association revealed that black beer is more active than any conventional beer or wine at fighting blood clots.

The online distribution channel has significantly changed the shopping habits of people as it offers benefits such as doorstep delivery, easy payment methods, heavy discounts, and the availability of a wide range of product selections on a single platform. Key players in the market are increasingly launching e-commerce websites in large lucrative markets owing to the rising internet penetration and increasing propensity of mobile shopping among consumers.

Packaging Insights

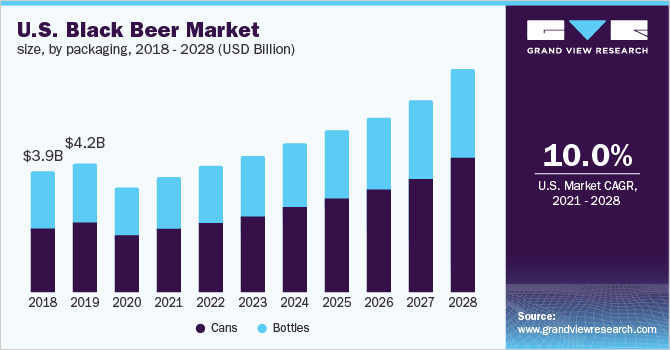

The cans segment held the largest revenue share of over 65.0% in 2020 and is expected to maintain its lead over the forecast period. Cans are considered more sustainable and better for the environment as compared to bottles. Based on a study by the EPA, U.S., 54.9% of beer cans get repurposed successfully after recycling, while only 26.4% of glass gets reused. Growing concerns over sustainability are anticipated to positively impact this segment's growth during the forecast period.

The bottles segment is projected to register a CAGR of 7.8% from 2021 to 2028. Bottled black beers are preferred by consumers since these glass bottles are free from BPA. Moreover, a large number of old authentic breweries prefer bottled products to be a part of the traditional art of brewing.

Product Insights

Dark lager held the largest revenue share of over 50.0% in 2020 and is expected to maintain its lead over the forecast period. Lagers have a higher consumer preference over other types of black beers owing to their smooth and mellow taste. Based on a study by Beacon Journal, consumers between 35-60 years prefer beer with a crisper and cleaner taste, which is anticipated to further fuel the demand for dark lager during the forecast period.

The brown porter segment is projected to register the fastest CAGR of 11.6% from 2021 to 2028. The growth of the brown porter segment can be attributed to the rise in preferences of millennial consumers for unconventional flavors. Porters offer a fruitier, spicier, and darker flavor, which is more robust and complex, and appealing to the newer generation of consumers.

Distribution Channel Insights

The online distribution channel held the largest share of over 75.0% in 2020. Online platforms offer significant advantages to consumers, such as freedom of selection, lower prices, and high visibility of international brands, which makes them a suitable platform for all types of customers. Furthermore, online platforms offered a more convenient and safer platform than conventional bars or stores during the pandemic and lockdown restrictions, which was one of the major factors behind the demand for black beer through online platforms.

The offline distribution channel is projected to expand at the highest CAGR of 11.5% from 2021 to 2028. The gradual lifting of lockdown restrictions throughout the globe is leading to the re-opening of bars, restaurants, hypermarkets, and stores offering black beers. This is anticipated to slowly bring back the on-premise consumer base as the number of vaccinated consumers increases and the threat of COVID-19 minimizes. Furthermore, the growth of this segment can be attributed to the rise in food festivals, events, parades, and carnivals in countries such as the U.S., Canada, and the U.K.

Regional Insights

Asia Pacific captured the largest revenue share of over 35.0% in 2020. The expansion of the alcoholic beverages industry in India and China, both of which are backed by regulatory support, is expected to ensure continuous production of black beers and thus, be a positive factor for the market growth in Asia Pacific over the forecast period. Furthermore, Asia Pacific accounts for the largest number of beer consumers across the globe. Based on a study by the Agricultural & Applied Economics Association, Chinese consumers accounted for more than 25% across the globe as of 2020.

North America is expected to register a CAGR of 9.2% from 2021 to 2028. Consumers in North American countries such as the U.S. and Canada are willing to pay a high price for unconventional premium beers. Furthermore, the presence of well-established manufacturers such as The Boston Beer Company, Inc. and J.J. Taylor Companies, Inc. in North America is another factor expected to support the product demand.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Companies have been expanding their type portfolios by incorporating new varieties of black beers to widen their consumer base. For instance, in March 2020, Anheuser Busch InBev SA/NV announced the launch of Budweiser Reserve Black Lager, a new limited edition black beer that had an ABV of 7.1%. The type was available across all states of the U.S. till the stock lasted. Some prominent players in the global black beer market include

-

Anheuser Busch InBev SA/NV

-

Asahi Group Holdings Ltd.

-

Beavertown Brewery

-

Buxton Brewery Co. Ltd.

-

Carlsberg Breweries AS

-

Diageo Plc

-

Heineken NV

-

Mikkeller ApS

-

Stone Brewing Co.

-

The Boston Beer Co. Inc.

Black Beer Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 28.55 billion

Revenue forecast in 2028

USD 51.20 billion

Growth Rate

CAGR of 8.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Packaging, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; Germany; U.K.; China; Japan; India; Brazil; South Africa

Key companies profiled

Anheuser Busch InBev SA/NV; Asahi Group Holdings Ltd.; Beavertown Brewery; Buxton Brewery Co. Ltd.; Carlsberg Breweries AS; Diageo Plc; Heineken NV; Mikkeller ApS; Stone Brewing Co.; The Boston Beer Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global black beer market report on the basis of packaging, product, distribution channel, and region:

-

Packaging Outlook (Revenue, USD Billion, 2016 - 2028)

-

Cans

-

Bottles

-

-

Product Outlook (Revenue, USD Billion, 2016 - 2028)

-

Dark Lager

-

Dark Ale

-

Brown Porter

-

Stout

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2016 - 2028)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Rest of the World

-

Brazil

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global black beer market size was estimated at USD 25.96 billion in 2020 and is expected to reach USD 28.55 billion in 2021.

b. The global black beer market is expected to grow at a compound annual growth rate of 8.9% from 2021 to 2028 to reach USD 51.20 billion by 2028.

b. Asia Pacific dominated the black beer market with a share of 37.0% in 2020. The expansion of the alcoholic beverages industry in India and China, both of which are backed by regulatory support, is expected to ensure continuous production of black beers and thus, be a positive factor for the market in Asia Pacific over the forecast period

b. Some key players operating in the black beer market include Anheuser Busch InBev SA/NV; Asahi Group Holdings Ltd.; Beavertown Brewery; Buxton Brewery Co. Ltd.; Carlsberg Breweries AS; Diageo Plc, Heineken NV; Mikkeller ApS; Stone Brewing Co.; The Boston Beer Co. Inc.

b. A rise in demand for preventing diseases caused due to obesity is expected to have a positive impact on the black beer market over the forecast period. Moreover, the increasing consumption of alcoholic beverages among millennials is anticipated to boost market growth further

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.