- Home

- »

- Next Generation Technologies

- »

-

Blockchain Supply Chain Market Size & Share Report, 2030GVR Report cover

![Blockchain Supply Chain Market Size, Share & Trends Report]()

Blockchain Supply Chain Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering, By Type, By Provider, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-421-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blockchain Supply Chain Market Summary

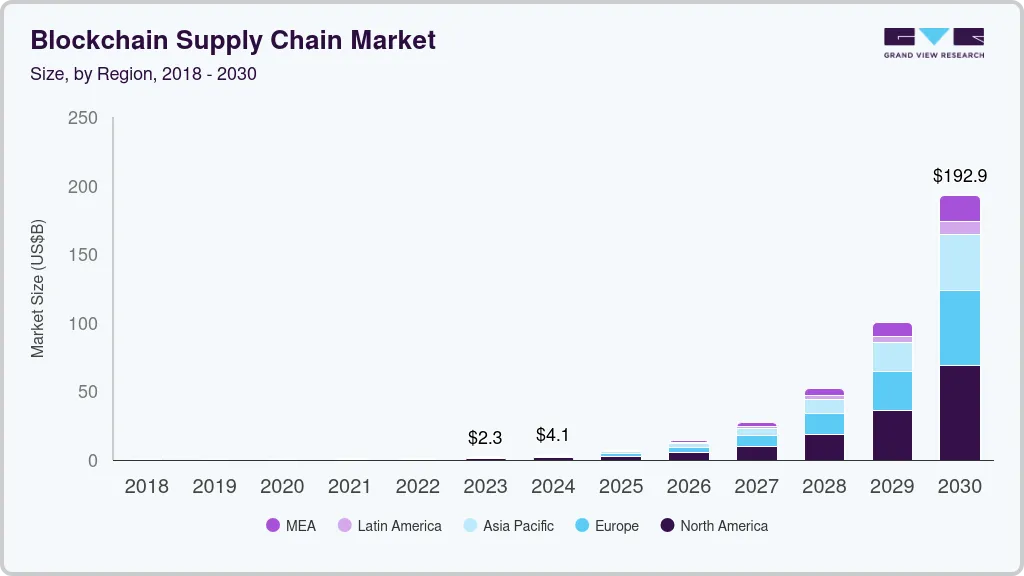

The global blockchain supply chain market size was estimated at USD 2,258.1 million in 2023 and is projected to reach USD 192,927.7 million by 2030, growing at a CAGR of 88.8% from 2024 to 2030. With increasing instances of data breaches and cyber-attacks, businesses are prioritizing the protection of their supply chain data to safeguard against potential threats.

Key Market Trends & Insights

- North America blockchain supply chain market dominated the global market and accounted for 36.55% in 2023.

- The U.S. blockchain supply chain market is anticipated to register significant growth from 2024 to 2030.

- Based on offering, the platform segment led the market and accounted for 60.42% of the global revenue in 2023.

- By type, the public segment accounted for the largest market revenue share in 2023.

- By application, the asset tracking segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,258.1 Million

- 2030 Projected Market Size: 192,927.7 Million

- CAGR (2024-2030): 88.8%

- North America: Largest market in 2023

Enhanced security measures are being implemented to protect sensitive information and prevent unauthorized access. This heightened focus on security is driving the adoption of advanced technologies, including encryption, multi-factor authentication, and real-time monitoring systems, to ensure that transactions are conducted securely. Companies are investing in robust cybersecurity solutions to mitigate risks associated with fraud and data tampering, which is, in turn, fueling market growth. As businesses continue to recognize the importance of secure transactions, the demand for innovative security solutions in the supply chain sector is expected to rise significantly.

Transparency in the supply chain has become a critical concern for businesses and consumers alike. The demand for greater visibility into the origins and movement of products is driven by the need to ensure ethical sourcing, compliance with regulations, and the ability to quickly address any issues that arise. Companies are increasingly adopting technologies that provide real-time tracking and reporting of goods as they move through the supply chain. This transparency helps businesses build trust with consumers by demonstrating a commitment to ethical practices and sustainability. In addition, it enables more efficient management of supply chain disruptions by providing visibility into potential bottlenecks or delays.

Blockchain technology is revolutionizing supply chain management by providing a decentralized, immutable ledger that enhances transparency and security. In the retail and consumer goods sector, blockchain is being increasingly utilized to track and verify the authenticity of products, streamline transactions, and reduce fraud. The ability to record every transaction in a secure, transparent manner allows for improved traceability and accountability throughout the supply chain. This technology enables retailers and consumers to access detailed information about the provenance of products, from raw materials to finished goods. The adoption of blockchain in the supply chain is also driving innovation in smart contracts and automated processes, which help reduce operational costs and improve efficiency.

The shift towards automation in supply chain management is transforming how businesses operate and manage their logistics. Automation technologies, such as robotics, artificial intelligence, and advanced analytics, are being implemented to streamline operations, reduce human error, and increase efficiency. Automated systems are capable of handling repetitive tasks, such as inventory management, order processing, and transportation scheduling, allowing human workers to focus on more strategic activities. This increased efficiency not only helps companies reduce costs but also improves accuracy and speed in the supply chain.

The integration of Internet of Things (IoT) technology into supply chain management is revolutionizing how companies monitor and manage their operations. IoT devices, such as sensors and connected equipment, provide real-time data on various aspects of the supply chain, including inventory levels, equipment performance, and environmental conditions. This data-driven approach enables businesses to make informed decisions, enhance operational efficiency, and proactively address potential issues before they escalate. IoT technology also facilitates improved coordination between different components of the supply chain, leading to better forecasting, planning, and execution.

Offering Insights

Based on offering, the platform segment led the market and accounted for 60.42% of the global revenue in 2023. The platform segment of the blockchain supply chain market is experiencing robust growth due to the increasing need for enhanced transparency and security in supply chain operations. Companies are turning to blockchain platforms to enable real-time tracking and verification of transactions, which helps reduce fraud and improve the efficiency of supply chain processes. The ability of blockchain platforms to create a tamper-proof, decentralized ledger is particularly appealing for industries with complex, global supply chains. In addition, the rising demand for automated solutions is driving the adoption of blockchain platforms that can seamlessly integrate with existing supply chain management systems.

The services segment is expected to register significant growth from 2024 to 2030. The services segment in the blockchain supply chain market is expanding rapidly, driven by the growing complexity of implementing and managing blockchain solutions. Companies are increasingly seeking expert services for the customization, deployment, and integration of blockchain platforms tailored to their specific supply chain needs. As blockchain technology becomes more integral to supply chain management, businesses require ongoing support to ensure the seamless operation of these systems, driving demand for managed services and technical consulting. The need for training and education on blockchain technology is also contributing to the growth of this segment, as organizations strive to upskill their workforce.

Type Insights

The public segment accounted for the largest market revenue share in 2023. The public segment in the supply chain market is witnessing significant growth due to its decentralized nature, offering open and transparent access to transaction records across the entire network. This transparency is especially appealing for businesses looking to build trust with consumers and stakeholders by providing verifiable data on product origins and supply chain processes. The rising importance of sustainability and ethical sourcing is also driving demand for public blockchains, as they allow for greater accountability in tracking materials and goods. In addition, the growing adoption of cryptocurrencies and decentralized finance (DeFi) within supply chains is further boosting the use of public blockchains.

The hybrid and consortium segment is expected to grow significantly from 2024 to 2030. The hybrid segment is growing rapidly as businesses seek a balance between the transparency of public blockchains and the privacy and control offered by private blockchains. Hybrid blockchains allow companies to keep sensitive data secure while still leveraging the benefits of a decentralized ledger for less sensitive transactions, making them ideal for industries with strict regulatory requirements. The flexibility of hybrid blockchains in enabling selective access to data is driving their adoption, particularly in sectors such as healthcare and finance, where data privacy is critical. Moreover, the ability to integrate with existing enterprise systems while maintaining control over certain aspects of the supply chain is contributing to the popularity of hybrid blockchains.

Provider Insights

The middleware provider segment accounted for the largest market revenue share in 2023. Middleware solutions are essential for bridging the gap between different platforms, ensuring interoperability, and enabling smooth data exchange across the supply chain. The growing complexity of supply chain networks is driving demand for middleware that can facilitate real-time communication and enhance the efficiency of blockchain-based operations. In addition, as companies adopt multi-cloud environments, middleware providers are becoming crucial in managing and optimizing these diverse infrastructures. With the rising need for streamlined operations and better connectivity, the middleware provider segment is set for substantial growth.

The application provider segment is expected to grow significantly from 2024 to 2030. The application provider segment is expanding rapidly as businesses adopt blockchain solutions tailored to specific supply chain needs, from tracking and tracing to smart contracts and compliance management. These applications are becoming increasingly sophisticated, offering features that help companies improve transparency, security, and efficiency in their supply chain operations. The rising demand for customized blockchain applications that address industry-specific challenges is a key driver for this segment. Moreover, the ability to deploy these applications across various sectors, such as retail, logistics, and manufacturing, is broadening the market's reach.

Application Insights

The asset tracking segment accounted for the largest market revenue share in 2023. The asset tracking segment is experiencing strong growth as companies increasingly prioritize transparency and real-time visibility across their supply chains. Blockchain technology enables precise tracking of assets, from raw materials to finished products, ensuring that every movement is recorded in a tamper-proof ledger. This enhanced traceability is particularly valuable in industries such as food and beverage, pharmaceuticals, and luxury goods, where verifying the authenticity and origin of products is critical. In addition, the growing demand for sustainability and ethical sourcing is driving the adoption of blockchain-based asset tracking, allowing businesses to provide verifiable proof of environmentally friendly practices.

The smart contracts segment is expected to grow significantly from 2024 to 2030. Smart contracts eliminate the need for intermediaries by executing contract terms automatically when predefined conditions are met, reducing the risk of disputes and speeding up transactions. This capability is particularly beneficial in complex supply chains, where multiple parties are involved and where efficiency and trust are paramount. The rising adoption of smart contracts is also driven by their ability to reduce costs and enhance compliance, as they provide a transparent and immutable record of all transactions. With the increasing focus on automation and efficiency, the smart contracts segment is expected to see robust growth as more companies integrate these solutions into their supply chain operations.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. The large enterprise segment is expanding rapidly as major corporations seek to enhance their supply chain operations with advanced blockchain solutions. These organizations are investing heavily in blockchain technology to improve transparency, security, and efficiency across their complex and global supply chains. The need for robust and scalable solutions that can handle large volumes of transactions and data is driving the adoption of blockchain platforms among large enterprises. In addition, large corporations are leveraging blockchain to achieve greater compliance with regulatory requirements and to integrate with existing enterprise systems.

The Small & Medium Enterprises (SMEs) segment is expected to grow significantly from 2024 to 2030. SMEs are adopting blockchain solutions to enhance transparency, reduce costs, and improve efficiency in their supply chain processes, often through more affordable and scalable solutions. The growing availability of blockchain-as-a-service (BaaS) offerings is making it easier for SMEs to implement these technologies without substantial upfront investments. In addition, as blockchain technology becomes more user-friendly and accessible, SMEs are leveraging it to compete with larger players by improving their operational capabilities and customer trust. The ongoing trend towards digital transformation among SMEs is contributing to the segment’s robust expansion.

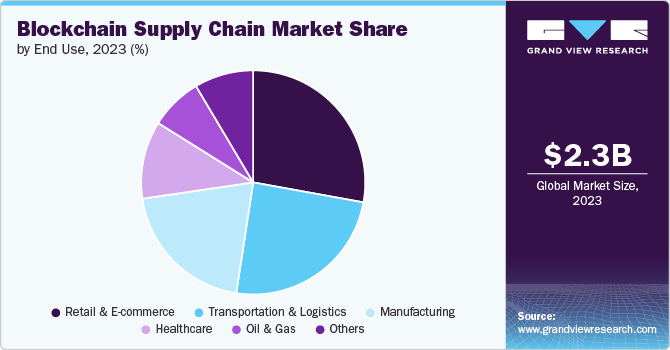

End Use Insights

The retail & e-commerce segment accounted for the largest market revenue share in 2023. Blockchain technology offers real-time tracking and verification of products, enhancing consumer trust and reducing fraud. The rise of digital shopping platforms and the need to manage complex supply chains efficiently are driving the adoption of blockchain solutions that streamline operations and improve inventory management. In addition, blockchain's ability to facilitate seamless returns and refunds is boosting its appeal in the retail and e-commerce sectors. As businesses seek to enhance their competitive edge and meet evolving customer expectations, the retail and e-commerce segment is expected to see continued expansion.

The healthcare segment is expected to grow significantly from 2024 to 2030. The healthcare segment is witnessing significant growth as organizations seek to improve the integrity and security of sensitive medical data and pharmaceutical supply chains. Blockchain technology offers enhanced traceability for medical products, helping to prevent counterfeiting and ensure compliance with regulatory standards. The ability to securely share patient data across different healthcare providers while maintaining privacy and accuracy is driving the adoption of blockchain solutions. In addition, blockchain's potential to streamline clinical trials and supply chain management is contributing to its growing use in healthcare.

Regional Insights

North America blockchain supply chain market dominated the global market and accounted for 36.55% in 2023. The presence of major tech hubs and a strong ecosystem of blockchain startups and established companies contribute to the rapid development and deployment of blockchain solutions. In addition, favorable regulatory environments and significant investments in research and development are accelerating market growth in North America. As companies continue to seek ways to optimize their supply chains and improve operational resilience, the North American market is poised for continued expansion.

U.S. Blockchain Supply Chain Market Trends

The U.S. blockchain supply chain market is anticipated to register significant growth from 2024 to 2030. High levels of investment in blockchain research and development, coupled with a supportive regulatory environment, are fostering rapid growth in this sector. The need for advanced solutions to manage complex and global supply chains is further driving adoption across industries such as retail, healthcare, and manufacturing.

Asia Pacific Blockchain Supply Chain Market Trends

The Asia Pacific blockchain supply chain market is anticipated to register significant growth from 2024 to 2030. Rapid growth due to the region’s burgeoning e-commerce sector and increasing demand for efficient supply chain solutions is a significant factor contributing to the growth of the Asia Pacific market. Rapid industrialization, expanding consumer markets, and the need for enhanced supply chain visibility are driving the adoption of blockchain technology. Countries such as China, India, and Japan are leading the way in implementing blockchain to improve transparency, streamline operations, and combat counterfeit products.

Europe Blockchain Supply Chain Market Trends

The European blockchain supply chain market is poised for significant growth from 2024 to 2030. Europe’s strong regulatory framework and emphasis on ethical sourcing and data protection are key drivers of blockchain adoption. The European Union’s initiatives to support digital innovation and blockchain technology are also contributing to market growth. In addition, the increasing need for efficient cross-border logistics and the growing popularity of blockchain for traceability in industries such as food and pharmaceuticals are accelerating adoption.

Key Blockchain Supply Chain Company Insights

Key players operating in the blockchain supply chain market include IBM Corporation, Microsoft, Amazon Web Services Inc., SAP SE, Guardtime, Bitfury Group Limited, Omnichain Solutions, Accenture, Digital Treasury Corporation, and TIBCO Software. Major players in the market are securing significant market shares by leveraging their technological advancements, strategic partnerships, and diversified offerings.

Several players in the blockchain supply chain solutions sector are increasingly focusing on product launches and partnerships as a key strategy to enhance their offerings. These launches are enabling companies to develop more efficient and innovative solutions that address the complexities of modern supply chains. For instance, in April 2024, Ripple has partnered with Japan's SBI Group to introduce the XRP Ledger (XRPL) blockchain for supply chain solutions, marking the first deployment of its kind in Japan. This move is part of Ripple's broader strategy to drive the adoption of enterprise blockchain solutions in the country. SBI Group's use of XRPL underscores its commitment to innovation within the supply chain sector. In addition, Ripple has formed a strategic partnership with Tokyo-based consultancy HashKey DX to further expand XRPL enterprise solutions in Japan. This collaboration signifies a significant step forward in the adoption of blockchain technology across Japanese industries.

Key Blockchain Supply Chain Companies:

The following are the leading companies in the blockchain supply chain market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Microsoft

- Amazon Web Services Inc.

- SAP SE

- Guardtime

- Bitfury Group Limited

- Omnichain Solutions

- Accenture

- Digital Treasury Corporation

- TIBCO Software

Blockchain Supply Chain Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.07 billion

Revenue forecast in 2030

USD 192.93 billion

Growth rate

CAGR of 90.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Offering, type, provider, application, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

IBM Corporation; Microsoft; Amazon Web Services Inc.; SAP SE; Guardtime; Bitfury Group Limited; Omnichain Solutions; Accenture; Digital Treasury Corporation; TIBCO Software

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blockchain Supply Chain Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the blockchain supply chain market based on offering, type, provider, enterprise size, application, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Platform

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

Hybrid and Consortium

-

-

Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Providers

-

Middleware Providers

-

Infrastructure Providers

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Asset Tracking

-

Payment and Settlement

-

Counterfeit Detection

-

Smart Contracts

-

Risk and Compliance Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-commerce

-

Healthcare

-

Manufacturing

-

Transportation & Logistics

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global blockchain supply chain market size was estimated at USD 2.26 billion in 2023 and is expected to reach USD 4.07 billion in 2024.

b. The global blockchain supply chain market is expected to grow at a compound annual growth rate of 90.2% from 2024 to 2030 to reach USD 192.93 billion by 2030.

b. North America dominated the blockchain supply chain market with a share of 36.55% in 2023. The favorable regulatory environments and significant investments in research and development are accelerating market growth in North America.

b. Some key players operating in the blockchain supply chain market include IBM Corporation, Microsoft, Amazon Web Services Inc., SAP SE, Guardtime, Bitfury Group Limited, Omnichain Solutions, Accenture, Digital Treasury Corporation, and TIBCO Software.

b. Key factors that are driving the market growth include the shift towards automation in supply chain management and the growing demand for greater visibility into the origins and movement of products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.