- Home

- »

- Clinical Diagnostics

- »

-

Blood Preparation Market Size, Share & Growth Report, 2030GVR Report cover

![Blood Preparation Market Size, Share & Trends Report]()

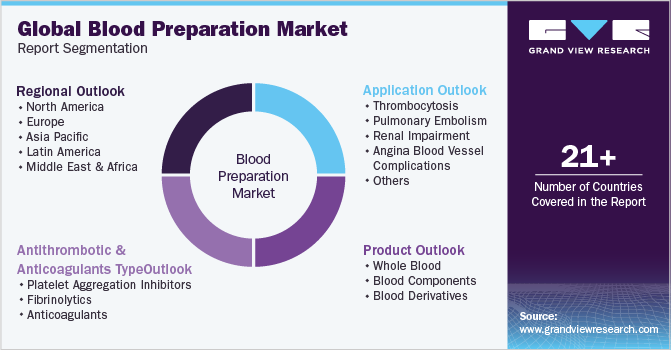

Blood Preparation Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Whole Blood, Blood Components, Blood Derivatives), Antithrombotic And Anticoagulants Type, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-455-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Preparation Market Summary

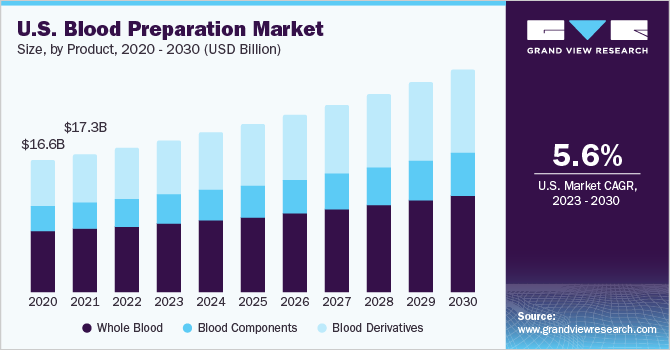

The global blood preparation market size was estimated at USD 45.25 billion in 2022 and is projected to reach USD 73.59 billion by 2030, growing at a CAGR of 6.4% from 2023 to 2030. Growing incidence of blood-related disorders, rising number of transfusion procedures, and increasing donations are the major factors driving the market.

Key Market Trends & Insights

- North America led the overall blood preparation market with a share of 44.60% in 2022.

- By product, the whole blood product segment held the largest share of 46.52% of the market in 2022.

- By type, anticoagulants segment held a share of 64.30% of the blood preparation in 2022.

- By application, thrombocytosis segment held major share of 22.00% of the market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 45.25 Billion

- 2030 Projected Market Size: USD 73.59 Billion

- CAGR (2023-2030): 6.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Moreover, extensive usage of blood and its components in several surgical procedures, increasing number of accidents, and growing donations are also expected to fuel the market over the study period. For instance, according to the American National Red Cross, in U.S. approximately 6.8 million people donate blood and about 13.6 million units of red blood cells and whole blood are collected annually in the U.S.

Transfusions are essential in the treatment of numerous conditions such as anemia, trauma, surgical procedures, and cancer treatments. For instance, in leukemia patients the body’s factory that makes blood damaged, hence transfusion are essential to manage the disease and its symptoms . Additionally, the rising prevalence of chronic diseases and advancements in healthcare technologies have further contributed to the growing demand for products.

Moreover, increasing research and development activities on preparation methods is anticipated to propel the market growth during the review period. For instance, in September 2020, researchers at Singapore-MIT Alliance for Research and Technology developed an efficient and fast technology to produce red blood cells. The novel technology utilizes more targeted cell sorting & purification methods and cuts cell culture time by half. Furthermore, launch of new blood bank centers across the globe are likely to offer ample opportunities for the market. For instance, in March 2023, Kenya's Ministry of Health, introduced a satellite blood bank center for improving access to quality and safe transfusion services in the region.

The introduction of novel technologies along with the increasing usage of plasma in the pharmaceutical industry is further projected to contribute to market growth over the forecast period. For instance, in April 2021, EryPharm introduced a medical device product to manufacture cultured red blood cells in large quantities and create new sources of blood for transfusions . Various governments across the globe are focusing on increasing the number of donations by applying reimbursement policies, such as monetary incentives for donors. For instance, in September 2021, The American Red Cross, introduced a national initiative to reach maximum number of donor to improve health outcomes in patients with sickle cell disease . These factor is also expected to help augment the growth of the global market over the next few years.

Product Insights

The whole blood product segment held the largest share of 46.52% of the market in 2022. The segment growth is majorly attributed to an increasing demand for major surgeries and transfusions along with its advantages, such as easy availability, low cost, and maintenance, is the major factor contributing to the segment’s high share. For instance, according to givingblood.org, an estimated 4.5 million American population need transfusion per year to deal with various healthcare conditions.

On the other hand, blood derivatives are likely to be the fastest-growing segment over the forecast years. The implementation of government initiatives for the development of plasma-derived proteins, such as immunoglobulins, coagulation factor products, human fibrin foam, dried human plasma, and human thrombin, are expected to drive the segment growth. For instance, in August 2022, Human and Health Services Department launched a new campaign with a focus to increase blood and plasma donations in the U.S.

Antithrombotic and Anticoagulants Type Insights

Anticoagulants segment held a share of 64.30% of the blood preparation in 2022. This maximum market share is attributed to the introduction of new products and increasing prevalence of cardiac conditions. With ongoing research and development activities, the anticoagulants market is expected to witness substantial growth in the coming years, offering improved therapeutic options for patients at risk of clotting disorders. For instance, in May 2023, Endo executed agreements with Gland Pharma Limited and MAIA Pharmaceuticals, Inc. to commercialize bivalirudin anticoagulant (thrombin inhibitor) that helps prevent the formation of clots in the U.S. market.

Fibrinolytics segment is expected to register highest CAGR during the forecast period. Biopharmaceutical companies are upgrading their products by launching novel and more efficient anticoagulant drugs in the market. Moreover, strategic programs conducted by market players are further projected to fuel the segment growth during the forecast period. For instance, in February 2023, Janssen Pharmaceuticals, Inc. and Bristol Myers Squibb entered into strategic collaboration and launched pivotal phase 3 Librexia clinical trial program.

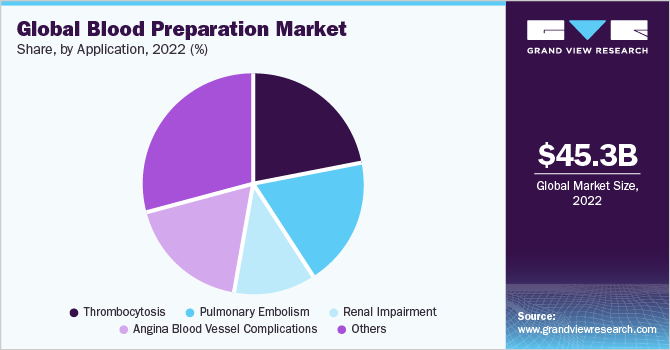

Application Insights

In 2022, thrombocytosis segment held major share of 22.00% of the blood preparation market. Increasing prevalence of thrombocytosis, growing awareness and diagnosis of the condition, and advancements in diagnostic techniques are substantially playing a role in maximum segment share. Additionally, the development of targeted therapies and novel treatment options for thrombocytosis is further expected to fuel market growth.

Angina blood vessel complications are expected to grow at the fastest CAGR during the forecast period. Certain factors such as rising R&D for the development of anticoagulants for cardiac problems and increasing prevalence of Cardiovascular Disorders (CVDs) are estimated to drive the segment growth. Furthermore, a rise in lifestyle-associated diseases, the popularity of oral anticoagulants, growing patient awareness, increased healthcare expenditure, and favorable government policies are the factors driving the segment.

Regional Insights

North America led the overall blood preparation market with a share of 44.60% in 2022 owing to the high incidence of CVDs, leukemia, and hematological and neurological diseases in the region. For instance, according to The American Cancer Society’s estimates for 2023 in the U.S., approximately 59,610 new cases of leukemia and 23,710 deaths from leukemia . Higher patient awareness and healthcare expenditure levels along with the presence of sophisticated healthcare infrastructure will boost the region’s growth further.

The Asia Pacific is expected to witness the fastest growth on account of improving healthcare infrastructure, the presence of untapped opportunities, economic development, and rising initiatives by private and public organizations. Moreover, active involvement of market players with an aim to launch new therapies in the region is also expected to offer a favorable opportunity for market growth.

Key Companies & Market Share Insights

Key companies in the market have adopted strategies, such as new product launches, mergers and acquisitions, and collaborations, to increase their market share. For instance, in May 2023, Bayer received U.S. FDA fast track designation for asundexian which is currently undergoing Phase III OCEANIC clinical trial program. The drug is a novel alternative treatment for thrombosis management with the goal to uncouple efficacy form increased bleeding risk . Some of the key players in the blood preparation market are:

-

Pfizer, Inc

-

Bristol-Myers Squibb Company

-

Leo Pharma A/S

-

Sanofi

-

Xiamen Hisunny Chemical Co., LTD

-

AstraZeneca plc

-

Baxter International Inc

-

Portola Pharmaceuticals, Inc.

-

GlaxoSmithKline PLC

-

Shandong East Chemical Industry Co.

-

Celgene Corp.

Blood Preparation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 47.82 billion

Revenue forecast in 2030

USD 73.59 billion

Growth rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, antithrombotic and anticoagulants type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Pfizer, Inc.;Bristol-Myers Squibb Company; Leo Pharma A/S; Sanofi; Xiamen Hisunny Chemical Co., LTD.; AstraZeneca plc; Baxter International Inc.; Portola Pharmaceuticals, Inc.; GlaxoSmithKline PLC; Shandong East Chemical Industry Co.; Celgene Corp

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Global Blood Preparation Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global blood preparation market report on the basis of product, antithrombotic & anticoagulants type, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Blood

-

Red Cells

-

Granulocytes

-

Plasma

-

Platelets

-

-

Blood Components

-

Whole Blood Components

-

Packed Red Cells

-

Leukocyte Reduced Red Blood Cells

-

Frozen Plasma

-

Platelet Concentrate

-

Cryoprecipitate

-

-

Blood Derivatives

-

-

Antithrombotic and Anticoagulants Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Platelet Aggregation Inhibitors

-

Glycoprotein Inhibitors

-

COX Inhibitors

-

ADP Antagonists

-

Others

-

-

Fibrinolytics

-

Tissue Plasminogen Activator (tPA)

-

Streptokinase

-

Urokinase

-

-

Anticoagulants

-

Heparins

-

Unfractionated Heparin

-

Low Molecular Weight Heparin (LMWH)

-

Ultra-low Molecular Weight Heparin

-

-

Vitamin K Antagonists

-

Direct Thrombin Inhibitors

-

Direct Factor Xa Inhibitors

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Thrombocytosis

-

Pulmonary Embolism

-

Renal Impairment

-

Angina Blood Vessel Complications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Spain

-

France

-

Italy

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood preparation market size was estimated at USD 45.25 billion in 2022 and is expected to reach USD 47.82 billion in 2023.

b. The global blood preparation market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 73.59 billion by 2030.

b. The whole blood product segment held the largest share of 46.52% of the blood preparation market in 2022. This is attributable to increasing demand for whole blood for major surgeries and transfusions along with its advantages, such as easy availability, low cost, and maintenance

b. Some key players operating in the blood preparation market include AstraZeneca PLC; Sanofi; LEO Pharma A/S; Bristol-Myers Squibb Company; Baxter International, Inc.; Pfizer, Inc.; Portola Pharmaceuticals, Inc.; and GlaxoSmithKline plc.

b. Key factors that are driving the market growth include growing demand for blood and its components in surgical procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.