- Home

- »

- Clinical Diagnostics

- »

-

Blood Transfusion Diagnostics Market Size Report, 2030GVR Report cover

![Blood Transfusion Diagnostics Market Size, Share & Trends Report]()

Blood Transfusion Diagnostics Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Reagents & Kits), By Application, By End-use (Hospitals, Blood Banks), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-855-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

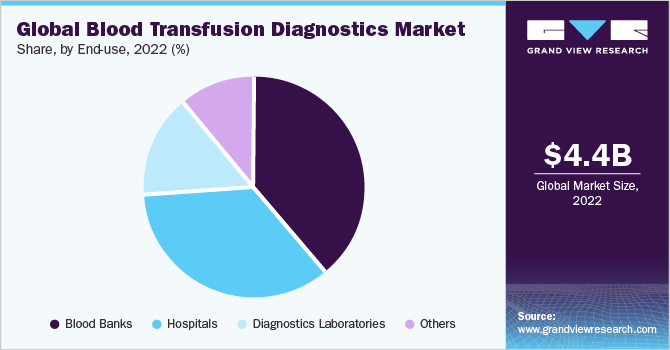

The global blood transfusion diagnostics market size was valued at USD 4.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The growing prevalence of blood-related diseases & awareness, the increasing rate of approval by the U.S.FDA for blood transfusion diagnostics products, and the introduction of new technologies to assist in blood donation and storage remain key drivers of market growth. Several technologies are being developed to provide real-time information regarding blood inventories including blood products, hemoglobin values, and their demand. This ensures efficient management of blood and treatment of related diseases leading to increasing demand for blood transfusion diagnostics systems.

The increase in the prevalence of infectious and blood-related diseases such as cancer, hemophilia, anemia, thrombocytopenia, and liver and kidney diseases is expected to drive market growth. According to a study published in the Journal of Hematology and Oncology in November 2021, 1,800 million cases of anemia were prevalent across the world in 2019. Furthermore, data published by the National Cancer Institute suggests, in 2020, approximately 490,875 people in the U.S. were suffering from leukemia. The increasing prevalence of blood-related diseases is also adding to the demand for blood cells across the world which is likely to boost the growth of the market. According to an article by Ohio University published in November 2021, around 36,000 units of red blood cells are required every day in the U.S.

A rise in the number of trauma, road accident, surgery, and childbirth cases has also led to significant transfusions, thus, driving the market. According to the data released by the World Health Organization (WHO) in June 2022, approximately 1.3 million people are killed in road accidents every year. Moreover, 20 to 50 million people suffer non-fatal injuries. Additionally, surgeries such as post-cardiopulmonary bypass, neurosurgery, posterior eye surgery, and chronic bleeding disorders also require platelet transfusions.

Many governments across the countries are continuously emphasizing enhancing the healthcare systems by providing product approvals and developing important guidelines related to blood transfusions to prevent any procedural complications. For instance, according to an article by the Economic Times published in March 2023, the Drug Controller General of India has issued guidelines that require all blood bank cold chain devices used in the process to be of medical grade and class B certified. Such steps can assist in the efficient management of blood and facilitate the growth of the blood transfusion and diagnostics market.

Moreover, an increase in awareness regarding blood donation is also fueling the growth of this market. Various initiatives by governmental as well as non-governmental organizations and the ease brought by technology in spreading awareness can be attributed to this growth. An article by the World Health Organization published in June 2023 suggests, approximately 118.5 million blood donations are collected globally and an increase of 10.7 million voluntary unpaid donations is reported from 2008 to 2018. Also, e-RaktKash, a blood collection organization in India, had planned approximately 53 campaigns across India from October 2021 to March 2022.

The adverse effects of the COVID-19 pandemic are also observed in this market. The onset of the pandemic compelled almost all the countries around the world to impose strict guidelines relating to social distancing and public gatherings. This negatively impacted the market since it became difficult to conduct blood donation drives or encourage people to donate. Therefore, increasing COVID-19 cases coupled with a lack of donors created a severe blood crisis during the pandemic. For instance, according to the Pan American Health Organization, a decrease of 20% in blood donations was observed during the pandemic in Latin America and the Caribbean region.

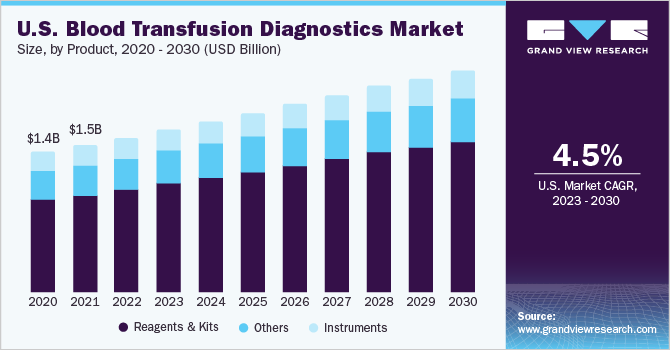

Product Insights

The reagents and kits segment accounted for the largest revenue share of 66.24% in 2022. The segment is also expected to grow at the fastest rate of 6.1% over the forecast period. Easy availability of products and repetitive purchase of these products necessitate screening of both donor and recipient samples, which remains a key driver of segment growth. In addition, the availability of a wide variety of blood grouping, typing, and donor screening reagents, kits, and assays manufactured and launched by both global and local players is another factor driving the segment growth.

In April 2021, Ortho Clinical Diagnostics, a company specializing in donor testing solutions launched ORTHO VISION Swift and ORTHO VISION Max Swift. These analyzers are built with improved diagnosis technologies and offer better processing power and advanced data security.

In addition, in March 2022, Mindray, a global medical solution provider, launched its BC-700 analyzer series, which facilitates the complete blood count and erythrocyte sedimentation rate tests. This series facilitates the empowerment of medium-volume laboratories due to the use of advanced technology. Analyzers are built with advanced diagnostics technologies that offer better processing power and advanced data security.

There is an increasing risk of Transfusion-transmitted Infections (TTIs) that has led to high demand for donor screening. To prevent patients from unsuitable blood and blood products and combat TTIs, the need for donor screening is increasing.The ease of access and availability of advanced donor analyzers are fueling the growth of this market. For instance, MosaiQ by Quotient is the first fully automated platform to conduct blood grouping and TTI screening of donor samples that helps efficient screening. In addition, the rising availability of rapid diagnostic kits for safe blood transfusion is expected to propel market growth in the coming years.

Application Insights

The disease screening segment accounted for the largest revenue share of around 60.4% in 2022. The segment is also estimated to register the fastest CAGR of 6.0% over the forecast period from 2023 to 2030. This can be attributed to a high number of transfusion-transmitted infection cases, increasing safety screening of donated blood to maintain safe transfusion, rising technological advancements, and wide product portfolios offered by key players in the market.

Moreover, there is an increasing requirement for blood transfusion owing to the increasing prevalence of blood-related diseases which also suggests possibilities of transfusion-transmitted diseases such as Hepatitis B, and HIV-1 that can further worsen a patient’s condition. Therefore, there is an increasing demand for screening of donors before blood transfusion, especially in less developed countries where the prevalence of such diseases is higher.

Furthermore, the growing focus of various research studies on performing experiments with serological testing approaches is expected to be a driving factor for the segment. For instance, a research study published in Nature Communication in 2021 reviewed the SARS-CoV-2 antibody seroprevalence among blood donors in the Chinese cities of Wuhan, Shenzhen, and Shijiazhuang. Such studies would increase the demand for blood transfusion diagnostics products.

In addition, increasing awareness regarding blood donation and therefore increase in the routine blood typing and cross-matching tests performed before transfusion therapy for identifying the compatibility of donor and recipient blood is further expected to drive the growth of this segment. For instance, American Red Cross launched an initiative in September 2021, to reach out to more blood donors to help patients suffering from sickle cell disease.

End-use Insights

The blood banks segment held the largest revenue of 39.22% market share in 2022 and is expected to grow at the fastest CAGR of 6.2% from 2023 to 2030. This growth can be attributed to the increasing screening for diseases before the blood transfusion. The advancement in infrastructure & other facilities and emphasis on blood safety is driving the growth of this segment. A few of the standard tests performed in these end-use settings with the donated blood include blood typing, Rh typing, unexpected RBC antibody screening, and infectious disease screening.

Various national and international organizations are also taking steps and emphasizing the importance of screening for the safety of both the receiver and the donor. For instance, an article by World Health Organization published in June 2023, suggests that 73% of the reporting countries had national blood policies whereas 66% of them had specific legislation related to the safety and quality of blood transfusion.

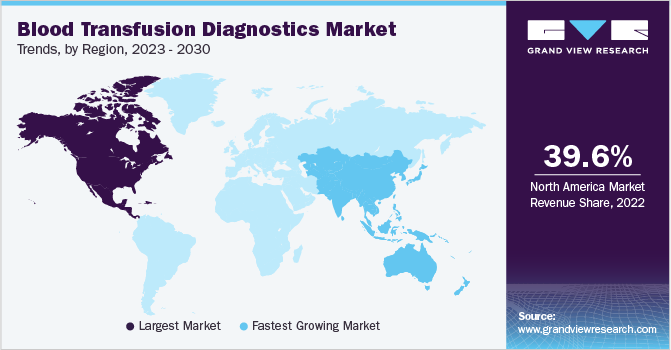

Regional Insights

In the regional segmentation, North America accounted for the largest revenue share of 39.59% in 2022. The segment is expected to maintain its position during the forecast period. Increasing disposable income, increasing awareness regarding health, improvement in the health infrastructure, and favorable reimbursement policies are some key factors boosting the regional market. Such steps help in ensuring the safety of blood and in turn add to the growth of the blood transfusion diagnostic industry in this region.

Moreover, the U.S. accounted for the largest share in North America. Increasing awareness regarding blood donation, easy accessibility to testing facilities, and the presence of global and local players are expected to propel the market growth in this region. According to the American Red Cross, approximately 16 million blood components are transfused every year in the U.S. This increasing requirement for blood components can further drive the demand for blood transfusion diagnostics.

Asia Pacific is expected to grow at the fastest CAGR of 7.1% over the forecast period from 2023 to 2030. The high occurrence of transfusion-transmitted diseases along with increasing awareness about blood donations in this region are expected to boost the market growth According to the data published by the Ministry of Health and Family Welfare of India, 1,578,846 units of blood have been collected in the country since January 2022.

Key Companies & Market Share Insights

The market is competitive with the presence of several global and local players. Companies are undertaking strategies such as new product launches, investment in R&D, and mergers & acquisitions to increase their share in the market.

For instance, in February 2023, MedGenome Labs launched FSHD1 genetic screening test to assess the genetic changes in patients at early stages to facilitate better treatment options. Various government initiatives and approvals are also encouraging players to enter the market. For instance, an article published in April 2023 in Hindustan Times suggested that in India, the State Blood Transfusion Council (SBTC) has informed registered blood banks to notify the council of all old and new hepatitis B & C patients reported at blood banks, to eradicate the disease. Some prominent players in the global blood transfusion diagnostics market include:

-

Grifols

-

Bio-Rad Laboratories, Inc.

-

F.Hoffman-La Roche AG

-

Quotient Limited

-

Abbott

-

Ortho Clinical Diagnostics

-

BIOMERIEUX

-

Siemens Healthcare Private Limited

-

MedGenome

-

Beckman Coulter

Blood Transfusion Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.70 billion

Revenue forecast in 2030

USD 6.96 billion

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Grifols, Bio-Rad Laboratories, Inc; F.Hoffman-La Roche AG, Quotient Limited; Abbott; Ortho Clinical Diagnostics; BIOMERIEUX; Siemens Healthcare Private Limited; MedGenome; Beckman Coulter

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

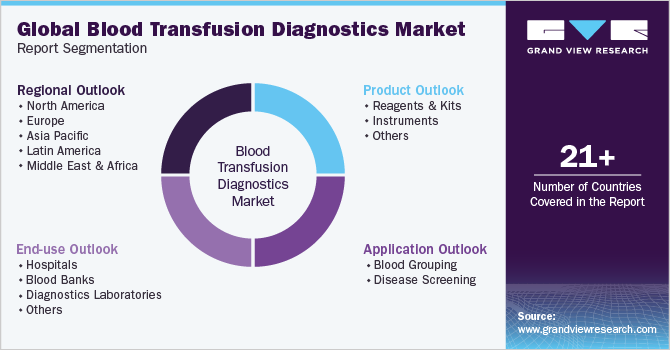

Global Blood Transfusion Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global blood transfusion diagnostics market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Kits

-

Instruments

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Grouping

-

Disease Screening

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Blood Banks

-

Diagnostics Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood transfusion diagnostics market size was estimated at USD 4.4 billion in 2022 and is expected to reach USD 4.7 billion in 2023.

b. The global blood transfusion diagnostics market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 6.96 billion by 2030.

b. North America dominated the blood transfusion diagnostics market with a share of 39.6% in 2022. This is attributable to the local presence of major market players, easy availability of various assays, and growing awareness among people about blood donations.

b. Some key players operating in the blood transfusion diagnostics market include Grifols S.A.; Immucor, Inc.; Ortho Clinical Diagnostics; Abbott; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd; Quotient Limited; BAG Health Care GmbH; DiaSorin S.p.A.; Beckman Coulter; and Biokit.

b. Key factors that are driving the blood transfusion diagnostics market growth include the rising prevalence of chronic diseases and increasing demand for donor screening.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.