- Home

- »

- Pharmaceuticals

- »

-

Sickle Cell Disease Treatment Market Size Report, 2030GVR Report cover

![Sickle Cell Disease Treatment Market Size, Share & Trends Report]()

Sickle Cell Disease Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Treatment (Blood Transfusion, Bone Marrow Transplant), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-442-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sickle Cell Disease Treatment Market Summary

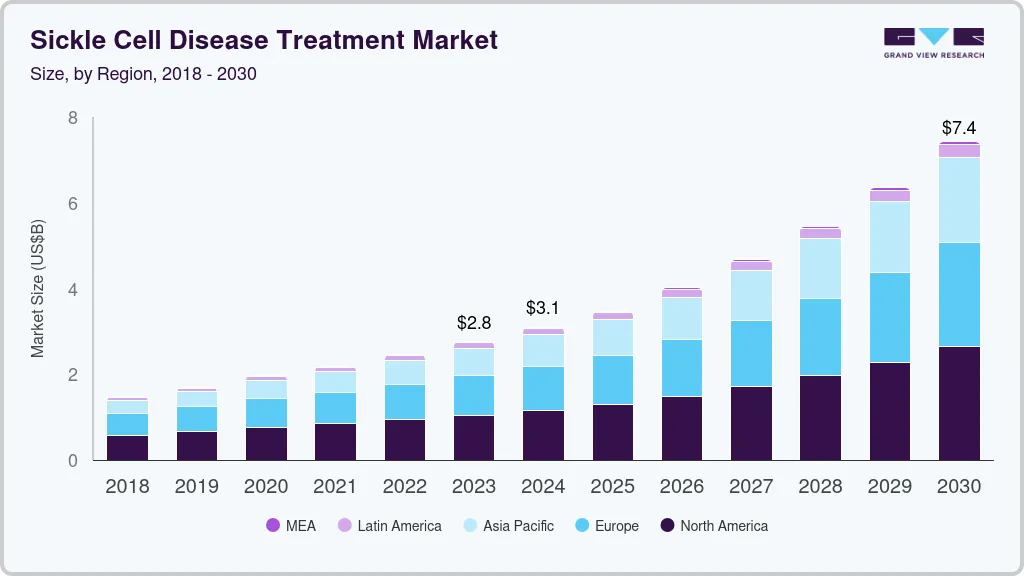

The global sickle cell disease treatment market size was estimated at USD 2,758.5 million in 2023 and is projected to reach USD 7,422.4 million by 2030, growing at a CAGR of 15.7% from 2024 to 2030. The market growth is driven by increasing disease awareness, advancements in medical research & technology, and a growing need for effective treatments.

Key Market Trends & Insights

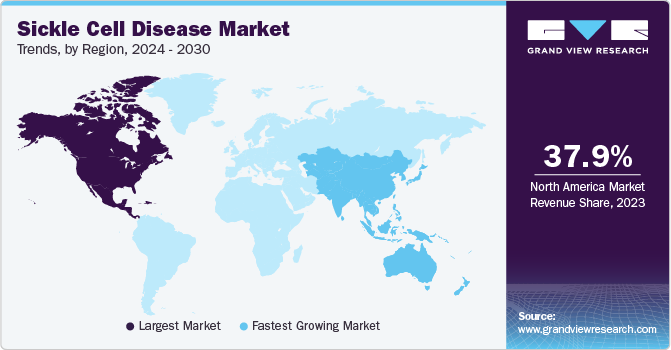

- North America dominated the global market with a share of 37.87% in 2023.

- Asia Pacific region is expected to grow exponentially over the forecast period.

- Based on treatment, the blood transfusion segment held the largest share of 48.45% of the market in 2023.

- In terms of type, the hospital segment held the largest share of 60.40% of the sickle cell disease treatment market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,758.5 Million

- 2030 Projected Market Size: USD 7,422.4 Million

- CAGR (2024-2030): 15.7%

- North America: Largest market in 2023

Government initiatives, healthcare policies, and collaborations between pharmaceutical firms & research institutions are also boosting market expansion and fostering innovation & therapy development.The COVID-19 pandemic has had a significant impact on the market. The disruption of healthcare services, including reduced access to diagnostics & treatments, adversely affected individuals with hemoglobinopathies.Increasing prevalence of hemoglobinopathies is expected to drive market growth over the forecast period. Migration & movement of the population globally, across regions and countries, can introduce SCD into populations where it was previously less common. This can be especially relevant in countries with a high rate of immigration. For instance, the prevalence of sickle cell trait is as high as 40% in some areas of central India, eastern Saudi Arabia, and sub-Saharan Africa but low in European countries.

Moreover, rising immigration of people from highly prevalent regions, such as South Asian countries, is anticipated to drive the market. In 2023, the Institute of Health Metrics and Evaluation published that the number of SCD patients globally has increased by 41.1% between 2000 and 2021, i.e., 5.46 million patients in 2000 to 7.74 million patients in 2021. This increase in number is also attributed to the decreased death rate of SCD patients between the 2 decades.

The presence of organizations, companies, and government institutions, such as the Sickle Cell Disease Association of America, Inc.(SCDAA) and Novartis AG, working toward enhancing awareness regarding the disease is projected to enhance market size. For instance, SCDAA announced the celebration of National Sickle Cell Awareness Month in September 2023 to raise awareness about the sickle cell trait. The Code Red campaign by Novartis aims to improve knowledge about SCD by showing the SCD patients' lives.

Increasing approval of novel therapeutic drugs for the treatment of the disease is further expected to fuel market growth. For instance, in March 2022, Emmaus Medical, Inc. received approval for Endari from the UAE Ministry of Health. Moreover, in April 2022, the company announced real-world Endari (L-glutamine) data to prevent severe complications associated with SCD in adult and pediatric patients in French Guiana and Qatar. Similarly, in February 2022, Agios Pharmaceuticals, Inc. received U.S. FDA approval for PYRUKYND (mitapivat) for the treatment of hemolytic anemia. The launch of these drugs is expected to increase market uptake over the forecast period.

Market Dynamics

Gene therapy and genome editing technologies, such as CRISPR-Cas9, are explored for potential SCD treatments. Researchers were investigating ways to correct the underlying genetic mutation responsible for these conditions, offering the possibility of a cure. Hydroxyurea is a medication that has been used to manage symptoms. Ongoing research was focused on optimizing the use of this drug, including personalized dosing strategies, to improve its effectiveness in individual patients. Wearable devices, such as smartwatches and fitness trackers, were being used to monitor patients' vital signs and other health parameters. This data could be shared with healthcare providers for continuous monitoring and early intervention.

Hematopoietic stem cell transplantation remains a potential remedial option for SCD. Raw materials involved in harvesting and processing stem cells, such as cytokines and growth factors, were significant for traditional transplantation and emerging therapies. The use of bio manufacturing technologies for SCD treatments, including bioreactors and cell culture systems, was increasing in production of cell-based therapies. Raw materials involved in these processes, such as culture media and bioreactor components, were crucial for rising production capacity.

Access to advanced sickle cell disease treatments, especially in regions with limited healthcare infrastructure, is a significant challenge. The cost of some advanced therapies, including gene therapies and certain medications, was a barrier to access for many patients. Affordability and reimbursement mechanisms were areas of concern. For some emerging treatments, long-term safety and efficacy data were limited. Establishing robust systems for long-term follow-up and monitoring of patients receiving novel therapies was crucial for ensuring their safety and effectiveness over time.

"In September 2024, Pfizer announced the voluntary withdrawal of OXBRYTA (voxelotor), its treatment for sickle cell disease (SCD), from all markets and the discontinuation of its clinical trials. This decision follows data indicating increased safety concerns, including a higher incidence of vaso-occlusive crises and fatal events, which outweigh the treatment’s benefits. Initially approved in 2019 and expanded to younger patients, OXBRYTA had contributed USD 328 million in revenue in 2023. Its removal marks a significant shift in the sickle cell disease treatment landscape, where options remain limited as Pfizer further investigates these safety findings."

Treatment Insights

The blood transfusion segment held the largest share of 48.45% of the market in 2023 and is expected to maintain its dominance throughout the forecast period. Increasing blood donations worldwide, limited availability of rival treatment options, high adoption rate, and effectiveness of blood transfusion method have significantly contributed to the segment share. According to a WHO article published in June 2023, between 2008 and 2018, there was a notable increase of 10.7 million blood donations sourced from individuals who willingly contributed without compensation. In 79 nations, around 90% of the blood supply is sourced from voluntary unpaid donors. In 54 countries, 50% of the blood supply is sourced from family/replacement or paid donors.

The pharmacotherapy segment is estimated to grow at a lucrative CAGR over the forecast period due to introduction of novel therapeutic drugs for the treatment of the disease and increasing prescription rate of pharmaceutical drugs.Rising number of research studies and clinical trials is anticipated to boost the segment during the forecast period. For instance, in April 2023, The University of California hosted its first-ever conference on pharmacotherapy and personalized healthcare, showcasing advancements in pharmaceutical science within modern commercial product development.

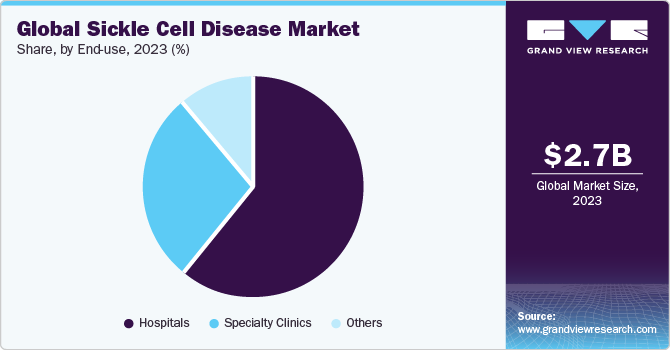

End-use Insights

The hospital segment held the largest share of 60.40% of the sickle cell disease treatment market in 2023 and is estimated to grow at the fastest growth rate over the forecast period. This growth can be attributed to several factors, including the increasing prevalence of sickle cell disease, advancements in medical technology, and a growing recognition of the specialized care required for individuals with this genetic disorder. According to The Institute for Health Metrics and Evaluation statistics updated in June 2023, the number of persons living with sickle cell disease increased by 41.4% from 5.46 million (4.62%-6.45%) in 2000 to 7.74 million (6.51%-9.2%) in 2021 globally.

However, the specialty clinics segment is estimated to attain second-highest revenue share of the market in 2023. Moreover, the development of advanced therapies, such as gene therapy and targeted medications, has made these clinics essential hubs for delivering cutting-edge treatments, attracting both patients and investment. In June 2023, at Cleveland Clinic, researchers engaged in the multicenter RUBY Trial shared a positive response on the efficacy and safety of EDIT-301 single dose. This clinically tested one-time gene editing cell therapy changes a patient's blood setup of stem cells to fix the mutation that causes sickle cell disease.

Regional Insights

North America dominated the global market with a share of 37.87% in 2023. Growth in the market is driven by increasing awareness regarding SCD and its treatment, advancements in research, and the need for effective treatments. With a focus on the U.S. and Canada, the market has witnessed increased investments in Research & Development (R&D), particularly in gene therapies and novel drug candidates. For instance, in October 2023, U.S. FDA granted Editas Medicine, Regenerative Medicine Advanced Therapy, to EDIT-301. EDIT-301 is a gene-editing medicine for the treatment of sickle cell disease.

Asia Pacific region is expected to grow exponentially over the forecast period. Several key trends are reshaping the landscape of the SCD treatment market in Asia Pacific. One prominent trend is the increasing focus on personalized treatment approaches. Healthcare providers in Asia Pacific recognize the importance of tailoring treatment plans to the specific needs of SCD patients. This shift towards personalized care aims to optimize therapeutic outcomes and enhance the overall quality of life for SCD patients. To prevent hemolytic disorders, key countries such as Japan, China, India, and others are taking favorable initiatives to manage disease efficiently. For instance, in May 2023, NHS England and NHS Blood and Transplant collaborated to provide genetic tests for patients with sickle cells and related diseases. The partnership also provides genetic counseling to patients and their families to help them understand the results of the testing and to make informed decisions about their care.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product developments, approvals, collaborations, acquisitions, and partnerships to strengthen their market position.

-

In April 2023,Editas Medicine, Inc. received Orphan Drug Designation from the U.S. FDA for its EDIT-301 for treating SCD.

-

In April 2023, Bluebird Bio submitted an approval application to U.S. FDA for its gene therapy drug for SCD treatment.

Key Sickle Cell Disease Treatment Companies:

- Novartis AG

- Bluebird Bio, Inc.

- Pfizer Inc.

- Bristol-Myers Squibb Company

- GlycoMimetics

- Emmaus Medical, Inc.

- Graphite Bio, Inc.

- CRISPR Therapeutics

Sickle Cell Disease Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.09 billion

Revenue forecast in 2030

USD 7.42 billion

Growth rate

CAGR of 15.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

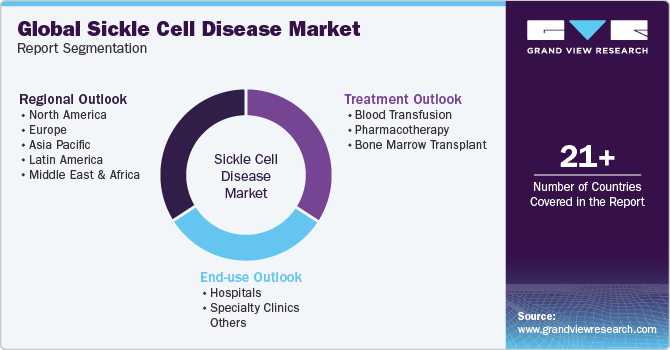

Segments covered

Treatment, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novartis AG; Pfizer Inc.; Bluebird Bio, Inc.; GlycoMimetics; Emmaus Medical, Inc.; Bristol-Myers Squibb Company; CRISPR Therapeutics; Graphite Bio, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sickle Cell Disease Treatment Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global sickle cell disease treatment market report based on treatment, end-use, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Transfusion

-

Pharmacotherapy

-

Bone Marrow Transplant

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the global sickle cell disease treatment market include Novartis AG, Pfizer Inc., bluebird bio, Inc., Global Blood Therapeutics, Inc., GlycoMimetics, Inc., F. Hoffmann-La Roche AG, Emmaus Life Sciences, Inc., Bristol-Myers Squibb, and CRISPR Therapeutics.

b. The global sickle cell disease treatment market size was estimated at USD 2.75 billion in 2023 and is expected to reach USD 3.09 billion in 2024.

b. The market opportunity for the global sickle cell disease treatment market includes high growth potential in emerging countries and the introduction of cost-effective therapies.

b. The global sickle cell disease treatment market is expected to grow at a compound annual growth rate of 15.7% from 2024 to 2030 to reach USD 7.42 billion by 2030.

b. Key factors that are driving the sickle cell disease treatment market growth include high unmet needs, a robust pipeline of novel sickle cell disease treatment drugs, and a rise in the number of government initiatives for the development of novel therapies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.