- Home

- »

- Clinical Diagnostics

- »

-

Blood Typing Market Size & Share, Industry Report, 2030GVR Report cover

![Blood Typing Market Size, Share & Trends Report]()

Blood Typing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Services (Instruments, Reagents & Consumables), By Test (Antibody Screening), By Technique, By End Use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-263-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Typing Market Size & Trends

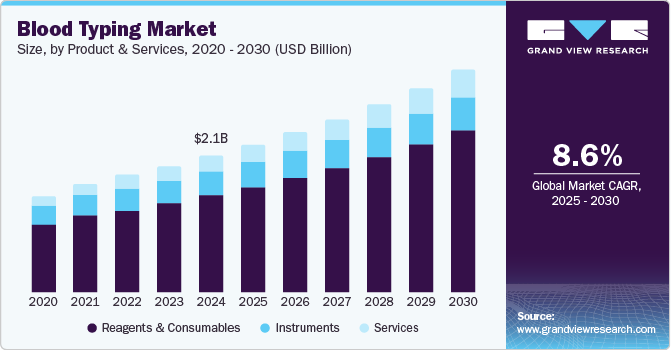

The global blood typing market size was estimated at USD 2.12 billion in 2024 and is projected to grow at a CAGR of 8.61% from 2025 to 2030. The market is driven by rising demand for safe blood transfusions, organ transplants, and prenatal screening. Technological advancements such as automated platforms, molecular genotyping, and AI-driven analyzers are improving accuracy and efficiency. Growing government support, expanded blood bank infrastructure, and increased awareness of transfusion-related complications further propel growth. Personalized medicine is also boosting the need for precise blood group profiling. Together, these factors are transforming blood typing from a routine test into a critical, data-enhanced diagnostic tool.

The increasing prevalence of conditions such as cancer, anemia, trauma, and chronic kidney disease has amplified the global demand for blood transfusions. Each transfusion must be preceded by accurate blood typing to prevent hemolytic transfusion reactions, which can be life-threatening. In many low- and middle-income countries, maternal hemorrhage and pediatric anemia are leading causes of transfusion needs. The growing number of surgeries and emergency cases in both developed and developing regions continues to drive blood typing as a fundamental pre-transfusion step. Health agencies like the WHO emphasize universal access to safe blood, further encouraging adoption of reliable typing systems across public and private healthcare institutions.

Organ transplantation requires precise ABO and Rh compatibility between donor and recipient to ensure graft acceptance and avoid rejection. In solid organ transplants (like kidneys, livers, and hearts), mismatched blood types can trigger hyperacute immune responses. As transplant volumes increase worldwide due to aging populations, better surgical outcomes, and organ sharing networks, the demand for accurate and rapid blood typing also grows. Agencies like UNOS (U.S.) and NHS Blood and Transplant (UK) mandate full blood group profiling, often with extended antigen typing. Molecular typing is increasingly used to supplement serological methods, especially in sensitized patients or those with rare blood types, reinforcing the role of advanced diagnostics in transplant programs.

In addition, Innovations in automation, digital imaging, microfluidics, and data analytics have significantly enhanced the speed, accuracy, and reproducibility of blood typing systems. Modern analyzers reduce manual errors and increase throughput in both centralized labs and point-of-care settings. Systems like Bio-Rad’s IH-1000 and Grifols’ Erytra automate testing workflows, while software-driven platforms enable real-time result interpretation and traceability. Moreover, integration with Laboratory Information Systems (LIS) supports compliance with accreditation standards. These technological improvements not only reduce turnaround time but also lower labor costs, making advanced blood typing accessible to mid-sized labs. Innovation is also driving miniaturized platforms for mobile or field settings in humanitarian and military applications.

Furthermore, Artificial intelligence and digital tools are revolutionizing laboratory diagnostics, including blood typing. AI algorithms assist in interpreting agglutination reactions, flagging discrepancies, and suggesting confirmatory tests. They enhance diagnostic precision, especially in high-volume labs and complex typing scenarios. Digital platforms also support inventory management, predictive analytics, and clinical decision-making. Systems like Grifols’ Erytra Eflexis and Bio-Rad’s IH-Web utilize image capture and AI-based analysis for consistent result interpretation. Cloud-based data sharing enables real-time connectivity between donor centers, labs, and hospitals. As AI matures, its integration with diagnostic equipment is expected to streamline workflows, improve safety, and support next-generation transfusion medicine.

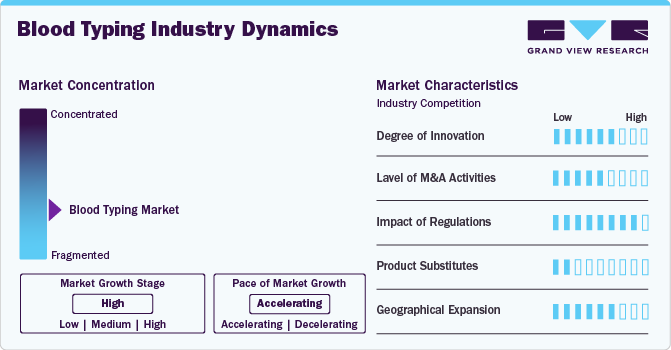

Market Concentration & Characteristics

The degree of innovation in high in the market characterized by integration of molecular techniques, microfluidics, AI, and automation that represents a significant leap in blood typing technology. For instance,In December 2024,BD (Becton, Dickinson and Company) and Babson Diagnostics introduced an innovative blood testing solution that utilizes fingertip blood collection. This system combines BD's MiniDraw Capillary Blood Collection System with Babson's BetterWay technologies, enabling accurate test results from as little as six drops of capillary blood obtained from a patient's finger. This innovation is driven by the increasing demand for transfusions and organ transplantations, as well as the rising incidence of road accidents and trauma cases that necessitate immediate transfusions.

The level of M&A activities in the market is relatively low. This can be attributed to several factors, including the specialized nature of the industry, the presence of well-established key players, and the focus on innovation and product development rather than consolidation through acquisitions.

Regulations for blood group testing products and services are strict, ensuring the safety and accuracy of transfusions and organ transplantations. The strict regulations impact the market by setting high standards for product development and testing, which can drive innovation and investment in the industry. However, it also poses challenges for market entry and expansion, as companies must navigate complex approval processes and adhere to stringent safety and quality standards. The regulatory environment, characterized by a focus on safety, accuracy, and quality, significantly influences industry dynamics, including product development, pricing, and industry growth.

The product substitute is generally low for the market. Some of the players are focusing on new product launches to cater to the growing demand. For instance, a synthetic red blood cell substitute ErythroMer containing purified human hemoglobin. It is currently in preclinical testing; not yet approved for clinical use.

The regional expansion in the market is primarily focused on reaching out to hospitals and blood banks in various countries, with these entities being the primary consumers of blood typing products and services. Hospitals, due to their extensive use of blood typing for patient care, including emergency situations, surgeries, and organ transplantations, represent a significant portion of the sector. Blood banks, on the other hand, rely heavily on accurate blood typing to ensure safe and effective transfusions. Other end-users, such as clinical laboratories and specialized testing facilities, also contribute to the sector but are less concentrated compared to hospitals and blood banks.

Product & Services Insights

Reagents and consumables led the product & services segment and accounted for 71.4% of the global revenue in 2024 and is anticipated to grow at lucrative growth over the forecast period. The recurring cost associated with the frequent requirement of reagents & kits is a significant factor contributing to the market's growth. This constant need for consumables is driven by the high frequency of blood typing tests in various clinical settings, including hospitals, clinical laboratories, and blood banks. Technological advancements continuously drive the development of new and improved reagents, enhancing the accuracy and efficiency of blood typing processes.

The service segment is anticipated to grow at significant growth over the forecast period. The increasing demand for transfusions and organ transplantations, the rise in surgical operations, and the growing use of reagents and serological fluids in laboratories. The elevated blood donation rates, which result in more blood sample analysis, also contribute to the expansion of the Services segment. The importance of blood group analysis is projected to rise as the trend of blood donation out of societal concern increases, further driving the demand for services related to blood group testing.

Test Insights

Antibody Screening led the test segment with a market share of 38% in 2024 due to the growing volume of prenatal testing, increasing transfusions and rising prevalence of chronic diseases. Pregnant patients require various screening tests, including blood group and antibody screening, increasing the growth of the segment. According to a study published in the Journal of Personalized Medicine in April 2023, between 2012 and 2022, there were 51,803 new genetic tests introduced to the market in the U.S., with a significant portion of these being diagnostic tests, which are fundamental for prenatal screening. For example, on May 2023, Versiti introduced a novel Anti-von Willebrand Factor (VWF) Antibody Assay designed to aid clinicians in diagnosing acquired von Willebrand Disease (aVWD), a rare bleeding disorder. This assay is particularly beneficial for patients presenting with unexplained bleeding symptoms and low VWF activity. This indicates a substantial volume of prenatal testing, including blood group and antibody screening, contributing to the growth of the antibody screening segment.

HLA typing segment is anticipated to grow at fastest growth over the forecast period. The number of individuals on the national transplant waiting list, which stands at 103,223, significantly contributes to this growth. Transplants require HLA typing to ensure compatibility between donor and recipient, crucial for preventing graft rejection and ensuring transplant success. HLA typing allows for more precise matching between donors and transplant patients, reducing the incidence and severity of graft-versus-host disease (GvHD) and increasing long-term survival. In October 2023, GenDx, a Eurobio Scientific Company, introduced NGS-Turbo, an innovative solution for high-resolution HLA typing utilizing Oxford Nanopore Technologies' sequencing devices. This product is designed to deliver precise HLA typing results in less than three hours, making it ideal for situations where rapid compatibility testing is crucial. The rise in autoimmune diseases and cancers has also increased the demand for HLA typing, as these conditions often involve the immune system attacking the body's own cells.

Technique Insights

PCR-based and Microarray-based led the technique segment with a market share of 53.2% in 2024. The adoption of automated blood typing technologies, including PCR-based and microarray techniques, has improved the speed, standardization, and safety of transfusion diagnostics. A team from Tokyo University of Science has developed a technologically advanced lab-on-a-chip device that can determine a person’s blood type within five minutes, significantly speeding up the process of blood transfusion in emergency situations. These technologies offer advantages over manual typing, including cost efficiency, increased efficiency, and reduced errors highlight the market's shift towards automated and high-throughput solutions. In March 2023, QIAGEN announced a strategic partnership with Servier, a global pharmaceutical group, to develop a companion diagnostic test for TIBSOVO (ivosidenib), an inhibitor used in the treatment of acute myeloid leukemia (AML) blood cancer. In May 2024, Thermo Fisher Scientific introduced the Applied Biosystems Axiom BloodGenomiX Array and Software, a pioneering solution designed to enhance blood genotyping precision in clinical research. This innovative array enables the detection of a wide array of extended and rare blood groups, as well as tissue (HLA) and platelet (HPA) types, all within a single high-throughput assay.

The Assay-based techniques segment is expected to grow significantly during the forecast period. These techniques include slide methods, test-tube methods, microplate methods, and gel/column centrifugation, are commonly used in hospitals and blood banks for general blood typing due to their convenience. As technologies continue to evolve, the efficiency and accuracy of these methods contribute significantly to the safety and success of transfusion and transplantation procedures. The increasing requirement for blood during surgical treatments and the growing number of hospitals further fuel the demand for accurate and swift blood group testing procedures, highlighting the essential role of assay-based techniques in the market.

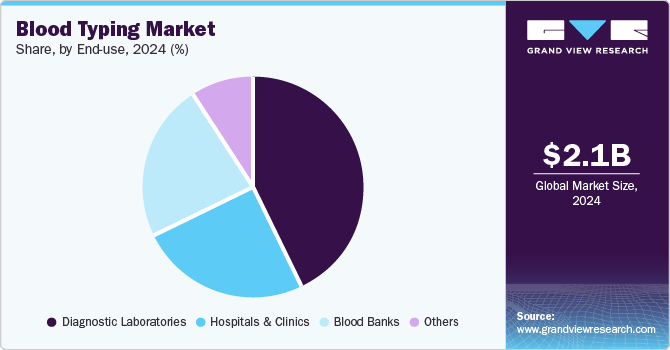

End Use Insights

Diagnostic laboratories dominate the end use segment with a market share of 43.4% in 2024. The rising prevalence of chronic diseases and traumatic injuries, necessitating increased transfusions and organ transplantations. This demand is fueled by the development of advanced blood typing technologies, enhancing accuracy, speed, and efficiency. Additionally, the growing awareness of the importance of blood typing for safe transfusions and transplantations, coupled with investments in healthcare infrastructure, particularly in emerging economies, drives the demand for blood typing products and services. Government policies and initiatives aimed at improving healthcare access and infrastructure further contribute to this market segment's growth. In January 2025, Beckman Coulter Diagnostics announced that the U.S. Food and Drug Administration (FDA) granted Breakthrough Device Designation to its access Tau/Amyloid plasma ratio blood test. This test is designed to assist healthcare providers in identifying patients with amyloid pathology associated with Alzheimer's disease.

Blood banks are the fastest-growing segment in the end use segment, driven by several key factors and drivers. The primary reason for this growth is the increasing demand for transfusions and organ transplantations, which necessitate blood typing to ensure compatibility between donors and recipients. This demand is fueled by a combination of factors including the rise in major surgical procedures, the volume of blood donations, and the growing prevalence of chronic diseases and blood disorders. Furthermore, the establishment of large blood banks and blood donation campaigns to ensure a constant supply of blood contribute to the market's growth. These initiatives are crucial in meeting the high demand for transfusions and organ transplantations, which in turn drives the need for blood typing services.

Application Insights

Diagnostic testing dominated the application segment with a market share of 54.2% in 2024. The adoption of automated blood analysis technologies, such as PCR-based and microarray techniques, which improve diagnostic speed, standardization, and safety. These technologies offer cost, efficiency, and error reduction benefits, making them attractive for healthcare institutions. The development of lab-on-a-chip devices for rapid blood type determination further enhances diagnostic testing's appeal. This growth is supported by the need for various screening tests during pregnancy, including blood group and antibody screening. In April 2025, ATED Therapeutics Ltd. announced a new diagnostic test for Parkinson’s disease developed at Hebrew University in Jerusalem, which has led to the development of a promising blood test capable of detecting Parkinson’s disease before symptoms emerge.

Organ transplants segment is anticipated to grow at fastest growth over the forecast period. Technological advancements, such as the introduction of molecular diagnostics methods such as NGS and PCR, have made organ transplantation more feasible and safer, thereby increasing the market's growth. Additionally, the rising incidence of infectious diseases and the aging population contribute to the need for organ transplants, further driving the demand for blood group testing services. The industry growth is also supported by strategic collaborations among firms, which accelerate product innovation and market expansion.

Regional Insights

North America accounted for 42.83% share in 2024 owing to factors such as the region’s well developed healthcare infrastructure and large number of transfusions happening in the region. Major companies operating in the blood group typing sector, such as Bio-Rad Laboratories, Inc., Quidel Ortho Corporation, and Thermo Fisher Scientific Inc., have significant expertise, resources, and established distribution networks. These companies' comprehensive product portfolios, expansive global footprint, and well-established brand recognition further support region dominance. Additionally, the high burden of chronic conditions on regional healthcare systems is a major driver for market growth, necessitating the need for blood donations and, consequently, blood typing services. In October 2024, Terumo Blood and Cell Technologies (Terumo BCT) introduced the Reveos Automated Blood Processing System in the United States to enhance blood and platelet supply management while improving operational efficiency for blood centers.

U.S. Blood Typing Market Trends

The blood typing market in the U.S. is expected to grow over the forecast period due to frequent approvals and novel diagnostics launches aided with the increasing investment in advancement of diagnostic solutions. For instance, the San Diego Blood Bank has expanded its Precision Blood initiative, aiming to enhance the safety and efficacy of blood transfusions in April 2023. The program also emphasizes the need for more diverse blood donors to ensure equitable matching and improve patient outcomes.

Europe Blood Typing Market Trends

Europe blood typing market was identified as a lucrative region in this industry. The growth of the market in the region can be attributed to rising chronic diseases aided with an increase in research funding and the local presence of key market players in this region.

The blood typing market in the UK is expected to grow over the forecast period due to the presence of well-established healthcare infrastructure, high disposable income and rising awareness pertaining to early diseases diagnosis.

The blood typing market in France is expected to grow over the forecast period attributed to increasing demand for blood group typing in prenatal testing in the country.

The blood typing market in Germany is expected to grow over the forecast period due to the rising number of initiatives been taken by government to help spread awareness regarding diagnosis and innovative diagnostic solutions.

Asia Pacific Blood Typing Market Trends

Asia Pacific is anticipated to witness the fastest growth in the blood typing market. The increasing number of blood donation activities and the rising incidence of trauma, accidents, and surgeries requiring blood transfusion are key drivers. Additionally, the growing demand for blood group typing in prenatal and postnatal testing, along with the stringency of prudent transfusions, is expected to boost the market. Technological advancements in healthcare, such as new molecular diagnostic tools, facilitate rapid and reliable group identification, providing opportunities for market growth.

The blood typing market in China is expected to grow over the estimate period due the growing focus on improving healthcare R&D aided with development of novel technologies. For instance, in April 2024, Grifols introduced its advanced blood-typing technology, the fully automated Erytra Eflexis, to the Chinese market following regulatory approval.

The blood typing market in Japan is expected to grow over the projected period due to the presence of well-established healthcare system and high adoption of advanced diagnosis tests & therapies for effective diagnosis & management of target diseases. On September 2024, Sysmex Corporation launched the HISCL HIT IgG Assay Kit in Japan. This assay kit is designed to detect IgG antibodies against platelet factor 4 (PF4)-heparin complexes, which are indicative of heparin-induced thrombocytopenia (HIT), a serious complication arising from heparin therapy.

Latin America Blood Typing Market Trends

Latin America blood typing market was identified as a lucrative region in this industry. Technological advancements and the increasing demand for transfusions in the region are anticipated to fuel market growth.

The blood typing market in Brazil is expected to grow over the forecast period due to the rising prevalence of chronic diseases and the technological advancement.

MEA Blood Typing Market Trends

MEA blood typing market was identified as a lucrative region in this industry. The market in this region is driven by the high prevalence of chronic diseases, aided by improvements in healthcare infrastructure.

The blood typing market in Saudi Arabia is expected to grow over the forecast period owing to the need for better diagnostics and improvements in treatment options due to the rising prevalence of chronic diseases.

Key Blood Typing Company Insights

Some of the leading players operating in the blood typing market include Siemens Healthineers AG, Abbott, and Beckman Coulter, Inc. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Randox Laboratories, Creative Diagnostics, and Life Diagnostics are some of the emerging market participants in the blood typing industry. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Blood Typing Companies:

The following are the leading companies in the blood typing market. These companies collectively hold the largest market share and dictate industry trends.

- Mesa Laboratories, Inc. (Agena Bioscience, Inc.)

- Danaher Corporation (Beckman Coulter)

- Bio-Rad Laboratories, Inc.

- DIAGAST

- Grifols, S.A.

- AXO Science

- Merck KGaA

- Quotient, Ltd.

- Thermo Fisher Scientific

- Immucor, Inc.

- BAG Diagnostics GmbH

- Seegene Inc.

Recent Developments

-

In May 2024, Thermo Fisher Scientific introduced the Applied Biosystems Axiom BloodGenomiX Array and Software, a pioneering solution designed to enhance blood genotyping precision in clinical research. This innovative array enables the detection of a wide array of extended and rare blood groups, as well as tissue (HLA) and platelet (HPA) types, all within a single high-throughput assay.

-

In June 2023, Alba by Quotient expanded into Netherlands and Sweden, joining existing European markets. Offering high-quality blood bank reagents, expert support, and reliable service. Quotient, with over 30 years of experience, also provides MosaiQ solution for advanced diagnostics.

-

In May 2023, Bio-Rad launched IH-500 NEXT, a fully automated system for ID-Cards, enhancing immunohematology lab efficiency with optimized result interpretation and cybersecurity. Offers flexibility with Bio-Rad or third-party reagents

Blood Typing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.30 billion

Revenue forecast in 2030

USD 3.47 billion

Growth Rate

CAGR of 8.61% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, test, technique, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Mesa Laboratories, Inc. (Agena Bioscience, Inc.); Danaher Corporation (Beckman Coulter); Bio-Rad Laboratories, Inc.; DIAGAST; Grifols, S.A.; AXO Science; Merck KGaA; Quotient, Ltd.; Thermo Fisher Scientific; Immucor, Inc.; BAG Diagnostics GmbH; Seegene Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Typing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood typing market report based on product & services, test, technique, application, end-use, and region.

-

Product & Services Outlook (Revenue, USD Million; 2018 - 2030)

-

Instruments

-

Reagents & Consumables

-

RBC reagents

-

Antisera reagents

-

Anti Human Globulin Reagents

- Blood Saline Reagents

-

-

Services

-

-

Test Outlook (Revenue, USD Million; 2018 - 2030)

-

Antibody Screening

-

HLA Typing

-

Cross-matching

-

ABO blood Tests

-

Others

-

-

Technique Outlook (Revenue, USD Million; 2018 - 2030)

-

PCR based and Microarray based

-

Assay based techniques

-

Massively Parallel Sequencing

-

Other

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Blood transfusions

-

Organ transplants

-

Diagnostic testing

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals & clinics

-

Diagnostic laboratories

-

Blood banks

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global blood typing market size was estimated at USD 2.12 billion in 2024 and is expected to reach USD 2.30 billion in 2025.

b. The global blood typing market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 3.47 billion by 2030.

b. North America dominated the blood typing market with a share of 42.83% in 2024. This is attributable to the high transfusion needs, advanced lab infrastructure, strong regulatory support, and major industry players. Automation and innovation further drive adoption, especially in managing chronic diseases, trauma care, and surgical procedures efficiently.

b. Some key players operating in the blood typing market include Mesa Laboratories, Inc. (Agena Bioscience, Inc.), Danaher Corporation (Beckman Coulter), Bio-Rad Laboratories, Inc., DIAGAST, Grifols, S.A., AXO Science, Merck KGaA, Quotient, Ltd., Thermo Fisher Scientific Inc., Immucor, Inc., BAG Diagnostics GmbH, and Seegene Inc.

b. Key factors that are driving the market growth include rising surgical procedures, trauma cases, and chronic diseases. Technological advancements, automation, and improved healthcare access in emerging regions are boosting adoption. Key players expand globally, supported by increasing blood transfusion demands worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.