- Home

- »

- Pharmaceuticals

- »

-

Bone Cancer Treatment Market Size & Share Report, 2030GVR Report cover

![Bone Cancer Treatment Market Size, Share & Trends Report]()

Bone Cancer Treatment Market Size, Share & Trends Analysis Report By Type (Chondrosarcoma, Ewing Sarcoma, Osteosarcoma), By Drug Type, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-172-3

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Bone Cancer Treatment Market Trends

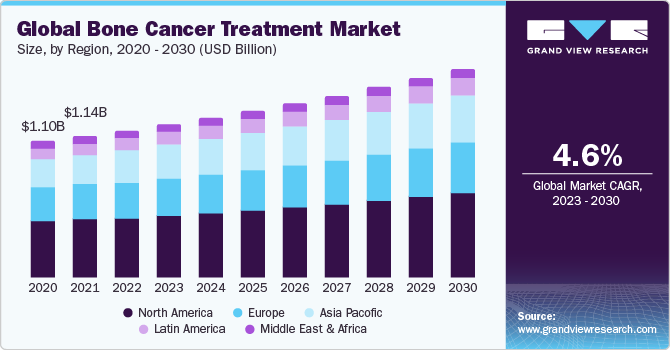

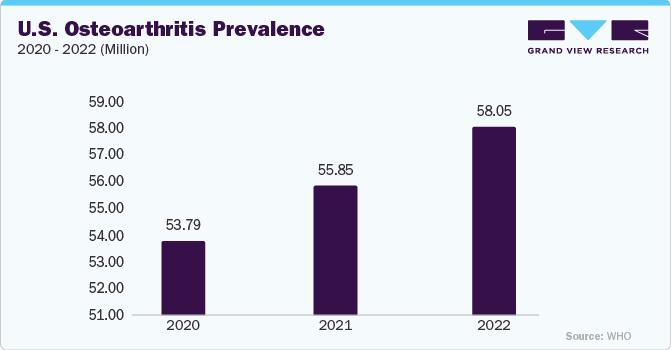

The global bone cancer treatment market size was valued at USD 1.18 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.59% from 2023 to 2030. Key factors propelling the growth of the bone cancer treatment market include government efforts, the growing incidence of cancer, and a surge in product approvals and launches. Notably, the rise in bone cancer cases, particularly osteosarcoma, significantly drives this market. Furthermore, over the past decade, there has been a clear upward trajectory in the launch of novel bone cancer treatments.

In clinical settings, conventional treatments for bone tumors primarily involve surgical procedures, chemotherapy, and radiation therapy. Unfortunately, surgical resection often falls short of completely eradicating micrometastases, potentially leading to postoperative recurrence and metastasis. Surgical interventions can also cause substantial bone defects, contributing to physical disability. Sometimes, chemotherapy can be hindered by drug resistance and severe side effects. Furthermore, certain bone tumors, such as osteosarcoma, resist radiation therapy and chemotherapy. Given the challenges associated with bone tumor treatment and the pressing clinical demand for novel approaches, researchers have recently concentrated on developing innovative biomaterials capable of eliciting specific cell responses essential for tumor therapy and bone tissue regeneration.

Furthermore, advancing and utilizing 3D printing technology presents a significant opportunity within bone-tissue engineering. Over time, this technology has rapidly progressed into sophisticated methods suitable for crafting intricate biomaterial scaffolds that closely mimic natural, complex geometries. In addition, 3D printing can be harnessed to design and produce structures resembling living tissue with properties akin to native bone tissue.

Additionally, computer-assisted design tools enable the generation of 3D models that closely emulate native tissue, enhancing the ability to replicate cellular interactions and processes. Overall, 3D printing is considered a groundbreaking and potent tool that has found successful medical applications, particularly in bone tissue engineering. Thus, growing research in bone cancer treatment is anticipated to drive market growth over the forecast period.

Type Insights

On the basis of the type, the market is segmented into chondrosarcoma, osteosarcoma, Ewing sarcoma, and others. The osteosarcoma segment held the largest market share in 2023. This can be attributed to technological advancement in the field of osteosarcoma treatment. Researchers have been exploring targeted therapies, such as monoclonal antibodies and small molecule inhibitors, to target and inhibit the pathways responsible for osteosarcoma growth specifically. These therapies aim to be more effective while causing fewer side effects than traditional chemotherapy. Developing therapy techniques for osteosarcoma has been a significant breakthrough for segment growth in the coming years.

Drug Type Insights

Based on the drug type, the bone cancer treatment market is segmented into targeted therapy & immunotherapy, and chemotherapy. The targeted therapy & immunotherapy segment held the largest market share in 2023. Targeted therapy and immunotherapy are gaining traction as treatment options for osteosarcoma (OS), with a growing array of U.S. FDA-approved therapies available for malignancies that show resistance to traditional treatment methods. Thus, the development and launch of new targeted therapy & immunotherapy drugs for the treatment of bone cancer are anticipated to drive segment growth.

Distribution Channel Insights

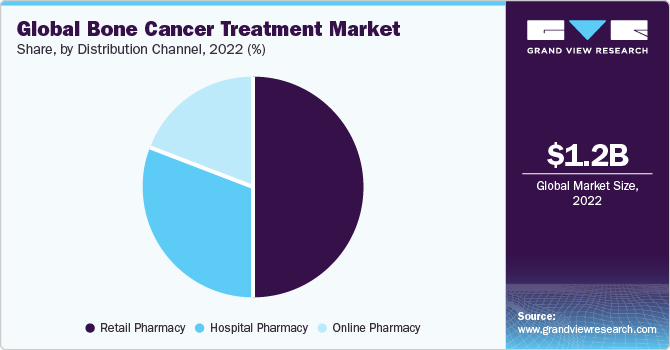

Based on the distribution channel, the bone cancer treatment market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacy segment held the largest market share in 2023. This can be attributed to increased unplanned hospitalizations for treating various diseases, including bone cancer treatment. As per the study published in the American Society of Clinical Oncology in 2019, the estimated emergency department admissions for cancer were lung (78.6%), breast (48.1%), thyroid (22.3%), bone and soft tissue (49.1%) cancer, and digestive cancers (73.8%), and pancreatic (75.3%). Thus, increasing hospitalization is projected to fuel the demand for pharmacies.

Regional Insights

North America dominated the market in 2022. This can be attributed to the growing number of bone cancer cases. As per the American Cancer Society, for 2023, approximately 3,910 new cases of bone cancer will be diagnosed, resulting in around 2,100 deaths. It's worth noting that primary and secondary bone cancers, which develop within the bones, are rare, comprising less than 1% of all cancer cases. Cancer that metastasizes to the bones from other organs is more prevalent than primary bone cancers in adults. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. This can be attributed to the increasing prevalence of bone cancer and rising investment in developing new medicines for treating bone cancers.

Key Companies & Market Share Insights

Key players operating in the market are Amgen Inc., Novartis AG, Pfizer Inc., Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services Inc. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues.

The following are some instances of strategic initiatives:

-

In March 2023, researchers at the University of Sheffield and the University of East Anglia developed a new drug called CADD522 for the treatment of patients with primary bone cancers. This drug showed a 50% increase in survival rate in preclinical models.

-

In October 2023, Zetagen Therapeutics published early clinical trial data of ZetaMet in the peer-reviewed journal Pain Management. This included data about the safety and efficacy of ZetaMet in patients with bone Metastases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."