- Home

- »

- Pharmaceuticals

- »

-

Bone & Joint Health Supplements Market Size Report, 2033GVR Report cover

![Bone And Joint Health Supplements Market Size, Share & Trends Report]()

Bone And Joint Health Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vitamins, Minerals), By Formulation (Tablets, Capsules), By Application, By Consumer Group, By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-974-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bone & Joint Health Supplements Market Summary

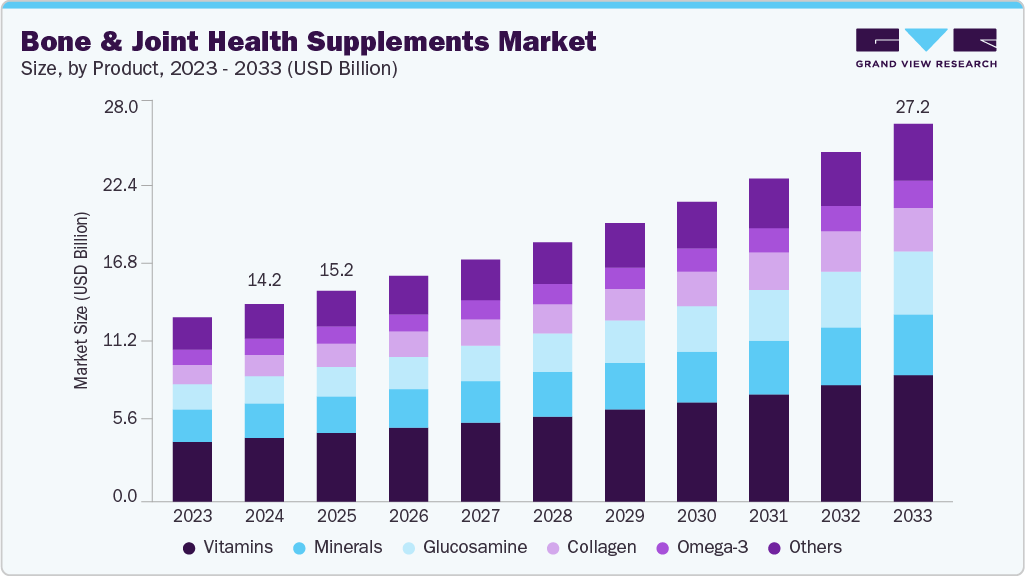

The global bone and joint health supplements market size was estimated at USD 14.17 billion in 2024 and is projected to reach USD 27.16 billion by 2033, growing at a CAGR of 7.57% from 2025 to 2033. Factors such as a rapidly growing geriatric population, the prevalence of orthopedic disorders, and rising awareness of micronutrient deficiencies drive this growth.

Key Market Trends & Insights

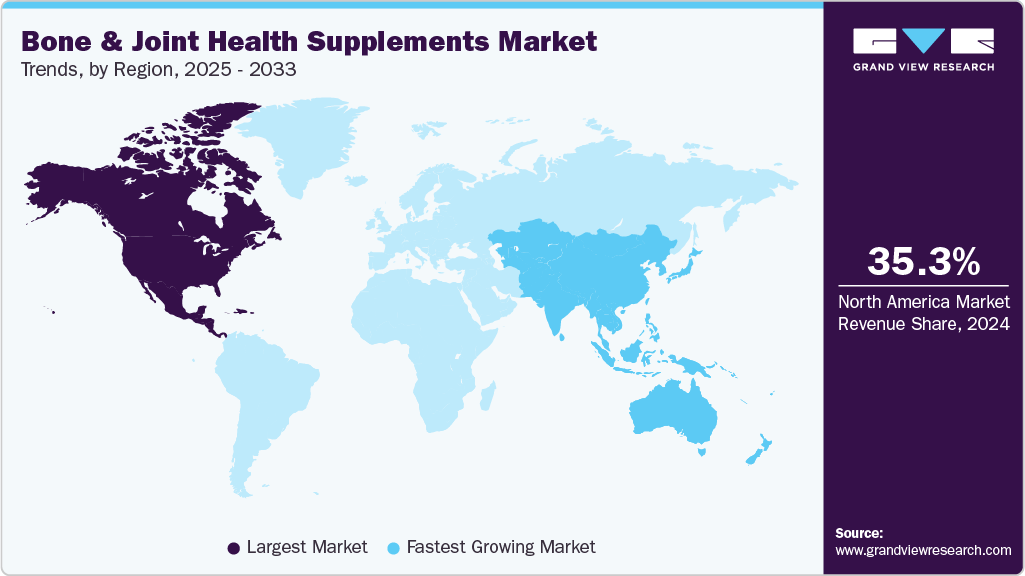

- The North America bone and joint health supplements market held the largest share of 35.30% of the global market in 2024.

- The bone and joint health supplements industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the vitamins segment held the highest market share of 32.39% in 2024.

- Based on formulation, the tablets segment held the highest market share in 2024.

- Based on application, the bone density support segment held the largest share of 20.01% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.17 Billion

- 2033 Projected Market Size: USD 27.16 Billion

- CAGR (2025-2033): 7.57%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

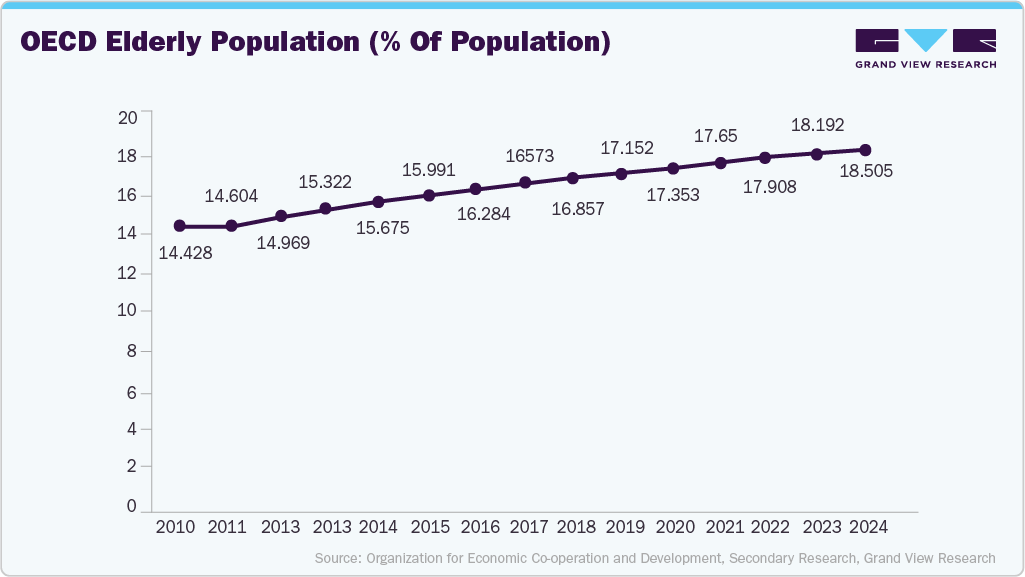

According to the World Health Organization (WHO), around 1.4 billion people in the global population will be above 60 by 2030. The population suffering from rheumatoid arthritis is expanding considerably, mainly due to increasing life expectancy, which creates demand for bone and joint health supplements.

Increasing geriatric population driving demand for joint health.

The rising geriatric population quickly becomes one of the most important market drivers for bone and joint health supplements. As life expectancy around the globe continues to increase, and healthcare improvements are prolonging people's lives, the population of older adults is rapidly growing, alongside an increase in age-related musculoskeletal diseases such as osteoarthritis, osteoporosis, rheumatoid arthritis, and general joint degeneration. The natural consequences of aging are compounded by decreased bone density, wear on cartilage, and lost flexibility, which expose seniors to chronic pain, inflammation, and mobility issues, all affecting quality of life. These hurdles require seniors to seek management options that preserve independence and mobility. Bone and joint health supplements are an increasingly popular form of preventive healthcare and symptom relief for older consumers. Many of these supplements contain calcium, vitamin D, glucosamine, chondroitin, collagen, and other vitamins and nutrients, making them ideal for seniors seeking better health.

Health professionals also endorse supplement products for their role in adjunct therapy to physical treatment interventions or medication, which solidifies the role of supplements in the care of older adults. The multitude of products on the market, in different forms, such as tablets, capsules, powders, and gummies, adds convenience and increases adherence based on needs. With the increased growth of older adults in both advanced and emerging economies, the demand for supplements for bone and joint health is expected to grow considerably. This trend signals a tremendous opportunity for manufacturers to develop targeted formulas and healthcare systems to build preventive care regionally, as the growth of the older adult population is the catalyst for growth.

Growing awareness of micronutrient deficiencies is boosting supplement use

Essential nutrients, including calcium, vitamin D, magnesium, zinc, and vitamin K are significant in preserving bone density, supporting cartilage repair, and stabilizing joint health. Not getting enough nutrients increases bone loss, osteoporosis, and worsens joint pain and inflammation. Public service messages, research, and media coverage have increased consumer knowledge of the connections between nutrients and their importance, motivating older adults and those at risk for joint and bone health problems to correct deficiencies proactively through a supplementation regimen. Factors, including poor diet, insufficient sun exposure, and chronic illness, have led to widespread nutrient insufficiency, with vitamin D and calcium being the most common gaps in the diet. Healthcare providers advocate supplementing these nutrients as a safe and effective preventive strategy.

The increased availability of personalized nutrition and new diagnostics is changing consumer behavior by facilitating the identification of deficiencies and their remediation through supplements. This level of personalization builds confidence in product efficacy and increases consumption. Moreover, consumers adopting a broader preventive healthcare mentality may ensure adequate consumption of micronutrients to avoid healthcare costs and complications. This mind shift has created a position for supplements as a treatment and tool for maintaining long-term health of the bones and joints.

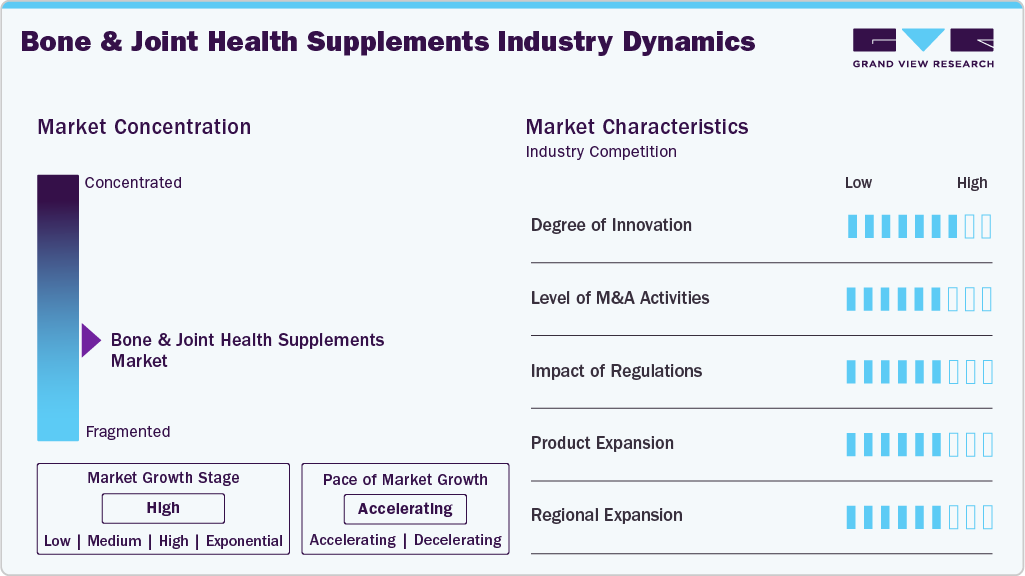

Market Concentration & Characteristics

The bone and joint supplements industry demonstrates a moderate-to-high degree of innovation, driven by advancements in formulation science, delivery formats, and personalized nutrition. Manufacturers are moving beyond traditional calcium and vitamin D blends to develop multi-ingredient formulations that combine glucosamine, chondroitin, collagen peptides, hyaluronic acid, and botanicals with proven anti-inflammatory properties. For instance, in April 2025, Qualia launched Joint Health, a new formula with breakthrough ingredients designed to support cartilage production, tendon strength, joint lubrication, and healthy joint aging.

The bone and joint supplements sector has seen a modest amount of mergers and acquisitions (M&A) activity primarily for portfolio diversification, entering new geographies, and enhancing R&D capabilities. For instance, in September 2023, Sanofi announced that it had completed the acquisition of Qunol, a US market leader in health and wellness, including joint health supplements, and this acquisition enhanced Sanofi's presence in the consumer health sector. Well-established nutraceutical and dietary supplement companies (distributors) are acquiring specialty companies focused on collagen, plant-based formulations, or clinically validated products to better serve the increased consumer demand for scientifically credible and natural products.

Regulations significantly impact the bone and joint supplements industry by regulating product safety, label information, and health claims. In the United States and Europe, supplements are considered food products, subjecting them to DSHEA and the EFSA's requirements without seeking drug-like approvals prior to marketing. This can limit the disease-related claims made by the manufacturers. While heavy regulation can hinder innovation, it also provides credibility to products and assures safety, while benefiting existing players who can comply with strict rules.

The expansion of products in the bone and joint supplement industry has been driven by increased consumer demand for options and convenience targets. Companies are diversifying beyond standard offerings, such as calcium and vitamin D, to include innovative products containing collagen peptides, glucosamine, chondroitin, hyaluronic acid, and various herbal extracts. The expansion of both ingredients and modes of delivery provides brands with the ability to connect with a broader cohort of consumers while building their competitive advantage.

Regional expansion in the bone and joint supplements industry, with businesses leveraging both mature and emerging economies. The industry aims for premium products backed by clinical verification in established regions such as North America and Europe. In contrast, in developing parts of the world, such as Asia-Pacific, Latin America, and the Middle East, the growth is driven by aging populations, increasing disposable incomes, and the knowledge of deficiencies in these populations. Customized formats, local marketing, and robust distribution networks enable brands to reach different consumer vectors globally.

Product Insights

The vitamins segment held a dominant revenue share of 32.39% in 2024. This can be attributed to the growing adoption of healthy lifestyles, increasing life expectancy, and rising focus on active lifestyles. Also, increasing consumption of vitamin D supplements to reduce the risk of bone fractures impels this segment’s growth. Also, vitamin K is linked to bone density and is subsequently found to be effective for bone health. It is consumed by people with osteoporosis to reduce the risk of fracture, which is expected to drive the segment’s growth.

The glucosamine segment is expected to grow at the fastest CAGR from 2025 to 2033. These supplements offer health benefits, especially for joint pain such as arthritis. Studies across the globe have shown that glucosamine helps relieve joint pain, especially in people suffering from osteoarthritis. Scientific backing for glucosamine is so strong that the glucosamine compound is available as a medicinal substance and not just a dietary supplement in the UK and other European countries. Supplements combined with glucosamine and chondroitin have shown similar effectiveness as osteoarthritis drugs like CeleBREX. This aids in driving the glucosamine segment’s growth.

Formulation Insights

The tablet segment held the largest revenue share, over 32.86% in 2024. Consumers prefer tablets for their ease of use, accurate dosing, and availability in various formulations. Manufacturers also favor tablets' stability and scalability, making them the leading format in this supplement category. Hence, factors such as convenience, longer shelf life, and cost-effective manufacturing are driving the segment.

The capsule segment is expected to grow at a significant CAGR throughout the forecast period. The availability of product types in various forms of encapsulation is responsible for an increase in the bioavailability of active ingredients. Multilayered or multi-membrane encapsulations, extended-release capsules for vitamins and minerals, and omega-3 fatty acids are some of the products currently available in capsule formulations, which have been responsible for the industry’s growth.

Application Insights

The bone density support segment held a significant revenue share of over 20% in 2024, driven by the rising focus on preventive healthcare and proactive wellness. The growing understanding of age-related degeneration of the bones especially among the older population, is driving the demand for preventive supplements that aid in maintaining bone density and the integrity of the structure. We are witnessing an increasing numbers of individuals consume bone-health supplements daily, as healthcare practitioners and wellness brands promote the functional nutrition movement. Thus, consumers move beyond a curative approach to a preventive approach, emphasizing Bone Density Support supplements as an integral part of health management for a lifetime.

The performance enhancement (sports & endurance) segment is expected to grow at the fastest CAGR throughout the forecast period. Consumers are demonstrating a growing desire for specific nutritional solutions that aid musculoskeletal performance and can help with higher activity levels. This has contributed to the increasing use of supplements designed to promote joint flexibility, improve bone density, and optimize muscle function, empowering users to push physical limits and reduce the risk of injury. Many companies are remarketing these products as part of the modern sports nutrition experience, and this shift away from general fitness maintenance toward performance optimization is supporting growth in this category.

Consumer Group Insights

The adult segment held the largest revenue share of over 47.25% in 2024, owing to increasing awareness regarding nutritional supplements. With rising trend of healthy and active lifestyles, adults are consuming various supplements to maintain bone health. As per the CRN survey, around 18% of people aged 18 to 34 years and 19% of people aged 35 to 54 years consume bone health dietary supplements. This number is expected to further rise due to an increase in adult population suffering from arthritis. As per the CDC, around 57.3% of the adult population in the U.S. suffers from arthritis.

The geriatric segment is expected to grow fastest from 2025 to 2033. The geriatric population is a major consumer of bone and joint health supplements as the prevalence of bone disorders rises with aging. Osteoporosis is the most common disorder in the elderly. With global life expectancy on the rise, there is a growing demand for supplements that increase bone density, improve joint stiffness, and increase mobility. Seniors are becoming more proactive in inspiring nutritional solutions to help them remain independent, reduce their fracture risk, and maintain quality of life, which is driving this market's adoption among older adults.

Sales Channel Insights

The brick-and-mortar segment held the largest revenue share, over 67.41% in 2024. One of the key factors responsible for this segment's growth is the rising number of retail stores selling supplements for bone and joint health with a wide variety of product types and different brands. Companies are investing in more stores to reach a larger population base and meet evolving consumer demand, further contributing to this growth.

The e-commerce segment is expected to witness the fastest CAGR during the forecast period. The growing penetration of smartphones and improved internet infrastructure, coupled with user-friendly mobile apps and websites, has significantly enhanced accessibility, particularly among tech-savvy urban and semi-urban consumers. Moreover, the flexibility of 24/7 shopping and doorstep delivery provides a compelling value proposition, encouraging first-time and repeat purchases.

Regional Insights

North America bone and joint health supplements market accounted for the largest global market share of over 35.30% in 2024. The regional market's growth is driven by an increasing geriatric population and people suffering from joint pain. The CDC states that approximately 14.6 million people have a diagnosis of severe joint pain. The growing incidence of arthritis and micronutrient deficiencies in adults also contributes to the sector's growth.

U.SBone And Joint Health Supplements Market Trends

The U.S. bone and joint health supplements industry continues to expand on the backs of an aging population, increased awareness of preventive care, and increased demand for natural/plant-based ingredients. Calcium and vitamin D are still the dominant forms of vitamins, but glucosamine and collagen-based products are increasingly popular. Consumers want clean labels, scientifically backed formulations. Now that e-commerce and direct-to-consumer sales are expanding, supplements are much easier to access for consumers, and purchases truly reflect the personalization around the overall expansion of the category. This is driving growth in the entire U.S. supplement market.

Europe Bone And Joint Health Supplements Market Trends

The Europe bone and joint health supplements industry is driven by an aging population, increasing prevalence of musculoskeletal disorders, and growing consumer awareness of preventive healthcare. Rising demand for natural, plant-based, and scientifically validated formulations and innovations in delivery formats such as gummies, powders, and functional beverages is further fueling growth.

The UK bone and joint health supplements industry is growing due to an aging population, rising awareness of bone and joint health, and increasing prevalence of conditions like osteoporosis and arthritis. Consumer preference for natural, plant-based, and clinically validated supplements, along with innovative product formats such as gummies and powders, is driving adoption.

Germany bone and joint health supplements industry is at the forefront of the European marketplace with its established healthcare system, high consumer awareness for preventive health, and preference for high-quality and scientifically validated supplements. An aging population and the growing demand for musculoskeletal disorders also contribute to demand.

Asia Pacific Bone And Joint Health Supplements Market Trends

Asia-Pacific bone and joint health supplements industry is expected to witness the fastest CAGR of 8.64% during the forecast period. Growing urbanization, altered eating habits, and increased access to online and retail distribution channels are boosting demand, while businesses are releasing formulations for specific regions and consumer-friendly product formats to address different needs.

China’s bone and joint health supplements industry is expanding rapidly, driven by an aging population, urban lifestyle changes, and government promotion of preventive healthcare. Moreover, the expansion of e-commerce platforms and modern retail channels is improving accessibility, while companies are introducing innovative product formats and targeted formulations to cater to diverse consumer needs.

Japan’s bone and joint health supplements industry is fueled by an aging demographic, significant health awareness, and a focus on preventative healthcare. Increased awareness of osteoporosis and joint disorders, along with an expectation for science-based and quality products, will contribute to the commercial opportunities within the sector.

Middle East & Africa Bone And Joint Health Supplements Market Trends

The MEA bone and joint health supplements industry is witnessing steady growth, driven by increasing health awareness. The introduction of innovative, natural, and clinically validated supplement formulations is encouraging adoption among consumers seeking preventive and holistic healthcare solutions in the region.

Kuwait’s bone and joint health supplements industry is growing due to rising government initiatives promoting healthy aging, increased physician recommendations for preventive nutrition, and a surge in fitness and wellness trends among the population. Moreover, increased media coverage about the advantages of micronutrients for bone and joint health, supported by partnerships between local distributors and international supplement brands, helps with product access for consumers and builds their trust, all of which additionally promotes growth in the market.

Key Bone And Joint Health Supplements Company Insights

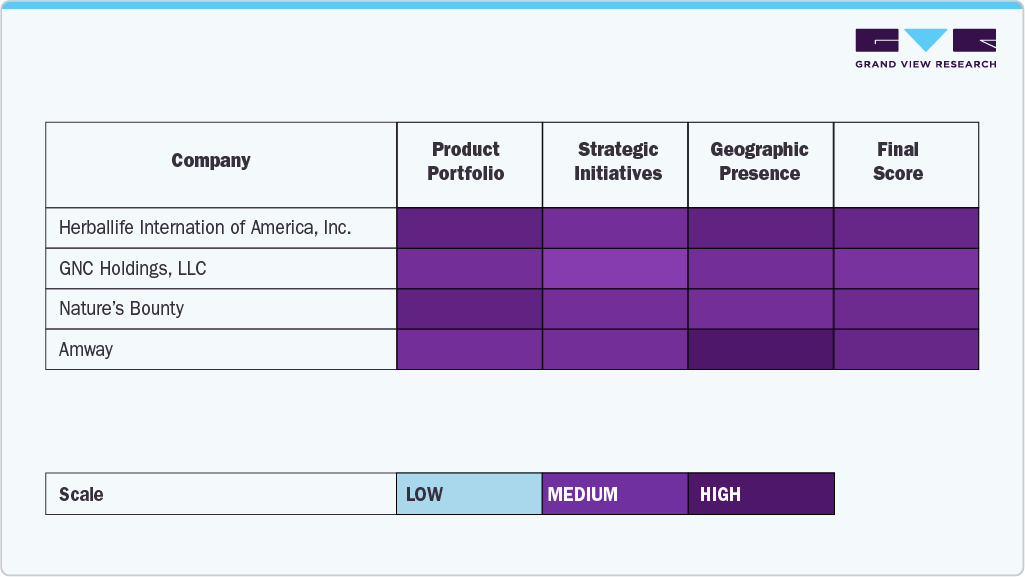

The bone and joint health supplements industry is highly competitive and features multiple major players that have maintained market leadership with strong product portfolios, innovation, and strategic distribution channels. Notable companies such as Herbalife International of America, GNC Holdings, and Nature’s Bounty, among others have gained significant traction in the market due to successful ranges that are grounded in scientific substantiation and designed to meet consumer needs, which include supporting bone density, joint flexibility, and overall musculoskeletal health.

Other companies in the sector are expanding their presence via novel delivery formats, targeted nutrient combinations, and personalized supplements. The increasing age demographic, health-conscious consumer segments, and preventive health movements have driven growth into formulations with added calcium, vitamin D, collagen, glucosamine, chondroitin, and other essential micronutrients.

Market leadership is more broadly defined by the ability to leverage innovation based on research, with consumer-aligned, clean-label, plant-based, and clinically validated products. As consumer awareness grows concerning preventive health and musculoskeletal well-being, companies prioritizing efficacy, accessibility, and product variety stand to capture sustained growth in the bone and joint supplement category.

Key Bone And Joint Health Supplements Companies:

The following are the leading companies in the bone & joint health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Herbalife International of America, Inc.

- GNC Holdings, LLC

- Nature's Bounty

- Amway

- Garden of Life

- Thorne.

- Solgar Inc.

- Pure Encapsulations, LLC.

- Glanbia plc

- NOW Foods

Recent Developments

-

In September 2025, Bayer launched Supradyn Mom’s and Supradyn Naturals Calcium+, a first-of-its-kind prenatal nutrition range designed to address critical nutrient gaps in maternal bone and joint health.

-

In April 2024, PharmaLinea launched a new joint pain supplement at Vitafoods Europe, supported by three clinical trials that demonstrated its effectiveness in reducing joint pain and improving mobility.

-

In September 2023, Voltaren launched its Joint Comfort & Movement Daily Supplement and Joint Health & Bone Strength Dietary Supplement to strengthen its market position.

Bone And Joint Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.15 billion

Revenue forecast in 2033

USD 27.16 billion

Growth rate

CAGR of 7.57% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, application, consumer group, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Taiwan; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Herbalife International of America, Inc.; GNC Holdings, LLC; Nature's Bounty; Amway; Garden of Life; Thorne.; Solgar Inc.; Pure Encapsulations, LLC.; Glanbia plc; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bone And Joint Health Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global bone and joint health supplements market report based on product, application, formulation, consumer group, sales channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Vitamins

-

Minerals

-

Collagen

-

Omega-3

-

Glucosamine

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules

-

Tablets

-

Powders

-

Softgels

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bone Density Support

-

Bone Strength Support

-

Mobility & Physical Function

-

Muscle Health & Recovery

-

Performance Enhancement (Sports & Endurance)

-

Pain Relief & Inflammation Management

-

-

Consumer Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Infants

-

Children

-

Adults

-

Pregnant Women

-

Geriatric Population

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Bricks and Mortar

-

Direct Selling

-

Chemists/Pharmacies

-

Health Food Shops

-

Hypermarkets

-

Supermarkets

-

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Taiwan

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bone and joint health supplements market size was estimated at USD 14.17 billion in 2024 and is expected to reach USD 15.15 billion in 2025.

b. The global bone and joint health supplements market size is expected to grow at a compound annual growth rate of 7.57% from 2025 to 2033 to reach USD 27.16 billion by 2033.

b. Vitamin segment dominated the global bone and joint supplements market with a share of 32.39% in 2024. This is attributable to the rising prevalence of vitamin D deficiency among adults and rising consumption of vitamin D to reduce the risk of bone fracture.

b. Some of the key players operating in the global bone and joint health supplements market include Herbalife International of America, Inc., GNC Holdings, Inc., Nature’s Bounty Co., Bayer AG, BY-HEALTH Co., Ltd., etc.

b. Key factors that are driving bone and joint health supplements market growth include the growing geriatric population, increasing prevalence of orthopedic disorders, and rising awareness of micronutrient deficiencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.