- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Vitamin Supplements Market Size, Industry Report, 2033GVR Report cover

![Vitamin Supplements Market Size, Share & Trends Report]()

Vitamin Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Multivitamin, Vitamin A), By Form (Powder, Tablets), By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-4-68038-386-7

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vitamin Supplements Market Summary

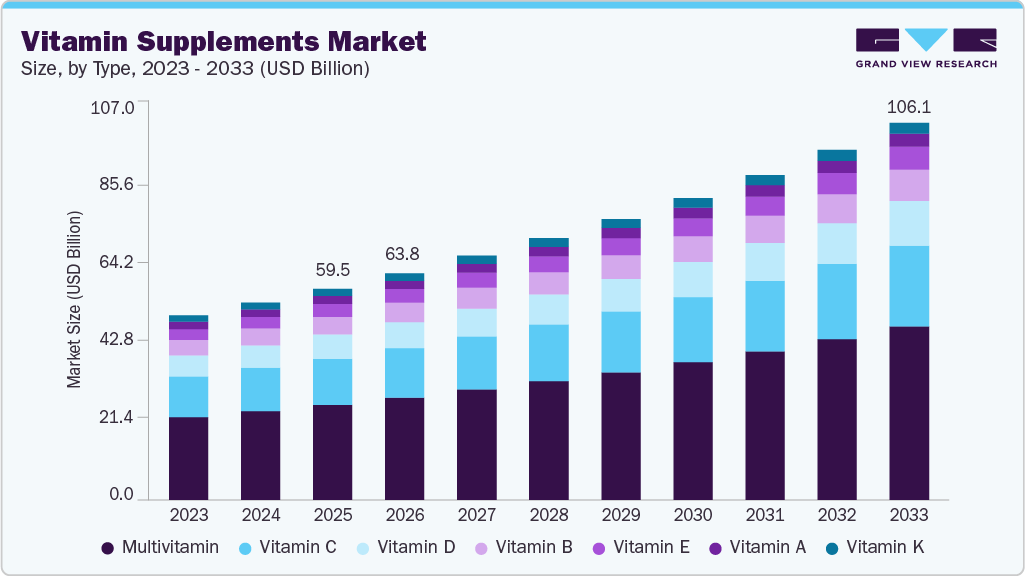

The global vitamin supplements market size was estimated at USD 59.45 billion in 2025 and is projected to reach USD 106.12 billion by 2033, growing at a CAGR of 7.5% from 2026 to 2033. Increasing awareness among consumers regarding nutrition, health, and wellness is a key factor driving the vitamin supplements industry.

Key Market Trends & Insights

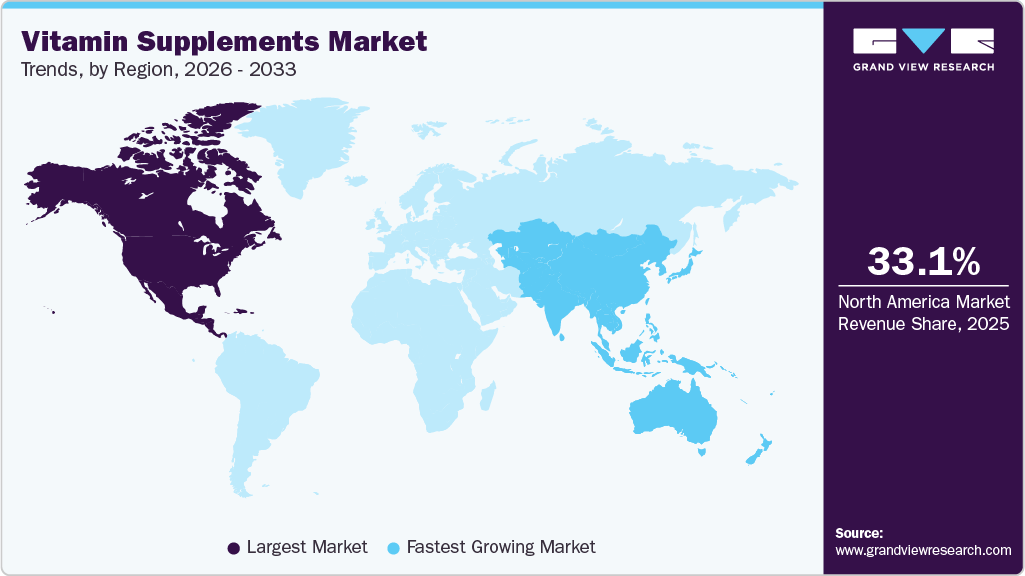

- North America held the largest share of the vitamin supplements market in 2025, accounting for 33.1%.

- The vitamin supplements market in the U.S. led North America in 2025, holding the largest market share with 79.5% of the region’s total revenue.

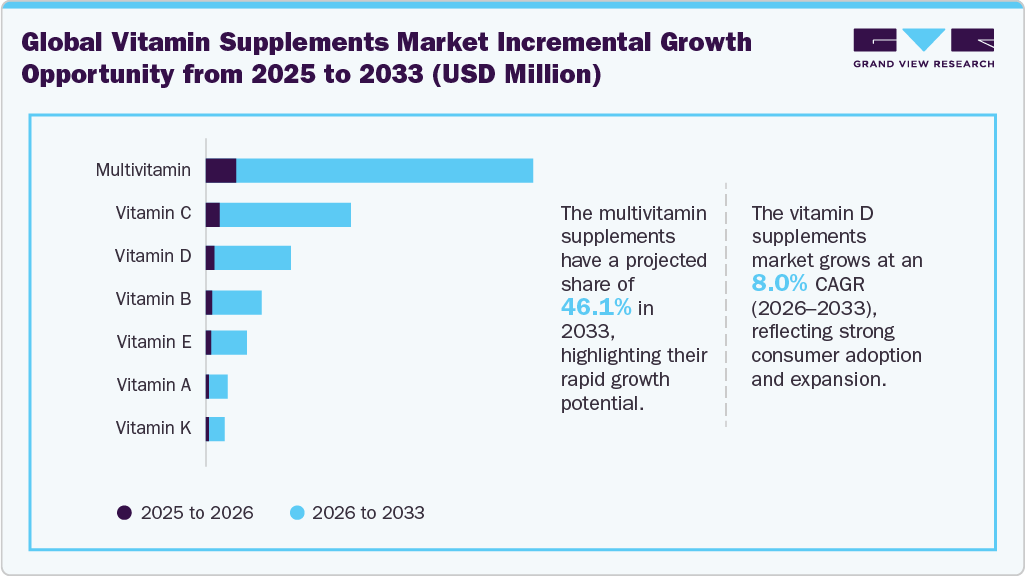

- By type, the multivitamin held the largest share of 45.1% in 2025.

- By form, gummies is experiencing significant growth, projecting a CAGR of 8.4% from 2026 to 2033.

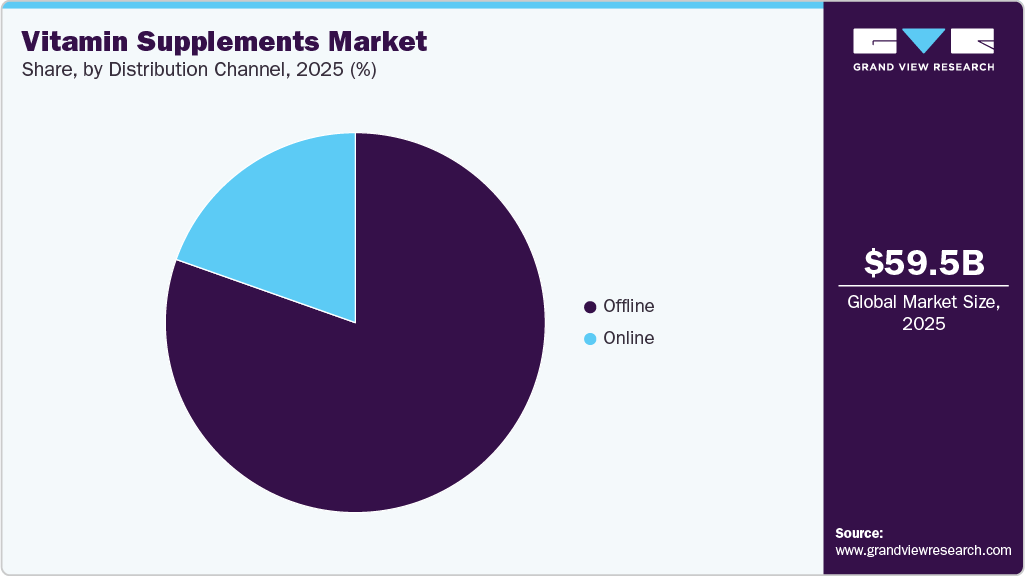

- By distribution channel, the offline channel segment held the largest market share of 80.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 59.45 Billion

- 2033 Projected Market Size: USD 106.12 Billion

- CAGR (2026-2033): 7.5%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Vitamin supplements are witnessing rising demand due to factors such as a growing aging population base and increased interest in preventive health care. Consumers are looking for ingredients with minimal side effects and high efficiency. In response, manufacturers are focusing on providing a blend of natural and synthetic ingredients in order to meet consumer demand across the globe.Campaigns run by non-government organizations, government agencies, and companies have heightened consumer awareness about the nutritional benefits of dietary supplements, including vitamin supplements, which is anticipated to propel market growth. In March 2023, the U.S. Food and Drug Administration (FDA) launched a new webpage called the Dietary Supplement Ingredient Directory. This directory allows the public to look up ingredients used in dietary supplements and find information about the FDA's actions and communication regarding each ingredient. The directory aims to be a one-stop shop for ingredient information that was previously scattered across different FDA webpages.

Leading vitamin supplement manufacturers focus on providing new products through R&D and technological advancements to provide cost-effective and high-quality products. In addition to adhering to international regulatory standards, companies are committed to raising consumer awareness about the ambiguity of ingredients used. To gain a greater share of the market and expand their geographical reach, market players are entering joint ventures, mergers, partnerships, agreements, expansions, and acquisitions. For instance, Pharmavite LLC began building a new manufacturing facility in Ohio to meet the increasing demand for its vitamin and supplement products. The company is investing over USD 200 million in the construction and expects production to begin by the end of 2024.

Moreover, fruits, vegetables, plant extracts, animal extracts, amino acids, and fish oil are some of the important raw materials used in the manufacturing of vitamin supplements. Raw material storage is also a major cost component for these manufacturers. The growing number of acquisitions and mergers in the market is aimed at ensuring an efficient supply of high-quality raw materials. VitaNatural Inc. completed the acquisition of Vitamin Bounty, a dietary supplement brand. The brand offers supplements that support overall health and high-quality vitamins. It has a strong online presence and distribution partnerships with major grocery retailers. The combined management team aims to drive the brand's growth and expand its product portfolio and distribution footprint.

The nutraceutical industry is an evolving and dynamic sector that offers novel opportunities to collaborate in scientific discovery with growing consumer interest in health-enhancing supplements and foods. It tracks and monitors consumer trends and relationships with mass distributors. Thus, the products developed in this industry are a response to direct demand. It may be used to improve health, delay the aging process, prevent chronic diseases, increase life expectancy, and support the structuring and functioning of the body.

Growing awareness among consumers regarding health and wellness is resulting in the “prevention is better than cure” ideology. This has led to more consumers relying on nutraceuticals, functional foods, vitamins, and dietary supplements to lead healthy and disease-free lives. Nutraceuticals, in particular, have received immense focus in the recent past owing to their nutritional and pharmaceutical benefits, along with being safe for consumption without significant side effects. This has led to the significant growth in the nutraceutical market, which is expected to grow at a CAGR of 9.4% over the forecast period.

Consumer Insights for the Vitamin Supplements Industry:

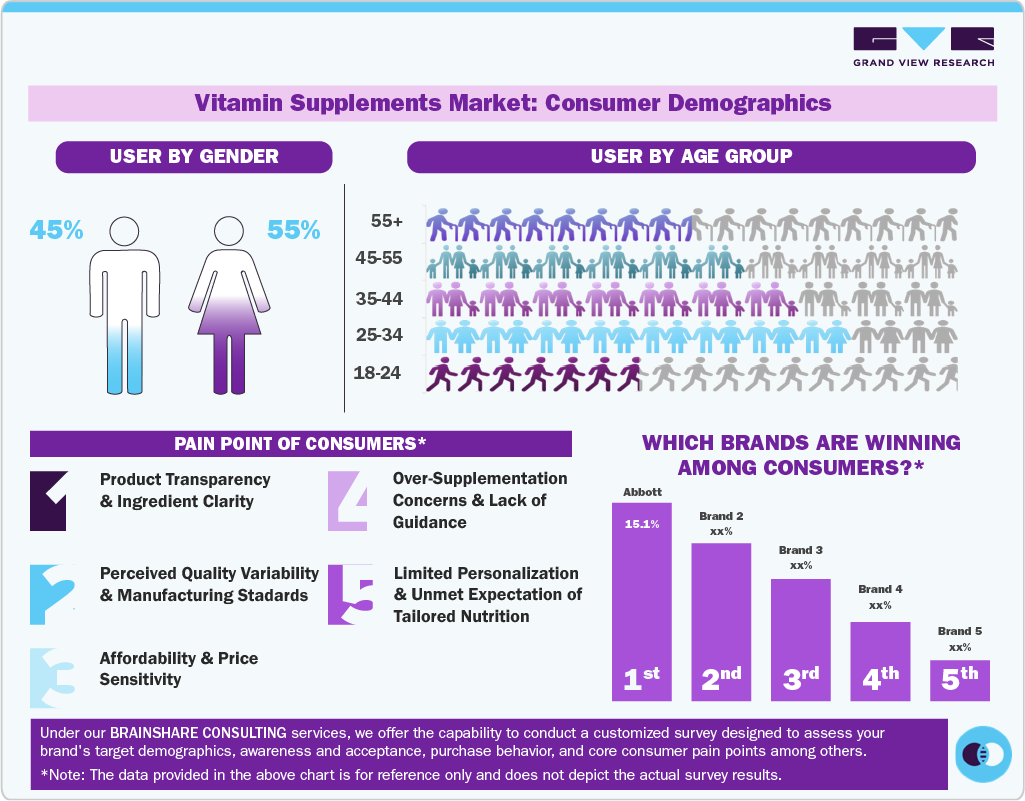

Vitamin supplements are increasingly being integrated into daily dietary routines. A survey conducted by the Council for Responsible Nutrition (CRN) indicated that individuals aged 18-34 represented the largest share of supplement consumers, accounting for 41% of total purchases. This was followed by the 35-54 age group, which contributed 32%, while consumers aged 55 and above accounted for the remaining 27%. These findings highlight a stronger inclination toward supplement usage among younger consumers compared with older age segments.

The study further indicated that multivitamins, omega-3 fatty acids, and vitamin D were the most commonly purchased supplements across all age groups, reflecting a broad focus on maintaining essential nutrient intake. In addition, it was observed that most supplement purchases continued to be made through physical retail outlets, while online channels accounted for a relatively smaller proportion of overall sales.

Moreover, according to a 2025 survey by YouGov, in the U.S., 56% of adults report purchasing or using supplements or vitamins in the past 12 months, making it the most common wellness product. In the UK, supplements or vitamins still top the list (46%) but fall 10% points behind U.S. levels. Fewer UK adults report buying organic food (16% vs. 26%) or using at-home fitness equipment (14% vs. 22%).

Type Insights

The multivitamin accounted for the largest share of 45.1% of the revenue in 2025. The growing adoption of preventive healthcare products for a healthier lifestyle and to reduce the risk of various illnesses has promoted the use of multivitamin supplements. Moreover, increased consumer awareness regarding the association between diet and health has fueled the demand for multivitamin supplements. Various groups, including working professionals and sports athletes, widely consume multivitamin supplements.

The National Institute for Health and Care Excellence (NICE) in the UK emphasizes that multivitamins and vitamin D are crucial for bone and muscle health, and they help boost the body's immune response to respiratory viruses. Therefore, the COVID-19 crisis boosted the consumption of multivitamin supplements as awareness of their benefits in supporting overall health and immunity grew.

The vitamin D supplements industry is projected to grow at the fastest CAGR of 8.0% from 2026 to 2033. There are multiple forms of vitamin D, with vitamin D3 and vitamin D2 being the most common. While the primary source of vitamin D is exposure to sunlight, many individuals do not receive enough, particularly those living in regions with limited sunlight during the winter or those who spend most of their time indoors. Consequently, these populations often rely on vitamin D supplements to maintain their health and overall well-being, contributing to the growing demand for vitamin D supplements. Players in the market are introducing numerous new products designed to cater to this growing need. For instance, Holista Colltech launched water-soluble vitamin D drops in Malaysia. This innovative product, HydroD, features more than five times greater bioavailability compared to fat-soluble vitamin D. It was created using a patented technology and launched through Alterni, the company's direct-selling subsidiary.

Form Insights

The tablets accounted for the largest share of 41.6% of the revenue in 2025. The demand for health supplements in tablet form is poised to experience growth over the forecast period, driven by the use of high-quality excipients that enhance tablet absorption and disintegration. Tablets offer convenience, making them an ideal choice for individuals with busy lifestyles. Furthermore, tablets can be precisely formulated to deliver accurate dosages, a critical factor for supplements requiring specific dosing for both efficacy and safety. While natural coatings may enhance dissolution, factors such as overall efficacy and quality also influence absorption rates. These advantages are anticipated to contribute significantly to the growth of the tablet vitamin supplements segment in the coming years. The growing demand for effervescent tablets is also favoring the segment's growth. Several consumers already incorporate vitamins into their daily routines, but they often find traditional vitamin forms less enjoyable. Effervescent vitamin tablets offer a novel and enjoyable way to take vitamins, as they come in various flavors and can be consumed in a fizzy drink form, making them more palatable.

The gummies vitamin supplements industry is projected to grow at the fastest CAGR of 8.4% from 2026 to 2033. Gummies are chewy vitamin supplements enriched with essential nutrients, resembling candies in appearance and texture. Gummies have gained popularity across different demographics due to their easy consumption and appealing appearance. They also provide a substantial dose of essential vitamins and minerals necessary for overall health. The nutraceuticals sector is expected to benefit significantly from the growing popularity of these products in the coming years. Vitamin gummies, which play a crucial role in supporting metabolic health, regulating glycemic index, and increasing folic acid levels in the body, are likely to find favor among working individuals due to their convenience and ease of consumption, making it easier for busy professionals to incorporate essential nutrients into their daily routines.

Distribution Channel Insights

The vitamin supplements through the offline channel accounted for the largest share of around 80.3% of the global revenue in 2025. Offline channels, encompassing hypermarkets, supermarkets, specialty stores, and pharmacies, play a pivotal role in offering consumers a diverse range of vitamin supplements. The continued growth and enhancement of the retail sector have become a driving force behind the increased sales of health and wellness products. These retail establishments feature a selection of global brands, contributing to the broader accessibility of various health products.

Major grocery stores like Kroger, Lidl, Target, and Walmart have made vitamin supplements readily available to consumers. An illustrative example is Target, which, in 2021, initiated collaborations with wellness brands, thereby expanding its product offerings. Among these brands is Sugarbreak, which specializes in blood-glucose management products and even offers gummy supplements designed to curb sugar cravings. These gummy vitamin products are strategically positioned in the health test and diabetes care section within each Target store, conveniently located alongside blood glucose monitors.

The vitamin supplements through the online channel is projected to grow at a significant CAGR of 8.4% from 2025 to 2033. Online channels are time-saving when compared to visiting physical stores, providing a convenient way to order required supplements directly from websites. Moreover, many online platforms offer free shipping and home delivery services, further enhancing their appeal to consumers.

The increasing influence of social media and promotional efforts by brands on various social media platforms has also driven the growth of this segment. Brands are increasingly launching their products exclusively on e-commerce websites as a strategy to attract a broader consumer base. For instance, Deerforia, a U.S.-based provider of vitamin supplements, announced its new e-commerce platform, deerforia.com. This website features a selection of premium vitamin gummies renowned for their delicious taste and efficacy in enhancing overall health and well-being.

Regional Insights

North America accounted for the largest market share of 33.1% in 2025. The prevalence of obesity and lifestyle-related diseases has risen in North America. As a result, the general populace is opting for functional foods & supplements that provide a variety of health benefits above and beyond basic nutrition. The consumption of products such as fortified, enhanced, and enriched, along with nutritional supplements, as part of a varied diet regularly can have favorable influences on health.

Multivitamins have emerged as a significant segment in the North American market owing to rising awareness about their benefits in overall health & bodily maintenance. As a result of these factors, vitamin supplement consumption is expected to increase in North America. A study by the US Centers for Disease Control and Prevention (CDC) found that Multivitamins are taken by nearly a quarter of kids and nearly a third of adults surveyed. The intake of nutritional supplements like vitamin supplements has increased, as the CDC's National Center for Health Statistics researchers specifically examined supplement usage.

U.S. Vitamin Supplements Market Trends

The vitamin supplements market in the U.S. led North America in 2025, holding the largest market share with 79.5% of the region’s total revenue. Growing concerns among U.S. parents regarding their children's overall well-being and health have driven an increased demand for nutritional supplements, including vitamins, probiotics, and various dietary supplements. In April 2022, the C.S. Mott Children's Hospital National Poll on Children's Health surveyed parents of children aged 1-10 years, seeking their perspectives on their children's dietary habits and supplement usage.

The results revealed that a significant proportion of parents in the U.S. provided their children with nutritional supplements, which include multivitamins (78%), probiotics (45%), omega-3 supplements (22%), as well as specific vitamins (44%) and minerals (25%). Of these parents, half (52%) reported that their children regularly take these supplements, while 33% mentioned that their children have tried them but do not use them consistently.

Europe Vitamin Supplements Market Trends

The vitamin supplements market in Europe held a significant market share of the global market in 2025, and is expected to benefit from technological advancements in the nutraceutical industry. The Federation of European Nutrition Societies invests in various nutria-cosmetics and nutritional foods businesses. It operates and nurtures the growth of such businesses in 26 countries in the region. The European Society for Clinical Nutrition and Metabolism governs and offers grants for businesses in the nutrition sector and honors the best-performing organizations in the industry. Such initiatives have encouraged participants to come up with highly beneficial and innovative products, thus boosting industry growth. Vitamin supplements continue to contribute significantly to the European dietary supplements market growth. Many medical professionals in Europe recommend the consumption of vitamin supplements owing to their various health benefits, including increased immunity.

Germany vitamin supplements market was identified as a lucrative region for Europe. Germany has a large population base that is quickly realizing the benefits of digestive foods and ingredients in their regular diets as food becomes the primary medium to obtain necessary vitamins, minerals, and other essentials. A significant portion of the country's food & beverage industry is also highly developed, with multinational companies introducing new products & technologies to meet the growing national demand. Many Germans are increasingly conscious of their dietary choices and actively seek ways to improve their nutritional intake. They recognize that vitamins are crucial in maintaining overall health and well-being. According to the statistics from the German Federal Institute for Risk Assessment (BfR) in May 2022, one-third of the German population regularly consumes food supplements at least once weekly to enhance their vitamin levels.

Asia Pacific Vitamin Supplements Market Trends

The vitamin supplements market in the Asia Pacific region is expanding at a fastest CAGR of 11.0% from 2026 to 2033. In the Asia Pacific, demand for vitamin supplements is expected to increase as key players adopt strategies such as introducing their brands to the untapped economies of Southeast Asian countries. Asia Pacific has the largest market for vitamin supplements in China, India, and Japan due to their large populations and high consumption levels. Countries such as Japan and Australia have experienced heightened awareness regarding the product's health benefits over the years, which is expected to strengthen regional growth over the forecast period.

Australia & New Zealand vitamin supplements market is considered a lucrative market for the distribution of vitamin supplements. During the fiscal year of 2020-21, 73% of Australians opted to buy complementary medicines, with vitamins emerging as the most preferred category. Within this category, the most favored specific products included vitamin D (40%), vitamin C (34%), and multivitamins (34%). A sizable number of health-conscious consumers characterizes the market in these countries.

The vitamin supplements market in China held the largest market share of 34.3% in the Asia Pacific region. Individuals in China have been increasingly focusing on their health in the past few years, which has boosted the demand for vitamin supplements in the country. The rising demand for these supplements can also be attributed to the diverse flavor options in the grab-n-go variety. The government of China has taken numerous initiatives in recent years to promote the benefits of consuming healthy food and following a healthy lifestyle. It also aims to raise the nutrient intake among consumers. The government also intends to focus on building a nutrient-fortified food industry and the development of healthy food products in the near future. The "Healthy China 2030" initiative is a significant and comprehensive government program in China that outlines a strategic roadmap for developing the healthcare industry and improving public health over the next several years, specifically aiming to make substantial progress by 2030.

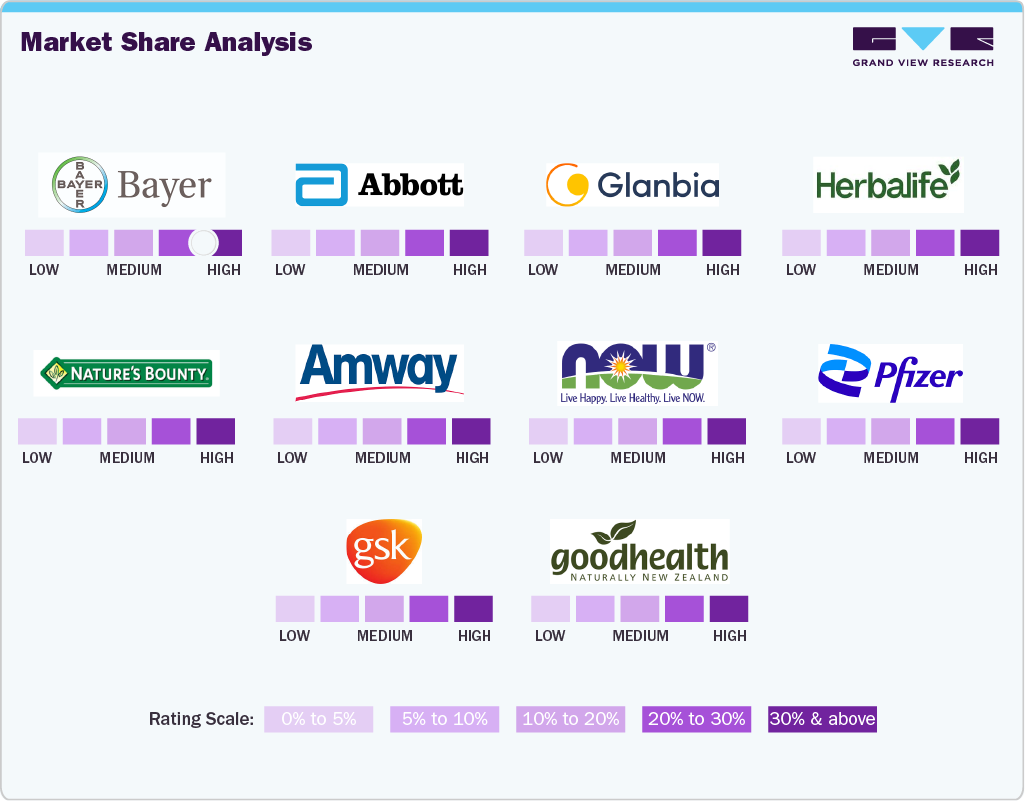

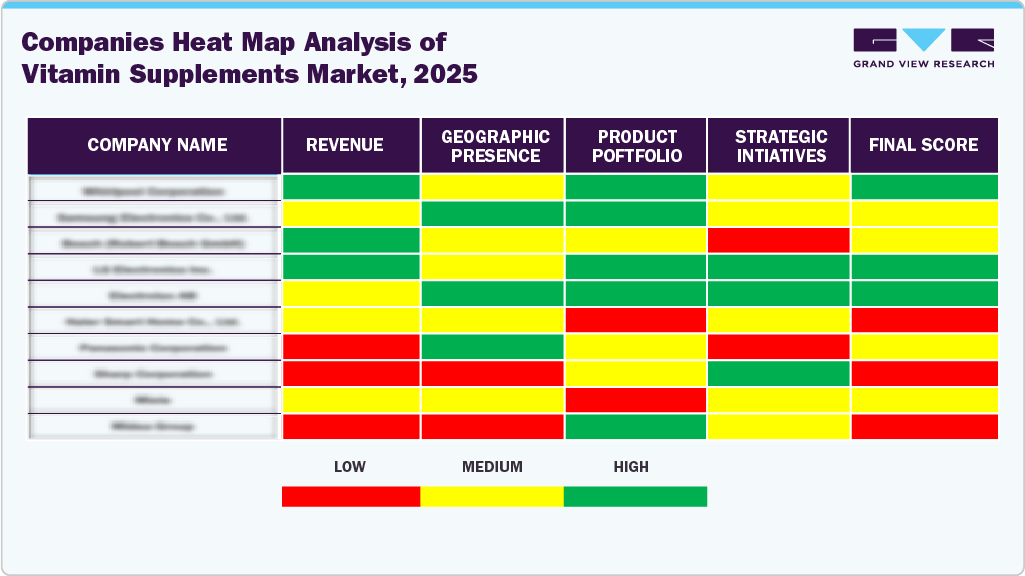

Key Vitamin Supplements Company Insights

Key players operating in the market are adopting various steps to increase their presence. These steps include strategies such as partnerships, mergers & acquisitions, development & launch of new products, global expansions, redesigning their packaging, and others. In February 2023, Amway Corp. introduced a new range of nutrition supplements under its Nutrilite brand. The products, including gummies and jelly strips, are designed to meet the nutritional needs of busy millennials. The range includes supplements for overall health and immunity, bone health, and eye health.

In February 2023, Bayer AG announced the expansion of its "Nutrient Gap Initiative" to improve access to nutrition. It aims to expand access to essential vitamins and minerals to 50 million individuals in underserved communities by 2030. The program primarily emphasizes nutritional supplementation as a vital tool in establishing a robust defense against malnutrition within these populations.

Key Vitamin Supplements Companies:

The following are the leading companies in the vitamin supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Glanbia plc

- Pfizer Inc.

- Bayer AG

- Amway Corp.

- GlaxoSmithKline plc.

- Good Health New Zealand

- The Nature's Bounty Co.

- NOW Foods

- Abbott

- Herbalife Nutrition

Recent Developments

-

In December 2024,USANA Health Sciences completed a USD 205 million acquisition of a 78.8% stake in Hiya Health Products, a DTC brand focused on children’s vitamins and wellness. The deal gives USANA access to Hiya’s subscription-based business model and a stronger presence in the children’s health segment.

-

In November 2024,PharmaNutra introduced a new Sidevit line, applying its patented Sucrosomial technology (previously for minerals) to vitamins, launching Sidevit D3 and Sidevit B12, along with other supplements like SiderAL Mamma and Lactopam.

Vitamin Supplements Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 63.79 billion

Revenue Forecast in 2033

USD 106.12 billion

Growth rate (revenue)

CAGR of 7.5% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative (Revenue) units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; CSA; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; Australia & New Zealand; India; South Korea; Brazil; Chile; South Africa; UAE

Key companies profiled

Glanbia plc; Pfizer Inc.; Bayer AG; Amway Corp.; GlaxoSmithKline plc.; Good Health New Zealand; The Nature's Bounty Co.; NOW Foods; Abbott; Herbalife Nutrition

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

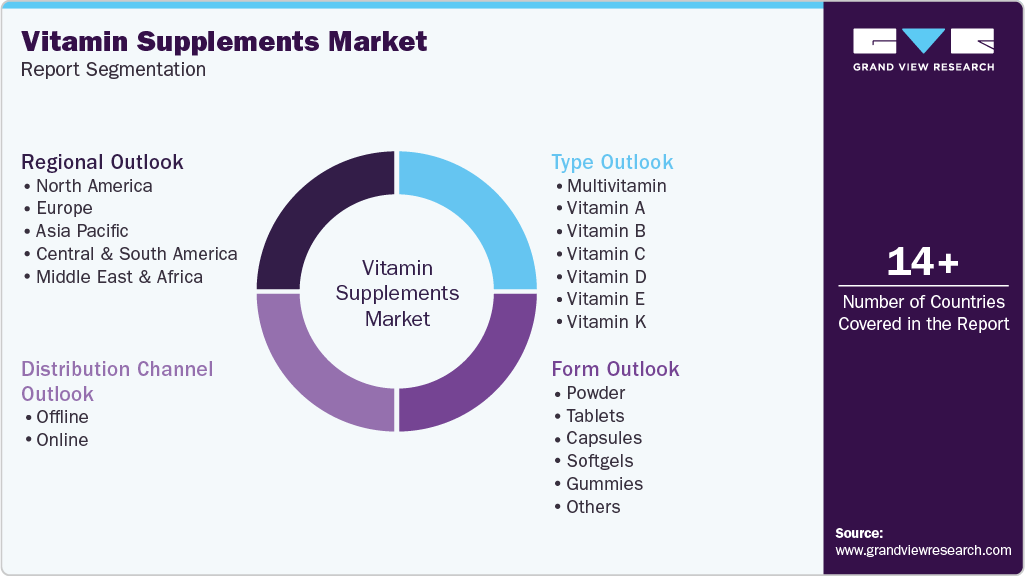

Global Vitamin Supplements Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global vitamin supplements market report based on type, form, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

Vitamin K

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Powder

-

Tablets

-

Capsules

-

Softgels

-

Gummies

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Pharmacies & Drugstores

-

Hypermarkets/Supermarkets

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Chile

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global vitamin supplements market size was estimated at USD 59.45 billion in 2025 and is expected to reach USD 63.79 billion in 2026.

b. The key market players in the vitamin supplements market includes Glanbia plc; Pfizer Inc.; Bayer AG; Amway Corp.; GlaxoSmithKline plc.; Good Health New Zealand; The Nature's Bounty Co.; NOW Foods; Abbott; Herbalife Nutrition.

b. Growth in the vitamin supplements market is being primarily driven by increasing awareness among consumers regarding nutrition, health, and wellness, and growing aging population base and increased interest in preventive health care.

b. The global vitamin supplements market is expected to witness 7.5% revenue growth from 2026 to 2033 to reach USD 106.12 billion by 2033.

b. The multivitamin supplements market accounted for the largest share of 45.1% of the revenue in 2025 due to growing adoption of preventive healthcare products for a healthier lifestyle and to reduce the risk of various illnesses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.