- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Botanical Supplements Market Size, Industry Report, 2030GVR Report cover

![Botanical Supplements Market Size, Share & Trends Report]()

Botanical Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Leaves, Flowers), By Form (Tablets, Liquid), By Application (General Health, Anti-Cancer), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-086-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Botanical Supplements Market Summary

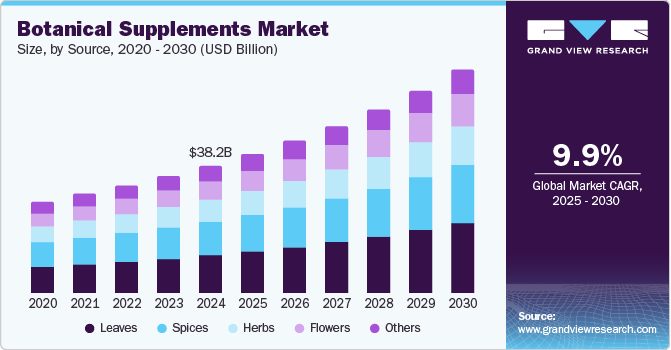

The botanical supplements market size was valued at USD 38.24 billion in 2024 and is projected to reach USD 67.01 billion by 2030, growing at a CAGR of 9.9% from 2025 to 2030. This growth is attributed to the increasing consumer preference for natural and plant-based products is a major driver, fueled by rising health consciousness and awareness about preventive healthcare. In addition, the aging population and focus on healthy aging are also contributing to demand.

Key Market Trends & Insights

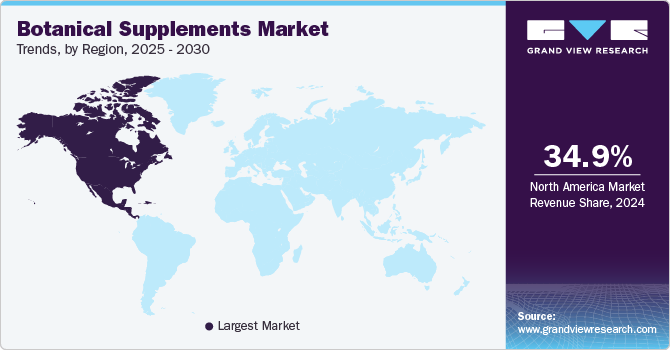

- North America botanical supplements market dominated the global market and accounted for the largest revenue share of 34.9% in 2024.

- Asia Pacific botanical supplements market is expected to grow at a CAGR of 10.8% over the forecast period.

- By source, the leaves segment dominated the market and accounted for the largest revenue share of 29.7% in 2024.

- By form, tablets led the global botanical supplements market and held the largest revenue share of 30.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.24 Billion

- 2030 Projected Market Size: USD 67.01 Billion

- CAGR (2025-2030): 9.9%

- North America: Largest market in 2024

In addition, the aging population and focus on healthy aging are also contributing to demand. Furthermore, the expansion of e-commerce platforms has improved accessibility, further boosting market growth globally. Botanical supplements, derived from plants, flowers, herbs, and roots, are products designed to enhance health and wellness by leveraging bioactive compounds such as flavonoids, polyphenols, and phytonutrients. These supplements have gained prominence due to their natural composition and ability to promote preventive healthcare. A growing consumer preference for natural flavors over synthetic ones, driven by heightened health awareness, has significantly boosted demand.

Innovation in the botanical industry is accelerating market growth. New product launches featuring unique flavors and formulations are attracting consumers seeking health benefits alongside sensory experiences. The shift from pharmaceutical products to botanical alternatives reflects a broader trend toward holistic wellness. Botanical supplements are increasingly being used to prevent chronic diseases, support healthy aging, and enhance body functions. This aligns with the ideology of "prevention is better than cure," encouraging consumers to adopt nutraceuticals for a disease-free lifestyle.

High-quality nutrition products symbolize social status in many regions, prompting consumers to invest in premium botanical supplements. Companies are leveraging organic ingredients and innovative packaging techniques to appeal to eco-conscious buyers while ensuring product differentiation.

Furthermore, advancements in extraction technologies have improved the potency and bioavailability of botanical ingredients, enabling manufacturers to create highly effective supplements. The rise of branded and private-labeled products, coupled with expanding retail channels like e-commerce platforms, has enhanced accessibility for consumers globally. With increasing demand for clean-label products and sustainability-focused practices, the botanical supplement industry is poised for robust growth, supported by scientific research, consumer trends, and continuous innovation in product development.

Source Insights

The leaves segment dominated the market and accounted for the largest revenue share of 29.7% in 2024, primarily driven by their extensive use in health and wellness products due to their rich bioactive compounds, such as chlorophyll and antioxidants. Leaves are widely utilized for weight management, immunity boosting, and skin health. In addition, increasing research on herbal plants and innovative product launches targeting obesity disorders have amplified demand. Furthermore, their versatility in dietary supplements, cosmetics, and pharmaceuticals has positioned leaf-derived botanicals as essential components in promoting overall health and well-being.

The flowers segment is expected to grow at a CAGR of 10.6% over the forecast period, owing to their unique therapeutic properties and appealing sensory attributes. Flowers are used in botanical supplements for stress relief, relaxation, and enhancing mood, making them popular in aromatherapy and wellness products. Furthermore, their bioactive compounds contribute to anti-inflammatory and antioxidant benefits, driving demand for flower-based formulations. Moreover, innovation in extraction techniques has improved their efficacy, while the rising consumer preference for natural remedies over synthetic alternatives continues to boost the market volume for flower-derived botanicals globally.

Form Insights

Tablets led the global botanical supplements market and held the largest revenue share of 30.6% in 2024. This is attributed to their convenience, precise dosing, and portability. Tablets are easy to consume and store, appealing to busy consumers seeking hassle-free supplementation. In addition, their extended shelf life and ability to incorporate multiple botanical ingredients in a single dose enhance their popularity. Furthermore, advancements in tablet formulation techniques ensure better bioavailability and efficacy. Moreover, the expanding pharmaceutical industry in emerging markets further supports the demand for tablet-based botanical supplements globally.

Liquid is expected to grow at a significant CAGR of 11.5% over the forecast period, driven by its fast absorption and versatility in consumption methods. Liquid botanical supplements are preferred by individuals who struggle with swallowing pills or require faster nutrient delivery. In addition, they allow for customizable dosages and can be easily mixed into beverages or consumed directly, catering to diverse consumer preferences. Furthermore, innovations in flavoring and packaging have made liquid supplements more appealing, while their suitability for children and older adults has expanded their market reach significantly.

Application Insights

The energy and weight management segment dominated the market with the largest revenue share of 20.6% in 2024. Botanical supplements in this category often include ingredients that enhance metabolism, suppress appetite, and promote fat oxidation. Furthermore, their natural composition appeals to health-conscious individuals seeking alternatives to synthetic weight-loss products. Moreover, the rising prevalence of obesity and related health issues has driven demand for effective botanical solutions.

The anti-cancer segment is expected to grow at the fastest CAGR of 12.6% over the forecast period, as consumers increasingly seek preventive healthcare options and complementary therapies. Botanical supplements containing antioxidants, flavonoids, and other bioactive compounds are recognized for their potential to reduce oxidative stress and support cellular health. These supplements are often used alongside conventional treatments to enhance overall well-being.

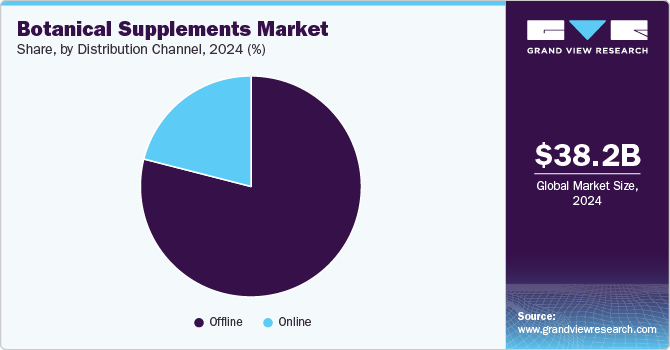

Distribution Channel Insights

The offline distribution channel held the dominant position in the global botanical supplements market with the largest revenue share of 79.0% in 2024. This is driven by its ability to offer consumers a hands-on shopping experience, allowing them to inspect botanical supplements physically and verify their authenticity. In addition, retail stores, pharmacies, and supermarkets provide personalized recommendations and immediate purchases, fostering trust and reliability. Furthermore, the ingrained habit of purchasing health-related items in person and the accessibility of offline outlets contribute significantly to the dominance of this segment.

The online distribution channel is expected to grow at a lucrative CAGR of 10.8% from 2025 to 2030, owing to the convenience of e-commerce platforms offering doorstep delivery, competitive pricing, and a wide variety of botanical supplements. In addition, consumers benefit from detailed product descriptions, user reviews, and promotional offers, enabling informed purchasing decisions. Furthermore, innovations like personalized recommendations and subscription models further enhance customer experiences. Moreover, the growing penetration of the internet and increased trust in online transactions have made digital platforms a preferred choice for tech-savvy and busy individuals seeking health solutions.

Regional Insights

The North America botanical supplements market dominated the global market and accounted for the largest revenue share of 34.9% in 2024. This growth is attributed to the growing health awareness and concerns about diet and lifestyle-related diseases. Rising obesity rates and a sedentary lifestyle have increased demand for weight management solutions.

U.S. Botanical Supplements Market Trends

The botanical supplements market in the U.S. led the North American market and held the largest revenue share in 2024, driven by increasing consumer preference for herbal formulations and preventive healthcare products. A significant rise in dietary supplement consumption, coupled with growing awareness of botanical extracts, has fueled demand. Retailers such as Walmart and Costco enhance accessibility through private-label brands, improved packaging, and consumer education.

Asia Pacific Botanical Supplements Market Trends

Asia Pacific botanical supplements market is expected to grow at a CAGR of 10.8% over the forecast period, owing to rising disposable incomes and heightened health consciousness among consumers. In addition, countries such as Japan and Australia have demonstrated strong awareness of the health benefits of botanical supplements, boosting regional demand.

The botanical supplements market in China led the Asia Pacific market with the largest revenue share in 2024, primarily driven by increasing urbanization and a growing middle-class population seeking natural health solutions. The popularity of traditional Chinese medicine has bolstered demand for herbal supplements targeting chronic diseases and overall wellness.

Europe Botanical Supplements Market Trends

Europe botanical supplements market is expected to witness significant growth due to its strong emphasis on preventive healthcare and sustainability. Consumers prefer organic, vegan, and non-GMO products, reflecting their commitment to eco-friendly choices. Furthermore, the aging population drives demand for supplements promoting healthy aging and disease prevention. Innovations in extraction technologies have enhanced product efficacy, while regional manufacturers focus on personalized nutrition strategies to cater to diverse consumer needs.

Key Botanical Supplements Company Insights

Key players in the global botanical supplements market include PLT health Solution, Mondelez International, Procter and Gamble, and others. These companies employ strategies such as product innovation to meet evolving consumer demands, strategic acquisitions to expand market presence, and digitalization to enhance efficiency.

-

NBTY Inc. manufactures and markets nutritional supplements, as well as offers a diverse range of products, including vitamins, minerals, amino acids, and botanical supplements. The company operates across various segments such as health, wellness, beauty, and fitness. With a strong portfolio of brands, NBTY caters to consumer needs through retail chains, online platforms, and pharmacies.

-

Ricola AG specializes in producing herbal-based lozenges, teas, and other botanical products aimed at promoting respiratory health and soothing throat discomfort.

Key Botanical Supplements Companies:

The following are the leading companies in the botanical supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Dabur India

- NBTY Inc.

- Ricola AG.

- PLT health Solution

- Mondelez International

- Procter and Gamble

- Nutraceutical International Company

- BASF SE

- The Himalaya Drug Company

- Glanbia Nutritionals

- Botanicalife International of America, Inc.

- Blackmores Limited

Recent Developments

-

In October 2024, PLT Health Solutions launched cellflo6, a patented, gallate-enhanced oligomer extract from green tea (Camellia sinensis), into global markets. Featured in sports, energy, and men's health formulations, cellflo6 supports endurance, recovery, blood flow, and energy.

-

In September 2023, Groupe Berkem introduced Biombalance, a new line of premium active ingredients targeting intestinal microbiota balance for the Nutraceuticals market. These innovations feature ethically sourced natural extracts, strengthening Groupe Berkem's position in the food supplements market.

Botanical Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.80 billion

Revenue forecast in 2030

USD 67.01 billion

Growth Rate

CAGR of 9.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in US million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, application, distribution channel,, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Argentina, South Africa

Key companies profiled

Dabur India; NBTY Inc.; Ricola AG.; PLT health Solution; Mondelez International; Procter and Gamble; Nutraceutical International Company; BASF SE; The Himalaya Drug Company; Glanbia Nutritionals; Botanicalife International of America, Inc.; Blackmores Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Botanical Supplements Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global botanical supplements market report based on source, form, application, distribution channel, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Herbs

-

Leaves

-

Spices

-

Flowers

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

Tablets

-

Capsules

-

Gummies

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.