- Home

- »

- Consumer F&B

- »

-

Bottled Water Market Size, Share & Trends Report, 2030GVR Report cover

![Bottled Water Market Size, Share & Trends Report]()

Bottled Water Market Size, Share & Trends Analysis Report By Product (Still Water, Sparkling Water, Functional Water), By Packaging (PET, Cans), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-411-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global bottled water market size was estimated at USD 303.95 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. Increasing concerns regarding various health problems such as gastrointestinal diseases caused by the consumption of contaminated water are leading to increased demand for clean and hygienic packaged options. Drinking water scarcity in several regions further necessitates demand for safe drinking water, leading to increased product sales, and augmenting the market growth.

The increasing preference for nutrient-fortified water is trending due to the rising importance of health and wellness among consumers. The demand has increased among travelers, working professionals, and in-house consumers. Over the past few years, products with labels such as alkaline, electrolyte-rich, fortified, caffeinated water, fortified with additional hydrogen or oxygen have been gaining popularity.

Consumers are increasingly prioritizing their health and wellness, which is boosting the demand for purified and ultra-purified bottled options. Consumers chose to opt for these bottles on the go, as it is a healthier option for high-calorie, carbonated, and sugary drinks such as sports drinks and juices. According to data from the Beverage Marketing Corporation, the volume growth of bottled water slowed down in 2022 compared to the previous year, but producers' revenues increased by nearly 12% due to higher prices.

The per capita consumption of bottled water reached a new high of 46.5 gallons, while carbonated soft drinks remained at 36 gallons. Single-serving sizes were the most popular type of bottled water, accounting for the majority of the category's volume. Beverage Marketing Corporation expects bottled water to continue to grow and surpass carbonated soft drinks.

Product Insights

In 2022, the still water segment held the largest market share of more than 74.5% in terms of revenue and is expected to maintain dominance over the forecast period. Diseases such as dysentery, diarrhea, and typhoid are usually caused due to contaminated particles in running water, thus, consumers are looking for safe water options and companies are addressing the same issues. For instance, Aquafina offers purified drinking options which are filtered and sodium-free. Similarly, Dasani offers purified options with added minerals for safe and clean drinking.

However, the functional water segment is projected to register the fastest CAGR of 6.9% from 2023 to 2030. The growing emphasis on health and wellness is a major driver for the market. Consumers are becoming increasingly conscious of their overall well-being and are actively seeking out functional beverages that can support their specific health goals. Bottled functional water provides a convenient and accessible option for consumers to incorporate these added benefits into their daily hydration routine.

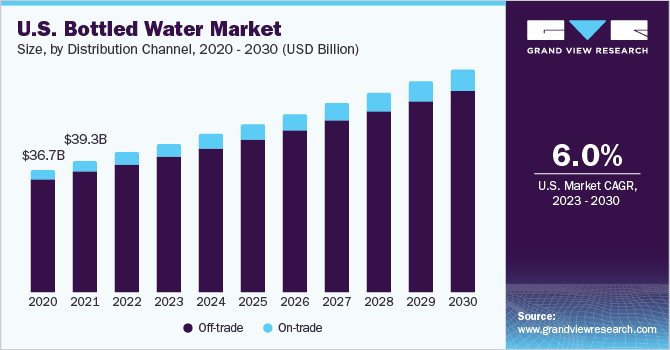

Distribution channel Insights

The off-trade segment dominated the market and accounted for a revenue share of more than 88.8% in 2022.The segment includes all retail outlets such as hypermarkets, supermarkets, convenience stores, mini markets, and traditional stores. The increasing convenience of quickly picking the required brand of bottled water with a particular set of minerals will boost the market in the forecast period. Some of the brands sold via the above-mentioned stores are Aquafina, Dasani, Nestlé, and Danone.

The on-trade channel is anticipated to register the fastest CAGR of 10.1% from 2023 to 2030. The on-trade channel benefits from the social and recreational aspects associated with dining out or visiting entertainment venues. Consumers often choose to enjoy a meal or drink in a restaurant or bar setting, where bottled water is readily available. This creates a continuous market for bottled water within the on-trade distribution channel.

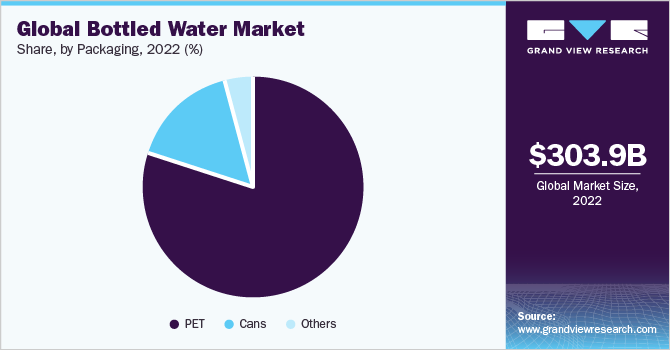

Packaging Insights

The PET segment dominated the market and held the largest revenue share of more than 80.0% in 2022 and is expected to maintain dominance over the forecast period.PET packaging stands out in the bottled water market due to its cost-effectiveness when compared to alternative materials like glass or aluminum. The production of PET bottles is relatively inexpensive, and their lightweight nature significantly reduces transportation costs. This cost advantage has established PET as the preferred packaging option for water, enabling manufacturers to provide affordable bottled water choices to a wide range of consumers.

Packaging has been playing a crucial role in the growing penetration of the product. In December 2022, Coca-Cola Bangladesh introduced 100% recycled PET (rPET) bottles for its Kinley water brand. This makes Coca-Cola Bangladesh the first company in the South-West Asia region to offer 100% rPET bottles in two-liter packs.The company has been working to reduce its reliance on virgin plastic and increase its use of recycled plastic. The company now offers 100% rPET bottles in over 40 markets around the world.

The cans segment is projected to register the fastest growth during the forecast period with a CAGR of 6.4% from 2023 to 2030. Cans offer superior product protection by creating an airtight and light-resistant barrier, safeguarding the quality and taste of the water. This advantage is of utmost importance for bottled water, as it guarantees the retention of its freshness and purity throughout its entire shelf life.

Regional Insights

Asia Pacific made the largest contribution to the global market with a revenue share of 45.1% in 2022. Growing awareness about the importance of health and wellness in countries including China, India, Malaysia, and Indonesia is one of the major factors supporting the market growth owing to the heightened demand for hygienic consumables. With the growing awareness about the importance of hygienic beverage options, the demand for bottled options is also increasing, thereby creating avenues for the bottled water market growth in the region.

North America made the second-largest contribution to the global market with a revenue share of 23.9% in 2022. The growing trend of living a healthy lifestyle and extensive sports and other physical and outdoor activities are also responsible for the high demand for bottled water. Most Americans do not prefer drinking water straight from the tap as they find packaged options to be a safer and more convenient option.

Moreover, the rising demand for eco-friendly and sustainable packaging solutions by customers is expected to offer lucrative opportunities for existing manufacturers and new entrants in the market. In 2022, the U.S. accounted for 57.7% of the market share. People are now more conscious about their health and are realizing the significance of consuming nutritious beverages. Bottled water is being recognized as a better choice compared to sugary drinks.

Europe is expected to grow at a CAGR of 5.2% from 2022 to 2030. The tourism industry plays a significant role in driving the demand for the market in Europe. With millions of tourists visiting European countries each year, the need for reliable and safe drinking water is essential. Bottled water offers a convenient solution for both domestic and international tourists who may be unsure about the quality of tap water in unfamiliar destinations.

Germany is expected to grow at a CAGR of 5.7% during the forecast period. The market is poised for growth primarily due to increasing awareness among individuals about the significance of maintaining proper hydration. Moreover, there is a rising demand for premium bottled water as people seek healthier options. Furthermore, the fact that consumers now have higher disposable incomes adds to the expansion of the market.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, and global expansions. Some of the largest food and beverage companies including Nestlé, PepsiCo, and The Coca-Cola Company have entered into the market. Along with that, to improve their efficiency and by using the international distribution channel, the companies have been ruling the industry.

-

For instance, in September 2022, Waterloo Sparkling Water, a brand known for its flavored sparkling water beverages, expanded its product lineup with the launch of two new flavors called "Sweater Weather." The new flavors, "Pumpkin Spice" and "Caramel Apple," aim to capture the essence of fall and the popular seasonal flavors associated with it.

Some prominent players in the global bottled water market include:

-

Nestlé

-

PepsiCo

-

The Coca-Cola Company

-

DANONE

-

Primo Water Corporation

-

FIJI Water Company LLC

-

Gerolsteiner Brunnen GmbH & Co. KG

-

VOSS WATER

-

Nongfu Spring

-

National Beverage Corp.

-

Keurig Dr Pepper Inc.

Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 325.83 billion

Revenue forecast in 2030

USD 509.18 billion

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; UK; Italy; Spain; China; India; Japan; Indonesia; Thailand; Singapore; Brazil; Argentina; South Africa, UAE

Key companies profiled

Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; Gerolsteiner Brunnen GmbH & Co. KG; VOSS WATER; Nongfu Spring; National Beverage Corp.; Keurig Dr Pepper Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bottled Water Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the bottled water market report based on product, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Still Water

-

Sparkling Water

-

Functional Water

-

Others

-

-

Packaging Outlook (Revenue, USD Billion, 2017 - 2030)

-

PET

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Off-trade

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Others

-

-

On-trade

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Thailand

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bottled water market size was estimated at USD 303.95 billion in 2022 and is expected to reach USD 325.83 billion in 2023.

b. The global bottled water market is expected to grow at a compounded growth rate of 5.9% from 2023 to 2030 to reach USD 509.18 billion by 2030.

b. The still water segment dominated the global bottled water market with a share of 74.5% in 2022. This is attributed to diseases such as dysentery, diarrhea, and typhoid are usually caused due to contaminated particles in running water, thus, consumers are looking for safe water options and companies are addressing the same issues.

b. Some key players operating in the bottled water market include Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; Gerolsteiner Brunnen GmbH & Co. KG; VOSS WATER; Nongfu Spring; National Beverage Corp.; Keurig Dr Pepper Inc.

b. Key factors that are driving the market growth include, increasing concerns regarding various health problems such as gastrointestinal diseases caused by the consumption of contaminated water is leading to increased demand for clean and hygienic packaged options.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."