- Home

- »

- Medical Devices

- »

-

Botulinum Toxin Market Size & Share, Industry Report, 2033GVR Report cover

![Botulinum Toxin Market Size, Share & Trends Report]()

Botulinum Toxin Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Botulinum Toxin Type A, Botulinum Toxin Type B), By Application (Therapeutic, Aesthetic), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-355-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Botulinum Toxin Market Summary

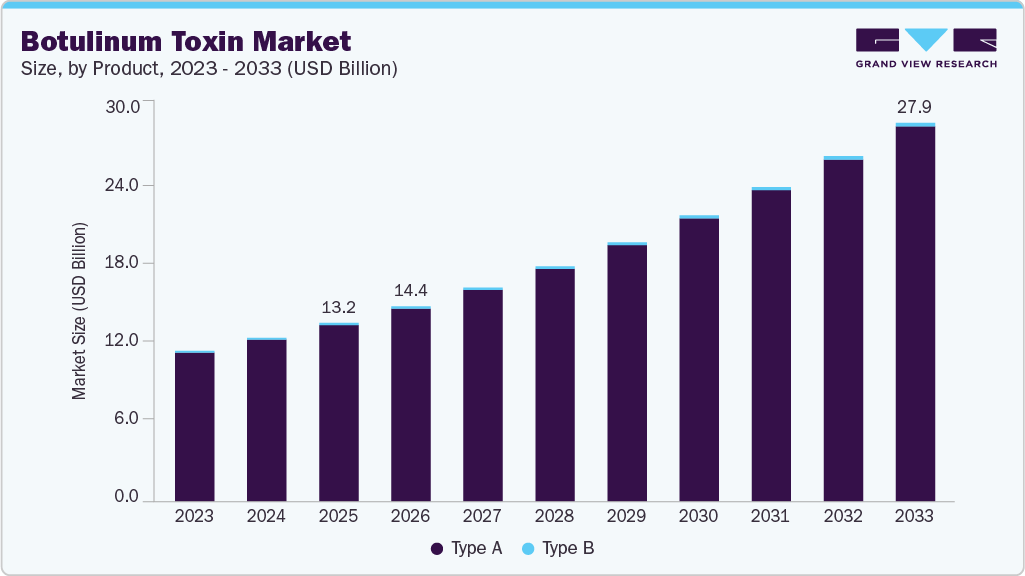

The global botulinum toxin market size was estimated at USD 13.2 billion in 2025 and is projected to reach USD 27.9 billion by 2033, growing at a CAGR of 9.9% from 2026 to 2033. Botulinum toxin is a protein and neurotoxin produced by the bacterium clostridium botulinum.

Key Market Trends & Insights

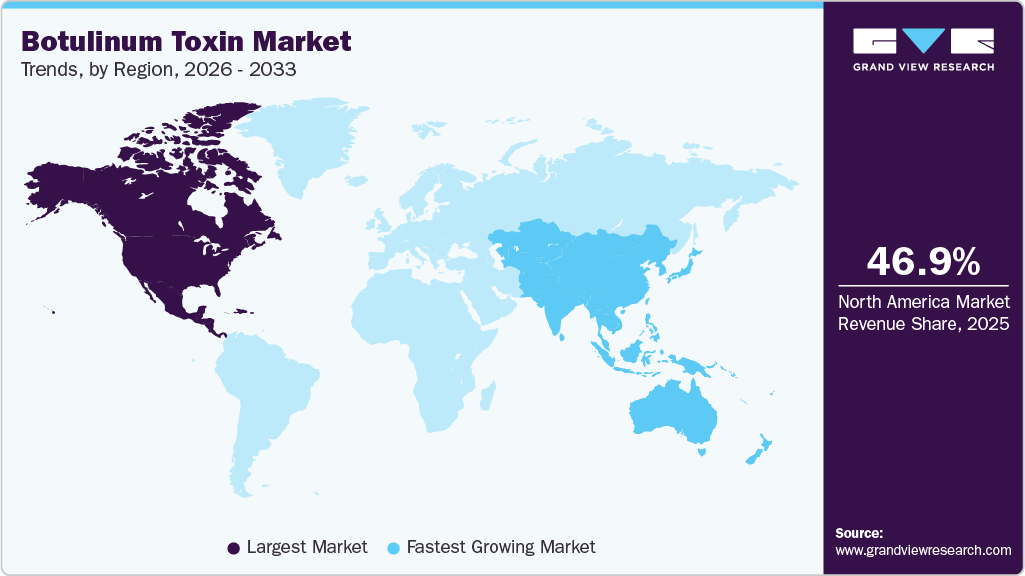

- The North America botulinum toxin industry accounted for largest revenue share of 46.9% in 2025.

- The botulinum toxin industry in the U.S. accounted for over 80.0% of North America’s market.

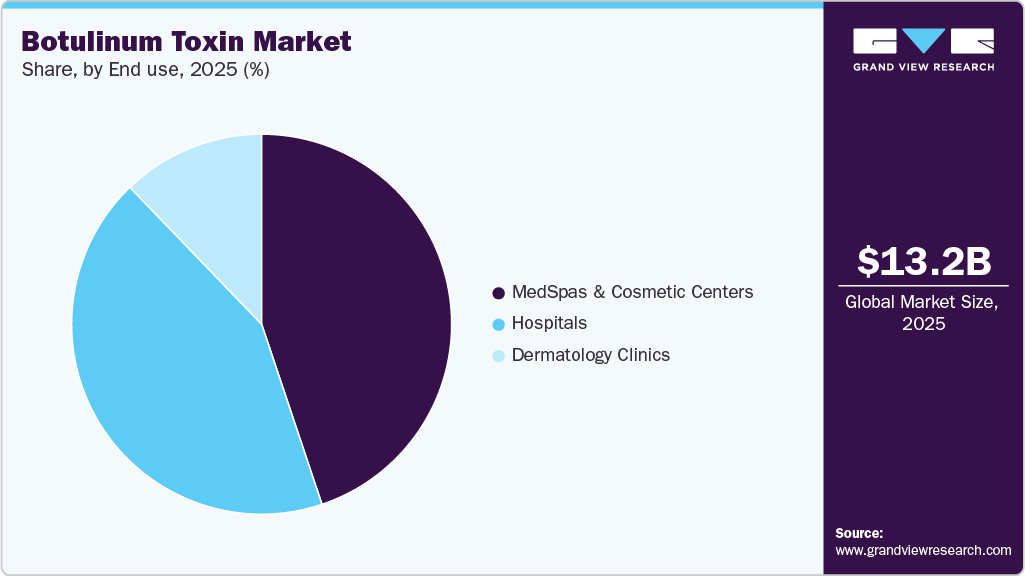

- Based on end use, the medspas and cosmetic centers segment accounted for the largest market share of 44.9% in 2025.

- Based on product, the botulinum toxin type A segment exhibited the largest revenue share of 98.8% in 2025.

- Based on application, the aesthetic segment is expected to witness a significant CAGR of 10.4% during the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 13.2 Billion

- 2033 Projected Market Size: USD 27.9 Billion

- CAGR (2026-2033): 9.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The toxin is a selective blocker of acetylcholine released from nerves, which blocks neural transmission from the nerves when injected into muscle. Botulinum toxin is one of the most exceptional substances encountered in medicine and science. The adoption of botulinum toxin in cosmetology has grown rapidly over the past decade, and at present it is one of the most common and widely performed aesthetic procedures in the world. The growing concern for aesthetic features in both developed and developing regions has led to a rise in the number of cosmetic procedures.

The availability of a variety of botulinum toxin products, such as botox, xeomin, dysport, and others, will accelerate the market growth. The increasing usage of botulinum toxin injection in several aesthetic procedures, including the treatment of glabellar lines, chemical browlift, forehead lines, and others, is expected to boost the botulinum toxin industry growth over the coming years. Presently, a few products of botulinum toxin - Type-A and only one product of Type-B (Myobloc) are commercially available in the market.

However, rising investment in R&D programs by major manufacturers to explore the therapeutic use of botulinum toxin is building opportunities for the expansion of its therapeutic application area soon. A shift from invasive to minimally invasive procedures is expected to fuel the market growth over the forecast period. Many people are opting for permanent procedures, such as fillers, fat grafting, and lip advancement.

Minimally invasive procedures offer advantages such as smaller incisions, shorter hospital stays, quick outpatient services, rapid wound healing, less pain, and a lower risk of complications than invasive surgeries. Thus, the demand for botulinum toxin is expected to increase over the forecast period.

Product Insights

The botulinum toxin Type A segment exhibited the largest revenue share of 98.8% in 2025. Botulinum toxin A is anticipated to grow at a significant rate due to a rise in customer preference, driven by advantages such as minimal pain, no blood loss, and a reduced risk of scarring during the procedure. Botulinum toxin type A has been increasingly utilized to treat chronic migraine, tension-type headache, and other primary neurological disorders.

Botulinum toxin type A products are utilized for a range of therapeutic and aesthetic applications. With the rising demand for aesthetic beauty, the segment is likely to grow further in the near future. Based on product, the botulinum toxin sector is classified into botulinum toxin type A and botulinum toxin type B. Also, various botulinum toxin type A products are commercially available in the market, including Botox and Dysport, have been clinically tested and proven to be safe and effective in long-terms with the least side effects.

Application Insights

Based on applications, the botulinum toxin sector is segmented into aesthetic and therapeutic applications. The aesthetic segment is expected to witness a significant CAGR of 10.4% during the forecast period. Botulinum toxin (BoNT), a bacterially produced neurotoxin, is a mainstay in the cosmetology armamentarium. The rising consciousness of aesthetic appearance and rising technological advancements in developed and developing countries have led to an increase in the number of cosmetic surgeries.

The therapeutic application segment accounted for 42.5% of the market share in 2025. Botulinum toxin is known to be the most potent known biological neurotoxin molecule, and holds great promise in the treatment of many disorders. The therapeutic benefits of botulinum toxin have been diversifying due to a deeper understanding of its different mechanisms of action and molecular behavior. Botox procedures are adopted for various therapeutic and preventive treatments for disorders such as chronic migraine, conditions such as hyperhidrosis, overactive bladders, and others.

End Use Insights

The medspas and cosmetic centers accounted for the largest market share of 44.9% in 2025. The higher preference for aesthetic procedures in dermatology clinics and cosmetic centers, and medspas is significantly contributing to the segmental growth. The segment is likely to grow at a CAGR of 10.4%. Plastic surgeons and medical spa owners are experiencing an increase in customer demand. In addition, the rising number of medical cosmetic centers and medspas in regions like the Asia Pacific is contributing to the market growth.

The hospital segment accounted for a revenue share of 43.0% in 2025. The rising number of hospitals with advanced care and facilities in developed and developing countries, and increasing awareness of aesthetic procedures performed contribute to the segment growth. Furthermore, the maximum number of therapeutic procedures, such as dystonia, spasticity, chronic migraine, and others, are being performed in the hospitals.

Regional Insights

The North America botulinum toxin industry accounted for largest revenue share of 46.9% in 2025 and is anticipated to reach USD 13.9 billion by 2033, owing to increasing disposable income and the growing number of cosmetic procedures. Thus, increasing use of botulinum toxin products in various cosmetic procedures performed in the region will boost the market growth.

U.S. Botulinum Toxin Market Trends

The botulinum toxin industry in the U.S. accounted for over 80.0% of North America’s market. High disposable income and growing awareness about the availability of a variety of aesthetic procedures are some of the factors responsible for market growth. Besides, factors such as technological advancements, relatively higher disposable income, and availability of several aesthetic procedures have boded well for the growth outlook.

Europe Botulinum Toxin Market Trends

The botulinum toxin industry in Europe followed North America in terms of revenue share in 2025 and is expected to maintain its position over the forecast period. The market size is justified by the contribution from developed European economies, such as Germany and the UK, which are major contributors to the Europe BoNT market. Europe is one of the most advanced regions globally with innovative technologies and well-established infrastructure, resulting in better healthcare facilities & patient care.

The botulinum toxin industry in the UK is booming, and treatments such as Botox account for 9 out of 10 aesthetic procedures. According to the British College of Aesthetic Medicine, over 60 facial injectable fillers are available in the UK market. Moreover, minimally invasive cosmetic procedures are quick and affordable, with lower risk and minimal scarring. Such procedures are also attracting patients who would never have considered cosmetic surgeries earlier, but are happy with a quick and easy short-term solution.

The Germany botulinum toxin industry is spearheading the BoTN market in Europe. Various factors, such as an increase in the popularity of cosmetic procedures, technological advancements, and a rise in beauty consciousness, are among the factors driving the market. Furthermore, the rising urban population, novel product approvals, advancements in noninvasive procedures, and availability of skilled professionals are some of the other factors leading to market growth. However, the high cost of aesthetic procedures is likely to impede the market growth.

Asia Pacific Botulinum Toxin Market Trends

The botulinum toxin industry in the Asia Pacific region is expected to witness the fastest CAGR of 11.3% over the forecast period owing to favourable reimbursement, a large patient population, and the availability of developed health care facilities in many countries. Many aesthetic procedures performed in South Korea, Japan, and China each year are primarily driving the market growth in this region. A large number of aesthetic procedures can be attributed to the easy availability of advanced techniques and cost-effective treatment options.

The China botulinum toxin industry growth can be attributed to increasing demand for antiaging and antipollution procedures. Nearly 23% of the population in China is geriatric, which is expected to boost the adoption of non-invasive aesthetic treatments, leading to market growth. The buying power of China’s growing middle-class population is increasing, and the local population is more inclined to buy quality products, making the country the world’s second-largest aesthetic market after the U.S.

The botulinum toxin industry in South Korea is growing with a notable trend for aesthetic procedures. South Korea is reportedly the 8th largest aesthetic market in the world, with the highest number of aesthetic procedures per capita globally, and there are 600+ clinics in Seoul alone. Key market drivers include rising medical tourism in South Korea, increasing public awareness about cosmetic procedures, availability of technologically advanced products, increasing geriatric population, and presence of extremely beauty-conscious individuals

Latin America Botulinum Toxin Market Trends

The botulinum toxin industry in Latin America is experiencing the presence of untapped opportunities in developing countries, such as Brazil. Latin American countries are increasingly preferred for medical tourism due to the availability of treatments at lower costs (30% to 70% discount) compared to North America and Europe. In addition, a stronger emphasis on physical beauty coupled with extensive acceptance of facial treatments has led to the high demand for botulinum treatment in the region, which is expected to propel the Latin America market growth over the forecast period.

Middle East and Africa Botulinum Toxin Market Trends

The botulinum toxin industry in the Middle East and Africa has gained momentum from increasing demand for facial injectables, such as BoNT. According to a factsheet presented by the Department of Trade and Industry of the Republic of South Africa, rising import demand for aesthetic and cosmetic products, increasing demand for organic natural products, access to natural ingredients, and strong R&D capabilities are attracting investments to the MEA market.

Key Botulinum Toxin Company Insights

The global botulinum toxin industry is competitive in nature and is a highly regulated market. The major players in the industry have built key business strategies such as product innovation, new product launches, strategic partnerships & collaborations, joint ventures, advanced service launches, and contracts to create their industry position, along with gaining a huge chunk of the market share.

Key Botulinum Toxin Companies:

The following are the leading companies in the botulinum toxin market. These companies collectively hold the largest market share and dictate industry trends.

- Ipsen Group

- Allergan, Inc.

- Metabiologics

- Merz Pharma

- US Worldmeds

- Evolus

- Galderma

- Medy-Tox, Inc.

- Lanzhou Institute of Biological Products

Botulinum Toxin Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 14.4 billion

Revenue forecast in 2033

USD 27.9 billion

Growth rate

CAGR of 9.9% from 2026 to 2033

Base year for estimation

2025

Historic data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Italy; France; Spain; Germany; Sweden; Denmark; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait;

Key companies profiled

Ipsen Group; Allergan Inc.; Medy-Tox, Inc.; Merz Pharma; US Worldmeds; Evolus; Galderma; Metabiologics Inc.; Lanzhou Institute of Biological Products

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

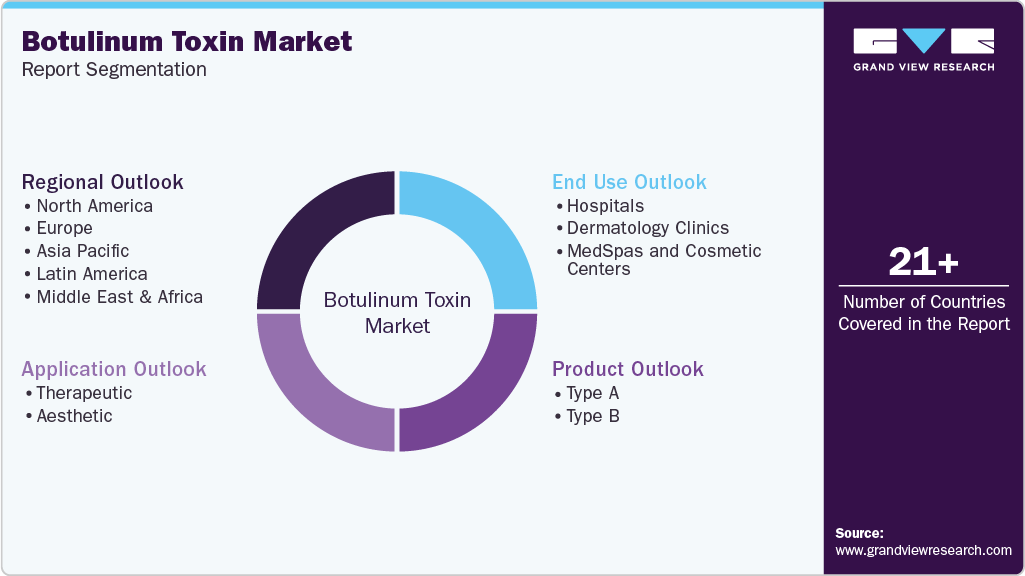

Global Botulinum Toxin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global botulinum toxin market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Type A

-

Botox

-

Dysport

-

Xeomin

-

Others

-

-

Type B

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Therapeutic

-

Chronic Migraine

-

Overactive Bladder

-

Cervical Dystonia

-

Spasticity

-

Others

-

Aesthetic

-

-

Glabellar Lines

-

Crow’s Feet

-

Forehead Lines

-

Others

-

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals

-

Dermatology Clinics

-

MedSpas and Cosmetic Centers

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

India

-

Japan

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global botulinum toxin market size was estimated at USD 13.2 billion in 2025 and is expected to reach USD 14.4 billion in 2026.

b. The global botulinum toxin market is expected to grow at a compound annual growth rate of 9.9% from 2026 to 2033 to reach USD 27.9 billion by 2033.

b. North America dominated the botulinum toxin market with a share of 46.9% in 2025. This is attributable to higher disposable income and the availability of a variety of aesthetic procedures for enhancing external appearance in the region

b. Some key players operating in the botulinum toxin market include Allergan, Inc.; Ipsen Group; Merz Pharma GmbH & Co. KGaA; Medytox,Inc.; US Worldmed,LLC; Lanzhou Institute of Biological Products Co.Ltd. and Revance Therapeutics, Inc.

b. Key factors that are driving the botulinum toxin market growth include the growing population aged between 25 to 65 years and increasing demand for minimally invasive or non-invasive procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.