- Home

- »

- Medical Devices

- »

-

Brain Imaging Devices Market Size, Industry Report, 2030GVR Report cover

![Brain Imaging Devices Market Size, Share & Trends Report]()

Brain Imaging Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Devices, Accessories), By Application (Stroke, Brain Tumor), By Modality (Fixed, Portable), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-307-3

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Brain Imaging Devices Market Summary

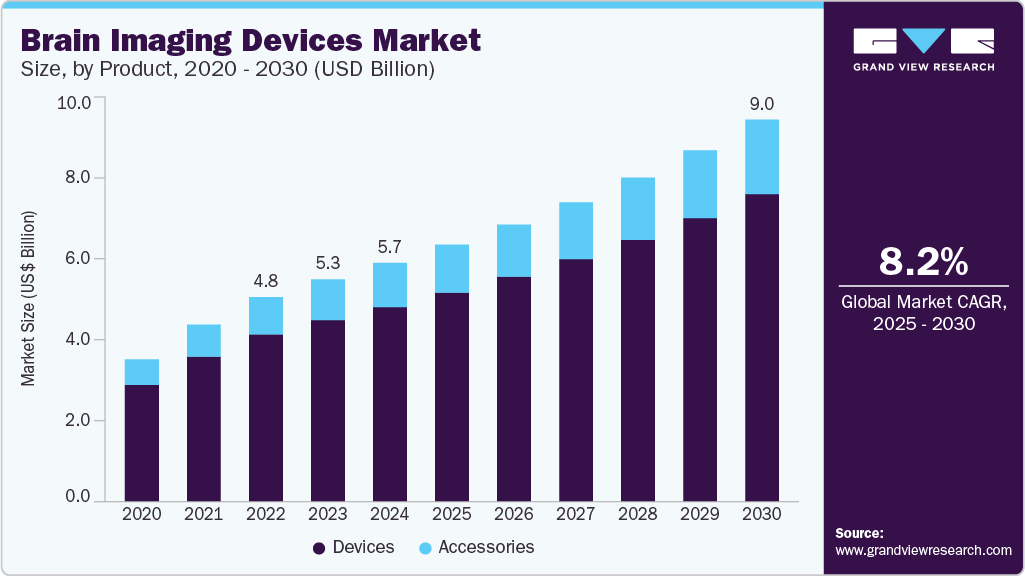

The global brain imaging devices market size was estimated at USD 8.87 billion in 2022 and is projected to reach USD 9.03 billion by 2030, growing at a CAGR of 8.2% from 2025 to 2030. Technological advancements in brain imaging, such as improved resolution, functional imaging techniques, and non-invasive methods, are significantly enhancing diagnostic capabilities.

Key Market Trends & Insights

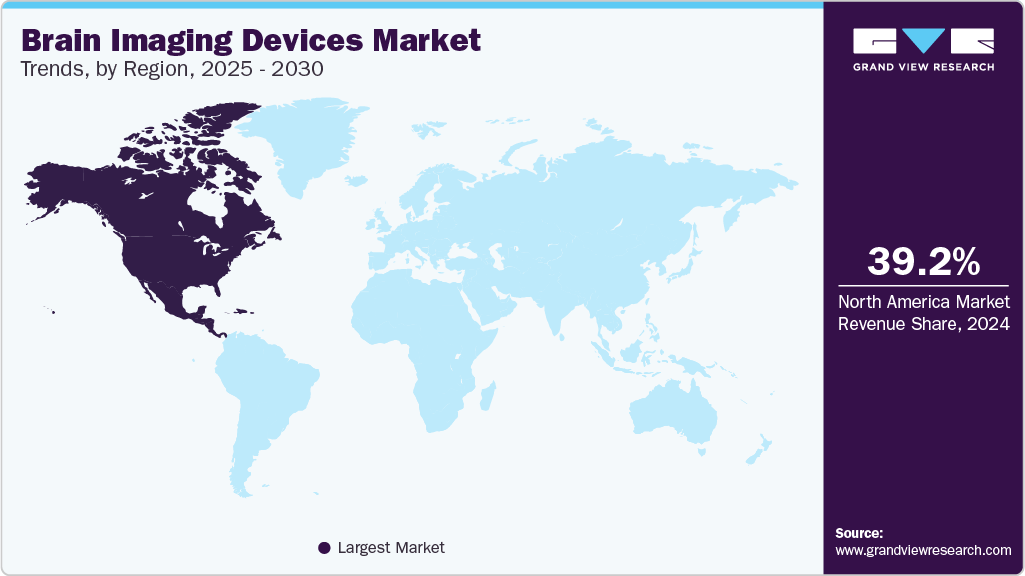

- The North America brain imaging devices market dominated the global market with the largest revenue share of 39.2% in 2024.

- Based on product, the devices segment dominated the market with the largest revenue share of 81.5% in 2024.

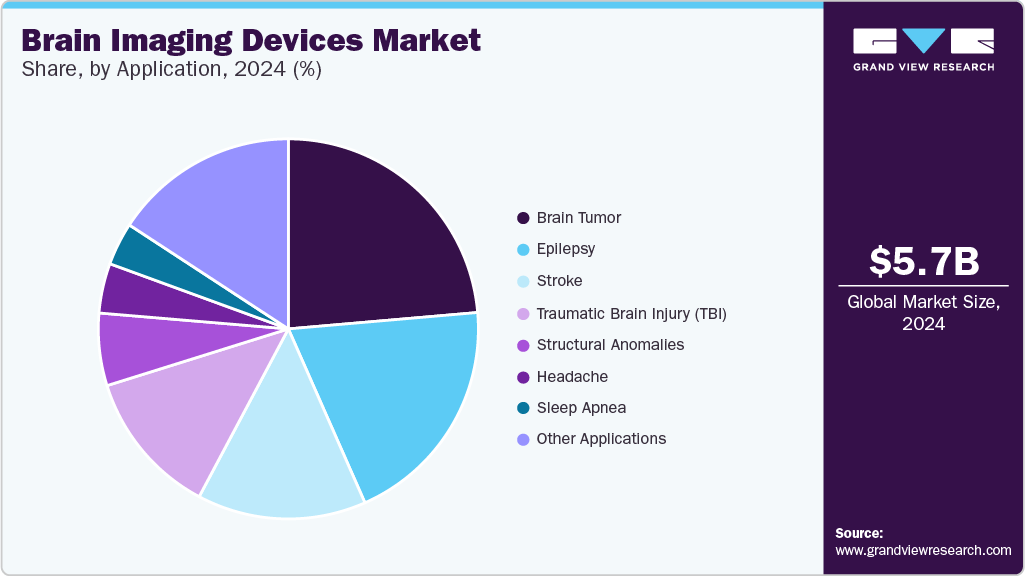

- Based on application, the brain tumor segment held the largest revenue share in 2024.

- Based on modality, the fixed segment dominated the brain imaging devices industry with the largest revenue share in 2024.

- Based on end use, the hospital segment held the largest revenue share in 2024.

Market Size & Forecast

- 2022 Market Size: USD 8.87 Billion

- 2030 Projected Market USD 9.03 Billion

- CAGR (2025-2030): 8.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing prevalence of brain and neurological disorders, including Alzheimer's, Parkinson's disease, and stroke, is further fueling the demand for these advanced imaging solutions. Healthcare providers and researchers are relying more on sophisticated brain imaging devices to detect, monitor, and treat these conditions effectively.

The market growth is anticipated to be driven by the availability of various brain imaging technologies, including magnetic resonance imaging (MRI), computed tomography (CT), Magnetoencephalography (MEG), Electroencephalography (EEG), and PET scanners, which offer applications for both functional and structural imaging. Additionally, technological advancements, such as the incorporation of AI, the development of wearable brain imaging devices, and other innovations, are expected to further contribute to this growth. For instance, Hyperfine, Inc. announced the FDA approval of the world's first portable magnetic resonance brain imaging system -the Swoop system in January 2024 . They introduced the eighth generation of its AI-enhanced Swoop system software. This latest update significantly boosts the image quality produced by the Swoop system and offers major enhancements in ease of use, including a real-time assistance feature for improved accuracy in patient positioning and a streamlined process for image uploads.

“Our latest AI-powered software, the eighth generation of our proprietary software platform, embodies our commitment to supporting clinicians in critical decision-making.

Our focus on image quality with this latest software has been on the DWI sequence, which is key in stroke imaging. Since its first FDA clearance in 2020, we’ve been dedicated to continually enhancing image quality and workflow efficiencies to define best-in-class, user-centric, ultra-low field MR brain imaging.”

-Tom Teisseyre PhD, Chief Operating Officer of Hyperfine, Inc.

Several initiatives undertaken by the government for the awareness and treatment of neurological disorders are expected to contribute to market growth. For instance, in 2022, during the World Health Assembly, member countries agreed to follow a new plan called the Intersectoral global action plan on epilepsy and other neurological disorders for the years 2022-2031 (IGAP). This plan aims to focus on neurological disorders, which have not received enough attention before. The plan provides a detailed guide for countries to better prevent, identify early, treat, and help people recover from neurological disorders. IGAP outlines specific goals and steps to make treatment and support more accessible for people with these conditions, promote brain health, improve research and data collection, and use a public health approach to tackle epilepsy and other neurological disorders.

“The Intersectoral Global Action Plan 2022-2031 sets out a roadmap for countries to improve prevention, early identification, treatment and rehabilitation of neurological disorders. To achieve equity and access to quality care, we also need to invest in more research on risks to brain health, improved support for the healthcare workforce, and adequate services,”

-Dévora Kestel, Director, WHO Department of Mental Health and Substance Use.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Technological advancements have significantly transformed the brain imaging market by enhancing imaging outcomes' accuracy, resolution, and speed. Innovations such as artificial intelligence integration, advanced software algorithms, and portable imaging systems have improved diagnostic precision and enabled faster decision-making in clinical settings. These developments have streamlined healthcare professionals' workflows and made brain imaging more accessible, especially in remote or underserved areas. Moreover, the rising incidence of brain disorders has heightened the demand for sophisticated imaging devices, driving continuous research, investment, and product development in the industry.

Major players in the industry are continuously working to improve their product offerings in order to expand their customer base and gain a larger market share. This involves upgrading products, exploring acquisitions, obtaining government approvals, and engaging in strategic partnerships. For instance, in February 2024, Neuro42, Inc.-a company specializing in MRI and robotic solutions for diagnosing and treating brain conditions-received FDA clearance for its compact diagnostic MRI scanner. This breakthrough eliminates the need to transfer patients to specialized imaging suites, enabling immediate diagnosis and improving treatment outcomes for individuals with serious neurological conditions.

Brain imaging technology has undergone significant innovation due to technological advancements, positioning it at the forefront of modern medical diagnostics. For example, in February 2024, Indian company InMed AI launched a new tool that uses artificial intelligence to detect serious brain injuries. The tool, called Neuroshield CT TBI, assists healthcare professionals by identifying and quantifying intracranial hemorrhage, fractures, and midline shifts. It does this by swiftly analyzing brain CT images and notifying doctors of any critical findings.

“Using this solution, patients can be automatically triaged for review by a neurosurgeon, and patients with normal scans can be discharged without the intervention of radiologists or neurosurgeons.”

- Dr. Deepak Agrawal, Professor of Neurosurgery, All India Institute of Medical Sciences Trauma Centre, New Delhi

Manufacturers of brain imaging devices are increasingly engaging in strategic partnerships and collaborative efforts. These strategies aim to enhance technological capabilities, broaden market reach, and maintain competitiveness. For instance, in January 2023, NeuroLogica Corp., a subsidiary of Samsung Electronics Co. Ltd., entered into a collaboration with the University of Dundee in Scotland to conduct research utilizing the OmniTom Elite with Photon Counting Detector (PCD) computed tomography (CT) imaging technology.

“This collaboration with the University of Dundee, a leading research institution, opens the pathway to great synergy for accelerating the pace of innovation. It will advance the clinical research of PCD CT imaging to the next level.”

- Jason Koshnitsky, Senior Director, Global Sales and Marketing, NeuroLogica

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a critical role in guiding the development and deployment of medical brain imaging technologies. Their oversight ensures that devices meet rigorous safety and effectiveness standards.

Securing government approvals is vital for remaining competitive in the market, especially as the demand for neurology-related medical imaging devices continues to grow. For instance, in June 2023, Ezra received FDA approval for its innovative AI-powered technology, Ezra Flash, which aims to enhance brain imaging processes. This technology is specifically designed to improve the quality of magnetic resonance imaging (MRI) scans.

“Our mission at Ezra is to detect cancer early for everyone in the world, and I’m really excited about this new AI enabling us to make our scans more affordable. By boosting quality while reducing scan time, we’re cutting the cost of a full-body MRI by 30% and passing these savings on to our customers.”

- Emi Gal, Founder and CEO, Ezra

The geographical reach of the brain imaging devices industry is expanding at a moderate to high pace, driven by population growth, increased healthcare spending, and evolving regulatory environments. For instance, in March 2024, the Indian division of Wipro GE Healthcare-an established player in medical technology-announced plans to launch 40 new products. This initiative reflects the company’s commitment to manufacturing in India, with the aim of serving both domestic and international markets.

Product Insights

The devices segment dominated the market with the largest revenue share of 81.5% in 2024 due to the increasing demand for advanced diagnostic tools. This segment encompasses devices used for brain imaging and functional scanning, including CT, MRI, MEG, EEG, PET, and other equipment such as sleep monitoring and electromyography devices. Among these, MRI held a significant market share in 2024, primarily due to its capabilities in functional magnetic resonance imaging (fMRI), which detects changes in blood flow and oxygen levels associated with brain activity. This technique utilizes the scanner’s magnetic field to manipulate the magnetic nuclei of hydrogen atoms, enabling their measurement and conversion into detailed images.

Furthermore, the electroencephalography (EEG) devices market is expected to exhibit the fastest CAGR among the device segments from 2024 to 2030. EEG devices record electrical activity in the brain and assist in diagnosing conditions such as epilepsy and sleep disorders. They are also increasingly used in neurofeedback therapies and brain-computer interfaces. Technological advancements in EEG devices are propelling the segment’s growth. Modern EEG systems are becoming more advanced, offering higher resolution, improved portability, and user-friendly interfaces. The integration of artificial intelligence (AI) and machine learning (ML) into EEG analysis is transforming the landscape of neurological research and clinical diagnostics.

AI algorithms can process and interpret complex EEG data more quickly and accurately than traditional methods. This capability enhances the diagnostic process for conditions like epilepsy, enabling faster and more precise detection of seizures. Moreover, AI-driven EEG analysis opens new possibilities for personalized medicine, where treatments can be tailored to an individual’s unique brain activity patterns. For example, in April 2024, a team from the Creativity Research Lab at Drexel University developed an artificial intelligence method capable of accurately estimating a person's brain age using EEG scans. This innovation could support early and frequent screenings for neurodegenerative conditions. The findings were published in the journal Frontiers in Neuroergonomics.

“Brain MRIs are expensive, and until now, brain-age estimation has only been done in neuroscience research laboratories. But my colleagues and I have developed a machine-learning technology to estimate a person's brain age using a low-cost EEG system. It can be used as a relatively inexpensive way to screen large numbers of people for vulnerability to age-related conditions. And because of its low cost, a person can be screened at regular intervals to monitor changes over time. This can help assess the effectiveness of medications and other interventions. Even healthy individuals could use this technique to evaluate the impact of lifestyle changes as part of an overall strategy for optimizing brain performance.”

- John Kounios, Ph.D., Professor, Drexel University College of Arts and Sciences, and Director of the Creativity Research Lab

The accessories segment is anticipated to be the fastest-growing segment with a CAGR of 9.2% from 2025 to 2030, owing to advancements in imaging modalities, the increasing demand for precise brain scans, and greater awareness of neurological disorders that require comprehensive diagnosis and monitoring. Essential components within this segment-such as electrodes, sensors, MRI machine coils, cables, batteries, and contrast agents-are enhancing image clarity and are expected to complement primary imaging devices. Ongoing advancements and innovations in these accessories are significant factors in improving the overall effectiveness and efficiency of brain imaging techniques, thereby driving the growth of this segment.

Application Insights

The brain tumor segment held the largest revenue share in 2024, attributed to the increasing prevalence of the condition. As brain tumor cases become more common, there is a growing demand for advanced imaging techniques to detect and monitor these tumors accurately. Consequently, the market for brain imaging technologies, particularly those specialized in tumor detection, is expected to experience significant growth. For instance, according to the International Agency for Research on Cancer, there were approximately 321,731 cases of brain and central nervous system cancer globally in 2022. It was reported that this type of cancer ranked 19th among all cancer types.

The epilepsy segment is expected to grow at the fastest CAGR during the forecast period. Advances in imaging technologies have improved the ability to identify and diagnose epilepsy-related anomalies in the brain, driving demand for specialized imaging equipment. Furthermore, increasing awareness of epilepsy and its neurological implications has led to a greater focus on early detection and intervention, contributing to market expansion. In addition, ongoing research and development efforts to improve imaging modalities for epilepsy diagnosis and monitoring are fostering innovation in the market and creating broader opportunities for industry participants. For instance, in September 2022, researchers at the Indian Institute of Science (IISc), in collaboration with AIIMS Rishikesh, announced the development of an algorithm capable of analyzing brain scans to detect the occurrence and type of epilepsy.

Modality Insights

The fixed segment dominated the brain imaging devices industry with the largest revenue share in 2024. Fixed imaging devices provide high-resolution images of the brain, facilitating precise diagnosis and treatment planning for various brain disorders. Commonly available in imaging centers, hospitals, and diagnostic facilities, these devices offer accessibility to both healthcare professionals and patients seeking accurate neurological assessments. Moreover, they often integrate advanced features such as multi-modal imaging and specialized software, which enhance diagnostic accuracy and adaptability. In addition, the rising incidence of neurological conditions has fueled the demand for effective brain imaging solutions, thereby contributing to the growth of the fixed imaging devices segment.

The portable segment is anticipated to be the fastest-growing segment from 2025 to 2030. These devices offer several advantages over traditional fixed systems due to their mobility and flexibility, enabling healthcare professionals to perform brain imaging procedures conveniently in a variety of settings, including clinics, ambulances, and remote locations. This portability enhances access to imaging services, especially in regions with limited healthcare infrastructure or during emergencies when rapid diagnosis is essential. Key drivers of growth in this segment include the increasing prevalence of neurological disorders, the need for early and accessible diagnosis, advancements in wearable technologies, and growing interest in brain-computer interfaces (BCIs). In addition, the demand for real-time monitoring of brain health in everyday environments is significantly accelerating market expansion. Emerging players are actively involved in the research and development of new and innovative brain imaging devices to remain competitive. For instance, in September 2023, EMVision was recognized as the top innovator in the health category of the 2023 AFR BOSS Most Innovative Companies list-a testament to their groundbreaking contributions to healthcare innovation. EMVision's standout achievement is its revolutionary portable brain-scanning device, designed to utilize advanced imaging technologies for rapid, non-invasive assessment of brain health and function. The device operates on the principle of electromagnetic imaging, using a combination of techniques to produce detailed images of the brain’s structure and activity.

End Use Insights

The hospital segment held the largest revenue share in 2024. Hospitals play a crucial role in diagnosing and treating neurological disorders, often requiring advanced brain imaging technologies. These facilities typically have financial resources to invest in cutting-edge equipment, enabling them to deliver comprehensive diagnostic services to patients. In addition, hospitals employ multidisciplinary teams of specialists-such as neurologists, neurosurgeons, and radiologists-who collaborate to ensure accurate diagnoses and effective treatment strategies. The growing global prevalence of neurological conditions is further expected to drive the demand for brain imaging devices in hospitals, highlighting the importance of precise and timely diagnostics in managing these disorders.

The diagnostic imaging centers segment is expected to grow at the fastest CAGR during the forecast period. With increasing awareness of the importance of early diagnosis and treatment for brain-related conditions, there is a growing reliance on these centers for their specialized equipment and expertise. Moreover, diagnostic centers are quick to adopt the latest advancements in imaging technology to maintain high diagnostic accuracy and efficiency. For instance, in March 2024, Fujifilm India announced the installation of its innovative open MRI machine, APERTO Lucent, at the Vijaya Diagnostic Centre in Hyderabad. The convenience and accessibility offered by these centers are also contributing to their rising adoption among patients.

Regional Insights

North America brain imaging devices market dominated the global market with the largest revenue share of 39.2% in 2024. Technological advancements in brain imaging devices, such as high-resolution MRI, PET scans, and functional MRI, significantly enhance diagnostic capabilities, fueling market growth in North America. These innovations are improving the accuracy and speed of detecting neurological disorders. Furthermore, the rising prevalence of conditions, particularly Alzheimer’s, Parkinson’s, and stroke, is driving increased demand for early and accurate diagnostic tools. Healthcare providers are increasingly adopting these advanced imaging solutions to support better treatment planning and monitoring, further boosting the growth of the brain imaging devices industry in the region.

Factors such as advanced healthcare infrastructure and substantial medical research and technology investments fuel market growth. This infrastructure supports the adoption of cutting-edge brain imaging technologies. In addition, North America is home to numerous medical device manufacturers and neuroscience research institutions. These organizations drive innovation and advancements in brain imaging devices, contributing to the market expansion in this region.

U.S. Brain Imaging Devices Market Trends

The U.S. brain imaging devices market held the largest share of the regional market in 2024, owing to the growing focus on early detection of neurological disorders. Early diagnosis enables more effective treatment and better patient outcomes, prompting increased adoption of advanced imaging technologies. Moreover, the trend toward developing portable and compact brain imaging devices is enhancing accessibility and convenience, making it easier to perform diagnostics in various settings, including remote areas and point-of-care locations. These innovations are improving healthcare delivery and fueling the overall market growth in the U.S.

The growth can also be attributed to major market players in this country, such as GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips N.V. Furthermore, various initiatives adopted by key players in the market are expected to contribute to market growth. For instance, in January 2024, Siemens Healthineers announced the FDA approval of the MAGNETOM Cima.X 3 Tesla (3T) magnetic resonance imaging scanner.

Europe Brain Imaging Devices Market Trends

The European brain imaging devices market is anticipated to witness significant expansion over the forecast period. Integrating AI and machine learning technologies into brain imaging devices is set to drive the regional market by enhancing diagnostic accuracy, efficiency, and treatment planning. These technologies enable more precise identification of neurological disorders, such as brain tumors, Alzheimer's, and stroke. Furthermore, the shift toward personalized medicine is fueling demand for advanced imaging solutions that cater to individual patient needs. AI-driven algorithms can analyze vast datasets to provide tailored treatment options, improving patient outcomes and driving the growth of the brain imaging devices industry in Europe.

The increasing prevalence of brain disorders in Europe, coupled with growing awareness of the importance of early diagnosis and intervention, is driving the demand for brain imaging devices. This demand is further accelerated by favorable reimbursement policies and government initiatives to improve access to advanced medical technologies. For instance, the Human Brain Project (HBP) was a collaborative effort spanning multiple European nations, aimed at advancing the fields of neuroscience and medicine and striving to develop brain-inspired information technology.

The brain imaging devices market in the UK is expected to grow due to technological advancements, which have led to the development of more precise and efficient imaging devices. Healthcare facilities are increasingly adopting these devices, and the country's growing research and development (R&D) activities are further expected to boost market growth. In February 2024, Cerca Magnetics, a spin-out company from the University of Nottingham, received USD 2.15 million in funding. This funding is part of a larger investment of USD 48.37 million by the government in the UK's quantum sector, aimed at supporting research in wearable brain imaging technology, with a specific focus on the early detection of dementia.

The brain imaging devices market in France is expected to grow from 2024 to 2030 due to the increasing cases of brain cancer, necessitating the use of brain imaging devices. For instance, according to the International Agency for Cancer Research, in 2022, brain and central nervous system cancers accounted for 41 cases, a number that is estimated to rise to 164 cases by 2027.

Germany's brain imaging devices market is also expected to grow from 2024 to 2030. This can be attributed to the rapid aging of the population, which increases the prevalence of brain disorders such as Alzheimer's disease. In addition, the country’s well-developed healthcare system, highly skilled workforce, and substantial healthcare spending contribute to this growth.

Asia Pacific Brain Imaging Devices Market Trends

Asia Pacific brain imaging devices market is expected to be the fastest-growing region with a CAGR of 9.4% from 2025 to 2030, propelled by rising healthcare investments and the growing aging population. Increased funding for healthcare infrastructure enhances access to advanced diagnostic technologies. At the same time, the aging population’s susceptibility to neurological conditions such as Alzheimer’s and stroke boosts the demand for accurate imaging solutions. These demographic shifts, coupled with innovations in medical technology, create a favorable environment for the market's growth, fostering the development of more advanced and accessible brain imaging devices across the region.

The increasing prevalence of brain-related disorders and ailments in countries across the Asia Pacific region is driving the demand for advanced diagnostic technologies. Conditions such as Alzheimer's disease, Parkinson's disease, and stroke are becoming more prevalent due to factors such as aging populations, lifestyle changes, and improved disease awareness. Thus, there is a growing need for accurate and timely diagnosis, which brain imaging devices can provide.

Japan Brain Imaging Devices Market Trends

Japan brain imaging devices market is projected to grow at the fastest CAGR in the regional market during the forecast period, attributed to the country's focus on technological advancement and the widespread adoption of advanced solutions. For instance, in November 2023, RapidAI, a healthcare technology firm specializing in imaging analysis software, announced its achievement of Class III Shonin clearance in Japan. Along with this regulatory milestone, RapidAI introduced a hybrid technology platform named Rapid Edge Cloud and a non-contrast CT solution for stroke identification within the Japanese market.

Latin America Brain Imaging Devices Market Trends

The brain imaging devices in the Latin American market are anticipated to undergo moderate growth throughout the forecast period. This is owing to the growing awareness and recognition of the importance of early detection and diagnosis of brain-related conditions among healthcare professionals and the general population. This increased awareness is driving the demand for advanced diagnostic technologies, including brain imaging and monitoring devices, to help timely identify and treat such conditions.

MEA Brain Imaging Devices Market Trends

The brain imaging devices market in MEA is anticipated to grow in the coming years. There is a rising prevalence of brain disorders across various countries in the MEA region. Factors such as aging populations, changing lifestyles, and increased awareness of mental health issues contribute to the increasing incidence of these conditions. As a result, there is a growing demand for early detection and treatment of brain disorders. Thus, boosting the brain imaging devices market growth.

Key Companies & Market Share Insights

Some of the key companies in the brain imaging devices industry include GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; Medtronic; and Canon Medical Systems Corporation.

-

Siemens Healthineers AG offers advanced medical technologies, including diagnostic imaging, laboratory diagnostics, and molecular medicine. The company provides solutions for healthcare providers to enhance patient care, improve efficiency, and drive innovation in medical treatments.

-

Medtronic provides a wide range of medical devices and therapies, including solutions for cardiovascular, diabetes, neurology, and surgical procedures. The company focuses on improving patient outcomes through innovative technologies and advanced healthcare solutions worldwide.

Key Brain Imaging Devices Companies:

The following are the leading companies in the brain imaging devices market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Medtronic

- Compumedics Limited

- MEGIN

- CTF MEG NEURO INNOVATIONS, INC

- FieldLine Inc

- Cerca Magnetics Limited

- Advanced Brain Monitoring, Inc.

- CANON MEDICAL SYSTEMS CORPORATION

- Natus

- Magstim EGI

- Cadwell Industries Inc.

- Nihon Kohden Corporation

- NeuroLogica Corp.

Recent Developments

-

In March 2024, Neurophet, a company specializing in AI solutions for brain disorders, participated in the AD/PD 2024, an international event focusing on Alzheimer's, Parkinson's, and related neurological diseases. At this event, Neurophet unveils technologies aimed at treating Alzheimer's disease, including tools for analyzing side effects and predicting amyloid positivity, which are nearing commercialization.

-

In March 2024, FUJIFILM India launched the Echelon Synergy MRI Machine during its CT & MRI User Conclave. Representing a significant advancement in healthcare technology, the Echelon Synergy offers unmatched performance, rapid examination times, energy efficiency, and affordability.

-

In February 2024, Philips, in collaboration with Synthetic MR, launched Smart Quant Neuro 3D for diagnosing and evaluating therapy effectiveness for brain disorders such as multiple sclerosis (MS), traumatic brain injury (TBI), and dementia. The Smart Quant Neuro 3D technology offers automated measurement of different brain tissues, decision-making support for brain diseases, tracking progression, and evaluating therapy outcomes.

Brain Imaging Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.08 billion

Revenue forecast in 2030

USD 9.03 billion

Growth Rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, modality, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; Medtronic; Compumedics Limited; MEGIN; CTF MEG NEURO INNOVATIONS, INC.; FieldLine Inc.; Cerca Magnetics Limited; Advanced Brain Monitoring, Inc.; Canon Medical Systems Corporation; Natus; Magstim EGI; Cadwell Industries Inc.; Nihon Kohden Corporation; and NeuroLogica Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brain Imaging Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global brain imaging devices market report on the basis of product, application, modality, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Devices

-

EEG

-

MEG

-

MRI

-

CT

-

PET

-

Other Devices

-

-

Accessories

-

Electrodes

-

Sensors

-

Other Accessories

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Stroke

-

Brain Tumor

-

Traumatic Brain Injury (TBI)

-

Epilepsy

-

Sleep Apnea

-

Headache

-

Structural Anomalies

-

Other Applications

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Portable

-

Wearable

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Diagnostic Imaging Centers

-

Ambulatory Surgery Centers

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global brain imaging devices market size was estimated at USD 5.26 billion in 2023 and is expected to reach USD 5.65 billion in 2024.

b. The global brain imaging devices market is expected to grow at a compound annual growth rate of 8.14% from 2024 to 2030 to reach USD 9.04 billion by 2030.

b. The brain tumor segment dominated the brain imaging devices market with a share of 23.38% in 2023. This is attributable to the increasing prevalence of this condition.

b. Some key players operating in the brain imaging devices market include GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; Medtronic; Compumedics Limited ; MEGIN; CTF MEG NEURO INNOVATIONS, INC; FieldLine Inc; Cerca Magnetics Limited; Advanced Brain Monitoring, Inc.; Canon Medical Systems Corporation; Natus; Magstim EGI; Cadwell; Nihon Kohden Corporation; NeuroLogica Corp.

b. Key factors that are driving the brain imaging devices market growth include technological advancements, increase in R&D activities, the rising awareness of neurodegenerative diseases, and growing incidence of brain or neurological disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.