Brazil Palm Oil Market Size & Trends

The Brazil palm oil market size was valued at USD 709.3 million in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2030, due to its cost-effectiveness and increasing consumer demand for ethically sourced products. Palm oil is a versatile, affordable, and high-yielding vegetable oil, making it a popular choice for manufacturers. Consumers are becoming more conscious of sustainability and ethical sourcing, encouraging companies to adopt responsible practices. As Brazil responds to these consumer preferences with sustainable palm oil production, the market is witnessing growth, balancing affordability with environmental and social considerations. The rising demand for biofuels and the expanding food industry are anticipated to propel the market growth.

As biofuels gain prominence in sustainable energy production, palm oil, being a versatile and efficient source, is increasingly sought after for biodiesel production. In addition, the food industry, particularly processed foods segment, relies heavily on palm oil due to its stability and cost-effectiveness. This combination of biofuel demand and the expanding food industry is expected to increase palm oil consumption, thereby favoring market growth in the coming years.

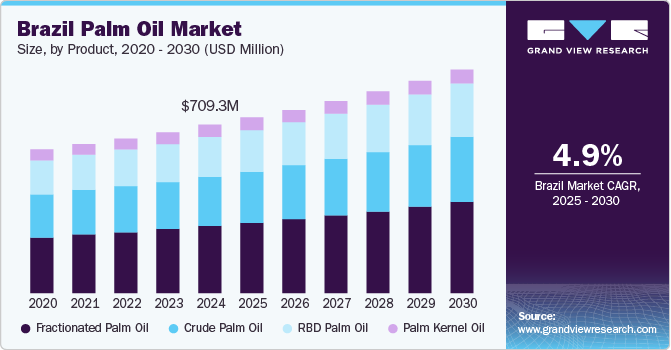

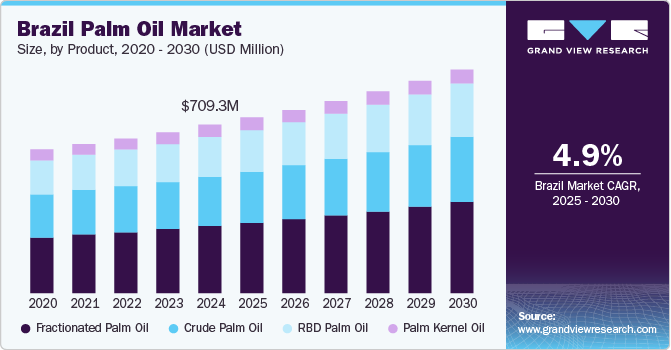

Product Insights

The fractionated palm oil segment dominated the market with the largest revenue share of 40.0% in 2024, fueled by its versatile application scope across various industries, particularly in food processing, cosmetics, and biofuels. Its ability to be customized by separating saturated and unsaturated fats has made it highly desirable for manufacturers seeking specific functional properties. Besides, burgeoning demand for healthier alternatives, cost-effectiveness, and longer shelf life has further boosted its popularity in the Brazil palm oil industry. The increasing use of fractionated palm oil in both local and international markets has significantly contributed to its prominent position in Brazil palm oil market.

The crude palm oil (CPO) segment is expected to emerge as the fastest-growing segment and is projected to grow at a CAGR of 4.7% over the forecast period, attributed to escalating demand for edible oils and biodiesel. As the country aims to diversify its agricultural exports, the cost-effectiveness and high yield per hectare of CPO make it a highly competitive choice. Also, the global shift toward renewable energy sources is fueling the demand for palm-based biodiesel, thereby enhancing the market potential of CPO.

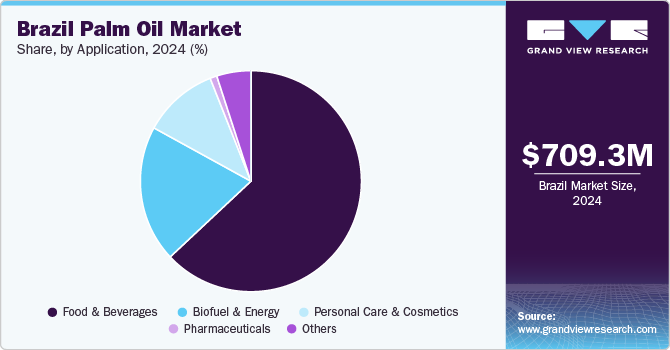

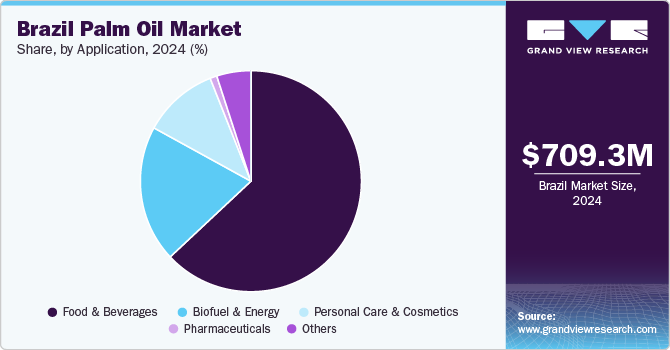

Application Insights

The food & beverage segment held the largest share of 63.2% in 2024, owing to its widespread use in cooking oils, processed foods, and snacks. The affordability, versatility, and long shelf life of palm oil make it a preferred choice for food manufacturers. The growing demand for packaged and convenience foods, coupled with cost-effectiveness of palm oil compared to other vegetable oils, has further strengthened its position in this segment. In addition, the stability of palm oil at high cooking temperatures makes it an ideal choice for frying and baking in the dynamic food industry across Brazil.

The biofuel & energy segment is anticipated to be the fastest-growing segment and capture a CAGR of 5.3% during the forecast period, driven by increasing demand for sustainable energy solutions. As Brazil works to reduce its carbon footprint, the high yield of palm oil makes it an attractive feedstock for biodiesel production. The push for renewable energy sources in the country, along with favorable government policies promoting biofuels, is driving this shift in the Brazil palm oil industry. With the efficiency of palm oil in producing biofuels compared to other crops, the segment is expected to record significant growth in the coming years, supporting both energy sustainability and economic development.

Key Brazil Palm Oil Company Insights

Some of the key companies in the Brazil palm oil industry include Archer Daniels Midland Company; BELEM BIOENERGIA BRASIL S.A.; AgroPalma; BIOPALMA; Denpasa; Marborges Agroindústria SA; Grupo BBF (Brasil Biofuels); Cargill; Kellogg (Kellanova); General Mills Inc.

-

Archer Daniels Midland Company (ADM) offers a wide range of agricultural products and services, including palm oil, biofuels, and food ingredients, with a focus on sustainability and innovation.

-

AgroPalma, a leading Brazilian palm oil producer, specializes in sustainable palm oil production. It offers high-quality palm oil for food, biofuel, and industrial applications while prioritizing environmental responsibility and social development.

Key Brazil Palm Oil Companies:

- Archer Daniels Midland Company

- BELEM BIOENERGIA BRASIL S.A.

- AgroPalma

- BIOPALMA

- Denpasa

- Marborges Agroindústria SA

- Grupo BBF (Brasil Biofuels)

- Cargill

- Kellogg (Kellanova)

- General Mills Inc.

Recent Developments

-

In November 2024, Agropalma, a leader in sustainable palm oil production, announced plans to boost investments in research and innovation, aiming to modernize agricultural practices and enhance productivity. The company projects production of 2 million clonal palm seedlings annually, starting 2026.

-

In May 2024, Pará officially started monitoring oil palm production, implementing new regulations to oversee the commercialization of palm oil in the state, aiming to ensure sustainable practices and better management of the industry.

Brazil Palm Oil Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 740.0 million

|

|

Revenue forecast in 2030

|

USD 940.7 million

|

|

Growth rate

|

CAGR of 4.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2024

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application

|

|

Key companies profiled

|

Archer Daniels Midland Company; BELEM BIOENERGIA BRASIL S.A.; AgroPalma; BIOPALMA; Denpasa; Marborges Agroindústria SA; Grupo BBF (Brasil Biofuels); Cargill; Kellogg (Kellanova); General Mills Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Brazil Palm Oil Market Report Segmentation

This report forecasts revenue and volume growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Brazil palm oil market report based on product type, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Crude Palm Oil

-

Palm Kernel Oil

-

RBD Palm Oil

-

Fractionated Palm Oil

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)