Market Size & Trends

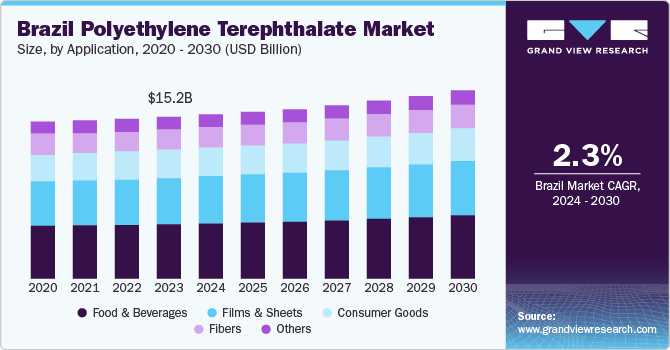

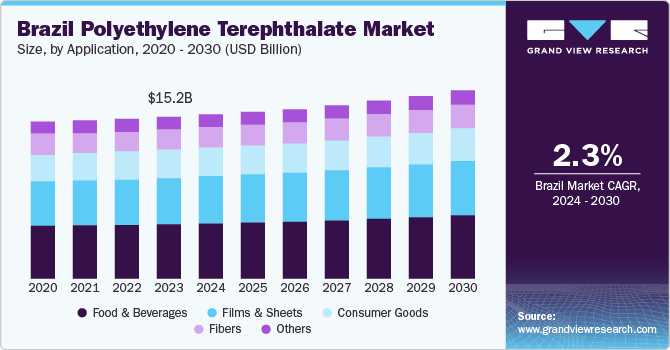

The Brazil polyethylene terephthalate market size was valued at USD 15.2 billion in 2023 and is projected to grow at a CAGR of 2.3% from 2024 to 2030. This growth is driven by the increasing demand for PET in the packaging industry, particularly for beverages and food products. PET’s properties, such as its lightweight nature, durability, and recyclability, make it an attractive choice for manufacturers aiming to reduce transportation costs and environmental impact. In addition, the rising consumer preference for sustainable and eco-friendly packaging solutions is boosting the adoption of polyethylene terephthalate (PET).

Technological advancements in PET production and recycling processes enhance the market's growth prospects. Innovations such as improved polymerization techniques and more efficient recycling methods make PET production more cost-effective and environmentally friendly. These advancements are reducing the carbon footprint associated with PET manufacturing and increasing the overall quality and performance of polyethylene terephthalate (PET) products.

Moreover, Brazil's expanding middle-class population and rapid urbanization are significantly impacting the market. As more people move to urban areas, the demand for convenient and packaged goods rises. This shift is driven by changing lifestyles and increased disposable incomes, leading to higher consumption of beverages, food products, and other consumer goods that utilize PET packaging.

Application Insights

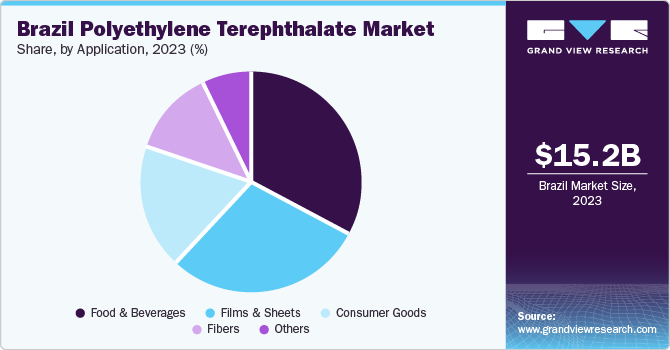

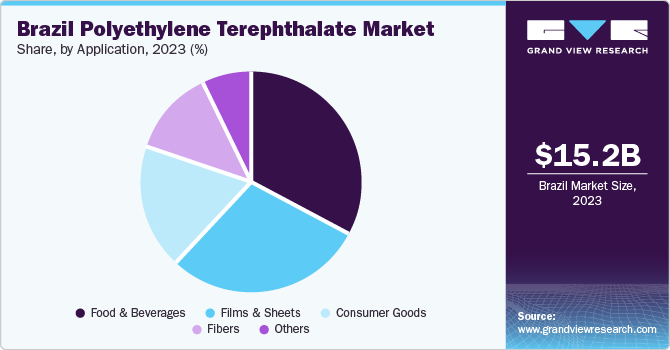

The food & beverages segment accounted for 33.1% revenue share in 2023 due to PET’s favorable properties, such as its excellent barrier characteristics, which help preserve the freshness and quality of food and beverages. polyethylene terephthalate (PET) is widely used in producing bottles for water, soft drinks, juices, and other beverages, as well as in packaging for various food products. The material’s lightweight nature and durability make it an ideal choice for manufacturers looking to reduce transportation costs and improve product shelf life. Additionally, the growing consumer preference for convenient and on-the-go food and beverage options further propels the demand for PET packaging. The increasing awareness and demand for sustainable packaging solutions also encourage manufacturers to adopt PET.

The films & sheets segment is expected to grow at a CAGR of 2.4% from 2024 to 2030 attributed to the extensive use of PET films and sheets in various industries, including packaging, electronics, and automotive. PET films are used for flexible packaging, labels, and protective coverings in the packaging industry, providing a strong barrier against moisture and gases. Due to their stability and durability, the electronics industry utilizes PET films for insulation and as a substrate for flexible printed circuits. In the automotive sector, polyethylene terephthalate (PET) sheets are used in interior and exterior components, offering high strength and resistance to impact and weathering.

Key Brazil Polyethylene Terephthalate Company Insights

Some key companies in the Brazil polyethylene terephthalate (PET) market include Universal Polychem (India) Pvt. Ltd., Indorama Ventures Public Company Limited, Four Seasons FZE, and others. Organizations prioritize expanding their clientele to obtain a competitive advantage within the sector. As a result, major players are implementing various strategic measures, including mergers, acquisitions, and collaborations with other key firms.

-

Indorama Ventures Public Company Limited has made substantial investments to enhance its PET recycling capacity in Brazil. In 2023, Indorama Ventures completed the expansion of its recycling facility in Juiz de Fora, Minas Gerais, increasing its production capacity almost three times for PET made from post-consumer recycled material.

-

Four Seasons is involved in the production and distribution of PET products, catering to various applications such as packaging and consumer goods. Four Seasons focuses on leveraging advanced manufacturing techniques to produce high-quality PET that meets the stringent requirements of the food and beverage industry.

Key Brazil Polyethylene Terephthalate Companies:

- Universal Polychem (India) Pvt. Ltd.

- Indorama Ventures Public Company Limited

- Four Seasons FZE

- AKRO-PLASTIC GmbH

- BASF

- LAVERGNE, Inc.

- Amcor plc

- PLASTICOS VOLOSCHIN

- SABIC

- DuPont

- Eastman Chemical Company

Recent Developments

-

In May 2024, the Administrative Council for Economic Defense (CADE) referred the Oben Group's proposed acquisition of Terphane to its Tribunal for further review. Terphane, a producer of biaxially oriented polyethylene terephthalate (boPET) films, is part of the Tredegar group operating in Brazil and the U.S. The Oben Group is a Peruvian company that has international operations in the boPET market. CADE is reviewing a potential horizontal overlap in the boPET market, both domestically and internationally.

-

In August 2023, Indorama Ventures successfully expanded its PET recycling capacity in Brazil, increasing production to 25 thousand tons annually. The expansion, funded by a Blue Loan from the International Finance Corporation, is part of the company's broader sustainability goals, aiming to recycle 50 billion PET bottles by 2025.

-

In October 2022, Packem introduced a new line of sustainable, flexible containers (big bags) for transporting and packaging bulk materials, including grains and ores. These containers are constructed from PET resin, a recyclable material that offers a more environmentally friendly alternative to traditional polypropylene resin. Packem inaugurated a state-of-the-art manufacturing facility in Santa Catarina to support this product launch.

Brazil Polyethylene Terephthalate Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 15.4 billion

|

|

Revenue forecast in 2030

|

USD 17.7 billion

|

|

Growth Rate

|

CAGR of 2.3% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, country

|

|

Key companies profiled

|

Universal Polychem (India) Pvt. Ltd.; Indorama Ventures Public Company Limited; Four Seasons FZE; AKRO-PLASTIC GmbH; BASF; LAVERGNE, Inc; Amcor plc; PLASTICOS VOLOSCHIN; SABIC; DuPont; Eastman Chemical Company

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Brazil Polyethylene Terephthalate Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Brazil polyethylene terephthalate market report based on application and country: