- Home

- »

- Pharmaceuticals

- »

-

Brazil Sports Nutrition Market Size, Industry Report, 2030GVR Report cover

![Brazil Sports Nutrition Market Size, Share & Trends Report]()

Brazil Sports Nutrition Market Size, Share & Trends Analysis Report By Product, By Application, By Formulation, By Consumer Groups, By Consumers, By Distribution Channel, By End Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-912-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Brazil Sports Nutrition Market Size & Trends

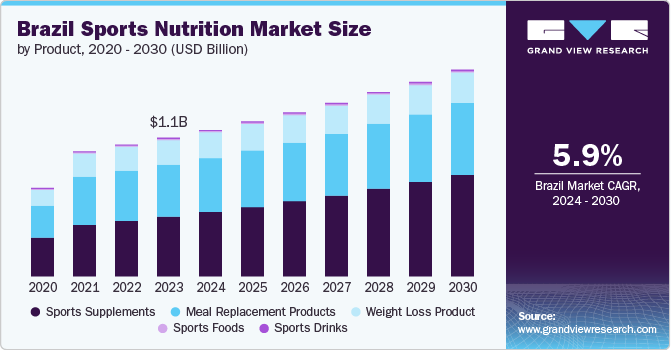

The Brazil sports nutrition market size was valued at USD 1.05 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. There is a growing prevalence of various lifestyle diseases such as diabetes, cardiovascular diseases, and obesity in Brazil. For instance, according to the International Diabetes Federation, 19.2 million people in Brazil are estimated to suffer from diabetes by 2030. This drives the increased demand for advanced sports nutrition solutions in the country.

Growing awareness regarding lifestyle diseases and the increasing popularity of preventive medications are increasing the adoption of sports nutrition products. Moreover, a growing number of active lifestyle users adopting sports nutrition products for various applications such as energy and weight management is boosting the market growth potential. Multiple products including gels, bars, RTD drinks, and gummies are easily available for various applications such as pre-workout, post-workout, and during work-out. This, in turn, is driving the adoption of these products.

The demand for sports nutrition products has significantly increased with increasing numbers of people engaging in fitness and wellness activities. Athletes, fitness enthusiasts, and health-conscious individuals seek products that help in performance enhancement, quick muscle recovery, and overall well-being. Consumers are becoming more conscious of their dietary choices. The rising adoption of specialized nutrition products, such as protein supplements, sports food, and sports drinks, is projected to fuel the market expansion.

Product Type Insights

Sports supplements held the largest market revenue share of 43.5% in 2023. The high demand for whey proteins is a major parameter fueling the segment growth. Moreover, the increasing popularity of plant-based protein supplements such as soy protein, rice protein, and pea protein supplements is estimated to boost segment growth in the coming years. The adoption of supplements such as vitamins, minerals, and proteins to enhance immunity and maintain health by athletes and active lifestyle users is positively impacting segment growth.

The sports foods segment is projected to grow at a significant CAGR over the forecast period. The availability of a considerable number of sports foods such as bars, waffles, and gels is fueling the segment's growth. Additionally, the increasing consumption of protein bars and energy bars as healthy snacking options is fueling the segment's growth. Manufacturers are introducing sports foods in innovative flavors to increase consumer demand and product market penetration.

Application Insights

The post-workout segment held the largest market revenue share in 2023. This is attributed to the growing awareness regarding the benefits of post-workout supplements such as increased muscle recovery and rehydration. High consumption of post-workout supplements by athletes and gym-goers is fueling the segment's growth. Additionally, the availability of multiple post-workout products that are plant-based is estimated to drive the segment in the forecast period.

Pre-Workout Segment is projected to grow with a significant CAGR over the forecast period. The demand for pre-workout supplements is on the rise, primarily driven by a growing fitness culture and an increasing number of health-conscious consumers. As more people exercise regularly, pre-workout supplements are gaining popularity for boosting energy, enhancing endurance, and improving focus. Additionally, expanding gyms and fitness centers nationwide has expanded access to fitness resources and supplements, further fueling demand.

Formulation Insights

The powder segment held the largest market revenue share in 2023. Powders offer convenience and versatility, allowing consumers to easily customize their intake by mixing different liquids or foods. This adaptability mainly benefits athletes and fitness enthusiasts who require specific nutrient profiles. Moreover, the growing number of gyms and fitness centers in Brazil is driving demand for easily transportable and quick-to-prepare nutrition options, further bolstering the popularity of powder formulations.

The gummies segment is expected to emerge as the fastest-growing formulation segment during the forecast period. The availability of healthy gummies in several flavors is supporting the market growth. Additionally, many consumers are suffering from pill fatigue. Such consumers are looking for alternatives such as gummies, thereby fueling the segment's growth. Gummies provide a convenient alternative to traditional pills and capsules, leading to their increased consumption by consumers who struggle with swallowing tablets. Their chewable nature improves compliance among consumers, particularly children and old age people.

Consumer Group Insights

The adult segment held the largest market revenue share in 2023. This is due to the presence of a large consumer group in this pool. Additionally, increasing health awareness and growing instances of lifestyle disorders are fueling the segment's growth. The increasing consumer base for sports nutrition products from athletes and bodybuilders to active lifestyle users. Increasing participation in fitness activities and the adoption of a healthy lifestyle are estimated to fuel the segment's growth in the coming years. Moreover, the increasing adoption of weight management products by adults is fueling the segment growth.

The children segment is projected to grow with a significant CAGR over the forecast period. As awareness grows about the benefits of physical fitness and a nutritious diet, parents are increasingly looking to support their children's active lifestyles with appropriate supplements. The proliferation of organized sports and recreational activities for young people has heightened the need for products to enhance performance, stamina, and recovery. Additionally, marketing campaigns effectively target parents, highlighting the importance of proper nutrition in supporting their children's growth and athletic endeavors.

Consumer Insights

The light user segment dominated the market in 2023. An increasing number of millennials are consuming protein bars, energy bars, and RTD drinks, among others, as a healthy snacking option. Moreover, consumers are consuming supplements containing vitamins, minerals, probiotics, and omega-3 fatty acids to maintain health and wellness. All these parameters are fostering segment growth. The high demand for supplements from millennials and the geriatric population to enhance energy and weight management is bolstering the segment growth.

The heavy user segment is projected to grow with a significant CAGR over the forecast period. As more people engage in intensive physical activities, such as bodybuilding, weightlifting, and competitive sports, there is an increased need for specialized nutrition products that support their rigorous training regimens. This demographic often seeks high-quality protein supplements, amino acids, and performance enhancers to maximize muscle gain, improve endurance, and accelerate recovery. The growing accessibility and variety of these products and an expanding base of fitness-focused consumers are key factors driving the demand among heavy users in Brazil.

Distribution Channel Insights

The brick and mortar segment accounted for the largest market revenue share in 2023. The presence of a considerable number of retail outlets including specialty stores, small retail stores, fitness institutes, grocery stores, general discount stores, and discount clothing retailers is responsible for the largest market share. Brick and mortar stores offer benefits such as customer loyalty programs and customer engagement platforms. Moreover, multiple brick-and-mortar stores offer guidance and counseling on supplement consumption. This, in turn, is increasing consumer preference for brick and mortar stores.

E-commerce segment is projected to grow with the fastest CAGR over the forecast period. The rising number of smartphone usage along with the growing network industry is driving the segments growth. E-commerce platforms provides the convenience of purchasing products from anywhere and at any time. The fast delivery services provided by e-commerce websites is attracting consumers to purchase products online including health supplements. E-commerce website often provide offers and discounts that attracts consumers.

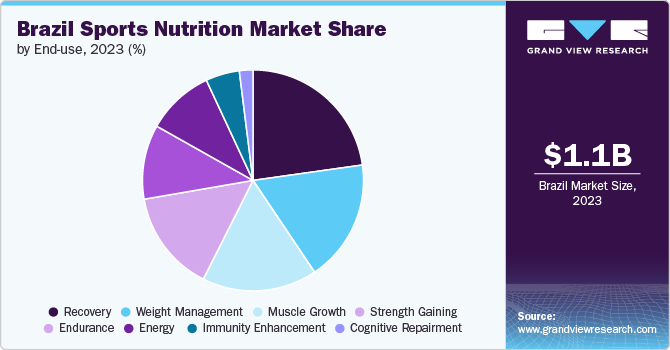

End-use Insights

The recovery segment accounted for the largest revenue share in 2023. It is attributed to the growing awareness and adoption of recovery foods and drinks after workouts and increasing spending on supplements. Furthermore, the easy availability of recovery supplements in various formulations and flavors is supporting the market growth. Moreover, the high demand for post-workout supplements is supporting the recovery supplements growth.

Endurance segment is anticipated to witness the fastest CAGR over the forecast period. Increasing participation in endurance sports is supporting segment growth. Some of the ingredients used in endurance supplements include caffeine, creatinine, beta-alanine, L-carnitine, branched chained amino acids, glutamine, and citrulline. Moreover, botanical ingredients such as beet juice and ashwagandha are gaining traction due to their endurance benefits.

Key Brazil Sports Nutrition Company Insights

Some of the key companies in the Brazil sports nutrition market include

-

Abbott provides a range of products designed to support athletes and fitness enthusiasts. Their Ensure provides balanced nutrition for muscle health and energy, and Pedialyte, delivers rapid rehydration and electrolyte replenishment. Additionally, EAS Myoplex supports muscle recovery and growth, and the Libre Sense Glucose Sport Biosensor helps athletes monitor glucose levels to optimize performance.

-

Glanbia with its wide range of products including Optimum Nutrition, SlimFast, BSN, Isopure, and Body&Fit. These brands provide high-quality protein powders, meal replacements, workout supplements, and more, catering to the needs of athletes and fitness enthusiasts. These products help individuals achieve their performance and healthy lifestyle goals.

Key Brazil Sports Nutrition Companies:

- Abbott

- PepsiCo

- The Coca-Cola Company

- MusclePharm

- Glanbia PLC

- Integralmédica Suplementos Nutricionais S/A

- Max Titanium

- Universal Nutrition

- Probiótica Laboratories Ltda.

Brazil Sports Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.10 billion

Revenue forecast in 2030

USD 1.56 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, formulation, consumer group, consumers, distribution channel, end use

Country scope

Brazil

Key companies profiled

Abbott; PepsiCo; The Coca-Cola Company; MusclePharm; Glanbia PLC; Integralmédica Suplementos Nutricionais S/A; Max Titanium; Universal Nutrition; Probiótica Laboratories Ltda.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Brazil Sports Nutrition Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Brazil Sports Nutrition market report based on product, application, formulation, consumer group, consumers, distribution channel, and end use.

-

Brazil Sports Nutrition Market Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Supplements

-

Protein Supplements

-

Animal- Based

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Plant-Based

-

Soy

-

Spirulina

-

Pumpkin Seed

-

Hemp

-

Rice

-

Pea

-

Others

-

-

-

Vitamins

-

Minerals

-

Amino Acids

-

Probiotics

-

Omega -3 Fatty Acids

-

Carbohydrates

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gels

-

-

Meal Replacement Products

-

Weight Loss Product

-

-

Brazil Sports Nutrition Market Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Workout

-

Post-Workout

-

Weight Loss

-

Others

-

-

Brazil Sports Nutrition Market Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Gummies

-

-

Brazil Sports Nutrition Market Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Children

-

Adult

-

Geriatric

-

-

Brazil Sports Nutrition Market Consumers Outlook (Revenue, USD Million, 2018 - 2030)

-

Heavy users

-

Light users

-

-

Brazil Sports Nutrition Market Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Bricks and mortar

-

Specialty Stores

-

Small Retail Stores

-

Fitness Institutes

-

Grocery Stores

-

General Discount Stores

-

Discount Clothing Retailers

-

-

Ecommerce

-

-

Brazil Sports Nutrition Market End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Endurance

-

Strength gaining

-

Muscle growth

-

Recovery

-

Energy

-

Weight management

-

Immunity enhancement

-

Cognitive repairmen

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."