- Home

- »

- Consumer F&B

- »

-

Bread Mix Market Size, Share, Growth, Industry Report, 2033GVR Report cover

![Bread Mix Market Size, Share & Trend Report]()

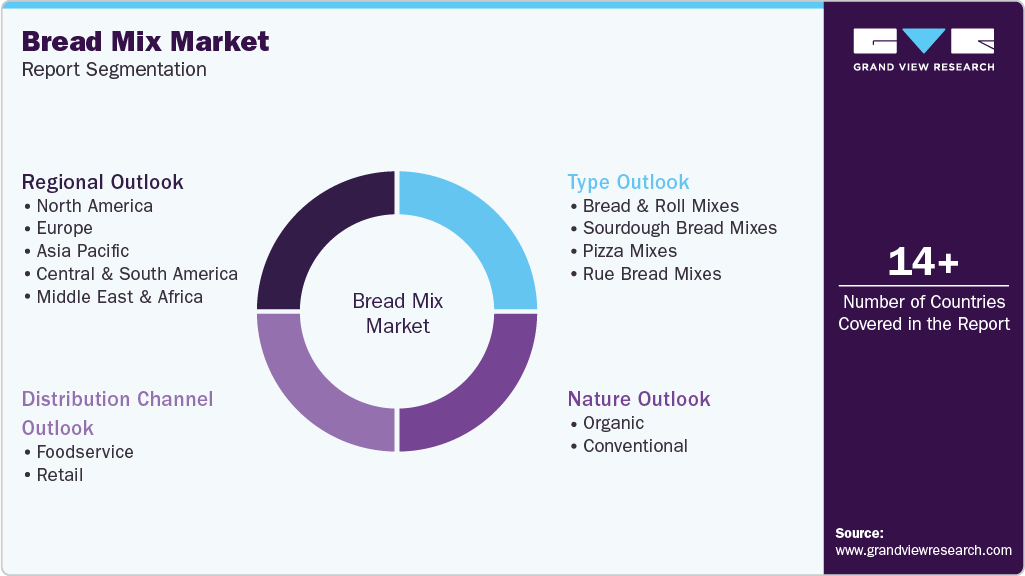

Bread Mix Market (2025 - 2033) Size, Share & Trend Analysis Report By Nature (Organic and Conventional), By Type (Bread & Roll Mixes, Sourdough Bread Mixes, Pizza Mixes, Rue Bread Mixes), By Distribution Channel (Foodservice, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-416-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bread Mix Market Summary

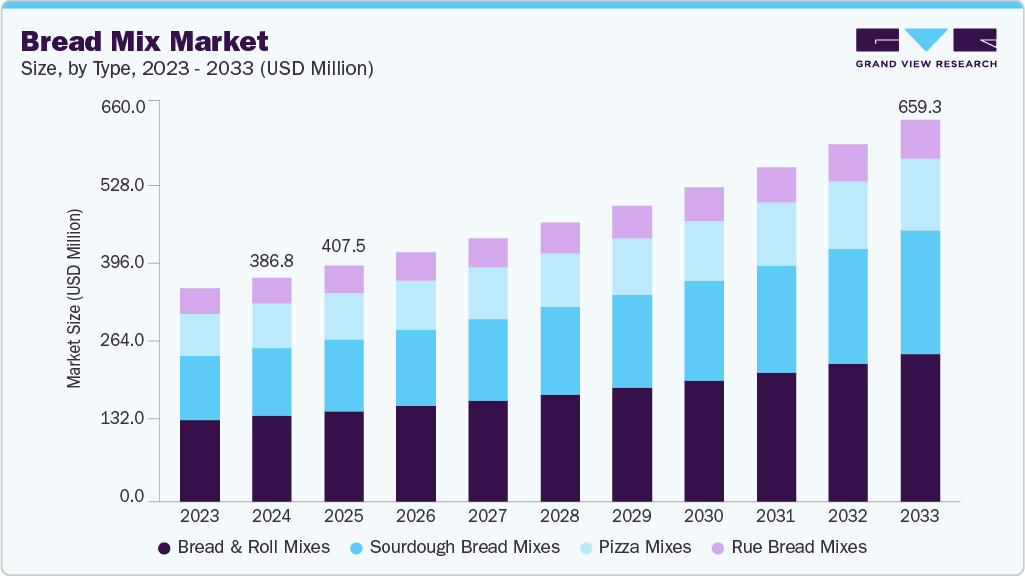

The global bread mix market size was estimated at USD 386.8 million in 2024 and is projected to reach USD 659.3 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The market growth is driven by rising demand for convenience, home-baking, and healthier formulations. Consumers increasingly prefer mixes that are whole grain, gluten-free, organic, or enriched with functional ingredients such as fibre and probiotics.

Key Market Trends & Insights

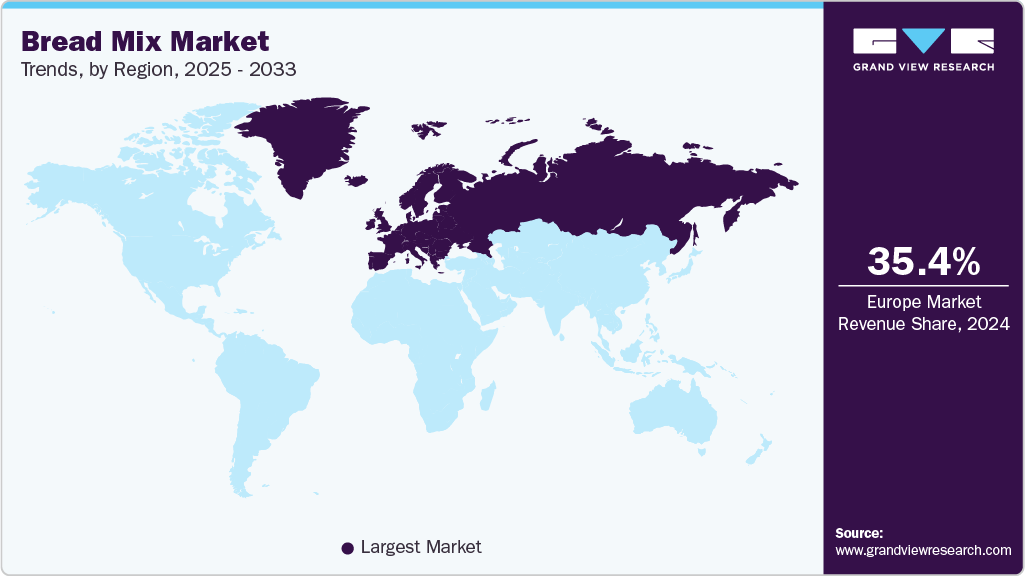

- Europe dominated the global bread mix market in 2024 with a revenue share of 35.4%

- Asia Pacific is growing at the fastest CAGR of 7.0% during the forecast period.

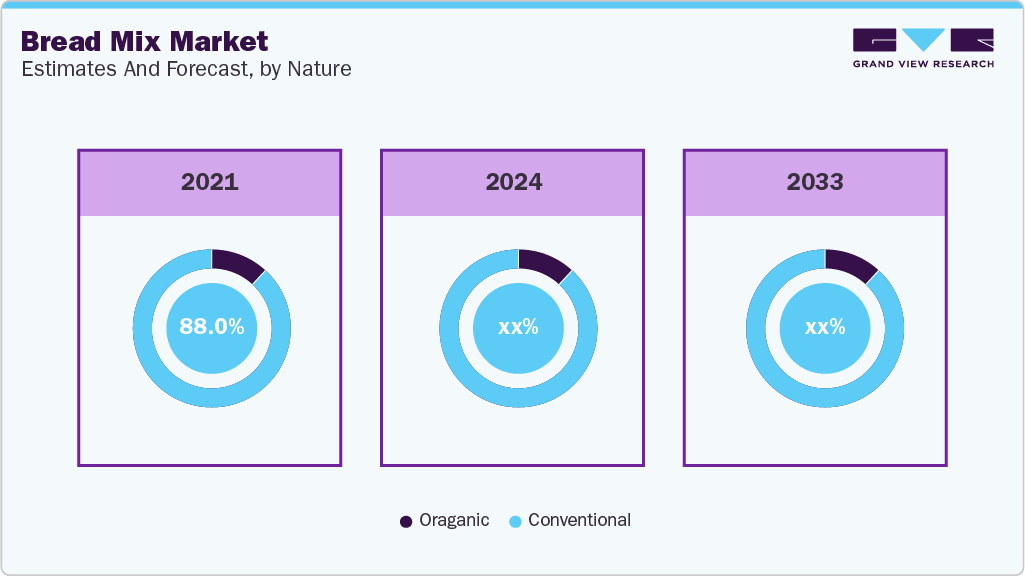

- By nature, the conventional bread mix segment accounted for the largest share of 87.4% in 2024.

- By type, the bread & roll mixes segment held a share of 38.2% in 2024.

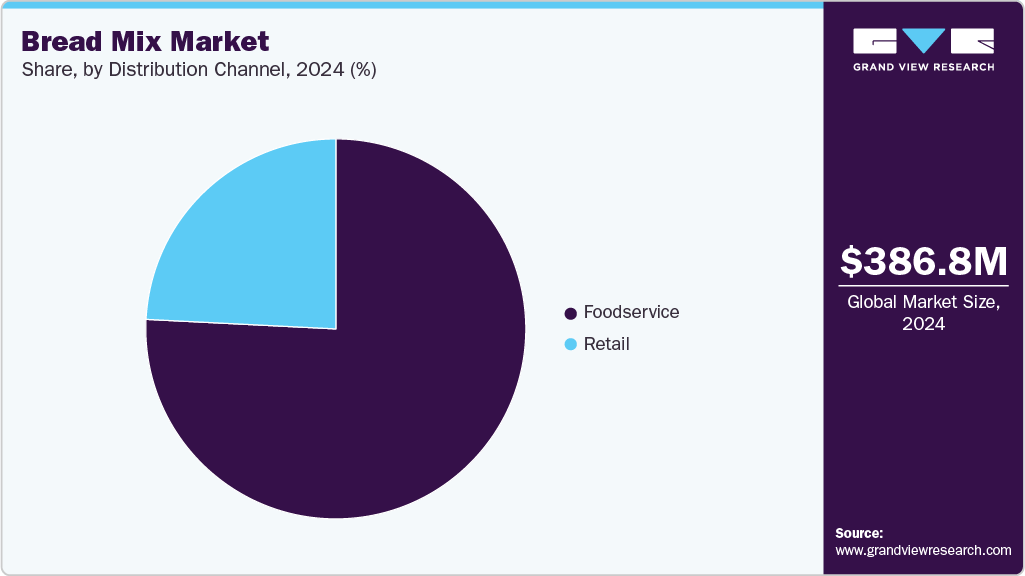

- By distribution channel, the foodservice segment dominated the market with a revenue share of 75.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 386.8 Million

- 2033 Projected Market Size: USD 659.3 Million

- CAGR (2025-2033): 6.2%

- Europe: Largest market in 2024

Urbanization, busy lifestyles, and a desire for homemade quality with less effort are boosting sales. Distribution through supermarkets, hypermarkets, and online channels is expanding access, while modern retail formats and e-commerce are also shaping how consumers discover and buy bread mixes. Key trends include taste/flavour innovation (ancient grains, artisanal/ethnic breads), clean-label/natural ingredients, and product formats for specialty diets. Challenges remain in raw-material volatility, regulatory hurdles, consumer price sensitivity, and competition from freshly baked goods.

The home baking trend has surged, especially during the COVID-19 pandemic, as people spent more time at home and sought new hobbies. Baking bread at home offers a sense of accomplishment and provides an enjoyable and productive way to spend time with family. In addition, consumers are increasingly health-conscious and seek to control the ingredients in their food. Bread mixes often include options such as whole grain, gluten-free, organic, and fortified mixes, catering to various dietary preferences and health needs. Homemade bread allows people to avoid preservatives and additives commonly found in store-bought bread.

There is also a rising popularity of artisanal and specialty breads, such as sourdough, multigrain, and ethnic varieties. Bread mixes offer an accessible way to recreate these gourmet breads at home, providing an experience similar to that of a professional bakery. Exposure to different cuisines and cultures has increased the popularity of diverse bread types. People are increasingly experimenting with recipes from around the world, and bread mixes for ethnic breads such as naan, pita, and challah make it easier to explore these culinary traditions.

Bread mixes allow for customization, enabling bakers to add their own ingredients or make modifications to suit their tastes. This flexibility encourages creativity and experimentation in the kitchen. Baking at home also offers an educational experience, particularly for families with children. It provides an opportunity to teach baking skills, basic chemistry, and the importance of home-cooked meals.

Consumer Insights for the Bread Mix Market

Diverse demographic preferences, evolving lifestyles, and growing awareness of nutrition and convenience shape the consumer landscape of the global bread mix market. Urban consumers, particularly millennials and working professionals, are increasingly drawn to bread mixes due to their ease of preparation and time-saving benefits. These consumers appreciate the ability to bake fresh, high-quality bread at home without complex baking skills. In contrast, older consumers tend to prioritize traditional taste profiles and familiar formulations, while younger demographics show higher interest in innovative, flavored, and artisanal bread mixes.

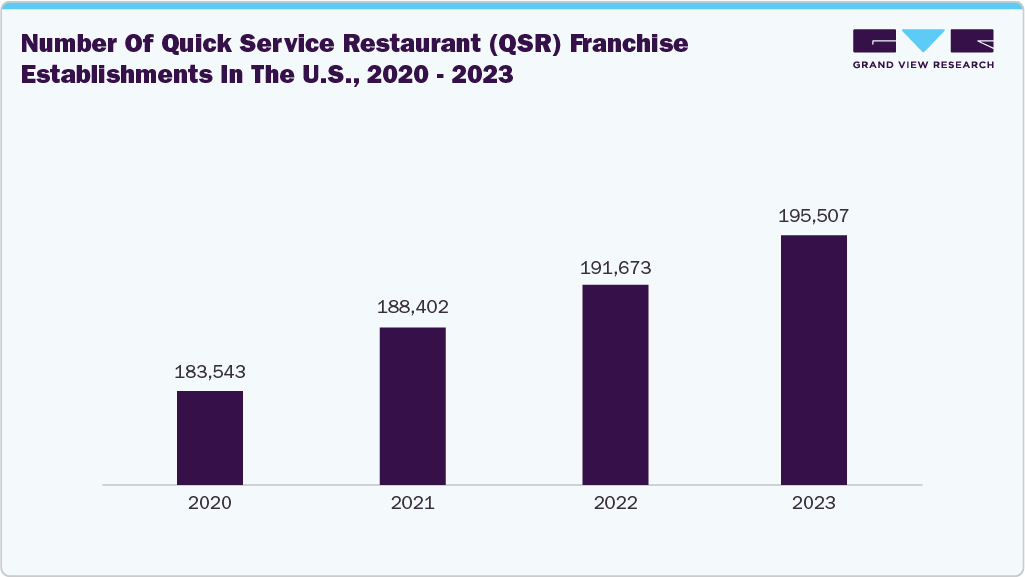

Health-conscious consumers are a major driver of demand, favoring mixes with clean-label ingredients, reduced sugar, and fortified nutritional profiles such as high-fiber, gluten-free, or multigrain variants. The rise of plant-based and allergen-free diets has further encouraged the adoption of specialty bread mixes made from alternative flours such as almond, oat, or quinoa. Consumers in developed regions such as North America and Europe exhibit strong preferences for organic and whole grain options, whereas in emerging markets, affordability and availability are key purchase factors. Moreover, the growing foodservice sector particularly quick-service restaurants (QSRs), cafes, and bakery chains-is fueling demand for ready-to-use bread mixes that ensure consistent quality and reduce preparation time. QSR operators increasingly rely on specialty mixes for premium sandwiches, buns, and artisanal bread offerings, highlighting a strong commercial adoption alongside home consumption.

Another notable trend is the growing influence of online retail and social media on consumer purchase behavior. The increasing popularity of home-baking communities and influencer-led recipe sharing has expanded awareness and trial of premium and artisanal bread mixes. Consumers are also seeking greater product customization, favoring mix variants that allow experimentation with flavors, seeds, and textures. Overall, the bread mix market is witnessing a shift toward health-driven, experience-oriented consumption, blending convenience with creativity, nutritional value, and commercial applicability.

Nature Insights

Conventional bread mix held the largest share, accounting for 87.4% of global revenues in 2024, driven by its widespread availability, affordability, and consumer familiarity with traditional bread varieties. These mixes are preferred for their consistent texture, neutral flavor, and versatility in producing everyday bread types such as white and whole wheat loaves. Their dominance is further supported by strong demand from both household and commercial bakers, particularly in developed markets where conventional recipes remain staples. Despite rising interest in gluten-free and specialty variants, conventional mixes continue to lead due to established consumer trust and robust retail penetration worldwide.

Organic bread mixes are anticipated to grow at a CAGR of 7.8% from 2025 to 2033, owing to rising consumer preference for clean-label, chemical-free, and sustainably sourced ingredients. Growing health consciousness and awareness about the harmful effects of artificial additives are encouraging consumers to shift toward organic alternatives. The segment’s growth is further supported by expanding availability in supermarkets and online platforms, alongside premiumization trends in the bakery sector. Increasing adoption among urban consumers and millennials, who associate organic products with superior quality and nutrition, is also boosting demand. Manufacturers are focusing on innovations using ancient grains, natural sweeteners, and plant-based ingredients to attract eco-conscious buyers.

Type Insights

Bread & roll mixes segment held the largest share of 38.2% in 2024 in bread mix industry. The dominance of bread & roll mixes is attributed to their versatile usage in both household and commercial baking applications, catering to daily consumption patterns. Consumers prefer these mixes for their convenience, consistent quality, and ability to replicate bakery-style freshness at home. The segment also benefits from the growing popularity of artisan-style breads, dinner rolls, and sandwich loaves in foodservice outlets and quick-service restaurants. In addition, innovations in flavor varieties, fortified ingredients, and clean-label formulations have enhanced product appeal, further solidifying bread and roll mixes as a staple choice in the global bread mix market.

Sourdough bread mixes are anticipated to grow at a CAGR of 7.0% over the forecast period. The segment’s growth is driven by increasing consumer preference for natural fermentation and gut-friendly products, as sourdough is perceived to offer better digestibility and enhanced nutritional value. Rising awareness of fermented foods’ health benefits, along with the artisanal bread trend, has made sourdough a popular choice among home bakers and premium bakery chains. The growing availability of ready-to-use sourdough starter mixes and easy-prep kits through online and retail platforms is further supporting demand. Additionally, consumers’ inclination toward authentic, tangy flavors continue to boost the segment’s appeal globally.

Distribution Channel Insights

The foodservice segment accounted for the largest revenue share of 75.8% of the global revenues in 2024. This dominance is driven by the extensive use of bread mixes in bakeries, cafés, hotels, and quick-service restaurants that rely on ready-to-use mixes for consistent quality and efficiency. The growing demand for freshly baked bread and rolls in commercial establishments, coupled with the expansion of global bakery chains, has significantly supported this segment. In addition, rising consumption of sandwiches, burgers, and artisan breads across foodservice outlets has boosted bulk purchases of bread mixes, ensuring steady market growth within this channel.

The sale of bread mix through the retail channel is anticipated to grow at a CAGR of 6.6% from 2025 to 2033, fueled by the rising popularity of home baking and the growing availability of premium and specialty bread mixes in supermarkets, hypermarkets, and online platforms. Consumers are increasingly seeking convenient, high-quality options that allow them to bake fresh bread at home without professional expertise. The trend of experimenting with artisanal and health-oriented recipes has further driven retail demand. Expanding product visibility through digital marketing and e-commerce platforms is also encouraging brand discovery and impulse purchases among home bakers worldwide.

Regional Insights

The North America bread mix market is expected to grow at a CAGR of 5.9% from 2025 to 2033. North America’s dominance is driven by the strong presence of established bakery brands, high consumer preference for convenience foods, and the increasing adoption of home-baking trends. Rising health awareness has also led to greater demand for clean-label, organic, and gluten-free bread mixes. The U.S. dominates the regional market, supported by widespread retail availability and innovation in artisanal and functional bread varieties. Additionally, the popularity of at-home meal preparation and e-commerce expansion continues to create new opportunities for bread mix manufacturers in North America.

U.S. Bread Mix Market Trends

The bread mix market in the U.S. held a market share of 32.8% of the North America bread mix market in 2024 due to the strong culture of home baking, high consumer spending on convenient and premium bakery products, and the presence of leading global and regional manufacturers. The popularity of ready-to-bake mixes among busy households, coupled with growing interest in artisanal and specialty bread varieties, has supported market growth. Furthermore, widespread product availability across supermarkets, hypermarkets, and online channels, along with continuous innovation in gluten-free and organic formulations, has reinforced the U.S. position as a key contributor to the regional bread mix market.

Europe Bread Mix Market Trends

Europe bread mix market held a share of 35.4% of the global market in 2024, supported by the region’s strong baking culture and the widespread consumption of traditional and artisanal breads. Consumers in countries such as Germany, France, and the UK are increasingly adopting bread mixes that offer convenience while maintaining authentic taste and quality. The growing demand for clean-label, organic, and high-fiber variants is further propelling market expansion. Moreover, the rise in home baking trends, especially after the pandemic, and the presence of established bakery mix manufacturers have reinforced Europe’s leading position in the global bread mix industry.

The bread mix market in the UK is expected to grow at a CAGR of 6.3% from 2025 to 2033, due to growing consumer preference for convenient, time-saving baking solutions and an increased interest in home baking during and after the pandemic. UK consumers are drawn to bread mixes that offer consistent quality, easy preparation, and a variety of flavors, including whole grain, artisan, and specialty options. In addition, rising health awareness has boosted demand for bread mixes with clean-label ingredients, high fiber, and reduced sugar or salt content, further supporting the UK’s strong position within the European bread mix market.

Asia Pacific Bread Mix Market Trends

Asia Pacific bread mix market is expected to grow at a CAGR of 7.0% from 2025 to 2033, supported by the growing urban population, rising disposable incomes, and increasing adoption of Western-style bakery products. Busy lifestyles in major cities are driving demand for convenient and ready-to-use bread mixes that save time while offering consistent quality. Additionally, the expansion of modern retail channels, e-commerce platforms, and bakery cafés has made a wide variety of bread mix products more accessible to consumers. Cultural shifts toward home baking and experimentation with international flavors are also contributing to market growth in the region.

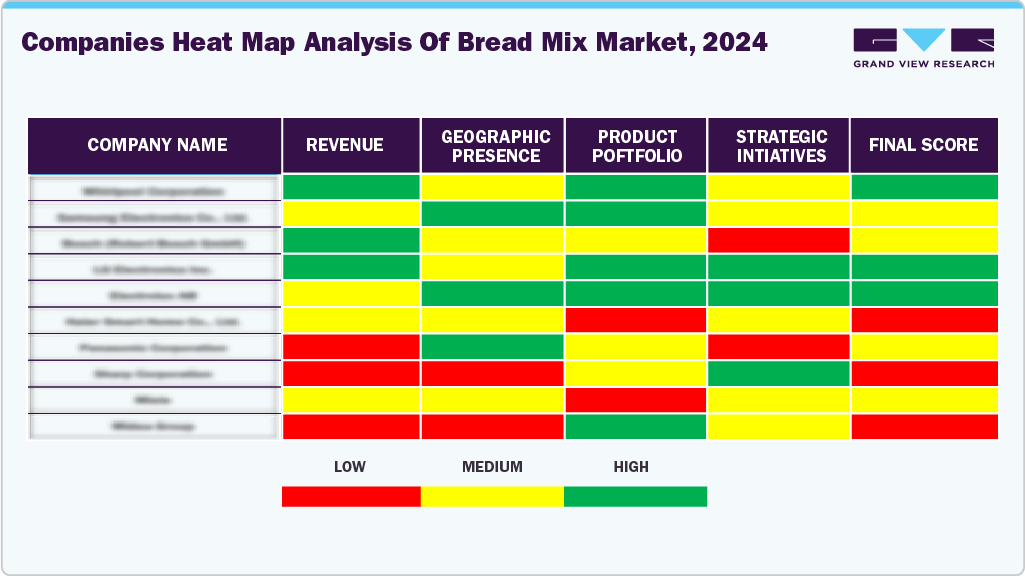

Key Bread Mix Company Insights

King Arthur Baking Company.; Sonneveld Group; Continental Mills, Inc; General Mills.; ADM; Bob’s Red Mill Natural Foods; British Bakels; Bäckerei Spiegelhauer.; Seitenbacher America LLC; CSM Ingredients are some of the dominant players operating in the bread mix market. The global bread mix market is characterized by intense competition. Key companies in the bread mix industry primarily focus on innovation, type diversity, and health-centric offerings. They are investing in product development, strategic partnerships, and sustainable packaging to cater to evolving consumer preferences, expand their footprint, and strengthen competitiveness across regions.

Key Bread Mix Companies:

The following are the leading companies in the bread mix market. These companies collectively hold the largest market share and dictate industry trends.

- King Arthur Baking Company.

- Sonneveld Group

- Continental Mills, Inc

- General Mills.

- ADM

- Bob’s Red Mill Natural Foods

- British Bakels

- Bäckerei Spiegelhauer.

- Seitenbacher America LLC

- CSM Ingredients

Recent Developments

-

In February 2025, Flowers Foods, Inc. completed the acquisition of Simple Mills, a market-leading natural brand offering premium better-for-you crackers, cookies, snack bars, and baking mixes. This acquisition expands Flowers Foods' portfolio in the natural and organic baking mix segment.

-

In May 2024, Archer Daniels Midland Company completed the acquisition of a specialty ingredients manufacturer in Brazil, expanding its Latin American bread mix offerings. This move enhances ADM's presence in the global bread mix market, particularly in the Latin American region.

-

In March 2024, King Arthur Baking Company introduced a line of premium savory bread mix kits, including Pull-Apart Garlic Bread, Soft & Chewy Pretzel Bites, Crisp & Airy Focaccia, and Perfectly Tender Flatbread. These kits cater to both novice and experienced bakers, emphasizing versatility and convenience in home baking.

-

At Bakery China 2024, Angel Yeast and BakeMark launched more than 40 new products under the BakeMark By Angel brand. The focus was on bakery mixes and icings, including bread mixes for bagels and sourdough, cake mixes, cookie and donut mixes, and a variety of decorative icings.

Bread Mix Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 407.5 million

Revenue forecast in 2033

USD 659.3 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

King Arthur Baking Company.; Sonneveld Group; Continental Mills, Inc; General Mills.; ADM; Bob’s Red Mill Natural Foods; British Bakels; Bäckerei Spiegelhauer; Seitenbacher America LLC; CSM Ingredients

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bread Mix Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Bread mix market based on nature, type, distribution channel, and region:

-

Nature Outlook (Revenue, USD Million, 2021 - 2033)

-

Organic

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Bread & Roll Mixes

-

Sourdough Bread Mixes

-

Pizza Mixes

-

Rue Bread Mixes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Foodservice

-

Retail

-

Supermarkets & Hypermarkets

-

Convenience Store

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bread mix market size was estimated at USD 386.8 million in 2024 and is expected to reach USD 407.5 million in 2025.

b. The global bread mix market is expected to grow at a compounded growth rate of 6.2% from 2025 to 2033 to reach USD 659.3 million by 2033.

b. Conventional bread mix accounted for a share of 87.4% in 2024. Conventional bread mixes are widely available in supermarkets, grocery stores, and online platforms. Their easy accessibility makes them a convenient choice for consumers looking to quickly purchase baking supplies.

b. Some key players operating in bread mix market include King Arthur Baking Company.; Sonneveld Group; Continental Mills, Inc; General Mills.; ADM; Bob’s Red Mill Natural Foods; British Bakels; Bäckerei Spiegelhauer.; Seitenbacher America LLC; CSM Ingredients.

b. Key factors that are driving the market growth include rising consumer demand for natural and organic bakery products and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.