- Home

- »

- Medical Devices

- »

-

Breast Tissue Markers Market Size, Industry Report, 2030GVR Report cover

![Breast Tissue Markers Market Size, Share & Trends Report]()

Breast Tissue Markers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Coil, Ribbon), By Material (Bio-absorbable, Non-absorbable), By Usage Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-567-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Breast Tissue Markers Market Summary

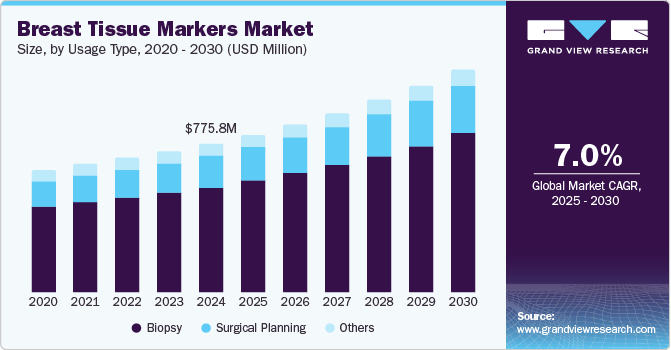

The global breast tissue markers market size was estimated at USD 0.77 billion in 2024 and is projected to reach USD 1.16 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030. The key factors driving market growth include the increasing incidence of breast cancer, increasing awareness regarding early detection, and growing adoption of minimally invasive diagnostic procedures.

Key Market Trends & Insights

- North America accounted for the highest market revenue share 44.8% in 2024.

- China breast tissue markers market is driven by the country's rapidly advancing healthcare infrastructure.

- Based on usage type, the biopsy segment held the largest share in 2024.

- In terms of product, the coil segment held the largest market share in terms of revenue in 2024.

- Based on material, the non-absorbable segment held the largest market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 0.77 Billion

- 2030 Projected Market Size: USD 1.16 Billion

- CAGR (2025-2030): 7.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Supportive government initiatives and screening programs, along with a growing geriatric population prone to cancer, further propel market growth. According to the World Band data, around 19% of the total female population in the U.S. was aged 65 years and above in 2023, a significant rise over the past years.

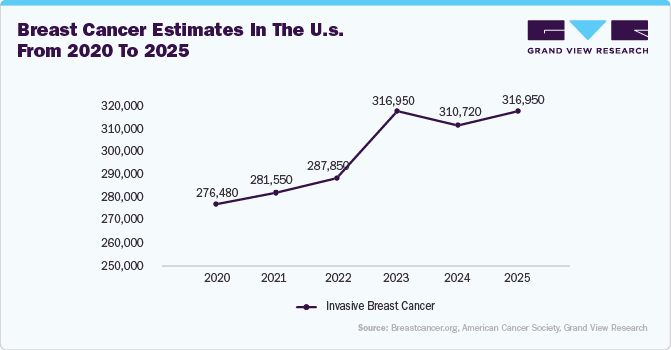

The increasing incidence of breast cancer globally and the rising adoption of minimally invasive procedures are some of the major factors driving market growth. For instance, according to the American Cancer Society, breast cancer is the most common type of cancer in women in the U.S., accounting for around 30% of all cancer cases. Moreover, it is estimated that in 2025, around 316,950 new invasive breast cancer cases can be diagnosed, and around 59,080 new cases of ductal carcinoma in situ (DCIS) can be diagnosed, while breast cancer is expected to cause around 42,170 mortalities in the same year. This high prevalence of breast cancer has significantly increased the focus on early detection through mammography and image-guided biopsies, thereby increasing the demand for accurate localization and tracking solutions.

Technological advancements in the design and composition of breast tissue markers have significantly contributed to market growth. Traditional metallic clips have evolved into bio-compatible markers with distinct shapes and radiopacity profiles that improve visibility across various imaging platforms. Manufacturers are investing in developing 3D-shaped markers, polymer-embedded markers, and bio-absorbable designs that minimize migration, reduce artifacts in post-placement imaging, and offer improved compatibility with MRI and mammography.

For instance, in March 2024, Mammotome announced the 510(k) clearance of its LumiMARK Biopsy Site Marker, a novel tissue marker designed for enhanced visibility across ultrasound, mammography, and MRI. Developed in collaboration with radiologists, the self-expanding nitinol markers come in three distinct 3D shapes-Tulip, Lotus, and Rose-to support various clinical scenarios. 510(k) are cleared for marking breast tissue and axillary lymph nodes. Its design aims to improve accuracy in biopsy site localization and patient care during follow-up procedures. These innovations improve the workflow and reduce patient discomfort and complications, increasing the demand for these breast tissue markers in healthcare facilities.

Moreover, the market growth is also driven by increased initiatives and funding from government bodies and organizations dedicated to cancer prevention and early detection. For instance, in January 2025, the CDC announced a five-year, USD 2.3 million fund to Weill Cornell Medicine to enhance care for young breast cancer patients, focusing on diverse populations in New York City. Led by Drs. Vered Stearns and Tessa Cigler, the initiative aims to improve access, education, and support services, addressing physical and cultural needs to boost treatment adherence and survival outcomes.

Similarly, various programs such as the National Breast and Cervical Cancer Early Detection Program (NBCCEDP) further increase women's access to breast cancer screenings. For instance, since its inception, the NBCCEDP has facilitated over 16.5 million breast and cervical cancer screenings, diagnosing nearly 80,000 invasive breast cancers. The convergence of governmental support, funding, and public health campaigns is expected to contribute to market growth over the forecast period.

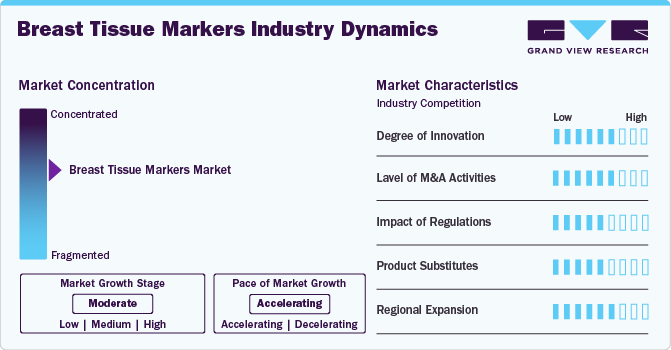

Market Concentration & Characteristics

The market growth stage is moderate, and pace of the market growth is accelerating. The breast tissue markers industry is characterized by a moderate-to-high degree of growth. Key drivers include increasing incidence of breast cancer, increasing awareness regarding early detection, growing adoption of minimally invasive diagnostic procedures, supportive government initiatives and screening programs, along with a growing geriatric population.

The breast tissue markers market has seen a moderate degree of innovation in recent years, driven by the growing need for precise tumor localization, especially in image-guided breast cancer procedures. Manufacturers focus on developing markers that offer enhanced visibility under multiple imaging modalities such as ultrasound, mammography, and MRI. However, despite these developments, the overall pace of innovation remains medium as the market is significantly shaped by regulatory constraints, which limit the rapid adoption of cutting-edge solutions.

Regulatory oversight significantly shapes the breast tissue markers industry, ensuring patient safety and guiding product innovation. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) classify these markers as Class I devices, the most serious type. This increases the impact of regulations on the overall market. For instance, in October 2024, Hologic recalled its BioZorb soft tissue marker after the FDA classified the action as a Class I recall, due to 71 reported injuries, including pain and infections. The device, used in breast cancer treatments, remains in patients’ post-surgery. The FDA advises clinicians to monitor patients closely for complications. Such regulatory interventions can impact the affected company, influence the broader market for regulatory expectations, and encourage other manufacturers to prioritize safety and compliance.

Companies are actively acquiring evolving market players to broaden their product portfolios and cater to a larger patient base. Major companies can acquire smaller firms to strengthen their market position, expand product portfolios, or gain access to new technologies. In July 2024, Stryker acquired MOLLI Surgical, enhancing its breast cancer care portfolio. MOLLI’s wire-free localization system uses a tiny 3.2 mm marker and real-time tablet guidance to target breast tumors precisely. This acquisition complements Stryker’s SPY fluorescence imaging and supports more accurate, patient-friendly breast-conserving surgeries.

The threat of substitutes in the breast tissue market is relatively low but not negligible. Breast tissue markers, which are essential for marking biopsy sites and guiding future surgeries or radiological assessments, have become a standard of care, particularly in image-guided breast procedures. Potential substitutes include advanced imaging technologies such as high-resolution ultrasound, MRI, and digital tomosynthesis, which can reduce reliance on physical markers by enhancing lesion localization capabilities. However, the clinical benefits, compatibility with various imaging modalities, and continued innovation in marker design, breast tissue markers are expected to remain the preferred solution.

The regional expansion of the breast tissue markers industry is driven by rising breast cancer incidence, increasing awareness about early diagnosis, and growing adoption of minimally invasive biopsy techniques. Many manufacturers are capitalizing on these opportunities by entering new geographic territories through strategic collaborations with local distributors, securing regulatory approvals, and enhancing product portfolios to meet region-specific clinical needs.

Usage Type Insights

The biopsy segment held the largest share in 2024, owing to the increasing adoption of image-guided biopsy procedures such as stereotactic, ultrasound, and MRI-guided biopsies. These minimally invasive procedures necessitate the precise localization of lesions, thereby increasing the demand for tissue markers. Biopsy-based marker placement enables accurate post-procedural identification of suspicious tissue. This trend is further supported by integrating molecular markers that help characterize tumors more effectively, leading to personalized treatment plans.

Surgical planning is expected to witness the fastest growth due to the rising adoption of image-guided localization techniques and increasing reliance on precision marking in pre-operative workflows. As breast-conserving surgeries become more prevalent, especially in early-stage breast cancer, there is a growing need for accurate localization of biopsy sites to assist surgeons during tumor excision. Furthermore, healthcare providers emphasize integrating surgical planning into multidisciplinary care pathways to improve clinical outcomes and reduce repeat surgeries. The ability of tissue markers to remain visible on multiple imaging modalities makes them critical tools for coordinated surgical interventions, enhancing their applicability in surgical planning.

Product Insights

The coil segment held the largest market share in terms of revenue in 2024 due to its enhanced visibility under multiple imaging modalities, particularly ultrasound and mammography. Coil-shaped markers provide superior anchoring within the breast tissue, reducing the risk of migration post-deployment. In addition, their compatibility with stereotype and MRI-guided procedures makes them a preferred choice across diagnostic centers and outpatient facilities. The consistent demand for reliable and durable markers further drives healthcare providers to choose coil designs over traditional marker forms.

Ring is expected to witness the fastest growth over the forecast period, owing to its superior visibility under multiple imaging modalities and ease of placement during biopsy procedures. The adoption of these markers is preferred in facilities emphasizing breast-conserving surgeries, where precision in tissue identification is preferred. Moreover, their compatibility with advanced biopsy devices and localization techniques enhances workflow efficiency for radiologists and surgeons, leading to increased procedural confidence, which is further expected to drive their demand over the forecast period.

Material Insights

The non-absorbable segment held the largest market in 2024, owing to the increasing demand for long-term visibility during follow-up imaging. These markers provide stable radiopacity over time, crucial in ongoing cancer surveillance and for accurately locating biopsy sites during surgery or radiation therapy. Non-absorbable markers' durability and consistent visibility offer a significant clinical advantage over absorbable alternatives, especially in patients undergoing extended treatment timelines. As minimally invasive procedures continue to rise, the reliance on robust, non-degradable markers is becoming increasingly important to maintain procedural accuracy.

Bio-absorbable is expected to witness the fastest growth during the forecast period, owing to the rising demand for minimally invasive and patient-friendly solutions in breast cancer diagnostics and post-biopsy localization. These markers naturally degrade within the body over time, eliminating the need for surgical removal and reducing long-term complications. The growing emphasis on reducing patient anxiety, improving outcomes, and avoiding permanent implants is driving the adoption of these products.

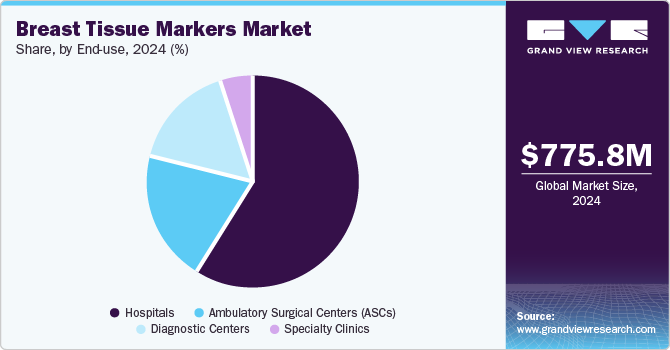

End Use Insights

The hospitals segment held the largest share in 2024 owing to their advanced infrastructure, skilled personnel, and access to high-throughput imaging systems. Hospitals perform a significant volume of breast biopsies and surgeries, increasing the demand for precise localization tools such as tissue markers. With a rising incidence of breast cancer and a shift toward image-guided interventions, hospitals are increasingly adopting markers to ensure surgical accuracy and effective tumor tracking. Moreover, the adaptability and rising investments in breast cancer screening programs further drive the segment’s growth.

The diagnostics centers segment is expected to grow fastest due to the increasing emphasis on early detection through image-guided biopsy procedures. Diagnostics centers are expanding their capabilities with advanced imaging modalities such as ultrasound, mammography, and MRI, requiring precise localization tools such as tissue markers. These centers serve as the first intervention point for many patients, especially in outpatient settings, driving the demand for minimally invasive tools. Furthermore, rising patient preference for ambulatory care and same-day diagnostics has accelerated procedural volumes at these facilities.

Regional Insights

North America accounted for the highest market revenue share in 2024. This can be attributed to the rising incidence of breast cancer and the widespread adoption of minimally invasive biopsy procedures. According to the Canadian Cancer Society, an estimated 30,500 Canadian women were diagnosed with breast cancer in 2024, representing 25% of all new cancer cases. Similarly, breast cancer was estimated to account for the deaths of 5,500 Canadian women, representing 13% of all cancer deaths in women in 2024. This high prevalence of breast cancer in countries such as the U.S. and Canada drives the market growth. Moreover, the widespread availability of high-end diagnostic imaging technologies such as MRI and 3D mammography, coupled with the adoption of minimally invasive procedures, has bolstered the use of tissue markers. Strong awareness campaigns and government-supported screening programs have also contributed to early detection, further fueling market demand.

U.S. Breast Tissue Markers Market Trends

The breast tissue makers market in the U.S. held the largest share of the North American market in 2024. This can be attributed to various factors, including better access to healthcare services, the high prevalence of breast cancer, and the rising government initiatives and awareness of cancer screening. For instance, programs such as the NBCCEDP provided screening and diagnostic services to thousands of women in the program year 2023. The program provided breast cancer screening and diagnostic services to 273,989 women, resulting in the diagnosis of 1,970 invasive breast cancers & 688 premalignant breast lesions. Such initiatives significantly contribute to market growth in the country.

Europe Breast Tissue Markers Market Trends

The breast tissue markers market in Europe is driven by technological advancement, increasing awareness, and supportive healthcare policies. As the prevalence of breast cancer continues to rise in the region, there is a growing demand for more precise and effective diagnostic tools. The increasing adoption of minimally invasive diagnostic procedures, such as biopsies using breast tissue markers, has significantly contributed to market growth. Moreover, the growing focus on personalized medicine in Europe is boosting the demand for breast tissue markers.

The UK breast tissue markers market is experiencing steady growth, driven by an increasing emphasis on early detection and personalized treatment for breast cancer. Furthermore, the UK's aging population, combined with a rise in breast cancer awareness campaigns, has increased the need for accurate diagnostic tools. For instance, in February 2025, the National Health Service (NHS) in England launched its first-ever breast screening campaign to encourage women aged 50-70 to participate in regular screenings. The initiative seeks to detect thousands of cancers earlier, emphasizing the importance of acting on screening invitations to improve early diagnosis and treatment outcomes.

The breast tissue markers market in Germany is experiencing significant growth, driven by the country’s advanced healthcare infrastructure and a growing focus on early-stage breast cancer detection. Germany's well-established medical technology sector supports the adoption of innovative diagnostic tools, including breast tissue markers. The demand for precise and efficient diagnostic solutions is growing as the country continues to prioritize cancer screening, considering its aging population. In addition, Germany's robust healthcare reimbursement system allows better access to these technologies, further contributing to market growth.

Asia Pacific Breast Tissue Markers Market Trends

The breast tissue markers market in Asia Pacific is being driven by a combination of increasing breast cancer awareness, rising healthcare expenditure, and advancements in medical technologies. Countries such as China, Japan, and India are witnessing a significant rise in the incidence of breast cancer, making early detection and treatment crucial. Moreover, with a growing focus on personalized medicine, healthcare systems in the region are investing in innovative diagnostic tools, including breast tissue markers, to improve detection accuracy. Moreover, government initiatives to enhance healthcare infrastructure and access to quality diagnostics further fuel market growth.

China breast tissue markers market is driven by the country's rapidly advancing healthcare infrastructure and rising awareness surrounding breast cancer detection. With the increasing number of breast cancer cases in China, the demand for early diagnosis and improved accuracy in screening is on the rise. Moreover, the aging female population further fuels the market growth. For instance, according to the World Bank data, around 16% of the country’s female population was aged 65 years and above in 2023. Furthermore, China’s government initiatives to enhance healthcare accessibility, including expanding public health programs and funding cancer research, are further increasing the adoption of these diagnostic tools.

Latin America Breast Tissue Markers Market Trends

The breast tissue markers market in Latin America is driven by a combination of demographic and healthcare developments. The increasing prevalence of breast cancer, particularly among women in countries such as Brazil and Argentina, is a key factor driving market growth. The region’s aging population is also contributing to a higher incidence of breast cancer, leading to greater demand for early detection technologies. In addition, growing awareness about breast cancer and the importance of early screening is encouraging healthcare providers to adopt innovative diagnostic solutions, including breast tissue markers, to enhance diagnostic accuracy and treatment planning.

Middle East Africa Breast Tissue Markers Market Trends

The breast tissue markers market in the Middle East and Africa (MEA) is driven by the increasing awareness of breast cancer, supported by health campaigns in countries such as Saudi Arabia and the UAE, which are encouraging early detection and screening, thereby fuelling the demand for tissue markers. Moreover, the region’s healthcare infrastructure is improving rapidly, with investments in advanced diagnostic technologies. This progress is supported by government initiatives to enhance healthcare access and reduce the cancer burden, driving demand for accurate diagnostic tools such as breast tissue markers in public and private healthcare facilities.

Key Breast Tissue Markers Company Insights

Market trends are shaping industry leaders' strategies. The leading players are adopting various strategies, such as product launches, acquisitions, and expansion, while focusing on user comfort through technological advancements and innovative products.

Key Breast Tissue Markers Companies:

The following are the leading companies in the breast tissue markers market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Hologic

- INRAD, Inc.

- Carbon Medical Technologies, Inc.

- Vigeo srl

- MOLLI Surgical (Stryker)

- Mammotome

- Mermaid Medical

Recent Developments

-

In April 2025, Carbon Medical Technologies' BiomarC Tissue Marker System achieved EU MDR certification, ensuring compliance with stringent European safety and performance standards. These non-metallic, pyrolytic carbon-coated markers enhance visibility across various imaging modalities, aiding precise breast biopsy site localization. Preloaded delivery systems offer flexibility for physicians, supporting improved patient care.

-

In July 2024, Stryker acquired MOLLI Surgical, enhancing its breast cancer care portfolio. MOLLI’s wire-free localization system uses a tiny 3.2 mm marker and real-time tablet guidance to target breast tumors precisely. This acquisition complements Stryker’s SPY fluorescence imaging and supports more accurate, patient-friendly breast-conserving surgeries.

-

In March 2024, Mammotome announced the 510(k) clearance of its LumiMARK Biopsy Site Marker, a novel tissue marker designed for enhanced visibility across ultrasound, mammography, and MRI. Developed in collaboration with radiologists, the self-expanding nitinol markers come in three distinct 3D shapes-Tulips, Lotuses, and Roses-to support various clinical scenarios. They are 510(k) cleared for marking breast tissue and axillary lymph nodes.

-

In April 2023, MOLLI Surgical introduced two innovative tools, MOLLI 2 and MOLLI re.markable, to enhance breast cancer surgery. MOLLI 2 employs a sesame seed-sized wire-free marker and a tablet interface to locate tumors precisely, improving surgical accuracy and patient comfort. MOLLI re.markable allows non-invasive repositioning of markers, reducing the need for additional procedures and enhancing overall patient experience.

-

In January 2021, Hologic, Inc. acquired SOMATEX Medical Technologies GmbH, enhancing its breast health portfolio with SOMATEX’s minimally invasive biopsy site markers, including the Tumark line. This acquisition strengthened the company’s European presence.

Breast Tissue Markers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 802.7 million

Revenue forecast in 2030

USD 1.16 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and product outlook

Segments covered

Product, material, usage type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD; Hologic; INRAD, Inc.; Carbon Medical Technologies, Inc.; Vigeo srl; MOLLI Surgical (Stryker); Mammotome; Mermaid Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Tissue Markers Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breast tissue markers market report based on product, material, usage type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Coil

-

Ribbon

-

Wing

-

U Shaped

-

Conic

-

Ring

-

Heart

-

Venus

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Bio-absorbable

-

Non-absorbable

-

-

Usage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopsy

-

Stereotactic

-

Ultrasound

-

MRI-guided

-

-

Surgical Planning

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Diagnostic Centers

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast tissue marker market size was estimated at USD 775.8 million in 2024 and is expected to reach USD 802.7 million in 2025.

b. The global breast tissue marker market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 1.16 billion by 2030.

b. North America dominated the breast tissue marker market with a share of 44.79% in 2024. This dominance is attributed to a combination of factors, including a well-established healthcare infrastructure, high patient awareness, and favorable reimbursement policies. The region's strong presence of key industry players and advancements in diagnostic technologies further bolster its leadership position.

b. Some key players operating in the breast tissue marker market include BD; Hologic; INRAD, Inc.; Carbon Medical Technologies, Inc.; Vigeo srl; MOLLI Surgical (Stryker); Mammotome; Mermaid Medical.

b. Key factors that are driving the market growth include the rising incidence of breast cancer and the increased adoption of image-guided biopsy procedures. Additionally, technological advancements and supportive reimbursement policies further strengthen market growth, especially in developed regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.