- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Brewer’s Spent Grain Market Size & Share Report, 2030GVR Report cover

![Brewer’s Spent Grain Market Size, Share & Trends Report]()

Brewer’s Spent Grain Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Wheat, Barley, Rye, Oats, Other Grains), By Application (Animal Feed, Food & Beverages, Dietary Supplements, Breweries (Return)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-077-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Brewer’s Spent Grain Market Summary

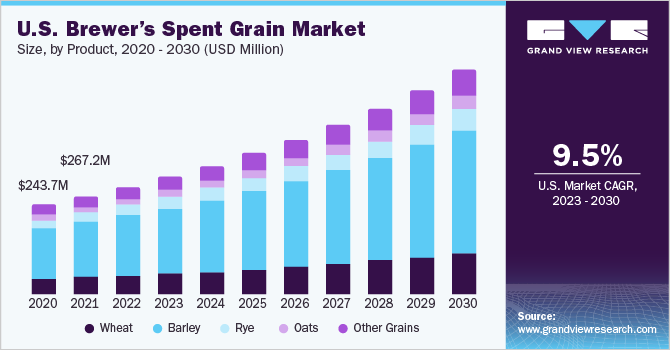

The global brewer’s spent grain market size was estimated at USD 1.60 billion in 2022 and is projected to reach USD 3.32 billion by 2030, growing at a CAGR of 9.6% from 2023 to 2030. The growth factors such as the increasing popularity of craft beer, the development of new technologies for upcycling spent grain, and the growing awareness of the environmental and social costs of food waste are being projected to augment demand over the forecast period.

Key Market Trends & Insights

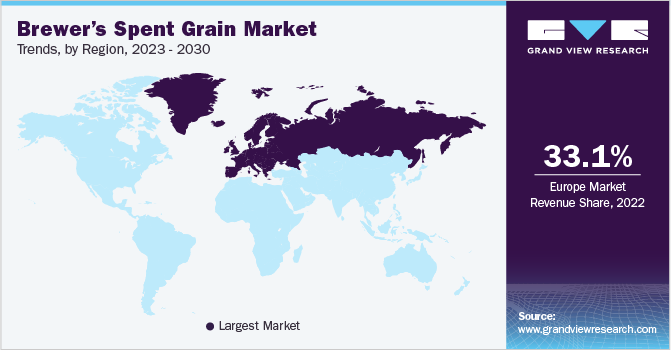

- The Europe region dominated the market with a revenue share of 33.1% in 2022 due to its long-standing brewing tradition.

- Germany dominated the European market with a market share of 17.0% in 2022.

- Based on products, barley dominated the market with a share of 55.1% in 2022 as it is the most common grain used in brewing.

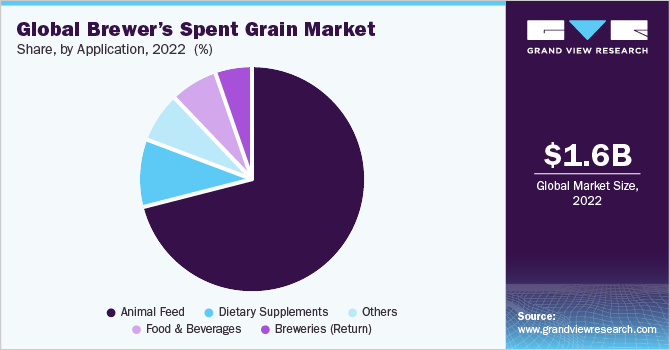

- In terms of application, the animal feed segment dominated the market with a revenue share of 71.0% in 2022.

- On the basis of application, the dietary supplements made using brewer’s spent grain are expected to expand at a CAGR of 9.7% from 2022 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 1.60 billion

- 2030 Projected Market Size: USD 3.32 billion

- CAGR (2023-2030): 9.6%

- Europe: Largest market in 2022

Furthermore, brewer’s spent grain (BSG) offers a sustainable and readily available option to enhance the nutritional profile and functional properties of products. This demand for alternative ingredients contributes to the growth of the BSG market.

Brewers Spent Grain (BSG), or draff, is a byproduct of the brewing industry that makes up 85 percent of brewing waste. It is the solid residue left over after the wort (the liquid part of the beer) is extracted from the malted barley during the brewing process. BSG is a nutrient-rich material that is high in protein, fiber, and carbohydrates. Craft breweries are actively exploring inventive approaches to minimize waste and make productive use of spent grain.

Traditionally, spent grain has been repurposed for agricultural applications like compost or animal feed. However, there are now numerous pioneering uses emerging, including powering breweries and upcycling grain for food production, cutlery, and other purposes. For instance, EverGrain, a spin-off of Anheuser-Busch InBev, upcycled the brewer's spent barley grain and launched two new ingredients: EverPro, a soluble plant-based protein, and EverVita, a high-protein barley flour.

Similarly, in July 2022, Kerry, a global food ingredients company, in partnership with Upcycled Foods Inc., introduced a protein crisp made with ReGrained's SuperGrain+ flour, derived from spent brewing grains. This ingredient is available through Kerry and is designed to enhance both texture and nutrition in snack products such as bars, cereals, clusters, and crunchy mixes.

The growing awareness of the environmental and social costs of food waste is a driving factor for the growth of the market. Brewer's spent grain is a valuable resource that can be used to create a variety of products, including animal feed, fertilizer, and biofuels. By upcycling spent grain, brewers can help to reduce food waste and create a more sustainable food system.

Manufacturers in the brewers' spent grain market are focusing on developing new delivery technologies. In May 2021, Against The Grain, a Boston-based startup launched its circular economy-inspired business model. Their focus is on upcycling spent grains, the byproduct of the brewing process, in a way that reduces disposal costs for breweries and simplifies the pickup and transportation process for farmers. By providing innovative scheduling and service protocols, the company aims to free up time for brewers and farmers to focus on their core activities of brewing and farming, respectively.

Products Insights

Barley dominated the market with a share of 55.1% in 2022 as it is the most common grain used in brewing.The abundance of barley usage in brewing naturally results in a higher volume of spent barley grains available for repurposing. Brewers' spent grain, primarily composed of barley, is rich in fiber, protein, and other nutrients, making it a valuable ingredient for various applications. It is commonly used as animal feed, compost, or in the production of biofuels.

In addition to its nutritional value, barley is also a sustainable crop. It can be grown in a variety of climates and soils, and it requires less water than other grains, such as wheat. Barley is also a relatively low-input crop, it does not require a lot of fertilizer or pesticides.

Wheat is expected to expand at the fastest CAGR of 9.9% from 2022 to 2030 owing to its versatility in brewing applications, nutritional value, and availability of wheat as a crop. The increasing popularity of wheat beers, such as hefeweizen and witbier, is driving up the demand for wheat as a primary ingredient in brewing. This surge in demand naturally results in a higher volume of spent wheat grains available for repurposing.

Application Insights

The animal feed segment dominated the market with a revenue share of 71.0% in 2022, owing to its texture, versatility, cost-effectiveness, availability, stability, and compatibility with other ingredients. BSG serves as a cost-effective and nutrient-rich ingredient in animal feed formulations, providing protein, fiber, and carbohydrates. The large quantities of BSG generated by breweries make it a convenient and accessible feed ingredient. Its incorporation into animal feed contributes to animal growth, performance, and overall health.

Furthermore, utilizing BSG in animal feed aligns with sustainability goals by reducing waste generation and promoting a circular production system. Strict regulations ensure the safe and appropriate use of BSG in animal feed, maintaining feed safety and quality.

The dietary supplements made using brewer’s spent grain are expected to expand at a CAGR of 9.7% from 2022 to 2030, owing to the functional benefits of BSG, consumer demand for natural and plant-based ingredients, ongoing research and innovation, and regulatory support. BSG contains bioactive compounds and antioxidants that can offer various health benefits. These functional properties make BSG a valuable ingredient for dietary supplements targeting specific health concerns, such as digestive health, immune support, or sports performance.

Manufacturers are increasingly producing dietary supplements utilizing BSG as a key ingredient. For instance, in January 2023, Osage Foods, a Missouri-based provider of ingredients and ingredient systems, introduced a new line of vegan plant protein blends called SolvPro. These protein blends are made using EverPro, an upcycled grain sourced from beer company Anheuser-Busch InBev (AB InBev).

Regional Insights

The Europe region dominated the market with a revenue share of 33.1% in 2022 due to its long-standing brewing tradition, resulting in a substantial supply of spent grain. Strict waste management regulations and a focus on sustainability have encouraged European breweries to find environmentally friendly solutions, leading to partnerships with industries that utilize spent grain.

Europe's emphasis on circular economy initiatives and innovation has also fostered the development of new applications for spent grain. The geographical proximity of breweries to buyers and well-established transportation infrastructure have further contributed to Europe's competitive advantage in distributing Brewer's spent grain. Germany dominated the European market with a market share of 17.0% in 2022, owing to its robust food industry's adoption of sustainable materials, stringent waste management regulations, and efficient logistics.

The Asia Pacific market is expected to expand at a CAGR of 10.1% from 2022 to 2030. The increasing emphasis on sustainability and resource efficiency, increasing consumption of beer, abundant agricultural resources, supportive government policies, and rapid urbanization are likely to be a key factors driving industry growth in economies such as China, India, and Japan. The China brewer’s spent grain market dominated the Asia Pacific market with a revenue share of 15.9% in 2022. The Asia-Pacific region has a strong agricultural sector and is a major producer of grains like barley, rice, and corn, which are commonly used in brewing. This abundant availability of brewing ingredients contributes to the substantial generation of BSG.

The North America market is expected to expand at a CAGR of 9.2% from 2022 to 2030. The factors such as increasing popularity of craft beer, the growing awareness of the environmental benefits of using BSG, and the development of new technologies for processing and using BSG are expected to be driving the market growth.

The Central & South America market is expected to expand at a CAGR of 10.3% from 2022 to 2030. The region's expanding beer industry, focus on sustainability, and increased participation in global trade are likely to be key factors driving industry growth in economies such as Brazil, and Argentina.

Key Companies & Market Share Insights

The global brewer’s spent grain industry is expected to witness moderate competition among the companies owing to the presence of numerous players across the industry. Owing to changing consumer trends, numerous companies are expanding their product portfolio to gain a competitive edge in the market. Some of the key market players in the brewer’s spent grain market are Malteurop; Anheuser-Busch Companies LLC; MGP; DSM; Lallemand Inc.; Leiber; Briess Malt & Ingredients; Kerry Group plc.; Buhler; ReGrained, among others.

Manufacturers are increasingly engaged in R&D activities related to products manufactured from brewer’s spent grain. They are also expanding their product lines through product launches, mergers, acquisitions, and partnerships to meet the growing demand for products manufactured from spent grain. For instance, in July 2022, Bühler, a global provider of process and equipment technologies for the food and beverage, agricultural sectors, and feed, and CN & Partners, a Switzerland-based investment firm announced the formation of Circular Food Solutions Switzerland AG, a joint venture aimed at producing a Swiss meat alternative using upcycled spent grain. Some of the prominent players in the global brewer’s spent grain market include:

-

Malteurop

-

Anheuser-Busch Companies LLC

-

MGP

-

DSM

-

Lallemand Inc.

-

Leiber

-

Briess Malt & Ingredients

-

Kerry Group plc.

-

Buhler

-

ReGrained

Brewer’s Spent Grain Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.75 billion

Revenue forecast in 2030

USD 3.32 billion

Growth rate

CAGR of 9.6% from 2022 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in metric tons, Revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; UAE; South Africa

Key companies profiled

Malteurop; Anheuser-Busch Companies LLC; MGP; DSM; Lallemand Inc.; Leiber; Briess Malt & Ingredients; Kerry Group plc.; Buhler; ReGrained

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brewer’s Spent Grain Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global brewer’s spent grain market report on the basis of product, application, and region:

-

Product Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Wheat

-

Barley

-

Rye

-

Oats

-

Other Grains

-

-

Application Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

Animal Feed

-

Cattle (Dairy/Beef)

-

Horse Feed

-

Poultry

-

Others

-

-

Food & Beverages

-

Dietary Supplements

-

Breweries (Return)

-

Others

-

-

Regional Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The China brewer’s spent grain market dominated the Asia Pacific market with a revenue share of 15.9% in 2022. China has a strong agricultural sector and is a major producer of grains like barley, rice, and corn, which are commonly used in brewing. This abundant availability of brewing ingredients contributes to the substantial generation of BSG in China, thus driving the market growth.

b. The global brewer’s spent grain market size was estimated at USD 1.60 billion in 2022 and is expected to reach USD 1.75 billion in 2023.

b. The Brewer’s Spent Grain market is expected to grow at a compound annual growth rate of 9.6% from 2023 to 2030 to reach USD 3.32 billion by 2030.

b. The Europe region dominated the market with a revenue share of 33.1% in 2022 due to its long-standing brewing tradition, resulting in a substantial supply of spent grain. Strict waste management regulations and a focus on sustainability have encouraged European breweries to find environmentally friendly solutions, leading to partnerships with industries that utilize spent grain. Europe's emphasis on circular economy initiatives and innovation has also fostered the development of new applications for spent grain.

b. Some of the key market players in the brewer’s spent grain market are Malteurop; Anheuser-Busch Companies LLC; MGP; DSM; Lallemand Inc.; Leiber; Briess Malt & Ingredients; Kerry Group plc.; Buhler; ReGrained, among others.

b. Key factors that are driving increasing consumer awareness of the health benefits of mushrooms growth include such as the increasing popularity of craft beer, the development of new technologies for upcycling spent grain, and the growing awareness of the environmental and social costs of food waste are being projected to augment demand over the forecast period. Furthermore, brewer’s spent grain (BSG) offers a sustainable and readily available option to enhance the nutritional profile and functional properties of products. This demand for alternative ingredients contributes to the growth of the BSG market.

b. Germany dominated the European market with a market share of 17.0% in 2022, owing to its robust food industry's adoption of sustainable materials, stringent waste management regulations, and efficient logistics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.