- Home

- »

- Medical Devices

- »

-

Buccal Drug Delivery Systems Market Size Report, 2030GVR Report cover

![Buccal Drug Delivery Systems Market Size, Share & Trends Report]()

Buccal Drug Delivery Systems Market Size, Share & Trends Analysis Report By Type (Buccal Tablets & Lozenges), By Application (Pain Management, Smoking Cessation, Angina Pectoris), By End-use, By Region, And Segment Forecast, 2024 - 2030

- Report ID: GVR-4-68038-397-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Buccal Drug Delivery Systems Market Trends

“2030 buccal drug delivery systems market value to reach USD 6.56 billion”

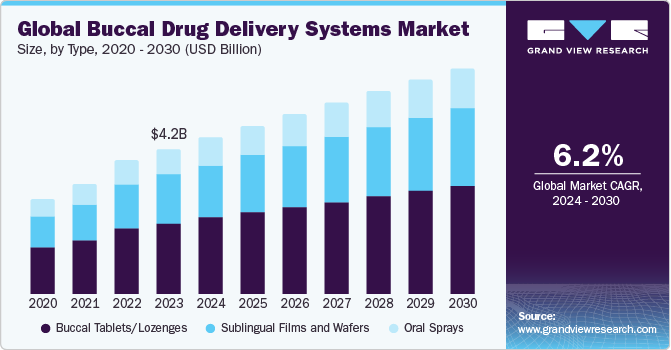

The global buccal drug delivery systems market size was estimated at USD 4.23 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030. Factors such as ongoing research and development pertaining to buccal drug delivery systemsto minimize biofluid interaction, reduce side effects, enhance concentration levels at the intended site, and shorten treatment durations are driving market growth. In addition, a rise in hospital admissions, particularly among elderly patients, along with product innovation and research conducted by community hospitals.

The buccal medication delivery system is preferred due to its advantages, including quicker absorption, fewer side effects, minimal biofluid interaction, higher concentration availability at the target site, and shorter treatment regimens. The increasing demand for self-administered pharmaceuticals, advancements in injectable drug delivery systems, high adoption of new healthcare technologies, and the rising prevalence of chronic diseases drive the industry’s growth.

The market for buccal drug delivery systems is projected to grow due to the increasing occurrence of chronic diseases. Chronic conditions such as cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes persist over a long period and necessitate ongoing medical attention. Sublingual, buccal tablets and lozenges, gels, buccal patches, liquid dosage, sublingual films, and oral sprays are among the primary types of buccal drug delivery systems used. Buccal drug delivery systems efficiently administer mucosal and trans-mucosal drugs, making them well-suited for patients with chronic ailments.

Type Insights

The buccal tablets and lozenges segment led the market in 2023 with a 48.9% revenue share, driven by consumer acceptance, ease of formulation, cost-effectiveness, and numerous drug candidates. This method bypasses initial metabolism, efficiently delivering pH-sensitive and degraded medications prone to degradation or sensitive to stomach acidity.

The sublingual films segment is projected to witness the fastest CAGR of 6.8% over the forecast period due to their ability to rapidly release high concentrations of medication directly to the target site, bypassing the liver’s first-pass metabolism and allowing for faster onset of action. This rapid absorption through the highly vascularized sublingual mucosa enables immediate drug availability, making them an attractive option for controlled-release formulations.

Application Insights

The smoking cessation segment accounted for the largest revenue share of over 30% in 2023. Buccal drug delivery involves administering medication through the oral cavity’s mucosal membrane, offering both local and systemic effects. This route enables targeted delivery to the mucosal surface and absorption into the bloodstream, making it an effective treatment for smoking and nicotine addiction. It’s also a preferred option for those hesitant to chew gum, reducing dependence on both low and high levels of smoking. This factor contributes to the market’s expansion.

The angina pectoris segment is expected to register the fastest CAGR of 7.2% during the forecast period. The rise in numbers can be attributed to the growing population of patients suffering from chronic angina pectoris, which serves as the initial indication of ischemic heart disease in almost half of the patients. Angina pectoris, also known as Stable angina, is chest pain that arises when the heart muscle demands more oxygen than usual but is unable to receive it due to heart disease.

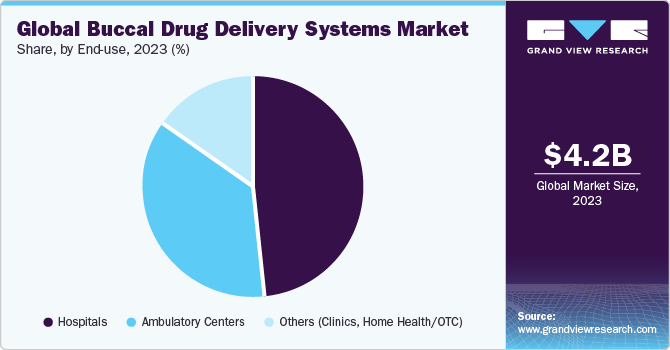

End-use Insights

The hospitals segment led the market in 2023 with a revenue share of 45.1%, owing to the recent increase in hospital admissions, especially in elderly patients. Moreover, various hospitals' product development and research initiatives are driving segment growth further. With hospitals equipped with trained professionals and necessary equipment, buccal delivery systems can be administered and monitored effectively, making them the better option for emergency medical care.

The ambulatory centers segment is expected to grow lucratively, registering a CAGR of 6.8% over the forecast period. The shorter admission and treatment periods in ambulatory centers drive segment growth. Furthermore, the progress in developing new formulations for buccal delivery, such as buccal patches with insulin for diabetes therapy, has increased the utilization of these systems in ambulatory centers.

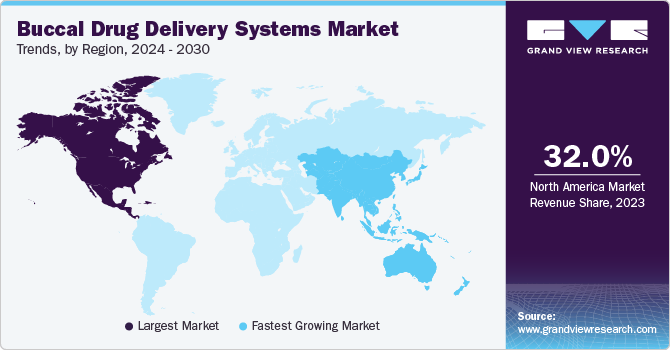

Regional Insights

The North America buccal drug delivery systems market dominated in 2023, accounting for a revenue share of nearly 32.0%. The presence of numerous market players drives the region’s growth, advancements in research to identify suitable drug candidates, significant investments by major players to develop new formulations, and improved diagnosis and treatment rates.

U.S. Buccal Drug Delivery Systems Market Trends

The buccal drug delivery systems marketin the U.S. generated 80.8% of the global revenue share in 2023. Market growth in the country is expected to be propelled by non-invasive drug delivery demand, increased research and development, and the introduction of rapid and controlled-release buccal tablets, muco-adhesive discs, and lozenges.

Europe Buccal Drug Delivery Systems Market Trends

The Europe buccal drug delivery systems market is poised to grow at a significant CAGR from 2024 to 2030, owing to the region’s adoption of innovative drug delivery technologies, a rising geriatric population, and a favorable regulatory environment. The presence of leading pharmaceutical companies has also contributed to the market’s growth, as they invest in the development and distribution of buccal delivery systems.

The buccal drug delivery systems market in the UK is expected to register significant growth over the forecast period due to factors such as improved patient compliance, rapid absorption, and avoidance of first-pass metabolism, leading to enhanced therapeutic outcomes and increased demand.

The Germany buccal drug delivery systems market is aided by a favorable regulatory environment and growing demand for convenient and effective drug administration methods, enabling the development and commercialization of innovative products. The presence of major pharmaceutical companies in Germany, which are actively investing in buccal drug products, also contributes to the market’s growth and development.

Asia Pacific Buccal Drug Delivery Systems Market Trends

TheAsia Pacific buccal drug delivery systems market is projected to register the fastest growth of 6.4% from 2024 to 2030. According to the United Nations Economic and Social Commission for Asia and the Pacific, the population in the region is growing at the fastest rate globally. Thus, market growth in the Asia-Pacific region is attributable to the increasing geriatric population and the associated rise in cardiovascular diseases, chronic conditions, respiratory disorders, and other healthcare needs.

The buccal drug delivery systems market in India is expected to enhance rapidly in the forecast period,driven by factors such as the rising elderly population, increasing demand for targeted therapies, and a favorable regulatory framework that fosters market confidence. This is expected to lead to increased adoption of innovative products and solutions.

Key Buccal Drug Delivery Systems Company Insights

Some key companies in the buccal drug delivery systems market are Teva Pharmaceutical Industries Ltd; Pfizer Inc.; GSK plc; Generex Biotechnology Corporation; and ARx LLC. Many contract manufacturers collaborate with major industry players to carry out research and produce innovative buccal muco-adhesive products. Furthermore, manufacturers are trying to find new drugs and introduce new product that will help patients at a higher rate.

-

Teva Pharmaceutical Industries Ltd offers a portfolio of generic drugs and active pharmaceutical ingredients (APIs). Leveraging advanced technologies such as artificial intelligence (AI), the company has significantly streamlined and optimized its research and development (R&D) process.

-

Pfizer Inc. is known for manufacturing pharmaceuticals and vaccines and varied consumer healthcare products. Pfizer’s operations span across developed and emerging markets, aiming to enhance overall health, prevent diseases, and combat the most formidable illnesses of our era.

Key Buccal Drug Delivery Systems Companies:

The following are the leading companies in the buccal drug delivery systems market. These companies collectively hold the largest market share and dictate industry trends.

- GSK plc

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Generex Biotechnology Corporation (LUMITOS AG)

- ARx, LLC.

- Endo, Inc.

- Catalent, Inc

- Cynapsus Therapeutics Inc.

- Collegium Pharmaceutical

- Indivior PLC

Recent Developments

-

In February 2024, Novo Holdings, responsible for managing the assets and wealth of the Novo Nordisk Foundation, acquired Catalent Inc., which provides advanced delivery technologies and development solutions. This acquisition aided the market expansion of Novo Holdings, strengthening its presence globally.

Buccal Drug Delivery Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.56 billion

Revenue forecast in 2030

USD 6.56 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd.; GSK plc; Pfizer Inc.; Generex Biotechnology Corporation (LUMITOS AG); ARx, LLC.; Catalent, Inc.; Collegium Pharmaceutical; Cynapsus Therapeutics Inc.; Endo, Inc.; Indivior PLC.

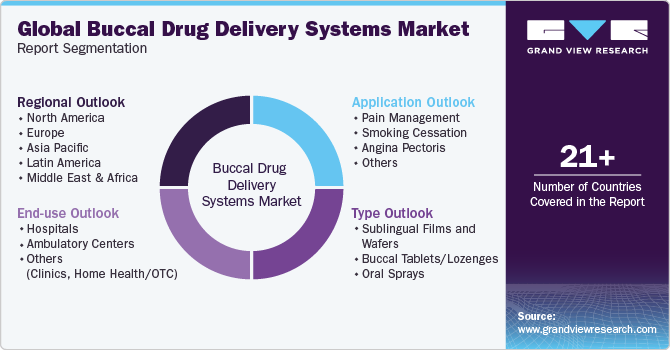

Global Buccal Drug Delivery Systems Market Report Segmentation

Forecasting revenue growth at the global, regional, and country levels, this report provides an analysis of the latest industry trends within each sub-segment from 2018 to 2030. Grand View Research has segmented the buccal drug delivery systems market report based on type, application, end-use, and region for this comprehensive study.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sublingual Films and Wafers

-

Buccal Tablets/Lozenges

-

Oral Sprays

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain Management

-

Smoking Cessation

-

Angina Pectoris

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Centers

-

Others (Clinics, Home Health/OTC)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global buccal drug delivery systems market size was estimated at USD 4.23 billion in 2023 and is expected to reach USD 4.56 billion in 2024.

b. The global buccal drug delivery systems market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 6.56 billion by 2030.

b. North America dominated the buccal drug delivery systems market with a share of over 31.0% in 2023. This is attributable to the presence of large market players and improved research to identify suitable drug candidates,

b. Some key companies in the buccal drug delivery systems market are Teva Pharmaceutical Industries Ltd; Pfizer Inc.; GSK plc; Generex Biotechnology Corporation; and ARx LLC.

b. Key factors that are driving the buccal drug delivery systems market growth include reduced side effects, high concentration availability at the target site, and a shorter treatment regime.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."