- Home

- »

- Plastics, Polymers & Resins

- »

-

Building & Construction Sealants Market Size Report, 2033GVR Report cover

![Building & Construction Sealants Market Size, Share & Trends Report]()

Building & Construction Sealants Market (2025 - 2033) Size, Share & Trends Analysis Report By Resin (Silicone Sealant, Polyurethane Sealant), By Technology (Water Based), By Application, By Function, By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-728-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Building & Construction Sealants Market Summary

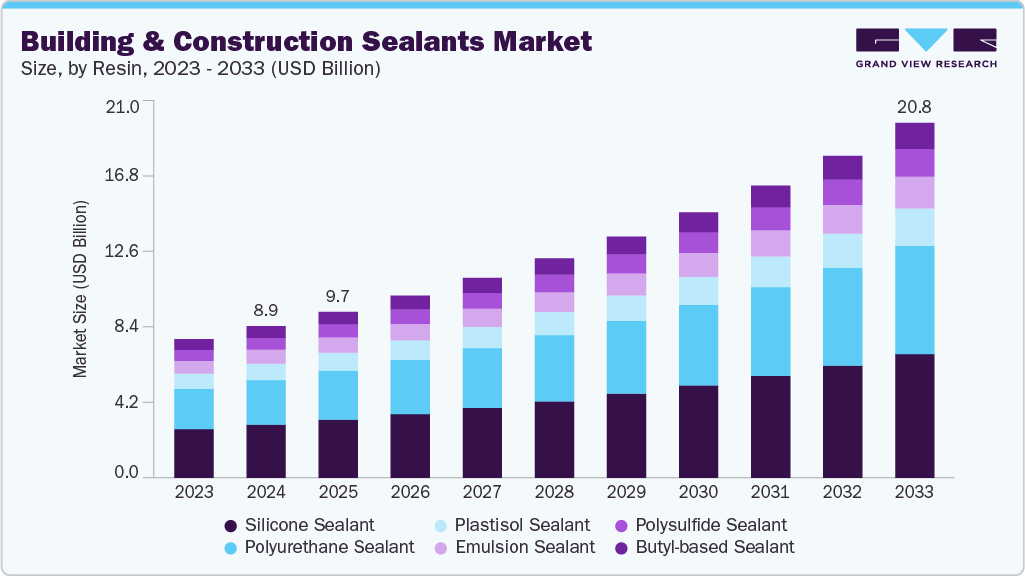

The global building & construction sealants market size was estimated at USD 8,882.5 million in 2024 and is projected to reach USD 20,797.49 million by 2033, growing at a CAGR of 10.0% from 2025 to 2033. The market is driven by rapid urbanization and expanding infrastructure projects.

Key Market Trends & Insights

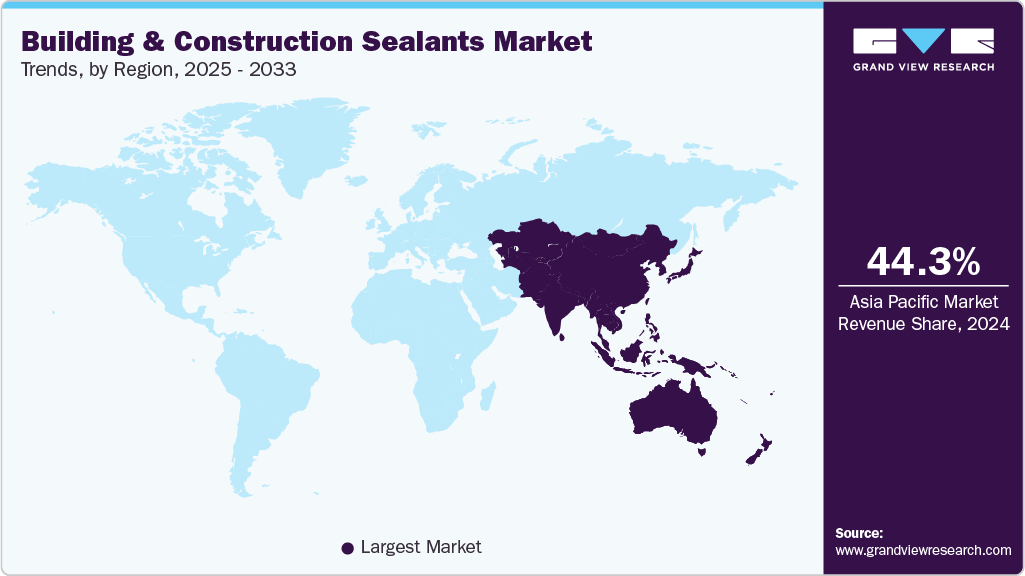

- Asia Pacific building & construction sealants market dominated the market with largest revenue share of 44.3% in 2024..

- By resin, silicone sealant segment dominated the market and accounted for the largest revenue share of 35.0% in 2024.

- By end use, commercial segment is expected to grow at the fastest CAGR of 10.3% from 2025 to 2033.

- By distribution channel, accounted for the largest market share of 83.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8,882.5 Million

- 2033 Projected Market Size: USD 20,797.49 Million

- CAGR (2025-2033): 10.0%

- Asia Pacific: Largest market in 2024

High-quality sealing solutions are increasingly required across residential, commercial, and public buildings for joints, windows, and façades. Emerging markets in Asia-Pacific and the Middle East are seeing accelerated adoption, supporting steady market growth for manufacturers.Energy-efficient building practices are driving demand for sealants that enhance air- and water-tightness. Stricter building codes and green certifications incentivize the use of high-performance products. Sealants reduce energy loss, operational costs, and improve structural durability. Builders and architects increasingly prioritize performance-oriented solutions.

Increasing focus on upgrading existing buildings for energy efficiency and durability is creating demand for high-performance sealants. Renovation and retrofit projects in both commercial and residential sectors present a steady revenue stream. Manufacturers can target these markets with specialized, long-lasting sealant solutions.

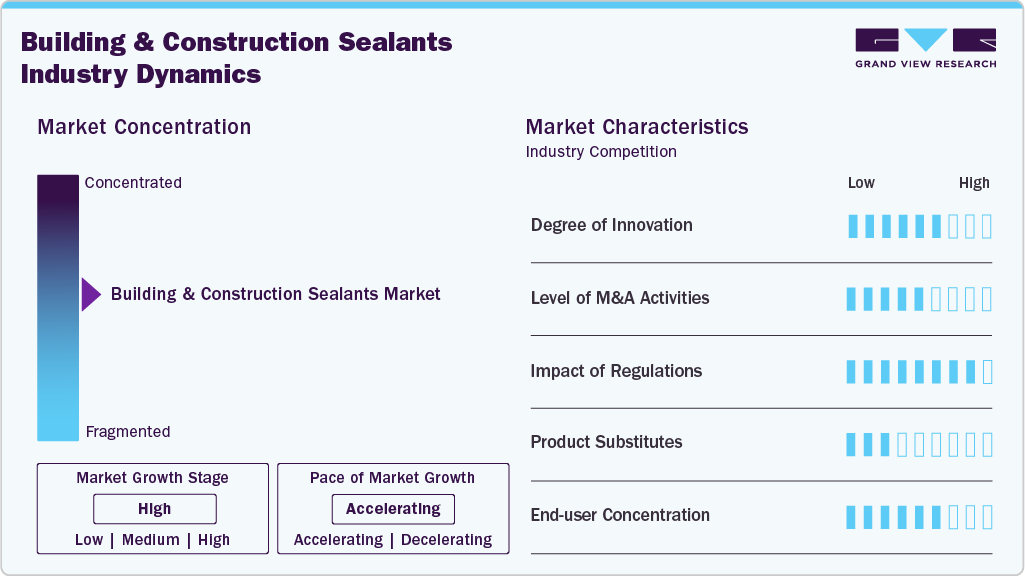

Market Concentration & Characteristics

The building and construction sealants market is moderately fragmented, with a combination of global chemical majors and regional manufacturers. Leading companies dominate the high-performance and specialty sealant segments, while smaller players compete in cost-sensitive and standard product lines. This structure allows both innovation-driven competition and opportunities for new entrants targeting niche applications or emerging regions.

The market is defined by demand for durable, high-performance, and environmentally compliant sealants. Products are differentiated by formulation-such as silicone, polyurethane, and hybrid-and by application in construction, glazing, and joint sealing. Key trends include energy-efficient building solutions, low-VOC and sustainable products, and increased adoption in renovation and retrofit projects, reflecting a shift toward long-term performance and sustainability.

Resin Insights

The silicone segment accounted for the largest market share of 35.0% in 2024, driven by its superior sealing and weatherproofing capabilities for structural joints. Silicone sealants enhance long-term durability and prevent interlocking of construction elements, making them a preferred choice for high-performance building applications.

The polyurethane segment is projected to register the fastest CAGR of 10.4% during the forecast period, supported by its extensive use in the construction and automotive industries. Its strong adhesion and resistance to oils, fuels, and corrosive materials make polyurethane sealants ideal for demanding environments and industrial applications.

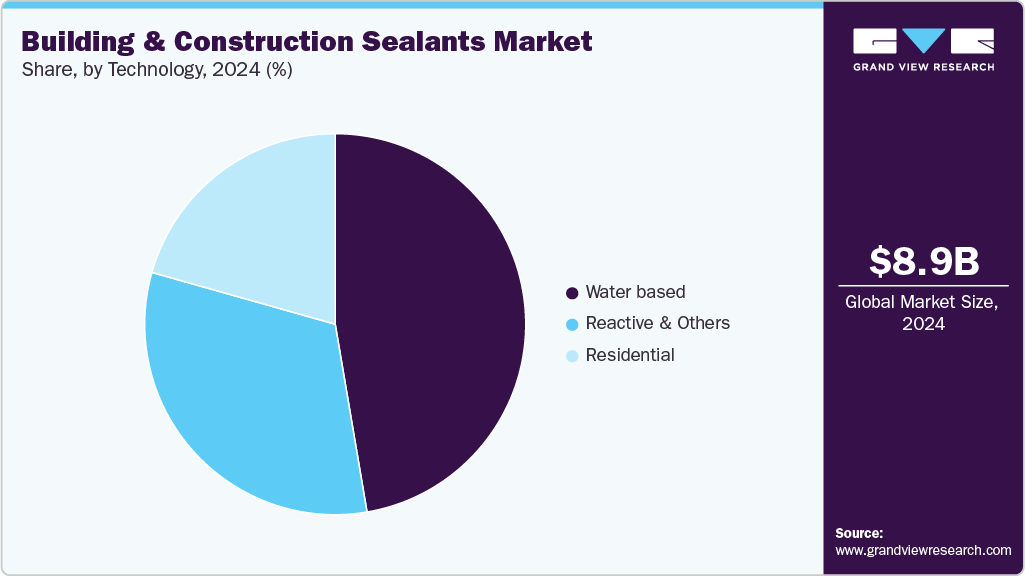

Technology Insights

The water-based sealant segment dominated the market in 2024, accounting for a revenue share of 47.3%. Its durable bonding properties and ease of application make it highly suitable for construction and woodworking projects. Additionally, the low odor and user-friendly formulation, which often eliminates the need for a caulking gun, continues to drive its widespread adoption across indoor applications.

The reactive and other sealant segment is projected to record a CAGR of 10.3% during the forecast period, supported by the growing use of low-modulus reactive silicone sealants. These products offer strong adhesion across various building substrates at a lower cost, making them a cost-effective and versatile choice for global construction companies.

Application Insights

The flooring segment is projected to register the fastest CAGR of 23.9% in terms of volume. Environment-friendly wood flooring sealants with sound-dampening properties are increasingly preferred for subfloor heating systems. Their strong adhesion, enhanced bonding strength, and improved hardness make them ideal for use in timber and wooden flooring applications.

The roofing segment accounted for the second-largest market share with a robust CAGR of 10.1% in 2024, driven by the rising use of high-performance sealants capable of withstanding extreme weather conditions. Polyurethane-based roofing sealants are gaining traction in both residential and commercial construction due to their fast-curing properties, durability, and superior bonding versatility.

Function Insights

The bonding segment accounted for a significant market share of 31.4% in 2024, driven by its extensive use in joining windows with ferrous and non-ferrous materials. Construction sealants are also widely applied for bonding decorative panels, tabletops, and mixed-material surfaces such as wood and metal, supporting their strong presence in both residential and commercial projects.

The protection segment is projected to expand at a CAGR of 10.1% during the forecast period, supported by the growing emphasis on fire safety and structural integrity. Sealants designed for fire protection and weather resistance are gaining traction as building codes tighten and awareness of construction safety standards continues to rise globally.

End Use Insights

The residential segment dominated the global market in 2024, accounting for a revenue share of 48.7%. Continuous growth in residential infrastructure, driven by rising urbanization and increasing demand for premium housing, supports the segment’s expansion. Sealants play a vital role in enhancing durability, insulation, and aesthetic appeal in modern housing projects.

The commercial segment is projected to record a CAGR of 10.3% during the forecast period, fueled by the rising number of business establishments and ongoing development of office, retail, and hospitality spaces. Polyurethane sealants are extensively utilized for both interior and exterior applications, offering superior bonding and flexibility for renovation and structural enhancement projects.

Distribution Channel Insights

The direct distribution channel accounted for the largest market share of 83.5% in 2024, driven by the strong and reliable supply chain networks established by major manufacturers. Growing construction activity in emerging economies has encouraged companies to strengthen direct sales channels to ensure timely product availability and consistent quality standards.

The third-party distribution segment is projected to grow at a CAGR of 9.3% during the forecast period. In regions with moderate construction activity, third-party distributors provide a cost-effective and efficient alternative for timely product delivery. Their strong regional presence enables manufacturers to optimize logistics, enhance market reach, and reduce overall distribution costs

Regional Insights

Asia Pacific building & construction sealants market dominated the market with largest revenue share of 44.3% in 2024. Rapid urbanization and industrial growth are driving high demand for residential, commercial, and industrial construction projects. Emerging economies such as India, China, and Southeast Asia are investing heavily in infrastructure, boosting the adoption of both standard and high-performance sealants.

China Building & Construction Sealants Market Trends

China registered highest CAGR of 9.7% during the review period. China dominated the market with a revenue share of 49.6%. Smart city initiatives and high-rise residential development are driving demand for high-quality sealants. Rapid industrial expansion and infrastructure projects require products with strong adhesion and long-term durability.

North America Building & Construction Sealants Market Trends

Technological innovation in construction materials and adoption of advanced sealing solutions for modern architecture are key drivers. Demand is rising for sealants with superior durability, flexibility, and performance in commercial and high-rise residential buildings.

U.S. Building & Construction Sealants Market Trends

In the U.S., renovation and retrofit activities are key growth drivers, particularly in aging residential and commercial buildings. Stricter energy-efficiency codes and green building regulations are increasing demand for eco-friendly, low-VOC sealants. High-rise construction and modern architectural designs require advanced sealing solutions with superior durability and flexibility, creating opportunities for innovative and high-performance products.

Europe Building & Construction Sealants Market Trends

Strict environmental regulations and sustainability initiatives are encouraging the use of eco-friendly, low-VOC, and long-lasting sealants. Retrofit projects aimed at improving energy efficiency in older buildings are also driving specialty product adoption.

Building & construction sealants market in Germany is expanding as sustainability priorities and rigorous environmental regulations boost the demand for high-performance, eco-friendly sealants. Both commercial and industrial construction projects increasingly require eco-friendly, low-VOC, and long-lasting sealants to comply with green building standards. Retrofit projects aimed at enhancing energy efficiency in older structures are also contributing to growth in specialty and high-performance sealants.

Latin America Building & Construction Sealants Market Trends

Growing urbanization, industrialization, and public infrastructure development are increasing demand for versatile and cost-effective sealants. Expansion in housing, commercial complexes, and government-led construction projects supports steady market growth.

Middle East & Africa Building & Construction Sealants Market Trends

Mega-construction projects, such as airports, stadiums, and urban development initiatives, are creating demand for high-performance, weather-resistant sealants. Harsh climatic conditions necessitate advanced formulations that ensure durability and long-term performance.

Key Building & Construction Sealants Company Insights

Some of the key players operating in the market include Sika AG, 3M, Dow Corning, H.B Fuller, BASF SE, Henkel AG & Co. KGaA, Bostik SA, Wacker Chemie AG, Pidilite Industries Limited, and Pecora Corporation.

-

Sika maintains a dominant market position in the building and construction sealants sector, leveraging its extensive global presence and diversified product portfolio. Its emphasis on high-performance, durable, and technically advanced sealants drives strong market penetration and sustained competitive advantage.

-

Henkel’s leadership in the market is driven by its innovative, sustainable, and low-VOC sealant solutions. Focused R&D, strategic product differentiation, and region-specific offerings strengthen its market share and reinforce its position as a preferred partner in global construction projects.

Key Building & Construction Sealants Companies:

The following are the leading companies in the building & construction sealants market. These companies collectively hold the largest market share and dictate industry trends.

- Sika AG

- 3M Company

- Dow Inc. (formerly Dow Corning)

- H.B. Fuller Company

- BASF SE

- Henkel AG & Co. KGaA

- Bostik SA (part of Arkema)

- Wacker Chemie AG

- Pidilite Industries Limited

Recent Developments

-

21-Aug-2025, Henkel introduced a new range of PVC-based, phthalate-free sealants under its “Darex COV” series, emphasizing sustainability and compliance with global safety standards. Although initially designed for industrial sealing, this innovation highlights Henkel’s broader R&D capability and commitment to developing safer, high-performance sealant technologies - reinforcing its leadership in the building and construction sealants market.

-

Sika announced a strategic minority investment in Giatec Scientific Inc. to advance digitalization within the construction sector. The collaboration focuses on integrating smart concrete testing and data analytics to enhance material performance, durability, and sustainability - reinforcing Sika’s innovation-driven approach in the building and construction sealants market.

Building & Construction Sealants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,727.1 million

Revenue forecast in 2033

USD 20,797.49 million

Growth rate

CAGR of 10.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Resin, technology, application, function, end use, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Sika AG; 3M; Dow Corning; H.B Fuller; BASF SE; Henkel AG & Co. KGaA; Bostik SA; Wacker Chemie AG; Pidilite Industries Limited; Pecora Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Building & Construction Sealants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global Building & Construction Sealants Market report based on resin, technology, application, function, end use, distribution channel, and region:

-

Resin Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Silicone Sealant

-

Polyurethane Sealant

-

Plastisol Sealant

-

Emulsion Sealant

-

Polysulfide Sealant

-

Butyl-based Sealant

-

-

Technology Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Water-based

-

Solvent-based

-

Reactive & Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Flooring

-

Walls & Ceilings

-

Windows

-

Doors

-

Roofing

-

Building Enveloping

-

Electrical

-

HVAC

-

Plumbing

-

Others

-

-

Function Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Bonding

-

Protection

-

Insulation

-

Glazing

-

Soundproofing

-

Cable Management

-

-

End Use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Direct

-

Third-Party

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global building and construction sealants market size was estimated at USD 8,882.5 million in 2024 and is expected to reach USD 9,727.1 million in 2025.

b. The global building and construction sealants market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2033 to reach USD 20,797.49 million by 2025.

b. Silicone Sealant dominated the building and construction sealants market with a share of 35.0% in 2024. This is attributable to efficient sealing as well as weatherproofing joints of structural components along with preventing elements from inter-locking and contributing to long-lasting quality.

b. Some key players operating in the building and construction sealants market include Sika AG, 3M, Dow Corning, H.B Fuller, BASF SE, Henkel AG & Co. KGaA, Bostik SA, Wacker Chemie AG, Pidilite Industries Limited, and Pecora Corporation.

b. Key factors that are driving the market growth include growing demand for bonding, fire protection, insulation, soundproofing, and cable management in the construction industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.