- Home

- »

- Advanced Interior Materials

- »

-

Building Insulation Market Size, Share, Industry Report, 2033GVR Report cover

![Building Insulation Market Size, Share & Trends Report]()

Building Insulation Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Glass Wool, Mineral Wool, EPS, XPS, Cellulose, PIR, Phenolic Foam, Polyurethane), By Product, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-821-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Building Insulation Market Summary

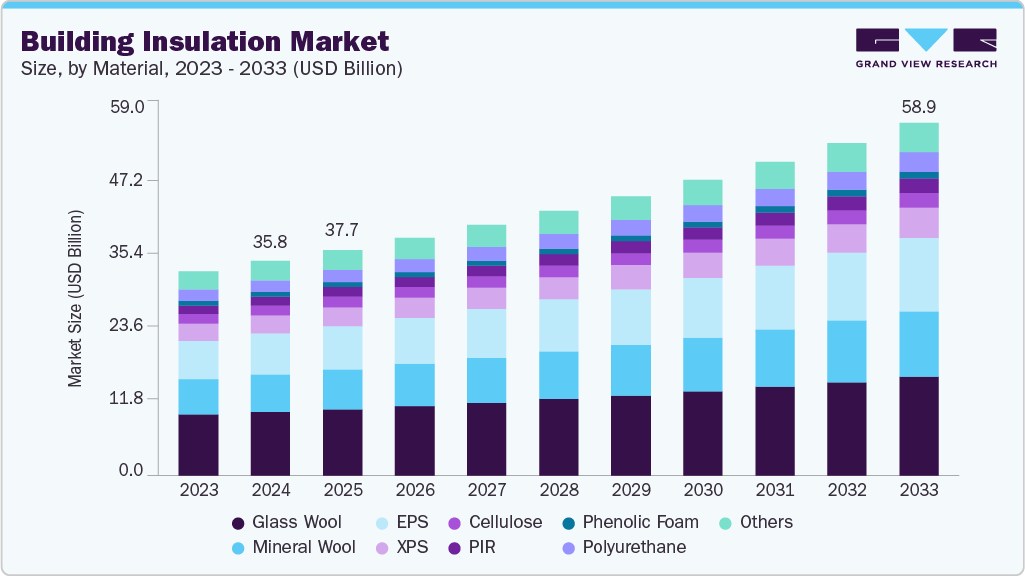

The global building insulation market size was estimated at USD 35.84 billion in 2024 and is projected to reach USD 58.91 billion by 2033, growing at a CAGR 5.7% from 2025 to 2033. The demand for building insulation is rising as global construction activity accelerates across residential, commercial, and industrial sectors.

Key Market Trends & Insights

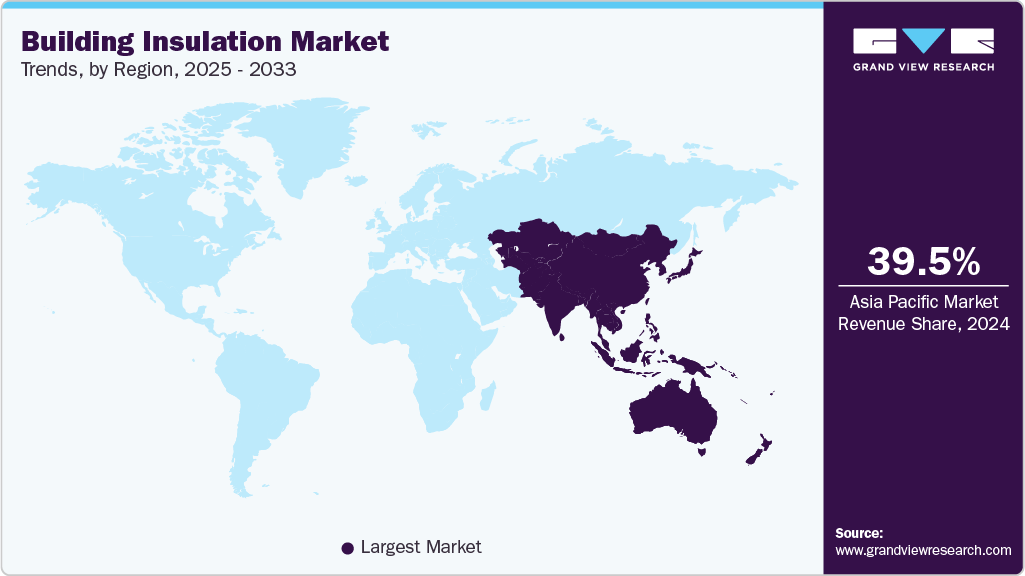

- Asia Pacific dominated the building insulation market with the largest revenue share of 39.5% in 2024.

- Building insulation market in China is witnessing significant growth due to massive urban development, high-rise construction, and industrial expansion.

- By material, the EPS segment is expected to grow at the fastest CAGR of 6.8% over the forecast period.

- By product, the rigid foam board insulation segment is expected to grow at the fastest CAGR of 6.4% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 35.84 Billion

- 2033 Projected Market Size: USD 58.91 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

The growing emphasis on energy-efficient buildings is prompting developers to upgrade thermal performance and reduce operational costs. Urban population growth and the rapid expansion of housing projects are further stimulating product consumption. Consumers and developers are now more aware of indoor comfort, air quality, and long-term utility savings, strengthening market adoption. Green building certifications and benchmarking systems are also promoting compliant insulation materials. Renovation and retrofitting of older building stock are expanding application opportunities.One of the major drivers is the global focus on energy conservation, enabling buildings to reduce heat transfer and improve temperature regulation. Stringent construction standards are pushing stakeholders toward high-performance insulating foams, boards, and mineral wool products. Climate change concerns are accelerating the implementation of low-carbon building technologies and eco-friendly insulants. Rising fuel and electricity prices are encouraging property owners to minimize energy consumption. Industrial growth and the expansion of logistics centers are generating demand for temperature-controlled structures. Technological upgrades in manufacturing methods are improving material durability and acoustic performance.

Manufacturers are developing advanced products such as vacuum insulation panels, aerogel boards, and nanotechnology-based materials to improve performance while reducing thickness. There is a clear trend toward bio-based and recyclable insulation derived from cellulose, agricultural fibers, and natural minerals. Digital modeling and building performance simulation tools are optimizing insulation decisions during project planning. Smart insulation solutions capable of controlling temperature dynamically are also gaining attention. The market is witnessing strong interest in fire-resistant and moisture-resistant materials to support safety regulations. Continuous investment in automation and precision manufacturing is improving cost efficiency. Strategic R&D investments are enabling new product classes for both new construction and renovation segments.

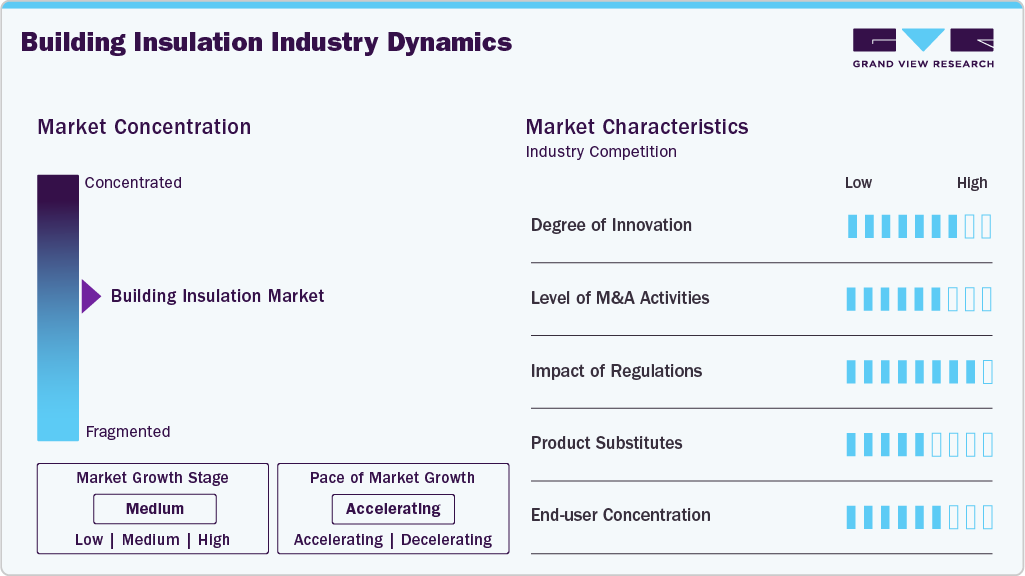

Market Concentration & Characteristics

The market includes several large multinational manufacturers along with numerous regional suppliers that cater to local construction demand. Major players typically operate extensive distribution networks, advanced insulation technology platforms, and strategically located production facilities. Smaller companies compete on pricing, local availability, and relationships with contractors. High brand recall, certification requirements, and compliance standards give larger firms a competitive advantage. However, strong growth opportunities in emerging markets allow new entrants to gain traction. Product differentiation is often based on energy performance, installation convenience, durability, and eco-credentials. Overall, the industry exhibits moderate consolidation with growing competition.

While traditional insulation materials remain dominant, substitutes such as phase-change materials, smart coatings, reflective products, and advanced cementitious layers are emerging. These alternatives sometimes offer thinner profiles or enhanced thermal performance, but often at a higher price. In certain climates, superior architectural design can reduce the need for conventional insulation materials. Adoption of substitutes also depends on local building codes and return-on-investment expectations. New substitutes are still in early commercial development and are not widely available in all markets. Performance variability across climate zones also limits rapid displacement. Therefore, threat of substitutes remains moderate.

Material Insights

The glass wool segment held the largest revenue market share of 29.7% in 2024, owing to its widespread use in residential, commercial, and industrial construction projects. Its superior thermal and acoustic performance, non-combustibility, and affordability make it one of the most preferred insulation materials across global markets. Moreover, glass wool is easy to install, compatible with various building structures, and widely available. Growing emphasis on energy efficiency and indoor comfort in both new builds and retrofit projects continues to support demand. Manufacturers are also expanding production capacities and introducing eco-friendly versions, further strengthening segment leadership.

The EPS segment is expected to grow at the fastest CAGR of 6.8% over the forecast period, due to increasing adoption in external wall insulation systems, roofing, and foundation applications. EPS offers excellent insulation efficiency, lightweight construction, and cost-effectiveness, making it suitable for large-scale residential and commercial development. Growing use in energy-efficient building envelopes and green construction initiatives is boosting demand. Furthermore, advancements in modified EPS formulations with enhanced fire resistance and moisture control are broadening end use potential. Rapid urbanization in emerging markets is also driving strong consumption growth in coming years.

Product Insights

The batt and roll (blanket) insulation segment held the largest revenue share of 39.7% in 2024, as it remains the most commonly used solution in residential construction, particularly for walls, attics, and floors. Its simple installation, affordability, and easy availability through retail and distribution networks make it popular among contractors and homeowners. The segment benefits from strong demand in new housing developments as well as renovation and retrofitting activity. Widespread use of fiberglass and mineral wool blanket products also supports steady sales. Growing consumer focus on improving indoor comfort and energy savings further reinforces segment leadership.

The rigid foam board insulation segment is expected to grow at the fastest CAGR of 6.4% over the forecast period, due to rising use in energy-efficient building envelopes, including roofs, walls, and foundations. These boards deliver high R-values, excellent moisture control, and structural stability, making them suitable for demanding thermal performance standards. Demand is particularly strong in commercial and industrial construction, where durability and long-term insulation performance are critical. Increasing adoption of external insulation finishing systems (EIFS) and advanced materials such as polyiso and extruded polystyrene is also supporting growth. Continued regulatory pressure for improved building efficiency is likely to accelerate market expansion.

Regional Insights

Asia Pacific building insulation market dominated the respective global market and accounted for the largest revenue share of 39.5% in 2024, due to vast construction activity in China, India, Southeast Asia, and Japan. Rapid urbanization and large-scale infrastructure development continue to enhance insulation demand. Governments are updating building codes to improve thermal performance and lower energy consumption in new structures. Rising middle-class income levels are increasing demand for well-insulated homes and commercial properties. Regional manufacturers are expanding production facilities and investing in technology upgrades. Retrofit programs are gaining momentum in developed economies such as Japan and South Korea. The region is expected to remain the major demand center over the coming years.

China Building Insulation Market Trends

Building insulation market in China is witnessing significant growth due to massive urban development, high-rise construction, and industrial expansion. The government is pushing green building standards, improving compliance levels across public and private projects. Energy-efficient building mandates are driving increased insulation deployment in walls, floors, and roofing systems. Large and mature manufacturing clusters provide cost advantages and faster supply chain response. Retrofitting of older residential blocks is becoming an important demand driver. Rapid improvement in living standards is increasing consumer preference for thermally optimized homes. China is likely to remain one of the world’s largest insulation markets.

North America Building Insulation Market Trends

North America benefits from strong regulatory enforcement of energy codes across states and municipalities. Renovation of mature building stock accounts for a large share of insulation demand. Consumer expectations for indoor comfort, humidity control, and noise reduction are influencing material choices. Builders are focusing on high-efficiency building envelopes to improve long-term performance. Industrial and warehousing sector expansion is contributing to continuous product adoption. Corporate sustainability commitments are motivating large developers to use environmentally responsible materials. Ongoing technology development continues to enhance overall product competitiveness.

The U.S. remains one of the most strictly regulated insulation markets, with detailed building energy requirements at federal and state levels. Home retrofitting is accelerating due to incentivized upgrade programs and increasing energy prices. The construction sector is benefiting from strong investments in commercial, residential, and industrial projects. Consumer awareness about reduced monthly utility bills is supporting the adoption of premium insulation materials. Several manufacturers are focusing on recyclable, low-VOC, and fire-safe products. Stricter green certification frameworks also guide procurement decisions. The U.S. is expected to maintain steady, policy-driven growth.

Europe Building Insulation Market Trends

Europe is a mature market with long-established insulation standards and strong emphasis on sustainable buildings. Ongoing renovation of older housing and public structures is a major market catalyst. EU climate agendas are encouraging deep building retrofits for energy reduction. Manufacturing capabilities are well developed, with leading companies headquartered across multiple European countries. Consumer preference for quiet, comfortable, and energy-efficient living spaces is driving usage. Long-term logistics and infrastructure expansion support industrial demand. Innovation continues to be an important growth determinant in Europe.

Germany Building Insulation Market is witnessing growth due tocountry’s stringent energy efficiency standards that strongly influence insulation adoption in new and renovated buildings. Public awareness regarding sustainability, heat loss reduction, and noise control remains high. Government incentives support low-emission materials and building retrofits, especially in older residential districts. Manufacturers in Germany invest heavily in R&D and quality engineering. Industrial construction growth and logistics facility expansion are contributing to demand. Strict compliance criteria drive the adoption of technically advanced solutions. Germany continues to be one of Europe’s most regulated and high-performance insulation markets.

Central & South America Building Insulation Market Trends

The building insulation market in Central & South America shows gradual growth led by rising construction activity in countries such as Brazil, Mexico, and Chile. Increasing awareness of indoor comfort, particularly in heat-prone regions, is driving the adoption of insulation. Industrial and logistics sector development is also creating additional demand outlets. Government building standards are evolving, improving material standardization and adoption rates. Local manufacturing capabilities are improving, although reliance on imports remains in certain product categories. Market growth is also tied to economic cycles and urban development plans. Adoption is expanding as developers increasingly prioritize energy-efficient buildings.

Middle East & Africa Building Insulation Market Trends

The Middle East & Africa market is influenced by stringent climatic conditions that require improved indoor temperature control. Rapid development of residential communities, commercial complexes, and industrial zones supports continued insulation demand. Governments are introducing building codes aligned with global sustainability benchmarks. Increasing electricity tariffs are pushing property owners toward materials that reduce cooling loads. Urbanization and investment in tourism, transportation, and logistics hubs further boost market potential. Adoption of advanced and fire-resistant products is growing in high-rise buildings. The region is poised for sustained but uneven growth depending on local construction cycles.

Key Building Insulation Company Insights

Some of the key players operating in the market include Huntsman International LLC and Owens Corning

-

Huntsman International LLC is a global chemical manufacturer known for producing performance materials and specialty chemicals used in industries such as construction, automotive, aerospace, and consumer products. The company has a strong portfolio of polyurethane systems that are widely used in insulation applications due to their energy efficiency and durability. Huntsman operates manufacturing and R&D facilities worldwide and focuses heavily on innovation, sustainability, and customer-driven solutions.

-

Owens Corning is a leading U.S.-based manufacturer of insulation, roofing, and fiberglass composites. The company is recognized for its advanced thermal and acoustic insulation products used in residential, commercial, and industrial buildings. With a strong global presence and a reputation for innovation, Owens Corning invests significantly in sustainability initiatives and energy-efficient construction technologies, making it one of the most influential players in the insulation industry.

DuPont and BASF are some of the emerging market participants in the building insulation market.

-

DuPont is a global technology and materials company known for developing advanced products in electronics, construction, packaging, and automotive industries. In the insulation market, DuPont provides solutions such as weatherproofing membranes, spray foams, and thermal barriers that enhance building efficiency and durability. With a long heritage of R&D, DuPont continues to lead innovation through high-performance materials that support modern construction and sustainability goals.

-

BASF is one of the world’s largest chemical producers, offering a wide range of products for construction, automotive, agriculture, and industrial sectors. The company is a major supplier of polyurethane and polystyrene-based insulation materials used to reduce energy consumption and improve building performance.

Key Building Insulation Companies:

The following are the leading companies in the building insulation market. These companies collectively hold the largest market share and dictate industry trends.

- GAF Materials Corporation

- Huntsman International LLC

- DuPont

- Owens Corning

- Saint-Gobain S.A.

- Kingspan Group

- BASF

- Knauf Insulation

- Carlisle Companies, Inc.

- 3M Company

Recent Developments

-

In May 2024, GAF Materials Corporation began production at its new polyiso (polyisocyanurate) insulation plant in Peru, Illinois, producing its EnergyGuard line, including non-halogenated (NH) boards.

-

In May 2024, Huntsman Building Solutions launched a new Icynene Series of spray polyurethane foam (SPF) insulation (open- and closed-cell) at the SprayFoam 2024 Expo.

Building Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.70 billion

Revenue forecast in 2033

USD 58.91 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

GAF Materials Corporation; Huntsman International LLC; DuPont; Owens Corning; Saint-Gobain S.A.; Kingspan Group; BASF; Knauf Insulation; Carlisle Companies Inc.; 3M Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

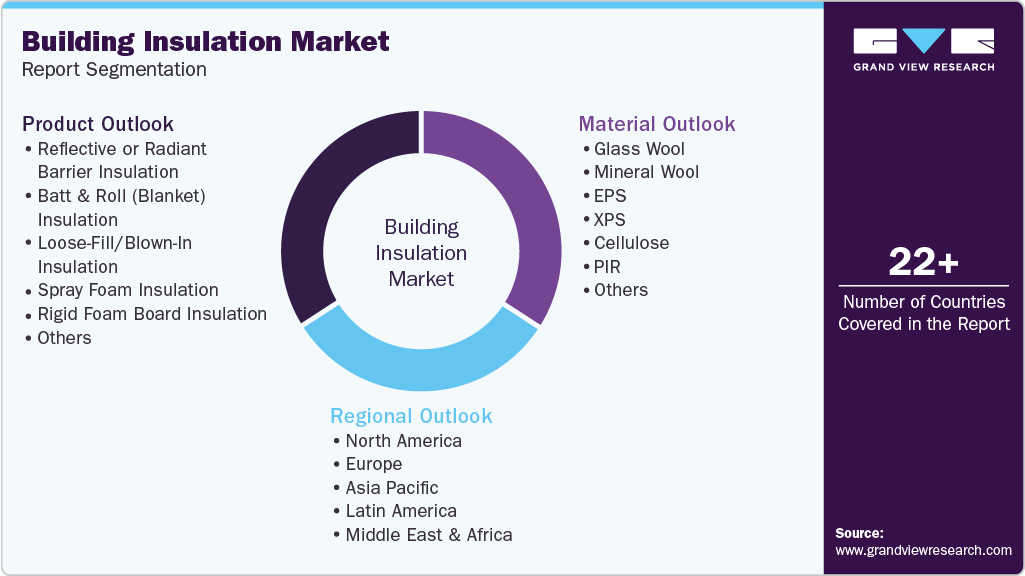

Global Building Insulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the building insulation market based on material, product, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Glass Wool

-

Mineral Wool

-

EPS

-

XPS

-

Cellulose

-

PIR

-

Phenolic Foam

-

Polyurethane

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Reflective or Radiant Barrier Insulation

-

Batt & Roll (Blanket) Insulation

-

Loose-Fill / Blown-In Insulation

-

Spray Foam Insulation

-

Rigid Foam Board Insulation

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global building insulation market size was estimated at USD 35.84 billion in 2024 and is expected to reach USD 37.70 billion in 2025.

b. The global building insulation market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 58.91 billion by 2033.

b. The glass wool segment held the highest revenue market share of 29.7% in 2024, owing to its widespread use in residential, commercial, and industrial construction projects.

b. Some of the key players operating in the building insulation market include GAF Materials Corporation, Huntsman International LLC, DuPont, Owens Corning, Saint-Gobain S.A., Kingspan Group, BASF, Knauf Insulation, 3M Company, and Carlisle Companies, Inc.

b. Rising energy-efficiency regulations, growing construction activity, increasing electricity costs, and greater awareness of indoor comfort are key factors driving the building insulation market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.