- Home

- »

- Advanced Interior Materials

- »

-

Vacuum Insulation Panel Market Size & Share Report, 2030GVR Report cover

![Vacuum Insulation Panel Market Size, Share & Trends Report]()

Vacuum Insulation Panel Market (2024 - 2030) Size, Share & Trends Analysis Report By Core Material (Silica, Fiberglass), By Product (Flat, Special Shape), By Raw Material, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-909-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vacuum Insulation Panel Market Summary

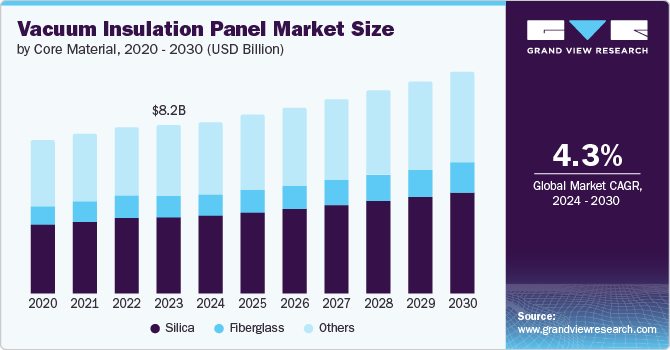

The global vacuum insulation panel market size was valued at USD 8.25 billion in 2023 and is projected to reach USD 10.82 billion by 2030, growing at a CAGR of 4.3% from 2024 to 2030. The expanding construction and consumer durable industries are significant drivers of the vacuum insulation panel market.

Key Market Trends & Insights

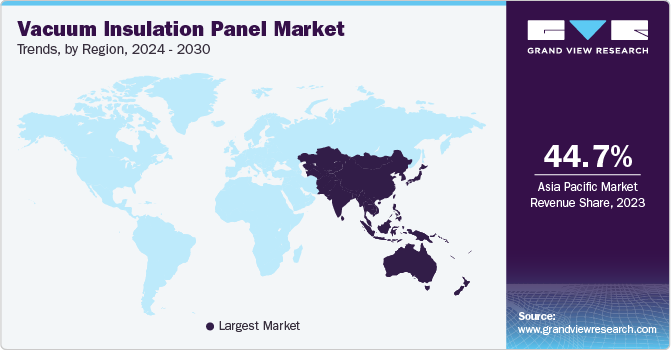

- Asia Pacific dominated the market in 2023 and is expected to grow during the forecast period.

- The China vacuum insulation panel market held largest market share in 2023.

- By core material, the silica segment dominated the market with 45.2% of revenue share in 2023.

- By product, the flat segment dominated the market with 55.1% of revenue share in 2023.

- By raw material, the metals segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.25 Billion

- 2030 Projected Market Size: USD 10.82 Billion

- CAGR (2024-2030): 4.3%

- Asia Pacific: Largest market in 2023

In addition, the expanding cold chain logistics sector and advancements in VIP technology are fueling market growth. The construction sector is one of the largest consumers of vacuum insulation panels due to their superior thermal insulation properties. As global awareness about energy efficiency increases, builders are increasingly adopting VIPs to meet stringent building codes and regulations aimed at reducing energy consumption. VIPs offer superior insulation compared to traditional materials, leading to substantial energy savings in buildings and appliances. Rapid urbanization in developing countries has led to increased demand for residential and commercial buildings, which in turn drives the need for effective insulation solutions.

Governments worldwide are implementing stringent building codes and energy efficiency standards to reduce carbon emissions. VIPs align perfectly with these regulations, driving their adoption in the construction sector. Ongoing research and development are leading to improvements in VIP production processes, reducing costs and expanding their application possibilities. The need for efficient cold chain management in the food, pharmaceutical, and chemical industries is driving demand for high-performance insulation materials such as VIPs.

Core Material Insights

The silica segment dominated the market with 45.2% of revenue share in 2023. This is due to their exceptional thermal insulation properties. The inherent stability and low thermal conductivity of silica enable VIPs to maintain high performance over extended periods. The versatility of silica in various applications, from construction to appliances, coupled with ongoing research to enhance its properties, is driving market expansion.

The fiberglass segment is anticipated to witness a significant CAGR of 4.4% over the forecast period. This upward trend is due to their cost-effectiveness and improved insulation performance compared to traditional materials. The lightweight nature of fiberglass makes it suitable for various applications, while advancements in manufacturing processes are enhancing its thermal resistance. The growing demand for energy-efficient solutions across sectors, combined with the competitive pricing of fiberglass-based VIPs, is propelling market growth.

Product Insights

The flat segment dominated the market with 55.1% of revenue share in 2023. This is due to their ease of manufacturing, handling, and installation. They are widely used in various applications, including construction, refrigeration, and transportation. The increasing demand for energy-efficient buildings and appliances, coupled with the simplicity of integrating flat VIPs into existing designs, is driving market growth.

The special shape segment is anticipated to witness a significant CAGR of 4.2% over the forecast period. This is due to their ability to fit specific design requirements and enhance product aesthetics. These panels are increasingly used in architectural applications, transportation, and specialized equipment.

Raw Material Insights

The metals segment accounted for the largest market revenue share in 2023. This is due to their excellent barrier properties, thermal conductivity properties and recyclability. The increasing demand for durable and high-performance VIPs, coupled with advancements in metal processing technologies, is driving the consumption of panels made of metals in the market.

The plastic segment is expected to register the fastest CAGR during the forecast period. The growth is due to their versatility, cost-effectiveness, and good insulation properties. The growing emphasis on lightweight and flexible VIPs, along with the development of new plastic formulations with enhanced thermal performance, is boosting the demand for plastic raw materials in the VIP market.

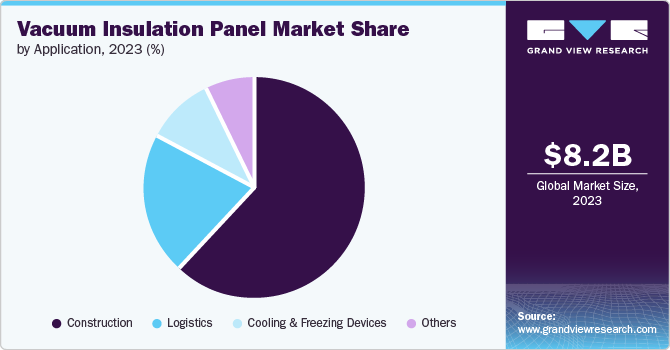

Application Insights

Construction accounted for the largest market with a revenue share of 61.5% in 2023. The increasing demand for energy-efficient building materials is a significant factor driving the growth of VIPs in the construction sector. VIPs offer superior insulation properties compared to traditional materials, leading to reduced energy consumption and lower carbon emissions. Furthermore, the growing trend towards sustainable construction and the need for improved indoor comfort are driving the adoption of VIPs in various building applications.

Cooling & freezing devices are projected to grow at a CAGR of 4.6% over the forecast period. Their exceptional insulation properties help maintain low temperatures efficiently, reducing energy consumption and extending product shelf life. The growing demand for refrigerated transportation, particularly in the pharmaceutical and food industries, is driving the adoption of VIPs in cold chain solutions. In addition, the increasing focus on energy efficiency in household appliances, such as refrigerators and freezers, is creating new opportunities for VIPs in this market.

Regional Insights

The North America vacuum insulation panel market is anticipated to grow at a CAGR of 4.1% during the forecast period. It is attributable to its robust construction industry, and a growing emphasis on sustainable building practices. Furthermore, the increasing adoption of green building certifications and government incentives for energy-efficient construction are further driving market growth.

U.S. Vacuum Insulation Panel Market Trends

The U.S. vacuum insulation panel market held a dominant position in 2023 due to its large construction sector, stringent building codes, and a growing focus on energy conservation. Moreover, the growing awareness of the benefits of VIPs in terms of improved indoor comfort and reduced utility bills is driving market expansion.

Europe Vacuum Insulation Panel Market Trends

The Europe vacuum insulation panel market was identified as a lucrative region in 2023driven by stringent energy efficiency regulations, a developed construction sector, and a strong focus on sustainability.

The UK vacuum insulation panel market held a substantial market share in 2023 owing to the country's strong emphasis on energy efficiency and sustainable development. Moreover, the UK's cold climate creates a favourable environment for utilizing VIPs to optimize energy consumption in residential and commercial buildings.

Asia Pacific Vacuum Insulation Panel Market Trends

Asia Pacific dominated the market in 2023 and is expected to grow during the forecast period, due to the rapid industrialization and urbanization in the region and a surge in construction activities.

The China vacuum insulation panel market held largest market share in 2023. The country’s massive infrastructure development, rapid industrialization, and a growing emphasis on energy efficiency are fuelling the market growth.

Key Vacuum Insulation Panel Company Insights

Some key companies in vacuum insulation panel market include Evonik Industries AG, LG Hausys Ltd, Panasonic Corporation, Thermocor , Va-Q-Tec AG , Microtherm Sentronic GmbH and others. The cost of the product is a significant factor expected to influence the market scenario.

- Evonik Industries AG is a leading specialty chemicals company based in Germany, recognized for its innovative solutions across various sectors, including construction, automotive, and consumer goods.

Key Vacuum Insulation Panel Companies:

The following are the leading companies in the vacuum insulation panel market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- LG Hausys Ltd

- Panasonic Corporation

- DOW

- OCI Ltd

- Kevothermal, LLC

- Porextherm Dämmstoffe GmbH

- Thermocor

- Va-Q-Tec AG

- Microtherm Sentronic GmbH

Vacuum Insulation Panel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.39 billion

Revenue forecast in 2030

USD 10.82 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Million Square Meters, Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Core material, product, raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Indonesia; Malaysia; Thailand; Australia; Argentina; Brazil; Saudi Arabia; UAE; Qatar; Oman; South Africa

Key companies profiled

Evonik Industries AG ; LG Hausys Ltd; Panasonic Corporation ; DOW; OCI Ltd ; Kevothermal; LLC ; Porextherm Dämmstoffe GmbH ; Thermocor ; Va-Q-Tec AG ; Microtherm Sentronic GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vacuum Insulation Panel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vacuum insulation panel market report based on core material, product, raw material, application, and region.

-

Core Material Outlook (Revenue, USD Million, Volume in Million Square Meters, 2018 - 2030)

-

Silica

-

Fiberglass

-

Others

-

-

Product Outlook (Revenue, USD Million, Volume in Million Square Meters, 2018 - 2030)

-

Flat

-

Special Shape

-

-

Raw Material Outlook (Revenue, USD Million, Volume in Million Square Meters, 2018 - 2030)

-

Plastics

-

Metals

-

-

Application Outlook (Revenue, USD Million, Volume in Million Square Meters, 2018 - 2030)

-

Construction

-

Cooling & Freezing Devices

-

Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Million Square Meters, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Malaysia

-

Thailand

-

Australia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.