- Home

- »

- Advanced Interior Materials

- »

-

Building Thermal Insulation Market, Industry Report, 2030GVR Report cover

![Building Thermal Insulation Market Size, Share & Trends Report]()

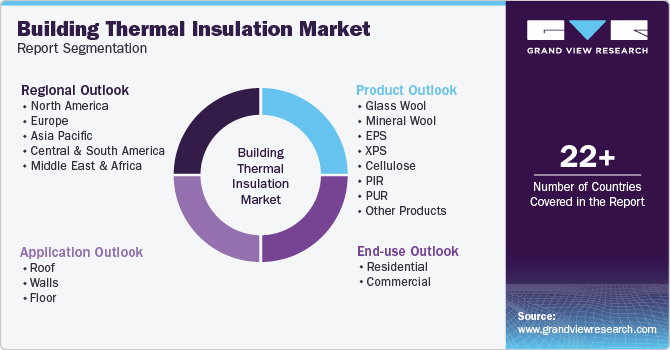

Building Thermal Insulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Glass Wool, EPS), By Application (Roof, Walls, Floor), End-use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-842-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Building Thermal Insulation Market Summary

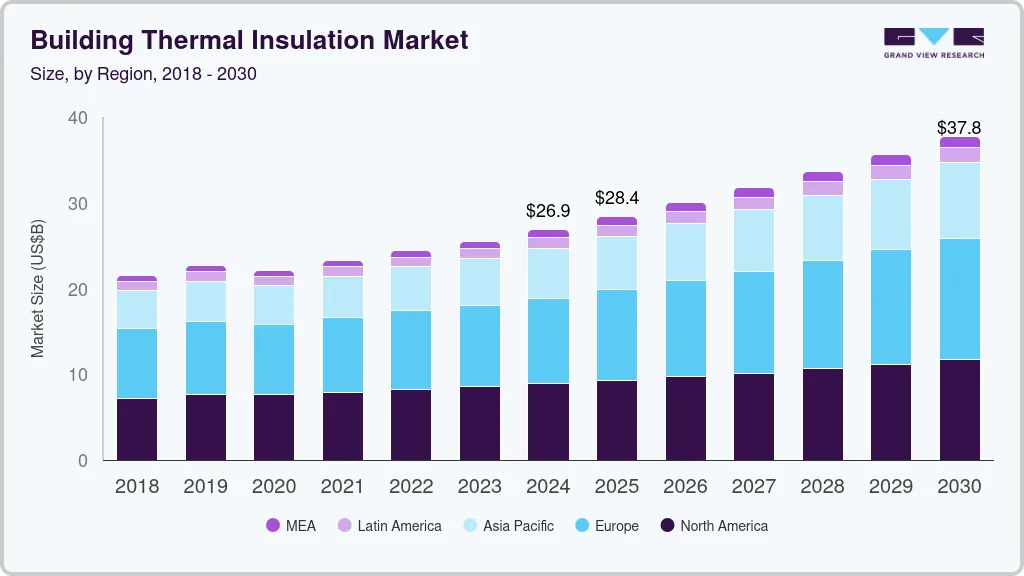

The global building thermal insulation market size was estimated at USD 26.9 billion in 2024 and is projected to reach USD 37.8 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. Increasing residential and commercial applications of the product to reduce overall energy costs, coupled with rising awareness about energy conservation, are expected to drive the growth.

Key Market Trends & Insights

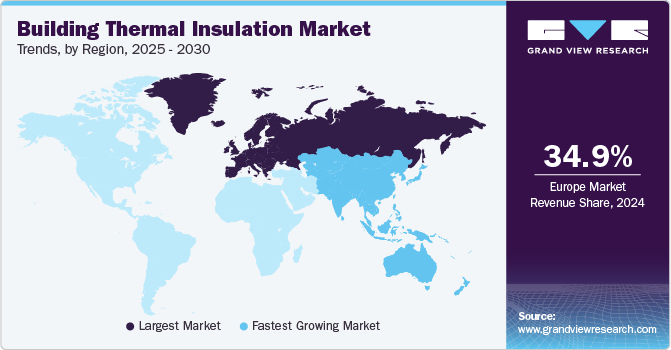

- The building thermal insulation market in Europe accounted for the largest revenue share of 34.9% in 2024.

- By product, glass wool insulation segment dominated the market with a revenue share of 37.1% in 2024.

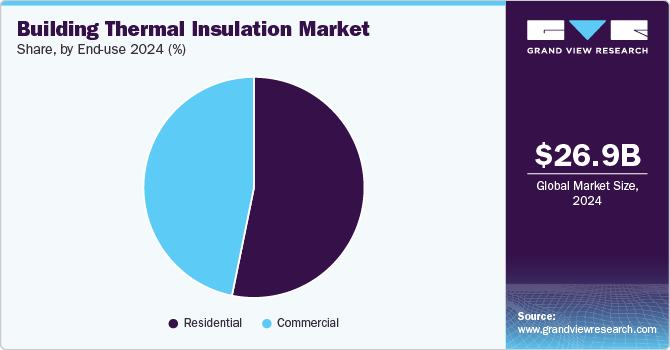

- By end-use, residential segment accounted for the highest revenue share of 53.2% in 2024.

- By application, wall segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.9 Billion

- 2030 Projected Market Size: USD 37.8 Billion

- CAGR (2025-2030): 5.9%

- Europe: Largest market in 2024

Favorable regulations that focus on lowering overall energy consumption are likely to be a major factor driving the market for building thermal insulation. Thermal building insulation helps reduce the dependency on Heat, Ventilation, and Air Conditioning (HVAC), thereby lowering overall energy consumption, which is expected to benefit growth.

Favorable building codes in the U.S. and Canada, coupled with the establishment of energy certification agencies such as the Leadership in Energy and Environmental Design (LEED) and the U.S. Green Building Council (USGBC), are expected to have a positive impact on the demand for building thermal insulation. However, stringent regulations imposed by the United States Environmental Protection Agency (EPA) on the use of foamed plastics, owing to their low biodegradability and carcinogenicity, may hurt the market growth.

The environmental impact of building insulation materials is likely to shift the industry’s focus to developing environmentally friendly products over the forecast period. Besides, increasing prices of plastic foam are expected to harm the industry's growth, thereby leading to the development of alternative products.

Recyclable insulation is gaining popularity due to the stringent regulations governing conventional products such as plastic foams. Due to increasing environmental awareness, homeowners, architects, and businesses are expected to favor green, biodegradable, and recyclable products. This is expected to boost the threat of substitutes in the building thermal insulation market over the forecast period.

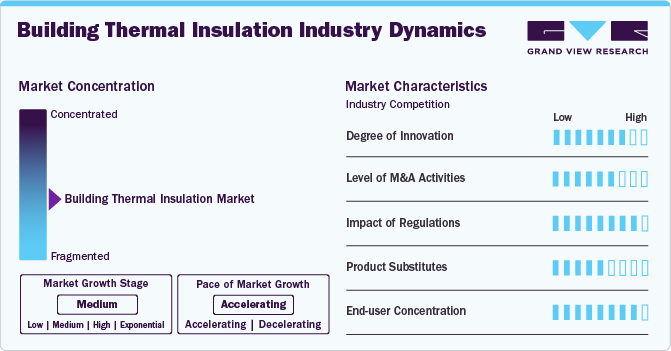

Market Concentration & Characteristics

The market growth stage is moderate, and the pace is accelerating. The market exhibits a moderate degree of innovation, as players aim to achieve optimum growth by introducing enhanced insulation products and implementing the latest technologies and product innovations.

Environmental regulations have a significant impact on the industry, as several bodies around the world govern and pass regulations regarding the production and installation of thermal insulation in buildings, such as The American Society for Testing and Materials (ASTM), Construction Products Regulation 2011 (CPR), and the British Standards Institution (BSI). Moreover, the manufacturing of insulation should meet the standard performance requirements. They have to pass various tests prior to their sales in the market.

Plastic foam and wool derived insulation materials are the most preferred choice globally owing to their superior insulating properties, vast availability, and comparatively low cost. However, materials such as wool fiber are used for numerous applications despite their high costs. Hence, the threat of internal substitution is expected to remain accurate.

The building thermal insulation market's end-user concentration is moderately high, with significant demand stemming from the residential and commercial construction sectors. Single-unit residential buildings account for a substantial portion of consumption. Moreover, commercial buildings, including educational institutions, retail shops, and hospitals, contribute to consistent product demand.

Product Insights

Glass wool insulation dominated the segment with a revenue share of 37.1% in 2024. Glass wool is manufactured by heating silica sand at 1200ºC to 1250ºC and converting it into fibers. It can be manufactured in the form of pipes, boards, and blankets of different sizes, with different technical properties, specific to its applications. The product also offers energy-efficient thermal and acoustic insulation, as well as fire safety, driving its growth over the forecast period.

Expanded Polystyrene (EPS) is expected to exhibit the highest CAGR of 6.8% over the forecast period, owing to its excellent thermal insulation properties and long life span. Also, increasing preference for the product owing to its non-toxic, rot-proof, and recyclable properties is expected to boost the growth.

Extruded Polystyrene (XPS) is estimated to witness significant growth over the forecast period, on account of its ability to reduce moisture-related damages, resistance to water, and the ability to enable energy savings. Besides, its ability to inhibit microbial or fungal growth in the insulated area is further expected to bolster growth.

Mineral/stone wool is one of the most environmentally robust insulation materials. It is a widely used material for thermal insulation in buildings as it maintains energy efficiency and provides fire protection with improved acoustics. Mineral wool is manufactured from volcanic rocks, such as dolomite, diabase, and basalt, which are easily available.

End-use Insights

Residential construction accounted for the highest revenue share of 53.2% and is estimated to witness the highest CAGR of 5.9% during the forecast period, owing to the high growth of single-unit houses, coupled with refurbishment and re-insulation of old houses. Besides, growth in multi-family housing construction activities is also predicted to aid building thermal insulation market growth.

The residential construction segment is inclusive of residential buildings, apartments, complexes, and small houses. The growth in the number of single-family houses in developing economies and the rising disposable income of consumers are among the various factors projected to drive residential construction activities.

The commercial construction segment is inclusive of buildings for office spaces, universities, hypermarkets, supermarkets, departmental stores, shopping malls, hospitals & clinics, restaurants & hotels, resorts, and others. The rapidly emerging trend of sustainable buildings is one of the major factors driving the growth of building thermal insulation. In addition, rising office spaces in emerging economies, especially located in subtropical regions, are expected to witness notable demand for insulation systems in order to maintain energy benchmarking as well as regulate temperature levels.

Application Insights

Wall application led the building thermal insulation market in 2024 and is estimated to expand at the fastest revenue CAGR of 6.1% over the forecast period, owing to the rising application of the product on exterior and interior walls. Also, increasing product penetration for the insulation of cavity walls is expected to bolster the industry's growth.

Roof application accounted for a market share of 35.2% in 2024 and is expected to witness significant CAGR over the forecast period, owing to the rising requirement to avoid heat penetration from direct sunrays through the roof in buildings. Also, an increasing number of single housings is expected to boost the market growth of building thermal insulation over the forecast period.

Insulation of walls is also one of the essential elements to make the building more energy efficient. Insulated walls, along with insulated roofs, create a protective envelope that eliminates heat transfer from the external environment through conduction and convection radiation. Mineral and XPS are some of the most popular materials used for external wall insulation owing to their low cost, high durability, and convenient installation.

Floor application is projected to witness moderate growth over the forecast period, owing to rising demand to reduce the energy costs of HVAC applications. Thermal insulation finds applications in flooring, including basements, garages, cantilevers, and crawl spaces. Increasing product penetration for floor insulation in extremely cold regions is expected to fuel building thermal insulation market growth.

Regional Insights

Burgeoning residential and commercial construction activities in the North America building thermal insulation market, coupled with the implementation of strict green building codes to reduce energy consumption per structure, are expected to aid growth. Furthermore, favorable government regulations for the adoption of the product for residential and commercial structures are expected to boost growth over the forecast period.

U.S. Building Thermal Insulation Market Trends

The U.S. building thermal insulation market dominated in North America in terms of consumption in 2024 owing to increased demand from the residential sector, development of the manufacturing industry, and government initiatives to develop public infrastructure. In addition, rising awareness regarding the benefits of insulating building structures is expected to benefit the market growth over the coming yearsCan you please provide me with access to this document? Can you please provide me with access to this document?

The building thermal insulation market in Canada is expected to witness substantial growth owing to the rising construction industry in the country, primarily due to the increasing population, urbanization, and high rate of migration. The country is also expected to witness strong growth in demand for multi-family housing units, augmenting product consumption over the forecast period.

Europe Building Thermal Insulation Market Trends

The building thermal insulation market in Europe accounted for the largest revenue share of 34.9% in 2024 and is predicted to remain a major market for building thermal insulation by 2030. Initiatives by Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) and the European Commission (EC) to promote thermal insulation as a means of energy conservation are expected to aid regional growth.

Residential construction in Germany is presumed to observe strong growth fueled by rising per capita income, low interest rates, and a rising number of immigrants. New residential construction, particularly apartment complexes, has driven the growth of the construction industry in Germany, further boosting the demand for building thermal insulation in Germany.

France building thermal insulation market is expected to benefit from the significant growth of the residential construction sector, which is driven by long-standing favorable demographic and sociological factors, including a high birth rate, a growing aging population, and a high divorce rate.

Asia Pacific Building Thermal Insulation Market Trends

The Asia Pacific is expected to exhibit the highest growth over the forecast period with a CAGR of 7.1%, owing to the rising construction activities in the region to cater to the requirements of a growing population. China is estimated to account for the largest share in the region, owing to the various government initiatives to improve its public infrastructure.

The development of smart buildings to provide sustainable solutions and energy efficiency is expected to penetrate insulated building materials for construction applications, thereby boosting the demand for building thermal insulation in China.

Residential construction is projected to witness the highest growth owing to the rising population, increasing urbanization, and growing investments by Non-Resident Indians (NRIs) in the sector. Growing residential construction activities may bolster the demand for building thermal insulation in India over the forecast period. However, low product penetration in the construction sector may restrain the market growth.

Central & South America Building Thermal Insulation Market Trends

The construction industry in Central & South America is expected to witness considerable growth due to increasing investments in various infrastructural projects by foreign and domestic players in the region. The economies contributing significantly to this region's growth are Argentina, Brazil, Chile, Colombia, and Peru.

The growth in Brazil's building thermal insulation market has been stagnant for the past few years due to restricted credit supply, rising economic recession, and declining demand from the residential and non-residential building segments. However, the country’s insufficiency in its existing infrastructure is projected to result in a market-friendly environment, boosting investments by the acquisition of small-and medium-scale players.

Middle East & Africa Building Thermal Insulation Market Trends

The upcoming government-funded construction projects in Nigeria, Ethiopia, and Uganda are expected to drive the growth of the construction industry in the Middle East & Africa in the coming years. This is anticipated to propel the demand for building thermal insulation in the region.

The Kingdom of Saudi Arabia has announced a reform program under its Vision 2030. The country is expected to exhibit robust economic growth, owing to the implementation of structural reforms. New taxes and fees, including value-added tax (VAT), extra fees on expats working in the country, and potential taxes imposed on foreign businesses, are expected to create additional revenues for the economy, leading to high demand for building thermal insulation in Saudi Arabia.

Key Building Thermal Insulation Company Insights

Some key players operating in the market are BASF SE, Saint Gobain S.A., Dow, and Owens Corning:

-

Saint Gobain S.A. is engaged in the design, manufacturing, and distribution of high-performance materials and building materials. In addition, it provides solutions for energy efficiency, growth challenges, and protection of the environment.

-

Dow operates in several sectors including agriculture, feed & animal care, beauty & personal care, building, construction & infrastructure, chemical manufacturing & industrial, and consumer goods & appliances. It has over 103 manufacturing sites in about 31 countries around the world.

Fletcher Building, American Rockwool Manufacturing LLC. GAF Materials Corporation and Byucksan are some emerging market participants in the building thermal insulation market:

-

Rockwool Manufacturing LLC manufactures mineral wool boards and cement for residential and industrial insulation applications. It offers its customers a broad product portfolio, including boards, metal mesh blankets, and pipes.

-

Byucksan produces various building products, including ceiling systems, insulation systems, exterior systems, interior systems, and floor systems.

Key Building Thermal Insulation Companies:

The following are the leading companies in the building thermal insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Rockwool International A/S

- GAF Materials Corporation

- Huntsman International LLC

- Johns Manville Corporation

- Cellofoam North America, Inc.

- Atlas Roofing Corporation

- Dow

- Owens Corning

- Saint-Gobain S.A.

- Byucksan

- Kingspan Group

- BASF SE

- Knauf Insulation

- American Rockwool Manufacturing, LLC

- Fletcher Building

Recent Developments

-

In December 2023, ROCKWOOL A/S announced the acquisition of Boerner Insulation Sp. z o.o. in Poland. The acquisition was expected to increase the former’s presence in Europe. In addition, the company's location is highly convenient for maintaining logistics and supply chains for the European market.

-

In February 2023, Saint-Gobain S.A. entered into a definitive agreement to acquire U.P. Twiga Fiberglass Ltd. (UP Twiga), a significant player in the glass wool insulation market in India. This acquisition strengthened the former’s presence in the regional market.

Building Thermal Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.4 billion

Revenue forecast in 2030

USD 37.8 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Central Eastern Europe; Romania; Czech Republic; Poland; China; India; Japan; South Korea; Indonesia; Malaysia; Taiwan; Brazil; Argentina; Saudi Arabia; UAE; Qatar; South Africa

Key companies profiled

Rockwool International A/S; GAF Materials Corporation; Huntsman International LLC; Johns Manville Corporation; Cellofoam North America, Inc.; Atlas Roofing Corporation; Dow; Owens Corning; Saint-Gobain S.A.; Byucksan; Kingspan Group; BASF SE; Knauf Insulation; American Rockwool Manufacturing, LLC; Fletcher Building

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Building Thermal Insulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global building thermal insulation market report based on product, application, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Glass Wool

-

Mineral Wool

-

EPS

-

XPS

-

Cellulose

-

PIR

-

PUR

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Roof

-

Walls

-

Floor

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, Kilotons; Revenue; USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Central Eastern Europe

-

Romania

-

Czech Republic

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Malaysia

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global building thermal insulation market size was estimated at USD 26.87 billion in 2024 and is expected to reach USD 28.37 billion in 2025.

b. The global building thermal insulation market is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2025 to 2030, reaching USD 37.8 billion by 2030.

b. Europe dominated the building thermal insulation market with a share of 34.9% in 2024. This is attributed to the implementation of strict green building codes to reduce the energy consumption per structure in countries like the UK, Germany, and France.

b. Some key players operating in the building thermal insulation market include Rockwool International A/S, GAF Materials Corporation, Guardian Building Products, Inc., and Huntsman International LLC.

b. Key factors driving the building thermal insulation market growth include the increasing residential and commercial application of the product to reduce the overall energy costs, coupled with rising awareness pertaining to energy conservation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.