- Home

- »

- Advanced Interior Materials

- »

-

Bulletproof Glass Market Size, Share & Growth Report, 2030GVR Report cover

![Bulletproof Glass Market Size, Share & Trends Report]()

Bulletproof Glass Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Bank Security System, Cash-In-Transit Vehicles, Defense & VIP Vehicles), By End-use, By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-334-3

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bulletproof Glass Market Summary

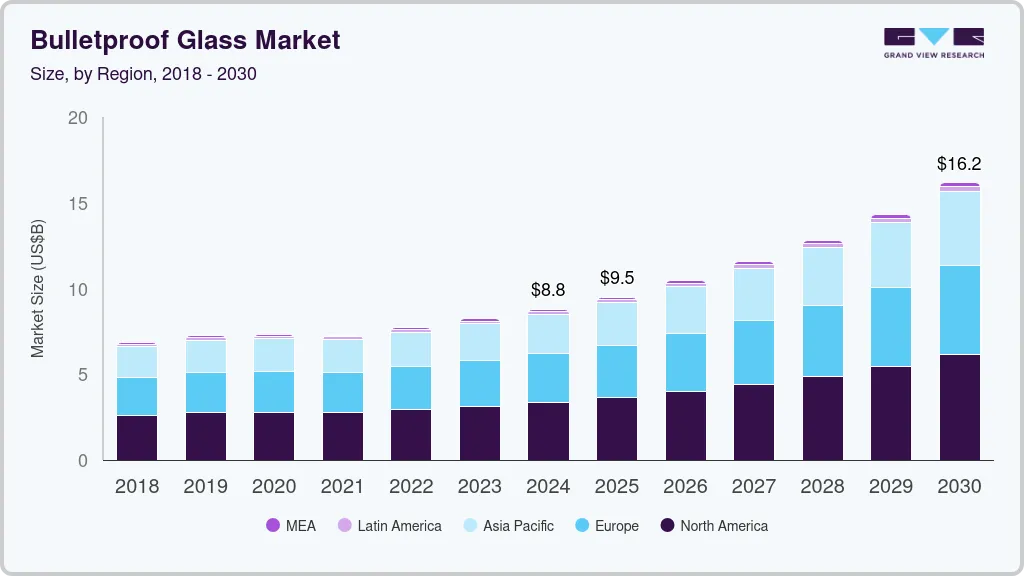

The global bulletproof glass market size was estimated at USD 8,798.3 million in 2024 and is projected to reach USD 16,153.0 million by 2030, growing at a CAGR of 11.2% from 2025 to 2030. The growing need for safety and security measures across various sectors, including automotive, military, banking & finance, and architectural applications, is expected to drive the market.

Key Market Trends & Insights

- The Asia Pacific bromine derivatives market dominated the global market and accounted for the largest revenue share of 51.1% in 2024%.

- The bromine derivatives market in North America held a significant revenue share in 2024.

- By product, the Tetrabromobisphenol A (TBBPA) dominated the global bromine derivatives industry with the highest revenue share of 26.9% in 2024.

- By application, the flame retardants led the market and accounted for the largest revenue share of 45.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8,798.3 Million

- 2030 Projected Market Size: USD 16,153.0 Million

- CAGR (2025-2030): 11.2%

- Europe: Fastest growing market

The demand will likely benefit from heightened risks of armed robberies, terrorist attacks, and geopolitical conflicts worldwide. Governments and private organizations are investing in advanced protective measures, such as bulletproof glass, to safeguard personnel, assets, and infrastructures against potential threats, thus propelling the market. These organizations deploy the glass to prevent terrorist attacks, shootings, and other violent incidents. In addition, bulletproof glass is used in sensitive locations to maintain confidentiality and prevent espionage, ensuring that classified information remains secure. Governments and private organizations are investing in advanced protective measures, such as bulletproof glass, to safeguard personnel, assets, and infrastructures against potential threats, thus propelling the market. These organizations deploy the glass to prevent terrorist attacks, shootings, and other violent incidents. In addition, bulletproof glass is used in sensitive locations to maintain confidentiality and prevent espionage, ensuring that classified information remains secure.

Drivers, Opportunities & Restraints

The surge in military spending around the world is anticipated to drive the bulletproof glass industry. Countries are focused on national security and defense capabilities amidst growing geopolitical tensions and security challenges, which has boosted investment in enhancing the safety and effectiveness of military infrastructure and equipment. This includes fortifying vehicles, bases, and command centers with bulletproof glass to protect personnel from threats like gunfire, explosions, and shrapnel.

The need to protect from rising violent incidents in schools and public spaces after an uptick in violent incidents calls is expected to provide new opportunities for market participants. As reported by the Centers for Disease Control and Prevention (CDC), more than 48,000 people died due to violence. Out of this, around 19,000 people were killed in homicides. In addition, mass shootings account for 1% of total gun violence.

A decline in the defense budget is likely to act as a restraining factor for the market. Countries such as South Korea, Italy, and Israel reported a decline in the defense budget in 2022 compared to the previous year. This financial constraint can result in decreased orders for bulletproof glass used in military vehicles, protective gear, and infrastructure, thus impacting the market's growth.

Application Insights

Defense & VIP vehicles dominated the market and held the largest revenue share in 2023, and is expected to grow at the fastest CAGR during the forecast period, along with the government & law enforcement segment. Owing to its high level of protection, bulletproof glass finds applications in armored cars, military vehicles, embassies, government vehicles, personnel transportation, and other important people. In defense, the product is deployed in fighting vehicles, battle tanks, tactical tanks, and other military carrier vehicles. Glass prevents bullet penetration and protects against different types of ammunition.

Digitization in banking has reduced physical transactions. However, threats to physical security remain a concern. The use of bulletproof or bullet-resistant glass is increasing in the banking sector to deter robberies, mitigate risks, and ensure a secure environment for transactions. Bulletproof glass is made from layers of polycarbonate or acrylic and glass. It absorbs and disperses the energy of a bullet upon impact, preventing it from penetrating the barrier.

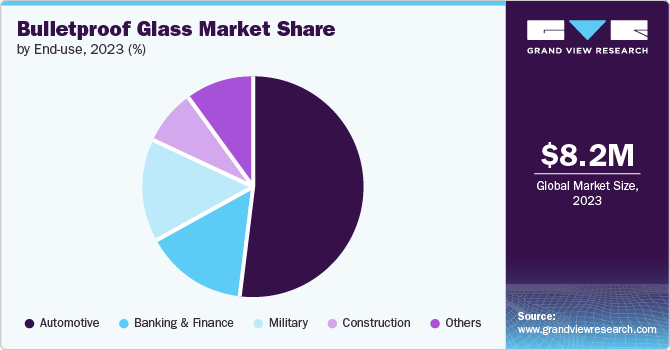

End-use Insights

The automotive segment dominated and held the highest revenue market share in 2023. The demand for bulletproof glass in vehicles is anticipated to grow, fueled by the increasing need for security owing to diverse threats. Vehicles are used by high-profile individuals, such as politicians and celebrities, security firms, and even civilians in regions with high crime rates. They are equipped with bulletproof glass to mitigate the risks associated with potential violent attacks.

Aside from its primary function of ballistic protection, bulletproof glass offers several ancillary benefits. For instance, the added thickness and durability of the glass can improve the vehicle's structural integrity, providing better resistance to crashes. In addition, some bulletproof glass solutions can offer UV protection, helping mitigate the effects of sun exposure on passengers and the vehicle's interior.

Regional Insights

The North American bulletproof glass market is characterized by strong demand driven by security concerns, particularly within the U.S., which has one of the highest firearm ownership rates in the world. In addition, rising investments in security measures across various sectors, including banking, retail, and especially government and military installations, are expected to benefit market growth.

U.S. Bulletproof Glass Market Trends

The bulletproof glass market in the U.S. is expected to grow lucratively during the forecast period. Rising mass shooting incidents are expected to benefit the bulletproof glass in the U.S. For instance, as reported by the Gun Violence Archive, 632 mass shootings were reported in 2023. For the previous three years, more than 600 mass shootings have been reported in the country, i.e., two incidents per day.

Asia Pacific Bulletproof Glass Market Trends

The bulletproof glass market in Asia Pacific will likely be propelled by the booming construction industry, particularly in China and India. Urbanization, economic growth, and increasing security concerns related to crime and geopolitical tensions have spurred demand for bulletproof glass in commercial and residential properties.

Europe Bulletproof Glass Market Trends

The bulletproof glass market in Europe is expected to grow significantly during the forecast period. Stringent safety regulations and the escalating need for security in the face of rising terrorism threats and civil unrest in certain areas are expected to influence the market. The emphasis on quality and innovation, coupled with strong regulatory frameworks, continues to drive the market forward.

Key Bulletproof Glass Company Insights

Some key players operating in the market include China Specialty Glass AG, Saint Gobain S.A., and Nippon Sheet Co. Ltd.

-

Saint Gobain S.A. manufactures and distributes materials and services for construction, infrastructure, automotive, and industrial markets. The company employs over 160,000 people and has a presence in 76 countries. Its diverse product portfolio includes glass, textiles, chemicals, and gypsum, among others.

-

China Specialty Glass AG manufactures various glass products, including architectural, hollow, laminated, bulletproof, and electric color-changing glass. The company serves the construction, infrastructure, automotive, and defense sectors.

Key Bulletproof Glass Companies:

The following are the leading companies in the bulletproof glass market. These companies collectively hold the largest market share and dictate industry trends.

- Apogee Enterprises, Inc.

- Armar Glass

- China Specialty Glass Co. Ltd.

- Consolidated Glass Holdings Inc.

- D.W. Price Security

- Guardian Industries

- National Glass

- Nippon Sheet Glass Co. Ltd.

- Saint Gobain S.A.

- Smartglass International

Recent Developments

-

In June 2024, Vedanta announced the acquisition of 46.5% stakes in Japan-based glass substrate manufacturer AvanStrate Inc. The acquisition was completed in the second quarter of 2024.

-

In June 2024, Allegion plc, a security and solutions provider company, acquired Unicel Architectural Corp., a Canada-based producer of timber, advanced glass, and aluminum products.

Bulletproof Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,502.0 million

Revenue forecast in 2030

USD 16,153.0 million

Growth rate

CAGR of 11.2% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; South Korea; Brazil

Key companies profiled

Apogee Enterprises, Inc.; Armar Glass; China Specialty Glass Co. Ltd.; Consolidated Glass Holdings Inc.; D.W. Price Security; Guardian Industries; National Glass; Nippon Sheet Glass Co. Ltd.; Saint Gobain S.A.; Smartglass International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bulletproof Glass Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bulletproof glass market report based on application, end-use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bank Security System

-

Cash-In-Transit Vehicles

-

Defense & VIP Vehicles

-

Government & Law Enforcement

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Banking & Finance

-

Construction

-

Military

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global bulletproof glass market size was estimated at USD 8.22 billion in 2023 and is expected to reach USD 8.80 billion in 2024.

b. The global bulletproof glass market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 16.15 billion by 2030.

b. By end use, automotive dominated the market with a revenue share of over 52% in 2023.

b. Some of the key vendors of the global bulletproof glass market are Acerinox SA, Aperam SA, JFE Steel Corporation, JSW Group, Metline Industries, Nippon Steel Corporation, Outokumpu, POSCO, Tata Steel and thyssenkrupp AG

b. The key factor driving the growth of the global bulletproof glass market is the rising security concerns amidst geopolitical tension, terrorism and violence and thus need for protection

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.