- Home

- »

- Medical Devices

- »

-

Burn Care Centers Market Size, Share & Growth Report, 2030GVR Report cover

![Burn Care Centers Market Size, Share & Trends Report]()

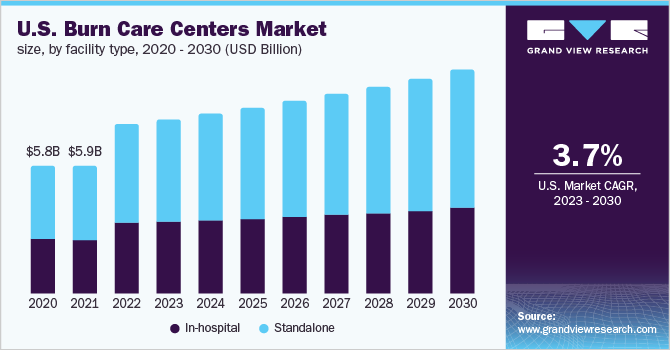

Burn Care Centers Market (2023 - 2030) Size, Share & Trends Analysis Report By Facility Type (In-hospital, Standalone), By Procedure Type, By Burn Severity, By Service Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-196-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Burn Care Centers Market Summary

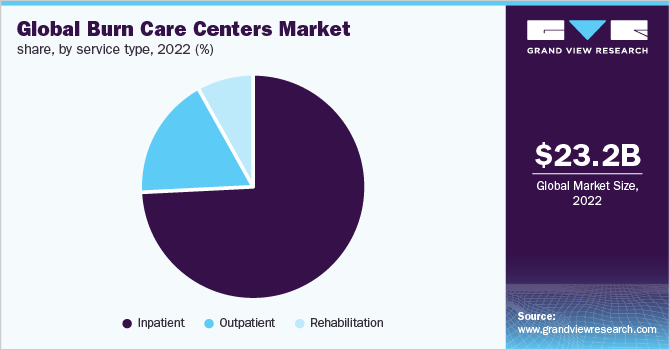

The global burn care centers market size was valued at USD 23.2 billion in 2022 and is projected to reach USD 31.9 billion by 2030, growing at a CAGR of 4.2% from 2023 to 2030. The increasing incidence of trauma cases, globally and the hospitalizations related to these are the primary drivers for the market.

Key Market Trends & Insights

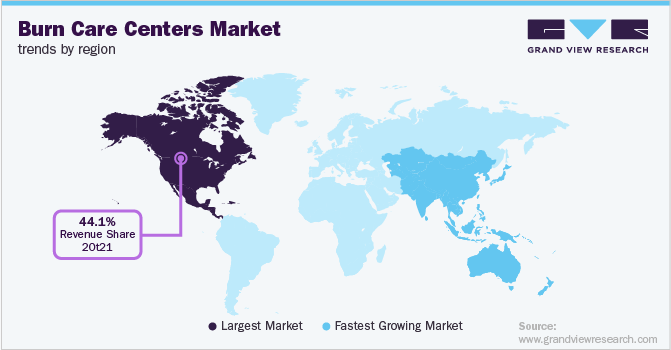

- North America dominated the burn care centers market and held the largest revenue share of over 44.1% in 2022.

- In the Asia Pacific, the market is expected to grow at a fastest rate of 5.6% during the forecast period.

- Based on service type, the in-patient segment dominated the market for burn care centers and held the largest revenue share of over 75.5% in 2022.

- In terms of burn severity, the partial-thickness burns segment dominated the market for burn care centers and accounted for the largest revenue share of 35.3% in 2022.

- Based on treatment type, the wound debridement segment dominated the market for burn care centers and held the largest revenue share of 35.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 23.2 Billion

- 2030 Projected Market Size: USD 31.9 Billion

- CAGR (2023-2030): 4.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The high risk of morbidity and mortality related to burn cases is another key factor responsible for the growth of the market. A paper published in Research Square listed the total number of cases, on a global level came up to nearly 8.3 million incidences, also resulting in 111,292 casualties in 2019. According to WHO, the majority of deaths occur in low-middle income countries. In India, over 1 million cases of moderate to severe burns are recorded each year.

Burns occur when the skin and/or other tissues are affected by coming in contact with hot liquids or solids or flames, called as scalds, contact or flame burns, respectively. According to CDC, burn injuries or accidents are one of the leading causes of home casualties. American Burn Association states that over 40% of all cases coming to treatment facilities are due to fire and flame burns. More than 30% of all the admissions in the facilities are caused by wet or moist heat scalding. The annual cost of care for patients costs hundreds of millions of USD per year. Burns result in permanent deformities, emotional trauma, and other socioeconomic factors which end up costing more in developing countries.

CDC estimates the cost of injuries to be more than USD 7 billion, annually, in which the majority share of over 60% is represented by the male population. Fatal injuries cost over USD 3 billion. Even though the total number of injuries and fatalities due to fires has gone down, but the cost of care and treatment has risen significantly. There have been constant advancements in treatment solutions to improve patient outcomes and wound management. These injuries are better-taken care of at specialized treatment facilities, which is the key driving force responsible for the growth of the market for burn care centers.

According to the recent National Burn Repository Update in 2019, across all categories except for ages above 80, the male patient population and admission were much higher compared to the female patient population. The pediatric age group (1-16 years) accounted for 22.5% of the total caseload. The two most common causes were fire/flame and scalds, accounting for over 72% of the total cases. The interventions in treatment facilities have improved over the years, and the infections and fatalities arising from burns have also decreased in lieu that.

During the COVID-19 pandemic, the number of cases decreased overall, the reduction was due to imposed lockdowns, which reduced the incidence of workplace injuries. The injuries related to accidents were reported but in lesser numbers. Furthermore, healthcare facilities and treatment centers had to undergo infrastructural transformations to accommodate Covid-19 treatment practices which impacted the visits and procedural volume. The focus on the treatment of COVID-19 cases took precedence over burns which did not require hospitalizations, thus there was a fall in terms annual global market revenues.

Facility Type Insights

The in-hospital segment dominated the market for burn care centers and accounted for the largest revenue share of 51.1%in 2022. The dearth of specialized treatment centers, especially within lesser developed regions is primarily responsible for the high popularity and market share of the in-hospital type facilities. Unlike the U.S., regions like the Asia Pacific, Latin America, and the Middle East have fewer and scattered specialized treatment facilities, due to which the shift in focus comes towards the in-hospital settings. Furthermore, there was a significant decrease in visits and admissions due to the COVID-19 pandemic, which significantly reduced the number of cases, especially for work-related injuries.

The fastest growth was seen in the standalone center types during the forecast period and is anticipated to grow at a fastest rate of 5.3%. The increasing demand for specialized treatment for injuries has primarily been the driving force behind the growth of these standalone facilities. Standalone centers are specialized units for the treatment of burns of all kinds. The specialized treatment offered at these centers results in better patient outcomes, better recovery, and reduced complications in the treatment journey.

Treatment Type Insights

The wound debridement segment dominated the market for burn care centers and held the largest revenue share of 35.3% in 2022. Wound debridement is the standard and recommended first-line treatment in injuries, wherein the necrotic tissue is removed via different methods to prevent or reduce the spread of infections and it drastically improves the survival rates, it also helps the wound heal so that the area can be prepared for the graft. A study published in American Family Physician Journal, states out of the total number of cases that the health workers encounter more than 90% can be managed by providing ambulatory care.

The pain management segment is expected to witness significant growth during the forecast period and is anticipated to grow at a fastest rate of 6.7%. A study published in Burns Journal pain management is one of the main aspects of treatment and management, it also plays a major role in the choice of an ideal dressing type for patients. More than 80% of respondents stated that the choice of wound dressing can cause a significant reduction in many inpatient visits and treatments required. The advancements in the pain management techniques such as improved pain medications, and immersive technologies like the use of virtual reality for pain management in patients, all of these factors have been pushing the growth in this segment.

Burn Severity Insights

The partial-thickness burns segment dominated the market for burn care centers and accounted for the largest revenue share of 35.3% in 2022. Partial-thickness burns affect the epidermis as well as the dermis, with varying depth. According to the American Burn Association, 63% of all caseloads have less than 10% Total Body Surface Area (TBSA). The increase in the need for specialized care for the treatment of second-degree or partial-thickness burns has been primarily responsible for the growth of the market. Wounds in partial thickness injuries, if not treated timely or properly can potentially become morbid. With proper treatment and rehabilitation, the wounds can heal properly and thus the need for specialized care facilities has been on the rise.

Full Thickness Burn is anticipated to grow at a fastest rate of 5.4% during the forecast period. The American Burn Association also recommends getting treatment at specialized care centers in case of full-thickness injuries. These usually occur due to flame, hot liquids, or superheated gasses. A paper published in the StatPearls Journal states that almost 86% of the injuries are thermal burns, across all age groups. The increased need for specialized care, for better patient outcomes as well as for shortening hospitalization periods, is positively boosting the demand for specialized and well-equipped treatment and management centers, especially in the low-middle income countries.

Service Type Insights

The in-patient segment dominated the market for burn care centers and held the largest revenue share of over 75.5% in 2022. Even though the number of cases being admitted for in-patient services has decreased, the high revenue can be attributed to the high cost of care associated with the treatment of partial-thickness and full-thickness injuries. Even though the patient volumes are declining, patient care is becoming costlier each year.

In-patient segment is anticipated to grow at a fastest rate of 4.2% over the forecast period, this has been due to the increased need for proper care and management of wounds in patients to minimize their stay duration at the hospital as well as to accelerate the recovery period of the patient. In-patient services at care centers and hospital units for patients having second and third-degree burns require more attention and specific care regime, the longer the patient stays, the more are the chances of contracting infections and the mortality increase. All the above-stated factors have been contributing significantly to overall market growth.

Regional Insights

North America dominated the burn care centers market and held the largest revenue share of over 44.1% in 2022. This is due to the presence of a large number of specialized treatment units in the region as well as advanced healthcare systems. There are 120 specialized treatment units in the U.S. alone, many of which are verified burn care centers. The reimbursement policies in the region are also key to the growth of the market for burn care centers in this region. Availability of high-quality care especially in wound care, rehabilitation as well as reconstructive surgery options, and post-healing are some of the factors contributing significantly to the overall market growth.

In the Asia Pacific, the market is expected to grow at a fastest rate of 5.6% during the forecast period, owing to large patient volumes in this region. An increase in demand for specialty care is a major contributor to the growth of the market in this region. The advancing healthcare technology and increased health expenditure are also contributing to the growth of the market for burn care centers.

Key Companies & Market Share Insights

Specialized care centers and treatment units are constantly evolving to provide a better quality of care to patients for faster recovery through better wound management as well as improved dressing options for patients. The market for burn care centers is highly concentrated in North America and European regions. The presence of renowned market players offering innovative care products and solutions is supporting the growth of the market in North America and Europe. Some of the prominent players in the burn care centers market include:

-

LAC+USC Medical Burn Center

-

Weill Cornell Medicine William Randolph Hearst Burn Center

-

Temple University Hospital Adult Burn Center

-

Parkland Memorial Hospital Regional Burn Center

-

Medstar Washington Hospital Center

-

UMC Lions Burn Center

-

Burn and Reconstructive Centers of America

-

Pediatric Burn Care Center (The General Hospital Corporation)

-

University of Rochester Medical Center

-

Chelsea & Westminster Hospital

-

St. Barnabas Burn Center

-

National Burns Center

Burn Care Centers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.0 billion

Revenue forecast in 2030

USD 31.9 billion

Growth Rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Facility type, procedure type, burn severity, service type, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; China; India; Japan; Australia; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

LAC+USC Medical Burn Center; Weill Cornell Medicine William Randolph Hearst Burn Center; Temple University Hospital Adult Burn Center; Parkland Memorial Hospital Regional Burn Center; Medstar Washington Hospital Center; UMC Lions Burn Center; Burn and Reconstructive Centers of America; Pediatric Burn Care Center (The General Hospital Corporation); University of Rochester Medical Center; Chelsea & Westminster Hospital; St. Barnabas Burn Center; National Burns Center

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the global burn care centers market report based on facility type, procedure type, burn severity, service type, and region:

-

Facility Type Outlook (Revenue, USD Million, 2016 - 2030)

-

In-hospital

-

Standalone

-

-

Procedure Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Wound Debridement

-

Skin Graft

-

Wound Management

-

Respiratory Intubation and Ventilation

-

Pain Management

-

Blood Transfusion

-

Infection Control

-

Rehabilitation

-

-

Burn Severity Outlook (Revenue, USD Million, 2016 - 2030)

-

Minor Burns

-

Partial Thickness Burns

-

Full Thickness Burns

-

-

Service Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Inpatient

-

Outpatient

-

Rehabilitation

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global burn care centers market size was estimated at USD 23.2 billion in 2022 and is expected to reach USD 24.0 billion in 2023.

b. The global burn care centers market is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 31.9 billion by 2030.

b. Wound debridement dominated the burn care centers market with a share of 35.3% in 2022. This is attributable to fact that wound debridement treatment is witnessed to be the most common treatment procedure associated with burn-related emergency department (ED) visits.

b. Some key players operating in the burn care centers market include Burn and Reconstructive Centers of America; Pediatric Burn Care Center (The General Hospital Corporation); University of Rochester Medical Center; National Burn Center (India); Chelsea & Westminster Hospital; and North Bristol NHS Trust.

b. Key factors that are driving the burn care centers market growth include the increasing number of burn-related emergency department (ED) visits and growing hospital admissions of patients majorly for second degree or partial thickness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.