- Home

- »

- Medical Devices

- »

-

Burn Care Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Burn Care Market Size, Share & Trends Report]()

Burn Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Advanced Dressings, Biologics), By Depth Of Burn (Minor, Partial Thickness), By Cause, By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-850-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Burn Care Market Summary

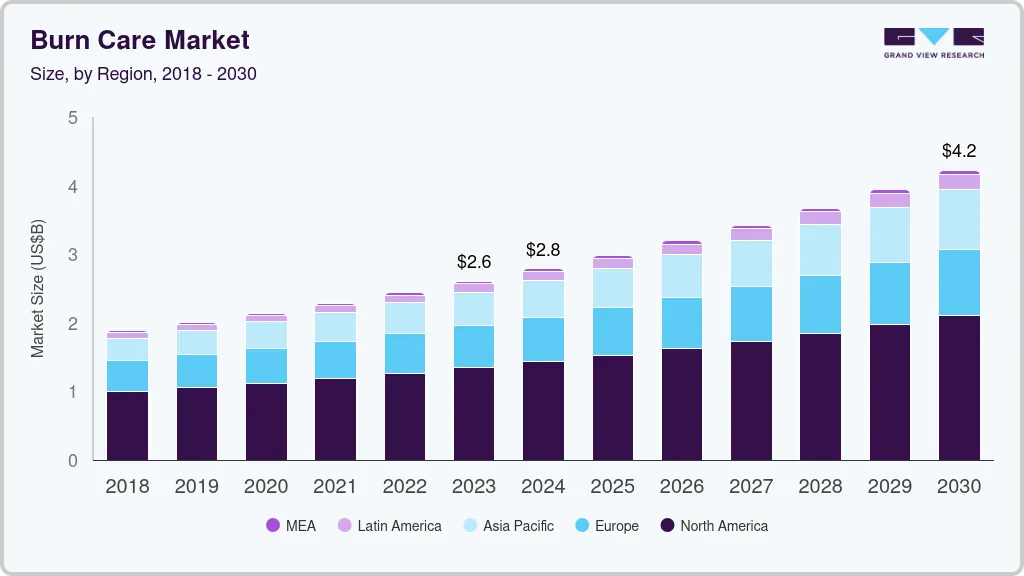

The global burn care market size was estimated at USD 2,607.1 million in 2023 and is projected to reach USD 4,227.3 million by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The rising burn incidence, high demand for skin grafts, and increasing awareness regarding the available treatment options are driving market growth.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 51.56% in 2023.

- Asia Pacific is anticipated to witness the fastest growth at a CAGR of 8.65% during the forecast period.

- Based on cause, In 2023, thermal burns held the highest revenue share at 74.79%.

- In terms of depth of burn, In 2023, full-thickness burns led the burn care market, holding the highest revenue share of 39.89%.

- Based on product, the advanced dressing segment was identified as the highest revenue generator with 42.54% share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,607.1 Million

- 2030 Projected Market Size: USD 4,227.3 Million

- CAGR (2024-2030): 7.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, the rising prevalence of chronic diseases that affect wound healing capabilities further elevates the demand for advanced wound products. Moreover, the rising preference for advanced burn care products and increasing disposable income further propels market growth.

In the post-pandemic times, there has been a noticeable rise in the demand for burn care products for at-home use as individuals seek to minimize visits to healthcare facilities. Moreover, a significant number of patients turned to virtual consultations for their medical needs. As a response to this, major companies in this industry are introducing new offerings to facilitate online consultations and guidance for those unable to seek in-person treatment at medical centers. For example, in April 2020, Healogics, Inc. rolled out a telehealth program specifically designed for patients requiring wound care, ensuring they have continuous access to care and a variety of treatment options. This initiative aims to lessen the likelihood of patients needing to visit hospitals or emergency rooms.

Moreover, multiple physicians and healthcare professionals have adopted telehealth platforms to manage their patient's conditions and offer guidance on the use of cutting-edge products for wound management. For example, a report from MobiHealthNews (HIMSS) in December 2021 revealed the development of VeCare, a point-of-care wound assessment tool by researchers at the National University of Singapore. This innovative technology integrates a smart wearable equipped with sensors capable of performing immediate bedside evaluations of chronic wounds via an app, providing results within 15 minutes. Innovations like these are anticipated to propel market growth.

Supportive measures from governments, including reimbursement schemes covering approximately 70.0%-100.0% of therapy expenses, encourage individuals to opt for sophisticated treatments for burns. Additionally, both government bodies and non-profit entities, such as the World Health Organization (WHO) and the American Burn Association (ABA), play significant roles in enhancing awareness. The WHO actively collaborates with the International Society for Burn Injuries among other organizations, aiming to refine burn treatment methods and implement preventive measures against burn injuries worldwide.

Biological or skin grafts are predominantly utilized for treating full-thickness and partial burns, playing a crucial role in injury treatment. This has led to a growing demand for skin grafts and various skin substitutes for the treatment and management of severe burns, a trend that continues to ascend. Moreover, efforts by major companies, including the introduction of new products and undertaking of mergers and acquisitions, contribute to the expansion of the market. For example, in January 2023, ConvaTec Group PLC launched a novel foam dressing called Convafoam in the United States.

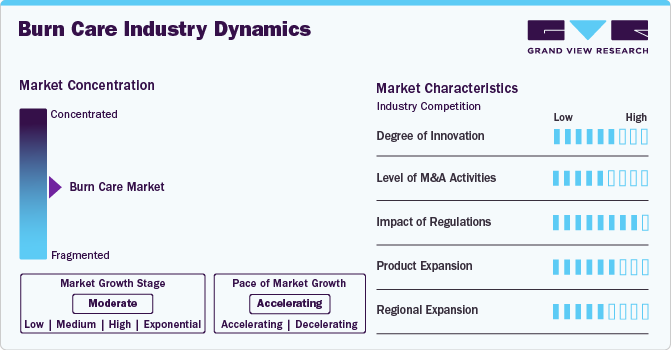

Market Concentration & Characteristics

The burn care market is driven by continuous innovations and product advancements, focusing on development to meet the evolving market demands. The advancement of wound care treatment that employs ex-vivo models is leading to robust and consistent data that supports clinical trials. Consequently, market participants are investing resources into novel technologies and methods to meet the growing demand.

The market is characterized by a moderate level of M&A activity conducted by the leading players, enabling them to increase their capabilities, expand product portfolios, and improve competencies.

Regulatory standards, such as the FDA (Food and Drug Administration) approvals in the U.S. or CE marking in the European Union, are essential, demanding comprehensive preclinical and clinical assessments, stringent manufacturing practices, and documentation to gain market approval.

The burn care market’s growth is driven by innovative therapeutics, using ex-vivo models to provide reliable data to support clinical trials. Product expansion is anticipated to continue, benefiting patients, surgeons, and healthcare providers.

The industry is experiencing moderate regional growth, attributed to the rising demand for advanced dressing products. Additionally, developing countries are making notable investments in enhancing healthcare infrastructure, which is expected to increase demand for burn care products.

Product Insights

The advanced dressing segment was identified as the highest revenue generator with 42.54% share in 2023. This can be attributed to the wide product range and extensive application in wound management such as varied range of advanced dressings including collagen, alginate, hydrocolloid, foam, hydrogel, film, and other advanced dressing products. Moreover, advanced products such as ConvaTec’s FoamLite foam dressing, which can be used for a range of low to heavy exuding wounds, further contributes to industry growth.

The biologics segment is expected to grow at the fastest CAGR of 8.24% over the forecast period, owing to the introduction of new products and extensive R&D in this field. Biologics entail utilizing live biological agents and molecules, including monoterpenes such as sulbogin, thymol, and sericin, known for their antioxidant, antimicrobial, and anti-inflammatory properties. Moreover, biologic dressings encompass skin grafts (such as allografts, xenografts, autografts, and cadaveric human skin) and engineered tissue products aimed at restoring the skin's structure and function, either for a temporary duration or permanently. One of the primary benefits of using biologic skin dressings or skin grafts is the readily accessible source of skin from patients.

Depth Of Burn Insights

In 2023, full-thickness burns led the burn care market, holding the highest revenue share of 39.89%. A report from WHO in October 2023 highlighted that burns are responsible for around 180,000 deaths annually. The market growth is further propelled by the increasing efforts of both governmental and non-governmental organizations focused on burn care treatments.

Additionally, chronic wounds, which are categorized into partial-thickness and full-thickness burns, are significant contributors in this market. Partial thickness burns are anticipated to grow at the fastest rate during the forecast period. According to the U.S. FDA, around 40,000 individuals require hospitalization each year due to partial burns. The rising demand for biologic treatments, including skin grafts and sophisticated dressing methods for partial burns, is contributing significantly to the market's expansion.

Cause Insights

In 2023, thermal burns held the highest revenue share at 74.79%, driven by the prevalent instances of fire burn. The American Burn Association (ABA) notes that fire burn accounts for 44.0% of admissions to burn centres. Scald injuries typically result from contact with hot liquids or gases, often due to high temperature tap water during baths or exposure to boiling cooking oil, steam, and hot beverages.

The chemical burns segment is expected to witness the fastest growth throughout the forecast period due to their immediate and harmful effects when skin encounters chemicals or their vapours, primarily acids. Such burns occur when skin is exposed to these substances, leading to injury without visible damage on the surface initially. The depth of the burn and tissue damage increase with longer exposure, often resulting in scarring. Acids cause cell damage by coagulation, while bases dissolve cells. Notably, alkalis pose a greater risk than acids or bases because they react with the body's lipids, leading to more severe injuries.

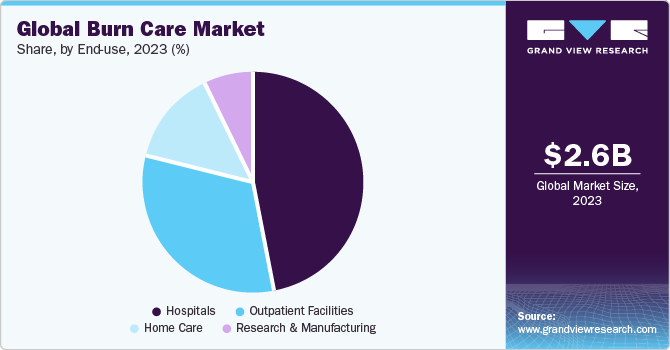

End-use Insights

The hospitals segment accounted for the largest revenue share in 2023, owing to the rising incidence of burns and consequent hospitalizations every year. According to an article published by the American Burn Association in January 2020, over 450,000 cases of burn injuries occur in the U.S. every year. Hospitals offer a comprehensive array of treatments for burn injuries and adhere to 504 DRG to speed up obtaining reimbursements for patients with burns through the Medicare program. Additionally, they supply sophisticated products for burn care, aiding in the expansion of the hospital sector. These elements are instrumental in the growth of this segment.

The outpatient facilities segment is anticipated to grow at the fastest CAGR of 8.13% over the forecast period. This includes all the facilities where care is provided at standalone establishments outside hospitals. These facilities are designed to provide specialized burn care services on an outpatient basis, meaning patients can receive treatment and care without staying in the hospital. Outpatient burn care facilities may provide various services, including wound care, pain management, rehabilitation, and counseling. Government initiatives to improve healthcare expenditure and infrastructure are also aiding in the segment's growth.

Regional Insights

North America dominated the market with the largest revenue share of 51.56% in 2023. This dominance can be attributed to the rising awareness among people about burn treatment options and increasing disposable income. Moreover, supportive healthcare reimbursement policies and government reforms are among the factors responsible for the largest market share held by North America.

U.S. Burn Care Market Trends

The U.S. held the largest revenue share in the North American market in 2023. Increasing market penetration by various major players with the launch of advanced products is a key factor contributing to market growth. In addition, the presence of nonprofit organizations, such as the American Burn Association, which is dedicated to improving the lives of burn patients, is expected to drive the U.S. burn care market’s growth.

Europe Burn Care Market Trends

The Europe burn care market is expected to grow steadily over the forecast period owing to the presence of a well-established healthcare system and various nongovernment organizations such as the European Burns Association. The organization conducts educational courses for multidisciplinary teams, surgeons, and other healthcare professionals. Major players in this region are undertaking various strategies, such as mergers & acquisitions and collaborations, contributing to market growth.

The burn care market in the UK is expected to grow over the forecast period owing to the presence of a well-established healthcare system. Moreover, the number of nonprofit organizations, such as the British Burn Association, which aims to provide and propagate information on the best treatment and rehabilitation following a burn injury, is increasing, thereby boosting the market in the country.

The Germany burn care market is anticipated to grow significantly over the forecast period. This growth is primarily driven by several key factors, including an increasing incidence of burn injuries, technological advancements in burn care products, and rising healthcare expenditure.

The burn care market in France is expected to grow over the forecast period due to increasing burn cases and Innovations in burn care products, such as advanced dressings and wound care solutions.

Asia Pacific Burn Care Market Trends

Asia Pacific is anticipated to witness the fastest growth at a CAGR of 8.65% during the forecast period. This can be attributed to the high rate of burn injuries and increased spending on healthcare, facilitating better access to advanced burn care products and treatments. However, emerging markets like India and China present significant growth opportunities due to their large populations and increasing industrial activities that contribute to higher burn injury rates.

Japan burn care market is moderately competitive, with some major companies offering wound care products. Major market players are adopting several strategies, such as mergers and acquisitions and partnerships and collaborations, to maintain their competitiveness. Furthermore, companies are investing in R&D, which is expected to increase awareness and demand for burn care products.

The burn care market in China accounted for the largest revenue share of the Asia Pacific market in 2023. The increasing incidence of burn injuries, advancements in treatment technologies, and rising healthcare expenditures are factors contributing to market growth.

Indiaburn care market is anticipated to grow rapidly over the forecast period due to the rising prevalence of burn cases and a rise in demand for both traditional and advanced burn care products. Additionally, government initiatives aimed at improving healthcare infrastructure, such as the National Programme for Prevention and Management of Burn Injuries (NPPMBI), have facilitated better access to specialized burn care services.

Middle East & Africa Burn Care Market Trends

The Middle East and Africa burn care market is anticipated to grow over the forecast period owing to the rising incidence of burn injuries due to accidents, industrial mishaps, and domestic incidents. Increased awareness regarding effective burn treatment options among healthcare providers and patients further propels market growth.

The burn care market in Saudi Arabia is expected to grow over the forecast period due to an increase in the number of burn cases, rising healthcare expenditures, and growing awareness among the general population and healthcare providers regarding burn prevention and treatment.

Kuwait burn care market is experiencing notable growth driven by several factors, including an increase in burn incidents, advancements in treatment technologies, and rising awareness about burn care management.

Key Burn Care Company Insights

Key players present in the burn care market are involved in various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Burn Care Companies:

The following are the leading companies in the burn care market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Hollister Incorporated

- Cardinal Health

- Integra LifeSciences Corporation

- Coloplast Corp.

- DeRoyal Industries, Inc.

- Smith & Nephew

- ConvaTec Inc.

- Mölnlycke Health Care AB.

- Johnson & Johnson

Recent Developments

-

In March 2023, Convatec received FDA clearance for its device designed to manage complex surgical wounds and burns. InnovaBurn placental extracellular matrix medical device will serve as advanced ECM technology for partial-thickness, second-degree burns.

-

In January 2023, Convatec Group PLC launched Convafoam, an advanced foam dressing in the U.S. The product is designed to fulfill the needs of patients and healthcare providers. It can be used for various types of wounds at any stage of the wound, which makes it the simple dressing choice for skin protection and wound management.

-

In December 2022, MediWound received FDA clearance for its NexoBrid. It is used for the treatment of severe thermal burns in adults.

-

In June 2022, Smith & Nephew PLC announced the construction of a new manufacturing and R&D facility for its Advanced Wound Management in the UK. The company is also planning to invest over USD 100 Million to develop modern R&D, manufacturing & flexible office environment in the country.

Burn Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.79 billion

Revenue forecast in 2030

USD 4.23 billion

Growth Rate

CAGR of 7.18% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, depth of burn, cause, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M; Hollister Incorporated; Cardinal Health; Integra LifeSciences Corporation; Coloplast Corp.; DeRoyal Industries, Inc.; Smith & Nephew; ConvaTec Inc.; Mölnlycke Health Care AB.; Johnson & Johnson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Burn Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global burn care market report based on product, depth of burn, cause, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Dressing

-

Alginate Dressings

-

Collagen Dressings

-

Hydrogel Dressings

-

Hydrocolloid Dressings

-

Wound Contact Layers

-

Film Dressings

-

Foam Dressings

-

-

Biologics

-

Traditional Burn Care Products

-

Others

-

-

Depth Of Burn Outlook (Revenue, USD Million, 2018 - 2030)

-

Minor Burns

-

Partial Thickness Burns

-

Full Thickness Burns

-

-

Cause Outlook (Revenue, USD Million, 2018 - 2030)

-

Thermal Burns

-

Electrical Burns

-

Radiation Burns

-

Chemical Burns

-

Friction Burns

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global burn care market size was estimated at USD 2.61 billion in 2023 and is expected to reach USD 2.79 billion in 2024.

b. The global burn care market is expected to grow at a compound annual growth rate of 7.18% from 2024 to 2030 to reach USD 4.23 billion by 2030.

b. Thermal burns held the largest share of the burn care market in 2023 with a market share of more than 74.5% owing to a rising incidence of fire-related burn injuries.

b. Some key players operating in the burn care market include Smith & Nephew, Johnson & Johnson, ConvaTec Inc., Mölnlycke Health Care AB, and 3M.

b. Key factors that are driving the burn care market growth include rising demand for minimally invasive procedures to improve cosmetic appeal for patients suffering from burns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.