- Home

- »

- Communication Services

- »

-

Business Process Outsourcing Market, Industry Report, 2033GVR Report cover

![Business Process Outsourcing Market Size, Share & Trends Report]()

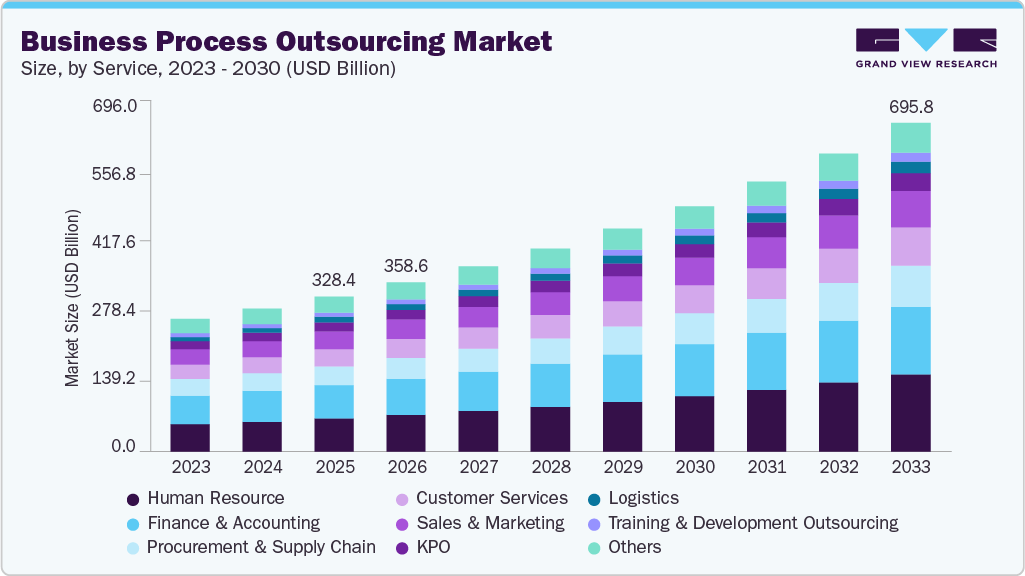

Business Process Outsourcing Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Customer Services, Finance & Accounting), By Outsourcing Type, By Deployment, By End Use, By Region And Segment Forecasts

- Report ID: GVR-2-68038-484-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Business Process Outsourcing Market Summary

The global business process outsourcing market size was estimated at USD 328.37 billion in 2025 and is projected to reach USD 695.77 billion by 2033, growing at a CAGR of 9.9% from 2026 to 2033. The rapid adoption of digital transformation initiatives is boosting BPO demand as organizations deploy cloud platforms, AI-driven analytics, and automation tools.

Key Market Trends & Insights

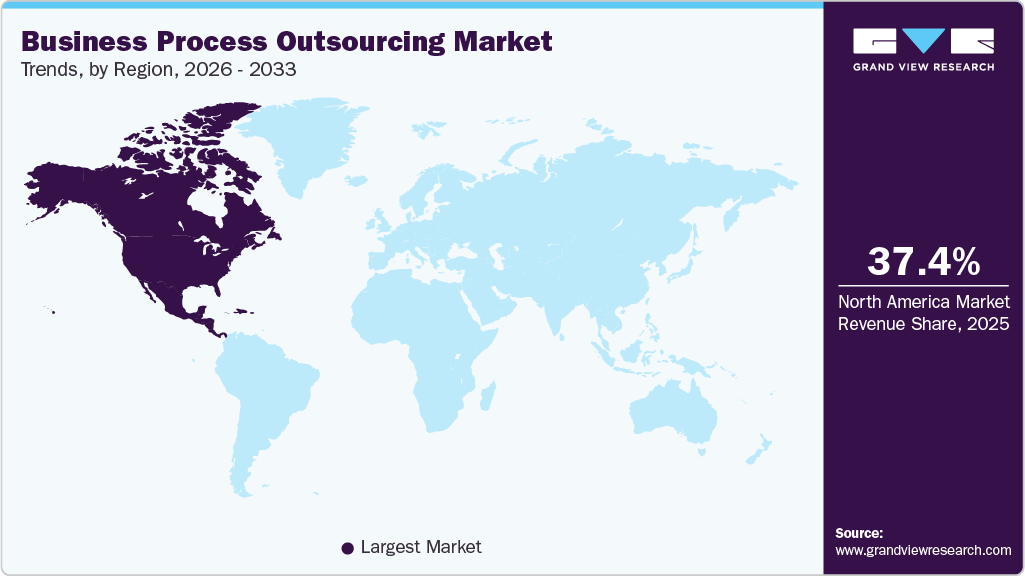

- North America business outsourcing dominated the global market with the largest revenue share of 37.4% in 2025.

- The business process outsourcing industry in the U.S. is expected to grow significantly over the forecast period.

- By deployment, cloud led the market and held the largest revenue share of 53.3% in 2025.

- By application, the retail segment is expected to expand significantly over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 328.37 Billion

- 2033 Projected Market Size: USD 695.77 Billion

- CAGR (2026 - 2033): 9.9%

- North America: Largest market in 2025

Companies increasingly depend on BPO providers with advanced digital capabilities to manage, integrate, and optimize these technologies. Modern BPO vendors function as strategic transformation partners, supporting process re-engineering, enhancing data transparency, and enabling faster, insight-driven decision-making across enterprise operations.The growth of customer experience (CX) management is a key driver of the BPO market as businesses face increasing pressure to deliver seamless, personalized, and round-the-clock customer interactions. Modern consumers expect consistent engagement across multiple channels, including voice, chat, email, and social media. To meet these expectations, organizations are outsourcing customer engagement functions to specialized BPO providers with multilingual workforces, advanced CRM platforms, AI-powered chatbots, and voice assistants. These providers enable faster response times, improved service quality, and data-driven personalization at scale. This trend is particularly strong in e-commerce, telecom, and financial services, where high customer volumes, competitive differentiation, and retention are critical to business success.

The rise of cloud technology plays a significant role in boosting the BPO sector due to its benefits, such as scalability, affordability, dependability, and flexibility. In addition, many businesses in the BPO industry have started offering their services through the cloud, which has further increased the adoption of BPO services. For example, in September 2024, NTT DATA, a Japanese technology services company, and IBM introduced SimpliZCloud, a completely managed cloud service powered by IBM LinuxONE, tailored to meet the infrastructure demands of critical workloads, particularly in financial services. The solution supports core banking, lending, and risk management applications, offering advanced performance, high availability, and robust security. By consolidating resources and optimizing infrastructure and enterprise software license costs, SimpliZCloud helps organizations reduce expenses. Its subscription-based model eliminates the need for significant capital investment and ongoing maintenance costs.

Technological innovations drive the expansion and growth of the business process outsourcing industry, heightened global competition, and advancements in technology. BPO enables organizations to enhance their profitability and minimize expenses. Advanced technologies such as process automation, cloud computing, and social networking are integrated with an organization’s existing BPO software. By capitalizing on the increasing uptake of these technologies, service providers can boost the efficiency of the services they offer. Outsourcing service providers are anticipated to utilize technological advancements to address talent shortages, enhance products and services, and tackle market challenges while keeping operational costs low.

Service Insights

The finance & accounting segment accounted for the largest market share of 21.4% in 2025. The adoption of automation and intelligent finance is driving growth in the F&A BPO segment as providers integrate RPA, AI, and advanced analytics into finance operations. Intelligent automation streamlines invoice processing, expense management, forecasting, and reporting, improving accuracy and reducing manual effort. These capabilities shorten financial close cycles and deliver real-time insights, enabling BPO providers to act as strategic finance partners rather than purely transactional service vendors.

The customer services segment is anticipated to grow at a CAGR of 11.2% during the forecast period. Rising customer experience expectations are driving demand for customer service BPO as consumers seek fast, seamless, and personalized interactions across multiple channels, including voice, chat, email, social media, and messaging platforms. To meet these expectations at scale, organizations outsource customer support to specialized BPO providers that offer advanced tools, trained agents, and standardized processes, enabling improved response times and consistent service quality across all touchpoints.

Outsourcing Type Insights

The onshore segment dominated the market and accounted for the largest revenue share in 2025. Onshore outsourcing helps organizations reduce costs by utilizing wage differences across regions within the same country. By outsourcing operations to areas with lower living costs and more affordable labor, businesses achieve savings while preserving common legal, linguistic, and cultural alignment. This model minimizes expenses and avoids the operational and coordination challenges typically associated with managing offshore or international teams.

The offshore segment is expected to grow at a significant CAGR over the forecast period. The offshore outsourcing segment is expanding steadily as it enables substantial cost savings and access to a broad global talent base. Organizations take advantage of lower labor costs in regions such as India, the Philippines, and Eastern Europe, where highly skilled professionals are available at significantly lower rates than in onshore markets. In addition to workforce savings, companies also benefit from reduced infrastructure, facilities, and overall operating expenses.

Deployment Insights

The cloud dominated the market and accounted for the largest revenue share in 2025. The integration of automation and advanced analytics is driving cloud-based BPO growth, as cloud platforms provide a scalable foundation for AI, RPA, and data analytics. BPO providers leverage cloud-native tools to automate workflows, reduce manual intervention, and deliver real-time operational insights. These capabilities improve accuracy, speed, and decision-making, enabling higher service quality, greater efficiency, and more value-driven outsourcing outcomes.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. Data security and confidentiality requirements are driving demand for on-premise BPO solutions, particularly among organizations handling sensitive financial, healthcare, or government data. By hosting systems within enterprise-controlled environments, companies maintain greater control over data access, reduce exposure to external cyber threats, and comply with stringent internal security policies. This approach ensures higher trust, stronger governance, and improved protection of critical information.

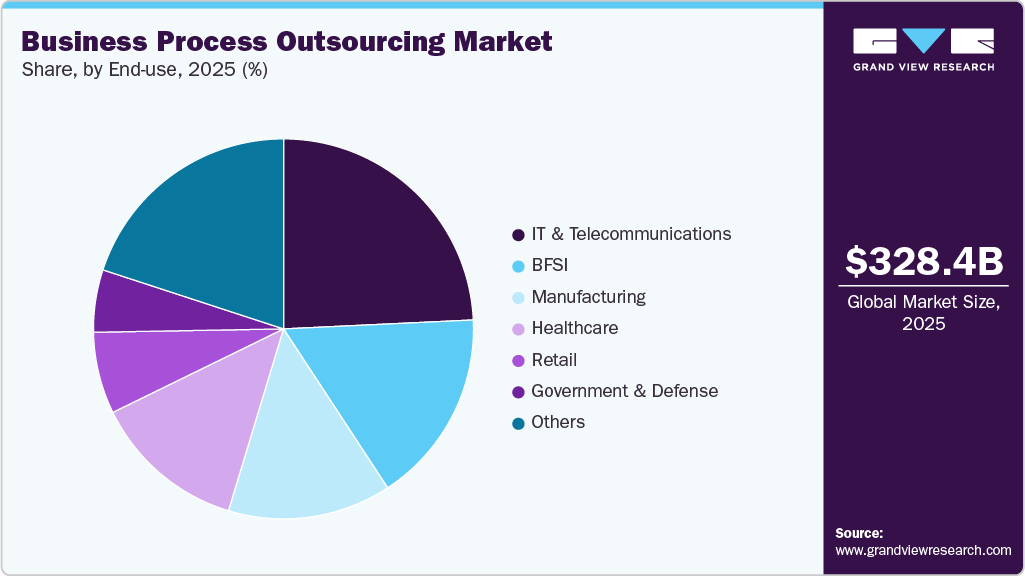

End Use Insights

The IT & telecommunications segment dominated the market and accounted for the largest revenue share in 2025. Telecom and IT companies manage extensive customer interactions, including inquiries about connectivity, billing, service activation, technical issues, and upgrades. Outsourcing these customer service and technical support functions to BPO providers allows organizations to scale operations efficiently, handle high volumes without service delays, and maintain consistent quality. This approach improves response times, enhances customer satisfaction, and ensures reliable support across multiple channels and time zones.

The retail segment is expected to grow at a significant CAGR over the forecast period. The rapid growth of e-commerce has led to higher order volumes, more customer inquiries, increased returns, and complex inventory management. To manage these demands efficiently, retailers are outsourcing order processing, customer support, and supply chain operations to BPO providers. This allows them to handle large transaction volumes, ensure timely responses, maintain consistent service quality, and focus internal resources on strategic activities such as marketing, product development, and enhancing the overall shopping experience.

Regional Insights

The business process outsourcing market in North America dominated the global market with the largest revenue share of 37.4% in 2025. The strong emphasis the incumbents of various industries, such as BFSI, IT, telecommunication, and human resources, in the region are putting on reducing costs and enhancing operational effectiveness is driving the growth of the market. For instance, mortgage processing, claims administration, credit card processing, finance and accounting, customer care, and risk management are some of the activities outsourced by BFSI companies to BPO service providers.

U.S. Business Process Outsourcing Market Trends

The business process outsourcing market in the U.S. is expected to grow significantly at a CAGR of 9.7% from 2025 to 2033. The demand for specialized services, particularly in sectors like healthcare, finance, and IT, is propelling the BPO market forward. Companies are increasingly seeking BPO providers with domain-specific knowledge and technical skills to handle complex processes, ensure compliance, and deliver high-quality outcomes. This trend underscores the shift towards value-added outsourcing partnerships that contribute to business growth and innovation.

Europe Business Process Outsourcing Market Trends

The business process outsourcing market in Europe is anticipated to register considerable growth from 2025 to 2033. Several European governments are increasingly investing in digital transformation initiatives across industries such as BFSI, healthcare, and defense. These investments are encouraging enterprises to adopt advanced technologies embedded within BPO services, enabling organizations to enhance operational efficiency, improve productivity, and modernize business processes.

The UK business process outsourcing market is expected to grow rapidly in the coming years. The increasing focus on enhancing customer experience is driving the market growth in the UK. Outsourcing customer service operations to specialized BPO providers allows companies to provide round-the-clock support, multichannel communication, and personalized service, improving customer satisfaction and loyalty.

The business process outsourcing market in Germany held a substantial market share in 2025. Germany’s strict regulatory environment and data protection standards have also shaped the BPO landscape. BPO providers that demonstrate strong compliance with GDPR and offer secure, transparent processes are gaining favor among German firms. This emphasis on data security is a key driver for the adoption of local or nearshore BPO services, especially for industries like banking, insurance, and healthcare, where regulatory compliance is non-negotiable.

Asia Pacific Business Process Outsourcing Industry Trends

The business process outsourcing market in the Asia Pacific held a significant share in the global market in 2025. Asia Pacific is a diversified and heterogeneous region marked by the presence of mature markets, such as Australia, Singapore, and Japan, and developing nations, such as India, the Philippines, and Malaysia. The increasing penetration of digital channels, mobile devices, and social networking platforms is driving the demand for seamless omnichannel customer experiences.

Japan business process outsourcing market is expected to grow rapidly in the coming years. With the globalization of markets, Japanese enterprises are increasing their overseas footprints. Business process outsourcing services offer a standardized and adaptable solution for managing various activities across several locations while ensuring operational consistency and compliance with local requirements. Japanese organizations considering BPO should opt for service providers with strong data protection procedures and those adhering to international data privacy regulations.

The business process outsourcing market in China held a substantial market share in 2025. The increasing demand for outsourcing services from domestic and international companies is driving the growth of the BPO market in China. Outsourcing provides companies with a viable option as businesses strive to streamline operations, reduce costs, and focus on core competencies. Chinese BPO providers offer various services, including IT outsourcing, customer support, finance and accounting, and supply chain management, catering to diverse industries and industry verticals and meeting clients’ evolving needs worldwide.

Key Business Process Outsourcing Company Insights

Key players operating in the business process outsourcing industry are Teleperformance SE, TTEC Holdings, Inc., CBRE, Delta BPO Solutions, Concentrix Corporation, NCR Corporation, and Amdocs. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, Amdocs and Google Cloud launched a strategic initiative to enhance the management and optimization of 5G networks through AI-driven solutions. Leveraging Google Cloud's Vertex AI and BigQuery, Amdocs is introducing its Network AIOps solution, designed to automate complex network operations, improve service reliability, and elevate customer experiences for telecom providers. This collaboration aims to drive greater efficiency and intelligence in 5G network ecosystems.

-

In January 2025, CBRE entered into a definitive agreement to acquire Industrious National Management Company, LLC, an India-based provider of workplace solutions. As part of the acquisition, CBRE aims to establish a new business segment, Building Operations & Experience (BOE), integrating building operations, property management, and workplace experience. This move aims to enhance CBRE’s ability to deliver scalable solutions across data centers, offices, warehouses, and other facilities.

-

In September 2024, Concentrix Corporation launched iX Hello, a GenAI-powered self-service application designed to enhance productivity and engagement with high security. This solution enables businesses to create virtual assistants for various use cases, such as data analysis, language translations, internal self-service chatbots, and more.

Key Business Process Outsourcing Companies:

The following are the leading companies in the business process outsourcing market. These companies collectively hold the largest Market share and dictate industry trends.

- Accenture

- Amdocs

- Atos SE

- Capgemini

- Capita plc

- CBRE

- Cognizant

- Concentrix Corporation

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation (IBM)

- Sodexo

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- Teleperformance

- TTEC Holdings, Inc.

- Wipro

Business Process Outsourcing Market Report Scope

Report Attribute

Details

Market size in 2026

USD 358.58 billion

Revenue forecast in 2033

USD 695.77 billion

Growth rate

CAGR of 9.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, outsourcing type, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Singapore; Malaysia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture; Amdocs; Atos SE; Capgemini; Capita plc; CBRE; Cognizant; Concentrix Corporation; HCL Technologies Limited; Infosys Limited; International Business Machines Corporation (IBM); Sodexo; TATA Consultancy Services Limited; Tech Mahindra Limited; Teleperformance; TTEC Holdings, Inc.; Wipro

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global business process outsourcing market report based on service, outsourcing type, deployment, end use, and region:

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Finance & Accounting

-

Human Resource

-

KPO

-

Procurement & Supply Chain

-

Customer Services

-

Sales & Marketing

-

Logistics

-

Training and Development Outsourcing

-

Others

-

-

Outsourcing Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Onshore

-

Nearshore

-

Offshore

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecommunications

-

Retail

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

Malaysia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business process outsourcing market size was estimated at USD 328.37 billion in 2025 and is expected to reach USD 358.58 billion in 2026.

b. The global business process outsourcing market is expected to grow at a compound annual growth rate of 9.9% from 2026 to 2033 to reach USD 695.77 billion by 2033.

b. The IT & Telecommunications segment dominated the market and accounted for the largest revenue share in 2025. Telecom and IT companies manage extensive customer interactions, including inquiries about connectivity, billing, service activation, technical issues, and upgrades.

b. Some key players operating in the BPO market include Accenture, Amdocs, Atos SE, Capgemini, Capita plc, CBRE, Cognizant, Concentrix Corporation, HCL Technologies Limited, Infosys Limited, International Business Machines Corporation (IBM), Sodexo, TATA Consultancy Services Limited, Tech Mahindra Limited, Teleperformance, TTEC Holdings, Inc., Wipro.

b. The finance & accounting segment accounted for the largest market share of 21.4% in 2025. The adoption of automation and intelligent finance is driving growth in the F&A BPO segment as providers integrate RPA, AI, and advanced analytics into finance operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.