- Home

- »

- Communication Services

- »

-

Business Process Outsourcing Market Size Report, 2030GVR Report cover

![Business Process Outsourcing Market Size, Share & Trends Report]()

Business Process Outsourcing Market Size, Share & Trends Analysis Report By Service Type (Customer Services, Finance & Accounting), By Outsourcing Type (Onshore, Offshore), By Deployment, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-484-0

- Number of Report Pages: 142

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

BPO Market Size & Trends

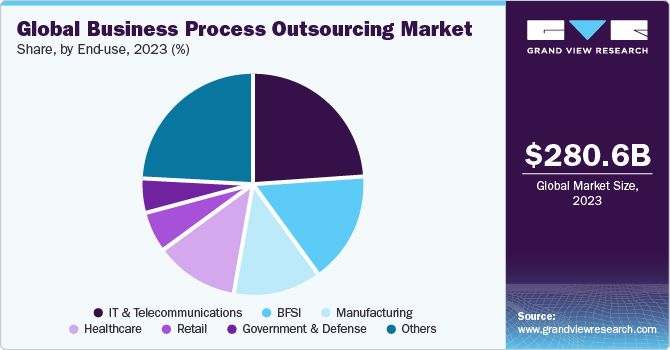

The global business process outsourcing market size was estimated at USD 280.64 billion in 2023 and is projected to grow at a CAGR of 9.6% from 2024 to 2030. Business process outsourcing (BPO) refers to the process of outsourcing operations and responsibilities of many business functions to external service providers. These services find prominent demand due to their benefits such as increased flexibility, reduced costs, and enhanced service quality. Moreover, the market allows businesses to refocus on their core business activities to deliver incremental value to their customers. Owing to these benefits, BPO services witness demand across end-use industries such as healthcare, BFSI, and IT & telecommunications.

The increasing popularity of cloud computing in business process outsourcing is one of the prominent factors influencing the adoption of BPO services. Cloud computing aids BPO operators in increasing the time to market, reducing costs, and improving the quality control process. Moreover, cloud computing in the market assures instant computing support and system access, universal access, and flexible provisioning whenever needed for required business purposes. These benefits are expected to positively impact the adoption of cloud computing in the market over the forecast period.

The need to control the operating costs, harmonize processes, focus on core competencies, and employ qualified talent is anticipated to drive the market over the coming years. BPO employers lead a consortia approach to recruiting and training entry-level staff. Such initiatives are creating youth employment opportunities and thereby contribute to the export revenues from offshoring services. For instance, the business process outsourcing market industry in South Africa has been growing continuously, offering new job opportunities, and subsequently playing a decisive role in country’s economic development. Outsourcing service providers believe that South Africa enjoys better opportunities as compared to other African countries to deliver business outsourcing services. Cape Town has particularly emerged as a BPO destination of choice. Therefore, such trends further drive the overall market’s growth.

Concerns related to security and intellectual property rights are expected to restrain the growth of the market from 2024 to 2030. The urge to reduce operational price lands the outsourcer in countries that do not have an established regulatory framework that is responsible for protecting the outsourcer from breach of confidentiality and violation of intellectual property rights. As a result, outsourcing companies are often concerned with the way they outsource and handle the information shared and are observed to be reluctant as even a small error can result in a permanent setback to the company’s market position. Additionally, the rise of government initiatives implemented to promote the adoption of cloud technology in the outsourcing sector is anticipated to the growth of the market.

The impact of COVID-19 led to economic, social disruptions and created challenges in outsourcing functions. However, the changes brought to business activities due to these disruptions are expected to provide impetus to the market in the long run. BPO companies have changed their business models by restructuring their Business Continuity Plans (BCP) to a distributed workforce. Businesses have realized the importance of continuous operations planning and disaster recovery to build a more reliable business model that can survive an unprecedented disruption like the COVID-19 pandemic. In 2020, the major vendors of the market, including Accenture and Infosys Limited (Infosys BPM) stated that due to COVID-19, more than 80-90% of their employees were working from a remote location. The resultant disruption in the workforce management process, lack of infrastructure equipment, and increased data security risks led to a reduction in work efficiency and delays in project completions in the market.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of is accelerating. Cloud computing is one of the prominent trends in the BPO market. Cloud computing offers various benefits to BPO service providers, which include 24/7 system access, enabling BPO companies to provide better quality control, flexible provisioning, and immediate computing access, among others. Moreover, BPO companies leverage cloud computing to complete data-intensive business procedures in minimum time and aid their clients in optimizing the data processing workflow with reduced turnaround time, thereby enabling market growth.

The BPO market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Through the acquisition, companies are enhancing their services portfolio and expanding in untapped market regions.

Various international and local regulatory bodies have drafted regulations to protect consumer data from unauthorized users and prevent any potential misuse of it. Market players must abide by various regulations and acts, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), related to personal data protection. Furthermore, in the BPO industry, compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) is crucial to defend against cybercrimes and maintain the security of business transactions.

The market does not have a holistic substitute for BPO services. The substitute of BPO can only be possible by in-house service providers. The lack of substitutes would enhance the growth of the market.

Leading end-user industries of BPO services include manufacturing, BFSI, retail, healthcare, manufacturing, and IT & telecommunications. The holistic value proposition of BPO services is encouraging their rapid adoption and strengthening the industry value chain as more support activities emerge to deliver consumer value.

Service Type Insights

The customer services segment dominated the market with a revenue share of 22.7% in 2023. The segment is anticipated to retain its dominance with a significant CAGR from 2024 to 2030. This segment is attributed to the rising number of service centers across the globe that need offline and online technical support. Customer service-based business process companies specialized in handling customer requirements and queries generated through social media platforms, chats, phone calls, emails, and other channels. Furthermore, most of them provide self-service support, so customers find answers to their queries at any time.

The training and development segment is predicted to witness significant growth from 2024 to 2030. The advent of new technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and data analytics has transformed the nature of work in BPO operations. Training and development services are essential for upskilling employees to effectively utilize these technologies, thereby improving productivity and quality of service delivery.

End-use Insights

The IT & telecommunication segment held the largest revenue share around 25.0% in 2023. The increase in the number of IT businesses and rapid industrialization globally are some of the factors boosting the demand for business process services across IT and telecommunication companies. IT & telecom BPO services cater to the increasing demand for connectivity, address security issues, and innovate new offerings for the latest devices and technology standards. Telecom companies outsource business functions, ranging from call-center outsourcing to billing operations to finance and accounting. Outsourcing enables telecom companies to reduce their capital expenses, access specialized resources, optimize current investments, create a flexible strategy for acquiring and retaining more customers, and manage cost pressures.

The retail segment is expected to witness the fastest growth from 2024 to 2030. Retailers are increasingly adopting omni-channel strategies to provide seamless shopping experiences across multiple channels, including brick-and-mortar stores, websites, mobile apps, and social media platforms. BPO providers assist retailers in integrating and managing these channels efficiently to meet the evolving needs of customers. For instance, in February 2024, iQor, a managed services provider specializing in customer engagement and technology-driven BPO solutions partnered with NICE, a cloud-native customer experience platform to offer transformative CX solutions for retail brands, leveraging iQor's Symphony [AI]TM generative AI ecosystem and CXone's metrics-based routing system.

Outsourcing Type Insights

The onshore segment held the largest revenue share in 2023, accounting for 45.2% of the overall market, and is expected to grow at the fastest CAGR from 2024 to 2030. Onshore outsourcing allows companies to work with service providers that are closer geographically and culturally, which can lead to better communication, understanding, and collaboration. This proximity reduces language barriers and facilitates smoother interactions between the client and the service provider.

The offshore segment is expected to witness significant growth at a CAGR of over 9.0% from 2024-2030. Industry-specific outsourcing, tailored to sectors such as healthcare, retail, and finance, is driven by factors such as regulatory compliance and industry expertise. Outsourcing to providers with knowledge of industry-specific regulations ensures adherence to standards while leveraging specialized expertise to enhance service quality and efficiency, thereby driving the growth of the segment.

Deployment Insights

The cloud segment accounted for the largest market share over 51.0% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030.Businesses across various industries are increasingly turning to BPO services delivered through the cloud for enhanced efficiency, scalability, and cost-effectiveness. Cloud computing facilitates seamless access to resources, applications, and services, enabling BPO providers to offer innovative solutions tailored to clients' evolving needs while ensuring agility and flexibility in operations. For instance, according to a report by Capgemini released in November 2023, the implementation of cloud technologies at scale is crucial for unlocking the full potential of investments in artificial intelligence (AI). The financial services sector, however, has experienced limited impact from AI largely due to the slow adoption of cloud infrastructure. There has been a significant rise in cloud adoption initiatives, with 91% of banking and insurance firms embarking on their cloud journey, marking a substantial increase from 2020 when only 37% had initiated such transformations. Over 50% of the surveyed organizations have migrated only a minimal portion of their core business applications to cloud platforms in the financial industry.

The on-premise segment is expected to witness significant growth from 2024 to 2030. Data security and compliance concerns have fuelled the demand for on-premise BPO solutions, especially in industries dealing with sensitive information such as finance, healthcare, and government. By keeping data within the client's infrastructure, on-premise BPO providers offer a higher level of control and customization, addressing regulatory requirements and minimizing the risk of data breaches.

Regional Insights

North America accounted for over 36.0% revenue share in 2023 and is expected to retain its dominance from 2024 to 2030 due to the rising demand for BPO services from several tech giants in the region. Customization of service offerings to better meet individual needs, coupled with the increasing demand for cloud computing, is further expected to support North America business process outsourcing market.

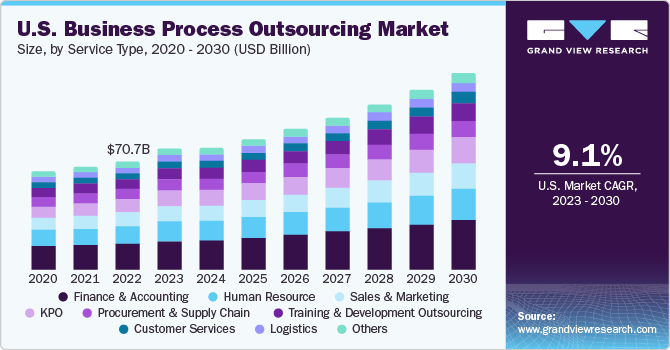

U.S. Business Process Outsourcing Market Trends

The U.S. business process outsourcing market is expected to grow at a CAGR of 9.4% from 2024 to 2030. The growing adoption of cloud computing is driving the market’s growth in the U.S. The cost-effectiveness of cloud-based BPO services empowers companies to allocate fewer resources toward capital projects and instead channel more funds into operational expenses. This approach contrasts with traditional models requiring substantial upfront investments in infrastructure, software, and hardware.

Asia Pacific Business Process Outsourcing Market Trends

The business process outsourcing market in Asia Pacific dominated the global marketin 2023, accounting for 25.6% of the total revenue share. Various factors such as reduced labor costs, rising demand for talented professionals, and significant digital investments by key vendors such as HCL Technologies Limited, Infosys Limited., Accenture plc, and Wipro Limited are driving the growth of the market.

The China business process outsourcing market is projected to grow at a CAGR of 11.8% from 2024 to 2030. The increasing penetration of digital channels, mobile devices, and social networking platforms are collectively driving the demand for a seamless omnichannel business process outsourcing market in this country.

The business process outsourcing market in Japan is projected to grow at a CAGR of 10.1% from 2024 to 2030. The integration of numerous technologies, such as Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA), into end users improves their efficiency, accuracy, and responsiveness. Moreover, the increasing focus on digital transformation among government organizations involves the incorporation of advanced technologies, digital platforms, and data-driven insights. The aforementioned factors are collectively driving the growth of the market in the country.

The India business process outsourcing market is projected to grow at a CAGR of 12.7% from 2024 to 2030. The market is expected to witness significant growth owing to the advancement of digital technologies, the increasing number of e-commerce platforms, and the rising demand for outsourced BPO services across a wide range of sectors, including telecommunications, BFSI, healthcare, retail, and travel & hospitality.

Europe Business Process Outsourcing Market Trends

The business process outsourcing market in Europe is growing significantly at a CAGR of 9.9% from 2024 to 2030. Government bodies in Europe are creating multi-channel service delivery models that enable seamless communication across numerous digital and physical interfaces. Thus, driving the market growth in this region. Moreover, the European Union's Digital Agenda intends to embrace the potential of digital technologies to accelerate economic growth, boost the productivity of business process outsourcing services, and support the development of the BPO market.

The UK business process outsourcing market is growing significantly at a CAGR nearly of 10% from 2024 to 2030. Government bodies in the country are actively supporting the BPO business through trade promotion measures, international collaborations, and market development programs. These factors collectively drive the growth of the market.

The business process outsourcing market in Germany is growing significantly at a CAGR of 10.9% from 2024 to 2030. The government strives to fulfill the increasing demands of the BPO market and maintain a sustainable talent pipeline for businesses by focusing on improving workforce employability, efficiency, and competence. Furthermore, in consideration of global trends and concerns about data privacy, security, and consumer rights, the government focuses on the data protection regulations, laws, and compliance frameworks governing the BPO industry.

The France business process outsourcing market is growing significantly from 2024 to 2030. There have been increasing investments in digital infrastructure, broadband connection, and technology adoption initiatives. Governments seek to promote innovation and value creation in the BPO market by improving digital connectivity, increasing internet access, and boosting the adoption of advanced technologies such as robotics, automation, and cloud computing.

Middle East & Africa Business Process Outsourcing Market Trends

The business process outsourcing market in the Middle East & Africa is anticipated to witness significant growth at a CAGR of 7.2% from 2024 to 2030. The market will be driven by technological innovation, digital transformation, and a growing emphasis on customer-centricity, personalization, and ethical business conduct.

The Saudi Arabia business process outsourcing market is anticipated to witness significant growth from 2024 to 2030. BPO providers are analysing large volumes of customer data, determining patterns, predicting trends, and establishing targeted strategies that connect with individual preferences, behaviours, and expectations, thereby fostering customer satisfaction, loyalty, and representation in a competitive and dynamic market environment.

Key Business Process Outsourcing Company Insights

Some key players operating in the market include Teleperformance SE; and TTEC Holdings, Inc.

-

Teleperformance SE offers BPO and other related services. Teleperformance’s service offerings comprise CX Management, Consulting, Analytics, and Technology, and Specialized Services. The group operates its business through two segments, namely Core Services & Digital Integrated Business Services (D.I.B.S) and Specialized Services. Moreover, company’s business offerings are spread across various industries and sectors, such as automotive, banking and financial services, energy and utilities, healthcare, media, insurance, government, retail and e-commerce, technology, telecom, travel, and hospitality.

-

TTEC Holdings, Inc., is a provider of BPO services. Its digital business consists of designing, building, and operating omnichannel contact center technologies, conversational messaging, and automation. TTEC comprises customer experience, contact center technology, contact center operations, data analytics, revenue generation, and intelligent automation, among others. The company is engaged in providing solutions across customer acquisition & growth, digital customer engagement, content moderation, fraud prevention, and data annotations.

Delta BPO Solutions and Go4Customer are some emerging market participants.

-

Delta BPO Solutions offers total support and aid in managing the activities of its clients. In addition, the organization offers profitable investment options such as call center projects, data entry projects, form filling projects, inbound BPO projects, small business ideas, online and offline businesses, BPO franchises, and other business ventures.

-

Go4Customer is as call center outsourcing India services. The company provides various BPO services, such as research & analytics, strategic consulting, data management, and data entry services. Moreover, the company provides services to various industries, such as automotive, BFSI, energy & utilities, government & public sector.

Key Business Process Outsourcing Companies:

The following are the leading companies in the business process outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Amdocs

- Capgemini

- CBRE

- Cognizant

- Delta BPO Solutions

- Go4Customer

- HCL Technologies Limited

- Infosys Limited (Infosys BPM)

- International Business Machines Corporation

- NCR Corporation

- SODEXO

- Teleperformance SE

- TTEC Holdings, Inc.,

- Wipro

Recent Developments

-

In November 2023, TTEC Holdings, Inc., a provider of customer experience BPO services, announced the opening of a customer experience delivery center in Cape Town, South Africa. This would provide customer experience services to numerous companies across several industries, such as manufacturing, automobile, healthcare, and telecommunications. The delivery center in Cape Town has space for several hundred employees.

-

In June 2023, Go4Customer, a BPO services provider, introduced Conversational Al to improve its BPO offerings. Conversational Al is an advanced technology that stimulates human-like consumer discussions using machine learning algorithms and natural language processing.

-

In April 2023, Delta BPO Solutions, a BPO services provider, introduced a FOCO (Franchise Owned, Company Operated) franchise business model that enables company owners to start their own BPO companies and earn regular monthly payments.The FOCO franchise model is a comprehensive business opportunity that gives entrepreneurs all the tools they need to start and run a profitable business providing business process outsourcing services.

Business Process Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 302.62 billion

Revenue forecast in 2030

USD 525.23 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, outsourcing type, deployment, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Singapore; Malaysia; Brazil; UAE; KSA; South Africa

Key companies profiled

Accenture plc; Amdocs; Capgemini; CBRE; Cognizant; Delta BPO Solutions; Go4Customer; HCL Technologies Limited; Infosys Limited (Infosys BPM); International Business Machines Corporation; NCR Corporation; SODEXO; Teleperformance SE; TTEC Holdings, Inc.; Wipro

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Process Outsourcing Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global business process outsourcing market report based on the service type, outsourcing type, deployment, end-use, and region.

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance & Accounting

-

Human Resource

-

KPO

-

Procurement & Supply Chain

-

Customer Services

-

Sales & Marketing

-

Logistics

-

Training and Development Outsourcing

-

Others

-

-

Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onshore

-

Nearshore

-

Offshore

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecommunications

-

Retail

-

Government & Defense

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

Malaysia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business process outsourcing market size was estimated at USD 280.64 billion in 2023 and is expected to reach USD 302.62 billion in 2024.

b. The global business process outsourcing market is expected to expand at a compound annual growth rate of 9.6% from 2024 to 2030, reaching USD 525.23 billion by 2030.

b. The customer services segment dominated the BPO market in 2023 with a revenue share exceeding 22%. Furthermore, the segment is expected to retain its dominance registering the fastest CAGR over the forecast period. This segment is attributed to the rising number of service centers across the globe that need offline and online technical support. Customer service-based business process companies are specialized in handling customer requirements and queries that are generated through social media platforms, chats, phone calls, emails, and other channels. Furthermore, most of them provide self-service support, so customers find answers to their queries at any time.

b. The IT & telecommunication segment dominated the business process outsourcing market in 2023 with a revenue share exceeding 25%. The segment is expected to register a significant CAGR during the forecast period.

b. Some key players operating in the BPO market include Accenture, Infosys Limited, HCL Technologies Limited, Wipro Limited, Capgemini, CBRE Group, Inc, NCR Corporation, TTEC Holdings, Inc., Sodexo, and Amdocs.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Business Process Outsourcing Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. Business Process Outsourcing Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Business Process Outsourcing Market: Service Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Business Process Outsourcing Market: Service Type Movement Analysis, 2023 & 2030 (USD Billion)

4.3. Finance & Accounting

4.3.1. Finance & Accounting Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Human Resource

4.4.1. Human Resources Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.5. KPO

4.5.1. KPO Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.6. Procurement & Supply Chain

4.6.1. Procurement & Supply Chain Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.7. Customer Services

4.7.1. Customer Services Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.8. Sales & Marketing

4.8.1. Sales & Marketing Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.9. Logistics

4.9.1. Logistics Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.10. Training and Development Outsourcing

4.10.1. Training and Development Outsourcing Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.11. Others

4.11.1. Other Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Business Process Outsourcing Market: Outsourcing Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Business Process Outsourcing Market: Outsourcing Type Movement Analysis, 2023 & 2030 (USD Billion)

5.3. Onshore

5.3.1. Onshore Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Offshore

5.4.1. Offshore Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Nearshore

5.5.1. Nearshore Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Business Process Outsourcing Market: Deployment Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Business Process Outsourcing Market: Deployment Movement Analysis, 2023 & 2030 (USD Billion)

6.3. On premise

6.3.1. On premise Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Cloud

6.4.1. Cloud Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Business Process Outsourcing Market: End-use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Business Process Outsourcing Market: End-use Movement Analysis, 2023 & 2030 (USD Billion)

7.3. BFSI

7.3.1. BFSI Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Healthcare

7.4.1. Healthcare Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Manufacturing

7.5.1. Manufacturing Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. IT & Telecommunications

7.6.1. IT & Telecommunication Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.7. Education

7.7.1. Education Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8. Retail

7.8.1. Retail Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.9. Government & Defense

7.9.1. Government & Defense Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.10. Others

7.10.1. Others Market Value Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Business Process Outsourcing Market: Regional Estimates & Trend Analysis

8.1. Business Process Outsourcing Market Share by Region, 2023 & 2030 (USD Billion)

8.2. North America

8.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.2.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.2.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.2.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.2.6. U.S.

8.2.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.6.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.2.6.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.2.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.2.6.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.2.7. Canada

8.2.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.7.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.2.7.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.2.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.2.7.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.2.8. Mexico

8.2.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.8.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.2.8.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.2.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.2.8.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.3. Europe

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.3.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.3.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.3.6. UK

8.3.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.6.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.3.6.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.3.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.6.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.3.7. Germany

8.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.7.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.3.7.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.3.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.7.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.3.8. France

8.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.8.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.3.8.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.3.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.8.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.4. Asia Pacific

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.4.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.4.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.4.6. China

8.4.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.6.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.4.6.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.4.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.6.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.4.7. India

8.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.7.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.4.7.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.4.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.7.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.4.8. Japan

8.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.8.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.4.8.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.4.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.8.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.4.9. Australia

8.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.9.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.4.9.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.4.9.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.9.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.4.10. South Korea

8.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.10.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.4.10.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.4.10.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.10.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.4.11. Singapore

8.4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.11.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.4.11.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.4.11.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.11.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.4.12. Malaysia

8.4.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.12.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.4.12.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.4.12.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.12.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.5. Latin America

8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.5.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.5.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.5.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.5.6. Brazil

8.5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.6.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.5.6.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.5.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.5.6.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.6. Middle East & Africa

8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.6.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.6.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.6.6. UAE

8.6.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.6.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.6.6.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.6.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.6.6.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.6.7. KSA

8.6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.7.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.6.7.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.6.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.6.7.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

8.6.8. South Africa

8.6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.8.2. Market Size Estimates and Forecasts by Service Type, 2018 - 2030 (USD Billion)

8.6.8.3. Market Size Estimates and Forecasts by Outsourcing Type, 2018 - 2030 (USD Billion)

8.6.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.6.8.5. Market Size Estimates and Forecasts by End-use, 2018 - 2030 (USD Billion)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Share Analysis

9.4. Company Heat Map Analysis

9.5. Strategy Mapping

9.5.1. Expansion

9.5.2. Mergers & Acquisition

9.5.3. Partnerships & Collaborations

9.5.4. New Product Launches

9.5.5. Research And Development

9.6. Company Profiles

9.6.1. Accenture Plc

9.6.1.1. Participant’s Overview

9.6.1.2. Financial Performance

9.6.1.3. Product Benchmarking

9.6.1.4. Recent Developments

9.6.2. Amdocs

9.6.2.1. Participant’s Overview

9.6.2.2. Financial Performance

9.6.2.3. Product Benchmarking

9.6.2.4. Recent Developments

9.6.3. Capgemini

9.6.3.1. Participant’s Overview

9.6.3.2. Financial Performance

9.6.3.3. Product Benchmarking

9.6.3.4. Recent Developments

9.6.4. CBRE

9.6.4.1. Participant’s Overview

9.6.4.2. Financial Performance

9.6.4.3. Product Benchmarking

9.6.4.4. Recent Developments

9.6.5. Cognizant

9.6.5.1. Participant’s Overview

9.6.5.2. Financial Performance

9.6.5.3. Product Benchmarking

9.6.5.4. Recent Developments

9.6.6. Delta BPO Solutions

9.6.6.1. Participant’s Overview

9.6.6.2. Financial Performance

9.6.6.3. Product Benchmarking

9.6.6.4. Recent Developments

9.6.7. Go4Customer

9.6.7.1. Participant’s Overview

9.6.7.2. Financial Performance

9.6.7.3. Product Benchmarking

9.6.7.4. Recent Developments

9.6.8. HCL Technologies Limited

9.6.8.1. Participant’s Overview

9.6.8.2. Financial Performance

9.6.8.3. Product Benchmarking

9.6.8.4. Recent Developments

9.6.9. Infosys Limited

9.6.9.1. Participant’s Overview

9.6.9.2. Financial Performance

9.6.9.3. Product Benchmarking

9.6.9.4. Recent Developments

9.6.10. International Business Machines Corporation

9.6.10.1. Participant’s Overview

9.6.10.2. Financial Performance

9.6.10.3. Product Benchmarking

9.6.10.4. Recent Developments

9.6.11. NCR Corporation

9.6.11.1. Participant’s Overview

9.6.11.2. Financial Performance

9.6.11.3. Product Benchmarking

9.6.11.4. Recent Developments

9.6.12. SODEXO

9.6.12.1. Participant’s Overview

9.6.12.2. Financial Performance

9.6.12.3. Product Benchmarking

9.6.12.4. Recent Developments

9.6.13. Teleperformance

9.6.13.1. Participant’s Overview

9.6.13.2. Financial Performance

9.6.13.3. Product Benchmarking

9.6.13.4. Recent Developments

9.6.14. TTEC Holdings, Inc.,

9.6.14.1. Participant’s Overview

9.6.14.2. Financial Performance

9.6.14.3. Product Benchmarking

9.6.14.4. Recent Developments

9.6.15. Wipro Enterprises Private Limited

9.6.15.1. Participant’s Overview

9.6.15.2. Financial Performance

9.6.15.3. Product Benchmarking

9.6.15.4. Recent Developments

List of Tables

Table 1 Global Business Process Outsourcing market 2018 - 2030 (USD Billion)

Table 2 Global business process outsourcing market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 3 Global business process outsourcing market estimates and forecasts by service type, 2018 - 2030 (USD Billion)

Table 4 Global business process outsourcing market estimates and forecasts by outsourcing type, 2018 - 2030 (USD Billion)

Table 5 Global business process outsourcing market estimates and forecasts by deployment, 2018 - 2030 (USD Billion)

Table 6 Global business process outsourcing market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 7 Service type market by region, 2018 - 2030 (USD Billion)

Table 8 Finance & Accounting by region, 2018 - 2030 (USD Billion)

Table 9 Human Resource by region, 2018 - 2030 (USD Billion)

Table 10 KPO by region, 2018 - 2030 (USD Billion)

Table 11 Procurement & Supply Chain by region, 2018 - 2030 (USD Billion)

Table 12 Customer Services by region, 2018 - 2030 (USD Billion)

Table 13 Sales & Marketing by region, 2018 - 2030 (USD Billion)

Table 14 Logistics by region, 2018 - 2030 (USD Billion)

Table 15 Training and Development Outsourcing by region, 2018 - 2030 (USD Billion)

Table 16 Others by region, 2018 - 2030 (USD Billion)

Table 17 Outsourcing type market by region, 2018 - 2030 (USD Billion)

Table 18 Onshore market by region, 2018 - 2030 (USD Billion)

Table 19 Offshore market by region, 2018 - 2030 (USD Billion)

Table 20 Nearshore market by region, 2018 - 2030 (USD Billion)

Table 21 Deployment market by region, 2018 - 2030 (USD Billion)

Table 22 On premise market by region, 2018 - 2030 (USD Billion)

Table 23 Cloud market by region, 2018 - 2030 (USD Billion)

Table 24 End use market by region, 2018 - 2030 (USD Billion)

Table 25 BFSI market by region, 2018 - 2030 (USD Billion)

Table 26 Healthcare market by region, 2018 - 2030 (USD Billion)

Table 27 Manufacturing market by region, 2018 - 2030 (USD Billion)

Table 28 IT & Telecommunications market by region, 2018 - 2030 (USD Billion)

Table 29 Retail market by region, 2018 - 2030 (USD Billion)

Table 30 Government & defense market by region, 2018 - 2030 (USD Billion)

Table 31 Others market by region, 2018 - 2030 (USD Billion)

Table 32 North America business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 33 North America business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 34 North America business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 35 North America business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 36 U.S. business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 37 U.S. business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 38 U.S. business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 39 U.S. business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 40 Canada business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 41 Canada business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 42 Canada business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 43 Canada business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 44 Mexico business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 45 Mexico business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 46 Mexico business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 47 Mexico business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 48 Europe business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 49 Europe business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 50 Europe business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 51 Europe business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 52 UK business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 53 UK business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 54 UK business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 55 UK business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 56 Germany business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 57 Germany business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 58 Germany business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 59 Germany business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 60 France business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 61 France business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 62 France business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 63 France business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 64 Asia Pacific business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 65 Asia Pacific business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 66 Asia Pacific business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 67 Asia Pacific business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 68 China business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 69 China business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 70 China business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 71 China business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 72 India business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 73 India business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 74 India business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 75 India business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 76 Japan business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 77 Japan business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 78 Japan business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 79 Japan business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 80 Australia business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 81 Australia business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 82 Australia business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 83 Australia business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 84 South Korea business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 85 South Korea business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 86 South Korea business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 87 South Korea business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 88 Singapore business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 89 Singapore business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 90 Singapore business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 91 Singapore business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 92 Malaysia business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 93 Malaysia business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 94 Malaysia business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 95 Malaysia business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 96 Latin America business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 97 Latin America business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 98 Latin America business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 99 Latin America business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 100 Brazil business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 101 Brazil business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 102 Brazil business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 103 Brazil business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 104 MEA business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 105 MEA business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 106 MEA business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 107 MEA business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 108 UAE business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 109 UAE business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 110 UAE business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 111 UAE business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 112 KSA business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 113 KSA business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 114 KSA business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 115 KSA business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 116 South Africa business process outsourcing market, by service type, 2018 - 2030 (Revenue, USD Billion)

Table 117 South Africa business process outsourcing market, by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

Table 118 South Africa business process outsourcing market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 119 South Africa business process outsourcing market, by end-use, 2018 - 2030 (Revenue, USD Billion)

List of Figures

Fig. 1 Business Process Outsourcing Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 Business Process Outsourcing Market: Industry Value Chain Analysis

Fig. 12 Business Process Outsourcing Market: Market Dynamics

Fig. 13 Business Process Outsourcing Market: PORTER’s Analysis

Fig. 14 Business Process Outsourcing Market: PESTEL Analysis

Fig. 15 Business Process Outsourcing Market Share by Service Type, 2023 & 2030 (USD Billion)

Fig. 16 Business Process Outsourcing Market, by Service Type: Market Share, 2023 & 2030

Fig. 17 Finance & Accounting Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Human Resource Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 KPO Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 Procurement & Supply Chain Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Customer Services Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Sales & Marketing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Logistics Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Training and Development Outsourcing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Business Process Outsourcing Market Share by Outsourcing Type, 2023 & 2030 (USD Billion)

Fig. 27 Business Process Outsourcing Market, by Outsourcing Type: Market Share, 2023 & 2030

Fig. 28 Onshore Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Offshore Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Nearshore Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Business Process Outsourcing Market Share by Deployment, 2023 & 2030 (USD Billion)

Fig. 32 Business Process Outsourcing Market, by Deployment: Market Share, 2023 & 2030

Fig. 33 On premise Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 Cloud Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 Business Process Outsourcing Market Share by End-use, 2023 & 2030 (USD Billion)

Fig. 36 Business Process Outsourcing Market, by End-use: Market Share, 2023 & 2030

Fig. 37 BFSI Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Healthcare Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 Manufacturing Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 IT & Telecommunications Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 41 Retail Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 42 Government & Defense Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 43 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 44 Regional Marketplace: Key Takeaways

Fig. 45 North America Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 46 U.S. Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 Canada Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Mexico Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 49 Europe Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 50 UK Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030) (USD Billion)

Fig. 51 Germany Business Process Outsourcing Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 52 France Business Process Outsourcing Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 53 Asia Pacific Business Process Outsourcing Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 54 China Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 India Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 Japan Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 South Korea Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 58 Australia Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 Singapore Business Process Outsourcing Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 60 Malaysia Business Process Outsourcing Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 61 Latin America Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 62 Brazil Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 MEA Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 64 KSA Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 65 UAE Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 South Africa Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 67 Key Company Categorization

Fig. 68 Company Market Positioning

Fig. 69 Key Company Market Share Analysis, 2023

Fig. 70 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Business Process Outsourcing Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Business Process Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Business Process Outsourcing Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Business Process Outsourcing End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Business Process Outsourcing Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- North America Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- North America Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- North America Business Process Outsourcing Market end-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- U.S.

- U.S. Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- U.S. Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- U.S. Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- U.S. Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- U.S. Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Canada

- Canada Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Canada Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Canada Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Canada Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Canada Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Mexico

- Mexico Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Mexico Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Mexico Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Mexico Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Mexico Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- North America Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe

- Europe Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Europe Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Europe Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Europe Business Process Outsourcing Market end-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- UK

- UK Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- UK Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- UK Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- UK Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- UK Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Germany

- Germany Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Germany Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Germany Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Germany Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Germany Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- France

- France Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- France Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- France Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- France Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- France Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific

- Asia Pacific Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Asia Pacific Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Asia Pacific Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Asia Pacific Business Process Outsourcing Market end-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- China

- China Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- China Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- China Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- China Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- China Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- India

- India Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- India Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- India Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- India Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- India Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Japan

- Japan Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Japan Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Japan Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Japan Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Japan Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- South Korea

- South Korea Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- South Korea Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- South Korea Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- South Korea Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- South Korea Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Australia

- Australia Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Australia Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Australia Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Australia Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Australia Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Singapore

- Singapore Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Singapore Business Process Outsourcing Market Outsourcing Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

- Nearshore

- Singapore Business Process Outsourcing Market Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On premise

- Cloud

- Singapore Business Process Outsourcing Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Singapore Business Process Outsourcing Market Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Malaysia