- Home

- »

- Next Generation Technologies

- »

-

C5ISR Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![C5ISR Market Size, Share & Trends Report]()

C5ISR Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End Use (Ground, Naval, Air, Space), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-525-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

C5ISR Market Summary

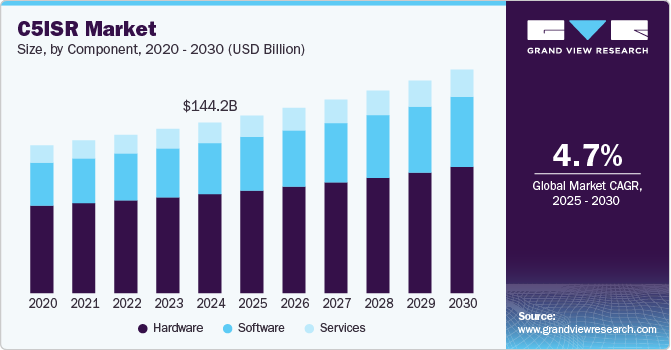

The global C5ISR market size was estimated at USD 144.23 billion in 2024 and is projected to reach USD 189.00 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. This development is fueled by a mix of technological innovation, rising defense budgets, and the growing requirement for higher operational effectiveness and situational awareness in both security and military uses.

Key Market Trends & Insights

- The North America C5ISR market dominated with a revenue share of over 40% in 2024.

- The U.S. C5ISR market is expected to grow at a CAGR of over 13% from 2025 to 2030.

- Based on component, the hardware segment accounted for the largest market share in the C5ISR industry in 2024.

- Based on application, the Intelligence, Surveillance, and Reconnaissance (ISR) segment accounted for the largest market share in the C5ISR industry in 2024.

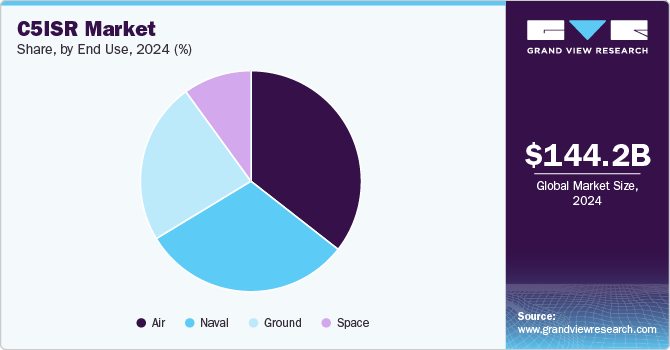

- Based on end use, the air segment accounted for the largest market share of over 35% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 144.23 Billion

- 2030 Projected Market USD 189.00 Billion

- CAGR (2025-2030): 4.7%

- North America: Largest market in 2024

As governments upgrade their defense infrastructure to counter evolving threats and improve their operating capabilities, demand for integrated Command, Control, Communications, Computers, Combat Systems, Intelligence, Surveillance, and Reconnaissance (C5ISR) solutions keeps on rising.

The market is heavily impacted by the ongoing transformation of communication networks, cloud computing, and AI, which form the core for enhancing real-time data analysis, decision-making activities, and operations performance. Merging machine learning, autonomous technologies, and 5G tech is defining C5ISR solution futures by enabling quicker and safer communication networks, improving surveillance and reconnaissance missions, and enhancing command missions. Furthermore, the growth of cybersecurity threats has created a greater need for secure and encrypted communication platforms in C5ISR systems to protect sensitive information and ensure operational integrity.

Major players in the C5ISR industry are industry leaders like Lockheed Martin, Northrop Grumman, Raytheon Technologies, General Dynamics, and BAE Systems, who are investing heavily in new technologies, product development, and strategic alliances to stay ahead of the competition. These firms emphasize improving system in and platform interoperability, and building scalable solutions to address the increasing need for end-to-end C5ISR capabilities. They are doing this by developing sophisticated combat management systems, intelligence collection platforms, and surveillance technologies that will aid in military operations and national security efforts.

One of the most important market expenditure areas is surveillance and reconnaissance systems, which are essential for intelligence gathering and real-time situational awareness. These systems are applied widely in military operations, border patrol, and intelligence agencies, enabling real-time monitoring of activities. Another important area is communication systems, which enable secure and effective command and control during operations, ensuring that personnel can work together seamlessly in dynamic environments.

As the defense sector remains committed to modernization, cloud-enabled and IoT-supporting devices are becoming increasingly prominent. These devices are increasing C5ISR system scalability and agility by making it possible to save, manage, and transmit data more efficiently. The use of edge computing is also increasing to process data in closer proximity to its source, decreasing latency while enhancing decision-making within real-time operating environments.

Component Insights

The hardware segment accounted for the largest market share in the C5ISR industry in 2024 due to the increasing demand for advanced communication, surveillance, and reconnaissance systems across defense and security sectors. Governments and military organizations globally prioritized investments in cutting-edge technologies such as radar systems, satellite communication, unmanned aerial vehicles (UAVs), and cyber defense infrastructure to enhance situational awareness and operational efficiency. Additionally, modernization initiatives and the replacement of aging defense systems drove significant procurement of C5ISR hardware, further solidifying its dominance in the market.

The software segment in the C5ISR industry is expected to witness the fastest CAGR from 2025 to 2030 due to the increasing reliance on AI, machine learning, and big data analytics for enhanced situational awareness and decision-making. As modern defense systems become more network-centric, the demand for advanced software solutions, including cybersecurity, data fusion, and predictive analytics, is rising. Additionally, software-driven upgrades offer cost-effective solutions for extending the lifecycle of existing C5ISR hardware, reducing the need for frequent hardware replacements. The shift toward cloud-based and edge computing solutions for real-time intelligence processing further accelerates software adoption, driving its rapid growth in the coming years.

Application Insights

The Intelligence, Surveillance, and Reconnaissance (ISR) segment accounted for the largest market share in the C5ISR industry in 2024. This segment’s dominance is driven by the increasing demand for real-time intelligence gathering, which is vital for modern defense operations. ISR solutions enable the collection and analysis of crucial data from various sources such as satellites, UAVs, and ground sensors. As geopolitical tensions and security concerns continue to rise, governments and defense agencies are prioritizing ISR capabilities to enhance national security and military effectiveness. The growing sophistication of ISR technologies, including advanced sensors and data analytics, is further fueling this segment’s growth.

The Command and Control (C2) segment is expected to witness the fastest CAGR from 2025 to 2030. The rapid expansion of this segment is attributed to the increasing need for effective management and coordination of military forces in complex, multi-domain environments. C2 systems enable seamless communication, decision-making, and the orchestration of tactical operations across air, land, sea, and cyberspace. The development of more integrated and automated systems, which can handle massive amounts of real-time data and support faster decision-making, is driving the demand for advanced C2 solutions. Additionally, the growing trend of network-centric warfare and the need for interoperability between different military branches and allied forces further accelerates the adoption of C2 technologies.

End Use Insights

The air segment accounted for the largest market share of over 35% in 2024, due to the growing dependence on airborne ISR platforms like UAVs (Unmanned Aerial Vehicles), reconnaissance aircraft, and radar systems, which are critical for gathering intelligence in distant or hostile environments. The U.S. Department of Defense (DoD) has spent approximately USD 2.8 billion in fiscal year 2024 to modernize airborne ISR platforms. Moreover, UAVs, being a key component of this sector, are likely to witness growth in demand at a rate of 7.5% annually over the period of five years. The increasing demand for real-time intelligence, surveillance, and reconnaissance in strategic military operations is driving the evolution of airborne ISR systems. These systems are being further combined with other defense systems, such as data processing tools, to further enhance the responsiveness and precision of intelligence reporting.

The Naval segment is expected to witness the fastest CAGR of over 5% from 2025 to 2030. The growing emphasis on securing sea borders, safeguarding key shipping routes, and countering threats in foreign waters has spurred heavy investment in naval ISR technologies. Autonomous platforms like unmanned maritime vehicles (UMVs) and autonomous underwater vehicles (AUVs) are becoming key assets for naval forces in gathering intelligence, surveilling the seas, and maintaining maritime security. This transition is manifest in the USD 1.3 billion commitment by the U.S. and China to modernization programs of their navies, which involves cutting-edge radar and sensor systems. The expanding requirement for greater maritime surveillance in contested areas such as the South China Sea further fueled the application of autonomous naval platforms capable of performing ISR missions in degraded environments.

Regional Insights

North America C5ISR market dominated with a revenue share of over 40% in 2024, primarily driven by the strong defense budgets of the United States and Canada. The region's market leadership is driven significantly by the sophisticated technological infrastructure, including the latest command, control, communication, and intelligence systems. In addition, the escalating demand for real-time situational awareness and expanding complexity of military operations are driving the demand for C5ISR systems. The availability of top defense contractors and ongoing innovation in ISR and command and control technologies further enhances the region's strength. Moreover, the U.S. military focus on modernization and data-driven decision-making systems continues to fuel market growth.

U.S. C5ISR Market Trends

The U.S. C5ISR market is expected to grow at a CAGR of over 13% from 2025 to 2030, driven by the increasing demand for advanced command, control, communications, and intelligence systems within the U.S. military. The demand for improved situational awareness, real-time data processing, and decision-making ability in complex military operations is a major growth driver of the market. In addition, there is a growing trend to incorporate new technologies like artificial intelligence, machine learning, and cutting-edge sensors into C5ISR systems to enhance operational effectiveness and efficiency. The U.S. defense sector is also seeing stepped-up investments in network-centric warfare, autonomous platforms, and satellite-based ISR solutions. Moreover, the increasing focus on security and secure communications in defense operations is adding to the market growth.

Europe C5ISR Market Trends

Europe C5ISR is expected to grow at a CAGR of over 15% from 2025 to 2030, driven by growing defense expenditures, technology, and intensifying security threats in the region. The growing demand for increased intelligence, surveillance, and communications capabilities to counter changing defense requirements is driving the implementation of sophisticated C5ISR systems. Some of the main trends are the incorporation of artificial intelligence, machine learning, and sophisticated data analytics into ISR technologies to enhance situational awareness and decision support. Countries are also placing high importance on the creation of satellite-based ISR systems and secure communication networks to enhance national security.

The UK C5ISR market is likely to expand considerably in the next few years, led by the nation's emphasis on upgrading defense infrastructure and intelligence capabilities. The U.K. government's investments in future-generation command, control, and communication systems are central to sustaining its military dominance. In addition, interoperability with NATO and other allied nations is a central priority, and the integration of C5ISR systems into a joint and multinational defense system is a top trend.

C5ISR market in Germany is dominated by robust digital infrastructure, high defense expenditures, and rising movement toward integrated defense solutions. Germany's investment in secure communications systems, ISR technologies, and network-centric warfare capabilities is expanding the market. One of the trends in the German market is the rising requirement for customized, real-time intelligence to aid defense operations and bolster military cooperation with EU allies. The growing uptake of cloud-based C5ISR systems and incorporation of next-generation sensors and AI tools are driving the transformation of Germany's defense industry.

Asia Pacific C5ISR Market Trends

The Asia Pacific C5ISR market is expected to grow at a CAGR of over 5% from 2025 to 2030, owing to rising defense budgets, changing security threats, and fast-paced developments in military technology. Regional nations are augmenting their defense capabilities by incorporating advanced C5ISR technologies to enhance situational awareness, data processing, and real-time decision-making. The increase in geopolitical tensions, especially in the Korean Peninsula and South China Sea, is further fueling the demand for advanced ISR and command and control systems in Asia-Pacific. Moreover, the region's focus on cybersecurity and safe communication systems is spurring the implementation of C5ISR technology.

The Japan C5ISR market is gaining traction, driven by Japan's sustained defense modernization program and security partnerships with strategic allies such as the United States. Japan is making significant investments in future ISR technologies to improve its defense profile, specifically because of regional security concerns with regard to North Korea and China. There is growing momentum towards AI-based systems, satellite-based observation, and encrypted communication networks. Japan's military forces are focusing on interoperability with U.S. and NATO military forces, which is leading to increased adoption of advanced, integrated C5ISR solutions. Trends consist of growth in maritime surveillance capabilities and the utilization of advanced analytics for enhanced intelligence gathering and improving operational efficiency.

C5ISR market in China is rapidly expanding, aided by the nation's aggressive military modernization program and heavy investment in cutting-edge technologies. As China aims to project greater military power globally, the emphasis on developing ISR and command and control capabilities to facilitate large-scale operations and border protection is increasing. The market is defined by autonomous system development, satellite-based reconnaissance technologies, and AI-driven analytics for real-time decision-making. China's pursuit of military self-sufficiency and cybersecurity robustness is spurring demand for secure communication infrastructures. Also, the integration of ISR capabilities with China's overall defense strategy, especially in regions such as the South China Sea, is propelling the use of advanced C5ISR technologies.

Key C5ISR Company Insights

Some of the key players in the C5ISR market include ADS, Inc., Kratos Defense & Security Solutions, Inc., and Lockheed Martin.

-

ADS, Inc. is a C5ISR solutions provider offering communications, surveillance, and command & control equipment and services to defense agencies. The company focuses on delivering various technologies to military organizations to increase operational effectiveness and ensure secure communication in challenging environments. ADS, Inc. specializes in delivering customized solutions that serve multiple C5ISR applications.

-

Kratos Defense & Security Solutions, Inc. is a technology solutions provider specializing in defense, security, and communications. Kratos is a leader in unmanned systems, satellite communications, and military cybersecurity. The C5ISR solutions of the company assist military customers in enhancing intelligence collection, mission command, and securing operational networks.

-

Lockheed Martin's C5ISR segment offers systems for aerospace, defense, and security. It offers integrated solutions for communication, command and control, and surveillance systems. Defense agencies worldwide employ Lockheed Martin's C5ISR solutions to enhance real-time data processing, surveillance, and situational awareness.

ManTech International Corporationand Intelsat US LLC. are some of the emerging market participants in the market.

-

ManTech International Corporation delivers technology solutions to government and commercial customers across business segments of cybersecurity, C5ISR, and mission support. The organization is growing its presence in the C5ISR sector by offering custom services for increasing data management, communications, and intelligence systems in defense and security agencies.

-

Intelsat US LLC is a satellite communication services provider. Intelsat provides defense agencies with dependable, high-speed communication networks to facilitate better military operations in the C5ISR market. The satellite infrastructure of the company is instrumental in enabling real-time communications and intelligence sharing for the military personnel worldwide.

Key C5ISR Companies:

The following are the leading companies in the c5isr market. These companies collectively hold the largest market share and dictate industry trends.

- ADS, Inc.

- Kratos Defense & Security Solutions, Inc.

- Lockheed Martin

- The Boeing Company

- Raytheon Technologies Corporation

- General Dynamics

- Northrop Grumman

- Thales Group

- Leonardo S.p.A.

- BAE Systems

- ManTech International Corporation

- Intelsat US LLC

Recent Developments

-

In 2024, Leidos introduced an advanced C5ISR system designed to enhance the U.S. Army's operational capabilities. This new system integrates cutting-edge technologies to improve situational awareness, real-time decision-making, and operational efficiency in defense operations.

-

In 2024, Kratos Defense & Security Solutions, Inc. announced the successful deployment of its next-generation Unmanned Aerial Systems (UAS) with integrated C5ISR technologies for defense use. The UAS will boost intelligence collection, surveillance, and reconnaissance activities by offering real-time information to defense decision-makers.

-

In 2024, Lockheed Martin acquired over $1 billion worth of contract from the U.S. Department of Defense to upgrade its C5ISR systems with cutting-edge satellite communication and cybersecurity capabilities. The new system will enhance the military's capability to have secure and robust communication channels amid high-risk operations.

C5ISR Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 150.16 billion

Revenue forecast in 2030

USD 189.00 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Saudi Arabia; Brazil; South Africa; UAE

Key companies profiled

ADS, Inc.; Kratos Defense & Security Solutions, Inc.; Lockheed Martin; The Boeing Company; Raytheon Technologies Corporation; General Dynamics; Northrop Grumman; Thales Group; Leonardo S.p.A.; BAE Systems; ManTech International Corporation; Intelsat US LLC

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global C5ISR Market Report Segmentation

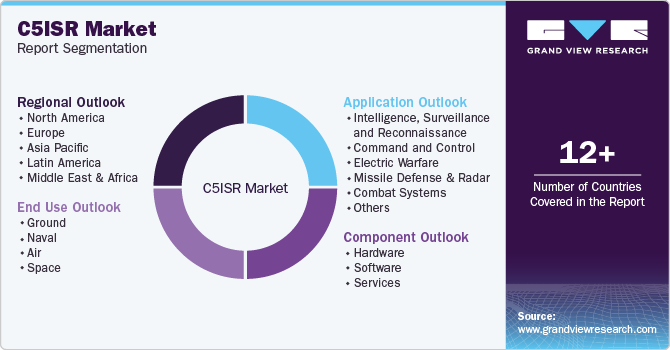

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global C5ISR Market report based on component, end use, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ground

-

Naval

-

Air

-

Space

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Intelligence, Surveillance and Reconnaissance

-

Command and Control

-

Electric Warfare

-

Missile Defense and Radar

-

Combat Systems

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global C5ISR market size was estimated at USD 144.23 billion in 2024 and is expected to reach USD 150.16 billion in 2025.

b. The global C5ISR market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 189.00 billion by 2030.

b. The air segment under the end use category of the C5ISR market dominated with the highest revenue share of nearly 58% in 2024. The highest revenue share can be attributed to growing dependence on airborne ISR platforms like UAVs (Unmanned Aerial Vehicles), reconnaissance aircraft, and radar systems, which are critical for gathering intelligence in distant or hostile environments.

b. The key players in the C5ISR market include ADS, Inc.; Kratos Defense & Security Solutions, Inc.; Lockheed Martin; The Boeing Company; Raytheon Technologies Corporation; General Dynamics; Northrop Grumman; Thales Group; Leonardo S.p.A.; BAE Systems; ManTech International Corporation; and Intelsat US LLC, among others.

b. Key factors that are driving market growth include technological innovation, rising defense budgets, and the growing requirement for higher operational effectiveness and situational awareness in both security and military uses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.