- Home

- »

- Distribution & Utilities

- »

-

Cable Assembly Market Size & Share, Industry Report, 2030GVR Report cover

![Cable Assembly Market Size, Share & Trends Report]()

Cable Assembly Market (2025 - 2030) Size, Share & Trends Analysis Report By Cable Type (Coaxial Cables, Twisted Pair Cables, Fiber Optic Cables, Flat Ribbon Cables), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-604-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cable Assembly Market Summary

The global cable assembly market size was estimated at USD 178.90 billion in 2024, and is projected to reach USD 253.81 billion by 2030, growing at a CAGR of 6.05% from 2025 to 2030. The market is witnessing steady expansion, fueled by the rising demand for efficient connectivity solutions across the automotive, aerospace, telecommunications, and healthcare industries.

Key Market Trends & Insights

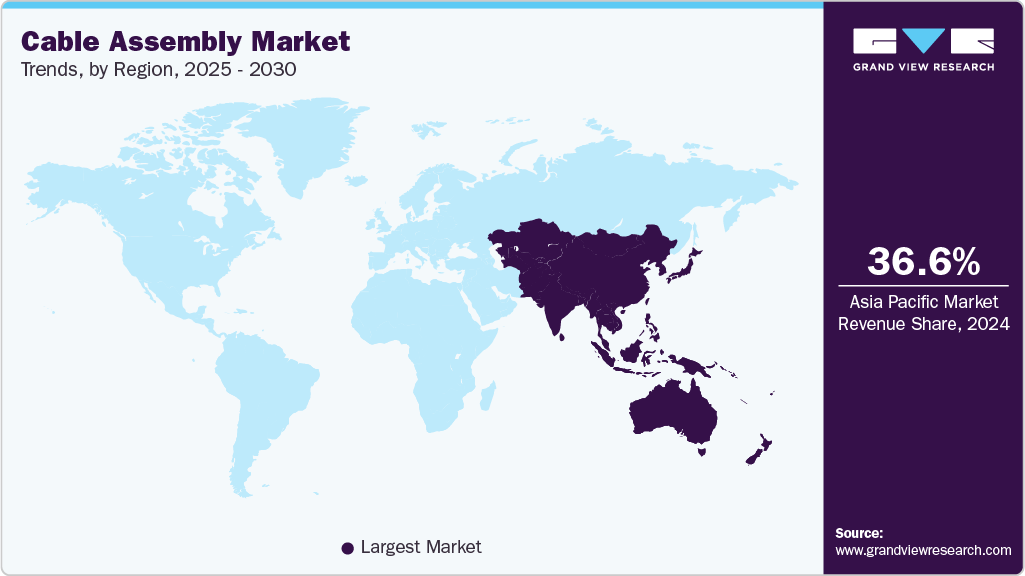

- Asia Pacific held 36.65% revenue share of the global Cable Assembly market in 2024.

- The U.S. cable assembly market is witnessing steady growth.

- By cable type, fiber optic cables segment held the largest market revenue share of over 37.74% in 2024.

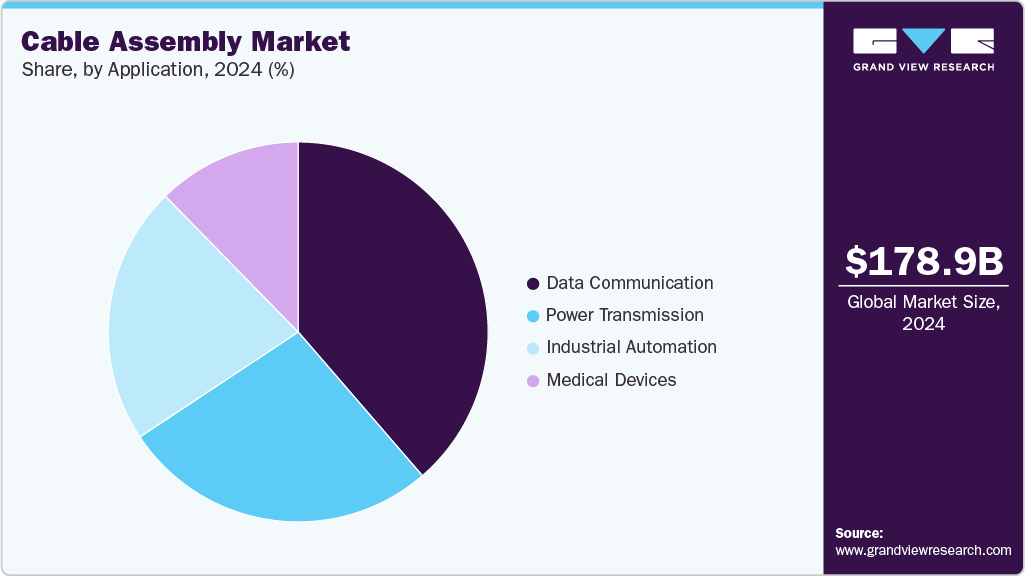

- By application, data communication segment held the revenue share of 38.66% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 178.90 Billion

- 2030 Projected Market Size: USD 253.81 Billion

- CAGR (2025-2030): 6.05%

- Asia Pacific: Largest market in 2024

Factors such as the miniaturization of electronic devices, increasing automation, and the proliferation of IoT-enabled systems drive the need for reliable and customized cable assemblies. In addition, advancements in materials and manufacturing techniques and supportive industry standards are further accelerating market growth, especially in sectors requiring high-performance interconnect solutions.Technological innovations, including advancements in high-speed data transmission, miniaturization, and materials engineering, are significantly improving the performance and efficiency of cable assemblies. These innovations enable greater durability, signal integrity, and flexibility in high-demand environments such as automotive electronics, aerospace systems, and industrial automation. Furthermore, the growing integration of smart systems and IoT devices is increasing the need for specialized cable assemblies capable of handling complex signal and power requirements, thus driving market expansion across multiple sectors.

The commercial and industrial sectors are rapidly adopting advanced cable assemblies to support automation, robotics, and digital transformation initiatives. The flexibility of customized and modular cable assembly solutions reduces installation time and maintenance costs, making them an attractive option for manufacturers and OEMs. This trend is particularly prominent in regions such as Asia Pacific, where booming electronics manufacturing and infrastructure development are fueling demand. Despite ongoing challenges such as fluctuating raw material prices and supply chain constraints, continuous R&D and the push for miniaturized, high-performance solutions are expected to keep the market on a strong growth trajectory. As connectivity demands grow globally, the cable assembly market is a vital enabler of next-generation technologies.

Drivers, Opportunities & Restraints

The cable assembly market is driven by increasing demand for reliable and high-performance interconnect solutions across diverse industries such as automotive, aerospace, telecommunications, and consumer electronics. Rapid technological advancements, including miniaturization, enhanced shielding, and the integration of fiber optics, are enabling faster data transmission and improved durability, making cable assemblies vital for modern electronic systems. In addition, the growing adoption of IoT devices and smart technologies is boosting the need for specialized cable assemblies capable of handling complex power and signal requirements.

The cable assembly market opportunities are expanding with the rise of electric vehicles, renewable energy projects, and industrial automation, which require customized, robust, and flexible cabling solutions. Emerging markets with expanding infrastructure investments offer significant growth potential, especially in Asia Pacific and Latin America. However, the market faces challenges such as fluctuating raw material prices, supply chain disruptions, and stringent safety and environmental compliance regulatory requirements. Furthermore, the increasing complexity of cable assemblies calls for advanced manufacturing capabilities and skilled labor, which can limit rapid scalability. Overcoming these challenges through innovation and streamlined production processes will be critical for sustaining long-term growth.

Cable Type Insights

The fiber optic cables segment plays a critical role in the global cable assembly market by enabling high-speed, reliable data transmission across various industries such as telecommunications, data centers, aerospace, and automotive. Known for their superior bandwidth, low signal loss, and resistance to electromagnetic interference, fiber optic cables are essential for meeting the growing demand for fast and secure communication networks. The segment’s dominance is driven by the widespread adoption of technologies such as 5G, cloud computing, and IoT, which require robust and scalable connectivity solutions. Furthermore, fiber optic cables support long-distance data transfer with minimal degradation, making them indispensable for modern infrastructure development.

Increasing investments in broadband expansion, data center construction, and smart city projects worldwide boost the demand for fiber optic cables. The segment’s ability to support high data rates and future-proof communication networks positions it as a key growth drive within the cable assembly market. In addition, ongoing advancements in cable design and manufacturing techniques enhance durability and ease of installation, contributing to broader adoption across developed and emerging markets.

Application Insights

The data communication segment is witnessing robust growth due to the escalating demand for high-speed, reliable data transmission across various sectors, including telecommunications, IT infrastructure, and cloud computing. This application involves cables that support large data transfer volumes with minimal latency and signal loss, making it critical for modern communication networks. The increasing adoption of 5G technology, edge computing, and IoT devices further propels the need for advanced cable assemblies tailored to data communication applications. The segment benefits from ongoing investments in data centers and network expansions worldwide, which drive demand for high-performance cable solutions.

Other applications, such as industrial automation and power transmission, are also contributing to market growth, but data communication remains dominant due to its foundational role in enabling digital connectivity. Cable assemblies' ability to support fast, secure, and scalable data networks makes them indispensable in the era of digital transformation. In addition, improvements in cable design, such as enhanced shielding and miniaturization, are facilitating broader deployment across urban and remote areas.

Regional Insights

The North American cable assembly market is experiencing steady growth, supported by strong demand from telecommunications, aerospace, automotive, and healthcare. The U.S. leads the region with ongoing investments in network upgrades, 5G deployments, and electric vehicle production, driving the need for high-performance cable assemblies. In addition, advancements in fiber optic technology and the expansion of data centers bolster market prospects. Canada is witnessing growth through increased demand for industrial automation and renewable energy projects, contributing to regional market expansion.

U.S. Cable Assembly Market Trends

The U.S. cable assembly market is witnessing steady growth, driven by the expanding telecommunications infrastructure, increased demand for high-speed data transmission, and advancements in fiber optic technology. The growing adoption of 5G networks and smart city initiatives are key factors propelling market expansion. Moreover, the automotive industry’s shift towards electric and connected cars is boosting demand for sophisticated cable assemblies. The presence of major technology firms and manufacturers investing in R&D further strengthens the market. In addition, government initiatives to upgrade aging infrastructure and promote energy efficiency support sustained growth in this region and industrial sectors seeking uninterrupted power supply and sustainability.

Asia Pacific Cable Assembly Market Trends

The Asia Pacific cable assembly market is the largest and fastest-growing globally, driven by rapid industrialization, expanding telecommunications infrastructure, and growing demand for data communication solutions. Countries such as China, India, Japan, and South Korea invest heavily in 5G networks, data centers, and smart city projects, all requiring advanced cable assemblies. The region’s increasing adoption of electric vehicles and renewable energy systems also fuels demand. Government initiatives to improve digital infrastructure and promote technology manufacturing further accelerate market growth, making the Asia Pacific a key hub for cable assembly production and innovation.

Europe Cable Assembly Market Trends

Europe’s cable assembly market is growing consistently, propelled by the region’s focus on advanced manufacturing, automation, and sustainable energy solutions. Countries like Germany, France, and the UK are at the forefront of deploying fiber optic networks and supporting the electrification of transport. The automotive sector’s shift towards electric and hybrid vehicles, alongside the growth of the aerospace industry, further drives cable assembly demand. In addition, stringent regulatory standards and incentives for clean energy projects promote innovation in cable technologies across the region.

Latin America Cable Assembly Market Trends

The Latin American cable assembly market is gradually expanding, driven by infrastructure modernization efforts in the telecommunications and energy sectors. Brazil, Mexico, and Argentina lead regional adoption with growing investments in fiber optic networks and industrial automation. Despite economic challenges, the increasing penetration of electric vehicles and renewable energy projects supports steady growth. The mining and agricultural sectors’ demand for reliable cable assemblies also contributes to market development.

Middle East & Africa Cable Assembly Market Trends

The Middle East and Africa cable assembly market is gaining momentum due to growing infrastructure investments and the need for reliable connectivity solutions. Countries such as Saudi Arabia, UAE, and South Africa focus on smart city developments, telecom expansions, and renewable energy projects, driving demand for specialized cable assemblies. The region’s oil and gas sector modernization and defense upgrades further support market growth. However, geopolitical uncertainties and economic fluctuations present ongoing challenges to market stability.

Key Cable Assembly Company Insights

Some of the key players operating in the market include Leoni AG, TE Connectivity, Belden Inc., Aptiv Plc, Tyco Electronics, Hirose Electric Co., Ltd., and others.

-

In February 2024, TE Connectivity announced the expansion of its high-speed data cable assembly production line in China to meet rising global demand from the data center and telecom sectors. The new facility aims to enhance manufacturing efficiency and reduce lead times for fiber optic and copper cable assemblies.

-

In January 2024, Molex unveiled a new series of rugged, high-density cable assemblies designed for harsh industrial environments. These next-gen solutions target automation, industrial IoT, and factory applications, offering improved signal integrity, reduced EMI, and compact form factors to support evolving connectivity needs.

Key Cable Assembly Companies:

The following are the leading companies in the cable assembly market. These companies collectively hold the largest market share and dictate industry trends.

- Leoni AG

- TE Connectivity

- Belden Inc.

- Aptiv Plc

- Tyco Electronics

- Hirose Electric Co., Ltd.

- Delphi Technologies

- Amphenol Corporation

- Molex

- JST Manufacturing Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

- Furukawa Electric Co., Ltd.

Cable Assembly Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 189.24 billion

Revenue forecast in 2030

USD 253.81 billion

Growth rate

CAGR of 6.05% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Cable type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Leoni AG; TE Connectivity; Belden Inc.; Aptiv Plc; Tyco Electronics; Hirose Electric Co., Ltd.; Delphi Technologies; Amphenol Corporation; Molex; JST Manufacturing Co., Ltd.; Sumitomo Electric Industries, Ltd.; Yazaki Corporation; Furukawa Electric Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cable Assembly Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cable assembly market report on the basis of cable type, application, and region.

-

Cable type Outlook (Revenue, USD Million, 2018 - 2030)

-

Coaxial Cables

-

Twisted Pair Cables

-

Fiber Optic Cables

-

Flat Ribbon Cables

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Communication

-

Power Transmission

-

Industrial Automation

-

Medical Devices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cable assembly market size was estimated at USD 178.90 billion in 2024 and is expected to reach USD 189.24 billion in 2025.

b. The global cable assembly market is expected to grow at a compound annual growth rate of 6.05% from 2025 to 2030 to reach USD 253.81 billion by 2030.

b. The Fiber Optic Cables segment accounted for the largest global cable assembly market share, with a revenue contribution of over 37.74 % in 2024. This dominance is attributed to the surging demand for high-speed data transmission and the expanding deployment of fiber optics in telecommunications, data centers, and enterprise networks. As industries move towards digital transformation, the need for reliable, high-bandwidth connectivity is accelerating the adoption of fiber optic assemblies.

b. Some of the key vendors operating in the global cable assembly market include Leoni AG; TE Connectivity; Belden Inc.; Aptiv Plc; Tyco Electronics; Hirose Electric Co., Ltd.; Delphi Technologies; Amphenol Corporation; Molex; JST Manufacturing Co., Ltd.; Sumitomo Electric Industries, Ltd.

b. The key factor driving the growth of the global cable assembly market is the rising demand for high-speed data transmission and reliable connectivity across industries such as telecommunications, automotive, aerospace, and healthcare. As digitalization accelerates and the adoption of advanced technologies like 5G, IoT, and AI expands, the need for robust and efficient cable assemblies has increased significantly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.