- Home

- »

- Clothing, Footwear & Accessories

- »

-

Camera Straps Market Size & Share, Industry Report, 2030GVR Report cover

![Camera Straps Market Size, Share & Trends Report]()

Camera Straps Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Commercial, Personal), By Material (Nylon, Polyester), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-530-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Camera Straps Market Size & Trends

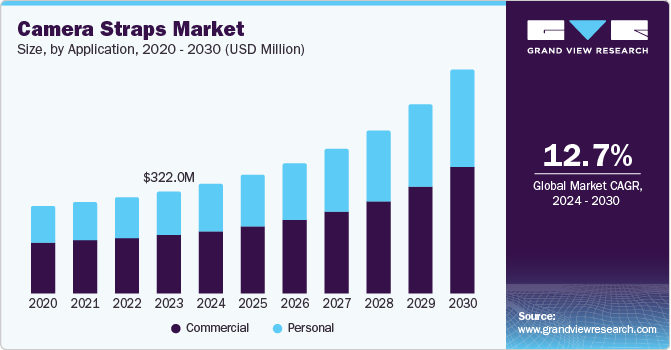

The global camera straps market size was valued at USD 322.0 million in 2023 and is projected to grow at a CAGR of 12.7% from 2024 to 2030. Rising number of photography enthusiasts across the globe, a budding vlogging culture, and availability of aesthetically appealing straps are some leading factors driving market growth. Camera manufacturers offer various product options to choose from, catering to the needs of both professionals and amateurs.

The utilization of cameras has broadened beyond traditional photography, encompassing videography, vlogging, and content creation. For instance, the rapid emergence of Instagram reels and sustained popularity of YouTube have led to the emergence of a young consumer base that is seeking high-quality videography equipment to create engaging content. This has consequently stimulated the demand for camera straps as a useful accessory to accommodate diverse user needs.

Consumers are increasingly willing to invest in high-quality, functional, and visually pleasing camera accessories, elevating the product into a fashion accessory. For instance, fancy camera bags, colorful skins, straps, tripod stands, and lens filters not only are useful in protecting cameras and related equipment but also enhance the visual appeal. Additionally, the desire for unique and personalized products has fueled the development of customizable camera straps, thereby expanding market opportunities for manufacturers. Brands have started allowing customers to add their names, logo, and distinct design to these straps so that they can be easily identified by others.

Straps are crucial for enhancing the utility and protection of cameras. For instance, camera straps provide a secure means of carrying photographic equipment, preventing accidental drops or damages. Moreover, they also optimize efficiency and versatility by allowing photographers to maintain a firm grip on their camera while simultaneously being able to carry out other tasks. For heavier camera bodies and lens combinations, straps help distribute the weight evenly, reducing physical strain on the user. These characteristics make straps among the most sought-after camera accessories by professionals and enthusiasts. In keeping with the trend of sustainability, manufacturers are introducing straps made from eco-friendly materials to lower their environmental footprint and appeal to the growing eco-conscious customer base.

Application Insights

The commercial segment led the market, accounting for a revenue share of 57.7% in 2023. The steady growth in the number of commercial photographers, videographers, and other media professionals that offer their services during functions, seminars, and other events has driven product demand from this application area. These professionals require durable, reliable, and specialized camera straps to support the weight of their camera equipment and withstand rigorous usage conditions.High-end cameras and lenses used in commercial applications require robust and protective straps to mitigate the risk of damage or loss. Commercial photographers often carry multiple camera bodies and lenses with the help of efficient and secure strap systems. Moreover, they generally own different types of camera straps that can serve various types of setup, which drives market expansion.

The increasing adoption of cameras in personal applications is expected to generate a notable market CAGR of 13.1% during the forecast period in the personal segment. There has been a continued rise in the number of individuals engaging in photography as a hobby or for personal documentation purposes. This rapidly expanding personal photography trend is directly correlated with heightened demand for camera straps that are tailored to individual preferences and styles. Moreover,camera straps have evolved from purely functional accessories to fashion statements. Their integration into personal style has broadened their consumer base and driven product demand.

Material Insights

Nylon camera straps held a significant revenue share in the global industry in 2023. This is primarily attributed to the increasing inclusion of nylon in the manufacturing of camera straps, owing to beneficial material characteristics such as durability, affordability, lighter weight, and resistance capacities to wear and tear. Multiple brands are relying on the production of neck and shoulder camera straps prepared from nylon. Ease of availability, enhanced accessibility, and consumer inclination are expected to fuel further growth in this segment during the forecast period.

Meanwhile, camera straps manufactured from cotton are expected to witness substantial demand in the coming years, owing to the extensive availability of cotton globally as well as its functional benefits. Advanced manufacturing techniques have led to the development of soft, comfortable, and strong cotton camera straps that can bear the high weight of camera and related equipment, thus generating strong sales. Photographers and videographers need to carry their equipment for an extended time, while also ensuring that they are not damaged. Cotton woven straps are extremely soft and smooth, meaning that they can be carried around for longer periods without fear of straining the back or neck. Their ease of cleaning and durability further enhances the appeal of cotton camera straps among end users.

Distribution Channel Insights

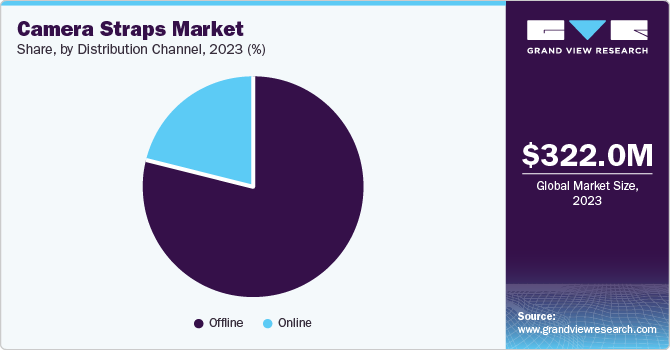

The offline channel accounted for the highest market revenue share of 78.8% in 2023. This large share is owing to a well-established offline distribution network for camera accessories. Consumers generally show a tendency to buy camera accessories from the same outlet where they purchased the camera, as these stores have knowledgeable staff that can explain product features and benefits to customers. Camera straps are physical products that need tactile evaluation by consumers to understand their durability. Offline retail stores provide an opportunity for customers to assess product quality, comfort, and aesthetic appeal. These factors have led to the domination of offline channels in this market.

Online channels are expected to witness a higher CAGR of 13.7% over the forecast period. The rapid expansion of e-commerce platforms has provided a convenient and accessible marketplace for camera strap manufacturers and retailers, facilitating direct consumer engagement. Online platforms offer a broader selection of camera straps, including niche products and customized options, thus catering to diverse consumer preferences. Additionally, online retailers provide competitive pricing structures due to lower operational costs, making camera straps more affordable for consumers.

Regional Insights

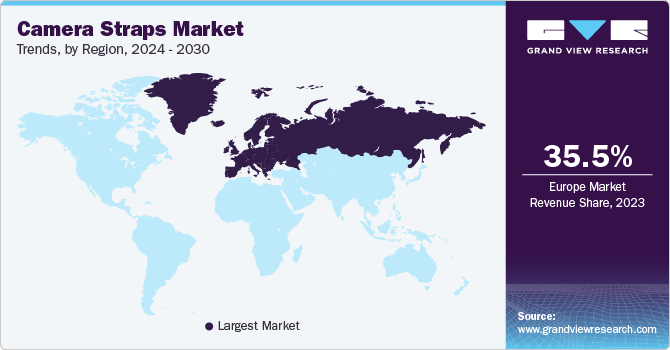

Europe camera straps market accounted for the highest market share of 35.5% in 2023. The region has a rich history of photography, with a substantial base of enthusiasts and professionals. This established market has led to a high demand for camera accessories, including straps. Additionally, European fashion trends have significantly influenced consumer preferences, with camera straps evolving into stylish accessories. This alignment with fashion sensibilities has driven the demand for premium and designer straps.

UK Camera Straps Market Trends

The UK camera straps market held a significant share in the regional market. This is attributed to the presence of a substantial number of professional photographers in the country. These photographers include those working in mass media, entertainment, and fashion industries who require straps of different lengths and materials according to the occasion and place of work. Furthermore, freelancing wildlife photographers and amateurs in the country account for a notable demand for straps, owing to the convenience offered by them in camera handling.

Asia Pacific Camera Straps Market Trends

Asia Pacific camera straps market is expected to advance at a substantial CAGR of 17.1% over the forecast period. This is owing to a rising disposable income among the middle-class population in this region, which has led to increased spending on discretionary items such as cameras. Since camera and its accessories are complementary goods, the market for straps is expanding at a similar rate. Furthermore, the region is a global manufacturing hub, offering cost-effective production capabilities for camera straps. This has attracted both domestic and international brands, stimulating market growth.

India camera straps market held a considerable share of the regional market in 2023. This is attributed to a budding photography and vlogging culture among the younger demographic in the country. An increasing interest in photography, driven by rising use of social media platforms and visual storytelling trends, has led to a surge in camera ownership and accessory purchases. Additionally, wedding photographers are among the prime consumers of the market, as they use multiple cameras for capturing photos and recording videos. The efficient handling of these expensive cameras is crucial for their protection from physical damage. These factors have created a sustained demand for straps, leading to market growth.

North America Camera Straps Market Trends

North America camera straps market accounted for a notable share in the market in 2023. The region has a large population of amateur photography enthusiasts, who prefer to carry cameras for the documentation of their adventure activities. For instance, wildlife photographers in the region visit remote places to capture rare animals in their natural habitat. These physical environments can be very challenging and handling cameras and lenses becomes difficult in such situations. Straps enable them to switch between cameras and lenses without fear of damage. A rise in videography culture among the youth is expected to further propel the demand for camera straps in regional economies.

The U.S. camera straps market holds a notable share in the North American market. This is owing to a rich culture of content creation in the country. An established film-making industry, popularity of online content creation, and the widespread social media usage have fueled substantial demand for cameras in the country. Manufacturers are offering distinct varieties of straps in terms of their material, length, and design, addressing the youth. With the availability of customization, the demand for designer straps is expected to increase over the forecast period in the economy.

Key Camera Straps Company Insights

Some key companies involved in the camera straps market include COOPH Cooperative of Photography GmbH, ALTURAPHOTO, and OP//TECH USA, among others.

-

COOPH Cooperative of Photography GmbH is an Austrian camera accessories manufacturing company. The company has a dedicated business of manufacturing photography-related accessories such as apparel for male and female photographers, camera leather protectors, canvas bags, bottles, and camera straps. The company offers a variety of camera straps such as rope-styled camera straps, braided camera straps, Leica rope straps, Leica Paracord straps, and leather camera straps.

-

ALTURAPHOTO is an American photography accessories manufacturing company. The company offers a variety of camera flashes, lenses for DSLRs, lens filter kits, lens hoods, camera bags, backpacks, pouches, camera cleaning kits, and straps. In its straps segment, ALTURAPHOTO offers Rapid Fire Hand Strap, wrist strap, and neck strap. The company’s wide range of product offerings ensures addressing the requirements of individual customers.

Key Camera Straps Companies:

The following are the leading companies in the camera straps market. These companies collectively hold the largest market share and dictate industry trends.

- SAMSUNG

- FUJIFILM Corporation

- Black Rapid, Inc.

- Peak Design

- ALTURAPHOTO

- gordy's camera straps

- Movo

- OP//TECH USA

- COOPH Cooperative of Photography GmbH

- ORIGINAL FUZZ

Recent Developments

-

In July 2023, Peak Design’s distributor in Ireland, Benelux, and Great Britain, the Transcontinenta Group, introduced the ‘Peak Design Micro Clutch’ hand strap designed for small mirrorless cameras. The solution has been launched through a Kickstarter campaign and features a machined aluminum baseplate with a hidden attachment tool for better battery access. It also has a removable tripod plate that can be used with PD, Capture tripods, and Arca-Swiss compatible tripods.

Camera Straps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 344.9 million

Revenue Forecast in 2030

USD 706.8 million

Growth Rate

CAGR of 12.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Application, material, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, South Africa

Key companies profiled

SAMSUNG; FUJIFILM Corporation; Black Rapid, Inc.; Peak Design; ALTURAPHOTO; gordy's camera straps; Movo; OP//TECH USA; COOPH Cooperative of Photography GmbH; ORIGINAL FUZZ

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

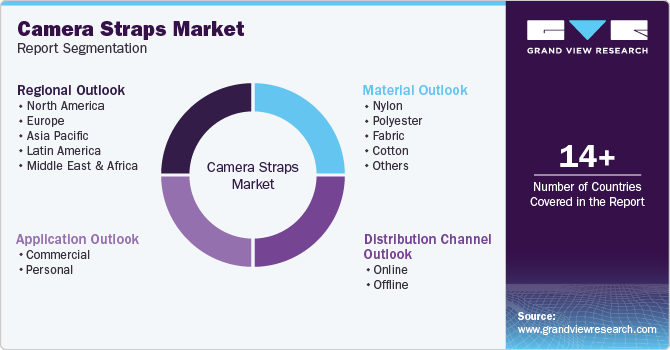

Global Camera Straps Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global camera straps market report based on application, material, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Personal

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Nylon

-

Polyester

-

Fabric

-

Cotton

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.