- Home

- »

- Petrochemicals

- »

-

Can Coatings Market Size & Share, Industry Report, 2030GVR Report cover

![Can Coatings Market Size, Share & Trends Report]()

Can Coatings Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin (Epoxy, Polyester, Acrylic, Polyolefins), By End-use (Food, Beverage), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-499-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Can Coatings Market Summary

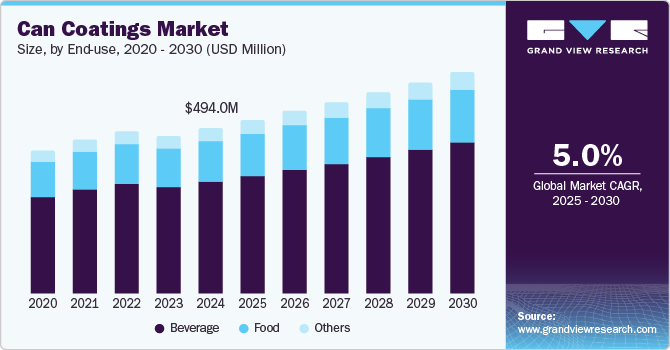

The global can coatings market size was estimated at USD 494.0 million in 2024 and is projected to reach USD 661.6 million by 2030, growing at a CAGR of 5.0% from 2025 to 2030. The market growth is driven by the increasing demand for canned food and beverages, which require robust and safe packaging solutions.

Key Market Trends & Insights

- The North America can coatings industry held the highest revenue share of 36.0% in 2024.

- Based on resin, the acrylic segment held the largest revenue share of over 49.6% in 2024.

- Based on end-use, the beverage segment held the largest revenue share of over 67.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 494.0 Million

- 2030 Projected Market Size: USD 661.6 Million

- CAGR (2025-2030): 5.0%

- North America: Largest market in 2024

As urbanization and the busy lifestyles of consumers continue to rise, the preference for convenient and long-lasting packaging, such as metal cans, has significantly grown. It has critical properties such as corrosion resistance, chemical stability, and enhanced aesthetic appeal, making it indispensable for maintaining the quality and safety of canned products. These features are vital for extending consumables' shelf life and ensuring compliance with stringent food safety regulations worldwide.

The rising consumption of carbonated soft drinks, energy drinks, and alcoholic beverages has amplified the demand for metal cans and, consequently, for effective coatings to preserve product integrity. In addition, growing health and environmental concerns have prompted manufacturers to develop BPA-free and eco-friendly can coatings, aligning with regulatory frameworks and consumer preferences. This shift toward sustainable solutions fosters innovation and creates new growth opportunities within the can coatings industry.

Technological advancements and the introduction of innovative coating materials also play a pivotal role in driving the market. Modern coatings are engineered to offer improved performance, such as enhanced resistance to high temperatures and abrasion while ensuring compatibility with a wide range of food and beverage formulations. Moreover, the rising adoption of lightweight and recycled metal cans further propels the demand for adaptable coatings that meet the evolving requirements of manufacturers and consumers alike.

Drivers, Opportunities & Restraints

The growing trend toward sustainability has encouraged the adoption of eco-friendly coatings, driving the market growth. Technological advancements in coating formulations, such as BPA-free and water-based coatings, cater to increasing consumer awareness about health and environmental safety. Rising urbanization and changing consumer habits have also increased the demand for ready-to-eat meals and processed foods. These products require packaging that preserves their flavor and nutritional value and withstands long transportation and storage periods. Can coatings, particularly those with advanced barrier properties, play a critical role in meeting these requirements, driving their adoption in the food and beverage industry.

Opportunities in the global can coatings industry stem from ongoing innovations in coating technologies and the increasing focus on sustainability. Developing bio-based and recyclable coatings presents significant growth prospects, aligning with the global push for reducing carbon footprints. Rapid urbanization and changing lifestyles, particularly in Asia Pacific and Latin America, offer untapped potential for manufacturers to expand their presence in these regions. Furthermore, advancements in digital printing technology can create customization opportunities, enhancing brand differentiation and consumer engagement. Partnerships and collaborations between coating manufacturers and packaging companies also present avenues for market expansion.

Despite its growth prospects, the global can coatings market faces several challenges. Stringent regulatory requirements regarding hazardous chemicals, such as BPA, increase compliance costs and pose challenges for manufacturers. The volatility of raw material prices adds another layer of complexity, impacting profit margins. Additionally, the market is highly competitive, with numerous players vying for market share, which can hinder new entrants. The shift toward alternative packaging solutions, such as pouches and tetra packs, also threatens the demand for can coatings. Lastly, limited consumer awareness about the benefits of advanced coating solutions in some regions can restrain market growth.

Resin Insights

The acrylic segment held the largest revenue share of over 49.6% in 2024. This is attributable to its superior performance characteristics, making it a preferred choice for various applications. Acrylic coatings offer excellent resistance to corrosion, chemical exposure, and UV light, ensuring durability and long-lasting protection for cans used in food, beverages, and industrial products. Their transparency and gloss retention also enhance the visual appeal of cans, meeting the demand for attractive packaging.

Epoxy segment is anticipated to grow at the fastest CAGR of 5.5% over the forecast period. It is driven by its superior protective properties, making it the most widely used resin type in can coatings. It offers exceptional adhesion, chemical resistance, and durability, which are critical for preserving the integrity of food and beverage products during storage and transportation. Their ability to prevent corrosion and contamination ensures the safety and quality of the packaged contents, making them a preferred choice for food-grade applications.

End-use Insights

The beverage segment held the largest revenue share of over 67.4% in 2024. Technological advancements in coating formulations, including water-based and powder coatings, enable manufacturers to meet the dual requirements of functionality and compliance with evolving safety standards. The beverage segment also benefits from the increasing penetration of canned beverages in emerging markets, where urbanization, rising disposable incomes, and changing consumer lifestyles drive demand for sustainable and durable packaging solutions.

The food segment is expected to grow significantly at a CAGR of 4.7% over the forecast period. This is attributable to the increasing demand for packaged and processed food products, which offer convenience, extended shelf life, and protection against contamination. As urbanization accelerates and lifestyles become more fast-paced, consumers increasingly opt for canned food products, driving the need for high-quality can coatings to preserve food quality and ensure safety.

Regional Insights

The North America can coatings industry held the highest revenue share of 36.0% in 2024. North America is a significant market for premium and luxury personal care products, often relying on innovative emulsifiers to deliver superior textures and sensory experiences. The demand for high-end cosmetics, anti-aging creams, and other specialized products has prompted manufacturers to invest in cutting-edge emulsifier technologies that enhance product performance and consumer satisfaction.

U.S. Can Coatings Market Trends

Stringent regulations by the U.S. Food and Drug Administration (FDA) on food safety and packaging materials have prompted manufacturers to adopt advanced and compliant coating technologies, such as BPA-free and water-based formulations. This regulatory framework and increasing consumer awareness of health and environmental concerns have accelerated the shift toward sustainable and eco-friendly coating solutions.

Asia Pacific Can Coatings Market Trends

The Asia Pacific can coatings industry is primarily driven by rapid urbanization and the growing middle class, which leads to increased consumption of packaged food and beverages. Shifting consumer preferences toward convenient and long-lasting packaging have surged demand for high-quality can coatings across the region. The rising popularity of carbonated beverages, energy drinks, and canned food products, particularly in emerging economies like India and Southeast Asia, further propels market growth.

Additionally, increasing awareness of health and environmental concerns has encouraged the adoption of BPA-free and sustainable coating solutions. Governments in the region are introducing regulations to promote environmentally friendly packaging materials, providing further impetus to the market. Growth in e-commerce and food delivery services, particularly post-pandemic, has amplified the demand for durable and aesthetically appealing packaging, bolstering the need for innovative can coating solutions in the Asia Pacific region.

The China can coatings market is expected to grow over the forecast period. China’s focus on sustainability and environmental protection has accelerated the adoption of eco-friendly and BPA-free coatings. Government regulations and initiatives to reduce carbon footprints and promote green packaging have encouraged manufacturers to develop innovative and sustainable coating solutions. The rising awareness of food safety among consumers further drives the demand for coatings that comply with strict health and safety standards.

Europe Can Coatings Market Trends

The Europe can coatings industry is primarily driven by the increasing demand for sustainable and eco-friendly packaging solutions, supported by stringent European Union (EU) regulations on environmental protection and chemical safety. The EU’s emphasis on reducing single-use plastics has led to a surge in the adoption of metal cans, thereby increasing the need for high-performance can coatings that ensure product safety and enhance shelf life.

Latin America Can Coatings Market Trends

The Latin America can coatings industry’s growth is primarily driven by the rising demand for packaged food and beverages, spurred by rapid urbanization and changing consumer lifestyles in the region. As the middle class expands and disposable incomes rise, the consumption of convenient, ready-to-use food products and beverages has surged, increasing the need for effective can coatings to ensure product quality and shelf life. Sustainability initiatives and increased environmental awareness are also driving the adoption of eco-friendly and BPA-free coatings in Latin America. Governments and regulatory bodies encourage sustainable materials, aligning with global trends to reduce carbon footprints. Additionally, the rising popularity of regional exports of canned goods, such as fruits, vegetables, and seafood, requires high-performance coatings that meet international quality standards, further fueling market growth.

Key Can Coatings Market Company Insights

Some of the key players operating in the market include BALL CORPORATION and Kupsa Coatings.

-

Ball Corporation is a global provider of sustainable packaging solutions. Ball Corporation's product offerings in the can coatings segment include advanced internal and external coatings designed to enhance metal cans' durability, safety, and aesthetic appeal. These include BPA-free and water-based coatings, corrosion-resistant linings, and decorative finishes that cater to diverse consumer and industrial applications.

-

Kupsa Coatings is a manufacturer and supplier of high-quality coatings specializing in the can coatings industry. Their product portfolio includes a wide range of can coatings, such as epoxy, polyester, and BPA-free coatings, designed for use in food and beverage packaging and industrial applications.

Key Can Coatings Companies:

The following are the leading companies in the can coatings market. These companies collectively hold the largest market share and dictate industry trends.

- BALL CORPORATION

- Kupsa Coatings

- Kansai Nerolac Paints Ltd.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- TOYOCHEM CO., LTD.

- VPL Coatings GmbH & Co KG

- National Paints Factories Co. Ltd.

- IPC GmbH & Co. KG

- Axalta Coating Systems

- CSC BRANDS, L.P.

Can Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 518.4 million

Revenue forecast in 2030

USD 661.6 million

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Resin, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain China; Japan; India; Singapore; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Ball Corporation; Kupsa Coatings; Kansai Nerolac Paints Ltd.; The Sherwin-Williams Company; PPG Industries, Inc.; Toyochem Co., Ltd.; VPL Coatings GmbH & Co. KG; National Paints Factories Co. Ltd.; IPC GmbH & Co. KG; Axalta Coating Systems; CSC Brands, L.P.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Can Coatings Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global can coatings market report based on resin, end-use, and region:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyester

-

Acrylic

-

Polyolefins

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverage

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global can coatings market was valued at USD 494.0 million in 2024 and is projected to reach USD 518.4 million by 2025.

b. .The global can coatings market is anticipated to grow at a CAGR of 5.0% from 2025 to 2030 to reach USD 661.6 million by 2030.

b. The acrylic segment held the largest revenue share of over 49.67% in 2024, driven by its superior performance characteristics, making it a preferred choice for various applications

b. Key industry participants include BALL CORPORATION, Kupsa Coatings, Kansai Nerolac Paints Ltd., The Sherwin-Williams Company, PPG Industries, Inc., Toyochem Co., Ltd., VPL Coatings GmbH & Co. KG, National Paints Factories Co. Ltd

b. The global can coatings market is driven by the increasing demand for canned food and beverages, which require robust and safe packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.