- Home

- »

- Medical Devices

- »

-

Canada Contrast Media Market Size, Industry Report, 2030GVR Report cover

![Canada Contrast Media Market Size, Share, & Trends Report]()

Canada Contrast Media Market (2025 - 2030) Size, Share, & Trends Analysis Report By Modality (Ultrasound, Magnetic Resonance Imaging), By Product, By Application, By Route of Administration, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-339-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Contrast Media Market Trends

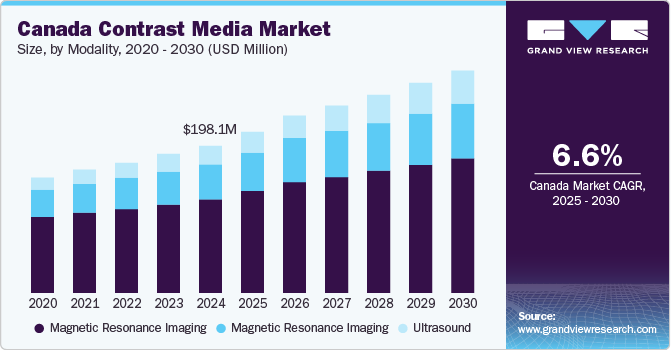

The Canada contrast media market size was valued at USD 198.1 million in 2024 and is projected to witness a CAGR of 6.6% from 2025 to 2030, driven by increasing demand for advanced diagnostic imaging techniques and the rising prevalence of chronic diseases.

The growing adoption of accurate diagnostic tools, such as MRI, CT, and ultrasound, has led to a higher consumption of contrast agents. Moreover, the increasing incidence of chronic conditions such as cancer, cardiovascular diseases, and diabetes emphasizes the importance of early detection and ongoing monitoring. This growing reliance on advanced imaging solutions fuels the demand for contrast media, contributing to the Canada contrast media industry expansion.

According to the Canadian Cancer Society's 2024 report, researchers anticipated 88,100 cancer-related deaths and 247,100 new cancer cases in Canada for 2024. They projected that each day in 2024, approximately 675 Canadians would be diagnosed with cancer, and 241 Canadians would succumb to the disease. Technological advancements in imaging techniques and the introduction of novel contrast agents further propel the market. In addition, government initiatives aimed at improving healthcare infrastructure and accessibility contribute significantly to market expansion. With healthcare facilities increasingly adopting advanced imaging modalities, the demand for contrast media is set to rise steadily, ensuring robust market growth over the coming years.

Technological advancements play a pivotal role in the market's growth. A significant driver is the development of new contrast agents that are more effective and safer for patients. For instance, the advent of microbubble contrast agents has enhanced ultrasound imaging, while gadolinium-based agents have improved MRI diagnostics. These innovations facilitate better image clarity and diagnostic accuracy, which are critical in early disease detection and treatment planning.

Furthermore, advanced imaging technologies, such as high-resolution and 3D imaging, require high-quality contrast media to achieve optimal results. For instance, in March 2024, Applied Pharmaceutical Innovation (API) and Voyageur Pharmaceuticals Ltd. entered into a Master Services Agreement (MSA). This collaboration is set to significantly boost both organizations' dedication to innovation and bolster Canada's life sciences sector. The strategic partnership aims to expedite Voyageur's imaging contrast medium's development, production, and commercialization. The integration of Artificial Intelligence (AI) in imaging processes also supports advanced contrast media, enabling more precise and efficient diagnoses. As technology evolves, the Canadian market will likely see the introduction of even more sophisticated contrast agents, further driving market growth.

In addition, government initiatives and healthcare policies significantly impact the Canadian market. The Canadian government has been actively investing in the healthcare sector to enhance the quality and accessibility of medical services. Policies to reduce diagnostic wait times and improve patient outcomes directly influence the demand for advanced imaging modalities and contrast media. Programs such as the Canadian Institutes of Health Research (CIHR) funding and provincial healthcare funding initiatives support the adoption of cutting-edge medical technologies, including advanced contrast agents.

Moreover, regulatory frameworks ensure the safety and efficacy of contrast media, promoting trust and widespread use among healthcare professionals. The government's ongoing focus on healthcare improvements and technological advancements is expected to drive the market through increased investment and supportive policies. For instance, in January 2023, Bayer AG announced that its iodine-based contrast agents, Ultravist-300 and Ultravist-370, were approved for Contrast-enhanced Mammography (CEM) in the European Union. Regulatory agencies worldwide are establishing guidelines to ensure Canada's contrast media therapies' safety, efficacy, and ethical use. Streamlined approval processes and clearer regulatory pathways encourage commercialization and market expansion investment, facilitating patient access to advanced treatment options.

Modality Insights

The X-ray/computed tomography segment dominated the market with the largest revenue share of 63.8% in 2024, owing to the widespread use of these imaging techniques in diagnosing various medical conditions. CT scans are known for providing detailed cross-sectional images of the body, making them crucial for detecting abnormalities such as tumors, fractures, and internal bleeding. The growing demand for noninvasive diagnostic tools, coupled with advancements in CT technology, has driven the dominance of this segment, positioning it as the preferred choice in both hospitals and diagnostic centers across Canada.

The ultrasound segment is projected to be the fastest growing with a CAGR of 10.3% from 2025 to 2030 due to its noninvasiveness and increasing adoption in diagnostic procedures. Ultrasound technology, paired with contrast agents, provides real-time, high-resolution imaging that enhances the accuracy of diagnostics, particularly in cardiology and oncology. Increasing demand for safer, cost-effective alternatives to other imaging methods, along with advancements in ultrasound technology, drives market growth. Rising healthcare awareness and a focus on early disease detection is projected to further fuel the expansion of the ultrasound segment.

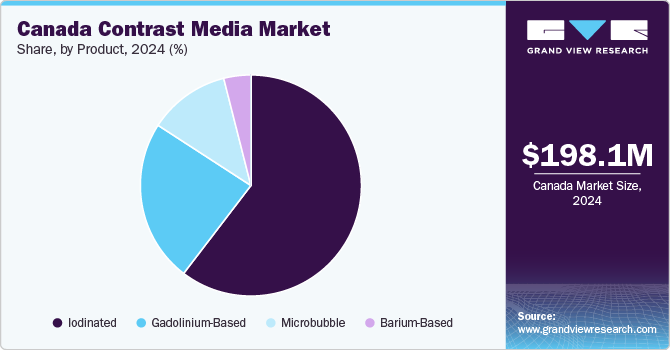

Product Insights

The iodinated segment dominated the Canada contrast media industry with the largest revenue share in 2024, owing to its widespread application in CT scans, angiography, and other diagnostic procedures. These agents offer high-quality imaging, providing clear and detailed visuals essential for accurate diagnosis in various medical fields, including cardiology, neurology, and oncology. Their reliability and established safety record contribute to their dominance in clinical settings. The growing prevalence of chronic diseases and the increasing need for advanced imaging technologies continue to drive the widespread use of iodinated contrast agents across healthcare institutions in Canada.

The microbubble segment is anticipated to be the fastest-growing segment from 2025 to 2030 due to its growing use in ultrasound imaging. Microbubbles enhance the visualization of blood flow and tissue structure, improving diagnostic accuracy for conditions such as cardiovascular diseases, tumors, and liver disorders. Their ability to provide high-resolution, real-time imaging with minimal invasiveness makes them increasingly popular among healthcare providers. Technological advancements, coupled with the rising demand for noninvasive diagnostic tools, are driving the adoption of microbubbles, positioning them for significant growth in Canada.

Application Insights

The neurological disorders segment held the largest market share in 2024, which can be attributed to the increasing prevalence of conditions such as stroke, brain tumors, and multiple sclerosis. Imaging techniques, particularly MRI and CT scans using contrast agents, play a crucial role in accurately diagnosing and monitoring these complex neurological conditions. The demand for precise and early detection, along with advancements in contrast media technology, has driven significant growth in this segment. Healthcare professionals increasingly rely on contrast-enhanced imaging to guide treatment plans and improve patient outcomes.

The cardiovascular disorders segment is expected to be the fastest-growing segment over the forecast period, driven by the rising incidence of heart diseases and related conditions. Contrast media enhances the effectiveness of imaging techniques such as coronary angiography and CT angiography, enabling the detection of cardiovascular abnormalities, particularly blockages, aneurysms, and heart defects. The growing demand for early diagnosis, precise cardiovascular health monitoring, and imaging technology advancements drive significant market expansion. In addition, an aging population and increasing awareness of heart health further fuel the segment's growth potential.

Route of Administration Insights

The intravenous segment dominated the market in 2024, attributed to its widespread use in enhancing imaging for various diagnostic procedures, including CT scans and MRI. Intravenous contrast agents are effective in providing clear and detailed images of blood vessels, organs, and tissues, aiding in the detection of conditions such as tumors, cardiovascular diseases, and internal injuries. Their ease of administration, quick onset of action, and high level of safety contribute to their preference for medical imaging, driving their dominance in the Canada contrast media industry.

The oral route segment is anticipated to grow at a significant pace during the forecast period. This growth can be attributed to its expanding applications in gastrointestinal imaging procedures. Oral contrast agents are commonly used in CT and MRI scans to enhance the visibility of the digestive system, helping diagnose conditions such as gastrointestinal cancers, Crohn's disease, and blockages. The non-invasive nature of oral contrast administration, combined with its effectiveness in providing clear imaging of internal organs, makes it an appealing option for both patients and healthcare providers, fueling segment growth in the market.

End Use Insights

The hospitals segment accounted for the largest market share in 2024, owing to their central role in providing diagnostic imaging services. Hospitals frequently use contrast media for a wide range of imaging procedures, such as CT scans, MRIs, and angiography, to diagnose and monitor various conditions, including cancers, cardiovascular diseases, and neurological disorders. The availability of advanced imaging equipment, skilled medical professionals, and the need for quick, accurate diagnoses contribute to hospitals being the primary users of contrast media, driving their dominance in the market.

The private clinics segment is projected to be the fastest-growing segment over the forecast period, propelled by the increasing demand for personalized and efficient healthcare services. These clinics are adopting advanced imaging technologies such as CT scans and MRIs to provide accurate and timely diagnoses, especially for conditions such as musculoskeletal disorders, cancers, and cardiovascular diseases. The rising preference for private healthcare, shorter waiting time, and convenience drive patients to private clinics. Their ability to offer specialized services and high-quality diagnostic imaging is expected to contribute to

Key Canada Contrast Media Company Insights

Some of the key companies in the Canada contrast media industry include Bayer AG; GE HealthCare; Guerbet; Lantheus; and Bracco.

-

GE HealthCare offers advanced medical technologies and services, including imaging, monitoring, diagnostics, and artificial intelligence solutions. It focuses on enhancing patient care, improving clinical outcomes, and advancing healthcare delivery across various medical specialties.

-

Lantheus offers diagnostic imaging and radiopharmaceutical products, specializing in innovative solutions for detecting and monitoring various diseases. Its portfolio includes imaging agents for oncology, cardiology, and neurology, enhancing diagnostic accuracy and patient care.

Key Canada Contrast Media Companies:

- Bayer AG

- GE HealthCare

- Guerbet

- Lantheus

- Bracco

- Voyageur Pharmaceuticals Ltd

- Grupo Juste

Recent Developments

-

In May 2024, Voyageur Pharmaceuticals, Ltd announced securing a USD 1.9 million sales contract for Smooth X 2% Barium Contrast. The agreement was made with a specialized radiology products sales company in Latin America. This initial contract granted the distributor exclusive marketing and sales rights for Smooth X 2% in two countries. It is a contrast medium used in diagnostic abdominal Computed Tomography (CT) examinations.

-

In March 2024, Lantheus Holdings, Inc. announced the approval of a supplemental New Drug Application (sNDA) for DEFINITY (Perflutren Lipid Microsphere) by Health Canada as an ultrasound-enhancing agent intended for pediatric patients with suboptimal echocardiograms.

-

In March 2024, Bracco Imaging and Samsung Medison unveiled a new agreement focused on optimizing the utilization of ultrasound contrast agents. The partnership aims to enhance image resolution, streamline workflow, and improve clinical benefits for healthcare providers and patients.

-

In April 2024, Bayer AG partnered with Google Cloud to co-develop artificial intelligence (AI) solutions to assist radiologists and improve patient care. As part of this collaboration, Bayer will broaden its innovation platform to expedite creating and implementing AI-driven healthcare applications, particularly in radiology. This initiative will harness Google Cloud's advanced technology, including its generative AI tools.

Canada Contrast Media Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 217.7 million

Revenue forecast in 2030

USD 300.2 million

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, product, application, route of administration, and end use

Key companies profiled

Bayer AG; GE HealthCare; Guerbet; Lantheus;Bracco;Voyageur Pharmaceuticals Ltd; and Grupo Juste.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Contrast Media Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Canada contrast media market report on the basis of modality, product, application, route of administration, and end use:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrasound

-

Magnetic Resonance Imaging

-

X-ray/Computed Tomography

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Microbubble

-

Gadolinium-Based

-

Iodinated

-

Iodixanol

-

Iohexol

-

Iopamidol

-

Others

-

-

Barium-Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Disorders

-

Neurological Disorders

-

Gastrointestinal Disorders

-

Cancer

-

Nephrological Disorders

-

Musculoskeletal Disorders

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Oral Route

-

Rectal Route

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Private Clinics

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.