- Home

- »

- Consumer F&B

- »

-

Canada Dairy Alternative Market Size, Industry Report, 2033GVR Report cover

![Canada Dairy Alternative Market Size, Share & Trends Report]()

Canada Dairy Alternative Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Soy, Almond, Coconut), By Product (Milk, Yogurt, Cheese), By Distribution Channel (Supermarket & Hypermarkets, Convenience Stores), And Segment Forecasts

- Report ID: GVR-4-68040-709-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Dairy Alternative Market Summary

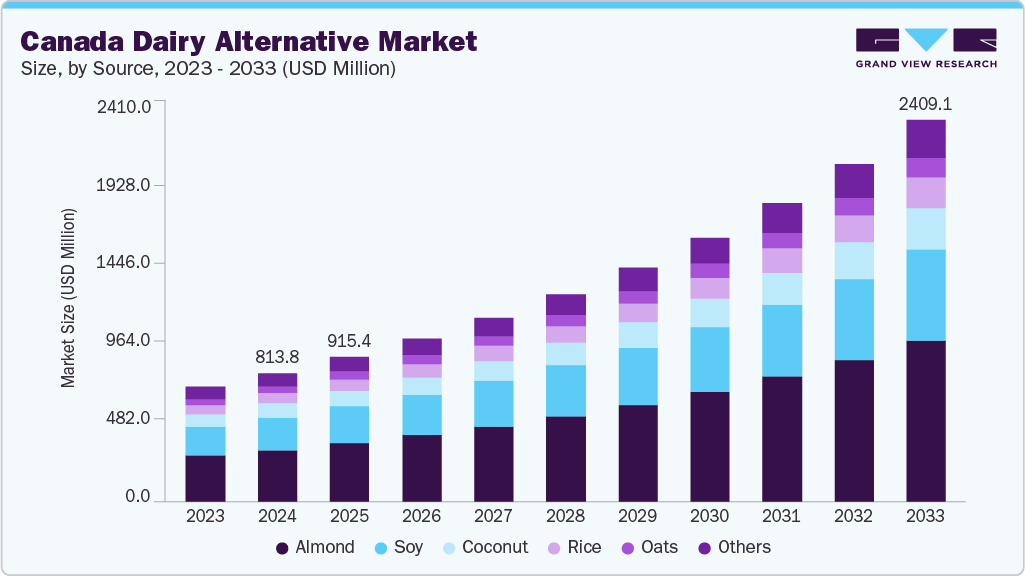

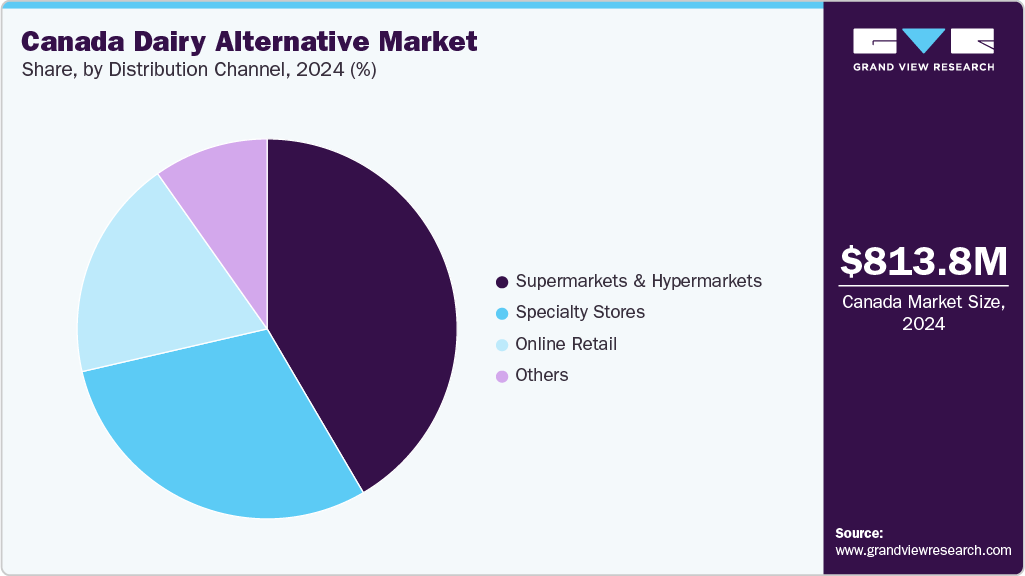

The Canada dairy alternative market was estimated at USD 813.8 million in 2024 and is projected to reach USD 2,409.1 million by 2033, growing at a CAGR of 12.9% from 2025 to 2033. The market growth is driven by the rising incidence of milk allergies among consumers, prompting greater demand for dairy-free and allergen-friendly alternatives.

Key Market Trends & Insights

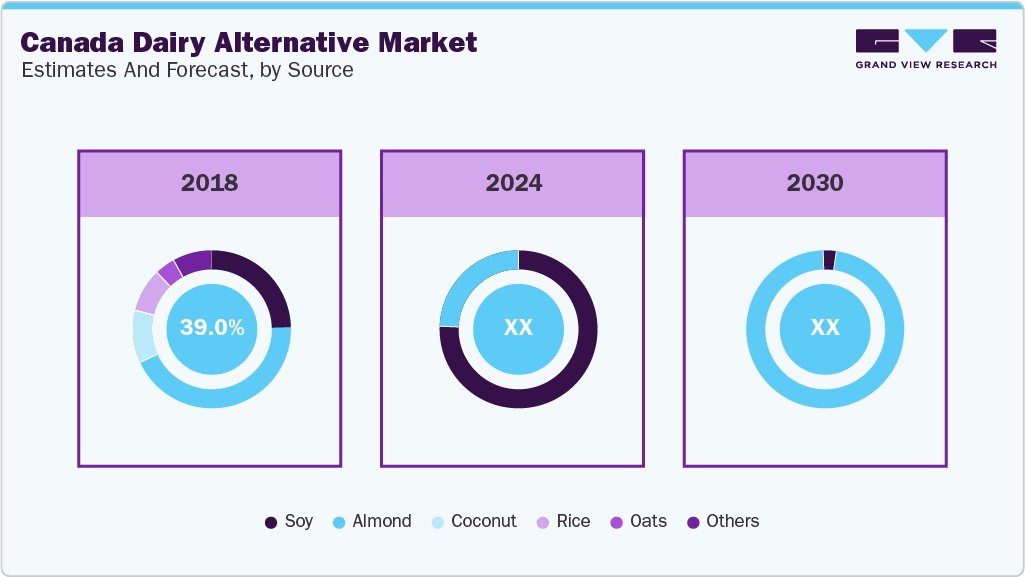

- By source, the almond source segment held the highest market share of 40.3% in 2024.

- Based on product, milk segment held the highest market share in 2024.

- Based on distribution channel, the supermarket & hypermarkets segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 813.8 Million

- 2033 Projected Market Size: USD 2,409.1 Million

- CAGR (2025-2033): 12.9%

Shifting dietary habits and the growing embrace of vegan and flexitarian lifestyles are expected to propel the growth of Canada’s dairy alternatives market during the forecast period. According to the Canadian Digestive Health Foundation, approximately 44% of Canadians experience some degree of lactose intolerance. This growing prevalence of lactose intolerance and milk allergies is a major driver of demand for dairy-free alternatives in the country.

Lactose intolerance, often hereditary, prompts many Canadians to seek plant-based options enriched with calcium and essential vitamins to maintain nutritional balance. Additionally, heightened health awareness and rising disposable incomes, particularly in urban centers such as Ontario and Quebec, are expected to support further expansion of Canada’s dairy alternatives market over the coming years.

Consumer Insights

The dairy alternatives market in Canada reflects a significant shift in consumer behavior, influenced by growing health consciousness, environmental sustainability concerns, and evolving dietary values. A rising number of Canadians are actively reducing their consumption of traditional dairy and incorporating plant-based alternatives such as almond, oat, soy, and coconut milk into their daily routines. This trend is especially prominent among younger consumers, urban populations, and flexitarian individuals who are not fully vegetarian or vegan but intentionally limit animal-based products in favor of plant-derived options.

Recent consumer insights indicate that plant-based milk has moved well beyond niche status in Canada. Most of the population now adopts flexitarian habits, contributing to the mainstream acceptance of dairy alternatives. Moreover, plant-based milks are regularly stocked in a growing share of Canadian households, underscoring the shift toward healthier and more sustainable consumption patterns. This evolving preference is also reflected in increased demand for clean-label, allergen-free, and fortified dairy alternatives, positioning Canada as a key growth market in the global plant-based landscape.

Source Insights

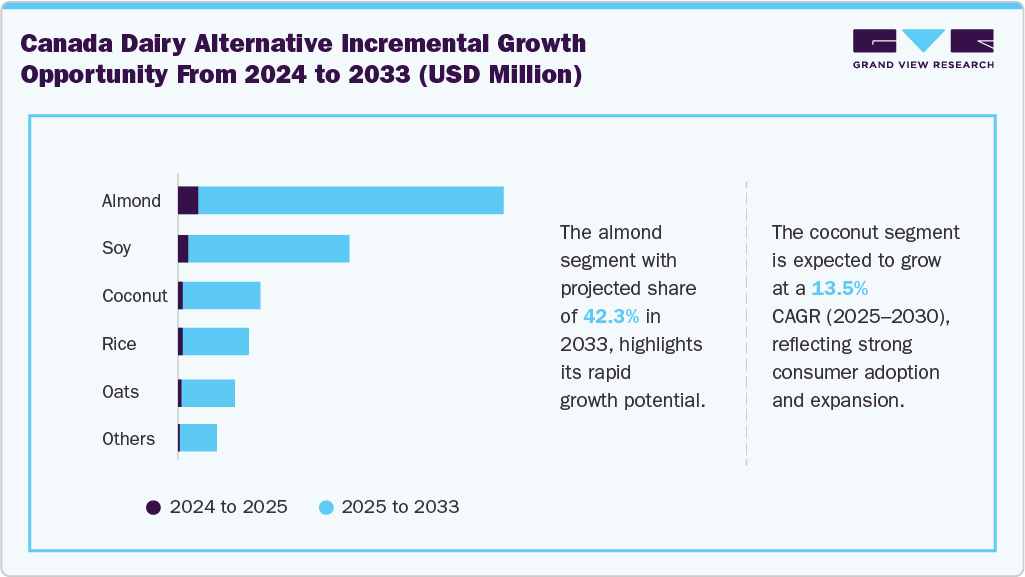

The almond segment accounted for the largest revenue share of 40.3% in 2024 and is expected to grow at the fastest CAGR over the forecast period. It occupies a prominent position as the most preferred dairy alternative among Canadian consumers. This preference is largely attributed to almonds' nutritional benefits, particularly their high vitamin B content, which supports metabolic function and enhances the body's ability to burn fat and calories efficiently. Almond-based dairy alternatives are also valued for being rich in protein, vitamin E, calcium, magnesium, and essential B vitamins. Furthermore, they contain important minerals such as iron, phosphorus, zinc, and copper, which contribute to regulating blood pressure, improving oxygen circulation in the blood, and strengthening the body's immune defense. These health advantages and growing demand for clean-label, plant-based products continue to drive the popularity of almond-based beverages and yogurts across the Canadian market.

The coconut source market is projected to grow at a CAGR of 13.3% from 2025 to 2033. Coconut-based products are emerging as a key growth driver in Canada's dairy alternatives market, supported by their nutritional benefits and compatibility with various dietary restrictions, including lactose intolerance and nut allergies. These products are gaining traction among health-conscious consumers seeking plant-based options with functional health properties. Coconuts are rich in healthy fats, particularly medium-chain triglycerides (MCTs), which are associated with improved heart health, enhanced energy metabolism, and weight management.

The rising demand for coconut-based dairy alternatives in the Canadian market is further driven by the increasing preference for clean-label, gluten-free, and fortified products. Many coconut-based offerings are enriched with essential nutrients such as calcium, vitamin D, and B12, meeting consumers' dietary needs and transitioning from traditional dairy.

Product Insights

The milk segment held the largest share in 2024. Plant-based milks such as almond, soy, oat, and rice milk are increasingly favored by health-conscious consumers due to their lower levels of saturated fat and cholesterol compared to traditional cow's milk, which are associated with improved cardiovascular health. Additionally, many plant-based milks are fortified with essential nutrients such as calcium, vitamin D, and vitamin B12, making them a nutritionally viable alternative to dairy. These features appeal to aging populations in developed markets such as Canada, where consumers seek functional, easy-to-digest options to support long-term health.

The ice cream segment is expected to grow at the fastest CAGR over the forecast period. The increasing consumer preference for dairy-free desserts, especially those formulated with soy, rice, almond, and coconut bases, is projected to be a key driver of growth in Canada’s dairy alternatives market, with notable expansion anticipated in the ice cream segment. As demand for plant-based, allergen-free, and lower-calorie frozen treats continues to rise, these non-dairy formulations are gaining traction across various consumer demographics, including health-conscious individuals, vegans, and those with lactose intolerance. According to Made in CA, there are approximately 850,000 vegans in Canada, reflecting a significant consumer base actively seeking plant-based dessert alternatives. As health-conscious consumers increasingly opt for low-calorie, plant-based dessert options, the popularity of non-dairy ice creams is gaining momentum. To meet the taste expectations of a broader audience, manufacturers have developed advanced flavoring and masking agents, improving the sensory appeal of these products.

Additionally, non-dairy ice creams are often priced more competitively than traditional dairy-based products, making them attractive to vegans and lactose-intolerant individuals and to a wider group of flexitarian consumers. The combination of affordability, improved taste profiles, and clean-label formulations is expected to accelerate market adoption during the forecast period. Leading players are responding to evolving consumer preferences by launching innovative offerings.

Distribution Channel Insights

Supermarkets & hypermarkets accounted for a share of 41.5% in 2024. The expanding presence of hypermarkets and supermarkets is driven by increased investments from international and domestic retailers. Global players seek to establish a footprint in Canada’s growing plant-based sector, while local retailers are actively broadening their product offerings to cater to evolving consumer preferences. This trend is further supported by rising consumer purchasing power and a growing demand for convenient access to a wide range of dairy-free products. As a result, major retail chains across Canada are dedicating more shelf space to plant-based alternatives, enhancing product visibility and driving market growth.

The online segment is projected to grow at the fastest CAGR of 13.9% from 2025 to 2033. The surge in online sales is driven by several key factors, including rising internet users, increasing smartphone penetration, and consumers’ preference for convenient, time-saving shopping solutions. Canadian consumers benefit from 24/7 access to a broad range of plant-based brands, the ability to compare prices, read product reviews, and explore various product options from the comfort of their homes.

Moreover, the availability of discounts, promotional campaigns, subscription services, and flexible payment options further enhances the appeal of online platforms. Discussion forums and social media influence also significantly guide consumer choices, helping boost trust and engagement.

Key Canada Dairy Alternative Company Insights

Some of the key players in the Canada dairy alternative market include Earth's Own, Natura, Daiya Foods., Laiterie Chalifoux for Maison Riviera, Oatly and others.

-

Daiya Foods is widely recognized for pioneering dairy-free cheese alternatives. Since its founding in 2008, the company has expanded its product portfolio to include plant-based cheeses, yogurts, dressings, and frozen meals, catering to vegan, lactose-intolerant, and health-conscious consumers.

Key Canada Dairy Alternative Companies:

- Earth's Own

- Natura

- Daiya Foods

- Laiterie Chalifoux for Maison Riviera

- Oatly

- Califia Farms, LLC

Recent Developments

-

In February 2024, Danone Canada’s Silk brand launched a new line of Greek-style, yogurt from Canadian pea protein and is available in key lime and vanilla flavors

-

In March 2024, Daiya Foods launched a new line of Mac & Cheese. This new line is made with gluten-free pasta and dairy-free cheese.

Canada Dairy Alternative Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 915.4 million

Revenue forecast in 2033

USD 2.409.1 million

Growth rate

CAGR of 12.9% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, product, distribution channel

Key companies profiled

Earth's Own, Natura, Daiya Foods., Laiterie Chalifoux for Maison Riviera, Oatly, Califia Farms, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Dairy Alternative Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Canada dairy alternative market report based on source, product, and distribution channel.

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Soy

-

Almond

-

Coconut

-

Rice

-

Oats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Milk

-

Yogurt

-

Cheese

-

Ice cream

-

Creamer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarket & Hypermarkets

-

Convenience Stores

-

Online retail

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.